Multiple Time Frame Analysis

Fiber (EurUsd) Short Idea. Aug 4-8 This Idea wont be precise as my Last Euro Analysis, You can check that out on my Profile.

Now the what do i mean by it not being precise? it means that there is room for upside Movement But it should break that high (Fib high) and the target is Sell-Side Liquidity for this week Key Things in this charts are Liquidity gap, Breaker block IFVG weekly Inverse rejection block.

80% drop into the abyss for Solana? - July 2025** The months ahead **

Examination of the 3-week chart for SOLANA reveals several compelling technical signals that suggest a potential bearish trend reversal. This analysis highlights crucial patterns traders and investors of Solana should consider.

1. Formation of a 3-Week Death Cross:

A notable bearish signal prints on the chart: a ‘3-week death cross’. This follows a ‘2-week death cross’ that preceded a significant downward movement, just as in early 2022. The death cross, where a shorter-term moving average crosses below a longer-term one, is a strong indicator of a shift towards a bearish trend, especially on higher timeframes like this 3-week chart.

2. Broken Market Structure:

The chart clearly indicates a “broken market structure.” This typically occurs when the price fails to create higher highs and higher lows during an uptrend, or in this case, breaks below a significant support level that had previously held. It is absolutely possible price action backtests past support for a resistance confirmation, however on looking left, such a test never occurred on the last death cross.

3. Resistance from Previous Peaks (Head and Shoulders Pattern):

Price action leading up to the recent highs resembles a potential ‘Head and Shoulders’ pattern. The three distinct peaks, with the middle peak being the highest, suggest a classic reversal pattern. A subsequent break below the ‘neckline’ (implied support level below the peaks) would confirm the bearish outlook.

4. RSI Oscillator (bottom of chart) resistance

The lower panel of the chart displays an RSI oscillator indicator, which shows a clear pattern of "resistance." following a period of support since 2023. The RSI has clearly confirmed resistance from almost 3 years of support.

5. Solana vs Bitcoin

All the bearish observations made on the SOL-USD trading pair can be observed on the same 3 week time frame for the SOLANA - BITCOIN trading pair:

6. Potential for Significant Downside Target:

Based on the measured move from the previous death cross and breakdown and Fibonacci extension, the chart illustrates a potential downside target of approximately -70% from current levels toward the $30-40 area. While this is a projected target and not guaranteed, the historical precedent following similar bearish signals provides a context for the potential severity of the downturn if the bearish momentum continues.

Conclusion:

Considering the confluence of a 3-week death cross, broken market structure, resistance from previous peaks (suggesting a potential Head and Shoulders pattern), and the confirmation of RSI resistance, the outlook for SOLANA on the 3-week timeframe appears distinctly bearish.

Is it possible price action continues upwards after a 3200% rally? Sure.

Is it probable? No

Ww

Ethereum Rejected from Supply - Bearish Shift in ProgressHello everybody!

Price has been rejected from a supply area.

The bullish trend has slowed down, and the market structure is slightly shifting bearish.

A polished upward trendline has been broken on the 1H timeframe.

We’re aiming for a target around the first untouched demand zone: 3437.

Manage your risk and trade safe!

SOL BEARISH CONTINUATIONAs the market continues to create new lows, something caught my eye.

3 areas of unwicked impulsive moves (FVG's) lying around 165.18 - 166.80, 167.65 - 169.69 and 170.32 - 172

With this, I identified two order blocks

.

I'm traditionally wired to prefer the latter because there's more confluence factors;

A liquidity pool 169.70 - 170.3 established by price struggling to close above that level followed immediately by a FVG into an OB.

Price would have an instant reaction downwards if it traded to those levels.

However, the buying pressure might not be sufficient to push price to those levels before the crash.

Hence the other order block.

I'd be paying close attention to observe how it plays out.

GOOGLE BUY SET UPGOOGLE is on an overall WEEKLY uptrend, coming off of a WEEKLY retest. Within that retest, we have a 4HR BOS. Waiting for 4HR retest in on of my zones for continuation to previous high. A WEEKLY candle would have to BREAK and CLOSE below the previous WEEKLY HL for possible reversal. Happy trading

~~~~I want everyone to succeed

MRVL Massive 15-Years Symmetrical Breakout Targets AheadMarvell Technology (MRVL) has just completed a monumental breakout from a 15-years symmetrical triangle, a rare and powerful long-term accumulation structure. This type of macro consolidation typically precedes a major directional expansion, and in this case, the breakout confirmed bullish continuation.

Currently, MRVL is forming a rising channel structure, with price bouncing cleanly from the lower boundary confirming demand and the continuation phase of the macro move.

The 1:1 projection from the symmetrical triangle gives us a clear target trajectory, with the final leg potentially extending to $229, aligning perfectly with the upper boundary of the rising channel.

In the short to mid-term, the ideal buyback opportunity rests near $67.50, should the market retest previous breakout support or the lower boundary of the channel once more. This zone offers asymmetric risk-to-reward potential for long-term investors and swing traders alike.

Key Targets

📈 $67.50 – Buyback Opportunity Zone

📈 $229 – Rising Channel Top / 1:1 Expansion Target

A breakout this large is no coincidence, it’s backed by years of price compression and institutional positioning. Now is the time to watch closely.

📩 Drop your view in the comments and share your stock requests for quick analysis.

Only stock assets will be accepted under this post.

Gold’s on a Roller Coaster — and We’re Riding It Down🎢 Gold’s on a Roller Coaster — and We’re Riding It Down 🎢

Gold just snapped up like it saw Trump tweet “TARIFFS ARE BACK” — but the move smells like a knee-jerk algo pump, not real conviction. We just rejected right into a thin-volume imbalance zone and tagged the underside of a long-standing trendline.

📉 Short Setup Locked In:

💥 Entry: 3405

🛑 Stop: 3415

🎯 Target: 3353

💰 R:R ≈ 5:1

🔍 Why I'm In This Trade:

That rip? Total headline panic, not structural strength.

Low volume shelf above, with a massive POC magnet below at 3353.

We tapped the Developing VAH (3414) and got rejected — classic trap setup.

SQZMOM showing the energy is already fizzling. Green flash, no follow-through.

🧠 The Narrative:

Gold’s trying to price in volatility from every angle — Trump talk, tariffs, macro chaos — but under the hood, this pop looks unsustainable. If this is just a liquidity grab, we could see a flush back into the meat of value fast.

Grab your helmets — this roller coaster might just be heading downhill 🎢📉

Bullish Channel Intact: BTC Poised for Next Leg Toward 152KBitcoin continues to coil within a bullish consolidation zone above the critical $114.5k–$117.5k Immediate Demand Zone, firmly riding the ascending channel structure that has guided price since the March swing low. The prior wave structure confirms a clean ABC correction, followed by a powerful breakout and a structured range indicative of accumulation, not exhaustion.

The RSI shows persistent bullish divergence, confirming hidden strength, with multiple support bounces confirming demand. The current tight consolidation above former resistance now flipped demand presents a launchpad scenario for a breakout towards major projected upside targets.

Targets to Watch:

🟢 $123,053 – Range breakout threshold, aligns with channel midline and prior local high.

🟢 $134,428 – Measured move from current range and top channel boundary intersection.

🟢 $152,174 – Final leg projection based on macro channel trajectory and bullish wave extension potential.

On the downside, failure to hold $114.5k opens the door to a test of the $105k Strong Support Zone, which aligns with prior structural demand and broader trendline confluence.

💬 Drop your favorite altcoins in the comments for quick analysis , let's catch the next movers before they fly!

XAU/USD 01 August 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

You will note that price has targeted weak internal high on three separate occasions which has now formed a triple top, this is a bearish reversal pattern and proving this zone is a strong supply level. This is in-line with HTF bearish pullback phase.

Remainder of analysis and bias remains the same as analysis dated 23 April 2025.

Price has now printed a bearish CHoCH according to my analysis yesterday.

Price is now trading within an established internal range.

Intraday Expectation:

Price to trade down to either discount of internal 50% EQ, or H4 demand zone before targeting weak internal high priced at 3,500.200.

Note:

The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively.

Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

H4 Timeframe - Price has failed to target weak internal high, therefore, it would not be unrealistic if price printed a bearish iBOS.

The remainder of my analysis shall remain the same as analysis dated 13 June 2025, apart from target price.

As per my analysis dated 22 May 2025 whereby I mentioned price can be seen to be reacting at discount of 50% EQ on H4 timeframe, therefore, it is a viable alternative that price could potentially print a bullish iBOS on M15 timeframe despite internal structure being bearish.

Price has printed a bullish iBOS followed by a bearish CHoCH, which indicates, but does not confirm, bearish pullback phase initiation. I will however continue to monitor, with respect to depth of pullback.

Intraday Expectation:

Price to continue bearish, react at either M15 supply zone, or discount of 50% internal EQ before targeting weak internal high priced at 3,451.375.

Note:

Gold remains highly volatile amid the Federal Reserve's continued dovish stance, persistent and escalating geopolitical uncertainties. Traders should implement robust risk management strategies and remain vigilant, as price swings may become more pronounced in this elevated volatility environment.

Additionally, President Trump’s recent tariff announcements are expected to further amplify market turbulence, potentially triggering sharp price fluctuations and whipsaws.

M15 Chart:

AUD/JPY bulls eye 99, 100The yen is broadly weaker, which is even allowing a weaker Australian dollar to rise. And with a decent bullish trend on the daily chart, I am now seeking dips within a recent consolidation range in anticipation of a move to 99 or even 100.

Matt Simpson, Market Analyst at City Index and Forex.com

Stock Of The Day / 07.31.25 / ALGN07.31.2025 / NASDAQ:ALGN

Fundamentals. Suspected of possible violations of federal securities laws on the back of a negative earnings report.

Technical Analysis.

Daily Chart: Downtrend. Level 127.88 formed by the trend break in March 2020 is ahead.

Premarket: Gap down on increased volume. We mark the trend break level in the premarket at 140.0.

Trading Session: The price held the 140.0 level twice during the first hour after the opening of the trading session. Note the clear hold in the first case and the hold with false breakouts in the second. Also note that each subsequent pullback was smaller than the previous one. We are considering a short trade to continue the downward movement in case of the breakdown and hold of the 140.0 level.

Trading scenario: breakdown with retest (tightening with retest) of level 140.0

Entry: 139.67 after breakdown and hold the price below the level.

Stop: 140.11 we hide it above the tail of the retest candle.

Exit: We observe the strong downtrend. Cover the part of the position at 132.08 when the structure of the downtrend is broken (RR 1/17), after the downtrend resumes, hold the rest of the position until level 127.88 (1/25).

Risk Rewards: 1/21 (max. 1/25)

P.S. In order to understand the idea of the Stock Of The Day analysis, please read the following information .

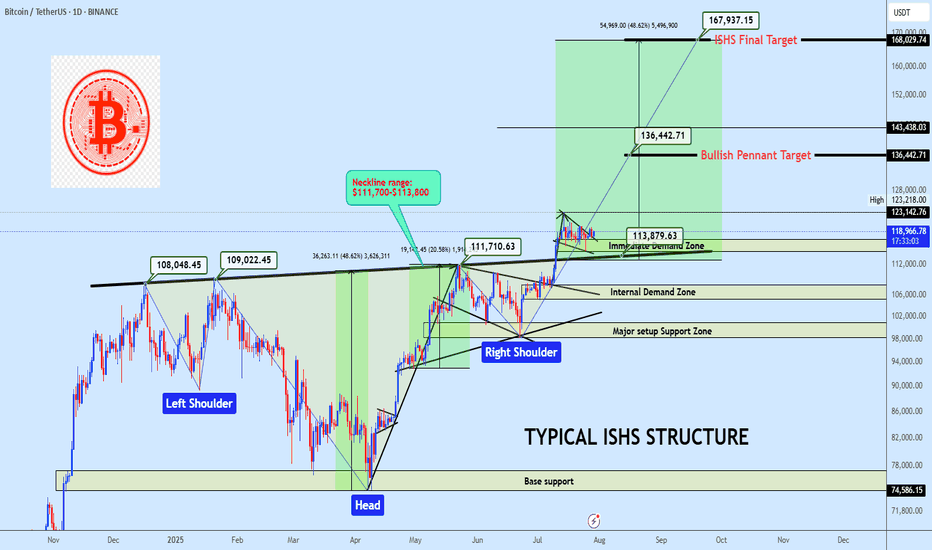

BTCUSDT ISHS Breakout with Bullish Pennant ContinuationBTC is holding above a clean neckline breakout from a inverse head and shoulders formation, currently consolidating inside a bullish pennant. A breakout from this range offers continuation potential to $136K and possibly to $168K. Bias remains bullish while price holds above the $114K region.

Market Structure

• Trend: Bullish continuation

• Pattern: Inverse Head & Shoulders + Bullish Pennant

• Price Action: Clean breakout and retest of neckline support, followed by tightening consolidation

Key Zones

• Immediate Demand Zone: $114,000 – $117,000

• Internal Demand Zone: $105,000 – $108,000

• Major Setup Support Zone: $98,000 – $101,000

• Base Support (ISHS Origin): $74,500 – $77,000

• Neckline: $111,700-$113,800 (Confirmed pivot level)

Technical Confluence

• Volume: Strong candle breakout through neckline, followed by low-volume bullish flag

• Price Geometry: ISHS measured move aligns with the final target at $168K

• Momentum: Bullish structure maintained with higher lows and reactive demand

Entry Plan

• Zone: $117,500 – $119,000

• Method: Limit buy on demand retest or breakout retest of $123K

• Execution: Swing entry with invalidation below demand base

Targets

• 🎯 TP1: $136,442 — Pennant measured move

• 🎯 TP2: $168,029 — Final ISHS target

Invalidation

• ❌ SL: Below $110,000

• Reason: Break below ISHS Neckline invalidates bullish thesis in the short term

• RRR: Estimated 1:4 depending on execution

If this structure aligns with your outlook, feel free to share your thoughts in the comments.

You’re also welcome to drop your preferred altcoins for a quick technical review.

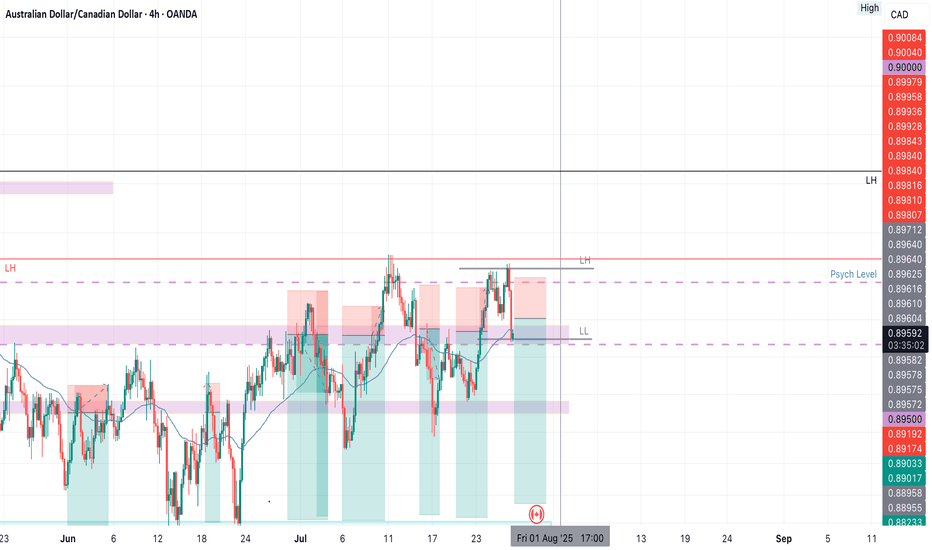

AUDCAD SHORT Market structure bearish on HTFs 3

Entry at both Daily and Weekly AOi

Weekly Rejection at AOi

Previous Weekly Structure Point

Daily Rejection at AOi

Previous Structure point Daily

Around Psych Level 0.90000

H4 EMA retest

H4 Candlestick rejection

Rejection from Previous structure

Levels 4.51

Entry 120%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

LONG ON EUR/USDEUR/USD is currently at a major demand level after sweeping sell side liquidity.

The Dxy (Dollar) is overall bearish. I expect the dollar to fall and EUR/USD to rise to the previous high / supply level for over 200-300 pips.

News most likely will affect this pair in terms of volatility.

GBPJPY: Important Demand Zone 🇬🇧🇯🇵

GBPJPY is trading within an important demand zone that

is based on a rising trend line and a horizontal support.

We see a false violation of that and a bear trap, followed

by a bullish imbalance candle.

I think that the pair may go up and reach at least 198.08 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Short Breakdown of Cardano (ADAUSDT) weekly/daily technicalsLooked over this for a friend. Rowland I would love your feedback in the comments 🫡

I will see my biggest expectation is for this to make it's way into the weekly imbalance range below the weekly Mother Candle we are existing within. The entire crypto market seems to want to revisit some key lows to correct some inefficiently delivered rally ranges (meaning too many pending orders left behind due to price not coming back to grab them, happens when HUGE money places--attempts to place/fill--bulk orders).

We are getting what I think is a temporary bullish correction due to taking of profits at key lows. It is my belief/observation that after correcting the newly minted bearish range (grabbing pending shorts above daily highs--turtle soup I think they call it), we will be able to drive down into the bullish imbalance weekly candle's range.

Let's see how we go! 😈

GBPUSD SHORTsMarket structure bearish on HTFs 3

Entry at both Weekly and Daily AOi

Weekly rejection at AOi

Previous Weekly Structure Point

Daily Rejection At AOi

Daily EMA retest

Around Psychological Level 1.34500

H4 EMA retest

H4 Candlestick rejection

Levels 5.55

Entry 105%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.