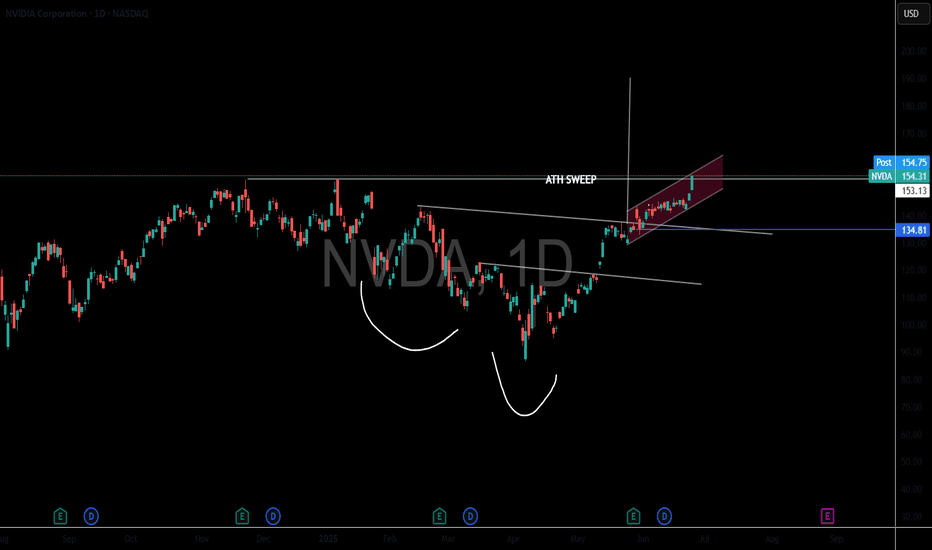

Nvidia & Nasdaq History - What you need to know!Record-high share price: NVDA hit a new all-time high as U.S. stock markets rallied and Wall Street analysts forecast continued upside

Nvidia is pushing towards the first ever $4 Trillion market cap.

Today it surpassed MSFT as the largest company in the world closing up over 4% on the session.

Micron earnings are adding extra fuel to the fire for semi conductors.

Short term picture for semis - they're very extended and need some consolidation.

Micron earnings: Revenue: $8.05 billion, up ~38% YoY, beating the ~$7.89 billion consensus

Data‑center revenue: Tripled YoY, powered by surging demand for high‑bandwidth memory (HBM)

HBM sales: Exceeded $1 billion, growing over 50% sequentially

Strong margin and revenue beat; robust cash flow (~$857 million free cash flow) with a solid balance sheet ($9.6 billion in liquidity)

MU

MU Micron Technology Options Ahead of EarningsIf you haven`t bought MU before the rally:

Now analyzing the options chain and the chart patterns of MU Micron Technology prior to the earnings report this week,

I would consider purchasing the 128usd strike price Calls with

an expiration date of 2025-6-27,

for a premium of approximately $5.52.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

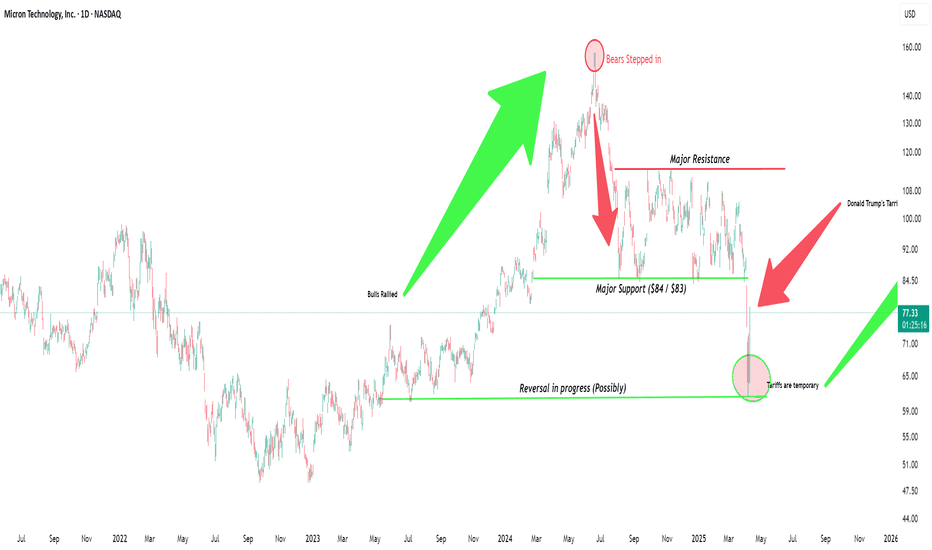

Micron Technology - Starting the next +80% move!Micron Technology - NASDAQ:MU - perfectly respects structure:

(click chart above to see the in depth analysis👆🏻)

Starting back in mid 2024, Micron Technology created the expected long term top formation. We witnessed a correction of about -60%, which ultimately resulted in a retest of a confluence of support. So far, Micron Technology rallied about +60%, with another +80% to follow soon.

Levels to watch: $150, $180

Keep your long term vision!

Philip (BasicTrading)

Micron Technology (MU) – Powering the AI Memory SupercycleCompany Overview:

Micron NASDAQ:MU is a crucial player in the AI infrastructure stack, providing advanced DRAM, NAND, and NOR flash memory solutions that fuel everything from data centers to mobile edge devices.

Key Catalysts:

AI-Driven Memory Demand ⚙️

High-Bandwidth Memory (HBM) adopted in AI accelerators from Nvidia, AMD, Broadcom, and Marvell.

Positions Micron at the core of the AI supply chain, reducing exposure to chip cycle volatility.

Data Center Surge 📈

Data center DRAM revenue tripled YoY in Q2 2025, driven by hyperscaler AI infrastructure upgrades.

Strengthens revenue diversification and margin profile.

Technology Leadership 🔬

Launch of 1-gamma DRAM node and LPDDR5X samples enhances mobile, cloud, and auto capabilities.

Keeps Micron on the cutting edge of memory innovation.

Investment Outlook:

Bullish Case: We remain bullish on MU above $95.00–$97.00.

Upside Target: $155.00–$160.00, supported by AI compute growth, hyperscale momentum, and next-gen product launches.

💡 Micron is not just riding the AI wave—it’s building its memory core.

#Micron #MU #Semiconductors #AI #HBM #DataCenter #DRAM #NAND #Nvidia #AMD #Hyperscalers #TechLeadership

Micron Technology - The Chart Is Still Perfect!Micron Technology ( NASDAQ:MU ) will reverse right here:

Click chart above to see the detailed analysis👆🏻

If you actually want to explain technical analysis to somebody, just show them the chart of Micron Technology. Almost every structure makes perfect sense, with this stock respecting all major trendlines and horizontal levels and with the current support area, the bottom is now in.

Levels to watch: $70, $210

Keep your long term vision,

Philip (BasicTrading)

Micron's Time to Be THAT Semiconductor is coming and FastNASDAQ:MU is extremely undervalued, I produced this chart last night. Its time that the market appreciates this monster with such solid fundamentals. Micron since 2022 has been working hard to become a major producer in the United States. I believe that Trump and his government could get behind the only major memory company to be based in the United States.

-----------------------

Balance Sheet:

Cash: $8.22b

Debt: $11.54b

Equity: $48.63b

Total Liabilities: $24.42b

Total Assets: $73.05b

All Stated in $ USD

-----------------------

Valuation:

Price To Sales: 2.72

Price To Earnings: 18.30

Forward Price To Earnings: 6.84

-----------------------

$SOXL Inverted Cup and Handlel (SELL NOW!)Grasping chart patterns is essential for market participants. This article explores the inverted cup and handle formation, a bearish signal that suggests potential downward movement.

The inverted cup and handle, also known as an upside-down cup and handle pattern, is a bearish chart pattern that can appear in both uptrends and downtrends. It is the reverse of the traditional bullish cup and handle pattern. The inverted formation consists of two main components: the "cup," an inverted U-shape, and the "handle," a small upward retracement following the cup.

SELL NASDAQ:NVDA AMEX:SOXL NASDAQ:AMD NASDAQ:AVGO NASDAQ:QCOM NASDAQ:MRVL NASDAQ:MU $TXN.

Lets BUY it again WHEN IT'S LOW guys.

Mark my word

Micron Technology - Fully Resisting The Stock Market Crash!Micron Technology ( NASDAQ:MU ) is one of the few bullish stocks:

Click chart above to see the detailed analysis👆🏻

Despite the stock market kind of "crashing" lately, Micron Technology is one of the few stocks which remains in a rather bullish environment. Following the uptrend, the bullish break and retest and the beautiful cycles on Micron Technology, this strength will soon become reality.

Levels to watch: $90, $180

Keep your long term vision,

Philip (BasicTrading)

MU, bound for more significant RISE ahead this 2025! from 100.Micron Technology, Inc. is an American producer of computer memory and computer data storage including dynamic random-access memory, flash memory, and solid-state drives. It is headquartered in Boise, Idaho.

Based on latest metrics, MU is now at basing zone finally after experiencing heavy downtrend since last years peak at 153 on June 2024.

The stock is currently on a massive SHIFT in trend hinting of a weighty reversal to the upside. It already bounced more than 20% from its lows at 80 levels since late last year.

Fridays' closing price of +6% is already conveying its directional context for the rest of the year -- more RISE ahead.

Also factoring its last QTR Results which are all in greens.

(USD) Nov 2024 Y/Y

Revenue 8.71B 84.28%

Net income 1.87B 251.54%

Diluted EPS 1.67 249.11%

Net profit margin 21.47% 182.23%

Operating income 2.17B 292.73%

Net change in cash -355M 30.39%

Cash on hand - -

Cost of revenue 5.36B 12.6%

----------------------------------

Spotted price at 100.

Interim target at 150

Mid at 200.

TAYOR. Trade safely.

$MU getting accumulated with PT $140-220- NASDAQ:MU GAAP eps is growing substantially in 2025 and 2026 but market hasn't rewarded NASDAQ:MU

- It appears that whales are accumulating the stock and/or suspicious of NASDAQ:MU future demand.

- If analyst expectation and company's projection is true then this stock is grossly undervalued.

Based on the fundamentals:

Year | 2025 | 2026 | 2027

Gaap EPS | 6.32 | 9.65 | 11.27

EPS growth | 730.48% | 52.72% | 16.80%

Bear case ( for. p/e = 15 ) | $94.8 | $144.75 | $169.05

Base case ( for. p/e = 20) | $126 | $193 | $225

Base case ( for. p/e = 25 ) | $158 | $241 | $281.75

Bull Case ( for p/e = 35 ) | $189 | $289 | $338

Opening (IRA): MU March 21st 75 Covered Call... for a 72.85 debit.

Comments: Looking to do something small here on weakness: Selling the -80 call against shares to emulate the delta metrics of a 20 delta short put, but with the built-in defense of the short call. Earnings are on 3/19, so will look to be out by then.

Metrics:

Buying Power Effect/Break Even: 72.85

Max Profit: 2.15

ROC at Max: 2.95%

50% Max: 1.08

ROC at 50% Max: 1.48%

AMD: A Once-in-a-Lifetime Opportunity!**🔥 AMD: A Once-in-a-Lifetime Opportunity!**

In pre-market, AMD briefly touched **$125** following earnings. You all know how this works—sooner or later, the algos will bring it back to that level. No hesitation, I’m **quadrupling my bet—going in MASSIVELY!** 🚀💰

Micron Technology - The Textbook Chart!Micron Technology ( NASDAQ:MU ) is retesting massive support:

Click chart above to see the detailed analysis👆🏻

For the past seven year, Micron Technology has been respecting a pretty clear rising channel pattern. With the recent all time high breakout, it is very likely that this level is now holding as support and we will eventually see a rejection and new all time highs.

Levels to watch: $90, $180

Keep your long term vision,

Philip (BasicTrading)

Micron (MU) Stock Update: Correction or Collapse?Morning Trading Family

Here's what's up with Micron (MU): If it bounces back at 92, cool. But if it keeps going down, it might hit 89-90 before it stops. If it drops past that, we might see it go to 84 or even 80. This could be a big moment for MU, so keep watching!

Kris/Mindbloome Exchange

Trade What You See

Micron's Next Move: Will $102 Trigger a Drop to $98?Micron (MU) is showing a head and shoulders pattern, and it’s at a critical level. If it breaks below $102, I think we could see it drop to $99.50 or even $98.

This could be a big move, so keep an eye on it!

If this helps, I’d love to hear your thoughts—drop a comment, like, or share. Let’s trade smarter and live better! 💡

Kris/Mindbloome Exchange

Trade What You See

Micron Technology's Journey to the 136 PeakGood morning, trading family! Here's the lowdown on Micron Technology (MU):

Picture MU climbing "136 Peak" with hurdles at $104, $111, and $114. Each is like a mountain bump where we might see a slip or a leap forward. With AI and memory chips in high demand, Micron's equipped for this climb, but expect some corrections like pit stops. Keep an eye on tech trends and the economy; they'll tell us if MU makes it to the top!

If you found this useful: boost, share, like, and comment. I appreciate all the support! If you're struggling as a trader to be sustainable, I get it - I've been there myself. Jump in, send me a DM or head to my profile; I'm more than happy to help.

Kris/Mindbloome Exchange

Trade What You See

Micron Technology: Bearish or Ready to Break Out?Good morning, trading family!

Micron (MU) is at an important spot right now:

If we move lower, I’m watching $97 and $96 as key levels, with potential for more downside.

If we hold above $100, there’s room to climb to $102, $103, and $104. A break above $104 could mean a smoother ride higher.

I’m also hosting a Master Your Mind Traders Class this Sunday to help you refine your skills and mindset. Want to join? Send me a message for details.

Kris/ Mindbloome Exchange

Trade What You See

Micron Technology (MU): Is a Big Move Just Around the Corner?Good morning, trading family!

Micron’s price has been moving between $92.90 resistance and $84.26 support, and it looks like a big move could be coming soon. Will we see a breakout to higher levels, or a pullback to retest support?

This is one of those setups where being patient and watching how the price reacts at these levels can really pay off. Stay ready, and let’s tackle this opportunity together!

Comment, like, follow, or send me a DM if you want a deeper analysis or more insights!

Kris/Mindbloome Exchange

Trade What You See

Is $AMD a massive buy opportunity for 2025?Is NASDAQ:AMD a massive buy opportunity for 2025?

AMD is doing great financially/fundamentally with chips that is 2nd to NVDA. In addition, their data center revenues are growing exponentially.

It is a probably a great buying opportunity here at $121 going into 2025.

MU Breakout Coming or Another RejectionNASDAQ:MU This is looking like it could go with earnings. If there is some good news MU could break through this Golden Zone and head back to ATH. If we get another Rejection at the bottom of that Zone. We could be heading back down. Either way chart looks good for a play.

Micron Technology - This Stock Will Double Soon!Micron Technology ( NASDAQ:MU ) is retesting massive support:

Click chart above to see the detailed analysis👆🏻

After we saw a test of the resistance trendline on Micron Technology a couple of months ago, it was quite likely that we will eventually retest the previous all time high. This structure is now acting as massive support and together with the rising trendline, we will see a bullish rejection.

Levels to watch: $90, $180

Keep your long term vision,

Philip (BasicTrading)