MULTIBAGGER Series - Stock 5Hello everyone!

I am back with 3rd company of the multibagger series.

The company is Gensol Engineering Ltd. Gensol Engineering Ltd is engaged in the business of Solar consulting & EPC. The company is among the top 10 EPC players in India and the top 5 in terms of independent EPC players. It has Solar Business, EV Lease Business, EV Manufacturing and Green Hydrogen Business. As of Q1 FY25, the company has a total order book of Rs. 5,025 Cr. The company has shown phenomenal rise in terms of revenue and profit.

Risk factors are that the company has very high debt, promoters are reducing their holding and the pledged shares by promoters stands at 79.8% which is not a good sign for the comapny. So investing in this company can be connsidered very risky due to these factors.

Investing in such companies will make our portfolio diverse and as they are smallcap company, chance of giving multibagger returns are more from such companies.

Investing in such companies bring a high risk factor so please do your own analysis before investing.

Hope you learned something new from this post.

Do like, share and follow me. Thank you!

Multibaggers

MULTIBAGGER Series - Stock 4Hello everyone!

I am back with 3rd company of the multibagger series.

The company is Nirman Agri Genetics Ltd. NAGL is an agricultural input company that produces, processes, and markets premium hybrid seeds, organic fertilizers, and bio-organic seeds for a variety of crops, including corn, sunflower, cotton, rice, sorghum, and grain. Majorly they are processing corn. It has recently started producing micronutrients and bioproducts. In addition, it grows non-hybrid seeds. Company is working towards creating seeds with greater yield potential, drought resistance, pest and disease tolerance, etc. As drought is a great issue in Maharashtra where the company operates, these seeds are playing an important role during droughts because of their resistance. It is also working on research and development projects about better breeding techniques and biotechnology instruments, which allows it to create hybrid seeds, micronutrients, and bioproducts.

In FY24, company generated revenue from Sale of Products which was ~121% higher than FY23. In has shown a triple digit growth this June quarter. Company has an advance Order Book for the Rabi season for Rs. 120 Crores. Currently the revenue stands at more than 100 crores and profit at 14 crores. The market cap of the company is 242 crore making it a small cap company.

Investing in such companies will make our portfolio diverse and as they are smallcap company, chance of giving multibagger returns are more from such companies.

Investing in such companies bring a high risk factor so please do your own analysis before investing.

Hope you learned something new from this post.

Do like, share and follow me. Thank you!

MULTIBAGGER Series - Stock 2Hello everyone!

I am back with 2nd company of the multibagger series.

The company name is Wise Travel India Ltd. with NSE code as WTICAB.

Wise Travel India Limited is a transport company that offers car rentals and transportation services across 130 cities in India. The company offers a range of services including car rental, employee transportation, end-to-end employee transport solutions (MSP), flexible fixed/monthly rental plans, airport counters, fleet management, mobility services for MICE, cutting-edge mobility tech solutions, sustainable mobility, project mobility solutions, strategic consulting and advisory on mobility, and community commute.

The company is currently available at a cheaper valuation than the stock 1 of multibagger series. The stock P/E is 27 which is lower than 30 of the previous company and the ROE and ROCE is higher and a good 26.4% and 22.4% respectively. Promoter holding is also at a higher side standing at 69.4%

Such companies earlier used to come under unorganized sector but after their listing and success of OLA and UBER and increasing urbanization, such companies have successfully entered organized sector and growing their market base and clientelle.

Investing in such companies will make our portfolio diverse and as they are smallcap company, chance of giving multibagger returns are more from such companies.

Investing in such companies bring a high risk factor so please do your own analysis before investing.

Hope you learned something new from this post.

Do like, share and follow me. Thank you!

TECHNOE is Hammering and Trapped At All Time HighTEECL, headquartered in Kolkata, is promoted by Mr P P Gupta, who is assisted by a team of professionals. It undertakes turnkey engineering, procurement and construction (EPC) projects, predominantly in the power sector, across generation, transmission, and distribution segments. In fiscal 2015, the company received the Best Safety Award from Power Grid. TEECL entered the renewable power generation space in 2009 with 45 megawatt (MW) of wind energy assets by acquiring Super Wind. It acquired Simran Wind Project Ltd (Simran) in 2009, which had installed capacity of 50.45 MW that was subsequently scaled up to 162.35 MW. The company divested 44.45 MW and 33 MW of capacity of Simran in May 2015 and January 2017, respectively. TEECL got its current name post its merger with Simran.

For the nine months through December 2023 profit after tax (PAT) was Rs 200 crore over total income of Rs 1198 crore compared with Rs 126 crore and Rs 516 crore, respectively, in the corresponding period the previous year.

Current

Order Book is

Rs 1600 Crores

Techno is targeting for

Rs 2000 - 2500 crores

every year in its segment

Techno envisages to develop

250 MW of Data Centers with

a capex of over USD 1.3 billion

in the next 5-6 years

As per, Gazette notification (GOI) all Thermal Power Plants

need to limit their sulphur emission.

Total Target is for 211.52 GW (67.25 GW by Central Govt.,

67.74 GW by State Govt. and 76.528 GW by private players)

by 2026.

Of these, around 10.6 GW is already installed, and bids for

102.96 GW are already awarded.

Bids for 23.67 GW has been opened

Around 71.42 GW are around various stages before being

awarded.

They have received the contract for 500 MW from DVC for Rs

3190 million (already commissioned) and an order worth Rs

14550 million from Rajasthan Rajya Vidyut Nigam Ltd.

They have tenders worth Rs 1000 crores under bidding in the

pipeline

Govt. of India plans to grow from 1 mn smart meters to 250 mn smart meters

Till now total smart meters sanctioned for installation is 229.8 mn

Out of the above, around 8.64 mn meters have been installed till now, and rest are

under various stages of implementation.

Currently, most of the orders getting bided are on the RDSS Scheme (87.71% of the

sanctioned meters)

Techno has received orders for 3.77 lakh meters at Jammu & Kashmir

Techno has also got an order worth Rs 633.23 crores for 5.53 lakh smart meters at

Indore and J&K for 7.25 lakh meters worth 1041 crores under the DBFOOT model.

Techno is bidding for various projects for 40 Lakh meter projects worth Rs 4500

crores.

Indian Oil: % years Inverse Head and Shoulder BreakoutIOC has been in an Inverted H&S pattern formation since March 2018 which it completed in July 2023. Inverted H&S patterns often implicate a bullish run post pattern breakout and they become crucial specially when the pattern is in formation phase for dew years.

IOC replicates a similar view and the stock has given a breakout in May 2023.

The run still continues supported with high crude oil prices as well. With a long term view the stock seems to go upto 129 levels in few months from now. (Given the pattern is observed in monthly chart)

KELLTONTEC - Buy TradeMultibagger Stock Pick

KELLTON TECH - Buy

CMP 78. Target Rs140

Kellton Tech Solutions Ltd. is an Indian IT, outsourcing and software development company headquartered in Hyderabad with offices in US and Europe

with market cap of around 727cr, trading on a PE of just 10.9, ROCE at 20.7%, Book Value of 46.7, Face value of 5 and has a promoters stake of 55.85% with FII 1.34%.

And why should I buy it ?

1) One of the leading company for digital transformation and integration.

2) Digital commerce & Marketing.

3) Outsource product development.

4) Delever SAP solutions end to end and is a certified SAP gold partner.

5) Internet of things platforms and solutions.

6) Strong presence in US, EUROPE. INDIA, and Asia Pacific.

7) The company appeard four time in the Deloitt technology fast 50 India list.

8) The company is a part of Forbes Asia under a billion top 200 company list.

9) Won the "Integration partner of the year" award in London.

10) They have a very big clienal list from startups to fortune 500 companies, to name few Cococola, Walmart, MAX life, UPS, Novartis, Univision, snapdeal, hatway, Flipkart, KFC, Paytm, Pizza Hut, Religare, Dupont, Makemytrip, policy bazaar, and many more.

11) Kelton recently announced that it has been chosen by ZEE5, India’s Entertainment Super-app, to build a next-generation, cloud-native content management system (CMS) that delivers relevant, real-time content experiences across all constituents of business.

12) Received a contractor $5ml from Food Corporation of India Ltd for implementation and maintenance of HR and management system.

13) Fy19 and 20 were very challenging years for IT companies and despite that the company registered a top line of 770cr, EBITDA 116cr, maintained margins of 15%, and PAT of 71cr. with an EPS of Rs. 7.55

14) Very strong return ratios, last three yrs. ROE track records is 24 to 25%

15) The average multiples for IT sector is around 50 to 60 PE levels, so now we can see how valuation are so attractive for Kellton.

Last and final point which I would like to highlight.

16) They have entered into a new streem which is booming right now, and that's *cryptocurrency trading.*

They have started developing platforms where crypto trading can be performed and is the hot theme running now a days, will develop NFT technologies and on that the trading platforms will be built. The contract which they received is very significant. Big giants are also about to enter in the same field and Kelllton will definitely have an upper edge.

Buy it to Double Your Money.

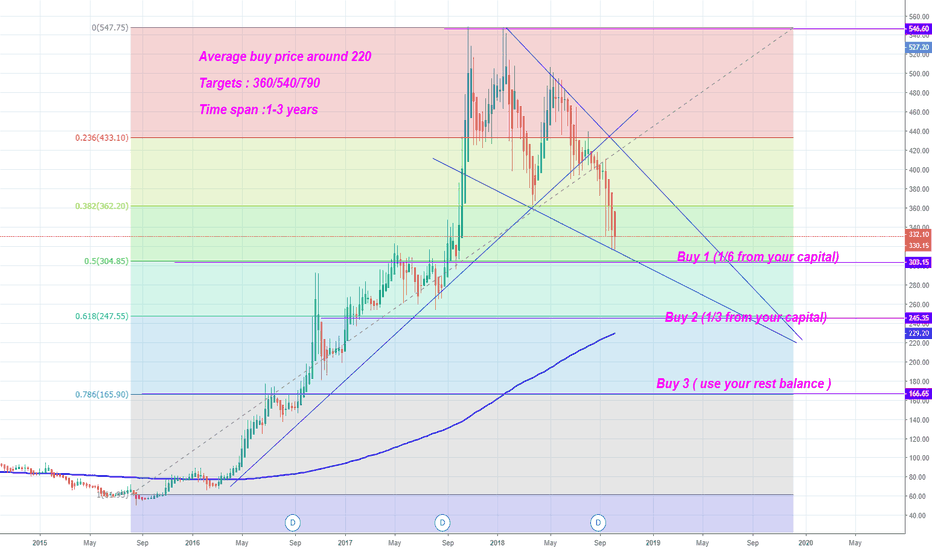

TEZOS: $1.46 | the ONE to rule em all at $500bn cap | $720organic and well positioned product validated through early birthpains in 2017 and

just like that came out of nowhere as deemed to be a game changer among the rest

could be the GOOGLE FB in the iT industry obliterating the rest of players

-

a $500bn cap should be at par with DOWs FANG super stocks

TEZOS: $720 a moment to look forward

A Multibagger in making Suven LifesciencesWith series of new patents filed in different countries and

rise in OBV over the last few year shows investor confidence in the stock.

Tech Indicators : Trendline breakout, MACD Crossover and OBV on rise and comfortably trading above 22 EMA

Levels

CMP 214.7

SL 199

Target 280

Can face resistance near 280 above which it can reach 300+ levels.

Time Frame: 1 month