NAS

Nasdaq BEARISH continuation on CORONA virus PANICS!!Big congratulations on our previous massive sell again from 9000-8400/300 parameters after the short bull pullbacks, we must keep taking advantage till we get a vaccine and shootup to 10k Thats another massive buy opportunity loadingup. But However for now listen carefully FAM NASDAQ on a very crucial point now on a buy trend zone technically, But with more fears and panics on the corona outbreak we expect more bearish movements after 6days consecuteively of stocks dropping, So therefore insert Sellstop@8200 - 7950(TP1) And wait for break/updates to TP2(7950-7500) Then a buy-stop due to technical buy zone high above @8830-9500 if you cant detect a reversal(Candle,Pattern). But once sellstop activates delete the buy pending order and seat on your sell whilst locking profits as you move downwards. Like and share your ideas on this particular pair too. Also always apply proper risk managements thanks!

NASDAQ BULLISH Trend break CORONA VIRUS EFFECT!??Congrats on our previous good sell to 9300 parameters from 9500 after the bearish gap seen today, However NASDAQ as now break the bullish trend for a new pattern due to i believe the corona virus effecting Big companies under the NASDAQ composite Apple inc e.t.c creating panic and slowing production rates and shorting on demands, But My idea is that we expect little pullback after supports hits(TP Parameters). Otherwise fundamentals takes over to continue the bearish movements, As technically we expect bulls taken over already. Like and share your ideas on this particular pair too. Also always apply proper risk managements thanks!

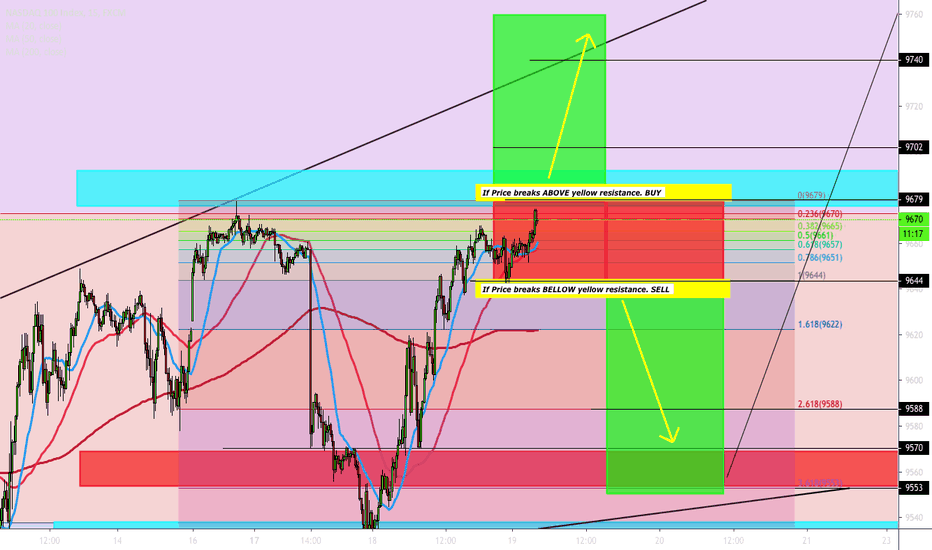

Nasdaq PULLBACK seen, Buysetup loading up(RESPECT TO TRENDLINE)!Nasdaq pullback seen after we protected lil profits from our previous buystop due to yesterdays US bank holidays, Still on the road to 10k but as said we must trade the ranges and pullbacks along the way, However now we see a short sell long buy on supports(- Nasdaq had a gap down, this is due to "Apple Inc. doesn’t expect to meet its revenue guidance for the March quarter because of work slowdowns and lower smartphone demand, showing that the corona virus outbreak in China is taking a bigger-than-predicted toll on one of the world’s most valuable companies" ), However if the support is broken, we see more sell to 9442/400 parameters then a sure buy hence MAJOR Bullish trend isn't broken. Please comment, like and share your ideas on this particular pair too. thanks!