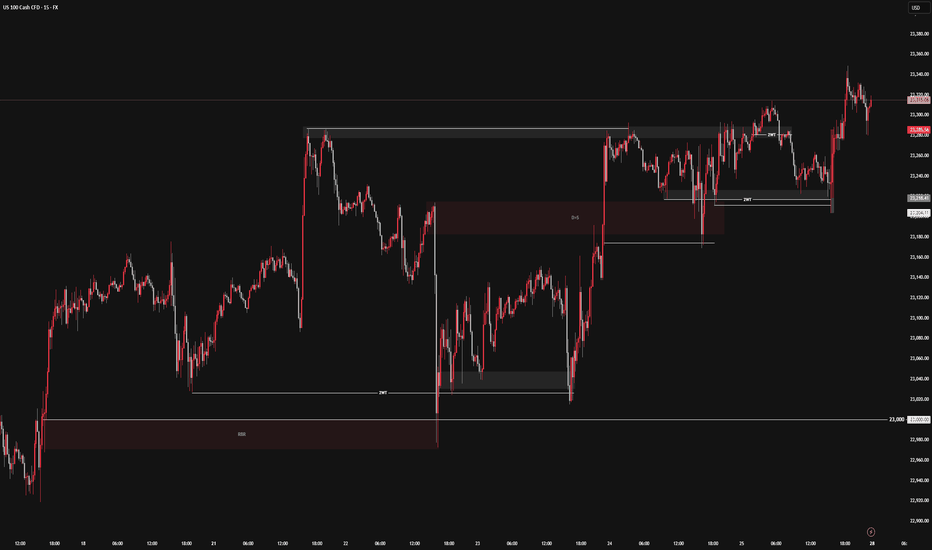

NAS100 Trade Idea: Liquidity Sweep & Bullish Reversal Potential📊 NASDAQ 100 (NAS100) Trade Outlook 📈

The NASDAQ 100 is holding a strong bullish trend on the higher timeframes 🟢. However, we’re currently seeing a notable pullback into a key support zone ⚠️ — price has dipped beneath previous lows, tapping into what appears to be an institutional accumulation range 🏦.

This move is likely targeting the liquidity resting below those lows 💧, where sell stops are positioned. Price is also reacting off a significant bullish order block 🧱 — a confluence area that could produce a strong reversal.

🎯 What to look for next:

Wait for a bullish break in market structure 🔁 to confirm a potential entry. If that occurs, consider a long setup with your stop loss below the swing low 🛑 and a 1:2 risk-to-reward target 🎯.

🚫 This is for educational purposes only and not financial advice.

NASDAQ 100 CFD

Top in Place? NASDAQ100 Signals Exhaustion After Incredible Run📈 The crazy run since April

NASDAQ100 has had a spectacular run since early April, when the index dipped to 16,300 amid rising tensions caused by Trump’s tax war. From that low, we’ve seen a mind-blowing rally of over 7,000 points, which translates to a 40% gain in just 4 months.

Such a rise is not just impressive— it’s overextended , especially by historical standards. Markets don’t move in straight lines forever, and this one might be showing signs of fatigue.

🕯️ Bearish signal at the top

Fast forward to this week: yesterday, the index marked a new all-time high at 23,700, but closed the day with a strong bearish engulfing candle — one that wipes out the gains of the previous 4 trading sessions.

This is not a small technical detail. Such candles, when appearing after an extended rally, often signal exhaustion and a potential shift in momentum.

❗ Top in place?

In my opinion, there's a high probability that a top has been set, at least temporarily. We might be looking at the beginning of a healthy correction, or even something more meaningful, depending on follow-through in the next sessions.

📉 Where to next?

The first major support to watch is the 22,200 level.

I expect that zone to be tested soon — and honestly, considering how much the index has gone up, this shouldn’t surprise anyone. It’s nothing more than a minor pullback, all things considered.

🧠 Stay smart!

When markets go vertical, it pays to stay disciplined and realistic. Tops rarely announce themselves, but when signals like this appear, it’s wise to listen.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

USNAS100 - Tech Weakness & Tariffs Drag NASDAQ LowerTariff Day Pressure Builds as Amazon Miss Weighs on Markets

Markets were hit by a wave of risk-off sentiment on Friday as renewed tariff headlines, weakness in pharma stocks, and a disappointing earnings report from Amazon clouded investor confidence. All this comes just ahead of the U.S. jobs report, which is expected to challenge the market's already diminished expectations for Fed rate cuts.

While macro markets appeared resilient earlier in the week, Wall Street futures and global equities turned cautious as sentiment deteriorated.

NASDAQ – Technical Outlook

The NASDAQ has dropped nearly 850 points from its recent all-time high of 23690, as anticipated in previous updates. The index remains under bearish pressure.

For today, the market is expected to remain sensitive due to recent macro and earnings-driven volatility.

If the price breaks below 22875, the decline is likely to extend toward 22710, with a deeper support zone at 22615.

To shift back to a bullish bias, the index must break and close above 23045 on the 1H chart.

Support Levels: 22875 • 22710 • 22615

Resistance Levels: 23140 • 23240 • 23320

Bias: Bearish while below 23045

Bullish confirmation: 1H close above 23045

US100The US100 (Nasdaq 100) has shown a dramatic shift in trend, forming what appears to be a large-scale bearish harmonic pattern or potential M-top structure. After reaching its peak in mid-2025, the index has entered a sharp downward trajectory, shedding significant value in a short span.

This chart raises a critical question for long-term investors and traders:

Are we witnessing the early phase of a prolonged bear market that could stretch into 2026 and beyond?

🔻 Key Observations:

Bearish structure developing with aggressive selling pressure.

Potential breakdown from long-term support trendlines.

Momentum suggests institutional risk-off behavior.

Stay alert for macroeconomic cues, interest rate policy, and earnings season signals. A break below 13,000 could confirm a deeper bear cycle

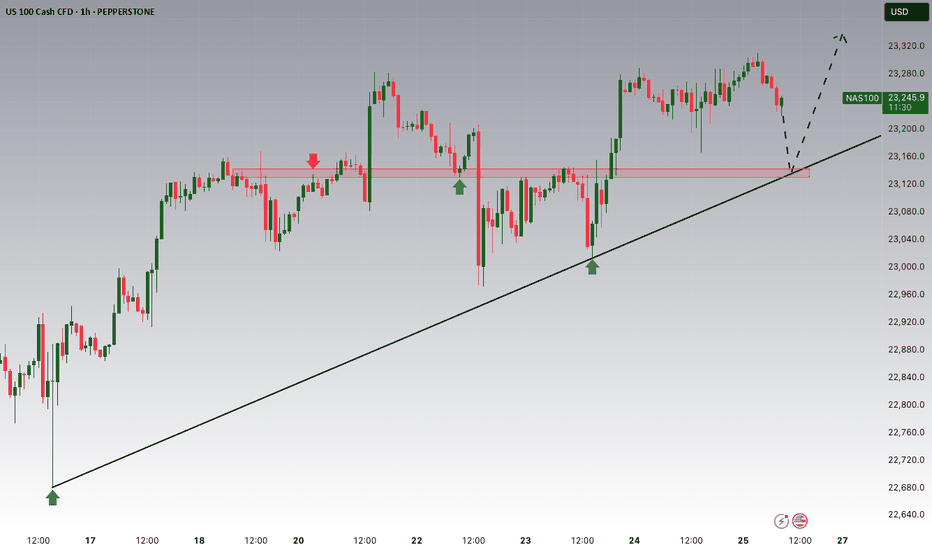

Fibonacci Retrace Strategy NAS100 Trade Idea📈 NASDAQ 100 (NAS100) is holding a strong bullish trend 🚀. After a weekend gap-up 🕳️➡️📈, price retraced back into the gap zone—exactly what you'd expect in a healthy trending market.

🔍 I'm applying my Fibonacci Expansion + Retrace Strategy 🔢, watching closely for a pullback into equilibrium ⚖️ within the previous price swing. That’s where I’ll be waiting for a bullish market structure break 🔓📊 to confirm my long bias.

🧠 Patience is key here—let the setup come to you.

📌 As always, this is not financial advice!

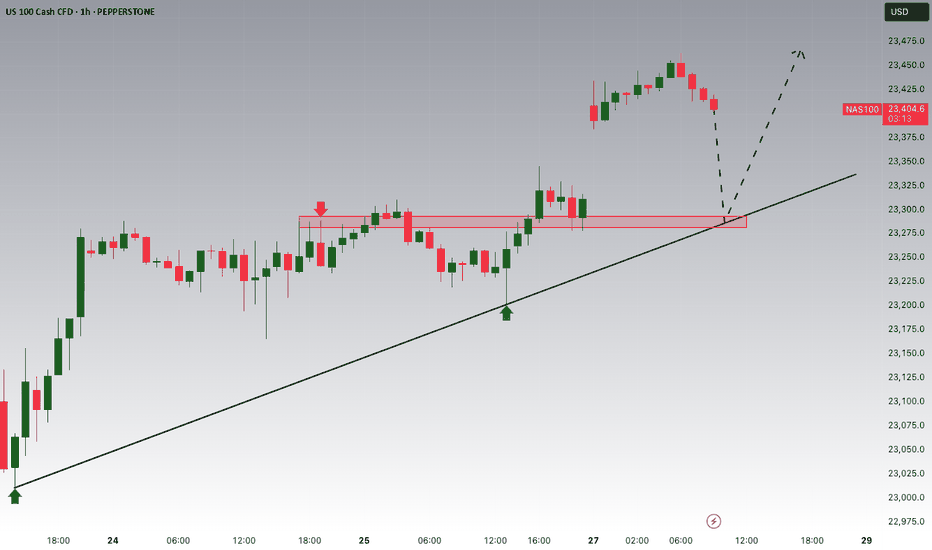

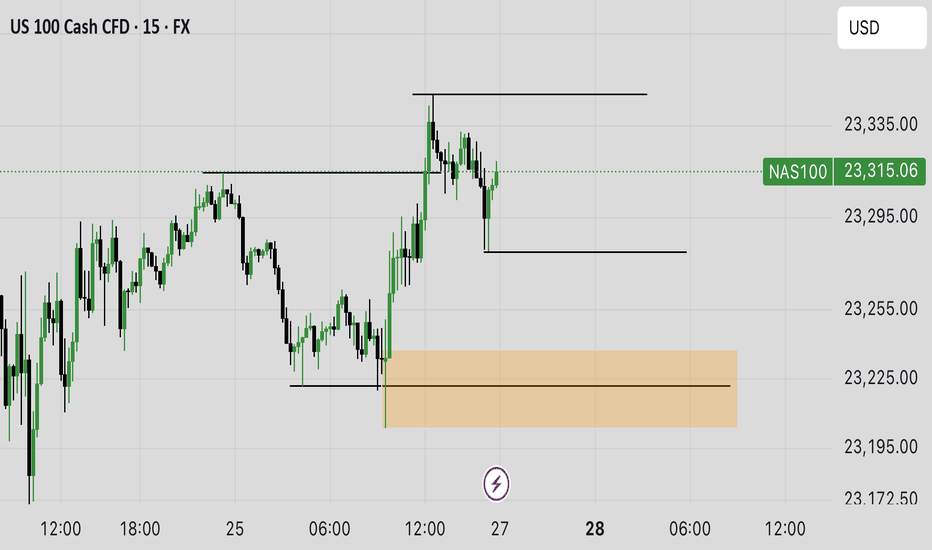

NASDAQ-Lets catch 250 Points togetherHello Fellow Traders,

Nasdaq has been wild since a time now. Today, I have spotted a rade to share with my fellow traders.

Yesterday closed with a good bullish candle. As the NY seesion has begun now, I am anticipating price to retrace to the highlighted breaker block that accurately aligns with an IFVG as well.

I am waiting for the price to fall into my area where I will monitor price's reaction, if we see signs of ejection from the highlighted areas, I wuld love to take a Buy Trade.

Entry= If rice enters the Breaker and IFVG and shows a good rejection.

SL= 23340

TP= Today's highs or 23700.

Manage your risk according toyour capital and only enter the trade if we happen to see a good rejection from the area. Be patient and don't hurry.

NASDAQ price dropAfter the Nasdaq price reaches around 23642.2, a historic drop will occur and the target is to drop to 16308.

Whatever happens at the highest price, the final destination is towards 16308.

I have identified the price levels in the middle of this expected drop that can cause the price to correct.

IG:NASDAQ

NAS100 - EXPECTING THE DUMPTeam, we got short well today with AUS200 - both target hit

we have set up the NAS entry , this is the entry price 23268 - 23200

STOP LOSS at 23100

Once it break above 23320 - bring stop loss to BE

Target 1 at 23320-60 - take 50%-70& partial

Target 2 at 23380-23400

LETS GO

NAS100 MAY FORM THE BEARISH HEAD AND SHOULDERS.NAS100 MAY FORM THE BEARISH HEAD AND SHOULDERS.

NAS100 has been trading sideways since the beginning of the week, forming local highs with lows staying at same price for the most part. The price seem to form the Head and Shoulders reversal pattern

What is a Head and Shoulders?

A Head and Shoulders pattern is a reversal chart pattern signaling a potential trend change. It consists of three peaks: two lower "shoulders" and a higher "head" in the middle, connected by a "neckline" (support level). A bullish (inverse) Head and Shoulders forms at a downtrend's end, signaling an uptrend; a bearish Head and Shoulders forms at an uptrend's end, signaling a downtrend.

Currently the SMA50 is pushing on NAS100 from above, while SMA200 is supporting the price. In case the SMA200 on 30-m minutes timeframe gets broken, we may see the decline towards 23,200.00 support level.

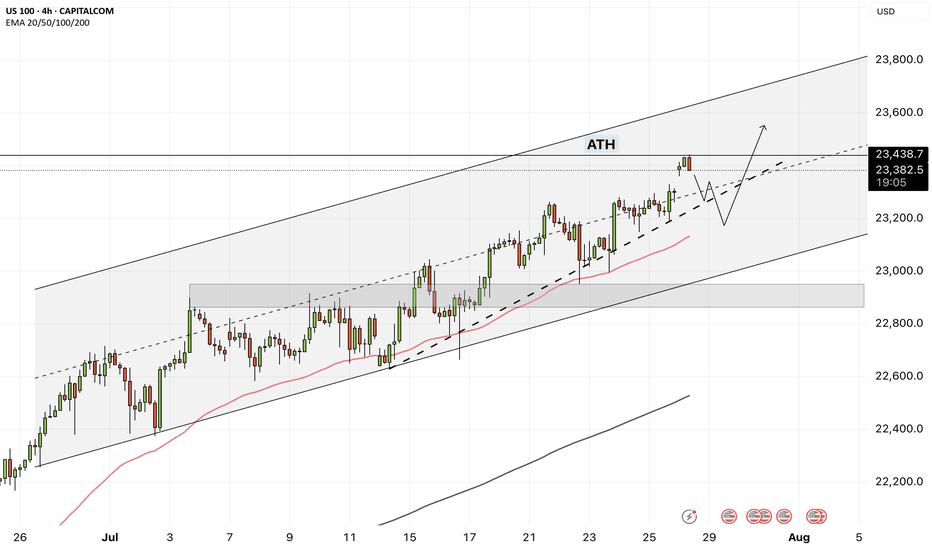

Nasdaq 100 Index Hits New Highs Ahead of Big Tech EarningsNasdaq 100 Index Hits New Highs Ahead of Big Tech Earnings

Earlier, we noted signs of optimism in the Nasdaq 100 index as the market anticipated earnings reports from major tech firms.

Now, companies such as Alphabet (GOOGL) and Tesla (TSLA) have already released their results (we previously covered their charts → here and here). Up next are the most highly anticipated earnings reports: this week, tech giants including Microsoft (MSFT), Amazon (AMZN), Meta Platforms (META), and Apple (AAPL) are set to publish their results. The combined market capitalisation of these four companies exceeds $11 trillion, and their reports could have a significant impact on a stock market that is already showing strong bullish sentiment:

→ The Nasdaq 100 index has climbed to an all-time high, surpassing the 23,400 mark.

→ The signing of trade agreements between the US and Europe (and earlier, Japan) has eased concerns about the negative impact of tariff barriers.

Technical Analysis of Nasdaq 100

The chart supports growing signs of optimism: earlier in July, the price remained within a rising channel (marked in blue). However, towards the end of the month, price action has begun to follow a steeper upward trajectory (marked in purple).

What could happen next? Much will depend on the earnings results and forward guidance from these tech giants.

On the one hand, continued enthusiasm around AI adoption could accelerate further growth. The stronger the optimism, the more fuel it may add to discussions around a potential bubble — with some analysts already drawing parallels to the dot-com era of the early 2000s.

On the other hand, earnings could temper market excitement and prompt a correction. For example, the index may retreat to the support level around 23,020, which is reinforced by the lower boundary of the blue trend channel.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

NAS100 - How will the stock market react to the FOMC meeting?!The index is trading above the EMA200 and EMA50 on the four-hour timeframe and is trading in its ascending channel. The target for this move will be the ceiling of the channel, but if it corrects towards the indicated support area, you can buy Nasdaq with better reward-risk.

As signs of easing global trade tensions begin to emerge, the Federal Open Market Committee (FOMC) is scheduled to meet this week. Analysts widely expect the Fed to hold interest rates steady for a fifth consecutive time. This anticipated decision comes as the U.S. President continues to push for rate cuts, persistently pressuring the Fed to adopt a more accommodative monetary stance.

So far, the Federal Reserve has kept its benchmark rate within a range of 4.25% to 4.5%. While some officials project two cuts by the end of the year, markets are waiting for the Fed’s patience to run out. According to the CME Group’s FedWatch tool, investors have priced in a 62% chance of a rate cut in the September meeting. By then, the Fed will have access to the July and August employment reports—key indicators of whether the labor market is weakening or remains resilient.

The upcoming week marks the peak of Q2 earnings season, with 37% of S&P 500 companies reporting results, including four major tech firms. In parallel, the August 1st tariff deadline for the EU and other countries is approaching, while legal challenges over existing tariffs remain ongoing.

According to a report by The Wall Street Journal, many large U.S. corporations have so far absorbed the bulk of tariff-related costs without passing them on to consumers. This strategy aims to maintain market share and avoid drawing criticism from President Trump. However, the question remains—how long can this continue?

Examples from the report include:

• General Motors paid over $1 billion in tariffs in Q2 alone without announcing any price hikes.

• Nike expects a $1 billion hit from tariffs this fiscal year and is planning price increases.

• Hasbro is working on a combination of price hikes and cost cuts to offset $60 million in tariff impacts.

• Walmart has made slight pricing adjustments (e.g., bananas rising from $0.50 to $0.54) and managed pressure through inventory reductions.

This week is shaping up to be one of the busiest on the economic calendar in recent months. A flood of key data on growth, inflation, and employment, alongside three major interest rate decisions, has markets on high alert.

On Tuesday, attention will turn to two significant reports: the Job Openings and Labor Turnover Survey (JOLTS) and the U.S. Consumer Confidence Index for July. These metrics will offer a clearer view of labor market dynamics and household sentiment heading into critical monetary policy decisions.

The most anticipated day is Wednesday. That day brings the ADP private payrolls report, the first estimate of Q2 GDP, and pending home sales data. Additionally, both the Bank of Canada and the Federal Reserve will announce rate decisions—events with the potential to simultaneously steer global market trajectories.

On Thursday, the July Personal Consumption Expenditures (PCE) price index will be released—a key inflation gauge closely monitored by the Fed. Weekly jobless claims data will also be published that day.

The week concludes Friday with two heavyweight economic indicators: July’s Non-Farm Payrolls (NFP) report, a crucial input for Fed policy decisions, and the ISM Manufacturing PMI, which offers insights into the health of the real economy.

Some economists argue that a September rate cut may be premature, and even suggest that no rate changes might occur in 2025. Analysts expect Fed Chair Jerome Powell to reiterate a data-dependent stance, consistent with previous meetings.

Still, beyond political dynamics, the July meeting holds independent significance.The Fed’s internal policy tone is gradually leaning more dovish, and subtle signals of this shift may emerge in the final statement. Given that only one meeting remains before September, if policymakers are leaning toward a rate cut then, it’s critical that the groundwork for such communication be laid now.

Beyond the Chart – NAS100 Through Technicals & Fundamentals📊 CAPITALCOM:US100 Analysis

Today, NAS100 opened with a huge gap up following former President Trump’s announcement that the U.S. has officially reached a trade agreement with the European Union.

🕳️ After price rejected the gap zone, and volume gets low low. I’m now looking for a potential test of the 23,540 level.

💼 With Q2 earnings season kicking off, stock-moving news will be hitting fast. While retail traders might scramble to catch up, smart money is already positioning for surprise earnings beats.

Stay sharp, this week could set the tone for the next major move.

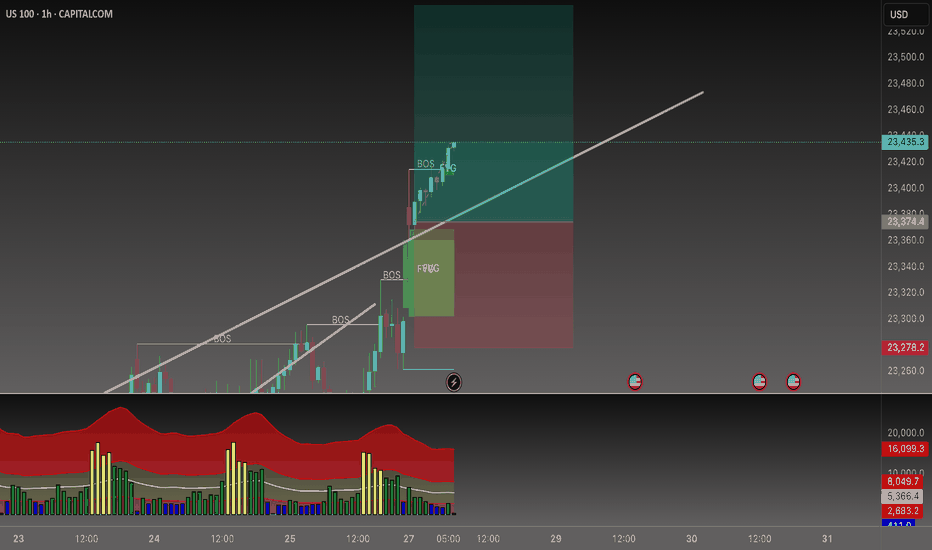

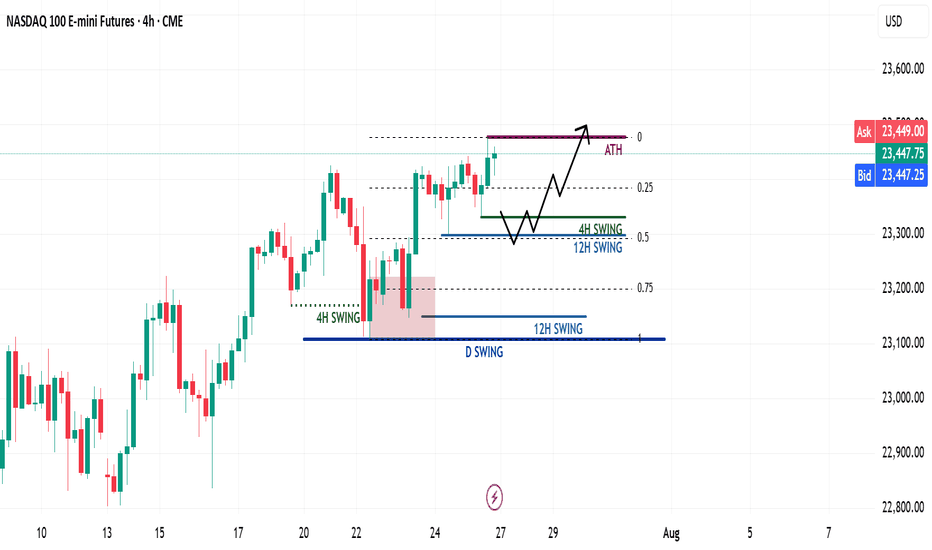

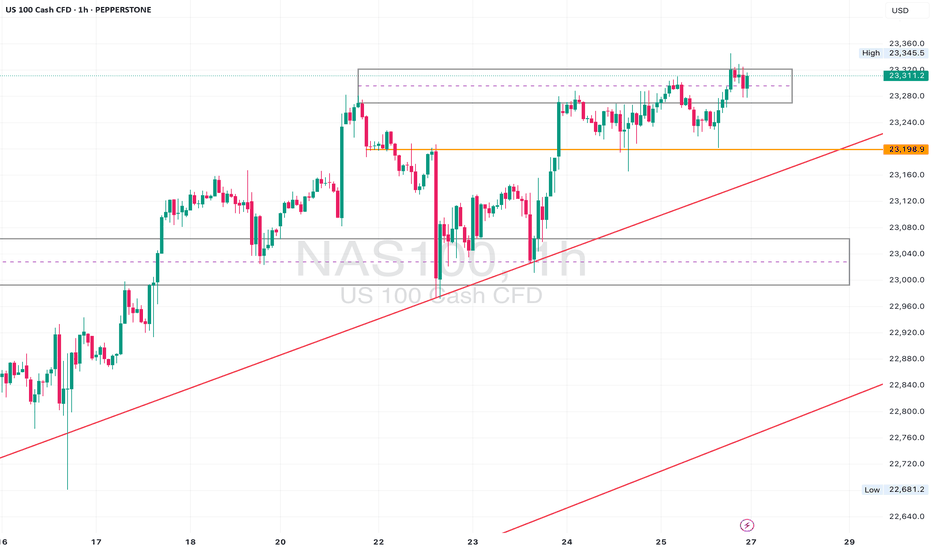

NQ Weekly Recap & Gameplan – 27.07.2025🧭 Market Sentiment

The overall sentiment remains bullish, supported by:

• Lower inflation data

• Trump’s policy shift toward aggressive rate cuts

This creates a strong risk-on environment across U.S. indices.

🔙 Previous Week Recap

• NQ continued its price discovery phase

• Price swept 4H swing liquidity and triggered a market structure shift

• A new 1H demand zone was formed after MSS

• Price revisited the 1H demand and launched toward new all-time highs (ATH)

• While I anticipated a deeper retracement, ES provided the cleaner pullback

• I executed longs on both ES and NQ using SMT divergence (ICT SMT concept)

📊 Technical Analysis

My bias remains bullish as long as the higher timeframe structure holds.

For the upcoming week:

• Watching for either the 4H or 12H swing high to get swept

• Ideally, a retracement toward the 0.5 Fib level, which aligns with my bullish discount zone

• A clean liquidity sweep into this zone could act as a launchpad for the next leg higher

⚙️ Trade Setup & Execution Plan

Entry Strategy:

• Wait for a new 1H–4H Market Structure Shift

• Identify the new demand zone post-MSS

• Look for price to return to the zone for a long opportunity with LTF confirmation

Trade Management:

🎯 Target: New ATH

⛔ Stoploss: Swing low of the 1H–4H demand zone

📌 Chart will include Fib levels, MSS zones, and execution trigger areas.

Let me know your thoughts or share your plan below.

Happy trading!

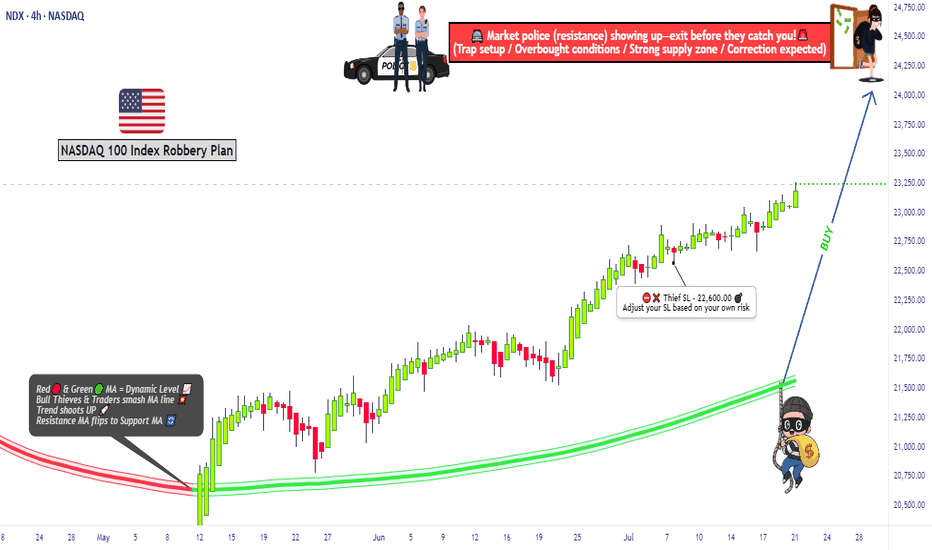

"NASDAQ 100 Heist – Scalp, Swing, or Hold? (Full Plan)🔥 NASDAQ 100 HEIST PLAN – BULLISH LOOT AWAITS! 🔥

🚨 Attention Market Robbers & Money Makers! 🚨

(Swing/Day Trade Strategy – High-Risk, High-Reward Play)

🎯 Mission Objective: Loot the NDX100/US100 (NASDAQ 100) Like a Pro!

Based on Thief Trading’s ruthless technical & fundamental analysis, we’re executing a bullish heist—targeting the Red Zone (high-risk, high-reward area).

⚠️ WARNING: Overbought market, consolidation zone, potential bear traps—weak bears may get slaughtered! Strong hands only!

🔐 ENTRY: The Vault is OPEN!

"SWIPE THE BULLISH LOOT!" – Any price is a steal, but smart thieves use:

Buy Limit Orders (15m-30m TF) near recent swing lows/highs.

DCA/Layering Strategy – Multiple limit orders for max loot.

Breakout Confirmation – Don’t jump in early; wait for the real move!

🛑 STOP LOSS: Protect Your Stash!

Thief’s SL Rule: Nearest 4H swing low (22,600) – WICK LEVEL ONLY!

DO NOT place SL before breakout! (Patience = Profit.)

Adjust SL based on risk, lot size, and number of orders.

🎯 TARGETS: Escape Before the Cops Arrive!

Main Take-Profit: 24,400 (or exit early if momentum fades).

Scalpers: Longs ONLY! Use trailing SL to lock in profits.

Swing Traders: Ride the wave like a true market pirate!

📰 FUNDAMENTAL BACKUP: Why This Heist Will Work

Bullish momentum in NDX100 driven by:

Macro trends (Fed, inflation, tech earnings).

COT Report & Institutional positioning.

Geopolitical & Sentiment Shifts.

Intermarket correlations (USD, Bonds, Tech Sector).

(Stay updated—markets change FAST!)

⚠️ TRADING ALERT: News = Danger Zone!

Avoid new trades during high-impact news.

Trailing SL = Your best friend.

Lock profits early if volatility spikes!

💥 BOOST THIS HEIST! 💥

👉 Hit LIKE & FOLLOW to strengthen our robbery crew!

🚀 More heists coming soon—stay tuned, thieves! 🚀

NAS100 Retesting Breakout – Eyes on 23170 for Bullish PushDaily Analysis:

Price is testing the upper boundary of the long-term ascending channel. Structure is still bullish with no major breaks of support. If momentum holds, we could extend toward the channel top.

4H Analysis:

Retesting breakout structure. Support is forming around 23000–23050. Bullish momentum remains valid unless price closes below this zone.

1H Analysis:

Micro-breakout confirmed with bullish impulse above 23120. If 23170 holds, continuation toward 23280–23320 is likely.

Confirmation & Entry:

Watch for continuation above 23170. SL below 23080. TP: 23280+

Use caution if 23000 breaks — this would weaken short-term bias.

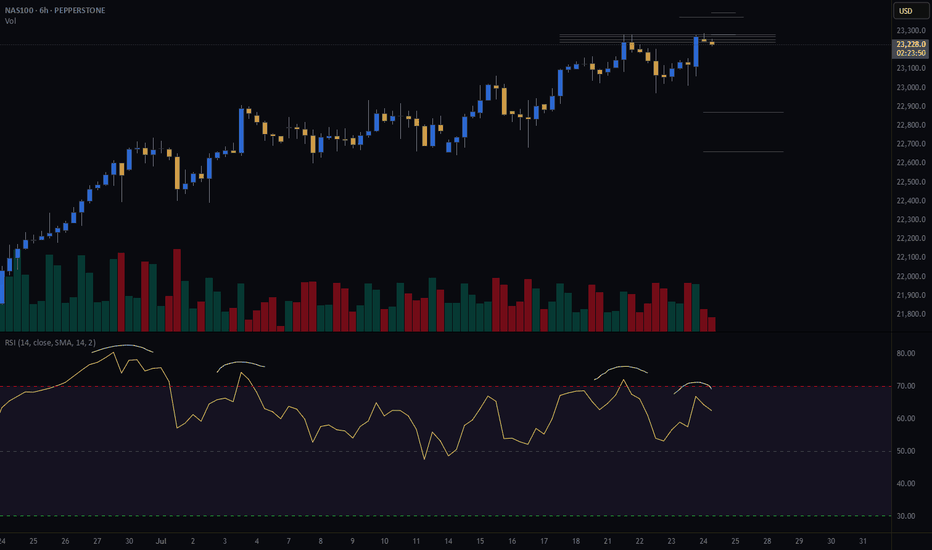

NASDAQ (CASH100) SHORT - double top H6Risk/reward = 4.3

Entry price = 23 282

Stop loss price = 23 398

Take profit level 1 (50%) = 22 871

Take profit level 2 (50%) = 22 663

If current H6 goes back into range, I will open short position.

All variables on checklist have been met.

I was out last night so I missed my initial entry. Hoping for a second chance.

Hopefully this short works because the last few higher time frame short setups have failed, although because of exit plan I have made very little losses.