Nasdaq Intraday Review – Friday 5 Jan 2024I trade Nasdaq intraday exclusively

Trading in GMT time zone

Sharing my post day review & analysis in case it can help you :)

Did my analysis at +- 5:20am GMT

Usually, I am looking exclusively for a buy because Nasdaq was bullish overall and trading with the trend is always a good idea.

I believe this bearish pushdown is a big buy retracement on the D TF and not a trend reversal.

During my analysis, I noted the following:

Today was NFP. I usually don’t like trading during the day of a big news event. Often times markets are muted during the day with the true volatility coming with the news event.

I entered a buy one minute before NFP came out – Confirmations:

Market Pattern – Price had already travelled down the full distance equal to the height of the D double top. In theory, it is at this point that often market will reverse to test the neckline of the pattern.

Fib: Price was just above the 0.618 fib level of the D TF (a very high and strong TF)

S&R: 4H 200 EMA

My NFP buy was at A.

As NFP hit I was expecting a big reaction. However, market seemed quite unreactive.

For 10min price was sliding down.

I was very surprised and thought to myself that if NFP can’t turn this bearish retracement around, then price will fall a long way still.

I have been taking small losses in the past few days, attempting to catch the correct reversal point. But these have been quite small losses and overall, I am not too sad about them because my risk management was pretty good.

But in this moment, during the 10min after NFP, fear took over and I was not able to think straight.

I didn’t want to take further unnecessary losses and I was fearful that market would slip down because even NFP couldn’t introduce bulls into the game.

So, I closed at B. (right on the 0.618 D fib level).

As I was writing this trade in my trade journal and I was documenting the reasons for entering the trade, I thought to myself that these are such strong confirmations and that I didn’t give my trade enough breathing room. I realized then I had been too quick to react (out of fear) and should have waited to see how the candles would react to the 0.618 fib level.

So basically, keeping my trade journal highlighted to me that I had acted in fear and not rationally. I took a minute to think clearly what I wanted to do and knew I was prepared to put some money on the table for those strong confirmations, so I entered a buy at C.

Overall, bulls pushed up from B. by 2400 pips – this could be the start of the bullish trend again, especially as we saw the day close with a green doji candle on the D TF.

When I saw the weakness on the 15min TF after price had touched the 4H EMA, I closed half my position at D. I secured my remaining half position at entry and was hoping for market to continue pushing up to at least test the neckline of the double top on the D TF. But alas, we did not get there on Friday and candles spiked down to take me out at entry.

But felt really good to make some pips (950 pips) for the day!

Dealing effectively with emotions is one of the hardest parts of trading. Today, fear came into the game for me, but happy that my good habit of trade journaling helped me recognize this and that I still came out with some pips!

What could I have done differently:

Controlled my emotions better.

Hope you had a good trading day!

Catch ya on Monday!

TF = timeframe

TP = take profit

1H = 1 hour

4H = 4 hour

D = day

W = week

M = month

S&R = support and resistance

EMA = exponential moving average

Nasdaq100

NASDAQ Elliott Wave Analysis for Friday 05/01/2024We are probably working on a wave (3) in the higher time frame. Wave 1 of wave (3) could be ongoing or we might see a relatively short wave (3). This is unclear for now. In the lower time frame, we can still expect a wave ((v)) up. The primary scenario suggests that we are now working on a wave ((iv)) as an expanded flat.

End of impulse pattern? or trend extensionHello there,

I hope you're having a great start to the new year. I wish you all the best in your trading ventures and a happy new year with your loved ones.

I'm a fan of the Elliott wave principle, which I find interesting and useful for market analysis. I've developed my analytical approach by combining this principle with my personal experience and considering various scenarios that are likely to occur in the market.

Although I'm going to share my analysis with you, please note that I won't be providing a buy or sell signal. My goal is to share my unbiased analysis so that you can use it as a guide to make an informed decision.

To give you confidence in my analysis, I'll always share my previous analysis from the same market so that you can compare. All the details of my analysis are clearly labeled, making it easy for you to understand.

I hope my analysis will be useful to you in your business journey, and I wish you the best.

I'm waiting to hear from you. Finally, I'd like to remind you that like-mindedness and support, comments, and likes are the most important pillars of progress, like support points in the financial markets. They give me the energy to continue and share more ideas with you.

Sincerely,

Nasdaq Intraday Review – Thursday 4 Jan 2024I trade Nasdaq intraday exclusively

Trading in GMT time zone

Sharing my post day review & analysis in case it can help you :)

Did my analysis at +- 5:20am GMT

Usually, I am looking exclusively for a buy because Nasdaq was bullish overall and trading with the trend is always a good idea.

Bears have totally dominated, with a push down of +- 7000 pips. I believe this is a big buy retracement on the D TF and am waiting for the reversal.

During my analysis, I noted the following:

A double bottom formed on the 1H TF (marked in purple lines).

Market pushed up to break the neckline of the double bottom & temporary down trend line (marked in light blue).

I entered a buy at A. – Confirmations:

- Market Pattern: This was the 1st time that a double bottom formed on the 1H TF since the bearish retracement, indicating the growing strength of the buyers. Entered at break of the neckline

- Fib: There was no buy fib level but there was some distance to travel to the 0.382 sell retracement (drawn at time I entered the buy and not as indicated on the chart now because swing low changed) so I felt there was enough distance for market to travel and secure my position at entry.

- Candle sticks: Strong 1H momentum candle + first time we saw 2 green candles in a row close on the 4H TF, again indicating the growing strength of bulls.

- S&R: Strong weekly and monthly support and resistance zone

It was a risky entry because the pivot + 1H EMA were just above pushing down, so I entered 50% of my usual position size.

Mental stop was place at thick pink line.

1H EMA proved too strong, and bulls were unable to break through. Took a 370 pip loss on this entry.

Not sad about it because I feel it was a valid entry and worth putting some money on the table for.

Bears push down further. Towards market open price was approaching the 4H 200 EMA (a very strong dynamic support zone) + the profit target of the D TF double top (marked by C. in bottom left corner – i.e., market will generally move the same distance as the height of the market pattern).

When a double bottom formed on the 15min TF in this zone, I was very interested to enter a buy.

However, just yesterday I said in my post “It’s ridiculous of me to think that its enough confirmation to enter a buy on a 15min TF (a very small TF). A 6000 pip bearish move will not come to a screaming halt on a 15min double bottom.”

The difference now was that this pattern was forming in an area of confluence as opposed to just a random 15min double bottom anywhere in the charts.

I chose to wait for the re-test of the neckline and entered a buy at B. as market was moving up again – Confirmations:

- Market pattern: retest of broken neckline of a double bottom of the 15min chart

- Fib: in the 0.50 fib zone on a D TF

- Candlestick: inverted green hammer candlestick on the 1H (a potential bullish reversal signal)

- S&R: in the zone of the 4H 200 EMA (a very strong EMA)

- Trendline: none

Mental stop was placed at thick pink line.

I also placed a buy limit at the thick pink line as I really believed a bullish bounced would occur from this zone.

Finally hit a nice buy with market moving up 1000 pips from my entry.

Wanting to see a strong move up, I secured my position at entry and am trading risk free.

What could I have done differently:

I should have taken profit (closed a portion of my position at D.)

D. represents the 5th time market tried to break this zone and on seeing weakness on the 15min TF, I should have secured some profit.

Good luck if you are still trading!

TF = timeframe

TP = take profit

1H = 1 hour

4H = 4 hour

D = day

W = week

M = month

S&R = support and resistance

EMA = exponential moving average

US100 16396.9 +0.18 % MULTI TIME-FRAMES 🐮🐻Good Day Traders

Here's a bit of a dive into the NASDAQ Multi time-frames out look.

WEEKLY

* Saw a sweep of some external range liquidity.

* Strong Momentum Shift & a CHANGE IN STATE OF DELIVERY

DAILY

www.tradingview.com

* The overall still bullish NASDAQ MIGHT just see some retracement into discount areas before continuation.

* NASDAQ has a shift in the momentum towards bearish side in the form of Market structure shift on the daily time-frame.

* looking for a possible bullish Day into Internal range Liquidity before continuation with the bears.

* Retracement into internal liquidity would be great for possible shorts in coming weeks

4H

www.tradingview.com

* A bullish day highly favored today

* looking for mitigations of bearish PD ARRAYS / INTERNAL LQ ABOVE BEFORE continuation.

* Momentum post-ASIAN SESSION indicative as well

1H

www.tradingview.com

* Ext liquidity was taken WED NY-SESSION

* just respected bullish FVG ON the hr.

* A shift above the fractal High will indicate that we might close the week bullish

lets see how it goes.

IF THIS IDEA ASSISTS IN ANY OR IF YOU LIKE THIS ONE

SMASH THAT LIKE BUTTON & LEAVE A COMMENT.

ALWAYS APPRECIATED

____________________________________________________________________________________________________________________

9 AM ZAR TIME

ICT SILVER BULLET EXECUTION

Here is today's SILVER BULLET set-up which presented multiple entries.

1. Swept Asian highs and internal range liquidity

2. Aggressive momentum into the range.

3. 1st entry was an inversion FVG + BALANCE PRICE RANGE

4. 2ND entry classic ICT 2022 ENTRY MODEL

5. 3RD ENTRY REJECTION AT THE FVG

Target > 1hr +FVG

www.tradingview.com

* Kindly follow your entry rules on entries & stops. |* Some of The idea's may be predictive yet are not financial advice or signals. | *Trading plans can change at anytime reactive to the market. | * Many stars must align with the plan before executing the trade, kindly follow your rules & RISK MANAGEMENT.

_____________________________________________________________________________________________________________________

| * ENTRY & SL -KINDLY FOLLOW YOUR RULES | * RISK-MANAGEMENT | *PERIOD - I TAKE MY TRADES ON A INTRA DAY SESSIONS BASIS THIS IS NOT FINACIAL ADVICE TO EXCECUTE ❤

LOVELY TRADING WEEK TO YOU!

Traders Adjust Their Expectations for Fed ActionFrom the beginning of November to the end of December 2023, the dollar index futures price fell by approximately 5.5%, according to the CME exchange. The weakening of the USD was caused by the sentiment of traders who expected the Fed to cut interest rates in March. As a result of the sentiment that prevailed at the end of 2023, stock indices, gold (setting a historical maximum on December 4) and cryptocurrencies rose.

However, the start of 2024 indicated a sharp change in sentiment, with the dollar index futures price rising more than 1% during the January 3-4 sessions.

This can be interpreted as:

→ during the pre-holiday period, there was a certain emotional component that helped to look into the future with optimism;

→ after the end of the holidays, market participants adjusted their expectations regarding the easing of the Fed's actions.

Data released yesterday showed that there is no clear indication that the Fed may start cutting rates, as its members still see the need for policy to remain restrictive for some time.

That is, in the first days of 2024, there was a correction of bullish sentiment at the end of 2023. In the cryptocurrency market, which is characterised by a high degree of margin (opening positions with borrowed funds), the correction turned into an avalanche of sales — the BTC/USD rate dropped rapidly to the level of $41,000, forming a false bullish breakout of the consolidation zone at the end of 2023, which we wrote about yesterday .

We also note the decline in the NASDAQ technology stock index, which, according to Bloomberg, showed the worst start to the year since 2001 (the time of the dot-com crash).

The NASDAQ-100 chart shows that:

→ the stock index price is still within the uptrend (shown in blue);

→ the price was within the intermediate correction (shown in red), forming a flag pattern;

→ the psychological level of 17,000 served as resistance.

The price may be supported by:

→ the psychological level of 16,000, which was broken by the bulls after some consolidation in the second half of December;

→ the median line of the ascending channel;

→ a level of 50% of the A-B growth impulse, located around the level of 15,500.

Price action near these levels (if reached) will provide more valuable information about how much sentiment has changed since the bullish end to 2023.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

At FXOpen UK and FXOpen AU, Cryptocurrency CFDs are only available for trading by those clients categorised as Professional clients under FCA Rules and Professional clients under ASIC Rules, respectively. They are not available for trading by Retail clients.

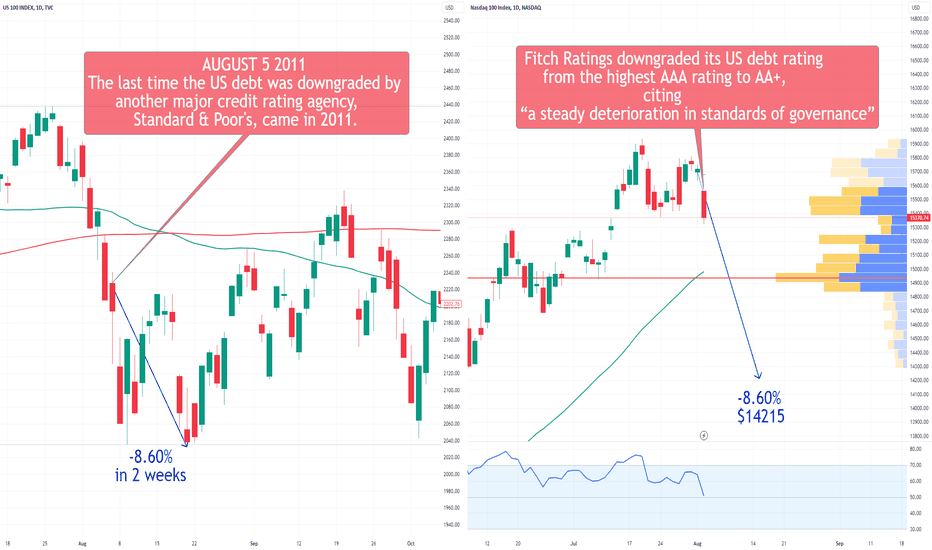

NDX Nasdaq100 Fell 8.60% After the Last U.S. Credit Downgradeitch Ratings downgraded the US debt rating on Tuesday, moving it from the highest AAA rating to AA+, citing concerns about "a steady deterioration in standards of governance."

This downgrade happened following last-minute negotiations among lawmakers to reach a debt ceiling deal earlier this year, raising the risk of the nation's first default.

In the past, a similar credit downgrade had a significant impact on the NDX, which fell 8.60% in just two weeks. Back in August 5, 2011, Standard & Poor's, one of the major credit rating firms, downgraded U.S. debt after another major debt ceiling battle.

Jim Reid, a strategist at Deutsche Bank, pointed out that while the news of Standard & Poor's being the first to downgrade 12 years ago was substantial, investors had already adjusted their perceptions of the world's most important bond market, recognizing that it was no longer a pure AAA. Nonetheless, Fitch's recent decision to downgrade is still significant.

In the current scenario, the U.S. 10-year Treasury yield has risen to 4.15%, reaching its highest level since November 2022.

As for the price target for this year, it remains at $16650, as shown in the chart below:

Looking forward to read your opinion about it!

QQQ Nasdaq 100 ETF Price Prediction for 2024This was my price prediction for QQQ in 2023. I was bullish, but not enough:

Considerations about 2024:

In the July 2023 meeting, the FOMC chose to raise interest rates to a range of 5.25%–5.50%, marking the 11th rate hike in the current cycle aimed at mitigating heightened inflation. The prevailing consensus among market experts hints at a potential shift in strategy, suggesting that the Fed might commence rate cuts later in 2024 as inflation gradually aligns with the Fed's 2% target. Statistically, historical data indicates that approximately 11 months after the cessation of interest rate increases, a recession tends to manifest. This pattern places us around June 2024, aligning with my prediction of a dip in the QQQ to approximately $370.

Given that 2024 is an election year, there's an additional layer of complexity in predicting market behavior. Despite the anticipated mid-year dip, my inclination is that the QQQ will conclude the year on a bullish note. This optimistic outlook hints at the onset of a 3-5 year AI bubble cycle, with the QQQ boasting a year-end price target of $460.

The integration of artificial intelligence into various sectors is expected to catalyze market growth and innovation, propelling the QQQ to new heights by the close of 2024.

Corrective trend continuation pattern? The end of the impulse paHello there,

I hope you're having a great start to the new year. I wish you all the best in your trading ventures and a happy new year with your loved ones.

I'm a fan of the Elliott wave principle, which I find interesting and useful for market analysis. I've developed my analytical approach by combining this principle with my personal experience and considering various scenarios that are likely to occur in the market.

Although I'm going to share my analysis with you, please note that I won't be providing a buy or sell signal. My goal is to share my unbiased analysis so that you can use it as a guide to make an informed decision.

To give you confidence in my analysis, I'll always share my previous analysis from the same market so that you can compare. All the details of my analysis are clearly labeled, making it easy for you to understand.

I hope my analysis will be useful to you in your business journey, and I wish you the best.

I'm waiting to hear from you. Finally, I'd like to remind you that like-mindedness and support, comments, and likes are the most important pillars of progress, like support points in the financial markets. They give me the energy to continue and share more ideas with you.

Sincerely,

Nasdaq Intraday Review – Wednesday 3 Jan 2024I trade Nasdaq intraday exclusively

Trading in GMT time zone

Sharing my post day review & analysis in case it can help you :)

Did my analysis at +- 5:20am GMT

Usually, I am looking exclusively for a buy because Nasdaq was bullish overall and trading with the trend is always a good idea.

But bears have totally dominated, with a push down of nearly 6000 pips.

This could be a total trend reversal i.e. we move into a bear market. Or it could be a big retracement on the D TF (from swing low at A. to swing high at B.)

Retracement levels marked with orange text.

I believe it will ultimately be a retracement.

A huge double top formed previously on the D TF (marked in pink). Market usually moves the same distance as the height of the pattern after the neckline is broken (marked by the pink vertical line). Yesterday we saw the D candle close below the neckline effectively breaking the neckline.

So far today, the D EMA and D 0.382 retracement level has not been enough to stop the bears, and judging by the pink vertical line, market could still fall some way.

I entered a small buy (10% of my usual position size) on a double bottom that formed on the 15min TM but closed soon after.

What could I have done differently:

It’s ridiculous of me to think that it's enough confirmation to enter a buy on a 15min TF (a very small TF).

A 6000 pip bearish move will not come to a screaming halt on a 15min double bottom. There will be a double bottom or other market pattern formed on a much larger TF.

Other than that, I just observed the market today. We are in a retracement zone….so not changing my bias to bearish until I can rule out a bull retracement.

Learnt a lot from these past few days. My biggest lesson was the power and strength of double tops forming on multiple timeframes at the same time - as we saw today again (double top on 1H and 4H).

If I had to enter a sell today, it would have been at C. (for an aggressive entry (0.618 sell fib level + respecting the 30 min EMA)) or at D. (break of the neckline of the double top).

Good luck if you are still trading!

TF = timeframe

TP = take profit

1H = 1 hour

4H = 4 hour

D = day

W = week

M = month

S&R = support and resistance

EMA = exponential moving average

NASDAQ Elliott Wave Analysis for Thursday 04/01/2024We are probably working on a wave (3) in the higher time frame. Wave 1 of wave (3) could be ongoing or we might see a relatively short wave (3). This is unclear for now. In the lower time frame, we can still expect a wave ((v)) up. The primary scenario suggests that we are now working on a wave ((iv)) as an expanded flat.

TARGET REACHED for Nasdaq at 16,956 now what?Nasdaq finally reached our first target of 16,956.

The price then started off on a bad note in 2024.

The USD is starting to strengthen again, which brings down the general markets.

So right now, there is no definitive price analysis for the Nasdaq.

We can only expect a form of consolidation to create the next pattern before it chooses a direction.

SO right now we are Neutral with a slight short term bearish tinge to it.

Nasdaq Intraday Review – Tuesday 2 Jan 2024I trade Nasdaq intraday exclusively

Trading in GMT time zone

Sharing my post day review & analysis in case it can help you :)

Did my analysis at +- 5:20am GMT

Usually, I am looking exclusively for a buy because Nasdaq was bullish overall and trading with the trend is always a good idea.

But I was considering just observing the market today as there is a fully formed Double top on a high TF (4H) + two red D candle closes + Nasdaq all-time highs.

Bears have just been waiting for the sell at all-time highs, but bulls have proven to be very strong over the last two months.

As the morning progressed, two double tops were forming on the 1H and 30min TF.

However, when a double bottom formed, I entered a small buy at A. – Confirmations:

- Market Pattern: Double bottom on the 1H TF. I entered my buy on the break of the neckline on the 30min TF

- Trend line: Break of the temporary down trend line (marked in blue)

- Fib: Double bottom formed at D 0.382 retracement level

- Candle sticks: Long wick candles on the 4H TF

Entered a position which is 20% of my usual position size, as I knew this was a risky entry (all EMA's + pivot point above my buy pushing down).

Set a tight mental stop loss, marked by the thick pink line. If candles started closing below this point then neckline of the 1H double bottom was broken and market would sell.

Bears pushed down and I took a 250 pips loss.

Entered a buy at B. – Confirmations:

S&R: Strong D level support and resistance

S&R: D 20 EMA was at this level

Fib: Bigger picture 0.382 D fib level

I knew there should at least be a bounce at this level and I entered a small buy.

I secured at entry after the market was +-250 pips up from my position, so I was trading risk free. Ultimately, market moved 850pips up from my position.

I was expecting a bigger move up to at least the 30min EMA but market turned around quite unexpectedly (for me at least) and I was out at entry. This is also the time of day that I am not in front of my trading screens and I was monitoring periodically on my phone.

What could I have done differently:

I could have jumped on the sell train, but generally I don’t like to flip flop between biases. I have lost a lot of money in doing that and trading with the overall trend has become part of my trading rules. This massive bearish move may be a bigger TF retracement or it may be a trend reversal.

Let’s see what the market has in store for us today.

Hope you caught the sell!

TF = timeframe

TP = take profit

1H = 1 hour

4H = 4 hour

D = day

W = week

M = month

S&R = support and resistance

EMA = exponential moving average

Nasdaq - First Quarter Might Be Red➡️Hello Traders, welcome to today's analysis of Nasdaq.

--------

➡️I will only take a trade if all of the rules of my strategy are satisfied.

➡️Consider hitting that like button for more free, daily analysis. Your support means a lot!

--------

➡️Let me know in the comment section below if you have any questions.

➡️Keep your long term vision.

It will happen if the corrective pattern is wave degree.Hello there,

I hope you're having a great start to the new year. I wish you all the best in your trading ventures and a happy new year with your loved ones.

I'm a fan of the Elliott wave principle, which I find interesting and useful for market analysis. I've developed my analytical approach by combining this principle with my personal experience and considering various scenarios that are likely to occur in the market.

Although I'm going to share my analysis with you, please note that I won't be providing a buy or sell signal. My goal is to share my unbiased analysis so that you can use it as a guide to make an informed decision.

To give you confidence in my analysis, I'll always share my previous analysis from the same market so that you can compare. All the details of my analysis are clearly labeled, making it easy for you to understand.

I hope my analysis will be useful to you in your business journey, and I wish you the best.

I'm waiting to hear from you. Finally, I'd like to remind you that like-mindedness and support, comments, and likes are the most important pillars of progress, like support points in the financial markets. They give me the energy to continue and share more ideas with you.

Sincerely,

US Equities 2024 OutlookCME: E-Mini S&P ( CME_MINI:ES1! ), E-Mini Nasdaq ( CME_MINI:NQ1! )

Stock investors around the world had a banner year in 2023. Of the ten major stock market indexes I monitor, eight delivered solid 1-year returns.

• North America: S&P 500, +23.9%; Nasdaq Composite, +53.6%;

• South America: Bovespa (Brazil), +22.3%;

• Europe: FTSE (UK), +3.0%; Stoxx (Germany), +11.3%;

• Asia: Nikkei (Japan), +28.2%; Kospi (Korea), +18.7%; Nifty (India), +19.5%;

• China: SSE (Shanghai), -3.2%; Hang Seng (HK), -13.7%.

In this second installment of new year outlook for major asset classes, I will discuss what opportunities may lay ahead for US stocks. Subsequent writings will cover Energy, Agricultural commodities, Interest Rates, Forex, and Cryptocurrencies.

FYI: The last writing was a year-end review for metal commodities – Gold, Copper, and Aluminum. If you haven’t read it yet, you may follow the link here:

Record Gains Built from Lower Baselines

While all four major US stock indexes booked double-digit returns in 2023, they each experienced a steep loss in 2022. The combined 2022-2023 returns aren’t so impressive.

• Dow Jones: +5.3%

• S&P 500: +3.3%

• Nasdaq 100: +9.3%

• Russell 2000: -5.9%

You may think that adding the 2022 return of -18.1 and 2023 return of 23.9% will give the S&P a 2-year return of +5.8%. But the actual return is only +3.3%. Why?

Simple Math: If you lose 20% first, you will need to gain 25% to make up for the loss and just get back to square one. Mathematically, 1/0.8 = 1.25, or (1-20%) * (1+25%) = 1.

This matters a lot to hedge funds. An active manager may have a 2-20 arrangement with his investors, which is 2% fee on asset-under-management, and 20% on carry interest. If a fund closely tracks the Nasdaq, the manager received no carry for 2022, and the carry for 2023 is based on the 2-year return of +9.3%, not the 2023 return of 53.6%. The fund usually would have a “high water mark” clause that requires the manager to make up for prior loss before getting paid. Therefore, Wall Street bonuses may not be that big this year.

2024 Outlook for US Equities

The December 26th CFTC Commitments of Traders report (COT) shows that:

• E-Mini Dow: “Asset Manager” has 26,070 long positions and 3,098 short positions.

• E-Mini S&P 500: Asset Manager has 1,147,149 longs and 275,037shorts.

• E-Mini Nasdaq 100: Asset Manager has 111,046 longs and 20,662 shorts.

• E-Mini Russell 2000: Asset Manager 229,229 longs and 142,312 shorts.

The overwhelmingly Net Long positions on all major US index futures indicate that futures traders are very bullish on US equities. Investors eye in a soft landing for the US economy and expect aggressive rate cuts by the Federal Reserve.

According to CME Group’s FedWatch Tool, the first rate-cut could occur at the March 20th Fed meeting, with a 73.5% probability. For June 12th, the odds of two or more rate cuts increase to 82.2%. By December 18th, investors expect the Fed Funds rate will be 1% to 2% lower than the current 5.25-5.50% range, with 98.5% odds (Data as of January 1st).

(Link: www.cmegroup.com)

US equity indexes could stay high as long as the Fed remains dovish. The past few months proved that investors are very resilient. The bullish market sentiment is very hard to break, unless really bad things happen.

If an investor owns US stocks, there is no good reason to sell them now. We have seen that geopolitical risks had done little damage to US equities. Fed policy still drives the market. Staying with the ride and hedging the stock portfolio with put options may be a good strategy.

Trading with CME E-Mini Equity Index Put Options

As US equity indexes take turn making all-time high, it’s costly to buy the underlying stocks. Options are an inexpensive alternative to get exposure in stocks. Depending your stock portfolio and views, you could either long or short the options on E-Mini S&P 500 futures

• Last Friday, the March E-Mini S&P 500 futures (ESH4) was settled at 4,812.75. Buying 1 long or short position requires initial margins of $11,800;

• January end-of-the-month (EOM) Call options with a 4910-strike costed 23.50 points. Premium for 1 call is $1,175 (= 23.5 x $50 multiplier);

• January EOM Put options with a 4710-strike priced at 27 points. Premium for 1 put is $1,350 (= 27 x 50).

We could construct a similar strategy with E-Mini Nasdaq 100.

• Last Friday, the March E-Mini Nasdaq futures (NQH4) was settled at 17,003.75. Buying 1 long or short position requires initial margins of $17,700;

• January end-of-the-month (EOM) Call options with a 17,200-strike costed 208.50 points. Premium for 1 call is $4,170 (= 208.50 x $20 multiplier);

• January EOM Put options with a 16500-strike priced at 127.70 points. Premium for 1 put is $2,551.40 (= 127.75 x 20).

In a rising market, out-of-the-money put options could be a strategy for small odds with big payoff. In January, we will have new data releases for December inflation (CPI and PCE) and nonfarm payroll employment, as well as a Fed meeting on January 31st.

My reasoning: If we see inflation rebound, stronger employment, or a hawkish Fed, the stock market could turn south, resulting in a gain for the put.

Hypothetically, if the March S&P futures price drops 150 points by January month-end options expiration, the put would be 47.25 points in-the-money (= 4710 – 4,662.75) and earn $2,362.5 (= 47.25 x $50). Using the initial margin as cost base calculations, the theoretical return would be 75% (= 2362.5 / 1350 - 1).

If the March Nasdaq drops 800 points (17,003.75-800=16,203.75) at January options expiration, the put would be 296.25 points in-the-money (= 16,500 – 16,203.75) and earn $5,925 (= 296.25 x $20). The theoretical return would be 132% (= 5925 / 2551.4 - 1).

On the other hand, if stocks continue to rise, put options will lose money, but never go beyond the premium already paid.

Options Calculator is a free tool CME Group provided for options traders. It generates fair value prices and Greeks for any of CME Group’s options on futures contracts or price up a generic option with this universal calculator. Traders could customize their input parameters by strike, option type, underlying futures price, volatility, days to expiration (DTE), rate, and choose from 8 different pricing models including Black Scholes.

www.cmegroup.com

Happy Trading.

Disclaimers

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

CME Group Real-time Market Data help identify trading set-ups and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

CAUTION: NASDAQ-100 SLOWING DOWN MAY REVERT TO MEAN!NASDAQ-100 last trading week of 2023 saw the index slowing down, which may indicate the start of weakness in the index.

The weakness may cause the index to revert to its mean. However, the index may also pick up its strength to create more highs.

N.B!

- NAS100USD price might not follow drawn lines . Actual price movement may likely differ from the forecast.

- Let emotions and sentiments work for you

- ALWAYS Use Proper Risk Management In Your Trades

#NASDQ

NAS100There isn't much I can say or do.

This is a missed trade from my eyes, it followed what my alternate view from US30 showed. It just happened earlier.

Right now any trades I can get from here will not be the most optimum RR but will still be worth the risk just probably not scalp traders.

It is heading for 16600

* 3 touches up, 3 touches down. In the channel its been in

* It broke the channel and retested

* continued downwards

* rejected 16865 (Showing the direct, downwards)

* wait for opening to get last confluence before looking for sell entries

TP1 = 16760

TP2 = 16680

TP3 = 16600

Nasdaq Intraday Review – Friday 29 Dec 2023I trade Nasdaq intraday exclusively

Trading in GMT time zone

Sharing my post day review & analysis in case it can help you :)

Did my analysis at +- 5:20am GMT

Looking exclusively for a buy, as Nasdaq is bullish overall – “The trend is your friend”

Even though we are at all-time highs, I keep my bias bullish.

So had my buy position C. open from yesterday.

Market moved up 380 pips from my position and I secured my trade once price was +-250 pips from my entry (this means I placed an actual stop loss at entry). As market moved down from 4. - I was out at entry.

Bulls were unable to break the 1H double top (pink) neckline at 4. (yesterday there were 3 attempts) and today’s fourth and final failed attempt led to the bears stepping in resulting in a market drop.

Although I wasn’t looking for a sell, the sell at E. makes sense because (confirmations for this sell):

Market pattern:

Double Top market in pink lines with a neckline tested 4 times

Double top (marked in orange lines) formed just above the pivot point on the 1H TF. Market broke the neckline and re-tested the neckline (pivot point) at E. and on failing to break, bears dominated.

Ascending wedge (marked by grey trend lines) formed on the D TF and broken bearish (at 2.&3.). Once officially broken, price usually moves the same distance as the height of the pattern. The market coming up to test the neckline of the 1H double top for the fourth time can also be seen as a retest of the ascending wedge.

Falling wedge (marked with green lines) + head and shoulders (easily seen on the 4H line chart) - as the day progressed a strong head and shoulders formed on the 4H TF. The neckline was sloping down, which makes it a more bearish market pattern.

Candle sticks: yesterday closed with a red D candle, warning of a possible retracement on a bigger timeframe.

I entered a buy at D - confirmations:

Market Pattern: This was the very limit, the tipping point, of a buy. If bulls were going to step in it would be to prevent the neckline of the 4H head and shoulders from breaking bearish. There was also going to be the re-test of the neckline of the orange Double top and I like being part of the re-test in the same direction as the overall trend, bullish in this case.

S&R: 4H EMA providing some dynamic support

Fib: This level represented yesterday’s 0.618 fib level – a strong fib level

Candlesticks: A doji formed on the 1H TF

This was a risky setup so I set a super tight mental stop loss, marked with the thick pink line. If candles broke this level Nasdaq would sell with momentum.

Bears dominated and I took a 200 pip loss.

I’m not sad about this, it was a calculated risk.

Ultimately market dropped like a stone, crushing my hopes of a Santa Rally and taking out my other position that I tried to swing till 3 Jan 2024.

I hope you caught the sell! It was a stunning ~2000 pip move and you would’ve ended the year with some nice profit.

What could I have done differently:

I’m happy with my risk management and how disciplined I was at securing my trades at entry. I would never have taken a sell because my bias was bullish, but we will see what happens in 2024!

All the best for the new year!

Hope all your (and my) trading dreams come true!

TF = timeframe

TP = take profit

1H = 1 hour

4H = 4 hour

D = day

W = week

M = month

S&R = support and resistance

EMA = exponential moving average

Nasdaq Intraday Review – Thursday 28 Dec 2023I trade Nasdaq intraday exclusively

Trading in GMT time zone

Sharing my post day review & analysis in case it can help you :)

Did my analysis at +- 5:20am GMT

Looking exclusively for a buy, as Nasdaq is bullish overall – “The trend is your friend”

Even though we are at all-time highs, I keep my bias bullish.

At time of analysis, I noted the following:

Early morning market had pushed up and by the time I was doing my analysis, price was consolidating in the blue circle.

At 7am GMT, the 4H candle closed a red hanging man candle, warning of a potential bearish push.

On the 1H TF, a double top market pattern started to develop. Neckline and potential move down (i.e. the same distance as the height of the pattern) if neckline was broken indicated with pink lines.

My morning fib was drawn from swing low at D. to swing high at E. and retracement levels written in blue.

I was cautious of a bearish pushdown and so entered half positions to see how price reacted.

Also noted that fib levels were relatively close together meaning that potential draw down / loss would be manageable.

Entered half a position buy at A. and then a few minutes later half a position at B. – Confirmations:

S&R: 1H 20EMA dynamic support. On the 5min TF, a doji candle formed at this level indicating that perhaps the EMA would provide support. But 5min TF is not very strong and this was weak confirmation – hence half a position.

Trendline: Market was near the bottom uptrend line of ascending wedge on the D TF. This trend line had been respected multiple times before.

Fib: none (kinda close to 0.382 level so these positions represented my aggressive shallow retracement entries)

Candle stick: there was a long wick green candlestick rejecting this level that formed on the 30min TF, that closed above the 1H neckline, indicating strength of buyers.

Market pattern: Usually market moves the same distance down as the height of the double top. And I like being part of the re-test of the neckline that is in the same direction as the overall trend.

Mental stop was placed below the 0.618 fib level where the 4H EMA would also have provided a bullish push up. If candles started closing past this point, then my buy would be invalidated.

Ultimately, buyers were unable to break through the 1H double top neckline and bears stepped in to create a big retracement move.

I entered a full buy position at C. – Confirmations:

S&R: pivot point

Trendline: Ascending wedge trendline had been broken bearish, so this could potentially be a breakout from the wedge and could lead to a massive bearish move. So extra risky here. But I had confidence that market would at least re-test this trendline.

Fib: C. represented a level between the 0.50 and 0.618 fib level. This was my last position and I would not have entered again at the 0.618 level. I preferred to take a draw down if market continued to move down. What makes trading Nasdaq so hard is the extreme volatility and long candles spikes. We saw just yesterday how market only touched the pivot point and then flew up.

Candle stick: Before I entered at C. there was a long wick candle that touched the pivot and closed above the 0.382 fib level, giving me confidence that buyers were rejecting this level.

Market pattern: none

So now I was in a risky position with 2 buy positions in a market that was temporarily bearish.

I knew that I wanted to close my A. and B. positions as soon as market moved up so I set a take profit at entry for both.

Going to sleep with 2 buy positions and a red day candle close was stressful.

But luckily market has moved up the next day and my positions automatically closed at entry and now I am left with my C. position.

In these types of situations you must control greed, because on the 1H TF where the red dots are marked, you can imagine that the 1H candle was fully green at a point in time (where it is now a spike) and you see the momentum with which the candle is moving, so thoughts come into your mind like “imagine market continues to move up and then I have 2 buys open – Cha CHING!!! Let me remove my automatic take profits”. But the bottom line is that it will take a big bullish push to break that neckline and market can easily turn down again (ascending wedge trendline was broken bearish after all). So one has to consider rationally how much risk you are willing to take and not act in greed.

My C. position is now secured at entry and I’m hoping for a strong move up!

Good luck if you are trading!

TF = timeframe

TP = take profit

1H = 1 hour

4H = 4 hour

D = day

W = week

M = month

S&R = support and resistance

EMA = exponential moving average