Technical Analysis Forecast for NAS100Open Price: 23242.3 (UTC+4)

1. Japanese Candlestick Analysis

4H/1H: Price opened at 23242.3 near resistance (23250–23300). Recent candles show bearish harami (4H) and dark cloud cover (1H), signaling rejection.

30M/15M: Gravestone doji at 23242.3 and three black crows indicate strong bearish momentum.

5M: Shooting star formation suggests exhaustion. Failure to close above 23250 confirms weakness.

Outlook: Bearish reversal likely if 23200 breaks.

2. Harmonic Patterns

4H/1H: Bearish Butterfly Pattern completing at 23242.3 (D-point).

PRZ: 23240–23250 (confluence of 127.2% XA and 161.8% BC).

Fibonacci Ratios: AB=CD symmetry (23240–23250).

30M: Bullish Crab forming at 23100, but secondary to larger bearish setup.

Outlook: High-probability short entry at 23240–23250 with target 23000.

3. Elliott Wave Theory

4H: Wave 5 of impulse cycle peaked at 23242.3.

Structure: Completed 5-wave sequence from 22800 → 23242.3.

Corrective Phase: ABC pullback targeting 23000 (Wave A) and 22850 (Wave C).

1H: Sub-wave (v) of 5 ending at 23242.3. RSI divergence confirms exhaustion.

Outlook: Bearish correction to 22850–23000 within 24 hours.

4. Wyckoff Theory

Phase: Distribution (after markup from 22800 → 23242.3).

Signs: High volume at 23242.3 (supply), upthrust above 23300 failed.

Schematic: Phase C (markdown) initiating.

1H/30M: Spring at 23200 failed to hold, indicating weak demand.

Outlook: Break below 23200 triggers markdown to 23000.

5. W.D. Gann Theory

Time Theory

24H Cycle: Key reversal windows:

UTC+4: 08:00–10:00 (resistance test), 14:00–16:00 (trend reversal).

Square of 9: 23242.3 aligns with 0° angle (resistance).

Square of 9

23242.3 → Resistance Angles:

0° (23250), 90° (23350), 180° (23450).

Support: 45° (23000), 315° (22850).

Price Forecast: Reversal at 23250 (0° angle).

Angle Theory

4H Chart: 1x1 Gann Angle (45°) from 22800 low at 23000. Price above angle = bullish, but overextended.

1H Chart: 2x1 Angle (63.75°) at 23242.3 acting as resistance.

Squaring of Price & Time

Price Range: 22800 → 23242.3 (442.3 points).

Time Squaring: 442.3 hours from 22800 low → 23250 resistance (442.3 points ≈ 442.3 hours).

Harmony: 23242.3 = Time Cycle Peak (24H from open).

Ranges in Harmony

Primary Range: 22800–23500 (700 points).

50% Retracement: 23150 (support).

61.8% Retracement: 23000 (critical support).

Secondary Range: 23000–23300 (300 points).

Key Levels: 23150 (50%), 23000 (61.8%).

Price & Time Forecasting

Price Targets:

Short-Term: 23000 (61.8% Fib, Gann 45° angle).

Extension: 22850 (100% of prior correction).

Time Targets:

First Reversal: 8–12 hours from open (UTC+4 12:00–16:00).

Second Reversal: 20–24 hours (UTC+4 00:00–04:00 next day).

Synthesized 24H Forecast

Bearish Scenario (High Probability)

Trigger: Break below 23200 (confirmed by 1H/30M close).

Targets:

T1: 23000 (61.8% Fib, Gann 45° angle).

T2: 22850 (Wyckoff markdown, Elliott Wave C).

Timeline:

8–12H: Drop to 23000 (UTC+4 12:00–16:00).

20–24H: Test 22850 (UTC+4 00:00–04:00 next day).

Confirmation: RSI <50 on 1H, volume spike >25% average.

Bullish Scenario (Low Probability)

Trigger: Sustained close above 23300 (Gann 0° angle).

Targets: 23350 (90° angle), 23450 (180° angle).

Timeline: 12–16 hours (if 23300 breaks).

Nasdaqlong

NAS - TIME FOR JUICYTeam, hope you all making a killing on SHORT tonight.

as we expected. Thank you for asking and be patience

TIME TO MAKE NAS100 GREAT AGAIN.

Sorry my entry was 23240, but now the market is 23332

you should entry small volume at the current price 23332 - if a little pull back below 23300 add more

STOP LOSS at 23230-50

TARGET 1 at 23385-23400

TARGET 2 at 23475-23515

LETS go - time to make ACTIVE TRADER ROOM GREAT AGAIN.!

NAS100 Buy Setup – VSA & Multi-Zone Demand Analysis✅ Primary Entry Zone: Major support for current week (around 23,325–23,350)

✅ Secondary Entry Zone: Potential reversal zone if primary support is broken (around 23,200–23,230)

🎯 Target 1 (TP1): Previous swing high near 23,500

🎯 Target 2 (TP2): Extension above 23,550

🛑 Stop Loss (SL): Below 23,170 (beyond secondary reversal zone to avoid false breaks)

📊 Technical Insight (VSA & Price Action Structure)

Support Structure:

The current major support zone has been tested multiple times with no follow-through selling, indicating strong buying interest from larger players.

Volume Spread Analysis Observations:

On the recent decline into the major support zone, we see wider spreads on high volume followed by narrow range candles on lower volume, a classic sign of stopping volume and supply exhaustion.

Within the secondary reversal zone, historical reactions show climactic volume spikes leading to sharp reversals, suggesting this level is watched closely by smart money.

Any test back into the zone on low volume would confirm the No Supply (NS) condition.

Trade Pathways:

Scenario 1: Price respects the major support and begins to climb, confirming demand dominance → target TP1 then TP2.

Scenario 2: Support is temporarily breached, triggering a liquidity grab into the secondary reversal zone, followed by a bullish reversal bar on high volume → strong buy signal with potentially faster move toward TP levels.

📍 Bias: Bullish as long as price holds above the secondary reversal zone.

📌 Execution Tip: Wait for a wide spread up-bar on increased volume from either zone to confirm the start of the markup phase.

NAS100 - EXPECTING THE DUMPTeam, we got short well today with AUS200 - both target hit

we have set up the NAS entry , this is the entry price 23268 - 23200

STOP LOSS at 23100

Once it break above 23320 - bring stop loss to BE

Target 1 at 23320-60 - take 50%-70& partial

Target 2 at 23380-23400

LETS GO

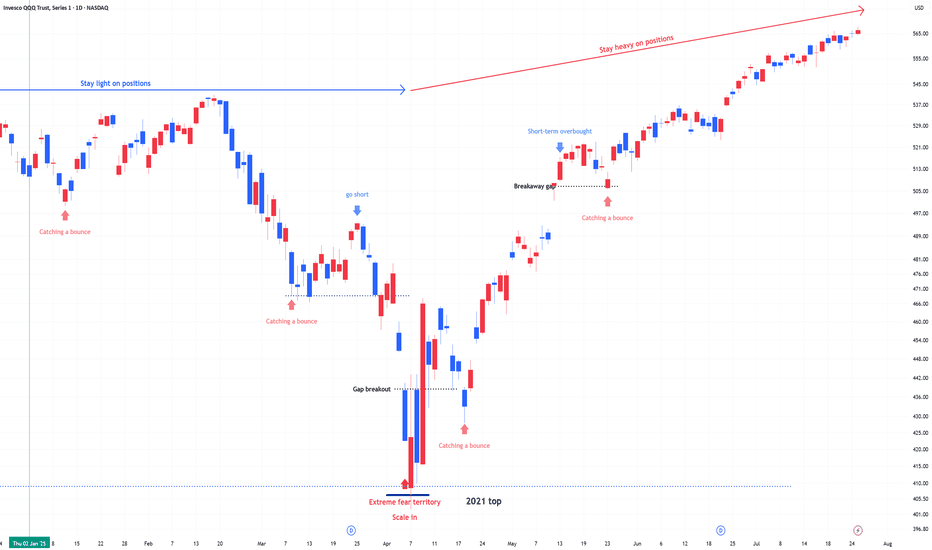

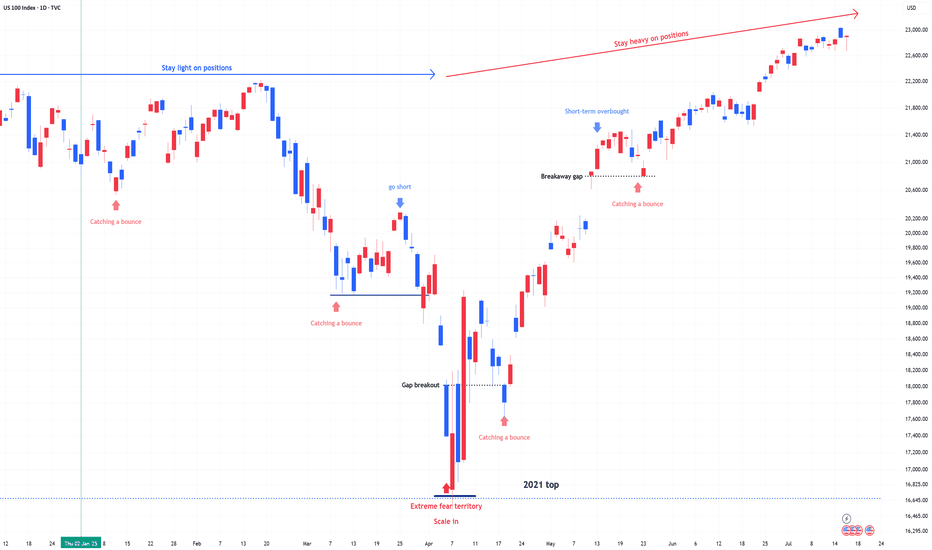

US 100 (NDQ) : Stay Heavy on PositionsApril Fear & Buy Signals

In early April, the Nasdaq 100 experienced a sharp sell-off, triggering extreme fear sentiment across the market.

At that point, scale-in buy signals appeared—classic "buy the fear" conditions.

Markets swing between greed and fear—unless the whole country collapses. Right now, greed is taking the lead, but the real blow-off top volatility hasn’t even started yet.

Stay Heavy on Positions

Despite short-term uncertainty, I’m maintaining an overweight position on the Nasdaq 100.

As long as we don’t see a major breakdown, the bias remains bullish.

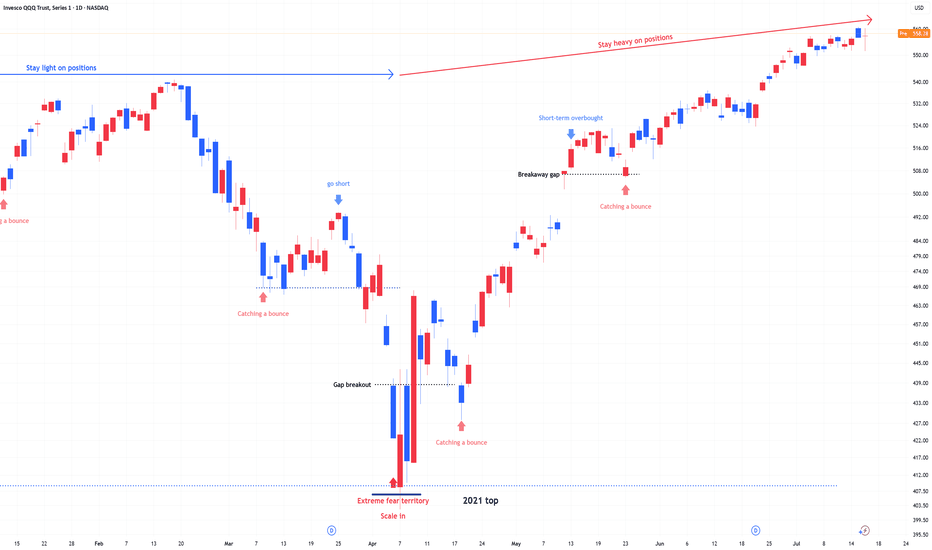

QQQ : Stay Heavy on Positions1) April Fear & Buy Signals

In early April, the Nasdaq 100 experienced a sharp sell-off, triggering extreme fear sentiment across the market.

At that point, scale-in buy signals appeared—classic "buy the fear" conditions.

2) Current Market State: No More Fear, but Watching

Since then, the market has stabilized.

The fear has disappeared, but we are still in a wait-and-see mode as traders assess the next move.

Momentum is holding, but participation remains cautious.

3) Stay Heavy on Positions

Despite short-term uncertainty, I’m maintaining an overweight position on the Nasdaq 100.

As long as we don’t see a major breakdown, the bias remains bullish.

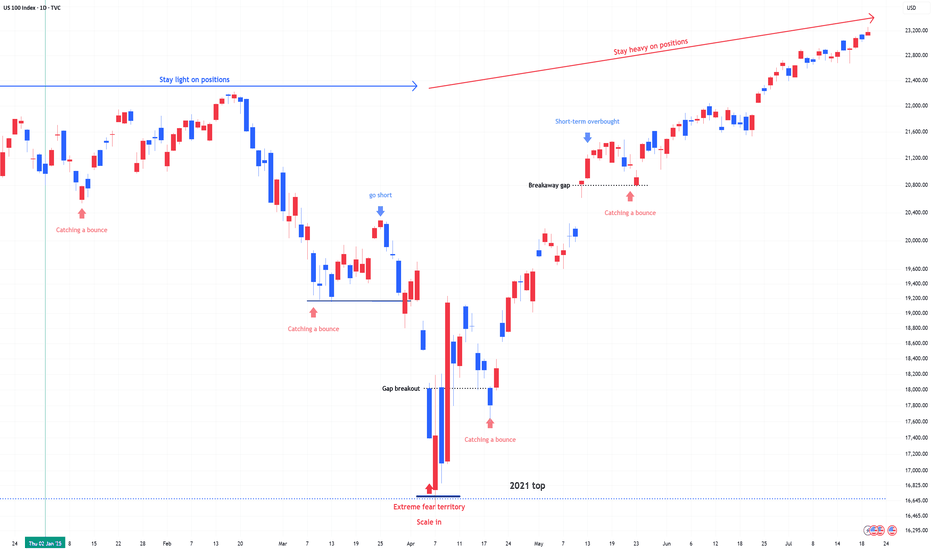

US 100 (NDQ) : Stay Heavy on Positions1) April Fear & Buy Signals

In early April, the Nasdaq 100 experienced a sharp sell-off, triggering extreme fear sentiment across the market.

At that point, scale-in buy signals appeared—classic "buy the fear" conditions.

2) Current Market State: No More Fear, but Watching

Since then, the market has stabilized.

The fear has disappeared, but we are still in a wait-and-see mode as traders assess the next move.

Momentum is holding, but participation remains cautious.

3) Stay Heavy on Positions

Despite short-term uncertainty, I’m maintaining an overweight position on the Nasdaq 100.

As long as we don’t see a major breakdown, the bias remains bullish.

nasdaq100OANDA:NAS100USD

has reached the previous highest level.

We see that the trendline has made a high possibility of the nasdaq 100 to reach a new high level because the price has gone above the previous high level, and came back to test it.

Now the price is going back up. It is fascinating as to what nasdaq100 will do next and how

other indices will be affected, including Gold and forex...

My opinion on nasdaq100:

1. It has made a different move compared to the previous high levels when they reached this level. Previously when the price reached the horizontal line (the resistance level) price began to push down and create very long spikes.

2. Nasdaq100 will go way too high and spike on that highest trendline. Spike from that level thereby create a new resistance level.

3. And then price will begin to push down strong. This will happen only if there will be a very strong spike meaning an incredible amount of sells pushing the price down.

NASDAQ 2 Expected Scenarios Very Clear , Which One You Prefer ?Here is my opinion on Nasdaq on 4H T.F , The price still below my res so we can sell it if the price touch the res level again , and if we have a daily closure above my res then we can buy it with retest for the broken res , so it`s very easy if we still below the res we can sell and if we going up it we can buy it . but we need a daily closure above first .

NAS - ACTIVE TRADE COMMUNITY - PLEASE BRING TO THE MOONTeam, we have successfully trade both LIVE trading on UK100 short yesterday and LONG both NAS AND DOWN yesterday.

Today we are entry small portion LONG for NAS.

WILL DOUBLE LONG if market drop low at 21650-21600

Target 1 - at 21850-21875

TAKE 50-70% volume on profit and bring stop loss to BE once target 1 hit

Target 2 remaining at 21900-21950

GOOD LUCK AND LET KILL THE BEAST TOGETHER

NAS - TIME TO MAKE ACTIVE TRADER ROOM GREATER AGAIN!Team, last week we got a good entry on both DOW/US30 AND NAS100/TEC100

Yes, i do know about the situation with ISRAEL AND IRAN.

This will drag on for at least 3-6 months for the solutions

however, I expect the cease fire should be stop within next week as President Trump's is negotiation with Iran

There are two strategy to trade for the NAS- NASTY market

Rule: make sure you calculate how much position and volume you are taking risk on the trade. Every time you enter, ensure you are understood each trade risk.

As I always do.

The last 90 days we have not losing a single trade - check my new video release soon.

OK, lets get back to the trade set up again

entry small volume at market now.

If market falling down during US session, buy more at the second setting

However, I expect the 1st setting likely to recover soon.

Jump on board now.

See you to the moon

NAS - LOOKING FOR RECOVERTeam This morning we got out of beautiful SHORT on UK100

Market dumping hard due to ISRAEL'S and Iran

However we expect market to be recover during UK market opening

Please follow the price accordingly to the chart

Once it reach 1st target, take 50-70% profit reduce the volume and bring stop loss to BE

LET'S GO.

NASDAQ100 Analysis – Key S/R Zones & Price Reaction Incoming! NASDAQ100 Analysis – Key S/R Zones & Price Reaction Incoming! 🚨

🔍 Chart Breakdown:

This is a technical chart analysis of NASDAQ100 (NAS100) with defined Support and Resistance zones. The price is currently at 21,314.50, sitting below a critical decision area.

🧱 Key Zones:

🔵 Resistance Zone:

‣ 21,640 – 21,800

‣ Strong supply area where price sharply reversed previously.

‣ If price breaks above the mid resistance zone, a bullish move towards this level is likely.

🟩 Support + Resistance Flip Zone:

‣ 21,280 – 21,420

‣ Former support, now acting as resistance.

‣ Price is struggling to reclaim this zone.

‣ Acts as a key decision level.

🟢 Support Zone:

‣ 20,630 – 20,750

‣ Strong demand zone from which previous rallies initiated.

‣ Target if bearish rejection continues.

🔄 Price Action Insight:

Price is currently rejecting the Support-turned-Resistance zone.

There’s a clear bearish rejection at the mid-zone (S/R flip), forming a lower high structure.

📉 A breakdown from current levels could lead to a retest of the support zone at 20,700 area.

🟢 However, a successful reclaim and bullish confirmation above 21,420 could see price target the upper resistance at 21,800.

📌 Outlook:

🔽 Bearish Bias if price fails to break above 21,420 – possible drop to 20,700.

🔼 Bullish Reversal above 21,420 could drive price to 21,800.

📅 Date: June 1, 2025

🕒 Timeframe: Likely 1H or 4H chart

💬 “Respect the levels, not the noise.”

Trade safe! ✅

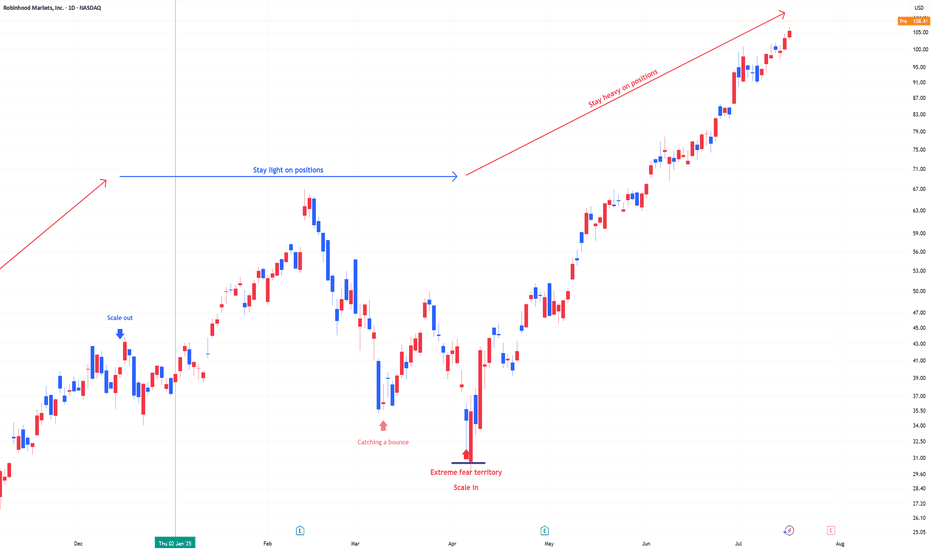

NAS100-TEC100 - THE SECRETE OF TRADING INDICES STRATEGYTeam,

yesterday we short the NAS, DOW, DAX and long the GOLD - 4 out of 4 perfectly target hit

Now, we are going long, i want you to carefully look at the picture and understand the concept of how I structure the trade. This has been calculate using my statistic and probability to ensure our entry is safe.

First picture, is buying small volume, if market volatile and push further down, i need you to double up your trade, this allow us to win better.

That's the reason why you saw my videos that everyday i show LIVE trading and profitable every trade. However, always carefully look at your capital and know exactly how much risk are you going to take.

Remember, you can win straight 3-6 months and if you failed risk management and overleverage yourself, the account can easily be kill within 1 day.

Hope you all have a great day.!