Natgas

Corn Futures ZC1 - Spooling Like a TurboBecause virtually the whole world is suffering from massive drought this summer, many crops are in bad shape. This is true with the U.S. cotton crop and it's also true with the U.S. corn crop, which according to USDA reports, barely half of is in good or excellent condition as of last week.

This is significant because the U.S. is the largest global producer of both, and by a huge margin.

This gives good cause to believe that a pump is on the horizon, but when, and how easily will it arrive?

The good news is for latecomers is that it seems as if the Ukraine panic pump and dump from April+ bottomed out in July, based on recent price action. "The second mouse gets the cheese."

There's a big gap on corn and wheat remaining from the June doom candle, which should transpire as a range that gets eaten into as we head into later September and October.

Winter may very well be new all time highs, because the world and humanity is in a lot of trouble. The environment is not in good shape, but to understand what this really means, you have to throw away the leftist-socialist-establishment "carbon" narratives, because those things are not only distractions, but they exist as a Communist Party pretext to take away your Freedom of Movement.

But just look at the lack of water and functioning ecosystem and ask yourself how long the happy is going to remain in North America.

The situation in Europe is already very dangerous.

Regardless, with the way price action has traded this month, it seems likely that corn futures has a good shot of breaking July's high before the end of the month. But it also looks like it may not run in a straight line up and take care of that business on Monday or Tuesday.

If you get a retrace into the 597 range, it seems there's a functional trade. However, it's entirely possible that August fails to break July's high. But if you can get out over 640 all the same before the month closes, you'll have done pretty well.

As for the rest of that gap above, I don't think we see that until the next commodities supercycle starts, likely beginning to ramp in late September-October.

Today is like a turbocharger. They all take a bit to spool. But once they do, it's really fun.

Unless you're the one standing in front of the Ferrari.

WTI oil - An indecisive moment in the oil marketWe warned about the possibility of a downtrend correction in the middle of August 2022. Indeed, we said that the breakout above the sloping support/resistance would lead to such action. Then shortly after that, USOIL rose from its lows and broke above the resistance, halting its rise at 97.65 USD per barrel.

Since then, the price fell back below the 90 USD price tag. However, the drop stopped slightly above the sloping support, which is bullish. Accordingly, we are bullish on oil for as long as the price stays above the support. However, an alternative position can be taken (with a tight stop-loss) on the breakout below the support.

In the short-term future, we will pay close attention to OPEC's rhetoric and any potential talks about more production cuts. In our opinion, cutting production risks higher prices for oil in the short term. Although with the prospect of global recession unraveling, we think production cuts will only have a temporary effect if any.

Illustration 1.01

The picture above shows the daily chart of USOIL. Yellow arrows indicate a bullish breakout above the sloping support/resistance and subsequent failure of the price to retrace below it. As long as the price stays above the sloping support/resistance, it stays in the bullish area.

Technical analysis - daily time frame

RSI and MACD are neutral. Stochastic is bearish. Overall, the daily time frame is neutral/slightly bearish.

Illustration 1.02

Illustration 1.02 shows the daily chart of USOIL and two simple moving averages, which still reflect a bearish constellation.

Technical analysis - weekly time frame

RSI is neutral. Stochastic and MACD are bearish. DM+ and DM- are bearish. Overall, the weekly time frame is bearish.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

Sep 4,22-NG Take my money and runLike I said on Fri, if NG drops I'll keep my order until Sun night to see what happens. Well now that I am seeing what is going on, I'm taking my profit at 8.8

I gotta get some sleep and I don't wanna wake up tomorrow with the price up at 9.3

I'll let you know my thoughts as the week progresses.

Heiko

A traders' week ahead playbook - energy markets to impact risk We start the week with a clear focus on the energy markets, with Russia’s response to the G7’s proposal for price caps, being the continued shutdown of the Nord Stream 1 (NS1) pipeline. We have crude futures opening first up, and amid a shortened session - due to US Labor Day - the lower liquidity may exacerbate the moves – EU Nat gas resumes trade at 4pm AEST and markets will be watching closely for a spike higher. With European index futures tailing off 3% on the NS1 news and the NAS100 lower in sympathy, it feels like the probability of this negative flow resuming in Asia is high. The GER40 July lows beckon.

The US payrolls report was solid enough but the rise in the participation rate (to 62.4%) made for a 20bp upside surprise in the unemployment rate. This saw a slight repricing of Fed rate expectations, and USD selling, where the FX move reversed once we saw equity markets being carved up on the NS1 news. Hard to bet too heavily against the USD and we’ll be watching for commentary from Powell and Brainard this week to guide. USDCNH could be central to the USD move, and a break above 6.93 suggests a real risk that we can talk 7.000 and this will likely impact EURUSD and AUDUSD.

The ECB meeting will get good attention and we could see some vol in the EUR, not that we need a central bank meeting to promote that when we have the energy markets to do that for us. The GBP gets attention as the trend is strongly lower and the pair has fallen for 6 straight days, losing 6.3% since 10 Aug. A spike in energy this week is really the last thing the UK needs when they are facing 20% inflation in Q123, so it seems we could be on for 1.1400 sooner.

Aside from the looming QT ramp-up, it’s another big week next ahead – global equities are in a tough spot right now and rallies are being sold in earnest – we’re going to need to see a far weaker US CPI print to promote some relief, but that is not out until next week – it feels like the path of least resistance is lower, with funds increasing portfolio hedging and buying volatility - a break of the 61.8% fibo of the June/Aug rally in the US500 will increase talk of revisiting the June lows.

By way of known event risks, here are seven key focal points for the week ahead:

• ECB meeting (Thursday 22:15 aest) – The market places a 64% chance of a 75bp hike, with the economist’s consensus call also for 75bp. At this meeting, we also get ECB staff projections on inflation and growth, so it will be interesting to see how drastically they take down growth expectations. EURUSD 1-week (options) implied vol has pushed higher, but this is also a function of NS1 remaining closed. A 50bp hike obviously can’t be ruled out and if this plays out then expect EURUSD to test 0.9900

• BoC meeting (Thursday 00:00 AEST) – A 75bp hike seems likely from the BoC, taking the lending rate to 3.25% - although there are risks of a 50bp. Short GBPCAD has been the trade here, and the trend seems to be a continued friend.

• RBA meeting (Tues 14:30 AEST) – the market is pricing a 50bp hike, and from here resuming to a more conventional 25bp rise from the October meeting. AUD 1-week implied vol sits at 11.9%, subsequently pricing a 93-pip move (up or down) from Friday’s close – not overly high, but last week's low of 0.6771 may come into play fairly soon.

• Fed vice chair Brainard and chair Powell speak (Thursday 02:35 & 23:10 AEST respectively) – the USD, gold, NAS100 could be very lively as they explain how the NF payrolls report affects their view on policy. With the market pricing a 54% of a 75bp hike in Sept FOMC, we’re going to need to see the US CPI (13 Sept) to decide the fate of the next hike – 75bp or 50bp – Rates aside, I remain of the view that QT holds big headwinds for risky assets.

• Liz Truss likely gets the gig as Tory leader/new UK PM (5 Sept) – GBP in play, although the outcome of Liz Truss as the new PM is fully expected, and clarity on emergency budgets might not be called straight away – there will some focus on Truss’s cabinet appointments, notably the choice of Chancellor. A big political headline event, but seemingly unlikely to spur much vol in the GBP.

• OPEC+ meeting (Monday) – the meeting starts at 9 pm AEST/12:00 BST, so we can expect headlines shortly after. The consensus position is for no change in group output levels, but recent comments from the Saudis, that they could cut production, suggest a cut to output can’t be dismissed – should we get a surprise cut, the magnitude of output cuts will determine the spike higher in crude. Risky markets can absorb a spike higher in crude, if it is driven by better demand dynamics, I am not sure they’ll be so receptive to higher crude on supply factors. A break of $86.41 and I’d look for $80.00/50.

• EU energy ministers meeting (Friday) – After Friday’s moves from the G7 moves to implement a price cap on purchases of Russian natural gas, the market is keen to explore the price of the cap– this should be discussed at length in the EU energy ministers meeting. Given the Russian response so far, one suspects the Europeans will need to talk about rationing too.

Good luck to all!

Sep 2,22-NG consolidating around 9?Not sure what's going to happen next week. There seems to be some consolidating around 9 the last few days with today also looking that way.

If I get cold feet, before days end today I might close my 9.5 order with about a 500 point profit. If price action breaks 9, I will keep my order to see how NG opens Sun night.

Stay safe.

HEIKO

WTI Crude Oil - Running and GunningAll of the fundamentals in the world tell everyone that because of mankind's insatiable requirement for oil to fuel its transportation network and electricity generation, supply and demand should result in a new all time high.

This is correct.

However, before this happens, the condition to be cleared first is that many unpleasant things will happen in the market and in the world.

Oil is about to take bulls and bears both for a ride with a run to $108~. The bears will say it shouldn't be happening, while the bulls will say that of course, oil is heading to $180, $350! and nobody can stop it.

After it takes a few heads it will begin to seek for new lows. $86 is the first stop. When I initially began to foresee this move in the last two months, I had assumed that this would come faster. However, with lows at $90, $93, and $92 in recent weeks, and the huge amount of volume being sold between $100 and $125, $86 is bound to be merely the first stop.

$80 will come next. It may come after some more chop and bucking, and it may just be bearish and run straight towards $74.

Be forewarned, before you mortgage grandma's couch to take a leveraged long on the nearest discount brokerage, numbers like $60 are probably enroute before we see any kind of bull activity.

But after everyone has capitulated, watch out. Oil is going to be expensive. Gasoline is going to be unaffordable. And the western Communist Party that runs our governments is going to install lockdown fuel rationing (Don't believe? Google: Sri Lanka QR Code Fuel Rationing, Ireland Oil Shortage Wargame).

Frankly speaking, I see Natural Gas hurting everyone's feelings under $5 before it turns around and runs to $18 near the end of the year. Never forget how cheap natural gas is is in North America and how expensive it currently is in Europe.

Going short at $108 with a stop of $111 and a target of $86 gives you an RR of 7.77. The perfect kind of number for cowboys, who love casinos.

What I want to tell you with this trade call is that when oil is dumping and everything seems hopeless, people who are good at detecting opportunities will realize they can find a glimmer of yield by investing in energy companies.

However.

And this is a big however.

You'll have to find energy companies who do not have links to China and the Chinese Communist Party. Those companies will be wiped out as the CCP is embroiled in scandals and targeted by the International Rules Based Order as the western regime makes a powerplay to depose and/or cuckold Xi Jinping in the coming months.

What I also want to tell you with this call is that the Party is over in this world, and it isn't coming back. This old paradigm you are used to of mashing the buy button in huge sizes of risk on anything listed on Nasdaq and making all time high after all time high before going and getting wasted at the bar every night and hiring call girls is over.

It's over, and it's never coming back. It's time to sober up. Now.

This new paradigm is a bear market. Have you traded a bear market before? Have you traded a choppy market before? A seek and destroy market before?

These types of markets are nothing like how getting long on the S&P and the Nasdaq have been. You will buy a dip and it will keep dipping and not come back. You will short a bump and it will be green for a day and then you'll get margin called in the morning and have to tell your wife you lost the last of your rice money.

For many, it would be better if you withdrew your coins, bought some gold , bought your wife something nice, and started to prepare to practice cultivation and return to tradition.

"What goes up, must come down" is a fundamental law of the Universe and part of how matter moves. Failing to respect it is the same as failing to respect an oncoming train.

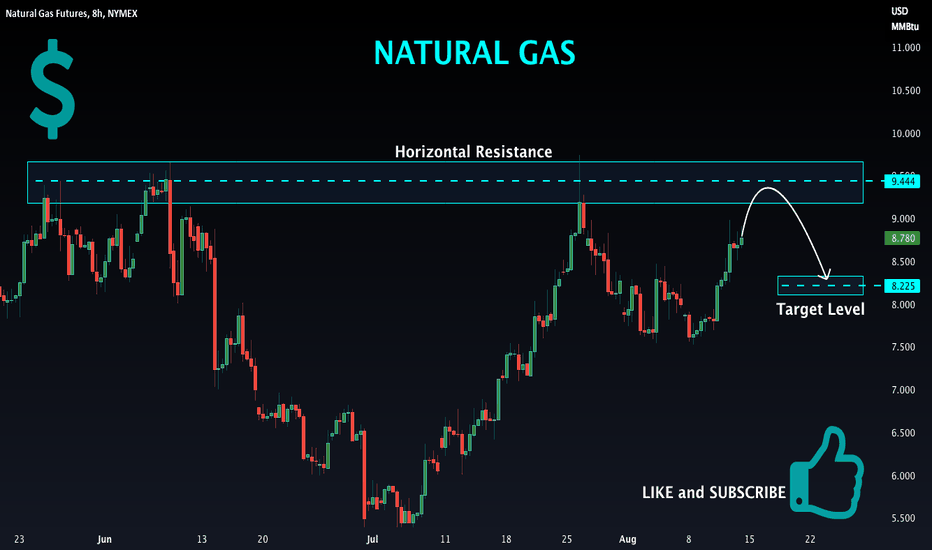

Natural Gas (NATGASUSD): Waiting For Breakout 💨

A lot of questions about Natural Gas:

The price is currently coiling around 8.8 - 9.65 resistance.

I am patiently waiting for its bullish breakout.

I believe that a weekly candle close above that structure will trigger a strong trend following move.

Only after the confirmed breakout, I will consider buying.

For now, be patient.

The market may be stuck around the underlined levels for a long time.

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

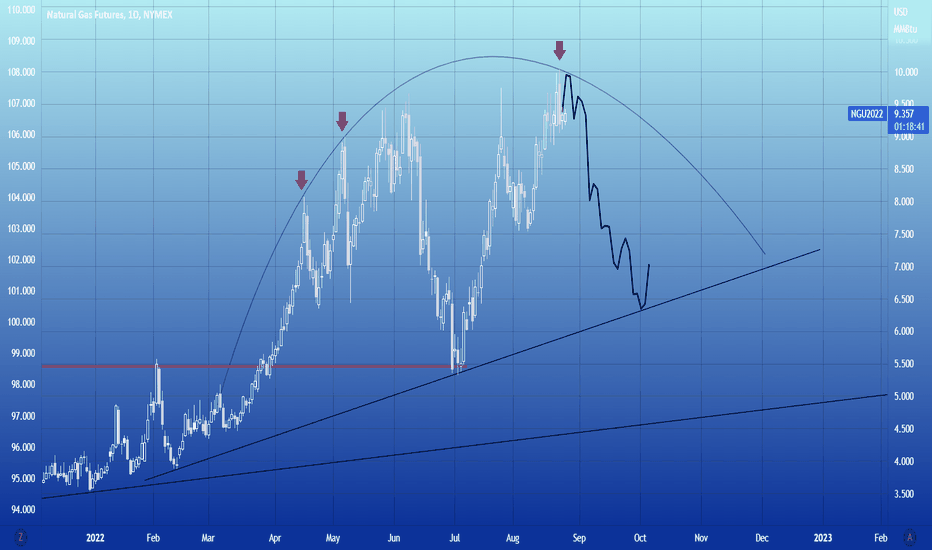

Natural Gas already priced in ? I always think it's great to look at the screen in the evening until you notice the patterns.

In this example, however, I find this not so uninteresting, as gas prices will also fall due to the rising dollar.

Perhaps a brief cooling of inflation.

Definitely not an easy topic.

Your opinions?

Aug 21,22 NG back up to 9.5?I know I know, I totally screwed the pooch on my last call.....totally incorrect. I lost some money - hopefully you didn't. Onwards and upwards.

I was on vacation for 3 weeks in the US for some downtime. Now I'm back.

I'm thinking price will go back up a bit, I will wait then for a pullback and go short.

Heiko

Natural GasHold the level and play the range, up to the res and retest trend line ...bull divergence on D-RSI and Elder

NATGAS MKT UPDATE: 1st TP HIT +50% CONGRATS TRADERS (UPDATED)Why get subbed to to me on Tradingview?

-TOP author on TradingView

-15+ years experience in markets

-Professional chart break downs

-Supply/Demand Zones

-TD9 counts / combo review

-Key S/R levels

-No junk on my charts

-Frequent updates

-Covering FX/crypto/US stocks

-24/7 uptime so constant updates

NATGAS MKT UPDATE: 1st TP HIT +50% CONGRATS TRADERS (UPDATED)

IMPORTANT NOTE: speculative setup. do your own

due dill. use STOP LOSS. don't overleverage.

TP1 Hit +50% gains click play to recap original trade

setup posted on June 30th 2022.

NATGAS WK: 250%+ gains BEST level to BUY/HOLD (SL/TP)(SWING)

🔸 Summary and potential trade setup

::: NATGAS weekly price chart review

::: chart looks strong / favors BULLS

::: natural gas STRONG BULL MARKET

::: 200% upside from current level

::: massive breakout in progress

::: expanding triangle bottom formation

::: we just got a clean breakout of the pattern

::: best strategy: BUY DIPS / ACCUMULATE DIPS

::: best reload BULLS: 4.50-5.50 USD range

::: TP bulls is 250% gains final TP 14-15 USD

::: we are currently entering commodities super cycle

::: prices are set to increase 100-300% over next 24 months

::: speculative setup always do your own due dill

::: fresh liquidity will be targeted by BULLS

::: BUY/HOLD setup do not expect miracle/fast gains

🔸 Supply/Demand Zones

::: N/A

::: N/A

🔸 Other noteworthy technicals/fundies

::: TD9 /Combo update: N/A

::: Sentiment mid-term: BULLS/SUPERCYCLE

::: Sentiment outlook short-term: BEARS/PULLBACK

RISK DISCLAIMER:

Trading Crypto, Futures , Forex, CFDs and Stocks involves a risk of loss.

Please consider carefully if such trading is appropriate for you.

Past performance is not indicative of future results.

Always limit your leverage and use tight stop loss.

BOIL: Rally into Year-EndFirst time creating my own chart.

Boil looks to be forming a cup & handle pattern if you ask me. I expect the down trend to continue for week or 2, but rally into the fall and summer looks like a good risk/reward set-up.

Hope to get some good feedback!

Let me know what you think!

Natural Gas, Cup & Handle or RSI Bearish DivergenceAt this point I am not sure what is going on with this chart...

One thing is obvious... there are some big entities behind these massive moves, it is most likely governments or big funds like BlackRock or alike. Retails are getting crushed on this ticker!

On one hand there is demand for winter, and on the other hand the supplies are getting filled for THIS winter in Europe.

If you plan for trading this ticker, be extra cautious.

I am sure that in the long run, we will go sub $6 ... but the timing is not so obvious.

NatGas: Energizer Bunny 🐰🔋🔋A certain fondness for pink is not the only thing, NatGas and the marketing mascot have in common. Both, NatGas and the mechanical toy rabbit, are also full of energy. NatGas has steadily been climbing upwards from the pink zone between $7.435 and $8.320 and has already finished wave (i) as well as wave (ii) in turquoise. Now, we expect it to rise above the resistance at $9.600, heading for the turquoise zone between $10.796 and $11.327 to complete wave (iii) in turquoise. There remains a 35% chance, though, that NatGas could lose steam and could decide to make a detour below the support at $6.898 first before resuming the ascent.