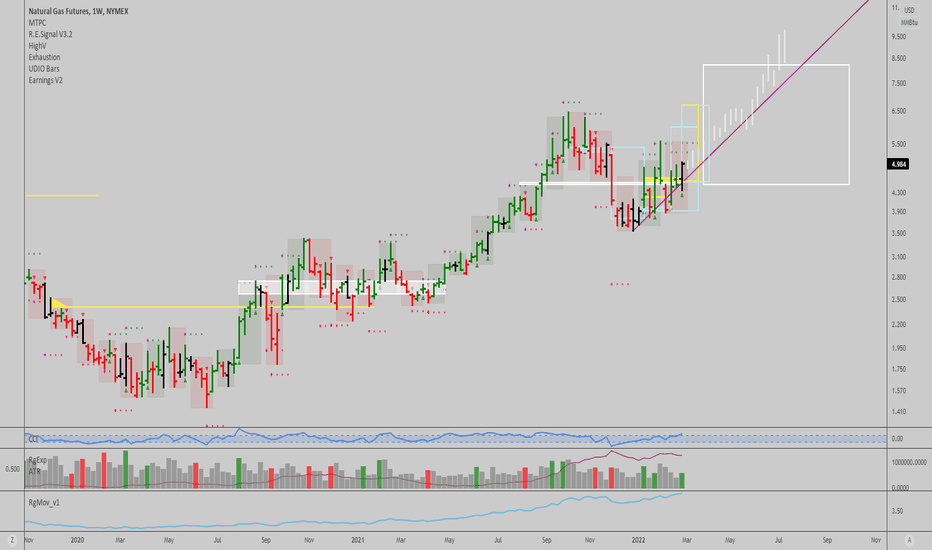

$NGAS: Natural gas can go 90% higher from hereIt's clear Nat Gas can gain traction fast here, I'm long since yesterday, via $UNG shares. Looking to add an options position here, since weekly charts are now bullish, I pre-emptively took a trade based on a daily signal, speculating on the weekly and eventually monthly kicking off. I commented about it in the Key Hidden Levels chatroom here and offered it to my clients as a signal as well.

With last night's shelling of a nuclear plant, escalation seemed likely, and the next step could be to enact sanctions on natural gas exports, which could deal a blow to supply and create a dramatic move to the upside as a side effect. Fundamentals aside, reward to risk and probability are on our side, so it's a good idea to get some decent exposure here.

Cheers,

Ivan Labrie.

Natgas

Tourmaline Oil - Beauty to Beast and Beast to BeautyTourmaline's pullback from it's $80 all time high and its bounce off the previous all time high is simply not deep enough, as evidenced by today's stop run over the June monthly close, which also produced one of those very credible "head and shoulders" patterns, on the back of the maniacs in the Natural Gas market running a monster short squeeze that ruined a lot of Q2s for "hedge funds."

WTI and NatGas are going to dump. Stocks are going to dump. It's not going to be a very pleasant period of time. But, natural gas and oil are something that the ruling regime cannot do without, because transportation and electricity rely entire upon them.

Oil is going to set a new all time high, and so is natural gas. They will do it at the same time, as the middle class is already experiencing maximum pain. This will give the central banks the handle they need to increasingly tighten, in addition to giving the Marxist-Leninist globalists a pretext to install social credit digital identification for the sake of fuel rationing.

Don't believe? Google Sri Lanka fuel rationing QR code & Ireland oil shortage war game.

Anyway, for Tourmaline, this Alberta gem is apt to give you a fine buying opportunity as commodities dump and the stock market crashes under $55 and $50. The target is simply $100+. With stops below the July 2021 highs of $35, you get an RR of 4.

Oil and natural gas, when they bounce, should be painfully brutal to bears. The situation should go parabolic, but it won't go all that high, and it won't go for all that long.

Think about what gold did when it set a new all time high, but faster, and for less time.

After the Party is over, the lights turn on and the music stops. Everyone will find a lot of vomit and trash to clean up, and it won't feel so fun and you won't feel so good with all that hangover and tab to pay, so make sure you sell your portfolio at the highs and buy your family something nice.

The best thing you can do is capitalize on your investment, put your wealth into something classical like gems, silver, gold, and prepare to return to tradition and prepare to cultivate yourselves.

Natural Gas NATGAS wave C is pending - Elliot Wave AnalysisNatural Gas NATGAS wave C is pending - Elliot Wave Analysis

NATGAS D4: 250%+ gains BEST level to BUY/HOLD (SL/TP)(UPDATE)Why get subbed to to me on Tradingview?

-TOP author on TradingView

-15+ years experience in markets

-Professional chart break downs

-Supply/Demand Zones

-TD9 counts / combo review

-Key S/R levels

-No junk on my charts

-Frequent updates

-Covering FX/crypto/US stocks

-24/7 uptime so constant updates

NATGAS D4: 250%+ gains BEST level to BUY/HOLD (SL/TP)(UPDATE)

IMPORTANT NOTE: speculative setup. do your own

due dill. use STOP LOSS. don't overleverage.

🔸 Summary and potential trade setup

::: NATGAS 4days/candle price chart review

::: BOUNCE hard from my zone

::: running PNL +55% since my update

::: congrats if you followed original setup

::: chart looks strong / favors BULLS

::: natural gas STRONG BULL MARKET

::: 200% upside from current level

::: massive breakout in progress

::: expanding triangle bottom formation

::: we just got a clean breakout of the pattern

::: best strategy: BUY DIPS / ACCUMULATE DIPS

::: best reload BULLS: 4.50-5.50 USD range

::: TP bulls is 250% gains final TP 14-15 USD

::: we are currently entering commodities super cycle

::: prices are set to increase 100-300% over next 24 months

::: speculative setup always do your own due dill

::: fresh liquidity will be targeted by BULLS

::: BUY/HOLD setup do not expect miracle/fast gains

🔸 Supply/Demand Zones

::: N/A

::: N/A

🔸 Other noteworthy technicals/fundies

::: TD9 /Combo update: N/A

::: Sentiment mid-term: BULLS/SUPERCYCLE

::: Sentiment outlook short-term: BEARS/PULLBACK

RISK DISCLAIMER:

Trading Crypto, Futures , Forex, CFDs and Stocks involves a risk of loss.

Please consider carefully if such trading is appropriate for you.

Past performance is not indicative of future results.

Always limit your leverage and use tight stop loss.

Natural gas: Will Russia's supply cuts lead to new price highs?The price of natural gas has been going up and down like a roller coaster over the past month.

After suffering a severe 45% drop between June 8 and early July, US Henry Hub prices have risen nearly 80% since July 7, recouping all the losses.

What's going on in the natural gas market?

Russia is squeezing gas supplies to Europe via the NordStream (NS1) pipeline, pushing EU Dutch TTF prices above €190/MWh, approaching the record high reached in March.

Gazprom , the Russian energy giant, has announced that it will reduce NS1 daily flow to 33 million cubic metres, or about 20% of its capacity, citing problems with the pipeline's turbines. This puts at risk the region's goal of filling 80% of its storage capacity before winter.

According to recent Bruegel calculations, Europe may run out of gas in storage this winter if demand is not reduced. Such supply concerns prompted EU members to sign an agreement to cut their gas consumption by 15% over the next six months.

The worsening of the European gas crisis prompted a rush for supplies from other major producers, such as gas LNG from the United States and JKM from Asia. These markets are near full capacity for gas exports to Europe, so prices are rising and we may not have seen the peak yet.

From a technical standpoint, price momentum is pushing upward. Nine of the most recent ten sessions ended in the green, a streak that hadn't been seen since late March/early April 2022.

The RSI is now approaching overbought territory (70), but it may still have room to decisively break through this level.

The June bearish divergence thesis, based on rising prices/falling RSI, is now invalidated, showing that fundamental factors dominate technical considerations in the current natural gas market.

Jul13, 22 NG NOW time to sell, again?So it looks like I was a week early - my Sell order at 6 is still in and I put in another Sell Order for 6.5 as a pyramid order to take advantage of higher prices.

I will be watching as the week progresses to see if price action goes way up past 6.5 or not. If price does not pass the red line of the Alligator then I should be fine and price action will come down. If I'm right, then this also means that the Jul 12th candle will become a fractal so that should be the high point.

Anyway, recession fears are in so as soon as everyone starts to freak out, price action will drop as no one anywhere will be going out and spending any money, so no demand.

Stay safe.

Heiko

NATURAL GAS expected move Elliot Wave - NATGAS NATURALGASNATURAL GAS expected move Elliot Wave - NATGAS NATURALGAS

WAVE C PENDING - expected heading towards $4-$4.3

USOIL - 100 USD hit, 95 USD hit... what is next?Our price targets of 100 USD and 95 USD were reached recently. Despite that, we continue to be bearish on USOIL. Accordingly, we still maintain our price target of 90 USD, which we would like to change from long-term to medium-term.

Illustration 1.01

Illustration 1.01 shows the daily chart of USOIL and two moving averages, 20-day SMA and 50-day SMA. These moving averages reflect the downtrend.

Technical analysis - daily time frame

RSI and Stochastic are bearish. MACD is bearish too. DM+ and DM- are bearish. Overall, the daily time frame is bearish.

Technical analysis - weekly time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the weekly time frame is bearish.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

Natural Gas time to easy Rally To evaluate the trend of Natural Gas we must take into account 2 factors:

1) The international macro political scenarios:

Russia, which is the world's leading producer, will export less to its main customer the European Union.

Winter in Europe is upon us and there is a serious risk of an energy blockade, Europe will find GAS but the cost from September onwards will be very high with the main natural gas producer out of the market.

2) Graphically we can deduce a strongly bullish graphic structure where increasing minimums and maximums constantly lean on well-defined supports, the price above the moving averages 100, 200 and the fibonacci extension speaks clearly the price should orbit soon at the price of $ 15.

GAS export data:

In 2020, the 5 largest gas exporters in the world were Russia (199,928 mcm), United States (149,538 mcm), Qatar (143,700 mcm), Norway (112,951 mcm), Australia (102,562 mcm).

Winter is coming (Cit 'GOT)

LPI.sa

NatGas: Pretty in PinkNatGas would look really pretty in pink, wouldn’t it? Therefore, it should proceed to move downwards to complete wave ii in pink in the upper pink zone between $6.055 and $5.325. Afterwards, it should turn around and climb upwards, crossing the resistance at $6.786 and heading for the next one at $8.118. There is a 33% chance, though, that NatGas could acquire taste for more pink, drop below the support at $5.325 and into the lower pink zone between $4.835 and $4.205.

EURUSD - reopening of the Nord Stream 1 - a major vol event?Talk of an unfolding energy crisis in Europe is well known, but we now come to a more defining and almost binary point in the proceedings – one EUR, commodity and EU equity traders should be aware of as a major event risk.

On 21 July, the Russians will need to make the call to resume the flow of natural gas (NG) through the Nord Stream 1 pipeline – the pipeline, which supplies c.10% of Europe’s consumption was closed this week for maintenance and is due to re-open on 21 July – or at least that is the plan.

Supply through the pipeline that transports NG from Russia to Germany has fallen some 60% since June, due to a mix of sanctions and because a key turbine used to pump the gas was removed and sent back to Canada for maintenance and has remained there due to global sanctions. The Europeans, notably, the Germans and Italians, are concerned the Russians may use the unavailability of the turbine as a pawn to halt the restarting of flow on 21 July.

Various news wires have suggested the Canadians, under some pressure from Germany, have agreed to export the turbine back to Germany, but Gazprom has suggested they’ve not yet seen any documents providing evidence the turbine will be allowed to return. Naturally, the concern is if Russia does not restart the flow, we could see European NG inventories fast depleted, and any hope they could build them through the July to September period, and ahead of the winter, reduced. Talk of gas rationing is certainly elevated and it could significantly impact EU inflation and lower growth. It would make the job of the ECB, which is largely expected to hike rates by 25bp on 21 September, far more challenging.

The Europeans would look to the LNG market as an alternative, but that market is already very tight, with sizeable demand out of Asia.

Current inventory levels are manageable and can supply European demands through the winter period, but much now relies on the future flow from Russia. Russia seemingly holds the cards and will be acutely aware that if they don’t restart the flow then EU NG prices could push from current levels of E180 per MWh and above E200 MWh. In a world where most commodities are trending lower, EU NG prices are appreciating rapidly and with falling growth and consumer sentiment, this is a toxic mix for Europe.

While we can look at relative excepted interest rate settings, terms of trade or other traditional metrics that showcase the relative attractiveness as an investment destination – the simple fact is that EURUSD and EU NG prices are incredibly negative correlated and seem to have the strongest statistical relationship. The 21-day rolling correlation between the two variables is -0.88.

Taking that into account, it almost seems binary that EURUSD will move in anticipation of the outcome of Russia’s decision on 21 July. We can argue that EURUSD is already pricing in a large degree that Nord Stream 1 won't restart immediately, so that needs to be considered.

Of course, in the near-term, the pair will move on other factors but it’s time to put the 21 July and Russia's call on flow on the radar, because FX traders will be watching closely and reacting to headlines – any view that the flow will resume, even at a lower rate than before the recent halt, could lead to relief that Germany (and other nations) may not have to ration gas through the winter period, in turn, driving a market short of EURUSD into 1.0150/1.0200 and pushing the GER40 higher. Of course, if they hold off then it could set a new leg lower in EU assets.

An event risk to put on the radar.

Natgas Day TF - butterfly pattern assumption - July 2022Following the theory, the X-A leg is the first leg of the price fall, then follow by the A-B leg up retracing 78.6%, then leg down to B-C leg retrace 38.2% - 88.6% and the final leg is C-D which normally price would go up to 127% or 161.8%.

if price follow as I drew, I would enter my long position from the low of C-D leg and take profit accordingly.

Please note, this is not a financial advice

Please feel free to comment - thanks!

NG! Coming down to earth? Or further price appreciation?NG! has had a historic two-year bull rally. Is the fun over for nat gas traders?

Fundamentally little has changed regarding the supply and demand of U.S nat gas despite the last few weeks of intense selling, with exception of a temporary surplus of U.S nat gas supply due to a fire in a Freeport export terminal.

Global weather remains extreme. Nat gas supply globally remains low compared to historical levels. Not to mention the effect of the added complications on the global energy trade from the war in Europe and the sanctions related to it. I think with all the uncertainties in today's world, a nat gas long position at these depressed prices (depressed on a short-term basis) at the very least provides some form of a hedge on the risk of escalation in the Russia-Ukraine war and/or worsening inflation.

Current Prices seem relatively attractive for a trade, but short-term momentum could push NG! down to the 4.54 support area. The 4.54 area would be an ideal entry for going long given that the fundamental narrative on U.S nat gas remains favorable.

This is not trading advice. Good luck!