NATGAS: Bearish Continuation & Short Trade

NATGAS

- Classic bearish formation

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell NATGAS

Entry Level - 4.401

Sl - 4.546

Tp - 4.137

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Natgas

NATGAS What Next? BUY!

My dear friends,

My technical analysis for NATGAS is below:

The market is trading on 3.819 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 4.073

Recommended Stop Loss - 3.667

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

———————————

WISH YOU ALL LUCK

NATGAS: Bullish Continuation is Expected! Here is Why:

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to buy NATGAS.

❤️ Please, support our work with like & comment! ❤️

E-cutieAll year EQT, an unloved natural gas producer has been a swing trader's paradise. I've harvested so many gains from these E-cutie trees I thought I'd make a thread just for it and post trading updates.

The macro technical picture is clear. Years of being battered by shorts ended with capitulation in 2020, followed by a swift rebound. Fundamentals are tightening. According to analysts, $25 is fair price for $2.50 NG price. Goldman Sachs has a $23ish target. Price action is showing signs of bottoming. It's lining up but this is much more profitable short term swings.

Currently, price is building a base at previous long term support around $18. More downside is certainly a possibility given that NG prices look overvalued. But, EQT is in a channel and fundamentally undervalued. Investors might front run this sector as demand picks up in later in the year, in which EQT will likely be closer to $25.

s3.tradingview.com

Long EQT

+200 @ 18.10

NATGAS Massive Short! SELL!

My dear subscribers,

My technical analysis for NATGAS is below:

The price is coiling around a solid key level - 4.257

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 3.892

My Stop Loss -4.468

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

———————————

WISH YOU ALL LUCK

NATGAS: Short Trade with Entry/SL/TP

NATGAS

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short NATGAS

Entry Point - 4.257

Stop Loss - 4.470

Take Profit - 3.881

Our Risk - 1%

Start protection of your profits from lower levels

❤️ Please, support our work with like & comment! ❤️

Gas Prices Catch Fire: 25-Month High Reached Amid Winter's FuryNatural gas futures have reached a 25-month high, marking a significant price increase.

This surge is attributed to two primary factors:

1. Cold Weather: Unusually cold temperatures in key regions have increased demand for natural gas, as it is a primary source of heating.

2. Supply Disruptions: Issues in natural gas production or distribution have tightened supply, further driving up prices.

◉ Technical Observations

● After breaking out of the Inverted Head & Shoulders pattern, the price soared to $4.350.

● Subsequently, the price faced a significant pullback to around the $3.30 mark.

● However, the price rebounded from this point and is now at a 25-month high, with expectations for continued growth.

Natural Gas Shows Bullish PatternVANTAGE:NG Natural gas looks to be turning bullish after a projected five-wave impulse from the lows, followed by an ABC correction. It gave us a nice bullish setup formation by Elliott Wave theory, so more upside is in view, especially if breaks back above 4.0 bullish confirmation level, just watch out for short-term intraday pullbacks.

NATGAS What Next? SELL!

My dear friends,

Please, find my technical outlook for NATGAS below:

The price is coiling around a solid key level - 3.726

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 3.366

Safe Stop Loss - 3.935

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

———————————

WISH YOU ALL LUCK

NATGAS: Bearish Continuation & Short Signal

NATGAS

- Classic bearish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Short NATGAS

Entry - 3.726

Sl - 3.886

Tp - 3.421

Our Risk - 1%

Start protection of your profits from lower levels

❤️ Please, support our work with like & comment! ❤️

NATGAS Massive Long! BUY!

My dear friends,

My technical analysis for NATGAS is below:

The market is trading on 3.072 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 3.428

Recommended Stop Loss - 2.914

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

———————————

WISH YOU ALL LUCK

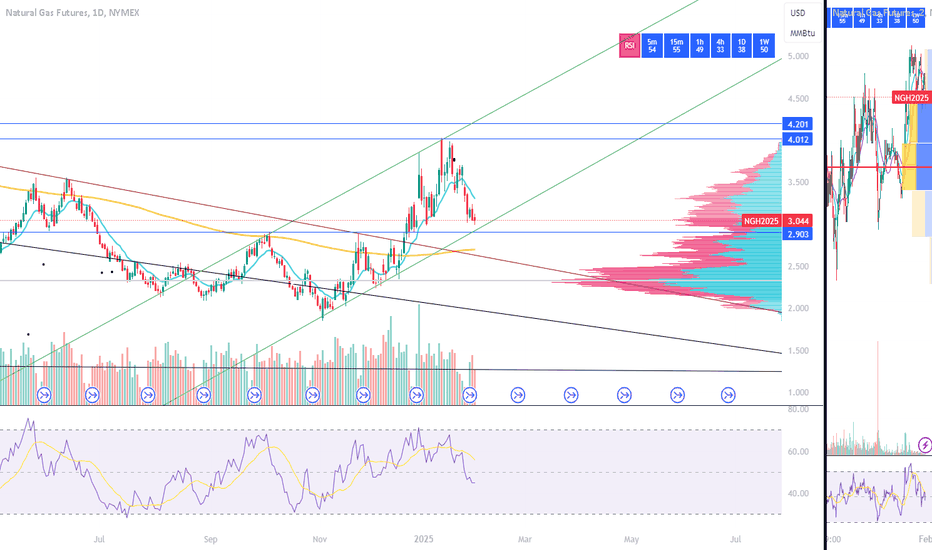

NATURAL GAS: Channel Down bottomed and is rebounding to 4.800Natural Gas is neutral on its 1D technical outlook (RSI = 47.119, MACD = -0.072, ADX = 39.523) as the bearish wave of the long term Channel Up found support on its bottom and the 1D MA100 and is rebounding. It hasn't yet crossed over the 1D MA50 but when it does the bullish signal will be validated. On any occassion, last time the 1D RSI rebounded near this level, it was on the October 18th and August 27th 2024 lows. Both later rebounded by at least +60.48%. We aim for a similar target (TP = 4.800).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Short Term Pain for Long Term GainAfter an amazing and wild week last week, I believe tomorrow will be the start of an even crazier one. Trump Tariffs, Oil and Gas up along with the US Dollar, while tech is on the verge of another break down. Will Bitcoin finally break below 89k, while Gold and Silver possibly break to the upside? Exciting times if you're ready for it.

NATGAS: Trading Signal From Our Team

NATGAS

- Classic bullish setup

- Our team expects bullish continuation

SUGGESTED TRADE:

Swing Trade

Long NATGAS

Entry Point - 3.072

Stop Loss - 2.846

Take Profit - 3.554

Our Risk - 1%

Start protection of your profits from lower levels

❤️ Please, support our work with like & comment! ❤️

NATGAS Swing Long! Buy!

Hello,Traders!

NATGAS has lost almost

30% from the local highs

In no time so It is oversold

And as the Gas is about to

Retest the horizontal support

Of 2.948$ we will be expecting

A local bullish rebound

And a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!