Dec 20,22-NG-Go Long at 5.4? or 5?Price is continuing to drop even though the temperature this week across the U.S. especially into Christmas is going to be damn cold!!

So the question is...will price drop all the way down to 5?? or should we get in now at around 5.4?

Both are areas of Support, and this cold is going to send demand through the roof, but when? Will price keep going down until Thurs or Fri this week? Or will price spike up early next week?

All I know is I'm not missing out on this trade....could be a nice 1000 point spike :-)

What are your thoughts?

Heiko

Natural Gas

Dec 19,22-NG-Not yet time to go longSO obviously my last call was horrible--I exited my position with a small loss.

The outside of the Linnear Regression Indicator is around the 5 mark so I'm thinking price action might drop to around there.

I will wait for clear signs of a turnaround, then I'll put in my Buy Order. I can't believe the price, I mean this is winter!! Anyway, sometimes there is no logic to trading.

When price gets down there I'll let you know what my plans are. With the holidays also, things are a bit wonky - might not even get a trade in until Jan.

To all, please have a safe and splendid Christmas, Holiday Season and a fantastic New Year!! Have a drink for me :-)

Heiko

Natural Gas to GrowIt seems NG has started a new impulse wave as it finished C move down in late October. The momentum in price sees a higher low, and a potential for a bullish continuation should see a test of $7.1 resistance level. Major resistance is seen at $9.7.

I see energy as the ONLY short-medium term gainer. NASDAQ has been underperforming greatly in the index range, and will probably continue to see lower demand as earnings have been disappointing, and Fed's tightening policy continues.

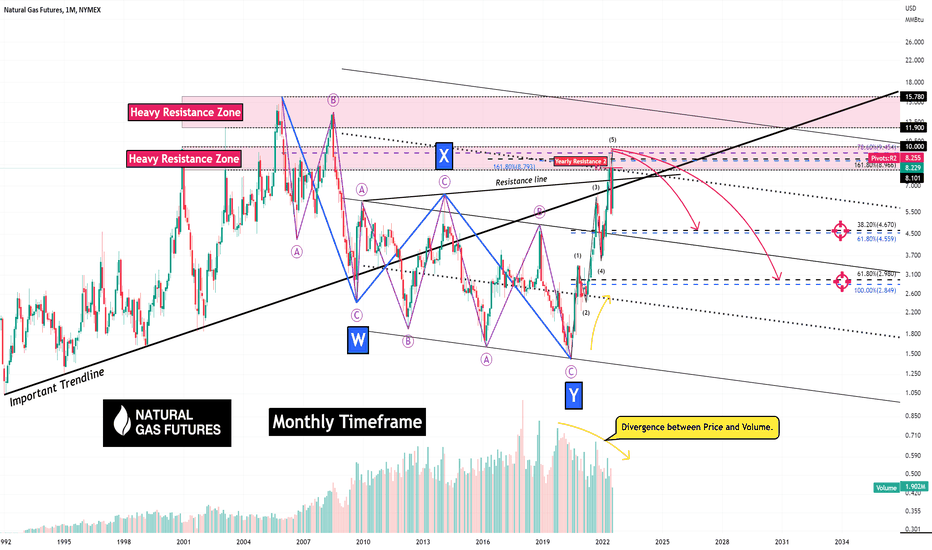

Natural Gas Futures (Road Map)!!!🗺️What are Natural Gas Futures ❗️❓

Natural Gas Futures can be used for hedging or speculating and can be traded nearly 24 hours per day, 6 days per week. Trading Natural Gas Futures allows hedgers to manage risk within the highly volatile natural gas price, which is driven by weather-related demand.

Natural Gas Futures is running in Heavy Resistance Zone & Important Trendlin & Resistance Line, and at the same time, it was able to pass the main wave 5 in this zone. So I expect Natural Gas Futures to go down to my🎯targets🎯 that I showed in my chart.

Where can Natural Gas Futures go (🎯Targets🎯)❗️❓

Target🎯: 4.67$-4.55$

Target🎯: 2.98$-2.84$

Natural Gas Futures Analyze, Monthly Timeframe (Logscale).

Also, we can see one of the valid candlestick reversal patterns (💫Shooting Star💫) at a weekly timeframe 👇

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy, this is just my idea, and I will be glad to see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

NatGas: Don't trip 🚶🏼NatGas is currently facing down and should leave the turquoise target zone to climb below the support line at $4.750 to complete the pink wave iii. Our alternative scenario implies, that the course could rise above the resistance mark at $7.064 instead, if the course would stay above the $5.337-mark. After the completion of the pink iii in our primary scenario, we're expecting the course to rise between $4.750 and $5.337 to finish off the pink wave iv, before dropping back South. The downwards slope should stretch until the turquoise target zone between $3.436 and $1.880 to end the green wave .

Dec 15,22-NG-Time to go long??I put in a Buy Order at 6.6.

Not sure what's going to happen tomorrow being the end of the week. What I do know is Europe is having colder than normal temps for this time of year and Germany just released that their supplies for NG have dwindled faster than expected for this time of year; hence, price for European NG could go up shortly.

Also, the Dec Contract Expiry is coming up and I have found NG goes up a bit toward contract end.

Also, the War - Also, weather in the U.S. is pretty cold - who knows if it will warm up or get colder - colder would be good for my Buy Order of course :-)

Anyway, I'm thinking price will drop a bit tomorrow and trigger my Buy Order. Then I will pray next week price goes up and up.

Heiko

InvestMate| Naturalgas Is Getting More Expensive🏭 🏭 Naturalgas is getting more expensive

🏭 Observing the behaviour of gas in the last few days, I come to the conclusion that the medium-term uptrend is not over yet.

🏭 As you can see gas has been in accumulation since the end of October.

🏭 But in recent weeks something like the next upward wave is building.

🏭 After today's 7.86% rise, further increases are not at all unlikely.

🏭 The nearest zone of resistance is around a cluster of two fibo levels. The first is 0.786 of the last major downward wave. The second is 1.618 of the last local downward wave.

🏭 The support zone is determined by the cluster of the 0.236 and 0.382 levels of the last downward wave.

🏭 Also noting that we have pierced the 50-period moving candle and the MACD and RSI are generating signals towards the continuation of the current uptrend.

🏭 We have no choice but to observe how the price will behave.

🏭 The scenario I'm playing out is a continuation of the uptrend to the designated resistance zone. I'm aware of the possibility of a correction at any time, this should be taken into account, If the outlook changes I will publish a post with an update, so I encourage you to actively follow the profile and read the description carefully.

🚀If you appreciate my work and effort put into this post then I encourage you to leave a like and give a follow on my profile.🚀

Update on US Henry Hub Natural Gas Prices – December 2022A cold weather snap forecast across much of the United States is driving demand for natural gas as a heating fuel higher. Prices of front month Henry Hub Natural Gas Futures have risen over the past week as a result. The front of the curve has moved more than the rest of the curve. The curve is now close to where it was two weeks ago.

Natural gas in storage is within seasonally normal range. Since June 2022, when Freeport LNG Terminal had to shut down after a fire, natural gas storage in the US has been ramped up as the gas produced in the US can no longer be exported at the same volume as prior to the shut-down. Freeport LNG accounts for close to 20% of US export capacity. Its re-opening has been delayed many times and the latest guidance from Freeport is a partial opening in mid-December 2022 and full production in March 2023 . However, in an email statement to Reuters they have pushed the reopening to end-of-year , and we remain sceptical that there will be any flow of LNG from the terminal this side of the of the New Year.

Ample storage could drive US natural gas prices lower when the cold weather snap passes.

Europe has been able to fill its natural gas storage capacity to close to 90% coming into the start of the winter period (October 2022) and is now drawing on that capacity at a slower than expected rate due to thrifting and an initially milder-than-expected weather pattern. However, colder weather has arrived, which could drive higher demand. Natural gas flows to Europe from Russia have slowed to a trickle and hence the region is reliant on Liquified Natural Gas from elsewhere. Unfortunately, with Freeport LNG offline, the US will not participate fully in meeting this demand over the coming weeks, but US Henry Hub may get a boost when Freeport LNG opens.

The European Union is currently trying to implement a price cap on imports. There is no final deal to speak of, but the European Commission’s proposal, is for a market correction mechanism that would kick in when the price of month-ahead contracts on the Dutch Title Transfer Facility exceeded €275 ($290) per megawatt hour and the gap between world prices was greater than €58 . Any success in approving this price cap, could limit upside for US Henry Hub used as feedstock for LNG exports to Europe. However, with the price gap between US and European natural gas prices being so wide (almost 6 times ), we believe the upside could nevertheless very large.

Source:

1 FREE PORTING NEW ROUTER

2 Reuters

3 Bloomberg 13/12/2022

4 WisdomTree calculation on 13/12/2022 using Dutch TTF Gas 1st Line Financial Futures (USD/MMBTU) as published by ICE Endex who convert megawatt hour to Metric Million British Thermal Unit (MMBTU) and USD using the WM/Refinitiv Closing EURUSD Spot Rates as published by Refinitiv at 4 pm UK time and Henry Hub Front month futures.

$NGAS - Is the Gas Crisis Over? (Short Trade)$NGAS - Is the Gas Crisis Over? (SHORT)

With the Economy slowing, a variety of commodities are showing weakness, think about $OIL and $COPPER.

$NGAS is still retesting this channel breakdown.

I'm looking for shorts in this area as the potential rewards are huge.

The war in Ukraine may be coming to an end, and this could have an impact on the price of natural gas. If the conflict ends, it may be possible to increase the supply of natural gas from Ukraine, which could lead to lower prices. Additionally, Europe already has enough natural gas to meet its needs for the entire winter, which could also help to keep prices down. However, it is important to remember that the price of natural gas is determined by many different factors, and it is impossible to predict with certainty how it will change in the future on a fundamental level. The charts look good.

Dec 11,22-NG-Who's pissed off now?a 700 point Gap Up??? SERIOUS??

I am sooooooooooooooooo pissed off - I can't believe I missed this buying opportunity last week - like I told you all in my last post last week, I missed the buying opportunity, I screwed up....but then for fate to rub it in my face with a 700 point gap up over the weekend???? CRUEL!!

Totally Cruel.

Anyway, now that NG has gone up over 1000 points in 6 days, can it go higher?? or is price going to come back down a bit. Hard to say.

I'll tell you this though.....I will be watching like a hawk. If price goes down a bit, I think I might put in a Buy Order at 6.8 or so in case price spikes up. If price keeps going down, hits 6.6, then 6.4 then lower, then I will keep my Buy Order about 200 points above the current price in case price action reverses quickly one day this week.

I know Wed the FED is going to hike rates again and this is going to cause the markets to go crazy. I've already shorted the S&P500 and making money there so I'm keeping that trade. I'm also Long on Oil as there is the whole Russia uncertainty and U.S. Supplies are dwindling quickly so I'm keeping that trade also.

But NG?? Again - I think between now and March price will go up no doubt...I just want to get in at the best price possible, and that was LAST WEEK!!! :-(

Anyway, stay safe and hit me up with your comments - I wanna know what you all think - am I crazy? Or is price still gonna go up from here?

Heiko

NATURALGAS - Bullish price action ✅Hello traders!

‼️ This is my analysis of NATURALGAS .

Here we can see that price rejected one more time from support zone, so I expect we can see bullish price action upcoming days, but for medium term perspective I see price to take out liquidity below support zone.

Like, comment, and subscribe to be in touch with my content!

Dec 9,22-NG-Didn't go as low as is shouldSo how many of you missed getting in on the long trade this week? I DID!!

Piss me off - I was expecting price to get to the late Oct low of around 5 - I actually had my Buy order in at 5 and as we all know, it never got that low. So I was without a trade this week.

Now it's back up to 6 so I missed an 800 pt profit - oh well - at least I didn't lose any money :-)

We will have to see next week where price goes...good chance it might keep going up - colder weather, the War etc. Even though Oil is tanking - who knows, maybe Oil will recover next week. Anyway, I digress...

I hope everyone has an awesome Holiday Season. I have 2 weeks off work so I know I will have an awesome time!! :-)

Tons of food - tons of people - tons of visits to an from my home. Time to reconnect with everyone and have some bloody fun!

Take care and stay safe.

Heiko

End of the lineCheniere Energy Inc. (LNG) stock has been on the rip since the Russian invasion on Ukraine in Febuary of '22. Russian invasion has shaken the global flows of natural gas and has enabled USA to replace Russia as dominant supplied of natural gas to Europe.

Cheniere is the company which basically dominates the shipping of LNG across the Atlantic, so its no wonder their stock did more than 50% since the start of the war.

As Natural gas, and energy prices in general, are slowly correcting to pre-war levels it makes sense for LNG stock to correct to its former support. It happens that support at about $120 is the same support which was tested after the war broke out, and the stock broke out to new highs.

Natural Gas - WEEKLY TIME FRAMEThe Structure looks good to us, waiting for this instrument to correct and then give us these opportunities as shown on this instrument (Price Chart).

Note: Its my view only and its for educational purpose only. Only who has got knowledge about this strategy, will understand what to be done on this setup. its purely based on my technical analysis only (strategies). we don't focus on the short term moves, we look for only for Bullish or Bearish Impulsive moves on the setups after a good price action is formed as per the strategy. we never get into corrective moves. because it will test our patience and also it will be a bullish or a bearish trap. and try trade the big moves.

we do not get into bullish or bearish traps. We anticipate and get into only big bullish or bearish moves (Impulsive Moves). Just ride the Bullish or Bearish Impulsive Move. Learn & Know the Complete Market Cycle.

Buy Low and Sell High Concept. Buy at Cheaper Price and Sell at Expensive Price.

Keep it simple, keep it Unique.

please keep your comments useful & respectful.

Thanks for your support....

Tradelikemee Academy

Natural Gas: Prices Could Plummet in DecemberEU and US futures remain stable, guided by the serene climate of the Chinese markets, where the launch of new support measures in China and other measures concerning the management of the pandemic could be announced shortly.

This week the macro agenda revolves around Dec. 8 and 9 with the speech of the president of the ECB and with the US annual PPI, very important for confirming the ongoing decline in inflation.

Nasdaq 100 Futures, S&P 500 Futures, DAX, FTSE MIB, IBEX 35: The rebound has almost exhausted its strength with the Christmas rally anticipated by the markets by a couple of weeks.

In the short term, I am optimistic that the higher-than-expected drop in inflation in Europe and the US will give further impetus to the markets thanks to the easing of restrictive central bank policies.

We saw last week what a boost any indication of easing the restrictive policy could give the markets. We properly exploited the situation with an excellent Buy operation on the Nasdaq 100 index near the market lows, a position still open.

From 2023 things will change, and I advise you not to miss the next articles to keep up to date.

Natural gas: Natural gas is in free fall as expected. The recent rebound was caused by the wave of intense cold across the US, which brought the demand for heating to a high level.

The cold weather immediately vanished, with temperatures now expected to be higher than the seasonal average for December. In the long run, the situation is interesting.

Europe will need even more LNG to replace Russian volumes next summer as the continent reloads storage. Chinese demand recovers from lockdowns and offsets lower imports from other Asian buyers. In the short term, the situation is pessimistic.

In addition, the reopening of various export plants that have been offline for some time is creating an excess in domestic supply, which is also negative for prices. I will not buy gas at these prices for the reasons mentioned.

I will evaluate a long entry only in the $ 4.50 area, which I expect will be tested in December.

Crude oil: We are before a setback for oil. Although not penalizing Russia, the price cap could lead to an increase in demand for American oil, which is very positive for prices.

Furthermore, the Chinese oil demand, held back by Covid, will pick up in 2023, and Opec is ready to intervene with a production cut to support prices in the event of a new collapse.

However, I remain positive in the long term with a target of $90, and I am ready to re-enter after closing an excellent buy operation in profit.

Natural gas 2023 outlook: Approaching a key confluence zone The recent price action in the daily natural gas price chart updated to December 5, 2022, saw prices falling rapidly and breaking below the supports of two moving averages (50dma and 200dma) and some key Fibonacci retracement levels, such as the 50% retracement of the post-Ukraine war rally to August highs.

The two moving averages earlier created a death-cross pattern on November 10, which proved bearish after a brief rally to $8.04/MMBtu.

In the summer, natural gas completed a head-and-shoulders pattern, falling below the $5.30 price support. That technical pattern was preceded by negative RSI divergence between April and June 2022, which also led in severe bearish price action to the $5.30 support level.

The double bottom in October and July, as well as the significant technical resistance between November 2021 and March 2022, signal a very critical confluence zone for natural gas.

The $5.30 critical support line is an important test for natural gas prices, which would have dropped by a recession-like 47% from their peak in August.

If the war in Ukraine persists, it is quite improbable that prices will return to the $4.3 level, where they were trading on February 24, 2022, when Russia invaded Ukraine. Bulls may therefore reappear if the $5.3 support line and $5 psychological level are tested.

On the upside, it is unlikely that the skyrocketing price levels observed in the summer of $9.5 or more will be retested anytime soon, as they coincide to an unprecedented supply issue in Europe that triggered an increase in US domestic prices due to increased LNG exports.

In the first quarter of 2023, a sideways market trend with prices ranging from $5 to $8 appears to be the most likely scenario for US natural gas. The colder the winter. The more severe the winter in the Northern Hemisphere, the greater the possibility that prices will trade between $6.5-8 range. Rising recession risks and warmer-than-average temperatures, on the other hand, could prevent a depletion in gas reserves, keeping prices under pressure.

SHORT NATURAL GAS Same Narrative as WTI, Sell the YTD winners, Buy Losers

NG has been a high performing asset this year, a potential ease in RUS-UKR resolution could bring price lower,

also the technical indicators are all pointing towards further negative trend.

Moving Average (ST, MT and LT) all acting as resistance

Momentum indicators not oversold either.

Risk Management (based on Dec22 Futures) Live price

Entry 5.75

Stop 5.9

Target 5

Dec 4,22-NG-How Low Can It Go?In my last post last week, I gave several reasons as to NG declining in price. I said that it would probably get down to 6, maybe lower.

It opened tonight in a Gap Down situation and now sits around 5.8 - crazy low.

What will it do this week? Good question...

I'm thinking it could get as low as 5.2, maybe touching 5 in a low 'rubber band' touch one day this week.

Longer term I believe price will go up...problem is you have this thing called a Worldwide Recession hanging over us in the 1st quarter next year. This will keep prices down.

You have Winter which will push prices up. And who knows what the War holds.

Bottom line...dangerous time to trade. Unless you have a sure bet (which we never do), maybe best to stay on the sidelines and keep your cash :-)

Stay safe and trade well.

Heiko

NATURALGAS - Long from here ✅Hello traders!

‼️ This is my analysis of NATURALGAS.

Here we are bullish from an H4 timeframe perspective, so I am looking for longs. I expect bullish price action from here as the price fills the imbalance and could reject from the bullish orderblock.

Like, comment, and subscribe to be in touch with my content!