Natural Gas

E-cutieAll year EQT, an unloved natural gas producer has been a swing trader's paradise. I've harvested so many gains from these E-cutie trees I thought I'd make a thread just for it and post trading updates.

The macro technical picture is clear. Years of being battered by shorts ended with capitulation in 2020, followed by a swift rebound. Fundamentals are tightening. According to analysts, $25 is fair price for $2.50 NG price. Goldman Sachs has a $23ish target. Price action is showing signs of bottoming. It's lining up but this is much more profitable short term swings.

Currently, price is building a base at previous long term support around $18. More downside is certainly a possibility given that NG prices look overvalued. But, EQT is in a channel and fundamentally undervalued. Investors might front run this sector as demand picks up in later in the year, in which EQT will likely be closer to $25.

s3.tradingview.com

Long EQT

+200 @ 18.10

Gas Prices Catch Fire: 25-Month High Reached Amid Winter's FuryNatural gas futures have reached a 25-month high, marking a significant price increase.

This surge is attributed to two primary factors:

1. Cold Weather: Unusually cold temperatures in key regions have increased demand for natural gas, as it is a primary source of heating.

2. Supply Disruptions: Issues in natural gas production or distribution have tightened supply, further driving up prices.

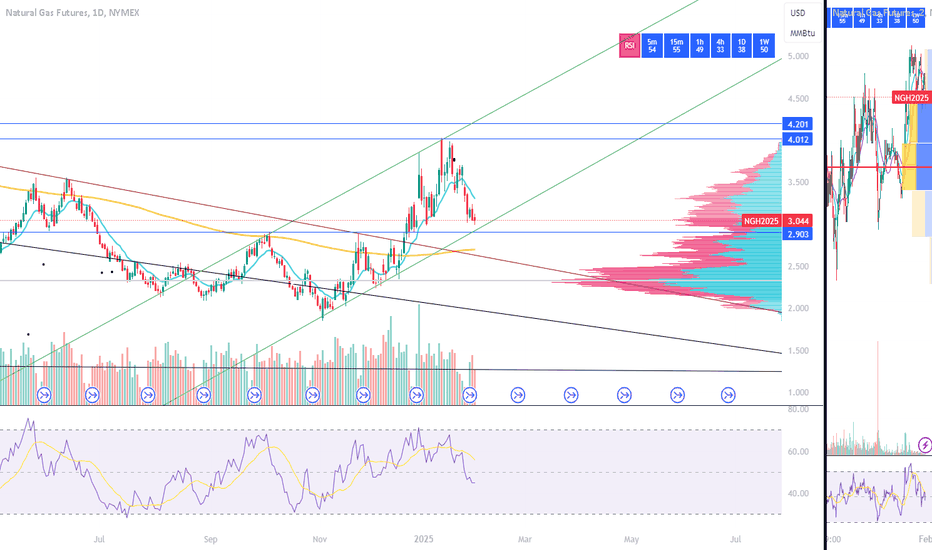

◉ Technical Observations

● After breaking out of the Inverted Head & Shoulders pattern, the price soared to $4.350.

● Subsequently, the price faced a significant pullback to around the $3.30 mark.

● However, the price rebounded from this point and is now at a 25-month high, with expectations for continued growth.

Natural Gas Shows Bullish PatternVANTAGE:NG Natural gas looks to be turning bullish after a projected five-wave impulse from the lows, followed by an ABC correction. It gave us a nice bullish setup formation by Elliott Wave theory, so more upside is in view, especially if breaks back above 4.0 bullish confirmation level, just watch out for short-term intraday pullbacks.

Natural Gas Price Hits Highest Level Since January 2023Natural Gas Price Hits Highest Level Since January 2023

The XNG/USD chart today shows that natural gas prices have surpassed the December 2024 peak, breaking through the key psychological level of $4.000/MMBtu. Since early February, prices have surged by over 20%.

Why Is Natural Gas Price Rising?

According to The Wall Street Journal, the bullish sentiment is driven by:

→ Weather models confirming forecasts of a significant cold spell.

→ LNG exports remaining at record highs.

Additionally, US gas exports may increase further after President Trump lifted the pause imposed by the Biden administration on new LNG export projects. Bloomberg reports that Trump’s administration is close to approving its first LNG export project.

Technical Analysis of XNG/USD

The price movements are forming an upward channel (marked in blue) on the chart:

→ Prices are currently near the upper boundary of this channel.

→ The RSI indicator is in the overbought zone.

→ The price briefly exceeded the $4.000/MMBtu psychological level.

→ Buyers may look to secure profits after the recent sharp gains.

Given these factors, traders may anticipate a potential pullback, which—if it occurs—could bring natural gas prices back towards the channel’s median level.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

OIL CallsThe market structure remains bullish as the Daily price broke the last swing high of $77.89 to make a new market top of $79.44.

Even though in the short term the price is retracing down to fill inefficiencies left by the last rally, we can expect a reversal of the trend at either $69 or $67 supply zones. In case of such reversal the price can with high probability retest the last swing high or the first supply zone which sits outside the current structure at $80.

On the other hand, if the price breaks below $66.80, it will signal the market is entering another bear run.

Natural Gas Short: Testing the $4 Barrier – Opportunity Knocks!Natural Gas (XNG/USD) has spiked to revisit the $4 price zone, activating my short trade. This marks the second time in two years that the price has reached this significant resistance area. The $4 level is pivotal, serving as a key psychological barrier and a historic zone of strong price action. With the position now live, I am leveraging the resistance for a retracement opportunity.

Fundamentals:

• Weather and Seasonal Demand: Short-term spikes in demand are driven by cold weather in the U.S., but with futures traders starting to focus on spring, we may see waning bullish momentum in the coming weeks.

• Russian Gas Supply Constraints: Limited Russian gas flows to the EU continue to add uncertainty to the market, but the current rally seems to be pricing in short-term factors rather than long-term structural changes.

• Historical Levels: The $4 spot price has attracted significant attention as a resistance zone, with $3.40 acting as a key support in recent months. The bounce from this level earlier this year highlights its importance.

• Market Behavior: Futures traders’ sentiment and seasonality are critical drivers. As winter progresses, reduced speculative demand may favor a bearish pullback.

Technicals:

• Entry: $4.00 (Resistance Zone)

• Target: $2.60 - 2.70

• Partials: From $3,19

• Stop Loss: $4.40 (Above Recent Highs)

• Timeframe: 12H

This short trade aligns with technical, fundamental, and seasonal narratives. As the price has shown rejection at this zone, I will actively monitor for a breakdown toward the $3.40 level while managing risk prudently. Stay disciplined, follow your trading plan, and remember to pay yourself as the market unfolds.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

How Can You Trade Energy Commodities?How Can You Trade Energy Commodities?

Energy trading connects global markets to the vital resources that power economies—oil and natural gas. These commodities aren’t just essential for industries and homes; they’re also dynamic assets for traders, influenced by geopolitics, supply, and demand.

Whether you’re exploring benchmarks like Brent Crude and WTI or understanding natural gas markets, this article unpacks the essentials of energy commodities and how to trade them.

What Is Energy Trading?

Energy trading involves buying and selling energy resources that power industries and households worldwide. These commodities are essential for modern life and are traded in global markets both as physical products and financial instruments.

Energy commodities include resources like oil, natural gas, gasoline, coal, ethanol, uranium, and more. In this article, we’ll focus on the two that traders interact with the most: oil and natural gas.

Oil is often divided into benchmarks like Brent Crude and WTI, which set global and regional pricing standards. These benchmarks represent crude oil that varies in quality and origin, impacting its trade and refining applications.

Natural gas, on the other hand, plays a critical role in electricity generation, heating, and industrial processes. It’s traded in various forms, including pipeline gas and liquefied natural gas (LNG), offering flexibility in transportation and supply.

What makes energy commodities unique is their global demand and sensitivity to external factors. Weather patterns, geopolitical developments, and economic activity all heavily influence their prices. For traders, this creates a dynamic market with potential opportunities to take advantage of price movements.

Additionally, energy commodities can act as economic indicators. A surge in oil prices, for example, might reflect growing demand from expanding industries, while a drop could indicate reduced consumption. Understanding these resources isn’t just about their practical use—it’s about grasping their role in shaping global markets and financial systems.

Oil: Brent Crude vs WTI

Brent Crude and WTI (West Texas Intermediate) are the world’s two leading oil benchmarks, shaping prices for a resource critical to industries and economies. Despite both being types of crude oil, they differ significantly in origin, quality, and market influence.

Brent Crude

Brent Crude is a globally recognised benchmark for oil pricing, primarily sourced from fields in the North Sea. Its importance lies in its role as a pricing reference for about two-thirds of the world’s oil supply. What makes Brent unique is its lighter and sweeter quality, meaning it has lower sulphur content and is easier to refine into fuels like petrol and diesel.

This benchmark is particularly significant in European, African, and Asian markets, where it serves as a key indicator of global oil prices. Its value is heavily influenced by international demand, geopolitical events, and production levels in major exporting countries. For traders, Brent offers a window into global supply and demand trends, making it a critical component of energy markets.

West Texas Intermediate (WTI)

WTI, or West Texas Intermediate, is the benchmark for oil produced in the United States. Extracted primarily from Texas and surrounding regions, WTI is even lighter and sweeter than Brent, making it suitable for refining into high-value products like petrol.

WTI’s pricing is heavily tied to North American markets, with its hub in Cushing, Oklahoma, a key point for storage and distribution. Localised factors, like US production rates and storage capacity, often create price differentials between WTI and Brent, with Brent typically trading at a premium. For example, logistical bottlenecks in the US can drive WTI prices lower.

The main distinction between the two lies in their geographical focus: while Brent captures the international market’s pulse, WTI provides insights into North American energy dynamics. Together, they form the foundation of global oil pricing.

Natural Gas: A Growing Energy Commodity

Natural gas is a cornerstone of the global energy market, valued for its versatility and role in powering economies. It’s used extensively for electricity generation, heating, and industrial processes, with demand continuing to rise as countries seek cleaner alternatives to coal and oil.

This energy commodity comes in two primary forms for trade: pipeline natural gas and liquefied natural gas (LNG). Pipeline gas is delivered directly via extensive networks, making it dominant in regions like North America and Europe.

LNG, on the other hand, is supercooled to a liquid state for transportation across oceans, opening up markets that lack pipeline infrastructure. LNG trade has grown rapidly in recent years, with key suppliers like Qatar, Australia, and the US meeting surging demand in Asia.

Pricing for natural gas varies regionally, with hubs like Henry Hub in the US and the National Balancing Point (NBP) in the UK serving as benchmarks. These hubs reflect regional dynamics, such as weather conditions, storage levels, and local supply disruptions.

Natural gas prices are also closely tied to broader geopolitical and economic factors. For example, harsh winters often drive up heating demand, while conflicts or sanctions affecting major producers can create supply constraints. This volatility makes natural gas an active and highly watched market for traders, offering potential opportunities tied to shifting global conditions.

Price Factors of Energy Commodities

Energy commodity prices are influenced by a mix of global events, market fundamentals, and local factors. Here’s a breakdown of key elements driving oil and gas trading prices:

- Supply and Production Levels: Output from major producers like OPEC nations, the US, and Russia has a direct impact on prices. Supply cuts or surges can quickly move markets.

- Geopolitical Events: Conflicts, sanctions, or political instability in oil and gas-rich regions often disrupt supply chains, creating volatility.

- Weather and Seasonal Demand: Cold winters boost natural gas demand for heating, while summer driving seasons often increase oil consumption. Extreme weather events, such as hurricanes, can also damage infrastructure and reduce supply.

- Economic Growth: Expanding economies typically consume more energy, driving demand and prices higher. Conversely, a slowdown or recession can weaken demand.

- Storage Levels: Inventories act as a cushion against supply disruptions. Low storage levels often signal tighter markets, pushing prices up.

- Transportation Costs: The cost of shipping oil or LNG across regions impacts pricing, particularly for seaborne commodities like Brent Crude and LNG.

- Exchange Rates: Energy commodities are usually priced in dollars, meaning currency fluctuations can affect affordability in non-dollar markets.

- Market Sentiment: Traders’ expectations, shaped by reports like US inventory data or OPEC forecasts, can influence short-term price movements.

How to Trade Energy Commodities

Trading energy commodities like oil and natural gas involves navigating dynamic markets with the right tools, strategies, and risk awareness. Here’s a breakdown of how traders typically approach energy commodity trading:

Instruments for Energy Trading

Energy commodities can be traded through various instruments, typically through an oil and gas trading platform. For instance, FXOpen provides access to oil and gas CFDs alongside 700+ other markets, including currency pairs, stocks, ETFs, and more.

- CFDs (Contracts for Difference): Popular among retail traders because they allow access to global energy markets without owning the physical assets. They offer leverage and provide flexibility to take advantage of both rising and falling prices. Additionally, CFDs have lower entry costs, no expiration dates, and eliminate concerns like storage or delivery logistics. Please remember that leverage trading increases risks.

- Futures: These are contracts to buy or sell commodities at a future date. While they provide leverage and flexibility, trading energy derivatives like futures is often unnecessarily complex for the average retail trader.

- ETFs (Exchange-Traded Funds): Energy ETFs diversify exposure to energy commodities or related sectors.

- Energy Stocks: Shares in oil and gas companies provide indirect exposure to commodity price changes.

Analysis: Fundamental and Technical

Energy traders rely on two primary types of analysis:

- Fundamental Analysis: Examines supply and demand factors like OPEC decisions, weather patterns, geopolitical tensions, and economic indicators such as GDP growth or industrial output.

- Technical Analysis: Focuses on price charts, identifying patterns, trends, and important levels to anticipate potential market movements.

Combining these approaches can offer a broader perspective, helping traders refine their strategies.

Taking a Position and Managing Risk

Once traders identify potential opportunities, they decide on position size and duration based on their analysis. Risk management is critical to help traders potentially mitigate losses in these volatile markets. Strategies often include:

- Diversifying positions to reduce exposure to a single commodity.

- Setting limits on position sizes to align with overall portfolio risk.

- Monitoring leverage carefully, as it can amplify both potential returns and losses.

Risk Factors in Energy Commodities Trading

Trading energy commodities like oil and natural gas offer potential opportunities, but it also comes with significant risks due to the market's volatility and global nature.

- Price Volatility: Energy markets are highly sensitive to geopolitical events, economic shifts, and supply disruptions. This can lead to rapid price swings, particularly if the event is unexpected.

- Leverage Risks: Many instruments, like CFDs and futures, allow traders to use leverage, amplifying both potential returns and losses. Mismanaging leverage can lead to significant setbacks.

- Geopolitical Uncertainty: Events like conflicts in oil-producing regions or trade sanctions can disrupt supply chains and sharply impact prices.

- Market Sentiment: Energy prices can react strongly to reports like inventory data, OPEC announcements, or unexpected news, creating rapid shifts in sentiment and price direction.

- Overexposure: Focusing too heavily on a single energy commodity can magnify losses if the market moves against the position.

- Economic Factors: Slowing industrial activity or recession fears can reduce demand for energy, putting downward pressure on prices.

The Bottom Line

Energy commodities trading offers potential opportunities, driven by global demand and supply. Whether focusing on oil, natural gas, or other energy assets, understanding the fundamentals and risks is key to navigating this complex market. Ready to explore oil and gas commodity trading via CFDs? Open an FXOpen account to access advanced tools, competitive spreads, low commissions, and four trading platforms designed to support your journey.

FAQ

What Are Energy Commodities?

Energy commodities are natural resources used to power industries, homes, and transportation. Key examples include crude oil, natural gas, and coal. These commodities are traded globally as physical assets or through financial instruments like futures and CFDs.

Can I Make Money Trading Commodities?

Trading commodities offers potential opportunities to take advantage of price movements, but it also involves significant risks. The effectiveness of your trades depends on understanding of market dynamics, analyses of supply and demand, and risk management. While some traders achieve returns, losses are also common, especially in volatile markets like energy.

How Do I Start Investing in Energy?

Investing in energy typically begins with choosing an instrument like ETFs or stocks, depending on your goals and risk tolerance. Researching market fundamentals, monitoring geopolitical and economic factors, and practising sound risk management are essential steps for new investors.

What Is an Energy Trading Platform?

An energy trading platform, or power trading platform, is software that enables traders to buy and sell energy commodities. These energy trading solutions provide access to pricing data, charting tools, and news feeds, helping traders analyse markets and execute trades efficiently.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

$GAIL REVIVES US LNG PLANS POST-TRUMP BAN LIFTNSE:GAIL REVIVES US LNG PLANS POST-TRUMP BAN LIFT

1/7

Good morning, energy traders! ☀️⚡️

Major shake-up in the LNG world: India’s GAIL is back on the hunt for a US LNG stake or long-term deals. What’s fueling this move? Let’s break it down!

2/7 – THE BACKSTORY

• Trump administration lifts the ban on new LNG export permits.

• GAIL had plans on ice since 2023—now they’re back in action.

• Sandeep Kumar Gupta (GAIL’s chairman) says: “We’re reviving our plans to buy a stake or sign long-term LNG contracts.”

3/7 – WHY IT MATTERS

• LNG Prices: Expected to soften post-2026 as supply ramps up.

• Impact on India: Cheaper energy imports, eye on boosting gas to 15% of energy mix by 2030. ♻️

• US Benefit: Strengthens position as a global LNG exporter—hello, bullish signals for Cheniere Energy (LNG) and Venture Global!

4/7 – MARKET IMPACT

• Prices: More supply could translate to downward pressure on LNG prices.

• Investment Angle: US LNG producers & infrastructure might see capital inflows. Keep an eye on relevant tickers!

• Energy Security: India aims for a cleaner, more reliable energy mix—this is long-term strategy at play.

5/7 – STRATEGIC ANGLE

• Aligns with India’s push to expand natural gas usage from ~6% to 15% by 2030.

• US Gains: Jobs, economic boost, and stronger foothold in global energy markets.

• Trade Partnerships: Could deepen economic ties between US & India.

6/8 What’s your take on GAIL’s US LNG strategy?

1️⃣ Bullish on US LNG exports 🐂

2️⃣ Bearish on LNG prices post-2026 🐻

3️⃣ Waiting for more clarity ↔️

Vote below! 🗳️👇

7/7 – YOUR TRADING PLAYBOOK

• Short-Term: Watch for volatility in LNG stocks (like LNG, Venture Global). GAIL might see a spike on renewed interest.

• Long-Term: Growing LNG supply + India’s energy push = potential contrarian bet on energy stocks before the broader market catches up.

Natural Gas key levels 09 Feb 2025Natural Gas key buy and sell levels for the coming week.

Looking to enter a buy at 3.333 follow the key levels up note 3.500 would be a key resistance.

On the sell side looking to enter at 3.280 following down keeping an eye on the levels marked for further continuation watching key resistance at 3.12 to 3.08

As always secure when in profit , markets are very volatile last 2 weeks so take the money secure and run

NATURAL GAS: Channel Down bottomed and is rebounding to 4.800Natural Gas is neutral on its 1D technical outlook (RSI = 47.119, MACD = -0.072, ADX = 39.523) as the bearish wave of the long term Channel Up found support on its bottom and the 1D MA100 and is rebounding. It hasn't yet crossed over the 1D MA50 but when it does the bullish signal will be validated. On any occassion, last time the 1D RSI rebounded near this level, it was on the October 18th and August 27th 2024 lows. Both later rebounded by at least +60.48%. We aim for a similar target (TP = 4.800).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

XNG/USD "Natural Gas" Energy Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XNG/USD "Natural Gas" Energy Metal market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 👀 Be wealthy and safe trade.💪🏆🎉

Entry 📉 : Traders & Thieves with New Entry A Bear trade can be initiated at any price level.

however I advise placing sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high level should be in retest.

Stop Loss 🛑: Using the 4h period, the recent / nearest high level

Goal 🎯: 2.950 (or) Before escape in the market

Scalpers, take note : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, Sentimental Outlook:

The XNG/USD "Natural Gas" Energy market is expected to move in a bearish direction, driven by several key factors.

Based on current market conditions, the XNG/USD Natural Gas market is expected to move in a Bearish direction.

🔆Fundamental Factors:

-Supply and Demand Balance: The natural gas market is expected to move into a supply surplus, driven by increasing production and decreasing demand.

-US Natural Gas Production: US natural gas production is expected to increase, putting downward pressure on prices.

-LNG Export Capacity: Increasing LNG export capacity from the US is expected to put downward pressure on natural gas prices.

🔆Macroeconomic Factors:

-Mild Winter Weather: Warmer-than-expected winter weather in the US is expected to decrease demand for natural gas, putting downward pressure on prices.

-Global Economic Slowdown: Slowing global economic growth, particularly in China, is expected to decrease demand for natural gas.

-US Dollar Strength: A stronger US dollar is expected to put downward pressure on natural gas prices, making them more expensive in international markets.

🔆Trader/Market Sentimental Analysis:

-Trader Sentiment: The CoT report shows that speculative traders are net short natural gas, indicating a bearish sentiment.

-Market Sentiment: The market sentiment is bearish, with many analysts expecting natural gas prices to decline due to the supply and demand balance.

-Technical Analysis: The technical analysis shows that natural gas is in a downtrend, with a bearish breakdown below the $3.00 level.

🔆Sentimental Outlook:

Bearish Sentiment: 65%

Bullish Sentiment: 20%

Neutral Sentiment: 15%

🔆Overall, the bearish outlook is driven by a combination of macroeconomic and fundamental factors, with a 60% chance of a bearish move, 20% chance of a bullish move, and 20% chance of a neutral move.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

🚨Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

🚨Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

XNG/USD "Natural Gas" Energy Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XNG/USD "Natural Gas" Energy Market market. Please adhere to the strategy I've outlined in the chart, which emphasizes long & Short entry. 👀 Be wealthy and safe trade 💪🏆🎉

Entry 📈 : "The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

Buy entry above 3.500

Sell Entry below 3.000

Stop Loss 🛑: Using the 1H period, the recent / nearest Pullbacks.

Target 🎯:

-Bullish Robbers TP 4.000 (or) Escape Before the Target

-Bearish Robbers TP 2.600 (or) Escape Before the Target

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

The XNG/USD "Natural Gas" Energy Market market is currently experiencing a bullish trend,., driven by several key factors.

🔆 Fundamental Factors

- Supply and Demand Imbalance: The global demand for natural gas is outpacing supply, leading to a surge in prices.

- Weather Patterns: Colder-than-expected winter weather in the Northern Hemisphere is driving up demand for heating fuels, including natural gas.

🔆 Macroeconomic Factors

- Global Economic Trends: The global economy is experiencing a slowdown, but the energy sector remains resilient due to strong demand for natural gas.

- Inflation Rates: Rising inflation rates are driving up the cost of living, but the impact on the XNG/USD pair is currently neutral.

🔆 COT Report

- Speculative Positions: Speculative traders are net long on the XNG/USD pair, indicating a bullish sentiment.

- Commercial Traders: Commercial traders are net short on the pair, indicating a bearish sentiment.

🔆 Market Sentiment and Positioning

- Client Sentiment: 60% of client accounts are long on this market, indicating a bullish sentiment.

- Market Positioning: The XNG/USD pair is currently overbought, with a possibility of a price correction.

🔆 Conclusion:

The sentimental outlook for XNG/USD is mixed, with varying degrees of bullishness and bearishness among institutional investors, large banks, investment companies, and retail traders. While some market participants are optimistic about natural gas prices due to rising demand and supply constraints, others are cautious due to mild winter weather and increased production.

🔆 Prediction and Overall Outlook

- Based on the analysis, the XNG/USD pair is expected to move in a bullish trend, with a 65% probability of reaching $4.50 in the short term. However, there is a 35% chance of a price correction to $3.80 due to overbought conditions.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

NATGAS GAP CLOSURE|LONG|

✅NATGAS gapped down massively

And the price has almost reached

The strong horizontal support

At the round level of 3.00$

And as Gas is objectively oversold

We are already seeing some

Gap closure moves and we

Will be expecting a further

Move up until the gap is

Closed completely

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Natural Gas ( XNGUSD ) Buy Opportunity Current Price: $3.267

Setup: Natural Gas is bouncing off a strong demand zone and respecting the ascending trendline support, indicating potential for a bullish move. The RSI is turning upwards, suggesting momentum in favor of buyers.

Entry: $3.267

Stop Loss: $3.15 (below demand zone and trendline support for safety)

Take Profits:

TP1: $3.36

TP2: $3.55

TP3: $3.98

Why Buy?

Price is rebounding from a solid demand zone.

Clear respect for the trendline, confirming bullish sentiment.

Rising RSI signals growing momentum for a move higher.

Up to 7,200 USD profit per lot!

$1,100 Risk per lot !

🎯 Plan your trade and manage your risk! Let’s make some great trades together! 💹

XNG/USD Analysis: Bears Pressure Key SupportXNG/USD Analysis: Bears Pressure Key Support

On 5 December, while analysing the natural gas chart, we noted that price movements:

→ were forming an ascending channel (shown in blue);

→ support from the lower boundary of the channel (reinforced by the psychological level of 3.000) was already evident in a nascent price reversal (indicated by an arrow).

As the XNG/USD chart illustrates, since that time (marked by a blue arrow), the price indeed rose, using the support from the lower boundary of the channel to reach its upper boundary on 30 December.

However, we now see supply forces displaying aggression – whenever the natural gas price climbs above 3.700, bears quickly intervene (marked by red arrows), pushing the price back down.

What could happen next?

From a technical analysis perspective of the XNG/USD chart:

→ The price is hovering near the key support, formed by the lower boundary of the ascending channel (which has been in place since last summer).

→ Bearish aggression, as mentioned above, sets the stage for a potential bearish breakout of this critical support, evidenced by the bearish gap at Monday’s market open.

From a fundamental analysis standpoint:

→ Meteorological reports of colder weather drove the price up to 3.570, but this appears to be a temporary rebound.

→ Bearish sentiment in the natural gas market may be amplified by statements from the Trump administration expressing a determination to lower oil prices.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.