NAV trading opportunitySo... I am still very long on this one. Graph is somehow funny, it's seems there have been a lot of pnd's. but trend still shows upward potential. We could bounce from this price up or dive to the next support line. And we are gonna see more of this funny pumps.

NAV

🆓Navcoin/BTC Analysis (3/2) #NAV $NAVNAV is trying to conquer 700sts to increase strongly in this February to 1100sts or even 1600sts.

However, NAV pumps are usually flash pumps so we need to place sell orders immediately when buying to ensure we do not lose profits.

📈BUY

-Buy: 675-725sts if A SL if B

📉SELL

-Sell: 1100-1150sts. SL if A

-Sell: 1600-1700sts. SL if A

❓Details

Condition A : "If 1D candle closes ABOVE this zone"

Condition B : "If 1D candle closes BELOW this zone"

AMB forming cup and handle patternAMB prepping up for going to higher levels. I somehow like and dislike this coin at the same time. Communication between community and team is lacking. Supply is increasing. So ... undetermined about how I feel about this coin. Still good shorterm trade.

Can LTO break this resistance lineLTO is probably the most undervalued coin. Fundamentals are off the charts, Top 10 in tx, real business transactions, real clients. It's almost too good to be true. Partnership/merger with VIDT is only making them stronger. In my opinion real unicorn over here. If it breaks this resistance line, sky is the limit. Let's be patient.

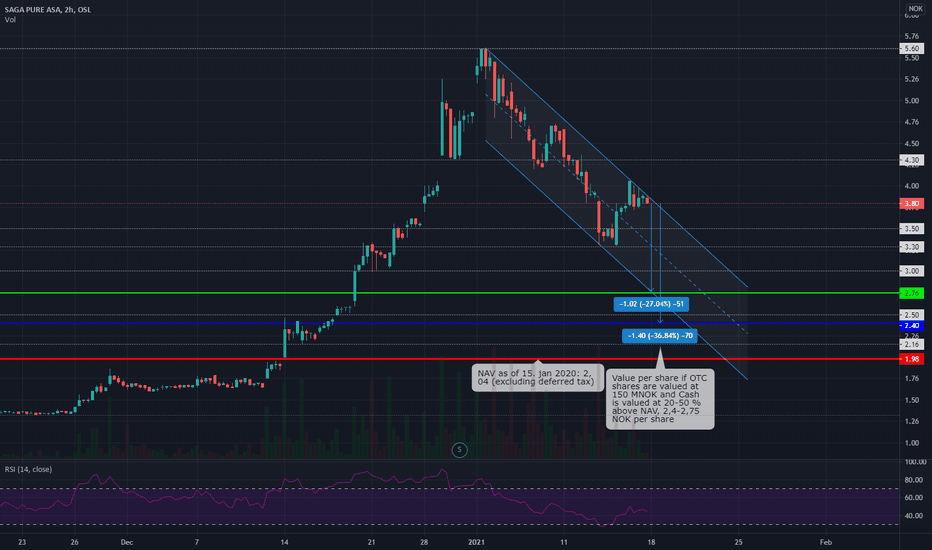

Saga Pure trading at 175-194 % of NAV (price target 2.2-2.9 NOK)Saga Pure ( OSL:SAGA ) is an investment company focusing on renewable and clean energy. Their investments are in both publicly traded companies and in private companies. The largest shareholder is Øystein Stray Spetalen.

The company was previously named Saga Tankers and owned stocks in S.D. Standard Drilling, an indoor sport arena and other smaller investments. Prior becoming an investment company the company owned various tanker vessels that was sold in 2011 and 2012. The company launched a new strategy in the fall of 2020 where investments would focus on renewable and clean energy. With a new strategy they divested what they considered outside the Company's main investment focus (except Vistin Pharma and Element), hired a new CEO (Bjørn Simonsen) and have issued shares a number of times to fund future investments.

According to my calculations, Saga Pure is currently trading at 175-194 % of net asset value. My price target is 2.2-2.9 NOK per share.

The company published a prospectus 11th of January 2021 as they are doing three subsequent offerings after the a number of private placements. According to my understanding of the prospectus:

Net asset value as of 15th of January 2021 before execution of subsequent offerings:

Sum listed investments (fair value, market price): 325.94 MNOK

Sum investment in private companies (investment value): 65 MNOK

Net cash-liabilities: 517.1 MNOK

Cash received from partial divestment of Everfuel ASA: 13.3-101.5 MNOK

NAV: 921.34-1,009.54 MNOK

In addition to the assets listed above they have an nine-month option for a 30 MNOK investment in Bergen Carbon Solutions.

NAV per share:

Post private placements (469,149,831 shares), NAV 1,96-2,15 per share

Post private placements + CEO options (484,149,831 shares), NAV 1,96-2,15 per share

Post private placements + CEO options + Subsequent offering I (488,149,831 shares), NAV 1,97-2,15 per share

Post private placements + CEO options + Subsequent offering II (493,049,831 shares), NAV 1,98-2,15 per share

Post private placements + CEO options + Subsequent offering III (497,849,831 shares), NAV 2.00-2.17 per share

If we assign the cash holdings with a value 20-50% above NAV the price target for Saga Pure is 2.2-2.8 NOK per share. If we value investment in private companies (executed in 11th and 28th of december 2020) at double the investment price target is 2.3-2.9 per share.

Investments:

Everfuel ( OSL:EFUEL ), 1.8 million shares, listed on Euronext Growth, market price as of 15th of January 2021 153 NOK, fair value 275.4 MNOK

Vistin Pharma ( OSL:VISTN ), 2,284,280 shares, listed on Oslo Stock Exchange, market price as of 15th of January 2021 20 NOK, fair value 45.69 MNOK

Element ( OSL:ELE ), 970 thousand shares, listed on Oslo Stock Exchange, market price as of 15th of January 2021 5 NOK, fair value 4.85 MNOK

Horisont Energi ASA, 35 MNOK, not listed, fair value at investment date 35 MNOK

Bergen Carbon Solutions AS, 30 MNOK (+option agreement with the right to invest additional 30 MNOK in a nine-month period), not listed, fair value at investment date 35 MNOK

Sum listed investments (fair value, market price): 325.94 MNOK

Sum investment in private companies (investment value): 65 MNOK

Capitalization and indebtedness adjusted for post-balance sheet events, private placements and investments:

Cash: +537.2 MNOK (including private placements, excluding potential proceeds from subsequent offerings)

Trading securities: +18.1 MNOK

Long term debt: -0 NOK

Other current financial debt: -38.2 MNOK (including 35 MNOK investment in Horisont Energy)

Net cash-liabilities: 517.1 MNOK

Other noteworthy changes in balance sheet:

Saga Pure has divested 700,000 shares in Everfuel between 29th of October 2020 and 6th of January 2021. Bringing their investment from 2.5 million shares to 1.8 million shares. The price for the 700,000 shares sold is unknown. The market price per share has a low of 19 NOK and a high of 145 NOK in the same period. This will have a positive effect on their cash holding by 13.3 - 101.5 MNOK.

Private placements since 20th of October 2020:

Number of shares prior 20th of October 2020: 286,149,831

54,000,000 (2020-10-20), gross proceeds 70.2 MNOK, cost 1.5 MNOK, net proceeds 68.7 MNOK

34,000,000 (2020-11-30), gross proceeds 54.4 MNOK, cost 1.2 MNOK, net proceeds 53.2 MNOK

35,000,000 (2020-12-14), gross proceeds 73.5 MNOK, cost 1.3 MNOK, net proceeds 72.2 MNOK

30,000,000 (2020-12-21), gross proceeds 87 MNOK, cost 2.0 MNOK, net proceeds 85 MNOK

30,000,000 (2020-12-29), gross proceeds 123 MNOK, cost 2.0 MNOK, net proceeds 121 MNOK

Number of shares post private placements: 469,149,831

Number of shares available in subsequent offerings:

4,000,000, price 2.1 NOK per share, potential gross proceeds 8,4 MNOK (bringing the total number of shares to 473,149,831)

4,900,000, price 2.9 NOK per share, potential gross proceeds 14,21 MNOK (bringing the total number of shares to 478,049,831)

4,800,000, price 4.1 NOK per share, , potential gross proceeds 19,68 MNOK (bringing the total number of shares to 482,849,831)

Subscription period ends on 27th of January for all three subsequent offerings.

Number of shares the board has allocated to share options (25 million shares authorized to allocate for options for employees and key persons):

5,000,000, strike 1.5 NOK

5,000,000, strike 2.0 NOK

5,000,000, strike 2.5 NOK

10,000,000, authorized but not allocated

Other information from the prospectus:

Saga pays a fee on a total of NOK 200,000 ex. VAT each month to Ferncliff Holding AS for consultancy services carried out by Martin Nes and Øystein Stray Spetalen. Ferncliff Holding AS is a company owned and controlled by director and main shareholder in Saga, Øystein Stray Spetalen.

The Company pays on a hourly basis for back-office services such as accounting, and a monthly fee for rent of office premises and common costs.

VIDT trading ideaVIDT is probably one of the coins with the best tokeneconomics (tokenomics). Besides LTO is one of the currencies that has best fundamentals in whole cryptocurrency world. For now it's probably going to 0.00002500 btc/coin. if it breaches that level ... This one is also long time hodl coin.

AMB buying opportunity (LONG position)RSI oversold on 1W. Good time to go long. Unless there is something fundamentally wrong with this project.... As you can see there is a lot of room for growth, just zoom out.

NAVCOIN - one to watchNav / USD

New privacy protocol release in the coming months could drive the price up to ATH.

NavCoin / USD - the bright future aheadNavCoin / USD - the bright future ahead

NavCoin is currenctly focussing on blsCT private transactions, bringing NavCoin on par with the leading Privacy Coins in the Cryptospace.

With many of the features this coin has, it will be curious to see how big this project can grow in the upcoming years.

NAV BULL💰 Buy #NAV/BTC

💰 Buy: 0.00001170

🥇: 0.000001220

🥈: 0.000001480

🥉: 0.000001920

⛔️ stop: 0.0000940

💹 market: Binance

NAV Ready for bullish Move! But!As I have drawn all the important support and resistance key levels, the trend from here is looking bullish but only in following case:

- The candle which I have circled has opened above the monthly level at 1346 sats. The candle has also wicked below this level and it was rejected, indicates that this level is a support.

Now this candle has to break the upper trend line resistance at 1455-1460 zone, if it wicked past this level and a new candle is formed above this level then the move will be bullish from there and we can see a 20 to 25 percent rise.

If you have any questions u can ask me in the comments section.

Trade save.

NAV Coin (NAV) Shows A Clear/Strong SignalNAV Coin (NAVBTC) Chart Signal

Look at this huge candle marked with a yellow circle on this chart... This is a strong reversal signal.

Look at the strong volume.

Look at the MACD and RSI...

All these signals are pointing up...

Get the picture?

NAV coin (NAVBTC) is now looking bullish after 'shaking out' weak hands.

This pair can print green after yesterday's candle.

This is not financial advice.

Remember to always have a plan before you trade and do your own research.

Diversify.

Namaste.

NAV/BTC Headed for a Bullish TurnaroundNAV/BTC is at an interesting point

Price seems to have found support at the 100 ema (gray) line and has started retracing back up.

Bullish signals (1D timeframe):

- Moving averages: if 10ema (purple line) doesnt crossover the 50 ema (gold) line but retraces back up, then its a bullish ride

- RSI: index is at 46 but is on the rise up, which shows increasing buying pressure.

- Volume: Bullish volume is on the increase

Price projection: Price can rebound to 0.00001576 (19.6% profits)

This is just a trading idea, its not a trade advice....

If you like my ideas, dont forget to like...

Follow me as well

NAVBTC Ready for Minimum 50% in this Month#NAVBTC TA Update:1

#NAVBTC now surged because of MainNet News.

But i am accumulating Here.

Buy some at 1420 Satoshi

And wait for dip also.

Entry1:- 1350-1420 Satoshi

Entry2:- 1250-1350 Satoshi

Targets:- 3057/5408 Satoshi

Why i bought..?

Because very Long Accumulation in #NAVBTC so I bought and also MainNet News in this Month.

Guys Please LIKE and Comments for Appreciate me.

Must follow for latest crypto Updates.

Thank you.

NAV Coin Activates Its Strongest Support, Time To Move?NAV Coin (NAVBTC) just activated its strongest support level and is preparing for a strong bullish move.

This next move can easily hit 144% or more in gains... Up to 240% if the 1.236 Fib. extension level is hit.

We have a strong RSI and bullish divergence can be spotted with the MACD.

NAV Coin is likely to move within 2 weeks.

It can happen within 1-3 days, just as it can take 11-14 days.

Thanks a lot for reading.

Wishing you a nice day.

Namaste.

NAV Coin Is Already Trading Above Resistance (150%)NAV Coin Is Already Trading Above Resistance, it can go higher this time.

Prices are now above EMA100 and MA200, after a recent test of the lower support (red).

With support fully tested and the bulls now back in control, NAV Coin can easily go bullish and print a nice jump.

The team behind this project is also very active, which is a good signal for any altcoin pair that we can use to trade.

This is not financial advice.

Namaste.

NAV Coin Long-Term Chart (4265% Potential Profits to ATH)NAV Coin (NAVBTC) has been bullish since our last chart was published on March 16, you can see it below:

NAV Coin Activates Its Strongest Support, Time To Move?

Seeing the above chart and also remembering past history, we know that NAVBTC tends to print long-wicks, so always make sure to set your sell orders beforehand.

Chart analysis

On the chart above we have NAVBTC weekly with long-term targets, right now we have prices moving above EMA10 after activating "strong support"...

NAV Coin can easily grow from this point forward.

Namaste.

NAVISTAR - 150% rally possible !!!Nav has the potential to go above 50 but at first let's go for at least 31-32 if we don't see it go below 15.70.

On daily we have a clean 5 waves rise followed by this ABC correction. We have length equality between A & C at 16.80 and the 50% retracement level of previous impulsive wave and also historic support.

On the 30min chart, looks like we have 5 waves up and are now seeing a correction. So, at 17.5 - 18.5 I'll buy.

Navcoin looking good and I still can not draw chartsProbably my fav coin (along with ICX and XMR). Devs are working hard on project and did even in full bear market. You can check their GitHub. Repositories receive commits on regular basis. I suspect shorterm goal is somewhere between 0.00003 and 0.00004. Good fundamentals to go (very) long if you haven't yet.