Short Position - NASDAQShort Position Entry: Consider initiating a short position if the Nasdaq-100 Index falls below 21,000.

Stop Loss (SL): Set a stop loss at 21,555 to manage potential losses.'

Market Sentiment: The combination of the Federal Reserve's cautious approach and rising inflation may contribute to a weakening market sentiment, potentially leading to a downward movement in the index.

his recommendation is for educational purposes only. Always consult your financial advisor before making any investment decisions. Stock trading involves risks, including the potential loss of capital. Ensure to evaluate your risk tolerance and conduct thorough research.

NASDAQ 100 CFD

QQQ: Tariff ReactionNASDAQ:QQQ As China strikes back with a 34% tariff on U.S. goods starting April 10, the global trade landscape could see some serious turbulence. This follows Trump's tariff moves, and the market's already feeling it: QQQ’s daily chart shows capitulation volume on the table, suggesting a potential bounce— IF tariffs ease.

But until these trade tensions subside, it's likely to be a rocky ride. Tariffs push prices up, inflation lingers, and the Fed finds itself boxed in. The outcome? A market crash, recession, and stagflation—yet, there's still hope for a bounce, depending on how these factors play out.

Manage the levels with us at ChartsCoach.

NASDAQ tanking! Do the right thing and CUT RATES NOW Jerome!The market is collapsing, China is retaliating with 34% tariffs and Powell is making jokes!

Well that pretty much sums up the market news since yesterday, with Nasdaq / US100 having the worst day since the COVID crash 5 years ago while President Trump shouting 'the market is going to boom'.

Today China imposed 34% reciprocal tariffs on imports of U.S. goods and the worst of all.. Jerome Powell on his speech a little earlier was making jokes about his purple tie, avoiding to address the elephant in the room and take action!

Nasdaq is testing the August 5th 2024 Low, having crossed even under the 1week MA100 for the first time since May 15th 2023! At the same time the 1week RSI just got oversold at 30.00.

Reminds you of something? Yes that's right the last time Nasdaq broke under its 1week MA100 that fast and got oversold on its 1week RSI was on the week of March 16th 2020: YES the COVID crash.

What happened then? Well dear old Fed stepped up, did what they HAD to and cut rates to near zero (0.25%).

Even President Trump tweeted just a few hours ago that Powell should cut rates now and stop playing politics!

Tariffs are in place and they will pay off very well in the long term. On the shorter term, it is in Powell's hands save the economy.

-- Do the right thing and finally CUT THE RATES Jerome! --

Follow us, like the idea and leave a comment below!!

Are Time and Reason in Harmony in SPX?Are Time and Reason in Harmony in SPX?

S&P 1D Technical and Fundamental Analysis;

This structure, which looks like an ordinary decline on the SPX daily chart ... in fact, we can say that it carries the pieces of a big scenario that develops synchronously both technically and fundamentally.

Let me explain now;

5 December 2024 was not just a breaking point. Because Trump's statements after taking the presidency for the second time, especially the message that ‘customs walls may rise’ had become clear.

In the same week, the uptrend in SPX quickly weakened and declined as the FED gave the message ‘Interest rate cut is not imminent’.

From here, Bullish Sharq started the formation of harmonic formation.

Now comes the week of 1 May.

- FED's interest rate decision,

- Trump's budget plan,

- And one of the critical macro thresholds where company balance sheets are announced.

While everything is going well so far, if we take into account that the chart will also touch a strong trend line, it may mean ‘either a bounce or a collapse from here’.

Because the price in the market does not just move, it looks for reasons .

I would also like to ask you here;

What will greet the market when this date comes?

Harsh interest rate rhetoric?

Trump's aggressive economic agenda?

Or a recovery supported by positive balance sheets?

Welcome to the real world Uncle Sam!The market can withstand a lot of pressure.

It can handle:

the dawn of "fake news" and outright "lying"

the pollution and "enshitification" of social media

imperialist ideas of a Gaza takeover

partnering with a Russian totalitarian state

overhyping of AI and Nvidia's overpricing

populist politics

unworldly valuations of tech stocks

What it cannot handle is:

Upsetting the world order

Undermining of NATO, Europe, and allies

Starting trade wars with your best friends

Establishing tariffs which will harm the US economy

I love the US stock market, and US animal spirits, it's the best in the world.

But when risk rises, then secure investments like bonds/treasuries become the smart money move. Stocks become "risk off"

Risk is rising, tariffs will pressure inflation, inflation kills economies and markets.

The European defense industry will benefit, the US consumer will pay higher prices.

Higher risk, could mean a lack of confidence, and confidence powers the stock market.

Batton Down the Hatches.

Trading Note: I sold all my US holdings on Tuesday, at the break of the double top neckline (see chart).

My target price is the 2021 high, before the one-year bear market. Its a big drop, I give it a 60-70% chance.

RSI & ROC Negative Medium-term divergences

Of course this could all change if Trump backtracks on trade wars, tariffs and imperialist rhetoric.

But until then, enjoy the ride.

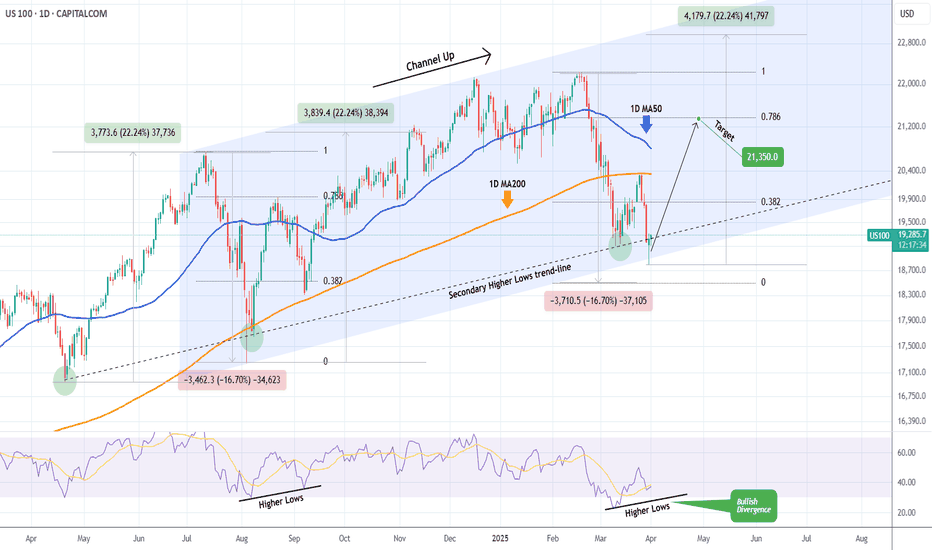

NASDAQ Huge Bullish Divergence points to 21350 inside April.Nasdaq (NDX) has been trading within a Channel Up pattern since the July 11 2024 High. The latest rally that started on March 11 2025 after a brutal 3-week downtrend/ Bearish Leg, got rejected on the 1D MA200 (orange trend-line) as the market digested the disappointing PCE.

Despite this aggressive rejection, the price hit and rebounded yesterday exactly at the bottom of the Channel Up with the previous such contact going back to the August 05 2024 Low. Not to mention that both the March 11 2025 and August 08 2024 Lows were formed exactly on the secondary Higher Lows trend-line.

What's perhaps more critical than any of these though, is that the 1D RSI didn't make a new Low last week and remains above the oversold barrier on a Higher Low trend-line that is a huge technical Bullish Divergence against the price's Lower Lows.

As with the August 22 2024 High, our first short-term Target is on the 0.786 Fibonacci retracement level at 21350.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

NASDAQ: Forming the bottom. Don't miss the 2025 rally to 28,000.Nasdaq is bearish on its 1D technical outlook (RSI = 35.342, MACD = -382.320, ADX = 38.919), headed towards oversold territory. 1W is also headed towards an oversold state (RSI = 36.953) as the price has crossed under the 1W MA50 and is approaching the 1W MA100. This is currently waiting at the bottom of the 2 year Channel Up. This 6 month correction is so far technically nothing but the bearish wave of this Channel Up and has been almost as strong (-15.89%) as the previous in July-Aug 2024.

Notice an key technical tendency here, no correction/bearish wave has ever crossed under the S1 level of two highs before. The current S1 is at 18,400. So taking those conditions into consideration as well as the fact that the 1W RSI is at the bottom of its Channel Down, we see this week as the bottom formation candle that will start a new bullish wave. The prior two such waves both made an incredibly symmetric rise of +52.60%, so expecting the same puts our target at TP = 28,000, most likely by December 2025-January 2026.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Moderna. Why Anti-Covid19 Juggernaut Goes 'The Bloodmachine'It's gone 5 years or so... (Duh..? 5 years, really? 🥴) since everyone was talking about COVID-19 pandemic, vaccines, "world will never be the same again", and so on.

- And now?..

- It's gone. It's absolutely gone..! Since nothing last forever and no one should chase a feather, or dust in the wind.

This is why we at our 💖Super-Duper Beloved @PandorraResearch Team decided to build this idea, as a educational idea to learn, even this story is about single Moderna stock, and we have reasonable considerations about fundamental, technical and price movement perspectives.

Well.. Let's the story begin...

Over the past few years, Moderna's stock has experienced a significant decline, primarily due to several key factors.

Here's a detailed explanation of why Moderna's stock has been moving downward:

1. Declining Demand for COVID-19 Vaccine

The primary reason for Moderna's stock decline is the waning demand for COVID-19 vaccines. During the pandemic, Moderna's mRNA-based vaccine was one of the first and most widely used, leading to a surge in sales and profitability. However, as the pandemic transitioned into an endemic phase, demand for vaccines decreased substantially. This shift has resulted in declining sales for Moderna, impacting its revenue and profitability.

2. Sales Guidance and Performance

In recent years, Moderna has faced challenges in meeting sales expectations. For instance, in 2025, the company forecasted sales between $1.5 billion and $2.5 billion, which was significantly lower than analysts' expectations of around $2.9 billion. This discrepancy led to a sharp decline in stock prices as investors became increasingly pessimistic about the company's future growth prospects.

3. Cost-Cutting Measures

To mitigate the impact of declining sales, Moderna has implemented cost-cutting measures. The company plans to reduce its cash operating costs by $1 billion in 2025 and an additional $500 million in 2026. While these efforts aim to improve profitability, they also reflect the challenges Moderna faces in maintaining its financial health without strong vaccine sales.

4. Competition in New Market s

Moderna is expanding into new markets, such as the respiratory syncytial virus (RSV) vaccine space, with its product mResvia. However, this market is highly competitive, with established players like Pfizer and GSK already present. The competition and uncertainty about market share have contributed to investor skepticism about Moderna's ability to drive growth through new products.

5. Delayed Break-Even Point

Initially, Moderna aimed to break even on an operating cash cost basis by 2026. However, this goal has been pushed back to 2028, indicating a slower-than-expected transition to profitability. This delay has further eroded investor confidence in the company's ability to execute its strategic plans effectively.

6. Valuation and Market Performance

Moderna's stock has underperformed both the industry and the broader market. The stock trades below its 200-day and 50-day moving averages, reflecting a lack of momentum. Additionally, Moderna's price-to-sales ratio is lower than the industry average, which might suggest undervaluation but also indicates a lack of investor enthusiasm for the stock.

7. Analyst Sentiment and Profitability Forecasts

Analysts have become increasingly pessimistic about Moderna's prospects, with many not expecting the company to turn profitable again until at least 2029. This negative outlook has contributed to the downward pressure on the stock. Furthermore, estimates for loss per share have increased, reinforcing the bearish sentiment among investors.

In summary, Moderna's stock decline is primarily driven by declining vaccine demand, missed sales expectations, increased competition in new markets, delayed profitability, and negative analyst sentiment. While the company is taking steps to adapt to these challenges, the path to recovery remains uncertain, contributing to ongoing investor skepticism.

--

Best 'No more Covid' wishes,

@PandorraResearch Team 😎

The Stock Market Decline Appears to be only in the US as of nowLast week on one of my member live videos I pointed out to the attendees that European markets were currently at, or very close to their All-Time highs...whereas in the US, we've entered the technical definition of a stock market correction...(down 10%). If you're so inclined to Google an economic calendar, it also appears the economic metrics like CPI, unemployment, etc... appear much better as well. There's an old adage in the markets.... "When the US sneezes, the global economy catches a cold" . However, at this very moment in time, the only thing that appears sick is the US. Maybe that changes with time. I suspect that will be the case...but in any event, one thing that is clear is that our stock market indices are signaling that whatever economic sickness is to be contracted, it will have originated here...in the United States.

That is certainly a new phenomenon.

For the past couple years I have been warning my members (and followers here on Trading View) of a long-term top in the stock markets. Week after week in my trading room, I have commented that I believe I have all constituent waves accounted for, to the best of my ability, to say with a high degree of confidence that a super-cycle wave (III) has topped .

What we have lacked is the price action to confirm that statement. This morning, I cannot tell you we have confirmation. That confirming probability only comes when price declines below the area of the wave 4 of one lesser degree. That area is outlined in the SPX daily chart entitled the "Must Hold Region". We are not there yet, nor do I think price makes a bee-line there in one shot. Therefore, I am NOT in panic mode this morning because I do believe we need a retrace higher and only that retracement's structure will inform us the higher probability of future price subdivisions....(higher or lower).

Panic is the necessary trader behavior needed to decline in such fashion as I believe a super cycle wave (IV) will start out. However personally, I do not think it's today. Futures are red this morning and closer to the recent lows than last week...the headlines surrounding the stock market appear very negative...but as of this morning, the MACD indicator on intraday charts is saying this type of sentiment is getting slightly weaker and NOT making new lows.

Therefore, I continue to maintain the price and technical indications tell me a minor B is either currently underway, or will be confirmed in the short term. Until those parameters get flipped, I'll reserve my panic (so to speak) for the c of (c) of intermediate (A) into the must hold region later this year... where it will probably be justified at that time.

Best to all,

Chris

NASDAQ Will the disappointing PCE today form a Double Bottom?Nasdaq is on a strong 3 day correction that has almost erased the recovery attempt since the March 11th low.

That was a higher Low inside the 8 month Channel Up and the current correction may be a bottom formation attempt like September 6th 2024.

Trading Plan:

1. Buy before the closing market price.

Targets:

1. 23350 (the 1.382 Fibonacci extension).

Tips:

1. The RSI (1d) illustrates the similarities with July-September 2024 in a much better way. Strong indication that the Channel Up is attempting to price a bottom.

Please like, follow and comment!!

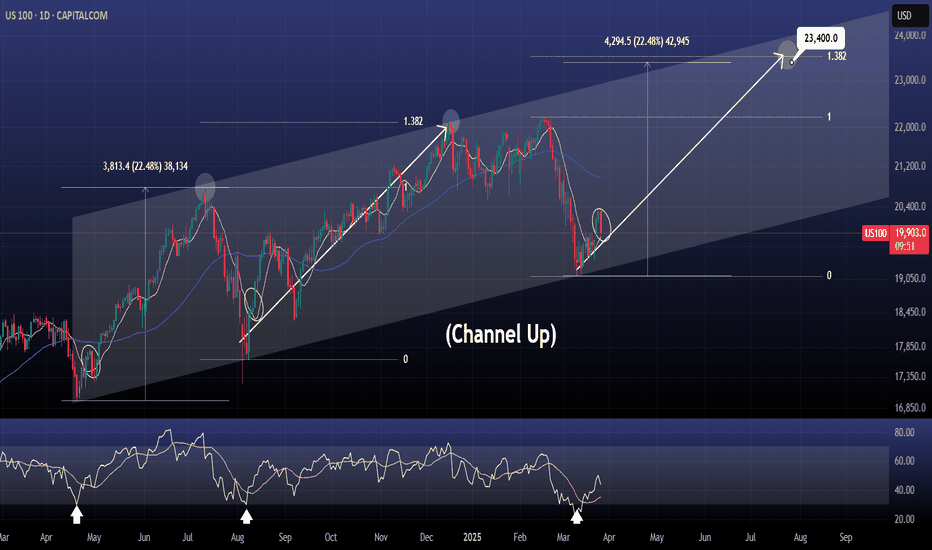

NASDAQ on the first minor pullback of the new bullish wave.Nasdaq / US100 has just started the new bullish wave of the long term Channel Up.

The bottom was made 2 weeks ago and every time the bullish wave crossed over its 4hour MA50, it is expected to make a pullback retest at some point.

This pullback is taking place today.

Whether it replicates the first bullish wave of the Channel Up or the second, the index aims for either a 22.48% total rise or the 1.382 Fibonacci extension.

Both happen to be around the same level.

Buy and target a little under them at 23400.

Previous chart:

Follow us, like the idea and leave a comment below!!

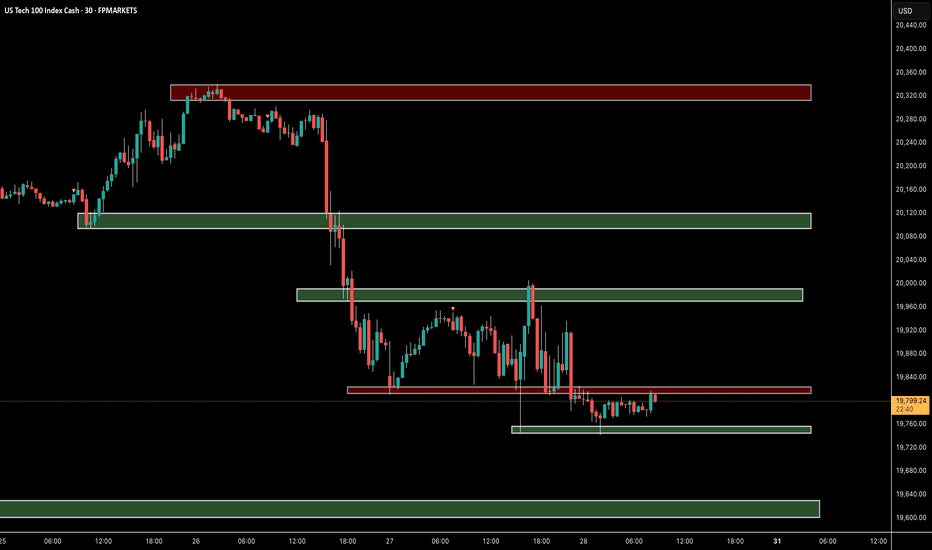

NASDAQ: Short term Channel Up on critical Resistance.Nasdaq is neutral on its 1D technical outlook (RSI = 49.418, MACD = -276.610, ADX = 37.535) as it has recovered from the oversold state of 2 weeks ago. By doing so, it has formed a Channel Up on the 1H timeframe but as the price hit its top and the 1H RSI has formed a bearish divergence like the previous HH, it is possible to see a quick pullback. As long as the price stays inside the Channel Up, target the 1H MA200 (TP = 19,900). If it crosses above the top of the Channel Up, buy and target the R1 level (TP = 20,650).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

NASDAQ The recovery has officially started.Nasdaq (NDX) has been trading within a 2-year Channel Up and with today's opening, it broke above the Lower Highs trend-line of February's Bearish Leg. Even though the confirmed bullish reversal signal technically comes above the 1D MA50 (blue trend-line), we already have the early bottom signals.

First and foremost, the 1D RSI rebounding from the same oversold (<30.00) level where all major Higher Lows of the Channel Up did (August 05 2024, April 19 2024, October 26 2023). Every time the price reached its -0.5 Fibonacci extensions following such bottoms. Also each Bullish Leg tends so far to be smaller than the previous.

As a result, targeting a +24% rise (-3% less than the previous Bullish Leg) at 23500 is a very realistic Target technically, as it is considerably below the -0.5 Fibonacci extension.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Looking for a minimum of ES 5850In the days to come our initial pattern off the recent has the high probability to get into the 5850 area.

Here I will be looking for a pullback.

If this pullback can be viewed as corrective in it's structure then I expect the subdivisions and pathway on my ES4Hr chart should follow suit. However, if the pullback turns out to be impulsive, I will be looking for follow through for either Minor B having completed early, or the alternate wave (iv). If that sort of price action were to materialize, it's Friday's low of 5651.25 that must support any drop if we're to continue to subdivide higher and have this minor B take more time.

NDX using HiLo Ema Squeeze bandsUsing Hio Ema Squeeze band you can quickly find support/resistance levels as confirmed here with the trend lines. Here I have used 1000 for all the bands, this makes it look cleaner.

Another trick is use two bands one with 200,1000,1000 and the other with 1000,1000,1000 and you will double squeeze bands resulting in one with 200 and other with 1000

NIKE INC. AMERICAN SHOOES LOOSING GLOSS, AHEAD OF U.S. RECESSIONNIKE Inc. or Nike is an American multinational company specializing in sportswear and footwear.

The company designs, develops, markets and sells athletic footwear, apparel, accessories, equipment and services.

The company was founded by William Jay Bowerman and Philip H. Knight more than 40 years ago, on January 25, 1964, and is headquartered in Beaverton, Oregon.

As of July 15, 2024, NIKE (NKE) shares were down more than 33 percent in 2024, making them a Top 5 Underperformer among all the S&P500 components.

Perhaps everything would have been "normal", and everything could be explained by the one only unsuccessful December quarter of 2023, when the Company’s revenue decreased by 2 percentage points to $12.6 billion, which turned out to be lower than analyst estimates.

But one circumstance makes everything like a "not just cuz".

This is all because among the Top Five S&P500 Outsiders, in addition to NIKE, we have also shares of another large shoe manufacturer - lululemon athletica (LULU), that losing over 44 percent in 2024.

Influence of macroeconomic factors

👉 The economic downturn hurts most merchandise retailers, but footwear companies face the greatest risk to loose profits, as higher fixed costs lead to larger profit declines when sales come under pressure.

👉 The Nasdaq US Benchmark Footwear Index has fallen more than 23 percent since the start of 2024 as consumer spending is threatened by continued rising home prices, banks' reluctance to lend, high lending rates, and high energy and energy costs. food products - weaken.

👉 In general, the above-mentioned Footwear Sub-Industry Index continues to decline for the 3rd year in a row, being at levels half as low as the maximum values of the fourth quarter of 2021.

Investment Domes worsen forecasts...

👉 In the first quarter of 2024, Goldman Sachs made adjustments to its forecast for Nike shares, lowering the target price to $120 from the previous $135, while maintaining a Buy recommendation. The company analyst cited ongoing challenges in Nike's near-term growth trajectory as the main reason for the adjustment, anticipating potential underperformance compared to market peers, noting that Nike's 2025 growth expectations have become "more conservative."

👉 Last Friday, Jefferies Financial Group cut its price target from $90.00 to $80.00, according to a report.

👉 Several other equity analysts also weighed in on NKE earlier in Q2 2024. In a research note on Friday, June 28, Barclays downgraded NIKE from an "overweight" rating to an "equal weight" rating and lowered their price target for the company from $109.00 to $80.00.

👉 BMO Capital Markets lowered their price target on NIKE from $118.00 to $100.00 and set an overweight rating on the stock in a research report on Friday, June 28th.

👉 Morgan Stanley reaffirmed an equal-weight rating and set a $79.00 price target (up from $114.00) on shares of NIKE in a research report on Friday, June 28th.

👉 Oppenheimer reiterated an outperform rating and set a $120.00 price target on shares of NIKE in a research report on Friday, June 28th.

👉 Finally, StockNews.com downgraded NIKE from a "buy" rating to a "hold" rating in a research report on Friday, June 21st.

...and it becomes a self-fulfilling prophecy

Perhaps everything would have been fine, and all the deterioration in forecasts could have been attributed to the stretching spring of price decline, if not for one circumstance - it is not the ratings that are declining due to the decline in share prices, but the shares themselves are being pushed lower and lower, as one after another depressing ones are released analytical forecasts from investment houses.

16 years ago. How it was

On January 15, 2008, shares of many shoe companies, including Nike Inc. (NKE) and Foot Locker Inc. (FL) fell after investment giant Goldman Sachs (GS) slashed its stock price targets, warning that the U.S. recession would drag down the companies' sales in 2008 as consumers spend more cautiously. "The recession will further increase the impact of the key headwind of a limited number of key commodity trends needed to fuel consumer interest in the sector," Goldman Sachs said in a note to clients.

In early 2008, Goldman downgraded athletic shoe retailer Foot Locker to "sell" from "neutral" and cut its six-month share price target from $17 to $10, saying it expected U.S. sales margins to continue to decline in 2008 despite store closures.

The downgrade was a major blow to Foot Locker, which by early 2008 had already seen its shares fall 60 percent over the previous 12 months as it struggled with declining sales due to declining demand for athletic shoes at the mall and a lack of exciting fashion trends in the market. sports shoes.

Like now, at those times Goldman retained its recommendation rating to “buy” Nike Inc shares, based on general ideas about the Company’s increasing weight over the US market, topped off with theses about the Company’s international visibility, as well as robust demand ahead of the Beijing Olympics.

However Goldman lowered its target price for the shares from $73 to $67 ( from $18.25 to $16.75, meaning two 2:1 splits in Nike stock in December 2012 and December 2015).

Although Nike, at the time of the downturn in forecasts, in fact remained largely unscathed by the decline in demand for athletic footwear among US mall retailers, it reported strong second-quarter results in December 2007 (and even beating forecasts for strong demand for its footwear in the US and growth abroad) , Goldman Sachs' forecasts for Nike's revenue and earnings per share to decline were justified.

Later Nike' shares lost about 45 percent from their 2008 peaks, and 12 months later reached a low in the first quarter of 2009 near the $40 mark ($10 per share, taking into account two stock splits).

The decline in Foot Locker shares from the 2008 peaks 2009 lows was even about 80 percent, against the backdrop of the global recession and the banking crisis of 2007-09.

Will history repeat itself this time..!? Who knows..

However, the main technical graph says, everything is moving (yet) in this direction.