Ready for the money! [NEOBTC]The strategy is based on EMA lines, which created support and resistance line for the price. In this case the price is trading above the 7EMA line on the 3dTF that means we have an uptrend with some resistance in the future. Let's look at them.

The first and the strong resistance from the 200 EMA (30 EMA too), so we can set the target equals to 0.0042 sats. With slow uptrend we can reach this target in the near-term.

Other indicators.

the RSI < 50, but has a stable uptrend after it has exited from oversold territory. the MACD has made a crossover with the signal line, this step can be a sign of possible trend change.

ENTER: 0.003 to 0.0035

CLOSE: 1) 0.0042 2) 0.0055

Likes/Comments. Yes please :)

NEOBTC

NEOBTC is breaking long-term falling On a weekly chart NEOBTC has broken falling wedge reaching its low

NEO is not going down after reaching most traded zone of 0,0026 and bounces back.

It does not mean that it won't definitely go down but optimistic scenario is obvious.

Long for NEOBTC but StopLoss is again 0,0026 or a bit lower ~0,00255

Indicators:

RSI bounces from oversold border

Stoch is still at its bottom

Need trading volume for solid break and establishing firm long-term biullish.

Low-risk weekly trade on Weekly chart

NEOBTC is accumulating in triangleNEO has found support at EMA13. Today bounced from this level.

Need to break and test EMA90 to reach first target point gaining minimum ~30%

Strategy:

1. Buy on breakout at 0,00322 and hold

2. Wait for a little correction if BTCUSDT shows correction itself and buy at 0,0028

Stop-loss in both cases: 0,0026

NEO Best buy in opportunity all yearMy opinion, this couldn’t be a much better position for entering a LongTerm NEO position.

The price level is nearly December 2018 lows and looks to be stabilizing a higher low between December 2018 and now, and also another higher low from the last dip from 10 days ago.

There should be a tight stop/loss set around December 2018 lows. We should see a push out of this downward trending channel, a bounce off 55EMA resistance and another supportive bounce on the outside of the trending channel. This will give us more confirmation in bullish reversal.

Oscillators are showing a very oversold sentiment, take a look and tell me what you think about NEO.

This is my personal opinion, this is not investment advice, invest at your own risk and good luck trading.

COMPLETED 10:08am (UTC-7) LOS ANGELES

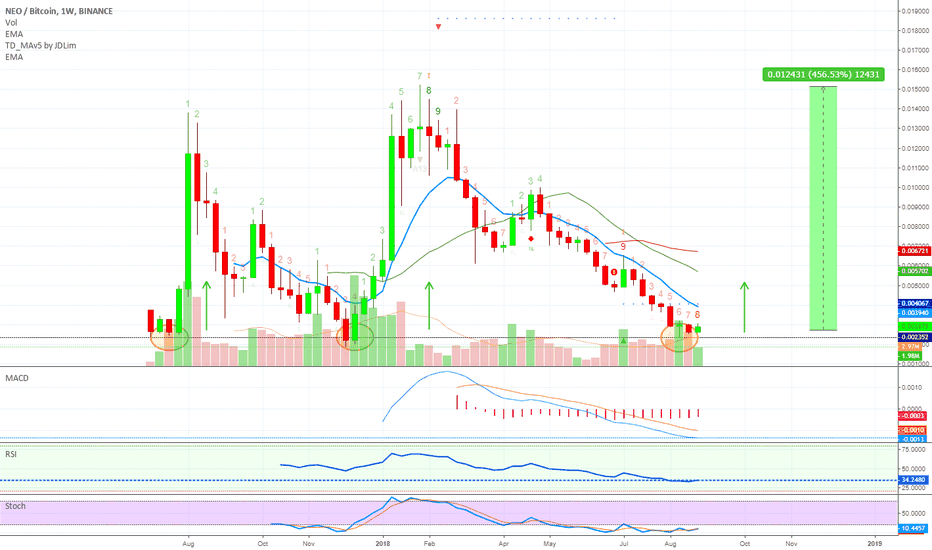

NEO on Watch-list (450%+ Profits Potential [PP] To Last ATH)NEOBTC is now on our watch-list.

Notice the green bar, that's over 400% profits potential to NEO's last all time high.

Also notice the yellow circles at the bottom, we are at a very strong support.

- NEOBTC bounced from RSI oversold at the support mentioned above.

- Bullish divergence can be spotted on the MACD.

- Good volume building up...

Keep an eye out for it.

Thanks a lot for reading.

Namaste.

NEO (NEO/USD) Shows Some Mixed Patterns!At the moment, NEO is grinding upwards in the rising channel, clean touches from trendline and also clearly visible higher highs(HH) and higher low(HL).

Like all the crypto market made a little pullback and so as NEO. Price falls below the round number area which is currently $20. The pullback finds the end from a 50% Fibonacci retracement level, old resistance area becomes a support area and it was close to the trendline. So, the criteria are good!

Currently, we fight with a round number $20 which works as a resistance, on the four-hour chart we are above the 50 and 100EMA and they are pointed upwards, which is a good sign!

To confirm bullishness then we have to make a new higher high and break above the 200EMA then we have almost a clean run to the next resistances $27.03 (June low) and the main resistance around $30.

The main resistance consist with two monthly levels July low and Aug. high + we have there a trendline which is pulled from four-chart candle bodies and pulled from 05.07-18.08

To confirm bearishness on the NEO/USD chart:

"Shows some mixed signs" - it means that we are in the bearish chart pattern "Bear Flag" and if You draw some lines differently (no mistake) then it could be also a continuation pattern called "Rising Wedge". And if we get a close below the gray area then it would be a easy confirmation. We have made a lower low, we have a break below the channel (rising wedge) bottom trendline and THE TREND IS YOUR FRIEND!

Hopefully, this helps you out a little bit to confirm your own analysis!

If You want to support us, please hit the LIKE button!

Have a nice day!

NEO/BTC Approaching Huge Bounce ZoneNEO/BTC on the daily chart.

Huge descending wedge where we may see a huge bounce at its apex off the green support line. This is a significant support as we originally bounced off it to start the massive run last year.

In saying this i do not expect a breakout from the wedge until at least a week as we have a decent bit more to drop to the green support line.

REASONS:

- Volume has not declined enough to convince me of the adequate decline of sellers to start a breakout (this is typical in descending wedges).

- RSI is forming a bearish ascending wedge in neutral territory and is currently at support.

- Mini bear flag forming within the wedge

I will be buying around the green line region with a S/L a little below the green support line.

China market trend VS ROW: The determinant of market valueAll described in detail in the chart:

China's 8 month bear market when combined with a clamp down on digital assets and other macroeconomic events have had a dominant negative effect on the value of crypto-currency assets globally. The effect is more pronounced on local currencies such as NEO and GAS.

However from July 2018 we see a bullish pattern developing in many other key markets:

-S&P 500

-Nikkei 225

-Dow Jones Industrial Average

-FTSE 100 Index

-US Technology Index

Generally a run in digital assets follows on from a run in the global markets as can be seen in H2-2017 when all markets discussed in this model were aligned and bullish.

For a similar run to take place analysts might wait for a loosening of China's regulation or some sort of resolve to the ongoing Fear Uncertainty & Disinformation FUD surrounding China and crypto-currency.

We are under the assumption that these negative conditions are temporary and that China are taking steps to regulate with the aim of finally adopting these technologies. We therefore see the current situation as an exceptionally good BUY opportunity with the possibility of phenomenal returns.

NEO testing 8-month resistance trend line NEO is finding itself in a similar situation to other coins as it is currently testing key resistance trend line. Given the importance of this trend line i.e. 5 touches on the daily chart in the time window of 8 months, the trend line can be regarded as the bull/bear line that will determine the direction of the price action in the next weeks/months. Another failure to break and trade above the trend line would facilitate more bearishness for the coin and potentially new 9-month low. On the other hand, the price action is suggesting a break may be on the table as the coin trades closely to the trend line, without making any bigger moves to the downside. Usually, this pattern of trading suggests a break is coming as the bears are getting tired. A potential break will clear stops placed above the trend line while any close on the daily basis above the trend line will bring more joy to the bulls. A move to, at least, 38.2% Fibonacci zone is on the cards, while the zone of 50% - 61.8% coupled with the horizontal resistance will likely attract a lot of interest from the sellers' point of view.

Daily Chart on NEOBTC with Fibonacci RetracementsDaily Chart bouncing around near previous lows, which could indicate we are near a bottom and could see a rise in NEO in the following months. Keeping an eye on this one as it has bounce several times from this lower trendline area. Anything under $20 seems like a good hold for a long term accumulation play. Watching for a rise near the .382 fib retracement level near .006942 btc.

coinmarketcap.com

$19.51 USD (11.25%)

0.00288910 BTC (10.24%)

Market Cap

$1,268,470,052 USD

187,791 BTC

Volume (24h)

$60,963,845 USD

9,025 BTC

Circulating Supply

65,000,000 NEO

Total Supply

100,000,000 NEO

Max Supply

100,000,000 NEO

NEO Massive VolumeNeo is showing us tremendous volume in current support, whales can't hide the fact that they're buying huge amounts of NEO at current prices, this is even healthier because the surge in volume is occurring in NEOUSDT.

There is also a double bottom in OBV.

Besides the technicals facts, fundamentally NEO it's a strong blockchain that got some FUD because of china continuous weird behaviour towards crypto (Sometimes banning sometimes unbanning)

Truth is big players are moving in.

Dont buy the dip, buy the opportunity NEO GAS BTCMy logic is explained in detail on the following graph.

My key point: I can demonstrate that the dramatic loss in value of NEO/GAS has been caused almost exclusively by a domino effect of negative external factors:

-Lack of Chinese Economic Market Strength

-Government intervention

-Negative International trade relations (TRUMP)

For those that are long term investors and believe that these external factors will not have a lasting effect on the markets (China and cryptocurrency) then this is your opportunity to buy into what i see as the markets best mid term opportunity.

I would be surprised and disappointed if NEO, but more specifically GAS (the fiat on the NEO Smart Economy) did not increase by at least 1000% by 2019. #teamgas

NEO Short Term Gains.. 43%!NEO is in its descending channel and now it has made a falling wedge and is trying to get out of its descending channel. So with the weak bullish market we have especially with BTC we can expect some good gains from alts and we should focus on top alts which are solid project with a strong community which is ready to buy and push the price when there is bullish action in the market and NEO is one of them.

So even if we check the trend it has made from its this year peak we can see that it has made a reversal pattern once and got out of it making 40% gains, and it retraced after that but making the same reversal pattern so making a reversal pattern now and getting out of the descending channel so we should expect the same gains here where the price should take us to 0.0036-4 BTC level..

Details of the trade:

-Bullish divergence on EWO (I LOVE EWO xD)

Targets:

-0.0036 BTC (short-term)

-0.0043 BTC(mid-term)

-0.0047 BTC (long-term)

-0.005 BTC (long-term)

-0.0055 BTC (long-term)

Stop-loss: 0.002381 BTC

Good Luck, Traders! #moon #mooncommunity

There is a possibility for the beginning of an uptrend in NEOBTCTechnical analysis:

. NEO/BITCOIN is in a downtrend and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 35.

. While the RSI and the price downtrend in the Daily chart are not broken, bearish wave in price would continue .

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.00253 to 0.00183). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.00253)

Ending of entry zone (0.00183)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about "Entry signal" and the special version of our "Price Action" strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.00317

TP2= @ 0.00364

TP3= @ 0.00470

TP4= @ 0.00560

TP5= @ 0.00640

TP6= @ 0.00740

TP7= @ 0.00963

TP8= @ 0.01110

TP9= @ 0.01200

TP10= @ 0.01400

TP11= @ 0.01520

TP12= Free