Neo Wave

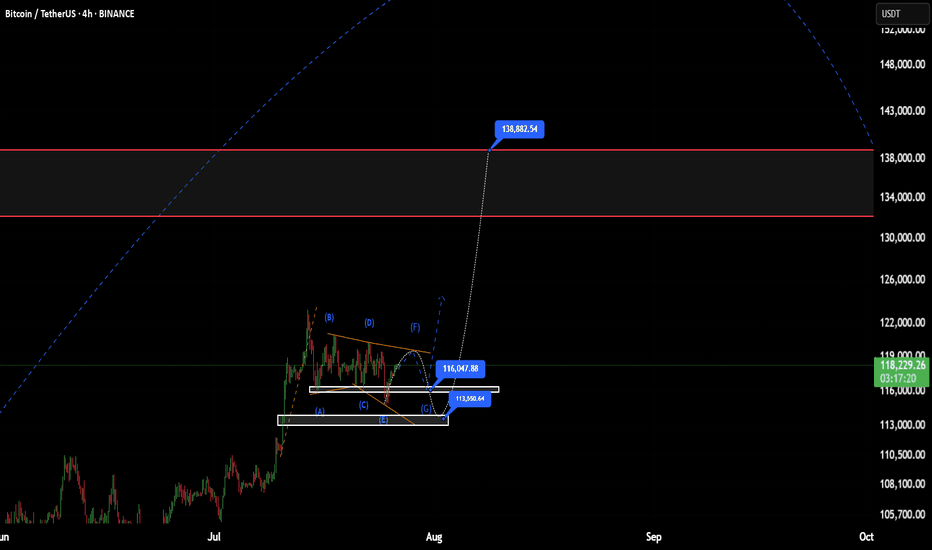

TOTAL 3 New Update (12H)This analysis is an update of the analysis you see in the "Related publications" section

This index has broken below the red zone; if a pullback to this area occurs, it may act as support again and the index could move upward

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

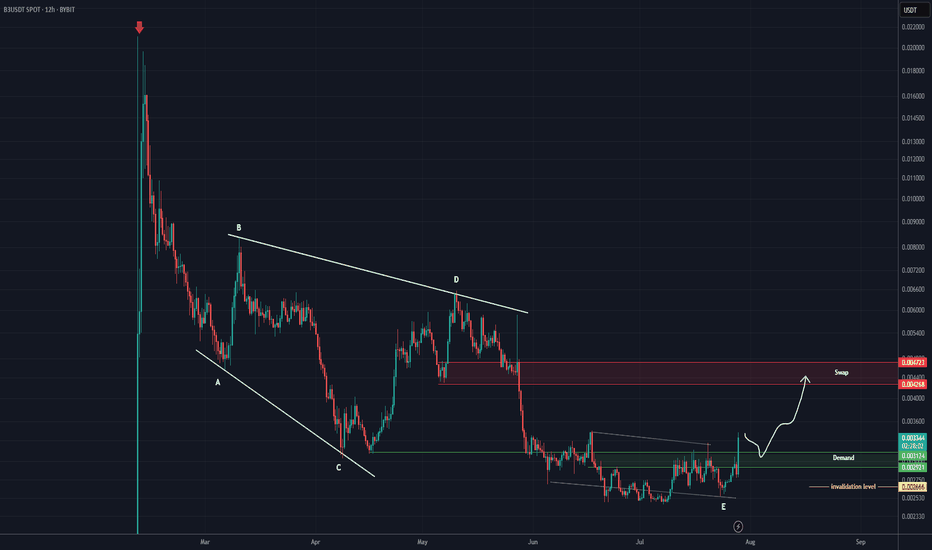

B3 Analysis (12H)From the point where the red arrow is placed on the chart, the B3 correction has started. It appears we have an expanding/diagonal/symmetrical triangle, and wave E now seems to be complete.

As long as the green zone holds, the price could move toward the red box, which is a swap zone.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

ARC Buy/Lonf Setup (1D)The ARC symbol, after completing a triangle and undergoing significant price and time correction, is approaching a strong and important origin.

It is expected that upon reaching the green zone, it will move toward the specified targets.

Since trading this symbol carries its own risks, make sure to practice proper risk management.

The targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

GOAT Looks Bullish (12H)It seems that a wave A of a higher-degree structure has completed, and the price is forming a triangle at the bottom, preparing for an upward movement in the form of either a wave B or a new impulse wave. Since this wave belongs to a higher degree, we expect the upcoming bullish wave to take time and show a significant upward retracement.

Try to avoid entering during pumps, and instead focus on entries during price corrections.

As long as the green zone holds, the price has the potential to move upward.

A daily candle closing below the invalidation level will invalidate this outlook.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

ALCH Looks Bearish (8H)ALCH is one of the altcoins that began its bullish rally earlier than others.

From the point where we placed the green arrow on the chart, it appears that an ABC correction has completed.

As long as the red box is maintained, price may move toward the FVG zone.

Targets are marked on the chart.

Additionally, a liquidity pool is forming below the candles, which is expected to be swept soon

A daily candle closing above the invalidation level would invalidate this bearish outlook.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

SANTOS ANALYSIS (1D)Football-related tokens in the crypto market have been quiet for a while and seem to be dormant. One of the tokens that shows good inflow during its moves is SANTOS.

SANTOS appears to be forming a symmetrical triangle and is currently at the end of wave E. While there are multiple wave count scenarios for this token, it is sitting on a strong support zone.

As long as it holds the green zone, it has the potential to move toward the targets.

However, a daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

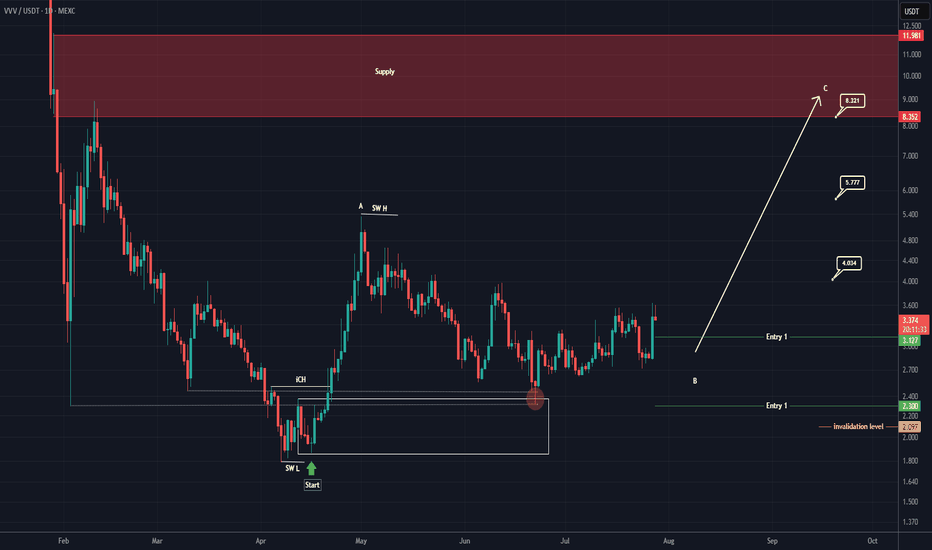

VVV Looks Bullish (1D)From the point where we placed the red arrow on the chart, it seems that the bullish phase VVV has begun.

This phase can be considered as an ABC structure.

We appear to be in the late stages of wave B.

We have identified two entry points to join the continuation of the bullish phase VVV. The likelihood of Entry 2 being reached is low, but you should split the volume you want to invest in this coin into two parts and keep some for Entry 2.

The targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You