Neowaveanalysis

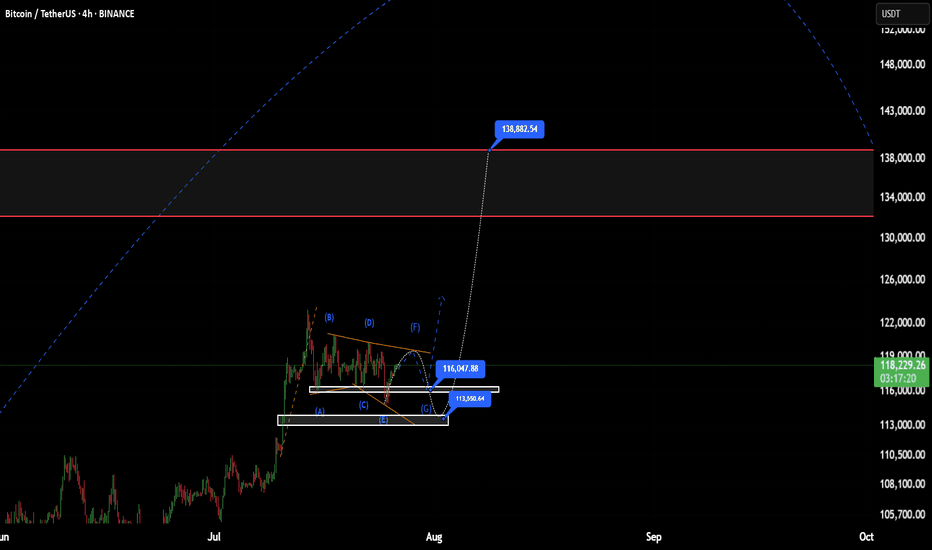

Bitcoin (BTCUSDT) - Possible Completion of a Complex CorrectionTimeframe: 4H + 1H

Methodology: NeoWave (Glen Neely) + Smart Money Concepts (ICT/SMC)

Posted by: @CryptoPilot

⸻

🧠 NeoWave Analysis: Complex Correction Ending?

From a NeoWave perspective, BTC seems to be in the final stages of a Complex Correction that started in March 2025 from ~72k. The upward move appears to form a Contracting Diametric structure (7 legs: A–B–C–D–E–F–G), with the current leg G potentially unfolding now.

• ✅ Wave A: Sharp recovery from March lows

• ✅ Waves B–F: Alternating corrective legs with varied time and complexity

• 🔄 Wave G: Could be starting now, expected to break structure to the downside

This suggests that the entire move from March till now may represent a large Wave B, setting the stage for a deeper Wave C down.

⸻

🔍 Price Action + Smart Money Confluence

The following observations strengthen the NeoWave scenario:

• 🟨 Liquidity Pools above 120k were swept recently, creating a potential Buy-side Liquidity Grab

• 🟥 Imbalance/FVGs below 114.5k remain unfilled

• 🔻 Market Structure Shift (MSS) evident on 1H chart — lower highs forming

• 🧠 Price rejected from a key Supply Zone, aligning with end of Wave F

• 🟩 If price re-tests the internal bearish OB (near 119.5k–120k), it may provide an ideal short trigger

⸻

📌 Key Levels to Watch:

Level

Description

120.2k

Liquidity sweep zone / MSS confirmed

118k

Current structure base (pivot)

114.5k

FVG + potential Wave G target

111–112k

Strong demand zone (accumulation support)

🧭 Scenario Outlook:

Primary:

→ Price is in Wave G of a Diametric (NeoWave)

→ Likely to unfold as a 3-leg Zigzag down or a Complex combination

→ Objective: break below Wave E low and target the unmitigated imbalances

Alternative:

→ Extended Flat or Triangle, if 120.5k is broken impulsively

→ Invalidation = clean break and hold above 121k

⸻

⚠️ Risk Note:

This analysis assumes Wave G is beginning. If bulls manage to reclaim 120.5k with momentum and close above, the bearish structure will be invalidated.

⸻

💬 Final Thought:

We are potentially nearing the end of a complex corrective rally. The confluence of NeoWave structural symmetry, Smart Money traps, and market inefficiencies suggests that BTC may be preparing for a retracement. Stay alert for confirmations before executing.

⸻

📌 Follow @CryptoPilot for advanced wave structure updates, market geometry insights, and ICT-style smart money traps.

💬 Share your views or alternate wave counts in the comments!

Saham PTBA: Tunggu Sinyal lenkap dgn 5 Peluru📊 Stock Analysis of PTBA Bukit Asam Tbk. using Profitmore Trade™'s 5 Bullets Strategy:

🔹 1. Zero Line

🔹 2. AO Divergence

🔹 3. SQUAT

🔹 4. Fractal

🔹 5. Momentum

🔍 Market Segmentation Analysis:

📅 Monthly: Even segment

📅 Weekly: 8 even segments (Monthly timeframe)

📅 Daily: Corrective even segment (2 waves) after a bearish odd segment

⚠️ Not Yet Time to Enter! The 5 Bullets signals are not yet complete. Wait ~2 weeks for confirmation of optimal entry conditions.

📌 Odd & Even Segment Theory: Even segments typically last as long as or longer than odd segments. Monitor the market closely!

#ProfitmoreTrade #StockAnalysis #PTBA #TradingView #TechnicalAnalysis #IndonesianStocks

Cardano and Diametric Pattern

We are currently in wave-g of the Diamond Diametric and it could continue to 0.43.

After the completion of the Diametric, if the Double Combination pattern does not form, we expect an uptrend to form. (The post-pattern movement will show us whether the Diametric has completed or not).

Good luck

NEoWave Chart

BTC Neowave analysis - 8 JuneAssuming wave D has completed, two potential scenarios can be considered for the development of wave E:

1. Contracting Triangle Scenario:

We are currently in the final wave (wave e ) of the triangle. Upon its completion, either wave a of E or the entire wave E could be considered complete. Confirmation of this scenario would be a strong breakout below 105,000 with solid momentum. However, this scenario would be invalidated if the price moves beyond 107,000.

2. Diametric Scenario:

If the price surpasses 107,000 or if the breakout below 105,000 lacks sufficient momentum (e.g., takes more than one day to play out), this alternative becomes more plausible. It suggests a 7-leg structure. In this case, waves f and g are expected to take approximately one to one and a half days each.

Will the Euro weaken against the US Dollar?EURUSD has started a price and time correction since July 28, 2008 in the form of a diametric pattern.

Wave-(f) currently appears to be forming. We see two price ranges for the end of wave-(f) in terms of price:

a - range 1.15758-1.17173

b - range 1.21357-1.23505

After the completion of wave-(f) we expect wave-(g) to continue to the specified range.

Good luck

NEoWave Chart

Has the Alt Season Started?Cash Data 1W

By analyzing the weekly Cash Data chart of TOTAL3, we observe that after a rapid and significant rise, a correction in TOTAL3 has begun, which appears to be forming a Neutral Triangle pattern.

Wave Analysis:

Wave-(c) is a double pattern with a small X-wave, making it the most complex wave. However, there is a possibility that wave-(d) could become more complex than wave-(c). We are currently in wave-(d). Given that wave-(b) has surpassed the start of wave-(a) and wave-(c) has been fully retraced by wave-(d), there is a likelihood that a Running Neutral Triangle is forming. For confirmation, wave-(d) must exceed the starting point of wave-(c).

Conclusion:

Based on the analysis, wave-(d) could rise to the range of 1.14–1.38 trillion USD. Subsequently, wave-(e) will begin and may conclude within the retracement zones identified on the chart. To accurately determine the target for wave-(e), we need wave-(d) to complete, allowing us to predict the end of the Running Neutral Triangle with greater precision.

After the completion of the Running Neutral Triangle, we expect a significant rally in altcoins.

Good luck

NEoWave Chart

A larger corrective pattern is formingIn the previous analysis, a specific range was determined for the price to reverse, after reaching that price range, the price jumped upwards and the price grew by 1700 pips. However, considering that the structure of wave-c is not an impulse, the zigzag was not confirmed and it seems that a larger corrective pattern is forming.

It seems that the reverse contracting triangle pattern is forming, which is currently in wave-d of the triangle. With the completion of wave-d, we can better find the end point of wave-e.