NETE Extremely clean daily chart imo. But this chart is completely dependent on the energy sector getting going. If SPI continues to run, though, keep NETE on watch for a continued curl.

NETE

The interested parties.."I generally ask and receive calls on a block of stock. I insist upon graduated calls as the fairest to all concerned. The price of the call begins at a little below the prevailing market price and goes up; say, for example, that I get calls on one hundred thousand shares and the stock is quoted at 40. I begin with a call for some thousands of shares at 35, another at 37, another at 40, and at 45 and 50, and so on up to 75 or 80."

Jesse Livermore describes how he manipulates share prices in Reminiscences Of A Stock Operator, written 1923.

(NCTY, January.4th, 2021)

"Our goal is to build up cryptocurrencies mining machines for The9 that will contribute 8% to 10% of the global hash rate of Bitcoin, 10% of the global hash rate of Ethereum and 10% of the global hash rate of Grin and become one of the world's largest cryptocurrencies mining companies in terms of hash rate."

The9 Ltd – ‘POS AM’ on 2/9/21

"On January 25, 2021, we entered into a share subscription and warrant purchase agreement, or the Purchase Agreement, with several investors in the cryptocurrencies mining industry, including Jianping Kong, the former Director and Co-Chairman of Canaan Inc. (Nasdaq: CAN), a Bitcoin mining machine manufacturer listed on Nasdaq, Qifeng Sun, Li Zhang and Enguang Li, based on the pre-agreed legally-binding term sheet. Those investors are collectively referred to as the Investors in this prospectus. Pursuant to the Purchase Agreement, we issued 8,108,100 Class A ordinary shares in aggregate at US$0.1233 per Class A ordinary share and 207,891,840 warrants in aggregate, each warrant representing the right to purchase one Class A ordinary share, to the Investors in February 2020. The warrants are divided into four equal tranches: Tranche I Warrants, Tranche II Warrants, Tranche III Warrants and Tranche IV Warrants. The exercise price of each of the Tranche I Warrants, Tranche II Warrants and Tranche III Warrants is US$0.1233 per Class A ordinary share while the exercise price of the Tranche IV Warrants is US$0.2667 per Class A ordinary share. Each tranche of the warrants will only be exercisable upon the satisfaction of its respective condition in connection with the market capitalization of our company reaching US$100 million, US$300 million, US$500 million and US$1 billion within the timeframes of 6 months, 12 months, 24 months and 36 months from its issuance date, respectively. In addition, the Tranche III Warrants will be automatically forfeited with nil consideration in the event that the Tranche II Warrants fail to become exercisable within the specified timeframe and the Tranche IV Warrants will be automatically forfeited with nil consideration in the event that Tranche II or the Tranche III Warrants fail to become exercisable within the specified timeframe. The Investors shall make payment of the purchase price and the exercise price for the warrants in (i) cash, (ii) cryptocurrencies, or (iii) a combination of both, at our election. Pursuant to the Purchase Agreement, upon the satisfaction of the market capitalization condition of Tranche III Warrants, the Investors will be entitled to collectively appoint one director to our board of directors. Such appointment right will automatically terminate on the later of (i) the third anniversary of the closing date, and (ii) the date on which the Investors collectively hold less than 5% of our total number of ordinary shares on a fully diluted basis. The transaction was closed in February 2021. The Investors are expected to devote cryptocurrencies mining industry resources to us for our development of cryptocurrencies mining business.

In February 2021, we issued and sold (i) a one-year convertible note in a principal amount of US$5,000,000, (ii) 50,000 ADSs, and (iii) 10,000,000 Class A ordinary shares, for an aggregate consideration of US$5,000,000 to Streeterville Capital LLC, or Streeterville. The convertible note bears interest at a rate of 6.0% per year, computed on the basis of a 360-day year. Streeterville has the right, at any time after six months have elapsed since the purchase date until the outstanding balance has been paid in full, at its election, to convert all or any portion of the outstanding balance into ADSs of our company at an initial conversion price of US$14 per ADS, each ADS representing thirty Class A ordinary shares, subject to adjustment. Beginning on the date that is six months from the note purchase date, Streeterville has the right, exercisable at any time in its sole and absolute discretion, to redeem any portion of the convertible note up to US$840,000 per calendar month. Payment of the redemption amount could be in cash or our ADSs, provided that any redemptions made in cash which exceed half of the original principal amount will be subject to a ten percent (10%) premium. In the event the principal amount and interest accrued for the convertible note issued to Streeterville are fully repaid, we have the right to repurchase the remaining Class A ordinary shares held by Streeterville that are unsold at US$0.0001 per share.

In February 2021, NBTC Limited, our wholly-owned subsidiary, signed a strategic cooperation framework purchase agreement, or the Cooperation Agreement, with Shenzhen MicroBT Electronics Technology Co., Ltd., the manufacturer of WhatsMiner bitcoin mining machines. Pursuant to the Cooperation Agreement, upon the payment of a deposit, NBTC Limited has the right of first offer to purchase 5,000 WhatsMiner bitcoin mining machines from MicroBT within one year, including but not limited to models M32 and M31S. We completed first batch purchase of 440 WhatsMiner M32 machines in February 2020. Other than WhatsMiner bitcoin mining machines, we also plan to continue purchasing different types of cryptocurrency mining machines in the near future.

In February 2021. we entered into a standby equity distribution agreement, or the SEDA, with YA II PN, LTD., a Cayman Islands exempt limited partnership managed by Yorkville Advisor Global, LP pursuant to which we are able to sell up to US$100.0 million of our ADSs solely at our request at any time during the 36 months following the date of the SEDA. For details of the SEDA, see “Corporate History and Structure.”

In February 2021, we entered into purchase agreements with five Bitcoin mining machine owners to purchase Bitcoin mining machines by issuance of our Class A ordinary shares. Pursuant to the purchase agreements, we issued an aggregate of 26,838,360 Class A ordinary shares in exchange for 26,007 Bitcoin mining machines, with a total hash rate of approximately 549PH/S, accounting for about 0.36% of the global hash rate of Bitcoin. Majority of these mining machines have already been deployed in Xinjiang, Sichuan and Gansu in China. The number of Class A ordinary shares issued to each owner was determined based on the fair market value of Bitcoin mining machines, as apprised by an independent valuation firm prior to the execution of the purchase agreements, at a pre-agreed per share price of approximately US$0.37 per Class A ordinary share (equivalent to US$11.18 per ADS)."

CRYPTOSTOCKERS IIAnother batch of Crypto Stockers...

Remeber..They chase bitcoin and bitcoin chases them..be always behind the trend.

Enjoy!

NETE: Strong Bullish BaseWeekly and daily patterns giving strong indication of a breakout. Relative strength massively strong on a potential indices breakout day.

Next leg up to 7+ comingHeld 200 day range nicely, back above 9 day. TL support and volume increasing into bell. Looking for another leg up on this soon to 7+ invalidate with 2 closes below 200day or breach of 20 day.

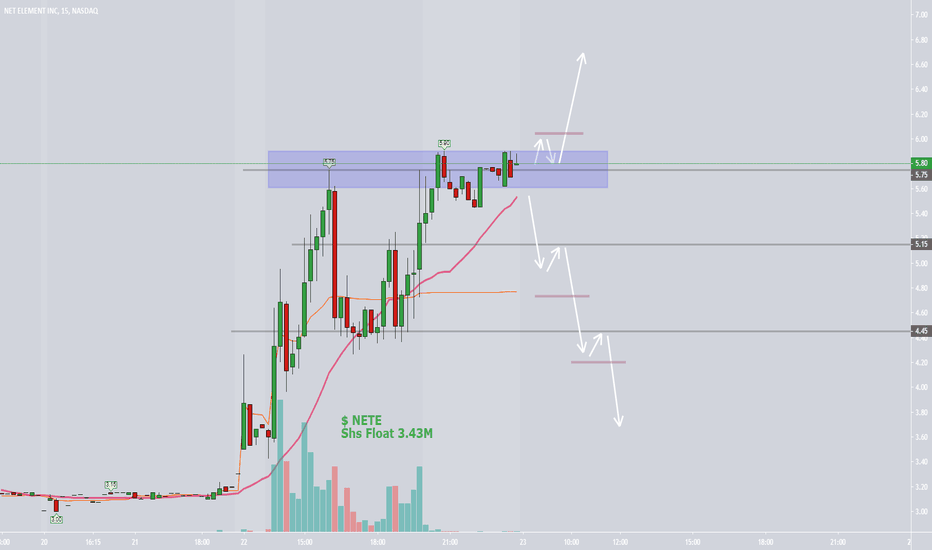

Could This Continue?Hello traders! Hope your having a great trading day. Let's get right into this, tomorrow ill be looking for the continuation trade. I will be watching the important level of 5.90 for a break above, and re-test of that zone to give us a heads up with confirmation for possible entry. Very important to watch that level, because it will need to be broken to move that momentum higher. For shorts, or people holding stock, your going to want to watch the 5.15 level for a break and re-test moving lower, as that would give the chart a bearish outlook. So watch out for both levels tomorrow, and set your alerts! @ 5.90 + 5.15! Good luck everyone! Be sure to leave a "LIKE" and follow me for more great chart analysis in the future!

NETE and a possible move upwardsNETE has played nicely down to my support line $6.36 and a nice one day bull move with supporting volume.

Does this mean that this stock will begin running north? My belief is that it is ready after consecutive bear moves, finding its floor.

I expect NETE to move north to $7.96....why $7.96? because that price point supports the $4.30 bull candle/plateau.

I expect a retest down to $7.09/$7.00 where that is my target dip buy and a move north nets me 12% - 14% profit.

Will this happen? It's stocks, who knows....

Let's see what happens!

*DISCLAIMER* - I am not a professional trader. These are merely my opinions and hopes and dreams pertaining to this stock. Please seek professional advice in all your trades.

NETE is building a baseI felle NETE may have a second test of the highs this year. If we build a base 2018 may be the year to close the GAP still open in the 18.00 region.

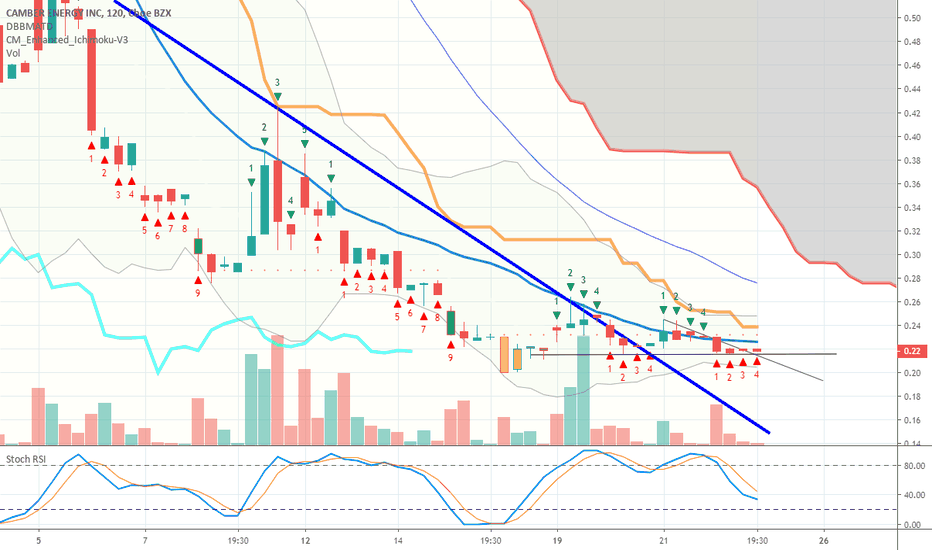

$NETE weekly once .42 breaksunless NETE management increases AS again, this has a chance of breaking upside

NETE bull swing?We could be seeing some continued gains here in the long term, as well as a potential squeeze in the 2nd half of 2016.

Future months will hopefully confirm or deny this. Any comments?

$NETE chart setupKey support & resistance levels for nete in the near future. Make sure to take profits & always set a manageable stop loss.