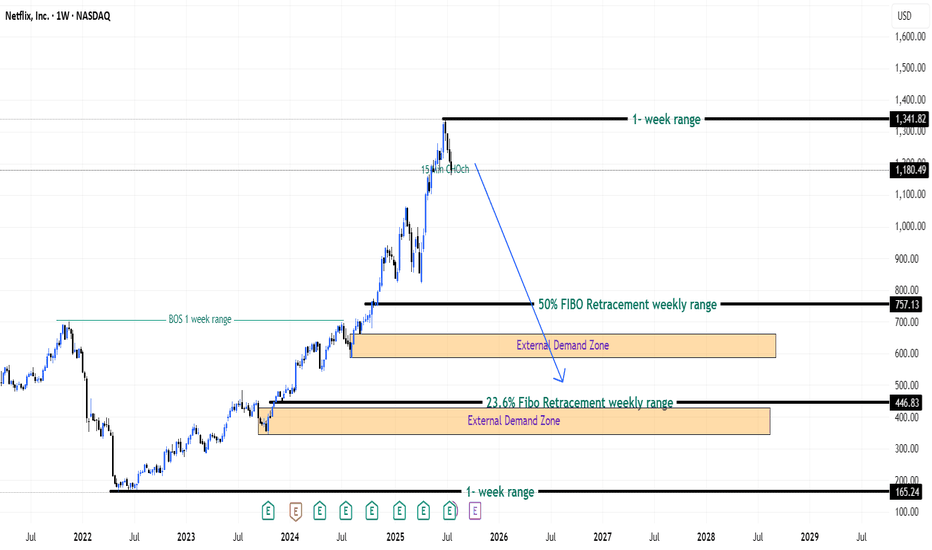

Bulls Quit? Bears Ready! - Netflix Stock (USA) - {27/07/2025}Educational Analysis says that Netflix (USA Stock) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - NA

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) Trading Range to fill the remaining fair value gap

Let's see what this Stock brings to the table for us in the future.

DISCLAIMER:-

This is not an entry signal. THIS IS FOR EDUCATIONAL PURPOSES ONLY.

I HAVE NO CONCERNS WITH YOUR PROFITS OR LOSS,

Happy Trading,

Stocks & Commodities TradeAnalysis.

My Analysis is:-

Short term trend may be go to the external demand zone.

Long term trend breaks the new high after going from discount zone.

Netflixsetup

How Earnings Reporting Could Impact Netflix (NFLX) Share PriceHow Earnings Reporting Could Impact Netflix (NFLX) Share Price

Earnings season is gaining momentum. Today, after the close of the main trading session, Netflix (NFLX) is set to release its quarterly financial results.

Analysts are optimistic, forecasting earnings per share (EPS) of $7.08, up from $4.88 a year earlier, and revenue growth to $11.1 billion.

The upbeat sentiment is driven by:

→ the fact that Netflix’s business model is relatively resilient to tariff-related pressures;

→ the company’s success in curbing password sharing and promoting a more affordable ad-supported subscription tier.

Netflix has reported revenue growth for six consecutive quarters, outperforming competitors such as Disney, Amazon, and Apple. Its market share has climbed to 8.3%, with YouTube remaining its only serious rival—YouTube's share increased from 9.9% a year ago to 12.8% in June, according to Nielsen. If current trends hold, this reporting quarter could mark another strong performance for Netflix.

However, is the outlook truly that bullish?

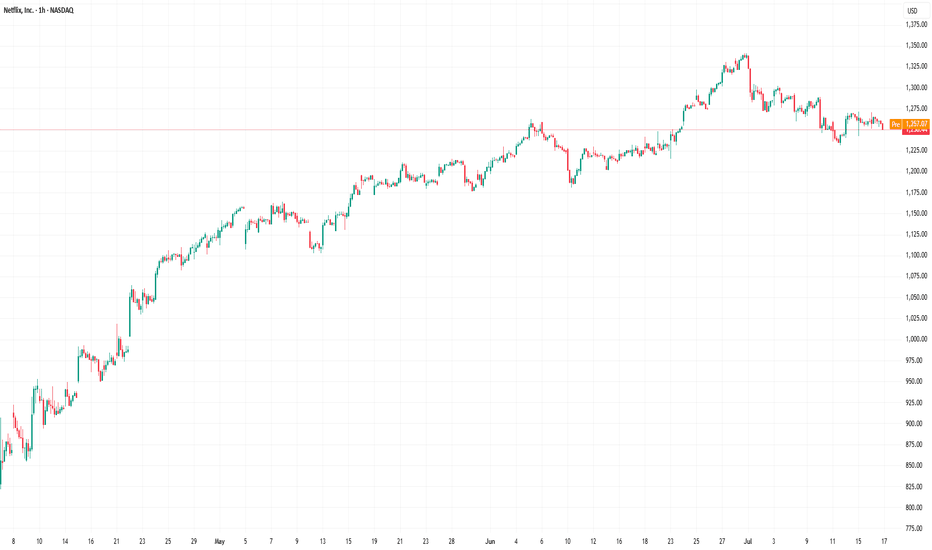

Technical analysis of NFLX stock chart

The NFLX stock price is currently moving within an ascending channel (marked in blue), and it is now testing the lower boundary of this formation. Of concern is the recent pronounced bearish movement (B), which has dragged the stock from the channel’s upper boundary to its lower edge—erasing the bullish momentum (A) that followed the breakout above the $1,250 resistance level.

What’s next?

→ On the one hand, bulls may attempt to resume the upward trend within the channel.

→ On the other hand, bears could build on their recent momentum (highlighted in red) and break the ascending trend that has been in place since May.

It appears the fate of the current uptrend hinges on the market’s reaction to today’s earnings release.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Netflix (NFLX) Share Price Reaches Record HighNetflix (NFLX) Share Price Reaches Record High

According to the charts, Netflix (NFLX) shares have risen above $1,170 – the highest level in the company’s history. Since the start of 2025, the price of NFLX stock has increased by approximately 33%, while the S&P 500 index (US SPX 500 mini on FXOpen) remains close to its opening levels from 2 January.

Why Is Netflix (NFLX) Performing Strongly?

A month ago, we highlighted several factors contributing to NFLX’s outperformance relative to the broader stock market. Among them is the fact that Netflix does not offer tradable goods subject to tariffs in trade wars. As a result, the company could potentially benefit from an economic downturn if consumers spend more time at home.

According to recent reports:

→ Netflix has announced that 94 million subscribers are now using its low-cost ad-supported plan – a figure more than a third higher than the 70 million reported in November.

→ The company also forecasts that advertising revenue will double this year.

Technical Analysis of the NFLX Share Chart

The share price continues to move within the upward channel (shown in blue) we identified previously. At the same time:

→ the price is currently near the upper boundary of this channel, which has repeatedly acted as resistance (as indicated by arrows);

→ the RSI indicator shows a potential bearish divergence.

Under these conditions, a corrective move in Netflix’s stock price cannot be ruled out – for example, towards line Q or the channel median.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Netflix Surges Following Stellar Earnings: Time to Buy or Wait.?Video streaming powerhouse Netflix (NASDAQ: NFLX) recently delivered outstanding fourth-quarter results, significantly bolstered by robust subscriber growth. This surge in subscribers is a clear indication of Netflix's ability to navigate and thrive in the increasingly competitive streaming landscape, where numerous platforms vie for viewer attention. In response to the impressive earnings report, Netflix's stock experienced a notable increase of approximately 10%, propelling it to a new all-time high and reflecting strong investor confidence.

Currently, the stock is displaying a symmetrical triangle pattern on the 4-hour chart, a technical indicator often associated with periods of consolidation before a breakout. Given market dynamics, a retest of previous resistance levels is anticipated, which could lead to a decline in price as it fills the gap. Consequently, this presents a potential buying opportunity, with the ideal entry point estimated at around $940. This strategic level may offer investors a favorable position to capitalize on future price movements.

Netflix (NFLX) AnalysisNetflix recently experienced a pullback, dropping to a significant demand zone around $820-$850, which has historically acted as strong support. This drop has attracted traders eager to capitalize on the current discounted price, anticipating a potential bullish rebound.

Looking at the chart:

1️⃣ Previous Earnings Reaction: The last earnings report sparked a 12% spike, showcasing Netflix’s potential for strong momentum following positive results.

2️⃣ Demand Zone Support: The stock is consolidating around this key level, indicating that buyers are stepping in to defend it.

3️⃣ Bullish Expectations: Traders are positioning themselves for the upcoming earnings report, expected on 01/21/2025 after market close, which could act as a major catalyst for upward movement.

If the earnings report meets or exceeds expectations, we could see Netflix rally toward all-time highs, with the first resistance zone around $940 and a longer-term target of $1,020.

NETFLIX’s Next Big Move: Massive Breakout Imminent?Technical Analysis:

NFLX (Netflix), on the 15-minute time frame, has set up a long trade with a strong entry at $744.60, supported by good volume. The breakout occurred above a consolidation phase, indicating market interest in a bullish move.

The price action is holding above the entry level, and the Risological Dotted Trendline is trending upward, providing a strong support foundation for the trade. This long setup points to a potential bullish continuation as Netflix approaches the following targets.

Key Levels:

Entry: $744.60

Stop Loss (SL): $715.10

Target 1 (TP1): $781.07

Target 2 (TP2): $840.08

Target 3 (TP3): $899.09

Target 4 (TP4): $935.56

Observations:

The breakout was backed by strong volume, reflecting confidence from the bulls.

Price is consolidating near TP1, suggesting momentum is building for further upside.

The Risological Dotted Trendline is trending upwards, giving strong support around $744, ensuring the trend stays intact.

Outlook:

Netflix's long trade setup shows strong potential for upward movement. With the support of the Risological Dotted Trendline and high volume backing, this trade is well-positioned to meet its targets. Watch for any pullback near $740, which could present another opportunity to re-enter or add to positions.

NFLX Jan 26th Update, Target got hitWe had a great bull flag setup going into the earnings.

Now the target got hit, will be watching for a retracement into early Feb and another push higher into Feb OPEX

Nothing bearish here to even try taking a short trade. There is still one more gap to close above the price, should be hit first before reversal starts.

Also the price might just consolidate/correct in time and push above to a new high. Any shorting should have solid stops

Netflix Breaking Major Support Not a Good look Hi guys! This is an Update on Netflix (NFLX) on the 1 day chart.

We are currently at risk of a trend change in the makings due to a breakdown of Major Support.

This is a zoomed in look on the daily timeframe.

But if you look at my previous idea below, notice the Uptrend Channel that Netflix has been following since June 2022.

Todays candle is currently BELOW this Support trendline of the Channel.

Not a good look for Netflix.

But brings in opportunity for take a Short, once confirmation comes in.

Notie also that with the print of the Massive BEARISH Engulfing Candle, we are now below the 21 EMA.

Note the BEARISH Engulfing Candle indicates extreme selling pressure. It shows that the majority of the previous move up to the resistance was sold off by this 1 candle print.

With this daily candle & the engulfing candle it equates to the entirety of that move.

Being BELOW the 21 EMA, tells us declines are likely ahead of us. ALso if we are where we are with the close of our current daily candle, we will confirm BELOW 21 EMA.

Thus supporting probability of further declines.

Look to the Black Horizontal Line below us for our current target for this price decline.

BUT if we can somehow move back ABOVE the channel, by the end of the week before CONFIRMATION. This could support the probability of us resuming our Uptrend.

__________________________________________________________________________________

Thank you for taking the time to read my analysis. Hope it helped keep you informed. Please do support my ideas by boosting, following me and commenting. Thanks again.

Stay tuned for more updates on NFLX in the near future.

If you have any questions, do reach out. Thank you again.

DISCLAIMER: This is not financial advice, i am not a financial advisor. The thoughts expressed in the posts are my opinion and for educational purposes. Do not use my ideas for the basis of your trading strategy, make sure to work out your own strategy and when trading always spend majority of your time on risk management strategy.

Netflix Overbought and Facing Resistance Netflix NASDAQ:NFLX

EARNINGS RELEASE TODAY (AFTER THE CLOSE)

Entry Pending Until:

- Break above overhead resistance, making it support

- A revisit of the 200 Day SMA

- In both, tight stop required

We are currently oversold on the RSI and whilst the stock could remain oversold for weeks the last 2 times we reached this exact RSI level we were rejected. For this reason I see no reason to be rushing into this trade. If you put on a trade you need a tight tight stop loss.

The head and shoulders pattern could take another year to play out. For the moment I am focused on the immediate resistance overhead, the overbought RSI signal and the 200 SMA.

Its amazing we don't see more Netflix in feeds, we are up 200% over the past 12 month period.

Hope this helps anyone trying to build a structure of the chart for a potential play.

PUKA

Netflix NFLX Next MovePair : NFLX ( Netflix )

Description :

Bearish Channel in Long Time Frame as an Corrective Pattern with the Breakout of the Lower Trend Line and Retracement

Break of Structure

RSI - Divergence

Completed " ABC " Corrective Wave

Bearish Channel in STF with the Breakout of the UTL need to wait until it Completed its Retest

Impulse Correction Impulse

Netflix: Continue Watching 🍿Bring on the Popcorn! The Netflix stock continues to rise and should finish the turquoise wave A soon. Once completed, the stock would fall into a correction until the course drops below the support line at $252.06 and wrap up the turquoise wave B. Once the stock hit its corrective low, the course can start an upwards trend to climb further North in the longterm.

Netflix breaking down? Netflix

Short Term

We look to Sell at 220.83 (stop at 236.96)

Although the bulls are in control, the stalling positive momentum indicates a turnaround is possible. Price action looks to be forming a top. We look for losses to be extended today. The medium term bias remains bearish.

Our profit targets will be 170.19 and 164.87

Resistance: 248.70 / 329.82 / 333.22

Support: 207.41 / 169.70 / 164.28

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.