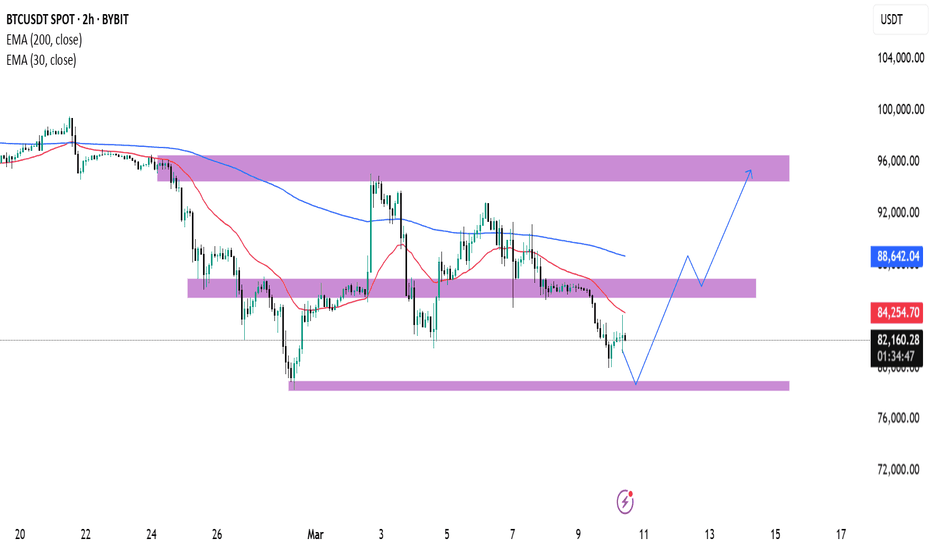

BTC/USDT Price Analysis: Reversal or More Downside?:

📊 BTC/USDT 2-Hour Chart Analysis

🔻 Current Trend:

BTC is in a downtrend 📉, trading below the 30 EMA (🔴 84,270 USDT) and 200 EMA (🔵 88,644 USDT).

The price is currently 82,406 USDT and approaching a key support zone (🟣 ~80,000 USDT).

Support & Resistance Levels

🟣 Support Zone (~80,000 USDT) – Possible bounce area ⬆️

🟣 Mid-Resistance (~86,000–88,000 USDT) – First hurdle 🚧

🟣 Major Resistance (~96,000 USDT) – Final target 🎯

Possible Price Movement (🔵 Blue Line Projection)

✅ Bullish Case:

If BTC bounces off support 🏋️, it could move towards 88,000 USDT 🚀 and then 96,000 USDT 🎯.

❌ Bearish Case:

If BTC breaks below 80,000 USDT, we might see more downside ⚠️.

💡 Trading Tip:

Watch price action 📊 at support & resistance.

Look for confirmation signals ✅ before entering trades.

🚀 Are you bullish or bearish on BTC? 🔥

Newsanalysis

FED Interest Rates and it's mechanism BINANCE:BTCUSDT

In the United States, the federal funds rate is the interest rate at which depository institutions (banks and credit unions) lend reserve balances to other depository institutions overnight on an uncollateralized basis. Reserve balances are amounts held at the Federal Reserve to maintain depository institutions' reserve requirements. Institutions with surplus balances in their accounts lend those balances to institutions in need of larger balances. The federal funds rate is an important benchmark in financial markets.

The effective federal funds rate (EFFR) is calculated as the effective median interest rate of overnight federal funds transactions during the previous business day. It is published daily by the Federal Reserve Bank of New York.

The federal funds target range is determined by a meeting of the members of the Federal Open Market Committee (FOMC) which normally occurs eight times a year about seven weeks apart. The committee may also hold additional meetings and implement target rate changes outside of its normal schedule.

The Federal Reserve uses open market operations to bring the effective rate into the target range. The target range is chosen in part to influence the money supply in the U.S. economy

Financial institutions are obligated by law to hold liquid assets that can be used to cover sustained net cash outflows. Among these assets are the deposits that the institutions maintain, directly or indirectly, with a Federal Reserve Bank. An institution that is below its required liquidity can address this temporarily by borrowing from institutions that have Federal Reserve deposits in excess of the requirement. The interest rate that a borrowing bank pays to a lending bank to borrow the funds is negotiated between the two banks, and the weighted average of this rate across all such transactions is the effective federal funds rate.

The Federal Open Market Committee regularly sets a target range for the federal funds rate according to its policy goals and the economic conditions of the United States. It directs the Federal Reserve Banks to influence the rate toward that range with open market operations or adjustments to their own deposit interest rates. Although this is commonly referred to as "setting interest rates," the effect is not immediate and depends on the banks' response to money market conditions. Separately, the Federal Reserve lends directly to institutions through its discount window, at a rate that is usually higher than the federal funds rate.

Future contracts in the federal funds rate trade on the Chicago Board of Trade (CBOT), and the financial press refer to these contracts when estimating the probabilities of upcoming FOMC actions.

When the FOMC wishes to reduce interest rates they will increase the supply of money by buying government securities. When additional supply is added and everything else remains constant, the price of borrowed funds – the federal funds rate – falls. Conversely, when the Committee wishes to increase the federal funds rate, they will instruct the Desk Manager to sell government securities, thereby taking the money they earn on the proceeds of those sales out of circulation and reducing the money supply. When supply is taken away and everything else remains constant, the interest rate will normally rise.

The Federal Reserve has responded to a potential slow-down by lowering the target federal funds rate during recessions and other periods of lower growth. In fact, the Committee's lowering has recently predated recessions, in order to stimulate the economy and cushion the fall. Reducing the federal funds rate makes money cheaper, allowing an influx of credit into the economy through all types of loans.

How to use news and data reports to make transactions profitableFrom central bank interest rate resolutions, non-farm payrolls, PMI indexes, inflation rates and other data reports, to geopolitical developments, and even natural disasters, these are major news that foreign exchange investors cannot ignore.Because the trend of the currency is always guided by these major economic events and news developments, it is accompanied by trading opportunities.

Of course, not all news is worth trading, so we must be familiar with how economic events will affect currency market trends.For major transaction news and data reports, we can follow the following three steps:

1. Select news events that will cause price fluctuations

Foreign exchange traders tend to pay attention to certain key economic data that have an impact on interest rate speculation. These economic data include: central bank decisions and speeches, gross domestic product (GDP) data, employment data, inflation rate and trade balance.

2. Choose the right currency pair

Generally speaking, we will choose currency pairs with high liquidity. There are mainly the following 8 pairs: EUR/USD, USD/¥, AUD/USD, GBP/¥, EUR/CHF, and CHF/¥.The sufficient liquidity of currency pairs is conducive to us to use lower transaction costs to win huge profits through greater volatility.

3. Pay attention to the news release time and forecast results

We have to trade based on data expectations, that is, the actual announced results are compared with the predicted values.For example, if the non-farm payrolls report is better than expected, the dollar will generally rise, and EUR/USD may fall.

In addition, before the data is released, we need to check the price movement of the short-term chart (5, 10, 15-minute chart), and use the closing price to decide whether to trade the current data report.After the price trend is confirmed, open a position and set a take profit and stop loss.

In order to facilitate everyone to continue to follow up on my analysis and sharing, you can like and follow me; in addition, I will share the daily real-time strategy in the channel. If you can't follow up in real time, you may make operational errors.You can use the following methods to enter my channel for free to follow the latest news and follow up on market trends in real time.

EU Looking to move to the upsideAfter News on 2/24/23 and After Top-Down analysis i'm looking for EU to move to the upside on 2/27/23

This is not trading advice or a signal!

The Website should not be relied upon as a substitute for extensive independent market research before making your actual trading decisions.

BTC "FINAL HOPE" on Nov 2ndFED FOMC Decision on Nov 2nd weighs heavy upon all markets, including crypto market. While other markets have shown high volatility in accordance with any macro related news, crypto market surprisingly moves in a calm manner despite being known for its infamous volatility, which actually scares me the most. Why? Because it means that any major macro news will release the spring that's been holding crypto market, especially Bitcoin, and will launch it with ultra volatility that can be either up or down. Knowing which movement will take place before the price action actually happens on Nov 2nd gives you total advantage on that very specific ultra volatile price action. So let's break down all the data that we can use to help us determine which direction will occur:

TECHNICAL ANALYSIS

- Heikin-Ashi Candles show that we are still in a strong downtrend, you can see it clearly especially on higher time frames (weekly, monthly)

- Ichimoku Cloud is still above the price, with a huge red cloud along with other strong resistances that we've seen rejecting the price for weeks

- A huge red Ichimoku Cloud is still being projected ahead, and no sign of turning green anytime soon

- Conversion Line (yellow) is below the Base Line (blue), crossing it down

- Lagging Span (purple) is still below the cloud, which crossed down back on April (and hasn't yet crossed up), which indicates we're still in a strong downtrend since then

- 50 EMA (yellow dots) is still above the price, and far below 200 EMA (blue dots) which is still waaay up there, untouchable

- A Bearish Descending Triangle from Sept 13th local top (in blue) which has rejected the price and acts as a strong resistance

- A Strong Support Zone between $17.500 - $18.500, along with the base line of the Descending Triangle, which has proven to be a strong support area

FUNDAMENTAL ANALYSIS

- Macroeconomic conditions is getting worse and worse, no sign of getting better anytime soon, including wars

- All those bad things combined with actual data, give no reason for the FED to stop their hawkish stance anytime soon, in fact these give them all the reason to keep getting it tighter and tighter, I really doubt FED will pivot even if the UN and all countries in the world urge them to do so, at least not on Nov 2nd

- USD is skyrocketing

- Previous similar bullish patterns might not work, considering the macros atm (if previous similar patterns indicate a capitulation, then it will most likely be the same this time around, unless something good miraculously happens)

CONCLUSION

- Overall I'm still super bearish at the time of this writing

- I won't even consider a trend reversal from bear to bull market, let alone saying that this bear market has bottomed, unless the price crosses above the ichimoku cloud, closes there, and maintains the position there ($21K-$22K range), or even shows some strong bullish momentums. I still prefer a breakout and close above $32K though.

!!! HOWEVER, CHANCES ARE, THESE ARE BULL TRAPS. BE CAREFUL NOT TO BE SUPER BULLISH IN A BEARISH MACRO !!!

- If this time price breaks $17.5K-$18.5K strong support zone in a single move, high chance it will be a disastrous cascade down (imagine all the SLs there)

- A break and close below the previous $17.6K low, and macro pressure, will signal a prolonged downtrend (it can be a fake, a bear trap, but only for a short time)

- If a big capitulation does occur, and BTC creates a lower low, I really can't say if the true bottom is there unless FED pivots and macro conditions are getting better, BUT there will be a quick recovery movement upwards (usually until the previously broken strong support), and then ranging again until the next major events

- A bear market doesn't mean the price can't go up big time

- Coin inflow/outflow from exchanges, volume, DOMs, etc might be the work of manipulators, ride the trend, stay with macros, and don't fight the FED

- Next BTC halving might indicate bottom and the start of the next bull run, we'll need to see how our macros doing then

DISCLAIMER

This is an article, not a financial advice

Do your own research, spend your money wisely

Your money is your own responsibility, so is your action

GOLD CHART AND MARKET ANALYSIS w/ ORDER FLOW and UPCOMING NEWSWelcome back to another video, today's video is about the analysis of GOLD using the monthly, weekly and daily timeframe to understand and see price movements for possible next direction (either downwards or upwards trend).

P.S NOT A FINANCIAL ADVISOR... JUST EDUCATIONAL AND LEARNING PURPOSE ONLY...

STEP 2 to MASTER TRADING: what to do with the NEWS. NEWS BRING TERRIBLE TRADING CONDITIONS

During release, spread is all over the place, in addition you can easily miss the fill. So actually worst time you can enter a position is on a release itself, hoping price will rise or fall. But usually, price will make massive moves up and down, liquidating hopeful "news traders" before going in either of direction. So next time when you will regret you were not involved in the news move, just remember that you would not have a good entry point anyway.

PRICE CAN GAP BELOW YOUR STOPLOSS

Another really important thing to keep in mind is that very often during red news, price can momentarily and significantly gap, and now instead of your breakeven or usual -1RR, you'll have -2 or -3RR, and what's worse - you'll have a big drawdown in your emotional capital.

ILLUSION OF UNDERSTANDING

Sometimes beginners, and even advanced traders, fall into this illusion. Someone reads 5 articles about a specific news type, and now begins to think they understand how the news will effect the market.

In reality, each trading instrument is effected by hunderds of factors, and anyone who wants to understand them, should spend months, even years with that one instrument, learning literally everything about it and what effects it. Everything else is just gambling or being naive.

EFFECT HAPPENS BEFORE THE RELEASE

If you've being familiar with smart money or institutional trading, ideas of Wyckoff, you'll know that institutions position themselves long time before news release, during accumulations and distributions. Market structure gets established long before actual realease, and what news do are just producement of sporadic moves, grabs of liquidity and easy manipulations. But only 0.01% of news actually change pre-established structure and starts a new trend, big picture doesn't change because of news. What actually starts a move and a trend are accumulations and distributions, and news really can be a part of it, but only a small part.

SO WHAT TO DO ABOUT THE NEWS?

1. Check red news releases during your day. Don't enter 15-30 min. before and after the news.

2. If you're already in a trade, and price came relatively close to your entry, it's better to close out the position now, because remember that price can gap below your stoploss.

3. If you're positioned in profit significantly away from the price, leave the position open.

So to recap everything above, you need to trade YOUR SYSTEM, YOUR EDGE - for me it's structure, SnD and confirmations - but also we need to acknoledge the short term chaotic news effect, and use our knowledge to manage risk and that's all.

Hope this post give you better understanding what should you do in order to become a successful trader.

I will be grateful if you support this post by smashing the BOOST button and sharing it with other traders. Thank you!

Dima

GBP JPY Sell to 151.450GBP JPY Has made some retrograde in the last 30 days. probably the sellers are still on their way to 149.300 -149.100.

NI225 Has made +3.55 % Last 30 days, By moving from 28583.83 to 29601.83, targeting 30500 Japanese yen are doing well right now, I am waiting for GDP Annualised news, with the previous: 1.3 the forecastings: -0.8

I expect high volatility to the downtrend continues, the price will continue to 151.400 - 151.600 support area.

152.600 is my sell open position now

I made a sell pending order at 153.250 just in case the pairs make some reversal moves.

targeting the 151.500 area as you can see in the chart,

always risk management will help you to protect your position.

SABESP: Are investors expecting bad 2020 results on March 25?TECHNICAL ANALYSIS

RSI-14 is almost going under 30-level boundary (change in trend is expected once this happens, what means going from downward to upward trend)

In the last week, sell volume has increased, specially on February 18 and 19.

Key support at 5.55-5.65

Besides, SBS is closing a triangle which could foster some volatility in its share-price.

FUNDAMENTAL ANALYSIS

Expected EBITDA 1577 and EPS 1.13

If results are better than expected, SBS will go up to test resistance level 12.34. If they are worse, then it could test next support level at 3.49.

In the meantime, it may look like investors are discounting bad 2020 results once they are issued in March 25. This psychological mindset may drag the price towards first support level at 5.55-5.65.

NEWS ANALYSIS

Bad news from SABESP: review of tariffs delayed until March 10

Last 9th of February, SBS announced it but now it looks like it's going to take more time. However, final results will still be issued on April 9, 2021.

XP Investimentos is optimist with the terms presented as they contain a positive calculus for SABESP.

SABESP incurred in emergency maintainances in Itaquaquecetuba, accidentally destroyed a gas pipeline in Taboão da Serra on February 19th and is now making some reforms in the mysterious Parque Sabesp Mooca (aka Parque Radialista Fiori Gigliotti) which was opened to the public in 2014 and most part of its 21200 m² are off-limits and no one knows why.

CONCLUSIONS

SBS may touch key support at 5.55-5.65 which means a buy in my opinion and then, once results are issued, if they are better than expected (or not that worse as expected), long-term perspective for the stock is bullish.

Biosearch: -37.8% EBITDA, +53.8% extract salesBiosearch is clearly improving its fundamental results but investors may not like that drop on EBITDA. That is why we could expect Biosearch go towards 0.50 Fib level at 0.876 and bounce back to 1.07 level, with the risk of losing 10% once the stock is bought at 0.876. So short the firm in the next 15 days, and long until you feel comfortable. It may also be a long-term investment due to the several patents the company is asking for.

HELLA: Joint venture at Jianxing Zhejiang, 700km away from WuhanSideways movement presents low volume and in the past two years (2018 and 2019), HLE has entered July in a bearish mood. From the upside, the price is at 0.5 fibonacci retracement level although the head formed on June 8 surpassed 0.618 for a bit. From the down side (blue fib retracement), the price is at 0.236 level. A sharp fall beyond 0.382 level in the next 2 weeks would mean a bullish trend reversal.

Causes for this to happen:

Due to covid19 tensions and also US-EU trade war we may see a short-term (6 months) decay predicted by the Head and Shoulders figure finished on June 22. Deutsche Bank sticks neutral on HLE's target price at 30€ although JP Morgan offers buy rating until 41€. In addition, HLE seems not to be scared about a new virus outbreak in China and has established close relationships with Jianxing, in Zhejiang province, shaping a joint venture with Minth to produce radomes and illuminated logos. In Zhejiang (currently +30ºC) there were 1,269 covid cases, 1.52% of the total Chinese Mainland cases. Zhejiang is 1000 km away from epicenter Wuhan. If news about covid19 evolving in China continue to happen, HLE will be seriously damaged by it.

LOGISTA: Shaping perfect bearish #headandshouldersAlthough its profits amounted at a record level last year 2019 at €165 million (+5.1% YoY), a head and shoulders figure appears in the short term maybe to drag the company to 14.10 zone at the end of July or beginning of August. Pharma logistics and convinience products division had a very good behaviour. EBITDA was €81.5 million (+11.3% YoY)

However, in the first fiscal semester, LOGISTA experienced -11.8% profits YoY even though revenues have been stable. Ebitda is down -9%, although they've applied IFRS 16 and then it's up 1.6%, as a consequence of it.

If the company decides to pay dividend as every year at the end of August, maybe LOG will go up for the dividend appetite from 14.19€ zone.

It is important to note that payout in 2019 was 93.6% and in 2020 they've increased it to 95%. Big payout, folks!

CAIXABANK: Approx. #Bearish #batpattern on its way & Q2 earningsThe bank's results are due on July 24th. JP Morgan and Wells Fargo saw sharp declines on profits (-51% and -71% respectively) yesterday and I expect Spanish banks will be unable to avoid them too. Besides, CABK has been the bank who's best performed in the short-term post-covid era, so we could expect bigger downward corrections than those in Santander or BBVA once their results come in. Barclays "saves" CABK and SAN's rating but still forecasts a -52% decline on profits for the sector although in my opinion, I expect -60% minimum.

From the technical point of view, an approximated bat pattern is being formed and its figure may be ended either today or tomorrow at level 2.10-2.12. Once it is completed, the bank's share price may drop towards 1.80 level (0.5 Fib level) or 0.382 Fib livel (1.878) in case earnings readings are better than expected.

DAX: Bearish bat pattern (approx) formingReading "The pandemic remains uncontrolled in the US, but the economic recovery continues apace" is not 100% good news. 4.5 million jobs in june still does not eclipse those 33 million lost. I think July is going to be a very volatile month and we might experience the DAX coming to 0.382 Fib level as of July 17 on wards, after reaching 12,800-12,900 level when RSI could be above 70.

Deoleo: Very risky although volatility may make see some gainsDEOLEO is back in the Spanish stockmarket and with higher average volume than the previous 3 months. It has cut its debt by 42% and earned €4.5 million in Q1, compared to -€7.5 million in losses in Q12019. It is a very risky investment and next results are set to be published around the first days of August (3/8/20).

I would call for a long position until first stop 0.23 and then make another technical analysis. Right now there is a bearish bat pattern threatening the stock until 0.1630 or second support at 0.1458.

Grifols: A new bullish channel up to +18%?Focused on hemoderivatives (blood plasma), Grifols is great value by most of investors. Even though the company might be one day spitted by any scandal on how it is gathering the plasma in the US, americans have got a high stake on it and today it is focusing on an hyperimmune immunoglobulin with specific antibodies against the SARS-CoV-2 virus. Grifols estimated an impact on its accounts of €200 million and many rating houses have downgraded the stock. Its 2019's profits were up 4.8% to 625 million and an EBITDA of 1,434 million (+17,3% YoY). In 2020, Q1 Net profits were up 63% and EBITDA 14.9%. Results on its tests will be presented in July (the mandatory 14 days to see whether the virus is gone or not). We may experience volatility in the price of the company until July 01. According to some news, Grifols' margins were not attractive and that is why the correction of the share price has taken place.

Technically speaking, the company might be immersed in a bullish channel started on March 16 and closing out a triangle started on Feb 20. We could expect the share price go at least up to 29.40 level in the next days. Best price to enter Grifols might be 27€. Also, note that when markets are down, Grifols is up acting like a safe haven asset.

US and EU #tradewar revived: $3.1 bn on tariffsTrump administration wants to put tariffs on German, French, English and Spanish exports to the US, amounting $3100 million. Tomorrow, US opens a query period lasting one month, until July 26. These tariffs could be set as 100% of the produce value. A new trade war has been started due to Airbus subsidies and revived taxes topic to american big tech companies such as Google, Facebook or Amazon. If this $3100 million see green light, Euro could be dismantled to 1.10, leaving back that sideways movement started on June 8. Looks like America has realised Euro is gaining strength (maybe too much for their taste) against major pairs since May 14.

EURUSD: New safe haven against major pairs?This morning, I saw an educational video from transparent-fx and showed that the EURUSD is shaping an inverse H&S in D chart and indeed it is. Besides, in the H4 chart it comes from shaping a non-inverse H&S what makes you realise that the pair is experiencing a sideways movement since June 8. If the figure is finished, by June 30 EURUSD could reach 1.14. In addition, fundamental readings have been quite strong, coronavirus is contained in most of the european countries and even though Germany has seen a surge in covid19 cases, Merkel is still the Chancellor so she knows how to deal with this. On the other side of the Atlantic, US and Latin America are not improving which is why investors are running away from america (which has recently seen a spike in bankruptcies filing in the past week, 13-20 June) and embracing euro as the only safe currency since Japanese yen lost that condition when covid19 outbreak sparked the markets around Feb 24. So EURUSD might be the safest currency (inveur, investing.com's euro index is staying around 101, highs not seen since 2014) for this summer-autumn only, until everything drops down again.

Indra: Seizing sideways momentum call opportunity?Indra is moving inside a lateral channel with a slight bearish trend. In the last days there have been good news about projects that are being signed (i.e. Defense, Ireland) but it looks like global pandemic situation is making investors undecisive whether to hold positions on the stock or withdraw. Lond term trend is clearly bullish. The company was planning to get back to dividend payments suspended back in 2014 and now due to covid19 it has left this topic in standby. The truth is that if I think markets are going to throw-back around July 14, IDR may not have time to do its last swing and may go further down to levels seen in 2012. However, if tomorrow decreases a sharp 6%, depending on the global market news we might experience a rebound on Monday or a continuing decline until 6.395€, the base of the slightly bearish channel. So we must be very focused on what happens tomorrow in macros, news, covid19 new outbreak and market sentiment and operate consequently. On the weekend there might be as well some news or none that may affect the global stockmarket sentiment. One thing is for sure: There is a lot of volatility and one could benefit or lose with it.

AI closing its triangle: Bull opportunity?Sometimes when a stock closes a triangle, it spikes up. However, we already saw DIA supermarkets that did not make this many-investors' wish come true (and I talk about before all this pandemic set in). In this company, there has been recent "good" news (by many investors) that its president will leave his chair. And he leaves with 2.2 million debt owed to the company, besides colouring the company all in red losses during these last years. As annual meeting is getting closer and an increase in capital is going to be approved, news about the company might appear between June 18 and 23. The company is also making disinvestments on business areas that are not strategic. It wants to focus on collaborative robots and the hyperloop. According to Diario de Cadiz (29/02/2020), Airtificial set its objective to initiate business activities in India since it believes the country will be the third one worldwide in the components production industry. In 2019, Airbus hired the firm to help it make the A350. However, these works may end due to disinvestment and focus on robotics. All in all, AI has a lot of potential but right now, from an investor point of view, you might just want to speculate on the share price and once there are good news about the company then get in and maintain your position. Short term, might be long due to volatility.

Buy target 0.043-0.048

Sell target 0.09-0.11

Intraday trading: Potential takeover of MoneyGramBloomberg News reported the potential takeover incurred by Western Union of MoneyGram. Price was not disclosed and now MGI faces high volatility a trader could profit from. Looking at the 4h chart, we might see that in 3 hours time MGI (at 17:30h GMT) might plummet until $3 to pullback at $3.80 after 17:30h GMT. Maybe, takeover price for MGI could be greater than current price due to greater average TTM market price. However, Moneygram holds around $800 million debt, so negotiations will be interesting. I suggest Long from $3 up to $4.40.