Volume spikes on down moves add to selling pressure.📉 BTCUSDT – 1H Chart Technical Outlook

🔍 Structure Insight:

Bitcoin is currently trading within a descending channel, forming lower highs and lower lows, indicating persistent bearish pressure. Price action appears compressed between key trendlines, hinting at an imminent breakout.

---

🔻 Scenario 1: Bearish Breakdown (Primary Bias)

If BTC fails to hold above the lower boundary of the range, a decisive break below could trigger a sharp move toward the 103,650–103,000 demand zone. The structure supports continuation to the downside if the price rejects resistance again.

🧊 Bearish Confluence:

Price is unable to break above dynamic resistance.

Momentum remains weak near the mid-range.

Volume spikes on down moves add to selling pressure.

---

🔼 Scenario 2: Bullish Breakout (Alternative View)

A breakout above the descending trendline and confirmation candle could flip bias short-term bullish. This would target the 105,400+ region as the next liquidity area.

⚡ Bullish Signs to Watch:

Break and retest above trendline resistance.

Bullish engulfing or breakout candle with volume.

---

🔍 Key Levels to Monitor

Support: 103,650 / 103,000

Resistance: 105,000 / 105,400

Breakout Zones: Watch for clean breaks and retests outside the wedge pattern.

---

📌 Conclusion:

BTC is coiling within a tightening range. The breakout direction will likely dictate the next short-term trend. Maintain flexibility — breakout confirmation is key before positioning.

🚨 Not financial advice — always DYOR before trading!

Newsignal

Gold (XAU/USD) Bearish Trendline Breakout – Short Set.Trend Channel: Price had been moving within a clear ascending channel. Recently, price action tested the lower trendline and appears to have broken below it, indicating potential bearish momentum.

Ichimoku Cloud: The price has moved below the Ichimoku cloud, which adds further bearish confirmation. This breakdown of both the trendline and the cloud indicates a possible shift in trend direction.

Volume Spike: A slight increase in volume during the breakout suggests growing interest from sellers.

Entry Signal: The chart marks a zone (circle) where traders should watch for a red candle confirmation. A bearish close below the trendline supports initiating a short position.

Targets:

TP1 (Take Profit 1): Around the 3,240 zone — this is a moderate support area and a conservative profit target.

TP2 (Take Profit 2): Around the 3,160 zone — this aligns with a previous demand zone and represents a deeper corrective move.

Trade Strategy:

Entry: After confirmation with a red candle below the trendline and Ichimoku cloud.

SL (Stop Loss): Ideally placed above the trendline or recent high to protect against a false breakout.

Conclusion:

If the price holds below the ascending channel and the Ichimoku cloud, the setup favors short sellers. Watch closely for bearish candlestick confirmation before entering. TP1 and TP2 offer clear targets based on past support zones.

Would you like a follow-up with live price tracking or updated levels?

XAUUSD Update: Bullish or Bearish? Key Levels to Watch! 🚨 Attention Traders! 🚨

XAUUSD is making waves and breaking through key levels! 🔥 The price is currently battling between 2980 and 2989 — will we see a breakout soon?

Bearish Alert: A dip below this range could lead us to targets like 2860 and 2850. ⚠️

Bullish Opportunity: A move above 2989 could trigger buying opportunities, with targets around 3004 and 3027. 🚀

💬 Let’s Talk Strategy! What’s your take on this? Share your insights as we ride this golden wave together and unlock new opportunities! 💰

$XRP Eyes $10 as SEC Case ClosesAnalysts predict that XRP CRYPTOCAP:XRP could reach $10 by 2030 after the SEC officially dropped its lawsuit against Ripple. Ripple CEO Brad Garlinghouse confirmed that the regulator will not appeal the court’s decision, marking the end of the legal battle that began in 2020. As of March 24, 2025, XRP CRYPTOCAP:XRP trades at $2.46, up 2.17% in the past 24 hours, with a market cap of $143.29 billion.

Despite bullish prospects, challenges remain. Market volatility and competition from Ethereum and stablecoins could slow growth. Analysts at InvestingHaven believe XRP’s success depends on Ripple’s network expansion, though crypto market instability remains a key factor.

While a 306% rise to $10 by 2030 seems feasible, today’s market is less competitive than in 2017 when XRP CRYPTOCAP:XRP surged 64,000%. Investors are closely watching regulatory changes and macroeconomic conditions that could impact the coin’s future trajectory.

STRONG REVERSAL COMMING FROM NEW ATH ALERT!📈 Description:

This is a 2-hour timeframe analysis of Gold, the market is currently consolidating between a strong support zone 📉 and a weekly high resistance level 📈. Two possible breakout scenarios can be expected:

✅ Bullish Scenario: If the price holds the strong zone at 3028 and gains momentum, it may break out above the weekly high 🚀.

❌ Bearish Scenario: If the price breaks below this strong support zone i.e 3028, it could trigger a downward move toward a lower support level 📉.

👀 Traders should watch for breakout confirmations before entering trades! 📊📉📈

follow risk management

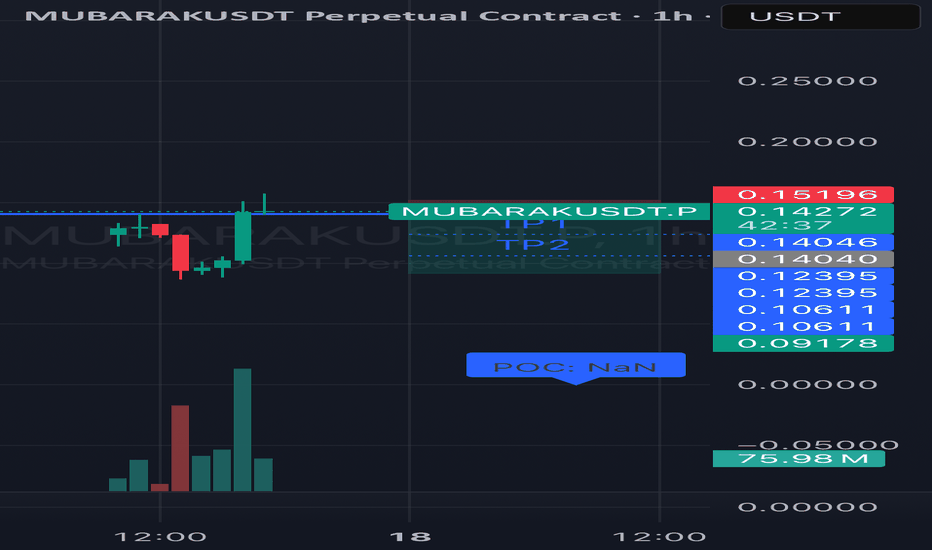

#MUBARAKUSDT continues its downtrend📉 Short BYBIT:MUBARAKUSDT.P from $0,14040

🛡 Stop loss $0,15196

🕒 1H Timeframe

⚡️ Overview:

➡️ The main POC (Point of Control) is Nan

🎯 TP Targets:

💎 TP 1: $0,12395

💎 TP 2: $0,10611

💎 TP 3: $0,09178

📢 Monitor key levels before entering the trade!

BYBIT:MUBARAKUSDT.P continues its downtrend — watching for further movement!

Gold (XAU/USD) 4H Chart Analysis: Resistance Test & Potential BrPrice Trend:

The chart shows a steady upward movement in the price of gold, starting from late February into March 2025. The price is currently around $2,917.25 and has reached near the resistance level marked on the chart.

Resistance Zone:

The resistance area, located between $2,911 and $2,920, seems to be a crucial level. Gold has faced difficulty breaking through this level multiple times, as seen in the sideways movement after hitting the resistance.

Target Level:

The target above this resistance zone is marked around $2,960, indicating the potential for further price appreciation if gold can break above the current resistance.

Price Action and Potential Breakout:

There's a potential for a breakout as the price appears to be forming a bullish structure near the resistance, indicating that if gold manages to break above this zone, it could continue its upward trajectory toward the target area.

Volume and Market Sentiment:

The volume indicators on the lower part of the chart are not heavily discussed here, but there might be a correlation with market strength. The chart suggests potential consolidation before a move upward if the resistance breaks.

Conclusion:

Gold is currently testing the resistance area, and if it successfully breaks through, it could aim for the target level around $2,960. Keep an eye on this price level as it could signal further bullish movement.

NEWS MOVE ALERT PPI AND UNEMPLOYEEMENT CLAIM.🚨 Gold Trading Update 🚨

Hey Traders! 👋

Here's the current scenario: Gold is heading towards the 2950-2955 level. Expect a possible fake-out, followed by a sharp drop. 📉

🔍 Key Insight: There’s an FVG on the H1 chart, signaling a potential sell-off before we see another GOLD rally. 🚀

Today’s News: PPI report 📊 drops, so expect a significant market move! Gold might respect the FVG and target these levels for a potential buy:

👉 2970

👉 2980

👉 3000

⚠️ Tip: Follow my strategy and always use proper risk management with a 1:2 risk-to-reward ratio. 💡

Happy Trading! 💰📈

XAUUSD NFPGold price remains depressed above $2,900, US NFP awaited

Gold price edges lower on Friday amid some repositioning ahead of the crucial US NFP release. Rising trade tensions, the risk-off mood, and a weaker USD lend support to the precious metal. Bets for more interest rate cuts by the Fed contribute to limiting losses for the XAU/USD pair.

Signals update shortly

XAUUSD📌Gold price holds the previous rebound from weekly lows early Wednesday.

📌Fresh haven demand on tariff uncertainty and US economic woes underpin Gold price.

📌Gold buyers stay hopeful amid bullish daily RSI, while the 21-day SMA at $2,883 holds.

🔥Buy Gold

$2905 -> $2903

SL $2900

TP 1->$2908 >2->$2912 >3->$2920

🔥Buy Gold

$2889 -> $2887

SL $2882

TP 1->$2895 >2->$2903 >3->$2910

🔥Sell Gold

$2946 -> $2948

SL $2953

TP 1->$2940 >2->$2930 >3->$2920

News TradingLet’s talk about news trading in Forex . While news trading is extremely lucrative it’s one of the most risky things a trader can do and experience. News and data cause extreme volatility in the market and as we always say “volatility can be your friend or your enemy” . Let’s take a deeper dive into news trading, which news and data affect the TVC:DXY precious metals such as OANDA:XAUUSD and other dollar related currency pairs. We will also cover having the right mindset for trading the news.

1. Understanding News Trading in Forex

News trading is based on the idea that significant economic data releases and geopolitical events can cause sharp price fluctuations in forex markets. We as traders, aim to profit from these sudden price movements by positioning ourselves before or immediately after the news hits the market. However, due to market unpredictability, it requires a strategic plan, risk management, and quick decision making.

2. What to Do in News Trading

1. Know the Key Economic Events – Monitor economic calendars to stay updated on high-impact news releases.

The most influential events include:

Non-Farm Payrolls (NFP) – A report on U.S. job growth that heavily influences the U.S. dollar.

Consumer Price Index (CPI) – Measures inflation, impacting interest rate decisions and currency valuation.

Federal Open Market Committee (FOMC) Meetings – Determines U.S. monetary policy and interest rates, affecting global markets.

Gross Domestic Product (GDP) – A key indicator of economic growth, influencing currency strength.

Central Bank Statements – Speeches by Fed Chair or ECB President can create large market moves.

2. Use an Economic Calendar – Websites like Forex Factory, Investing.com, or DailyFX provide real-time updates on economic events.

3. Understand Market Expectations vs. Reality – Markets often price in expectations before the news is released. If actual data deviates significantly from forecasts, a strong price movement may occur.

4. Trade with a Plan – Whether you are trading pre-news or post-news, have clear entry and exit strategies, stop-loss levels, and a defined risk-to-reward ratio.

5. Monitor Market Sentiment – Pay attention to how traders are reacting. Sentiment can drive price action more than the actual data.

6. Focus on Major Currency Pairs – News trading is most effective with liquid pairs like FX:EURUSD , FX:GBPUSD , FX:USDJPY , and OANDA:USDCAD because they have tighter spreads and high volatility.

3. What NOT to Do in News Trading

1. Don’t Trade Without a Stop-Loss – Extreme volatility can cause sudden reversals. A stop-loss helps prevent catastrophic losses.

2. Avoid Overleveraging – Leverage magnifies profits but also increases risk. Many traders blow accounts due to excessive leverage.

3. Don’t Chase the Market – Prices may spike and reverse within seconds. Jumping in late can lead to losses.

4. Avoid Trading Without Understanding News Impact – Not all economic releases cause the same level of volatility. Study past reactions before trading.

5. Don’t Rely Solely on News Trading – Long-term success requires a balanced strategy incorporating technical analysis and risk management.

4. The Unpredictability of News Trading

News trading is highly unpredictable. Even when a report meets expectations, market reactions can be erratic due to:

Market Sentiment Shifts – Traders might focus on different aspects of a report than expected.

Pre-Pricing Effects – If a news event was anticipated, the market might have already moved, causing a ‘buy the rumor, sell the news’ reaction.

Liquidity Issues – Spreads widen during major news events, increasing trading costs and slippage.

Unexpected Statements or Revisions – Central banks or government agencies can make last-minute statements that shake the market.

5. How News Affects Forex, Gold, and the U.S. Dollar

1. U.S. Dollar (USD) – The USD reacts strongly to NFP, CPI, FOMC statements, and GDP reports. Strong economic data strengthens the dollar, while weak data weakens it.

2. Gold (XAU/USD) – Gold is an inflation hedge and a safe-haven asset. It often moves inversely to the USD and rises during economic uncertainty.

3. Stock Market & Risk Sentiment – Positive economic news can boost stocks, while negative reports may trigger risk aversion, benefiting safe-haven currencies like JPY and CHF.

6. The Right Mindset for News Trading

1. Accept That Volatility is a Double-Edged Sword – Big moves can mean big profits, but also big losses.

2. Control Emotions – Fear and greed can lead to impulsive decisions. Stick to your strategy.

3. Risk Management is Key – Never risk more than a small percentage of your capital on a single trade.

4. Adaptability – Be prepared to change your approach if market conditions shift unexpectedly.

5. Patience and Experience Matter – The best traders wait for the right setups rather than forcing trades.

Thank you for your support!

FxPocket

XAUUSD BULLISH PATTERN CHARTHEY,

all my trader friends if you see m30 there is strong support at 2895 to 2899 so posible to gold fall and retest the area of this level and pull back to 2915.

if powell speaks is good for currency that time so we see gold fall wanna gold again buy from 2895.

BUY scenerio target 2916 this position all trader booked their 50% profit and half for continue to 2940

EUR RALLY ON ECB MEETING?Trading Plan for ECB Rate Decision

1. BASELINE 📊

- Market Expectations for Interest Rates: The market is anticipating a rate cut by the ECB, with a forecasted main refinancing rate of **2.90%** down from **3.15%**. The STIR markets have priced in a 50 bps cut, suggesting strong expectations for a reduction.

- Upcoming Event Predictions: Consensus is that the ECB will cut rates by either 25 bps or 50 bps to stimulate the economy due to lower inflation and weaker-than-expected growth.

- Trend Analysis: The ECB has been lowering rates since last year in response to economic challenges. This trend is likely to continue.

- Pre-positioning Observation: The flat movement in the proprietary euro index suggests cautious pre-positioning, indicating that significant moves might occur post-announcement.

2. SURPRISE⚡ :

- 25 bps Cut: If the ECB cuts rates by **25 bps**, it could lead to an upside in the euro due to repricing, as the market has priced in a 50 bps cut.

- 50 bps Cut: If the ECB cuts rates by **50 bps**, it might be seen as expected, leading to a less significant market reaction.

3. BIGGER PICTURE 🌐

- Short-term Play: If the ECB cuts rates by **25 bps**, initiate a short-term intraday trade on the predictable directional volatility, taking advantage of the potential upside in the euro due to repricing.

- Long-term Play: The broader expectations for future interest rates remain unchanged, suggesting that neither scenario will alter the bigger picture significantly.

Traders MindsetLet’s talk about mindset! You hear everyone saying; mindset is the most important in trading. But what is having “the right mindset” ?

Now here is a little secret. Mindset is not just being focused on the money. “I must be profitable”. No. Having the right mindset is having a set of attitudes. Quite literally the definition..

Mindset /ˈmʌɪn(d)sɛt/

noun (usually in singular) the established set of attitudes held by someone.

How you approach the market is very important.

Have a set of rules for yourself.

- Do I have a trading plan? Having a trading plan is important. It helps you follow something day in and day out.

- Do I have good market conditions? Having good market conditions is important as it helps you make more clear decisions. Trading in sideways markets usually ends badly. It forces the trader to become impatient and entering too soon, expecting a breakout to either side usually leads to loses.

- Do I know the risk? Understanding the risk before you enter the trade is important. Majority of traders over-leverage, meaning they use high leverage thus being able to open higher lot size positions. That usually leads to blown accounts. Knowing what you are risking, eliminates a lot of the emotions.

- Do I have any confirmations? Whether that’s a break, a pullback, fundamentals supporting your view that’s great! Having confirmations on your analysis or trade is important.

- Is this trade forced? Am I being nervous before entering? Am I not sure? Am I gambling on this trade? Understanding your emotions is important. Ever felt like this when you opened a trade, knowing you shouldn’t and it instantly went against you? Avoid these trades.

One more thing I would like to add. Ever been stuck to your screen 24/7? Lost sleep over a trade. Here is a fact. You watching the chart, won’t change its path. Sad truth. There is nothing wrong with following your trade, but if you are watching your losing trade, then I already know where it leads. You do too. Avoid this. Going back to the #1 rule. Know your risk before entering. Eliminate emotions.

Having the right mindset is following your own rules and having a set of habits. Habits that help you to grow as a trader. Eliminate bad habits. Review your past trades. You all know why you lost a trade. But will you look for an excuse? “Ah the market did a liquidity sweep” or “market is manipulated”. The market is never wrong. You as a trader are.

Don’t celebrate wins or mourn loses on your account. Treat it as your full time job. You have some good days, you have some bad days. You win, you move on. You lose, you move on. As long as you are following the trading plan, you will succeed.

Understanding this, combined with experience will grow you as a trader. And guess what the by product of this is? Money.

So don’t focus on money. Focus on self-growth, mindset, experience and upgrading your skillset of trading. Money will be the byproduct of your journey.

Create your mindset plan. A set of rules for yourself. Try doing it for 30 days. Come back to this post and tell us if you have improved.

Nothing or no one is stopping you from being a successful trader but yourself. It’s not the market and no it’s not the broker.

Majority of traders quit after blowing a few accounts. The rest stick around for years but make no progress. Only a few % of them actually find the meaning behind it and succeed.

What’s the secret? Signals? Prop Firms? Account managers? EA’s? No. Sure all these things can benefit you slightly. But what truly is the secret to being successful in trading?

You! You are the secret. Understanding yourself, your emotions, your reactions to certain events. Trading is a mirror of you. An amplified picture of you. Are you impatient? Scared? Nervous? Greedy? Forex will amplify those emotions.

The biggest battle you have to win is the battle with yourself. Not the market.

Trading is easy, you have a trading plan, you stick to it. Sometimes you may have a loosing week, happens right? But as long as you are sticking to your strategy, understanding the market, using a positive R:R and understanding the importance of consistency you should be fine. But here is the hard part. Your reactions. Your emotions.

Let’s take for example NFP Data release. Weeks or even months of progress can be wiped out due to irrational decisions during news. Don’t be that trader. Suppress your emotions, don’t get greedy. Take a jab at the market, but only after the data is out.

Remember, no one is stopping you from being a successful trader, but yourself.

A key element added to a traders mindset is PATIENCE .

patience /ˈpeɪʃns/

(noun) - the capacity to accept or tolerate delay, problems, or suffering without becoming annoyed or anxious.

That’s the definition of patience. Trading is a stressful field. Not only does your analysis have to be on point, you have to be focused, have a trading plan, use proper risk to reward ratio… so many factors and then comes the patience. We already know that the market always provides unexpected problems. It plays with our emotions, ranges, does not move, goes against us etc.

How many times have you entered in a position and the price started to range, while you float in loss? You start doubting, you get scared and you close the position. Or even worse, you get stopped out. Later in the day you check the chart and you see your Take Profit (TP) would have been hit, but only if you were more patient?

Or how many times have you had an A+ setup, everything was going to plan but you closed it early because you wanted to secure the profit?

Being a good trader is hard, but it’s not impossible. Discipline is everything as well as patience. Without patience you are bound to lose.

From talking to many people, you would be surprised at how many of them want to “flip” their account. “Do you think I can make 2000$ this week” with 1000$ in their account.

We will always advocate for patience. Playing the long game. Consistency + patience will get you far.

Check some of the last trades you did. Were you patient? Ask yourself. Majority can find themselves in these stories.

Work on your patience, and you will get far.

For example, check out this long-term analysis on XAUUSD (Gold) posted on January 9th. Now we did close it earlier, but we still managed to secure +500 pips (50$ price action) in 3 days of holding. Patience.

This post was made due to a high request of people liking our minds, so it has all been posted in a single educational post.

FxPocket

Gold Analysis Update: Resistance Levels and Market OutlookHello Everyone!

How are you all? I hope everything is going great! I'm excited to announce my return with a new TradingView account. I hope you’ll show the same love and support as you did with my previous account.

Gold Analysis

I'm observing that gold is facing resistance at 2762 on the H1 chart. It has been retesting this level repeatedly and pulling back to 2756.

If gold fails to break 2763 on the H4 candle, we can anticipate a bearish market movement in the next few hours.

All targets are clearly explained in the chart above for your easy understanding.

Please like, comment, follow, and support! Thank you for your love and encouragement! 🙏

"FTM eyes a rebound with Sonic conversion and airdrop catalysts! Fantom (FTM) shows a recent downtrend, but the upcoming Sonic (S) conversion and the associated incentives like the free swaps and airdrop could catalyze significant price action. Here’s a detailed analysis:

Current Technical Overview:

1. Price Action:

- The price is currently trading at $0.74250, down significantly from its recent highs, but it appears to be nearing a support level.

- Historically, these levels may attract buyers looking for value or anticipating upcoming events.

2. Moving Averages:

- The yellow line represents the 50-day moving average (MA), while the red line is the 200-day MA.

- The price is below both MAs, suggesting bearish momentum in the short term. However, a catalyst like the Sonic conversion could reverse this trend if it sparks significant buying activity.

3. RSI (Relative Strength Index):

- The RSI is near 38.93, which is close to the oversold region (below 30).

- This indicates potential for a rebound, especially with the upcoming news providing a fundamental driver.

4. Volume:

- There is moderate volume, but it hasn't yet shown the surge that might accompany the January 19 event. If trading activity picks up in anticipation, this could signal increased interest.

Impact of Upcoming Events:

1. Sonic (S) Conversion:

- The free swaps for the first 90 days provide a strong incentive for current holders to stay invested and for new investors to join.

- This could reduce selling pressure on FTM while potentially driving demand.

2. Airdrop*:

- A points-based airdrop with 6% of the supply set aside can encourage accumulation of FTM to qualify, likely increasing buying pressure over the coming months.

3. Psychological and Market Sentiment:

- Such large-scale events often generate positive sentiment and FOMO (Fear of Missing Out), potentially pushing the price upwards as we approach the event.

Strategy and Outlook:

1.Short-Term:

- As the January 19 date approaches, there is a strong possibility of a price rebound if volume picks up and sentiment turns bullish.

- Traders may look for entries near the current support level with tight stop-losses in case of further downside.

2. Mid-Term:

- The incentives from the free swaps and airdrop could sustain higher interest in FTM through Q1 2025.

- Monitor for a breakout above the 50-day MA as a confirmation of trend reversal.

3. Risks:

- If the broader market remains bearish or if the events fail to meet expectations, the price could consolidate or continue its downtrend.

- Keep an eye on the volume and RSI for early signals of a move.

Key Levels to Watch:

- Support: $0.70 (current zone) and $0.60 (major support).

- Resistance: $0.95 (50-day MA) and $1.20 (recent high).

With the January 19 event on the horizon, this could be a pivotal moment for Fantom's price action. It's a good opportunity to prepare for potential volatility and capitalize on positive momentum.

XAUUSD 1 HR STRUCTURE CHANGEXAU/USD on the 1-hour chart has shifted its structure back into the established range, signaling a period of consolidation. With the Non-Farm Payroll (NFP) release on the horizon, there is a high probability of a liquidity hunt around the 2655 level. Traders should exercise caution and wait for clear confirmations before entering positions, as volatility is likely to spike during the NFP event. This could present opportunities for sharp moves, but patience and a well-defined strategy will be key to navigating these conditions effectively.

TCS Analysis - Multi-Year Deal with Air France-KLMTrend: TCS is in a strong uptrend within an ascending channel since 2021, signaling steady growth potential.

Technical Signals:

EMA Support : Price bounced above key EMAs (20/50/100/200), showing strong support.

Volume Surge : High buying volume after the Air France-KLM deal indicates increased investor confidence.

RSI : Above 50, supporting bullish momentum.

Levels to Watch:

Support : ₹3,995.45 – Reliable base.

Immediate Resistance : ₹4,411.25

Final Target : ₹4,587.95 – Top of the channel.

Trade Setup:

Entry: On pullbacks or above ₹4,217.30.

Stop Loss : Below ₹3,995.45.

Target : ₹4,411.25 - ₹4,587.95.