5 Lessons from My First 100 TradesAfter executing and reviewing over 100 real trades in crypto, forex, and gold — I found patterns. Bad patterns. Repeating mistakes. And lessons I wish someone had told me earlier.

So I broke them down into 5 key insights that changed how I trade — and might just save you thousands.

📘 Here’s what’s inside:

1️⃣ Smart Profit-Taking:

How I turned 10 R/R into 32 R/R using a dynamic exit plan.

📘Further resource:

Cycle Mastery (HWC/MWC/LWC)

---

Multi-Timeframe Mastery

2️⃣ The Sleep Edge:

70% of my losing trades happened after bad sleep. Here’s why that matters more than emotions.

3️⃣ No More Blind Stop Orders:

Why I stopped using buy/sell stops without real candle confirmation — and what I do instead.

📘 Further reading:

Breakout Trading Mastery

---

Indecision Candle Strategy

4️⃣ Multi-Layered Setups Win:

How structure, S/R, patterns, and timing stack into high-probability entries.

5️⃣ News Trading? Just Don’t.

The data behind why most of my SLs were hit near news time — and how I avoid the trap.

💡 These aren’t theories. These are real lessons from real trades.

If this video helped you or sparked an “aha” moment, give it a boost, commenting your takeaway, and sharing it with a fellow trader.

lets grow together :)

Newstrading

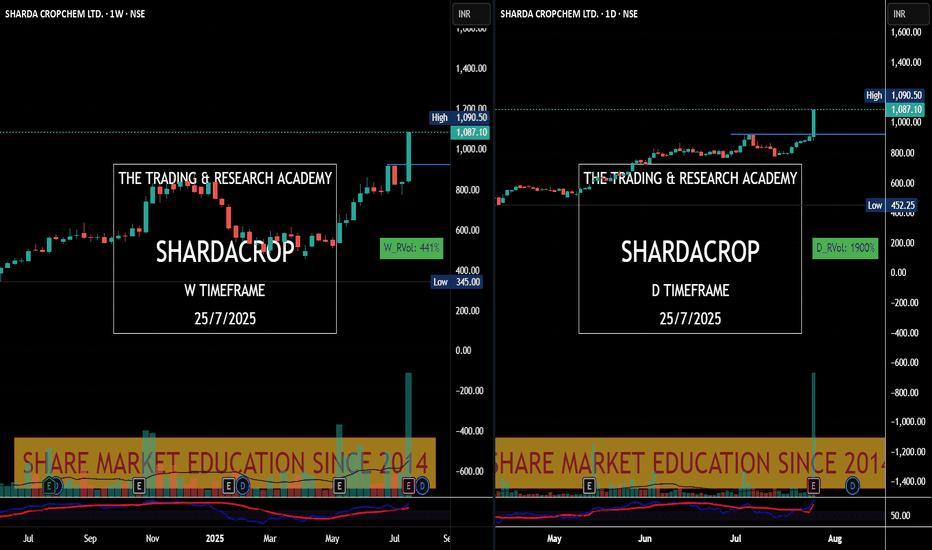

Charts Speak #Sharada Cropchem

Sharada Cropchem

Charts always lead the News! This is yet another example where price was leading & News came later.

Stock was under accumulation since June with higher qty. In fact since May 25, it was getting bought in average 2-3M qty weekly. What a planned buying..

28th May, 4 June, 18th July were nice buying alarms for us. Today it was just a final nail in the coffin.

$GOOGL Breakdown – AI Risk Is No Longer "Future Tense"🚨 BREAKING: NASDAQ:AAPL confirms they are exploring AI-powered search within Safari after a decline in browser searches for the first time ever.

💥 NASDAQ:GOOGL is down over 8% intraday, cracking long-term trendline support and decisively below the 200DMA ($173).

📉 The setup is ugly:

Insiders sold post-earnings (again).

Trendline + moving average both lost.

Volume spike and vertical price action = capitulation risk ahead.

🔻 Downside momentum could accelerate if price fails to reclaim $155 quickly.

Possible H&S Forming – It’s All About the News NowOANDA:XAUUSD

📉 Watching closely: Possible Head and Shoulders formation developing on the 4H and 1H charts

As of April 24, 2025, Gold (XAU/USD) is forming a potential Head and Shoulders pattern on the shorter timeframes (4H and 1H), which could indicate a reversal setup. While multiple scenarios are still in play, the price action around the $3368 level will be crucial.

If price fails to break above this resistance in the near term, it could suggest weak bullish momentum and open the door for a pullback toward and possibly below the neckline around $3250 .

🔔 Key Economic Events – April 24

08:30 EDT – Durable Goods Orders MoM

Forecast: +2.0%

Personal outlook: Numbers might come in weaker than forecasted.

Durable goods orders are a solid gauge of industrial demand. Weaker-than-expected numbers would likely weaken the USD and could offer some upside pressure on Gold.

10:00 EDT – Existing Home Sales

Forecast: Lower than previous.

As a key barometer of consumer confidence and economic stability, lower-than-expected figures could also put pressure on the USD, potentially providing Gold a short-term bullish impulse.

📊 Potential Scenarios

Scenario 1 – Bullish Breakout

Weak economic data → USD weakens → Gold spikes above $3400

If both data points disappoint, we could see a rally in Gold, possibly breaking the resistance and invalidating the H&S pattern.

Scenario 2 – Bearish Breakdown (Preferred H&S Scenario)

Strong data → USD strengthens → Gold falls below $3200

While less likely, if economic data comes in stronger than forecasted, Gold could see a significant drop, forming the right shoulder and breaking the neckline – confirming the Head & Shoulders reversal.

Scenario 3 – Sideways Movement

Neutral data + Tariff talks in focus

In the absence of impactful data or if figures come in as expected, Gold might consolidate sideways. Ongoing developments around US-China tariff negotiations could dominate sentiment, delaying or nullifying the H&S pattern entirely.

📉 Market Sentiment Snapshot

US stocks are rallying on optimism around tariff reductions

Trump administration signaling potential easing of China tariffs

➡️ Gold under pressure as risk-on sentiment rises

📍 Conclusion

Keep an eye on the $3368 level and $3250 neckline. Short-term moves will likely be dictated by today’s economic releases and the evolving trade narrative. A confirmed break below the neckline would validate the bearish H&S scenario with potential downside toward $3200 and below.

👉 Stay nimble and trade the reaction, not just the forecast.

-------------------------------------------------------------------------

This is just my personal market idea and not financial advice! 📢 Trading gold and other financial instruments carries risks – only invest what you can afford to lose. Always do your own analysis, use solid risk management, and trade responsibly.

Good luck and safe trading! 🚀📊

XAUUSD NFPGold price remains depressed above $2,900, US NFP awaited

Gold price edges lower on Friday amid some repositioning ahead of the crucial US NFP release. Rising trade tensions, the risk-off mood, and a weaker USD lend support to the precious metal. Bets for more interest rate cuts by the Fed contribute to limiting losses for the XAU/USD pair.

Signals update shortly

EURUSD - Analysis and Potential Setups (Intraday- 12.02.25)Overall Trend & Context:

The pair is in an overall downtrend on the higher time frames and we are now waiting for the lower time frames to shift in accordance with the narrative.

Technical Findings:

Price is at a daily level of supply (as well as refined zones down to the 15m & 5m)

LTF oversold conditions.

We could still see further upward movement so will wait for either a break at 1.03650 or for our OANDA:GBPUSD trade to run into profits (or both).

Potential Scenarios:

For now I will only be considering shorts.

Risk accordingly and be safe for CPI today.

US500 Trade insight Price breaks above December high 6102.21 so I believe we are currently on a retracement to 5901.87 for continuing to the upside.

If the ISM manufacturing PMI news happening at 10:00 UTC-5 NY push proce to my POI then I'll stick to my buy bias but if it pushes price to the upside without getting to my point of interest then I might look for a short sell from 6024.40 down to my Poi for buy.

If you find this insightful, 🫴 kindly boost and share

GBP/USD - H1 Chart - Triangle Breakout (31.01.2025)The GBP/USD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Triangle Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 1.2342

2nd Support – 1.2295

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Airtel Vs (TTML, MTNL, IDEA) - Pre-Rally Vs Post-RallyHere’s an assertive revision of your content:

---

**Why Airtel Dragged While TTML, MTNL, and IDEA Blasted?**

The government’s consideration of waiving 50% interest and 100% penalties on AGR dues created a buzz, and certain "gurus" began hyping a potential rally in **Bharti Airtel**, a fundamentally strong telecom stock compared to **TTML**, **MTNL**, and **Vodafone Idea**.

**But the market did the exact opposite.**

TTML (+16.5%), MTNL (+10.5%), and IDEA (+9.11%) soared, while Airtel struggled below 1%. The question is **why?**

**The Answer: The Importance of Technical Structures, Supports, and Resistances.**

Market participants often assume that fundamentals drive prices. This is the **biggest myth.** Fundamentals (valuations, PE ratios, book value, order books, quarterly results) can create momentum but never dictate its **direction.** Supports and resistances are the **primary drivers** of price movement. Relying solely on fundamentals is like pressing the accelerator while trying to reverse park—damages are inevitable.

Now, let’s review the technical factors behind the explosive moves in TTML, MTNL, and IDEA compared to Airtel’s stagnation.

---

### **TTML**

On the **monthly chart**, TTML formed a **bullish flag pattern**, breaking out in **July 2024**. However, the lack of momentum in the telecom sector kept it range-bound until now.

**Key Points:**

1. A **77% correction** from its all-time high (ATH) formed the flag.

2. Sideways consolidation since March 2024 created a **strong base**.

3. This base aligned with the **Fib 0.618 retracement** from the previous high.

TTML was primed for a move. The AGR news provided the necessary trigger, leading to the much-anticipated breakout.

---

### **MTNL**

The **monthly chart** of MTNL shows a **multi-decade bullish inverted head and shoulders pattern**. After breaking out, the stock faced resistance at ₹103 and retraced **58.5%**, aligning perfectly with the breakout zone and the **Fib 0.618 retracement level.**

**Why the Rally?**

MTNL’s bounce was overdue, and the AGR news acted as a catalyst, triggering the massive move.

---

### **IDEA**

Vodafone Idea, the weakest of the group, also surged 10% (hitting an intraday high of 15% before closing at 9.11%). Despite its struggles, IDEA displayed critical technical alignments:

1. A **65.54% correction** from its previous high.

2. Support at the **Fib 0.786 retracement** level.

3. A bounce from the **bottom of a rising parallel channel**.

Though IDEA lacked the fundamental strength of TTML and MTNL, it still rallied due to the technical setup.

---

### **Bharti Airtel: Why Didn’t It Rally?**

**Quarterly Chart** (Right):

1. Airtel has been traveling within a **multi-decade parallel channel**.

2. After consolidating for 13 years, it broke out in **October 2018**, delivering **613% returns** since then.

3. The stock reached an **extended Fibonacci target (Fib 2.618)**—an exhaustion zone.

**Weekly Chart** (Left):

1. Airtel corrected only **15%** from its ATH.

2. It is still in a **lower high-lower low (LH-LL)** bearish formation.

3. The price was at a critical juncture of **two resistances**:

- The **falling trendline** from ATH.

- A **weekly resistance** at ₹1640.

**Verdict:**

Airtel had already rallied significantly before the news and was in an exhaustion phase. Strong resistances at current levels obstructed its movement.

---

### **Key Takeaways:**

- TTML, MTNL, and IDEA rallied because they **completed major corrections, formed strong bases, and awaited a trigger.**

- Airtel, having already rallied, was in a consolidation phase with significant resistance levels.

**Conclusion:**

Blindly trading based on news or fundamentals without considering technicals is a recipe for disaster. Fundamentals may create momentum, but the **direction** is always governed by supports and resistances.

A sector-wide news event will not trigger the same momentum across all stocks unless their **technical structures** align. Always combine fundamentals with technical analysis for informed decision-making.

**Disclaimer:**

With over **3 years of teaching experience** in the stock market, including **Technical Analysis**, **Behavioral Analysis**, **Advanced Patterns**, **Emotional Management**, and **News-based Trading**, we are dedicated to educating, not advising on buy/sell decisions.

We are **NOT SEBI Registered** and do not provide specific **Buy/Sell recommendations or calls**. Our primary goal is to deliver **detailed analysis** on how to review charts and offer multi-timeframe perspectives purely for **educational purposes**.

We strongly recommend that our followers **"Learn to Ride the Tide, Regardless of Its Side."**

**Important:** Always consult with a **financial advisor** before making any investment decisions.

If you appreciate our detailed analysis, we encourage you to **rate, like, boost, and share your feedback**.

**- Team Stocks-n-Trends**

US30 Bullish Play for the WeekUS30 hit my zones perfectly and I am excited for this week to be a continuation. I will be looking for another entry to this swing trade on the dips to 42.600-42.700 anything below 42.550 has potential to retest 42.250 which would suck ! Lol so let’s hope the whales are full and ready to leave this area.. next stop 43.500

Scenario: if scenario plays out the week will start bullish with a potential drop back into the KILL ZONE on Wednesday w the red folder news that day but afterwards buyers will clean all that liquidity back up and NFP Friday will propel it to the 1st major target 43.500 w the week closing very Bullish.

Will monitor the play through out the week and update accordingly but if it does close as predicted the following week will most likely be a continuation to the next Major Zone at 44.450 & beyond.

May the pips be in our Favor !

GSAT Update and Plan OverviewI've been long for awhile with my entire position in stock and options paid for with profit from calls and puts worked. I'll will be adding stock and options on dips in a ratio that will match post spilt as to not end up holding non-standard options. The ratio has not been announced yet and I will be actively adjusting positions as needed. I intend to accumulate over the coming years. Good luck if you play. No where but up long term.

I don't have a specific target, but I'm focused on GSAT's FCC spectrum, the Qualcomm partnership, and their terrestrial network. They're developing a new cell modem to utilize Band 53 (n53) in standard handsets, coupled with their Apple deal. The more devices sold, the greater the benefit for GSAT, particularly as climate emergency applications gain attention. This creates a self-sustaining cycle of demand for devices and satellite connectivity.

Investor Day on December 12 could act as a catalyst, especially given recent positive developments like expanded licensing, the Qualcomm partnership, and progress with Apple. Price action may see accumulation leading up to the event as investors position for updates. Post-event, the trajectory will likely depend on the depth of announcements and forward guidance. Given the past month's price consolidation, a breakout above key resistance levels is possible if news aligns with expectations

XAUUSD 100% CPI signal Alert!The latest CPI update is in, and with Trump elected as the new President of the U.S., we’re seeing a strong bullish reaction from the DXY while gold is in a steep decline.

We have two scenarios to consider:

Scenario 1: If the government pauses interest rates until the new administration is in place, we may initially see a bullish spike in gold, followed by a decline.

Scenario 2: If the government cuts interest rates by 0.5%, we could see gold drop by approximately 200 to 300 pips.

Weekend Russia-Ukraine Update for Natural Gas Traders in FX MarkHey everyone,

I wanted to share some important updates with you regarding recent developments that could significantly impact our natural gas trades. In the past few days, Ukraine's attack on the Sudzha gas transfer station in Russia's Kursk region has raised some serious concerns. As you know, the Sudzha station is a critical point for gas flow from Russia to Europe, and any disruption here could directly affect our natural gas trading. It's something we all need to keep a close eye on.

To give you some context, Gazprom supplied approximately 14.9 billion cubic meters (bcm) of gas through Sudzha in 2023. This volume accounts for about 4.5% of the EU's annual consumption and nearly half of all Russian gas exports to Europe. Since the beginning of the year, the daily gas flow through this station has remained above 40 million cubic meters. These numbers highlight just how vital Sudzha is for European gas supply.

The main function of the Sudzha gas metering station is to record gas consumption and measure the quality indicators of the gas. The gas flow is measured using two primary methods: variable pressure drop and the more precise ultrasonic method, which measures the propagation speed of ultrasonic waves in the gas flow. The station is equipped with converters, pressure and temperature sensors, shut-off valves, and other equipment essential for accurate gas flow measurement.

In addition, the station features an automated control system that collects, processes, and transmits data on gas parameters. This system is responsible for overseeing the operation process and maintaining accurate records. If there’s an issue at the station, not only would the gas flow be disrupted, but tracking the quality and quantity of the gas would also become much more difficult.

Given these details, it’s crucial for us to closely monitor what's happening in the gas markets and adjust our strategies accordingly. As uncertainty increases, so do the potential risks and opportunities, so I strongly advise you to carefully set your stops in your trades.

Wishing you all a profitable week ahead!

CAPITALCOM:NATURALGAS FOREXCOM:NATURALGAS

75: Record Gold Prices What’s Driving the Surge and What’s Next?The price of gold has recently surged to a new all-time high, driven by the anticipation of interest rate cuts by the U.S. Federal Reserve. Gold traders are predicting that the Federal Reserve will implement two rate cuts this year, which is boosting the appeal of gold as a safe-haven asset. Historically, when interest rates are low, gold prices rise due to the decreased opportunity cost of holding non-yielding assets. Additionally, ongoing geopolitical uncertainties and economic instability are further supporting the demand for gold.

Central banks around the world, including China, have been significantly increasing their gold reserves, contributing to the rising prices. This accumulation of gold by central banks indicates confidence in gold's enduring value, which in turn encourages other investors to follow suit. As the Federal Reserve aims to stimulate the economy through lower interest rates, the weakening U.S. dollar makes gold more attractive to foreign investors, further pushing its price upwards.

New high reached $2482.35 - what are the expectations?

Bullish Scenario:

At the moment, a new high has been reached with substantial buying pressure. The buying pressure is evident with the almost straight line up. Given this scenario, the risk of shorting is high. However, when new highs are reached, it's prudent to hedge long positions. You might consider shorting on a lower time frame, targeting $2420.61.

The support level around $2420.61 is clearly identifiable. We could see a retest of this level, presenting an opportunity to initiate new long positions. There is also a possibility that prices will continue to rise. If buying pressure continues, we could see new highs beyond $2482.35, pushing the gold price even further.

Bearish Scenario:

If we lose the support level at $2420.61, it becomes apparent that we should look for short positions and new local lows. In this case, the decline could indicate a reversal in the current bullish trend. The break below this support could lead to a further drop in prices, potentially targeting lower support levels. Traders should watch for signs of weakening momentum and be prepared to shift strategies if the market sentiment turns bearish.

Bitcoin (BTC) Analysis: Navigating Key Levels Amid Market News🔍Bitcoin (BTC) is responding to significant market events. Here's a detailed analysis to guide your trading decisions.

📆Coin of the Day: Bitcoin (BTC)

About the Project:

Bitcoin is the first and most widely recognized cryptocurrency, often referred to as digital gold. It operates on a decentralized network without a central authority, using blockchain technology to facilitate secure and transparent transactions.

🧩Technical Analysis

4-Hour Timeframe

This analysis focuses on shorter-term trends, identifying critical levels and potential scenarios.

📉Support and Resistance:

Key Supports:

66,208.06

64,616.89

62,450.00

Key Resistances:

70,108.93

73,305.41 (Major Supply Zone)

📈Bullish Scenario:

Supply Zone Test: BTC is currently within a significant supply zone (70,108.93 to 73,305.41). A break above this zone could indicate strong bullish momentum.

Targets: Key resistance levels to watch are 70,108.93 and 73,305.41. Breaking above 73,305.41 could signal a continuation of the uptrend.

📉Bearish Scenario:

Break Below Key Support: If BTC fails to hold above 66,208.06, it could signal a bearish reversal.

Targets: The next support levels are at 64,616.89 and 62,450.00.

📊Volume and RSI:

Volume Analysis: Recent volume spikes suggest increasing interest, which is critical for sustaining upward momentum.

RSI Analysis:

Current RSI: 41.09, indicating neutral momentum. Key RSI levels to watch are 55.29 for resistance and 41.09 for support.

💡Key Triggers:

For Long Positions:

Entry Trigger: Break and hold above 70,108.93.

Strategy: Open a position on the hold of this level, targeting 73,305.41. Use tight stop-loss orders to manage risk.

For Short Positions:

Entry Trigger: Break and retest below 66,208.06.

Strategy: Open a position if the price confirms a break below this level, targeting 64,616.89 and 62,450.00. Adjust stop-loss orders accordingly.

📉Market News Impact

Upcoming News: The U.S. interest rate and inflation data are expected today. These macroeconomic factors can have a significant impact on Bitcoin's price.

Interest Rate Decision: A higher interest rate might lead to a stronger USD and potential bearish pressure on BTC.

Inflation Data: Higher inflation rates could increase demand for Bitcoin as a hedge, potentially driving the price up.

👨💻Trading Positions

Long Position

Entry Trigger: Hold above 70,108.93 with confirmation from RSI and volume.

Strategy: Open a position on the hold of this level, targeting 73,305.41. Use tight stop-loss orders to manage risk.

Short Position

Entry Trigger: Break and retest below 66,208.06.

Strategy: Open a position if the price confirms a break below this level, targeting 64,616.89 and 62,450.00. Adjust stop-loss orders accordingly.

📝Bitcoin is currently navigating key levels amidst significant macroeconomic news. Traders should closely monitor these levels and the impact of the U.S. interest rate and inflation data. Volume and RSI trends will provide additional insights into momentum shifts.

🧠💼Always remember the inherent risks in futures trading, with the potential for margin calls if risk management is neglected. Stick to strict capital management principles and use stop-loss orders, ensuring an initial target with a risk-to-reward ratio of 2.

🫶If you found this analysis helpful and want to support me, please boost this analysis. Feel free to leave a comment or suggest a coin you'd like me to analyze next.