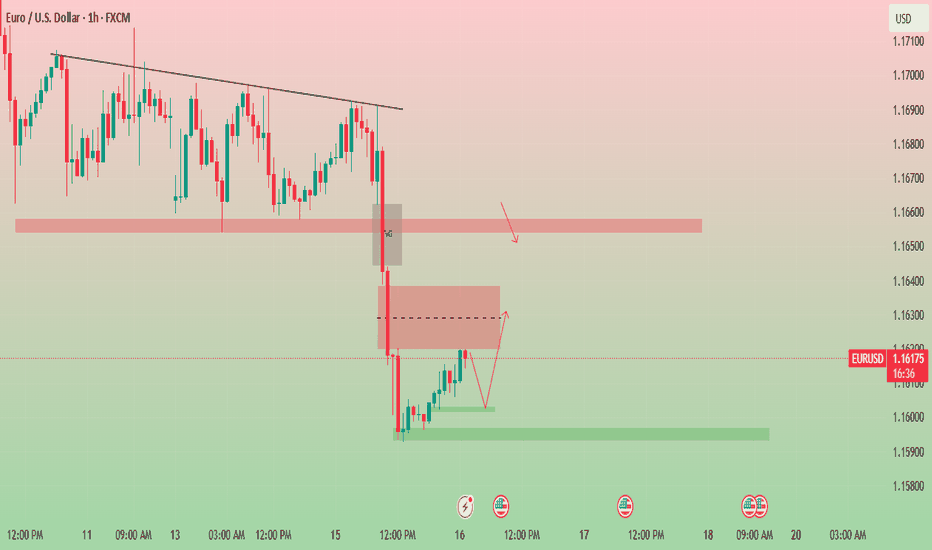

Eyes on 1.16300: EUR/USD Prepares for the Next Move.📉 EUR/USD Technical 📈

The pair has broken a strong support level and is now finding footing around 1.15970, forming a fresh bullish Fair Value Gap (FVG) at this zone.

At the moment, EUR/USD is moving within a bearish FVG. Here's what to watch next:

🔻 If the market dips from here, we could see a reversal from the lower edge of this FVG.

🔼 But if it holds and pushes higher, breaking above 1.16300 — the CE (Continuity Equation) level of the bearish FVG — that could unlock further bullish momentum.

🚨 Key Levels to Watch:

Support: 1.15970

Resistance/Breakout Zone: 1.16300

📊 Stay alert — price action at these levels could define the next move.

👉 DYOR – Do Your Own Research

📌 Not financial advice.

Newstrategy

A NEW US30 Quarter Point SCALP METHOD Still trying to figure out a new strategy and this one i can say has been going pretty well this week...

What im doing is trading only around the quarter points. 000 250 500 750

Im looking for the SToch RSI to be undersold or over bought..

So on a SELL im looking for the Stoch to be over bought, then i wait for a bullish candle to reach my Quarter Point then enter..

I set my SL & TP 110 pips (So this is a 1:1 ratio trading style)

Follow and ill keep you posted on my new strategy...

If any Question feel free to message me...

LETS MAKE 2022 a great year guys and gals

EURJPY4 individual strategies combined into one, simple to use. when a buy is valid the candle will turn GREEN with a {BUY} label. when a sell is valid the candle will turn RED with a {SELL} label. this works on ALL timeframes and pairs!

pips banked on buys and sells, also Current EURJPY BUY in profit

work study experiment - fib circle projection for bitcoinThese fibs were placed way ahead of price action using a method i'm calling fib projection. This is being posted so i can see how this chart plays out over time. I will be making a video down the road on how and why i created this chart and why i think this could be a potential a game changer for calling tops and bottoms way in advance.

Daily AMGN forecast timing analysis by Supply-Demand strength21-Jun

Investing strategies by pretiming

Investing position about Supply-Demand(S&D) strength: In Rising section of high profit & low risk

Supply-Demand(S&D) strength Trend Analysis: In the midst of an upward trend of strong upward momentum price flow marked by the temporary falls and strong rises.

Today's S&D strength Flow: Supply-Demand strength has changed from a weak buying flow to a strengthening buying flow again.

View a Forecast Candlestick Shape Analysis of 10 days in the future: www.pretiming.com

(You can easily create a trading plan.)

D+1 Candlestick Color forecast: GREEN Candlestick

%D+1 Range forecast: 0.8% (HIGH) ~ 0.1% (LOW), 0.4% (CLOSE)

%AVG in case of rising: 1.2% (HIGH) ~ -0.6% (LOW), 0.8% (CLOSE)

%AVG in case of falling: 0.5% (HIGH) ~ -1.4% (LOW), -0.8% (CLOSE)

Price Forecast Timing Criteria: Price forecast timing is analyzed based on pretiming algorithm of Supply-Demand(S&D) strength.

GBPJPY NEWS Short + 100 PIp PotentialAlthough, I am not a big fan of taking trades late in the US Session, This news trade is a good one. That said, please use appropriate risk management as the spreads tend to expand considerably late in the US Session into the Sydney Session.

We had a good push down on the GBP pairs on UK Brexit news and this pair has now gone into a consolidation between 137.73 (High) and 137.564 (Low). Moreover, it is now below the Daily 60 and 15 clouds, as well as the Daily KS, 60 KS and 15 KS

Entry = 137.72

Stop = 138.02

Risk = 30 pips

Profit target = 136.62

Reward = 100 Pips

RRR = 3-1

Once this trade is up + 25 pips, move your stop to breakeven and let it run.

News Set Up for GBP pairs 2/11/19 4:30amThis setup looks great for a new setup trade strategy. The GBPEUR pair moved between a range of 36-188 pips on previous days we've had the following factors:

Gross Domestic Product (GDP)

Manufacturing Production m/m

On this date, however, we'll also have two other releases to add to the volatility of this pair:

Prelim GDP q/q

Prelim Business Investment q/q

News Set Up for GBPEUR pair 2/11/19 4:30amThis setup looks great for a new setup trade strategy. The GBPEUR pair moved between a range of 36-188 pips on previous days we've had the following factors:

Gross Domestic Product (GDP)

Manufacturing Production m/m

On this date, however, we'll also have two other releases to add to the volatility of this pair:

Prelim GDP q/q

Prelim Business Investment q/q

OIL: THE CHANCE OF the WEEK? High potential trade!#ChanceHey tradomaniacs,

welcome to another free signal!

This is a plan for the upcoming Cruide Oil Inventories!

We`ve finally seen a waiting market which is currently consolidating after this huge Sell-Off!

It seems like the market is just waiting for positive news which are very likely since the OPEX has found an agreement to reduce the output of oil. (Less supply, higher price)

The U.S. API Weekly Cruide Oil Stock has shown an amazing result of -10.180m instead of the previous 5.360M!

That`s a good difference.

I expect the same good results for the Cruide Oil Inventories since the forecast is way higher than the previous result for today!

Important: OIL is very volatile! Don`t use tight stop-loss-levels to reduce the risk of SL-fishing!

OIL is very very volatile! Beginners should not trade this!

Daytrader: Do not re-enter after a loser! You would just burn your money!

----------------------------------------------------------

Type: Day - Swingtrade

Buy-Stop: 53,80

Stop-Loss: 50,83

Target 1 INTRADAY: 57,97

Target 2 SWING: 60,00

Target 3: 62,66

Risk-Reward: 2,98

------------------------------------------------

----------

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

News background and trading ideas for 11/10/2018Let's start the review with an analysis of the Tuesday events. We noted that the release of UK data would almost certainly provoke a rise in pound pairs volatility and recommended buying a pound even in case of weak data, noting that in that point, you need to wait for sales to subside. The data is not the best (GDP is worse than forecasts, as the producing in the manufacturing industry. Concerning the trade balance, it came out with a significant deficit, but really in predictions). In the end, everything happened, as we predicted. The pound threw two black hourly candles, and after that followed the steady currency appreciations.

This growth is adequately explained by our basic idea, which we have been running for more than a month already (an incorrect assessment of the outcome of the Brexit negotiations by markets). We received another confirmation not only in the form of the actual dynamics of the pound but also in the information field. European Commission President Jacques-Claude Juncker expressed confidence that the parties will be able to agree.

On this occasion, we can not miss the executive director of London-based hedge fund Eurizon SLJ Capital quote: “The chances for a tough Brexit, exit without a deal are meager, and the deal will happen in the coming weeks, which is likely to provoke a pound rally.” Sterling is very undervalued and oversold. It is still reasonable to treat 1.55 as a truly fair value. ” So, we continue to recommend looking for points for purchases pound.

Among other events, it should be noted Trump’s further attacks on the Fed, who criticized the Central Bank for the too rapid rate hikes and said that he is a supporter of low interest rates. The dollar suffered losses as a result and was forced to defend itself. In this regard, today's data on consumer inflation in the US look extremely important. Very likely they will determine the dynamics of the dollar until the end of the week. Recall that inflation growth is a signal for dollar purchases. If the data come out below forecasts, it may well be followed sales of the US currency.

However, the dollar has a few new problems. In particular, yesterday's sales in the US stock market. Let’s remind that the bubble is pretty severe there and if it decides to break the consequences will be very serious.

Hurricane Michael continues to gain momentum. However, even a 40% reduction in oil production in the Gulf of Mexico could not support the oil quotes, which continued to crumble. Pressure on oil increased data on oil reserves in the US from the API, which showed their growth by almost 10 million barrels. Recall, we recommend its medium and long-term sales.

We advised selling the Russian ruble either. The latest news in favor of this is the record exodus of foreign investors from the Russian stock market since March 2017. As well as a sharp increase in total capital outflow from the country (according to the Central Bank of the Russian Federation, the outflow of capital from the Russian Federation reached $ 31.9 billion in the first three quarters of this year against $ 13.7 billion for the same period of 2017). So we are looking for points for sales of the ruble.

News background and trading ideas for 10/10/2018Tuesday was expected to be rather weak on essential statistics and other fundamental events. Nevertheless, the dynamics in the dollar was quite volatile: it strengthened, then lost its positions, which provided opportunities for active trading.

Today regarding statistics promises to be much more interesting. This refers to a significant block of statistical data for a pound. On it and the features of the trade with the pound today we will dwell. We are waiting for data on UK GDP for August, the trade balance, as well as industrial production. If the data comes out better than expected (and this is very likely, because the forecasts look undervalued), then the pound will most likely receive an upward momentum. If the statistics come out weak, then this will also be an excellent opportunity for purchases, but you will need to wait until the first negative reaction takes place and try to buy it in the area of a minimum.

The point is that this statistics will be forgotten in a day, but the primary driver of the global pound movement - Brexit is still in the game. On our trading idea concerning working with the pound, we have already written earlier. So today we are looking for points for pound purchases both before and after the publication of data. Moreover, yesterday there was news that a group of 30-40 Labour’s is ready to go against the party leader’s will and support the plan of Theresa May.

Of particular interest are also data on producer inflation in the United States, but the consumer inflation will be in focus, and this one will be published on Thursday.

From other news, we note that oil prices were supported by information about the hurricane "Michael," which threatens oil production in the Gulf of Mexico. Particularly the US Bureau of Environmental Safety reported a suspension of work on 19% of platforms in the bay due to a hurricane. In this regard, we note that a hurricane is a temporary phenomenon and its impact on oil quotes is short-term. So we recommend using this upward momentum for more expensive oil sales. And one more news in support of this idea - the IMF has updated oil forecasts for the next and 2023 years.

According to their forecasts, the world oil supply will gradually increase, which will lead to a decrease in black gold quotations from $68.78 in 2019 to $60 in 2023. Recall one more time that the idea to sell oil is long-term. That is relevant not for a day or a week, but for months and even years.

In emerging markets, there is trouble near (the IMF stirred the pot, which lowered forecasts for the world economic growth, linking this with a sharp slowdown in the economic growth of emerging markets), and this is a good reason for selling the Russian ruble (one of our favorite trading ideas).

Among other current trading ideas: sales of USDCAD pair , buying a pair USDJPY, working on clock oscillators in gold with no clear preferences.

CHFJPY shortAs of now, 01:30 20/09/2018, I have almost completed a new trading plan and this is the first set up I have come across to fit it so far.

What we are looking at is price at a very key level, also respected for months on the WEEKLY chart. It has been ranging for quite some time and has just tested and retraced slightly the 200 MA on the daily chart. These all being confirmation for me that the market here is showing weakness- BEAR power.

coming out side of the bottom of the range we have a trend line that has been respected on its way up through the consolidation zone, making higher lows to make a valid, small trend. At a first look this was my fist idea, a sell all the way to the line, but, a move like this is quite unlikely and quite risky. I have decided to put the stop loss at the next minor resistance on the 4 HOUR chart so it is a tight SL, I can't see this price level having much air to breathe at this point though.

My general trade idea is for the price to carry on this bearish rejection down to the trend line i mentioned, but my TP is at the next majorsupport alost half way. This is so i can exit with profits and re evaluate price action and look for anoter, safer entry.

LITECOIN the dead coin or GREEN SOON? CHECK IT OUT!Litecoin (LTC-USD) comes from a huge drop, we can see from charts that the 16th February peak was followed then by a catastrophic 7 months short, a descending triangle and a lack of volume makes it one of the worse runner..but it is maybe the time for a change?

The end of the game for the LTC may come sooner then expected, a recovery to the 82$ zone is possible, due to the latest Crypto market re-bounce, the descending triangle could be over and a nice pull out of the 50$ area due to momentum is the next opportunity for the bulls, the coin itself hasn't shown signs of improvement in the last months, it has some advantages over other cryptovalues and is traded on over 400 markets , making it a very popular coin..but for how long? is lifespam could be over and investor could decide to go for new projects instead..

would be very risky to open any long positions until proper confirmations of a trend change , that will occur if the support at 62 $ will sustain after the 80$ tap followed by a recovery price. RSI and other indicators shows already an oversold situation in middle of august, that makes the recovery from that areas possible but doesn't confirm the uptrend yet.

If the volume doesn't rise and the oscillators (rsi) confirm the overbought around the 80$ area in the next weeks there will be room for the bears, a dramatic continuations drop to the 30$ would be the consequences.

We will see in the next days if those days are back or is it really time to call it LITECOIN dead.

Hope this will inspire some new ideas, don't forget to hit the like/follow button if you feel like this post was helpful, that's the best way to support us and our work.

Happy trading days

C-Monkeys