Netflix Options Flash Green – $1170 Target in Sight?

## 🚨 NFLX Options Alert: Quiet Volume, Loud Calls 🚨

**Earnings Loom, Institutions Lean Bullish** 💥

🔹 **Models Align:** 4 out of 5 models flash *Moderate Bullish*

🔹 **RSI**: Daily (35.6) cooling off, Weekly (56.1) still rising

🔹 **Call/Put Ratio**: 1.47 → Bullish positioning building

🔹 **VIX**: At 17.9, IV environment favors options buyers

🔹 **Volume Weakness**: Institution hesitation = key risk

### 📈 TRADE IDEA:

🎯 **NFLX \$1170 Call**

💵 Entry: \$11.80 | 🎯 Target: \$17.70 | 🛑 Stop: \$4.70

📆 Expiry: 2025-08-08 | ⚖️ Confidence: 65%

💡 *Enter at market open. Position size small. Event risk high.*

> “Volume is low, but flow is glowing.”

> Could this be *the* earnings week breakout?

---

### 🏷 Hashtags for Viral Reach:

`#NFLX #OptionsFlow #EarningsTrade #TechStocks #UnusualOptionsActivity #Netflix #TradingSignals #CallOptions #WeeklySetup #TradingViewIdeas`

Nflxlong

NFLX Wait For Break Out Fibo Level

## 📈 \ NASDAQ:NFLX WEEKLY TRADE IDEA (AUG 5–9)

**🔥 BULLISH FLOW | CALL/PUT RATIO: 1.84 | CONFIDENCE: 65%**

---

### 🧠 AI-DRIVEN SENTIMENT

* **Weekly RSI**: 54.9 ✅ (Bullish Momentum)

* **Daily RSI**: 38.4 ↗️ (Climbing but still weak)

* **Volume**: 📉 0.7x last week = Low institutional follow-through

* **Options Flow**: Massive call buying = Institutions lean bullish

* **Volatility**: VIX at 18.2 = Option-friendly zone

---

### 🛠️ TRADE SETUP

| 🔹 | Trade Type | Long Call |

| -- | --------------- | ------------------- |

| 🎯 | **Strike** | **\$1200** |

| 📅 | **Expiry** | **Aug 8 (Fri)** |

| 💵 | **Entry** | **\$4.05** |

| 📈 | **Target** | **\$6.00 – \$8.00** |

| 🛑 | **Stop** | **\$2.50** |

| 🔐 | **Size** | 1 contract |

| ⚖️ | **Risk/Reward** | \~1:2 |

---

### ⚠️ RISK CHECK

* 🔸 Daily RSI still < 45 — needs breakout for full confirmation

* 🔸 Volume not convincing — watch for fakeouts

* 🔸 Short expiry = 🔥 gamma risk

---

### 🧩 STRATEGY INSIGHT

> "Call buyers are in. RSI is rising. But volume is soft. You’re early — not late."

🎯 Enter @ Open

🚀 Target quick momentum pop

👀 Exit if RSI fails to break or macro hits

---

💬 **Plan to enter?** Comment “IN”

🔁 Repost if you're tracking NFLX

📊 Follow for more AI-synced trades

NFLX WEEKLY OPTIONS TRADE (07/28/2025)**🎬 NFLX WEEKLY OPTIONS TRADE (07/28/2025) 🎬**

**Institutions Are Buying Calls – Should You?**

---

📈 **Momentum Breakdown:**

* **Daily RSI:** Mixed ➡️ Possible short-term weakness

* **Weekly RSI:** Bullish bias intact ✅

🔥 Overall = **Moderate Bullish** trend confirmed on the **weekly timeframe**

📊 **Options Flow:**

* **Call/Put Ratio:** **2.23** 🚨

💼 Strong institutional call flow = **bullish bias** from big money

* **Strike Ideas from Models:**

* \$1260 (Grok/xAI)

* \$1230 (Gemini/Google)

* \$1220 (Meta)

* ✅ **\$1200** (Consensus Strike)

🧨 **Volume Warning:**

* 📉 Institutional participation is **lower than average**

* 🚫 Could signal weak follow-through or fading interest

---

🧠 **AI Model Consensus (Grok / Gemini / Claude / Meta / DeepSeek):**

✅ Call buying favored across the board

✅ Weekly bullish momentum confirmed

⚠️ Daily RSI & low volume = headwinds

📌 Play it smart: momentum’s real, but conviction isn’t maxed

---

💥 **RECOMMENDED TRADE (65% Confidence):**

🎯 **Play:** Buy CALL Option

* **Strike:** \$1200

* **Expiry:** 2025-08-01

* **Entry:** \~\$8.50

* **Profit Target:** \$16.00 → \$17.00

* **Stop Loss:** \$5.10

📆 Entry Timing: Monday market open

📏 Position Size: Risk-managed (2-4% portfolio)

---

⚠️ **RISK CHECKLIST:**

* 🟡 **Volume Fragility:** Institutions not fully loading

* 🟥 **Gamma Risk:** Expiry this week = possible sharp swings

* 🔴 **Daily RSI Divergence:** Short-term weakness still possible

---

📌 **TRADE DETAILS (JSON Format for Automation):**

```json

{

"instrument": "NFLX",

"direction": "call",

"strike": 1200.0,

"expiry": "2025-08-01",

"confidence": 0.65,

"profit_target": 16.00,

"stop_loss": 5.10,

"size": 1,

"entry_price": 8.50,

"entry_timing": "open",

"signal_publish_time": "2025-08-01 09:30:00 UTC-04:00"

}

```

---

**TL;DR:**

🟢 Weekly bullish setup with strong options flow

🟡 Daily weakness = proceed with discipline

🎯 \ NASDAQ:NFLX \$1200C for short-term momentum upside

💬 Are you following the institutions or fading the low volume?

\#NFLX #OptionsFlow #AITrading #WeeklySetup #InstitutionalMoney #TechStocks #UnusualOptionsActivity #TradingView #MomentumTrading

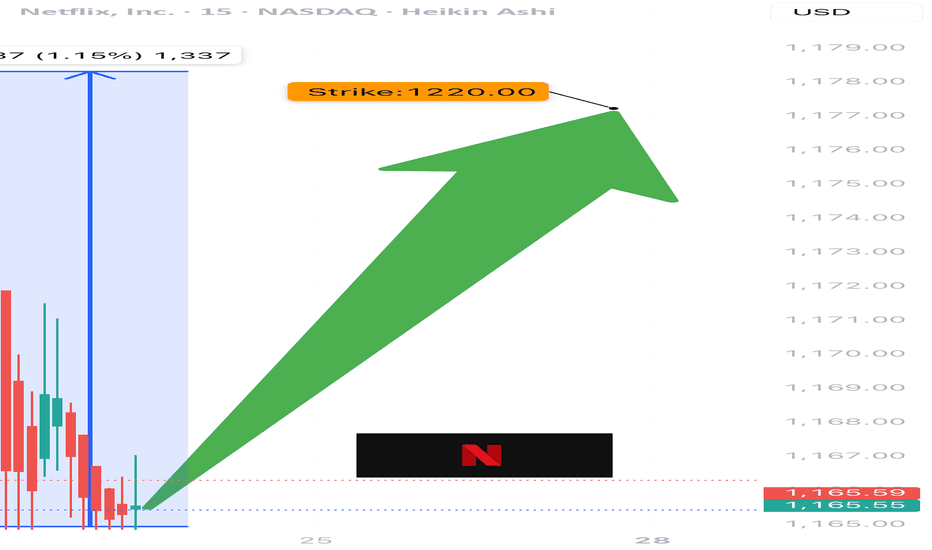

NFLX TRADE IDEA (07/24)

🚨 NFLX TRADE IDEA (07/24) 🚨

⚔️ Bulls vs. Bears… but calls are winning 🐂📈

🧠 Quick Breakdown:

• Call/Put Ratio: 1.27 → bullish edge

• RSI < 45 = 🔻oversold territory

• VIX favorable = room to run

• High gamma = big moves incoming ⚡️

• Expiry: TOMORROW = 🔥 time decay risk

💥 TRADE SETUP

🟢 Buy NFLX $1220 Call exp 7/25

💰 Entry: $0.50

🎯 Target: $0.90

🛑 Stop: $0.30

📈 Confidence: 65%

⚠️ Watch volatility closely. Fast exit = smart exit.

#NFLX #OptionsFlow #OptionsAlert #BullishPlay #DayTradeSetup #NetflixStock #TechOptions #UnusualOptionsActivity #TradingView #GammaSqueeze

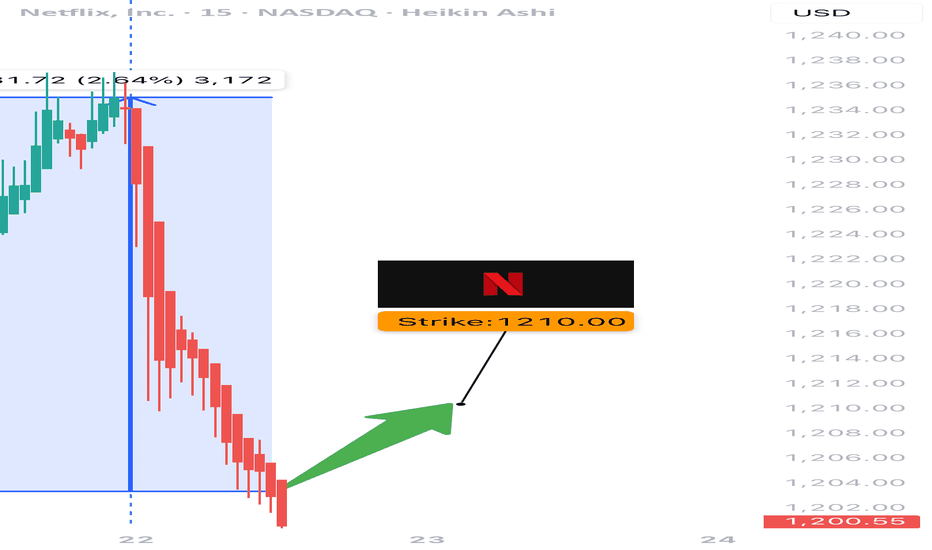

$NFLX Weekly Call Setup – 07/22/25

🚀 NASDAQ:NFLX Weekly Call Setup – 07/22/25

Volume Surge 📈 | RSI Bullish ✅ | Options Flow Mixed 🔁 | 3DTE Lotto Play 🎯

⸻

📊 Market Snapshot

• Price: $1203.16

• Call/Put Ratio: 1.01 → ⚖️ Neutral

• Weekly RSI: ✅ 63.2 (Momentum confirmed)

• Volume Surge: 📈 1.6x previous week

• Gamma Risk: ⚠️ Moderate

• DTE: 3 (Theta decay accelerating)

⸻

🧠 Trade Setup

{

"Instrument": "NFLX",

"Direction": "CALL",

"Strike": 1210.00,

"Entry": 24.10,

"Profit Target": 7.00,

"Stop Loss": 12.00,

"Expiry": "2025-07-25",

"Confidence": 0.65,

"Size": 1,

"Entry Timing": "Open"

}

⸻

🔎 Sentiment Breakdown

Indicator Status

📈 Weekly RSI ✅ Bullish confirmation

📉 Daily RSI ⚠️ Flat – no momentum edge

🔊 Volume ✅ Surge (1.6x baseline)

🔁 Options Flow ⚖️ Neutral (C/P = 1.01)

💨 VIX ✅ Favorable for calls

📰 News Risk ❌ Downgrade noise = volatility

⸻

📍 Chart Zones to Watch

• Support: $1198

• Breakout Trigger: $1210

• Resistance Targets: $1220 → $1250

• ⚠️ Key Watch: Gamma acceleration if $1210 breaks with volume

⸻

🎯 Viral Caption / Hook (for TV/X/Discord):

“ NASDAQ:NFLX 1210C is riding a volume rocket. RSI says go — options flow says maybe. Gamma vs. downgrade risk. 3DTE = Lotto edge or fade?”

💵 Entry: $24.10 | 🎯 Target: +30–50% | 📉 Stop: $12.00 | ⚖️ Confidence: 65%

⸻

⚠️ Best For:

• 📊 Breakout traders riding weekly momentum

• 🚀 Volume chasers following RSI confirmation

• ⏳ Scalpers with a handle on 3DTE gamma dynamics

⸻

💬 Want a debit spread alternative (e.g., 1200/1225)? A theta-scalped condor? Or 0DTE lotto scalp?

Drop a comment!!!

NFLX Weekly Options Outlook — June 1, 2025🚨 Multi-Model Summary

This week’s analysis from top AI models (Grok, Claude, Llama, Gemini, DeepSeek) shows moderate bullish momentum for NASDAQ:NFLX , with a range of technical insights and trade strategies.

🧠 Model Highlights

Grok (xAI)

🔹 Technicals: Price above 10EMA, nearing overbought.

🔹 Sentiment: Bullish news (BofA), VIX low.

🔹 Trade: Buy $1290C @ $0.94 → PT $1.41 / SL $0.47

🔹 Confidence: 60%

Claude (Anthropic)

🔹 Technicals: Strong EMAs, bullish MACD on 5M.

🔹 Sentiment: BofA upgrade + options flow into $1300.

🔹 Trade: Buy $1220C @ $12.25 → PT $18–20 / SL $8

🔹 Confidence: 72%

Llama (Meta)

🔹 Technicals: Bullish near-term; RSI normalized.

🔹 Sentiment: BofA bullish note, minor CNBC drag.

🔹 Trade: Buy $1290C @ $0.94 → PT $2.50 / SL $0.40

🔹 Confidence: 65%

Gemini (Google)

🔹 Technicals: Uptrend, MACD divergence noted.

🔹 Sentiment: Strong BofA note, watch $1180 max pain.

🔹 Trade: Buy $1250C @ $4.40 → PT $6.60 / SL $2.20

🔹 Confidence: 60%

DeepSeek

🔻 Bearish Divergence

🔹 Technicals: Overextended short-term.

🔹 Sentiment: Max pain + put skew → downside risk.

🔹 Trade: Buy $1100P @ $0.71 → PT $1.77 / SL $0.35

🔹 Confidence: 65%

✅ Consensus Takeaways

🟢 4 out of 5 models lean bullish

📊 Price > EMAs, sentiment tailwind (BofA upgrade)

⚠️ Max pain at $1180 could act as late-week magnet

⚡ Risk-on setup but overbought—watch for short pullbacks

🎯 Chosen Trade Setup

💡 Trade Idea: Buy NFLX $1220C (2025-06-06)

💵 Entry: $12.25

🎯 Target: $18.40 (+50%)

🛑 Stop: $7.96 (−35%)

🔢 Size: 1 contract

🧠 Confidence: 70%

⏰ Entry: At open (Monday)

⚠️ Key Risks to Watch

RSI near overbought → potential pause

Max pain gravity at $1180 into Friday

Late-week gamma decay = faster premium loss

Macro news or earnings surprises may shift bias

📊 TRADE DETAILS (JSON)

json

Copy

Edit

{

"instrument": "NFLX",

"direction": "call",

"strike": 1220.0,

"expiry": "2025-06-06",

"confidence": 0.70,

"profit_target": 18.40,

"stop_loss": 7.96,

"size": 1,

"entry_price": 12.25,

"entry_timing": "open",

"signal_publish_time": "2025-06-01 16:24:59 EDT"

}

Netflix Skyrockets After Q1 Revenue Surge: What’s Next?📺 NASDAQ:NFLX has recently exhibited a strong bullish trend, supported by both technical breakout structure and positive fundamental developments. After an extended rally from the March lows, the stock managed to break above a key resistance zone between $1,080 and $1,100, it has now been decisively cleared. With this breakout, the structure confirms bullish momentum, and the expectation is for a retest of this newly formed support area before resuming the uptrend.

The price is currently around $1,133, and a pullback into the $1,060–$1,080 zone would present a high-probability buy opportunity. This aligns with classic price action behavior: after a breakout, markets often retrace to test former resistance, now turned support. If we see it retest, it would validate the technical setup for a continuation move toward the projected target of $1,220.

🌟From a fundamental perspective, the recent Q1 earnings report (released on April 17, 2025) added strong fuel to the upside momentum. Netflix reported $10.54 billion in revenue for the quarter, exceeding Wall Street’s expectations and representing a 13% year-over-year growth. Net income also impressed, coming in at $2.9 billion. Perhaps more telling than the earnings themselves was Netflix’s decision to stop reporting quarterly subscriber numbers. This shift in focus toward profitability and revenue per user signals confidence in their monetization model and emphasizes a transition to a more mature phase of growth. Management’s tone on the earnings call adds to all this, citing growing traction in its ad-supported tier and plans to expand into live sports and podcast-style content.

💰Technically, the overall structure remains bullish. The breakout is clean, and volume is supportive. The area above $1,140 has low volume resistance, which means price can move relatively easily toward the next psychological barrier at $1,220. Any deeper pullback that breaches below $1,020 would invalidate the short-term bullish bias, as it would signal a failure to hold above former resistance and could mean the start of a deeper correction toward the trendline support from last October.

🚀 In conclusion, the current market behavior suggests Netflix is in the process of forming a bullish continuation, supported by a clean breakout above prior resistance, robust financial performance, and an optimistic revenue outlook.

Price is likely to retest the breakout zone, offering a potential long setup anticipating a move higher if momentum remains strong. The technical picture is backed by future growth plans, making Netflix a stock to watch closely in the coming weeks for confirmation of the pullback and continuation.

Breaking: Netflix ($NFLX) Surges 3% Amidst Topping Q1 Earnings The shares of Netflix (NASDAQ: NASDAQ:NFLX ) is surging 3.5% in Friday's premarket session amidst Q1 earnings beat.

Netflix (NASDAQ: NASDAQ:NFLX ) reported first-quarter earnings that topped analysts’ expectations, sending shares higher in extended trading Thursday, extending the gains to Friday's premarket session.

The streaming giant's revenue grew over 12% YoY to $10.54 billion, above the analyst consensus from Visible Alpha. Net income of $2.89 billion, or $6.61 per share, rose from $2.33 billion, or $5.28 per share, a year earlier, beating Wall Street’s expectations. The period marked the first quarter Netflix did not report subscriber numbers.

Netflix's Gains Come as Subscription Prices Rise

The better-than-expected results came in part due to higher subscription and ad revenues, the company said, along with the timing of expenses.

Netflix had raised prices for its plans in January, hiking its ad-supported plan to $7.99 from $6.99 per month, the standard ad-free plan to $17.99 from $15.49 a month, and its premium plan to $24.99 from $22.99 a month.

Netflix maintained its fiscal 2025 revenue projection of $43.5 billion to $44.5 billion. Analysts on average had expected $44.27 billion. The company's second-quarter revenue forecast of $11.04 billion exceeded Wall Street's estimate of $10.91 billion.

Co-CEO Greg Peters said Netflix expects to double its advertising revenue this year, as the company rolls out its ad tech suite. The suite is live in the U.S. and Canada, with 10 other markets expected in the months to come.

Technical Outlook

As of the time of writing, NASDAQ:NFLX shares are up 3.29% in Friday's premarket session. NASDAQ:NFLX chart pattern has formed a perfect resistant and support point carved out since the 11th of November, 2024. Should NASDAQ:NFLX break the $1064 resistant point, a break out might be imminent for the entertainment giant.

Conversely, failure to break above that point could resort to a cool off to the $800 support point. NASDAQ:NFLX RSI is primed for a breakout as it is not oversold nor overbought but well positioned for a bullish move.

Netflix (NFLX) – A Safe Haven Amid Tariff UncertaintyKey Supporting Arguments

Amidst the unpredictability of Donald Trump's tariff policies, Netflix might serve as a defensive play.

Positive consumer sentiment, a surge in subscriber growth, and strategic hikes in subscription prices are poised to power robust results for the first quarter of fiscal year 2025.

Investment Thesis

Netflix (NFLX) is a global leader in video streaming, offering a vast library of original and licensed content to subscribers worldwide. With over 95% of its revenue stream coming from subscriptions, the company secures a solid foundation against the whims of market volatility. NFLX’s nascent foray into advertising contributes a mere 3% to its revenue, ensuring that any tremors in the macroeconomic climate have a minimal ripple effect.

Netflix's business model, anchored in subscription revenue and expansive geographic diversification, shields the company from the whims of unpredictable tariff policies. Amidst the relentless cycle of tariffs being slapped on and lifted from a variety of products and the growing tide of protectionism, streaming platforms such as Netflix, which thrive on subscription-based models, emerge as devensive assets. This is largely because they steer clear of the tumultuous world of physical goods production, importation, and exportation. The sustainability of the company’s streaming empire is anchored in its formidable user engagement—clocking in at around 2 hours per household daily—paired with historically low subscriber churn and entertainment value that punches well above its price tag. These elements collectively mitigate NFLX’s risk profile in the face of a potential recession. While advertising revenue may take a hit if trade tensions intensify and trigger an economic downturn, it is worth noting that ads only contribute to about 3% of Netflix's total revenue. Despite its worldwide footprint, the company still rakes in a hefty slice of its revenue—around 40-45%—from the U.S. market, offering a protective buffer against possible international sanctions or restrictions. Meanwhile, its strategic geographic diversification across Europe, Latin America, Asia, and the Middle East not only mitigates risks but also fortifies the sustainability of its business model.

Netflix is poised to potentially exceed expectations in its Q1 2025 earnings report. In Q4 2024, the company shattered expectations by pulling in a recordbreaking 19 million new users, a surge we anticipate will roll into 2025, powered by its rich and diverse content lineup. By the year's end, Netflix strategically hiked prices in the U.S. and UK, a move poised to bolster its Q1 2025 revenue. With a bold target of 29% growth for 2025, the company is banking on buoyant consumer spending and these subscription price upticks to hit the mark. Netflix projects a free cash flow of no less than $8 billion, creating a strategic opportunity for potential share buybacks.

Our target price for NFLX over the next two months is pegged at $1,080, paired with a "Buy" recommendation. We suggest setting a stop-loss at $880.

OMNICHART presents => NFLX - long term trendNetflix is still in an upward channel - in a long term bullish trend. In the coming months if it meets the support line and bounces off then that would be the time to buy leaps or scale into additional long term positions. Or start scaling in along with a put spread/s until the support line for a year. A tweak in the trade do make additional income would be to sell put at the support line for every week or month and most likely it will expire worth less and then sell a subsequent put (for week or month) at a point higher on the support line , basically keep selling your puts on the support line as time moves along and the price is above the support line. This was you might just cover the price of the long put you bought today and even make additional income. And if the stock goes up you are still making money. This buys you additional protection for free based on how disciplined you are with managing the put spread (especially the short end of it).

NFLX - Fundamentals and simply a great company to invest in!Hi guys, next we would be looking into NFLX , which has had a tremendeous year already! It is up 480.28$ YTD as of today 26th December , which accumulates to 103.99% upside of their stock value. Currently they have shown fantastic financial data throughought Q1,Q2,Q3 not only that they showed a good growth towards their subscribers, and last but not least they just started their NFL Program which launched recently which definitely would boost their revenue.

Additionally they signed a very important contract that goes as follows :

Contract:

Deal with Fifa, soccer’s global governing body, covers the 2027 and 2031 editions of the Women’s World Cup

Agreement covers Puerto Rico and includes both English and Spanish-language broadcasts

Netflix will produce an exclusive documentary series in the lead-up to both tournaments

Streaming platform’s coverage will also feature studio shows

So the stars are alligning for this company and I am deffinetely looking for the break through to the levels above 1,000$ per share.

Entry: on market open - 935$

Target: 1,150$

As always my friends happy trading!

P.S. If you have questions or inquiries about one of my existing set-ups or personal questions / 1 on 1 sessions consider joining my channel so you can follow up with me in private!

Netflix on the Rise Bullish Breakout in Motion!Trendline Support

The price is respecting an ascending trendline, indicating a strong bullish sentiment.

Recent candles have bounced off this support line, confirming its reliability.

Breakout Confirmation

The price has broken above a key horizontal resistance level around $870.

This breakout suggests bullish continuation, especially with volume support.

Risk-to-Reward Setup

A well-defined risk-to-reward ratio is visible.

Stop-loss appears to be placed below $853, protecting against a false breakout.

Target set around $939 aligns with a significant resistance zone, offering a potential reward.

Indicators

Positive price momentum is evident, with higher highs and higher lows forming.

Likely supported by broader market strength in tech stocks.

Next Steps

Monitor the price action for sustained movement above $870.

A retracement to retest the breakout level could provide a secondary entry.

Key resistance to watch: $900 and $939.

NFLX is poised for a bullish continuation, with the current setup offering a high-probability trade opportunity.

Netflix Stock Up 14% Premarket Following Record-Breaking QuarterNetflix Inc. ( NASDAQ:NFLX ) is making headlines with a significant 14% surge in premarket trading, fueled by the company’s record-breaking fourth-quarter performance. This milestone, driven by live sports programming and the return of its flagship series, *Squid Game*, marks a pivotal moment for the streaming giant. Here’s an in-depth look at the technical and fundamental aspects behind this remarkable rally.

Record Subscriber Growth

Netflix added an unprecedented 18.9 million subscribers in Q4 2024, bringing its global subscriber base to over 300 million. This growth, more than double Wall Street’s expectations, surpasses the company’s previous record of 15 million new subscribers in Q1 2020. Notably, this quarter marked the final time Netflix will report subscriber numbers, signaling a shift toward emphasizing financial metrics such as revenue and profit.

Revenue and Profit Surge

Netflix reported a 16% year-over-year increase in revenue, reaching $10.2 billion for the quarter—its most substantial growth since 2021. For 2025, the company projects revenue of up to $44.5 billion, a 14% increase, with an operating margin of 29%. These robust financials underscore the company’s ability to sustain growth amidst a competitive streaming landscape.

Key Drivers of Growth

1. Live Programming: Netflix’s venture into live sports, including its first major National Football League games and the Jake Paul vs. Mike Tyson boxing match, has proven to be a game-changer. These events attracted record sign-ups, highlighting the potential of live programming to drive subscriber growth.

2. Content Strategy: The return of Squid Game and the success of the hit movie Carry-On further bolstered subscriber numbers. Netflix’s diverse programming mix ensures broad audience appeal, while no single title dominated subscriber additions.

3. Password Sharing Crackdown: The company’s crackdown on password sharing contributed to its best-ever year for subscriber growth, with 41 million new customers added in 2024.

4. Advertising Revenue: While still in its early stages, Netflix’s advertising business is gaining traction. A majority of new subscribers in markets with ad-supported tiers opted for this model, signaling growing acceptance of ad-supported streaming.

Price Increases

Netflix is boosting prices across several markets, including the U.S., Canada, Portugal, and Argentina. The most popular U.S. plan now costs $17.99 per month, a $2.50 increase. These price hikes are expected to contribute significantly to revenue growth in 2025.

Market Reaction

Netflix shares closed at $869.68 in New York on Tuesday and are set to open with a 14% gain in premarket trading. If sustained, this would mark the stock’s most significant gain since October 2023.

Technical Analysis

As of premarket trading, NASDAQ:NFLX is up 14.70%, reflecting bullish sentiment driven by the record-breaking quarterly performance. The Relative Strength Index (RSI) was at 48.99 before this surge, indicating the stock was neither overbought nor oversold.

Bullish Gap-Up Pattern

The premarket rally sets the stage for a potential gap-up pattern at market open. This technical phenomenon occurs when a stock’s opening price is significantly higher than its previous closing price. Historically, gap-ups are strong bullish indicators, often followed by brief pullbacks as traders digest the news.

Resistance and Support Levels

- Resistance: The stock is eyeing its one-month high as the next resistance level. A breakout above this point could trigger further bullish momentum.

- Support: Immediate support lies at the $776 level. A breakdown below this level could lead to a retest of lower support zones, but this scenario appears less likely given the current bullish momentum.

Market Outlook

With the broader stock market expected to rally following Donald Trump’s inauguration earlier this week, NASDAQ:NFLX is poised to capitalize on favorable market conditions. The combination of strong fundamentals and bullish technical indicators suggests a continued upward trajectory in the near term.

Conclusion

Netflix’s record-breaking quarter underscores its resilience and adaptability in an evolving streaming landscape. The company’s strategic focus on live programming, diverse content offerings, and advertising is paying off, driving subscriber growth and revenue to new heights. From a technical perspective, the stock’s premarket surge and bullish patterns point to a strong start for 2025.

As Netflix pivots toward prioritizing financial metrics over subscriber numbers, investors have much to look forward to in terms of sustained growth and profitability. With NASDAQ:NFLX setting the stage for a historic year, the streaming giant remains a compelling investment opportunity for traders and long-term investors alike.

NETFLIX’s Next Big Move: Massive Breakout Imminent?Technical Analysis:

NFLX (Netflix), on the 15-minute time frame, has set up a long trade with a strong entry at $744.60, supported by good volume. The breakout occurred above a consolidation phase, indicating market interest in a bullish move.

The price action is holding above the entry level, and the Risological Dotted Trendline is trending upward, providing a strong support foundation for the trade. This long setup points to a potential bullish continuation as Netflix approaches the following targets.

Key Levels:

Entry: $744.60

Stop Loss (SL): $715.10

Target 1 (TP1): $781.07

Target 2 (TP2): $840.08

Target 3 (TP3): $899.09

Target 4 (TP4): $935.56

Observations:

The breakout was backed by strong volume, reflecting confidence from the bulls.

Price is consolidating near TP1, suggesting momentum is building for further upside.

The Risological Dotted Trendline is trending upwards, giving strong support around $744, ensuring the trend stays intact.

Outlook:

Netflix's long trade setup shows strong potential for upward movement. With the support of the Risological Dotted Trendline and high volume backing, this trade is well-positioned to meet its targets. Watch for any pullback near $740, which could present another opportunity to re-enter or add to positions.

Netflix - Bullish Move Of +50% Ahead!Netflix ( NASDAQ:NFLX ) is trading at an important breakout level:

Click chart above to see the detailed analysis👆🏻

Netflix is just another one of these stocks which is perfectly following cycles and market structure. After the recent drop of about -80%, Netflix perfectly tested the bottom of the reverse triangle pattern, created bullish confirmation and took off towards the upside.

Levels to watch: $700, $1.000

Keep your long term vision,

Philip (BasicTrading)

Netflix Stock Gains as Evercore ISI Raises TargetNetflix Inc. (NASDAQ: NASDAQ:NFLX ) continues to capture the spotlight in the investment world, with Evercore ISI raising its price target from $710 to $750. The decision to increase the target stems from robust survey results and an optimistic outlook for the streaming giant, reaffirming Netflix's position as a dominant player in the entertainment industry.

Strength and Growth Potential

Evercore ISI’s decision is underpinned by comprehensive research, including detailed surveys conducted in the U.S. and Mexico. The results reveal that Netflix's core metrics—content selection, customer satisfaction, and churn rates—remain stable and strong. In Mexico, Netflix boasts an impressive 83% satisfaction rate, a testament to the platform's ability to deliver consistent, high-quality content.

Moreover, Netflix (NASDAQ: NASDAQ:NFLX ) is expanding its competitive lead over other streaming platforms. Evercore ISI emphasizes that the quality of Netflix's content is a significant factor driving its continued dominance. The firm’s surveys indicate that subscribers are particularly excited about upcoming content, such as "Squid Game II," which is expected to further enhance Netflix’s appeal.

The firm also highlights Netflix's foray into live events and gaming as key growth areas. With 60% of subscribers likely to remain loyal if more live content, like sports and stand-up comedy, is introduced, and 47% of U.S. subscribers already engaging with gaming offerings, Netflix is well-positioned to tap into these emerging markets.

A Bullish Yet Cautious Outlook

On the technical front, Netflix (NASDAQ: NASDAQ:NFLX ) shares are up 1.28% at the time of writing, continuing its upward trajectory. The Relative Strength Index (RSI) is at 68, nearing the overbought territory. This suggests that while the stock has been on a steady rise, investors should exercise caution, as the momentum could reverse if bearish forces gain strength.

The stock has seen modest gains each day, pushing it closer to new highs. However, if the bullish momentum wanes, Netflix (NASDAQ: NASDAQ:NFLX ) could face a critical test of support. The major support level identified on April 19th, 2024, could serve as a key indicator of the stock’s direction. A break below this support might signal a potential correction, so traders should keep a close eye on this level.

Conclusion: A Strong Buy with Caution

Evercore ISI’s increased price target reflects a strong confidence in Netflix's fundamental and competitive position. The company's ability to consistently deliver high-quality content, coupled with its expansion into new areas like live events and gaming, positions it for continued growth. However, with the RSI approaching overbought levels, investors should remain vigilant for any signs of a potential pullback.

NFLX shark harmonicNASDAQ:NFLX daily chart is showing a bullish shark harmonic, with the entry point at D corresponding to the critical daily 50 SMA. The first profit target at B corresponds to the daily 34 EMA, and the second target at C corresponds to the daily upper Bollinger Band. NASDAQ:NFLX starts off the NASDAQ:QQQ earnings season, and reports after market close on Thursday.

Netflix : Is a Major Market Correction coming? 📉Following our last analysis, Netflix has precisely achieved the forecasted targets, with the wave ((iii)) extending to 227 to 261%. This suggests that a correction towards wave ((iv)) might be imminent, expected to range between 38% and 61.8%, thus laying the groundwork for a wave 5 and the culmination of a significant cycle in the form of a potential wave (2).

A closer examination of the daily chart reinforces our primary scenario: the completion of Wave II at the low of $162.80. We are currently in the process of developing Wave (1), followed by Wave (2), and so forth.

In our alternative scenario, we consider the possibility of a Regular Flat, especially when analyzing the complex correction currently unfolding. This might indicate that rather than concluding Wave (2) at $162.80, it was actually Wave (A), and we are now witnessing Wave (B) achieving exactly 100% of Wave I. Such alignment could signal a 5-wave decline towards a double bottom, marking a significant correction of 70%.

While such a correction would be substantial, it is essential to explore all scenarios to be prepared for any market developments. Despite the potential for a significant pullback, our underlying outlook remains optimistic, expecting a continued upward momentum for Netflix.

$NFLX last leg higher? $661-680 targets?NASDAQ:NFLX looks like it's setting up for a final move into resistance.

It just broke above resistance and reclaimed it as support. Now the final thing it needs to do is break up above the trendline.

If it can do that, then I think we'll hit one of the final two resistance targets.

Let's see how it plays out.