NFLX WEEKLY OPTIONS TRADE (07/28/2025)**🎬 NFLX WEEKLY OPTIONS TRADE (07/28/2025) 🎬**

**Institutions Are Buying Calls – Should You?**

---

📈 **Momentum Breakdown:**

* **Daily RSI:** Mixed ➡️ Possible short-term weakness

* **Weekly RSI:** Bullish bias intact ✅

🔥 Overall = **Moderate Bullish** trend confirmed on the **weekly timeframe**

📊 **Options Flow:**

* **Call/Put Ratio:** **2.23** 🚨

💼 Strong institutional call flow = **bullish bias** from big money

* **Strike Ideas from Models:**

* \$1260 (Grok/xAI)

* \$1230 (Gemini/Google)

* \$1220 (Meta)

* ✅ **\$1200** (Consensus Strike)

🧨 **Volume Warning:**

* 📉 Institutional participation is **lower than average**

* 🚫 Could signal weak follow-through or fading interest

---

🧠 **AI Model Consensus (Grok / Gemini / Claude / Meta / DeepSeek):**

✅ Call buying favored across the board

✅ Weekly bullish momentum confirmed

⚠️ Daily RSI & low volume = headwinds

📌 Play it smart: momentum’s real, but conviction isn’t maxed

---

💥 **RECOMMENDED TRADE (65% Confidence):**

🎯 **Play:** Buy CALL Option

* **Strike:** \$1200

* **Expiry:** 2025-08-01

* **Entry:** \~\$8.50

* **Profit Target:** \$16.00 → \$17.00

* **Stop Loss:** \$5.10

📆 Entry Timing: Monday market open

📏 Position Size: Risk-managed (2-4% portfolio)

---

⚠️ **RISK CHECKLIST:**

* 🟡 **Volume Fragility:** Institutions not fully loading

* 🟥 **Gamma Risk:** Expiry this week = possible sharp swings

* 🔴 **Daily RSI Divergence:** Short-term weakness still possible

---

📌 **TRADE DETAILS (JSON Format for Automation):**

```json

{

"instrument": "NFLX",

"direction": "call",

"strike": 1200.0,

"expiry": "2025-08-01",

"confidence": 0.65,

"profit_target": 16.00,

"stop_loss": 5.10,

"size": 1,

"entry_price": 8.50,

"entry_timing": "open",

"signal_publish_time": "2025-08-01 09:30:00 UTC-04:00"

}

```

---

**TL;DR:**

🟢 Weekly bullish setup with strong options flow

🟡 Daily weakness = proceed with discipline

🎯 \ NASDAQ:NFLX \$1200C for short-term momentum upside

💬 Are you following the institutions or fading the low volume?

\#NFLX #OptionsFlow #AITrading #WeeklySetup #InstitutionalMoney #TechStocks #UnusualOptionsActivity #TradingView #MomentumTrading

Nflxsetup

NFLX TRADE IDEA (07/24)

🚨 NFLX TRADE IDEA (07/24) 🚨

⚔️ Bulls vs. Bears… but calls are winning 🐂📈

🧠 Quick Breakdown:

• Call/Put Ratio: 1.27 → bullish edge

• RSI < 45 = 🔻oversold territory

• VIX favorable = room to run

• High gamma = big moves incoming ⚡️

• Expiry: TOMORROW = 🔥 time decay risk

💥 TRADE SETUP

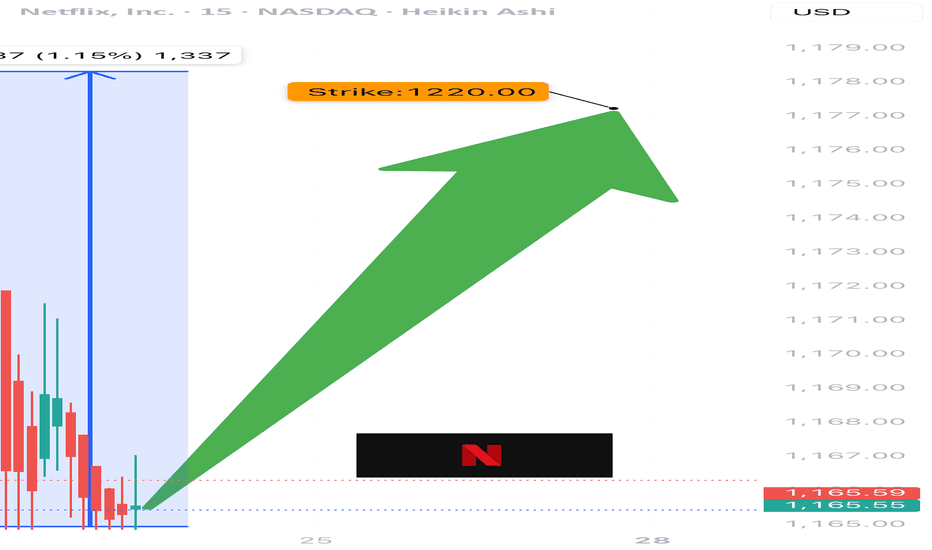

🟢 Buy NFLX $1220 Call exp 7/25

💰 Entry: $0.50

🎯 Target: $0.90

🛑 Stop: $0.30

📈 Confidence: 65%

⚠️ Watch volatility closely. Fast exit = smart exit.

#NFLX #OptionsFlow #OptionsAlert #BullishPlay #DayTradeSetup #NetflixStock #TechOptions #UnusualOptionsActivity #TradingView #GammaSqueeze

NFLX WEEKLY BEARISH PLAY — 07/23/2025

📉 NFLX WEEKLY BEARISH PLAY — 07/23/2025

🧠 Multi-model AI Consensus Trade Setup

⸻

🔍 QUICK SUMMARY

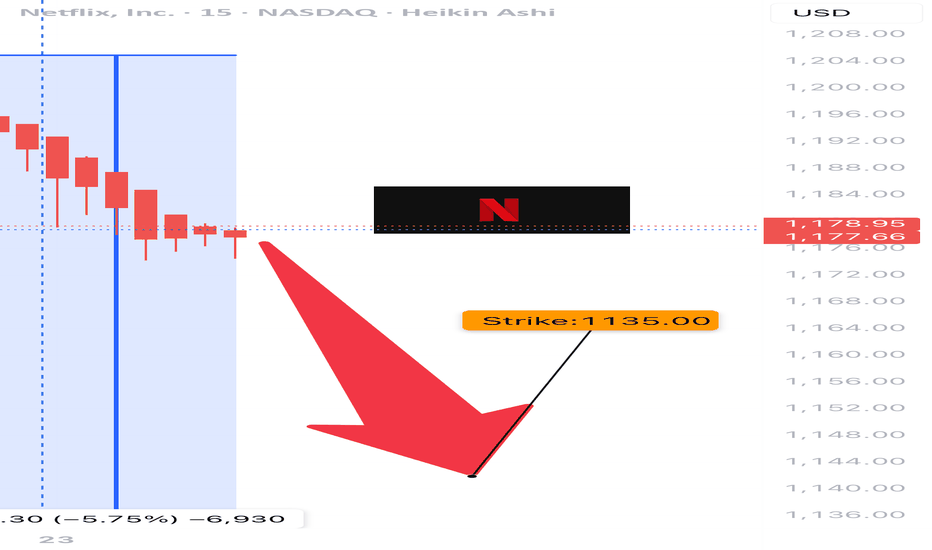

After reviewing 5 AI model reports (Grok, Gemini, Claude, Meta, DeepSeek), the consensus is moderate bearish for NFLX this week following heavy institutional selling and post-earnings weakness.

💣 Key Reason:

All reports cite declining daily RSI, strong institutional outflows, and mixed-to-bearish volume trends. Despite some caution, the majority lean bearish.

⸻

🎯 TRADE IDEA (WEEKLY PUT PLAY)

{

"instrument": "NFLX",

"direction": "PUT",

"strike": 1135,

"entry_price": 0.77,

"profit_target": 1.50,

"stop_loss": 0.41,

"expiry": "2025-07-25",

"confidence": 70%,

"entry_timing": "Open",

"size": 1 contract

}

⸻

📊 TRADE PLAN

🔹 🔸

🎯 Strike 1135 PUT

💵 Entry Price 0.77

🎯 Target 1.50 (approx. 95% upside)

🛑 Stop Loss 0.41

📅 Expiry July 25, 2025 (2DTE)

📈 Confidence 70%

⏰ Entry Market Open

🧠 Gamma Risk High (be nimble!)

⸻

🧠 Model Summary

• Gemini/Google: 🔻 Strong SELL — Institutional unload, 85% confidence

• Grok/xAI: ⚠️ NO TRADE — mixed signals

• Claude/Anthropic: ⚠️ NO TRADE — high sell volume, but conflicting indicators

• Meta/LLaMA: 🔻 Moderate Bearish — suggests 1175P but supports this setup

• DeepSeek: 🔻 Bearish lean — supports 1135P w/ caution on gamma/time decay

⸻

🚨 NOTES

• 🕒 Only 2DTE — expect volatility + fast decay

• 🔍 Watch price action into open + first 30 mins

• 📉 If NASDAQ:NFLX cracks below $1130 support zone, this setup could fly

⸻

💬 Drop a ⚠️ if you’re watching

💣 Drop a 🔻 if you’re in this PUT

📈 #OptionsTrading #NFLX #WeeklyTrade #AITradeAlert #MemeStocks #PutOptions #ShortSetup

$NFLX Weekly Call Setup – 07/22/25

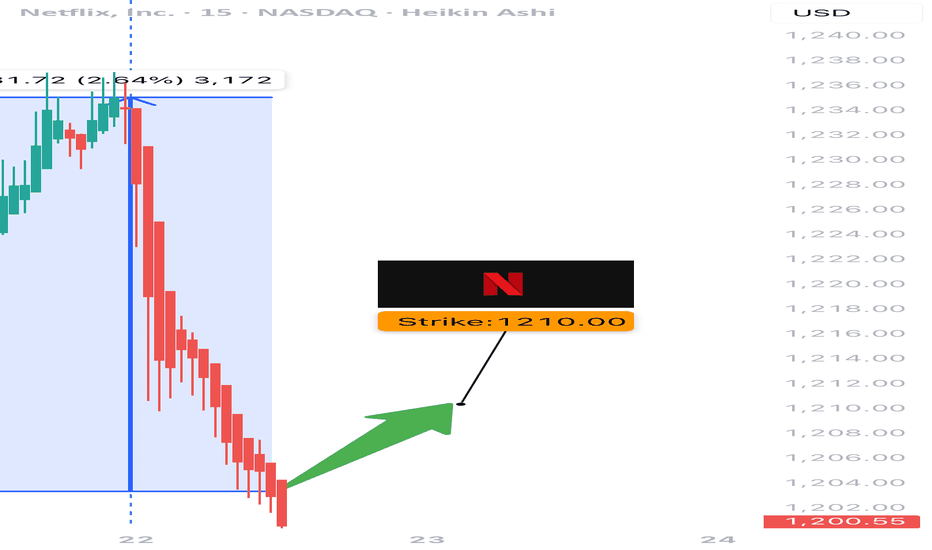

🚀 NASDAQ:NFLX Weekly Call Setup – 07/22/25

Volume Surge 📈 | RSI Bullish ✅ | Options Flow Mixed 🔁 | 3DTE Lotto Play 🎯

⸻

📊 Market Snapshot

• Price: $1203.16

• Call/Put Ratio: 1.01 → ⚖️ Neutral

• Weekly RSI: ✅ 63.2 (Momentum confirmed)

• Volume Surge: 📈 1.6x previous week

• Gamma Risk: ⚠️ Moderate

• DTE: 3 (Theta decay accelerating)

⸻

🧠 Trade Setup

{

"Instrument": "NFLX",

"Direction": "CALL",

"Strike": 1210.00,

"Entry": 24.10,

"Profit Target": 7.00,

"Stop Loss": 12.00,

"Expiry": "2025-07-25",

"Confidence": 0.65,

"Size": 1,

"Entry Timing": "Open"

}

⸻

🔎 Sentiment Breakdown

Indicator Status

📈 Weekly RSI ✅ Bullish confirmation

📉 Daily RSI ⚠️ Flat – no momentum edge

🔊 Volume ✅ Surge (1.6x baseline)

🔁 Options Flow ⚖️ Neutral (C/P = 1.01)

💨 VIX ✅ Favorable for calls

📰 News Risk ❌ Downgrade noise = volatility

⸻

📍 Chart Zones to Watch

• Support: $1198

• Breakout Trigger: $1210

• Resistance Targets: $1220 → $1250

• ⚠️ Key Watch: Gamma acceleration if $1210 breaks with volume

⸻

🎯 Viral Caption / Hook (for TV/X/Discord):

“ NASDAQ:NFLX 1210C is riding a volume rocket. RSI says go — options flow says maybe. Gamma vs. downgrade risk. 3DTE = Lotto edge or fade?”

💵 Entry: $24.10 | 🎯 Target: +30–50% | 📉 Stop: $12.00 | ⚖️ Confidence: 65%

⸻

⚠️ Best For:

• 📊 Breakout traders riding weekly momentum

• 🚀 Volume chasers following RSI confirmation

• ⏳ Scalpers with a handle on 3DTE gamma dynamics

⸻

💬 Want a debit spread alternative (e.g., 1200/1225)? A theta-scalped condor? Or 0DTE lotto scalp?

Drop a comment!!!

How Earnings Reporting Could Impact Netflix (NFLX) Share PriceHow Earnings Reporting Could Impact Netflix (NFLX) Share Price

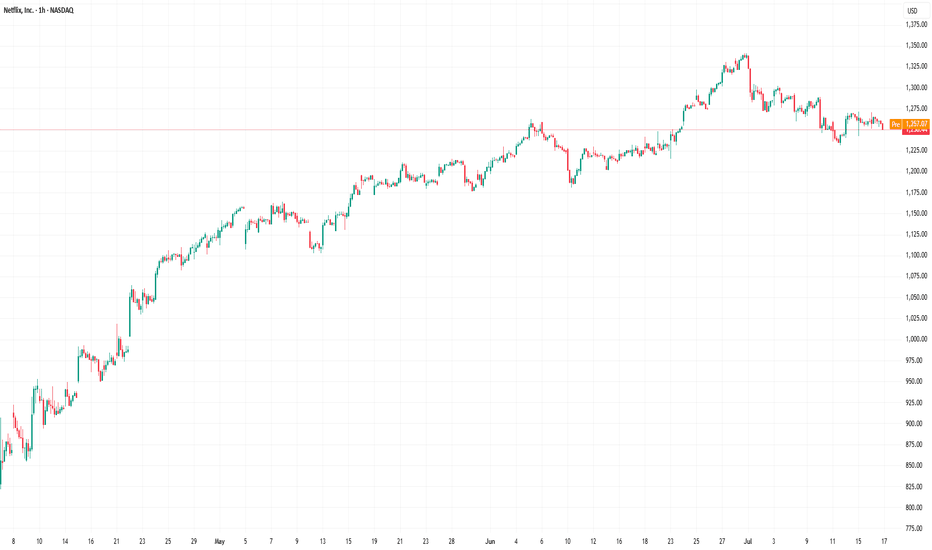

Earnings season is gaining momentum. Today, after the close of the main trading session, Netflix (NFLX) is set to release its quarterly financial results.

Analysts are optimistic, forecasting earnings per share (EPS) of $7.08, up from $4.88 a year earlier, and revenue growth to $11.1 billion.

The upbeat sentiment is driven by:

→ the fact that Netflix’s business model is relatively resilient to tariff-related pressures;

→ the company’s success in curbing password sharing and promoting a more affordable ad-supported subscription tier.

Netflix has reported revenue growth for six consecutive quarters, outperforming competitors such as Disney, Amazon, and Apple. Its market share has climbed to 8.3%, with YouTube remaining its only serious rival—YouTube's share increased from 9.9% a year ago to 12.8% in June, according to Nielsen. If current trends hold, this reporting quarter could mark another strong performance for Netflix.

However, is the outlook truly that bullish?

Technical analysis of NFLX stock chart

The NFLX stock price is currently moving within an ascending channel (marked in blue), and it is now testing the lower boundary of this formation. Of concern is the recent pronounced bearish movement (B), which has dragged the stock from the channel’s upper boundary to its lower edge—erasing the bullish momentum (A) that followed the breakout above the $1,250 resistance level.

What’s next?

→ On the one hand, bulls may attempt to resume the upward trend within the channel.

→ On the other hand, bears could build on their recent momentum (highlighted in red) and break the ascending trend that has been in place since May.

It appears the fate of the current uptrend hinges on the market’s reaction to today’s earnings release.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Netflix on the Rise Bullish Breakout in Motion!Trendline Support

The price is respecting an ascending trendline, indicating a strong bullish sentiment.

Recent candles have bounced off this support line, confirming its reliability.

Breakout Confirmation

The price has broken above a key horizontal resistance level around $870.

This breakout suggests bullish continuation, especially with volume support.

Risk-to-Reward Setup

A well-defined risk-to-reward ratio is visible.

Stop-loss appears to be placed below $853, protecting against a false breakout.

Target set around $939 aligns with a significant resistance zone, offering a potential reward.

Indicators

Positive price momentum is evident, with higher highs and higher lows forming.

Likely supported by broader market strength in tech stocks.

Next Steps

Monitor the price action for sustained movement above $870.

A retracement to retest the breakout level could provide a secondary entry.

Key resistance to watch: $900 and $939.

NFLX is poised for a bullish continuation, with the current setup offering a high-probability trade opportunity.

NFLX Jan 26th Update, Target got hitWe had a great bull flag setup going into the earnings.

Now the target got hit, will be watching for a retracement into early Feb and another push higher into Feb OPEX

Nothing bearish here to even try taking a short trade. There is still one more gap to close above the price, should be hit first before reversal starts.

Also the price might just consolidate/correct in time and push above to a new high. Any shorting should have solid stops

Impact of Netflix Subscription Increase on Stock PriceFirstly, let's acknowledge that as a leading global streaming platform, Netflix has experienced tremendous growth and success over the years. However, the recent announcement of a subscription price increase raises concerns about the company's future profitability and market dynamics.

While the subscription increase may seem logical to counter rising content production costs and maintain profitability, it is essential to consider the potential consequences. Historically, price hikes have been met with mixed reactions from subscribers. In some cases, these increases have resulted in customer churn as consumers seek alternative, more affordable streaming options.

Given the intensely competitive nature of the streaming industry, with established players like Amazon Prime Video, Hulu, and Disney+, it is essential to assess the potential impact on Netflix's subscriber growth. A possible slowdown in subscriber acquisition or an increase in customer churn could negatively impact the company's revenue and, consequently, its stock price.

Therefore, please exercise caution and consider holding off on buying Netflix shares until we have more clarity on the market's response to the subscription increase. Monitoring key metrics such as subscriber growth, churn rate, and competitive positioning will be crucial in making informed investment decisions.

As investors, it is our responsibility to assess risks and opportunities objectively. While Netflix remains a dominant player in the streaming industry, the potential repercussions of its subscription increase must be noticed. By adopting a wait-and-see approach, we can better evaluate the long-term implications on the company's financial performance and stock price.

In conclusion, I encourage you to exercise caution and closely monitor the developments surrounding Netflix's subscription increase. Holding off on buying Netflix shares until we have more visibility on its impact will allow us to make more informed investment decisions.

Concerns about Netflix's Future Subscription GrowthOver the past few years, Netflix has undoubtedly revolutionized how we consume entertainment. Its vast library of content and the convenience of on-demand streaming have attracted millions of subscribers worldwide. However, recent trends and market indicators raise questions about the sustainability of Netflix's exponential growth.

Firstly, the streaming landscape has become increasingly competitive. With the emergence of new players such as Disney+, Apple TV+, and Amazon Prime Video, the market has become saturated, leading to a fragmented audience. This intense competition poses a significant challenge for Netflix, as it struggles to retain its subscriber base while attracting new ones.

Moreover, the COVID-19 pandemic has temporarily boosted Netflix's subscriber numbers due to lockdown measures and increased demand for home entertainment. However, as the world gradually returns to normalcy, we cannot ignore the possibility of a decline in Netflix's subscriber growth. The return of outdoor activities, cinemas reopening, and live events resumption may divert consumer attention away from streaming platforms, affecting Netflix's long-term growth potential.

Additionally, the rising cost of content production and licensing rights is a significant financial burden for Netflix. While the company has successfully created original content, the competition for exclusive rights to popular shows and movies has become increasingly fierce, leading to soaring expenses. This escalating cost may hinder Netflix's ability to invest in new content and maintain its competitive edge in the long run.

Considering these concerns, I urge you to pause and reevaluate any long-term investment plans for Netflix. It is essential to assess the company's ability to sustain its growth trajectory amidst fierce competition, changing consumer preferences, and mounting financial pressures.

Concerns about Netflix's Future Subscription Growth - A Call to Pause Long-term Investment

As traders, we make informed decisions based on a comprehensive understanding of the market dynamics. I encourage you to explore alternative investment opportunities within the streaming industry or diversify your portfolio to mitigate potential risks associated with Netflix's uncertain future.

In conclusion, the future subscription growth of Netflix remains uncertain, given the intensifying competition, shifting consumer habits, and mounting financial challenges. It is crucial to exercise caution and carefully assess the risks before making any long-term investment commitments.

Research firm claims Netflix adding new subscribers According to a recent report by a research firm, Netflix has added a significant number of subscribers after their password crackdown.

This is excellent news for investors as it shows that Netflix is taking proactive measures to protect its content and attract new subscribers. As we all know, a growing subscriber base is crucial for the success of any streaming service.

With this in mind, I encourage you to consider investing in Netflix. The company has a proven track record of success and constantly innovates to stay ahead of the competition. By investing in Netflix, you can be a part of their continued growth and success.

I hope you will join me in investing in Netflix and taking advantage of this exciting opportunity. I look forward to your comments.

msn.com/en-us/money/technology/netflix-added-subscribers-after-password-crackdown-research-firm-says/ar-AA1cleMG?li=BB16M4hs

Predicting the future using the wolfe wave in Netflix?$NFLX The wolfe wave indicator is increasing in popularity as we continue to see more people using it and enjoying the results. NFLX has been traded aggressively in long puts and has done extremely well using the wolfe on shorter time frames. Now there is a massive setup for a gap fill down to 249 before filling any of the gaps above. The gaps that are above 300 will likely fill on the next earnings run up mid December or early January 2023. Be cautious of any dump first week of January 2023, which we would consider as a buying opportunity into earnings. Markets will pump and then dump.

Last week, there is a daily wolfe wave setup that triggered on Nov 16. The projected target is calculated by extending a linear line between pivot 1 and 4 and projecting the line. This is represented as the red perforated line, as shown in the chart. The projected target is around 252 but keep in mind the gap is at 249. I hope all of you bank on this!

$NFX battle of the ads in streaming..A bounce-back for Netflix (NFLX) shares seems to rest on the coming launch of ad-supported tiers for the two streaming leaders, Jack Hough writes in this week’s edition of Barron’s. For Netflix, the goal is to reverse subscriber losses with cheaper plans. For others like Disney+, it’s to offset a recent acceleration in cable cord-cutting. Much could go wrong in the near term for these companies and their rivals, the author notes. Yet, if the television industry is successful, it could not only rekindle growth, but also pull back power that has been lost to the closed-off advertising economies of Google (GOOGL) and Facebook (META). News source from tipranks.

In my prespective view. i think its a good idea for streaming services to add the advertisement since youtube already doing it. If NFLX will have a similar advertisement like youtube where you can skip the ads i dont think its not a bad idea since customer might use to youtube ads.

But it would come down to how the ads are setup for streamers.

The rectangle box is my support/resistance level

Below is my price level entry and exit for intraday or scalp play.

============================================================

For calls; buy above $245.50 and sell at 249.82 or above

For puts, buy below $236.73 and sell at $234.42 or below

============================================================

Bot generated technical analysis:

1st resistance level: 245.09

2nd resistance level: 249.09

1st support level: 231.57

2nd support level: 222.94

Welcome to this free technical analysis. ( mostly momentum play )

I am going to POST where i look for possibly entry and exit for intraday or scalp for trading.

i try my best to make the idea short and simple as possible.

If you have any questions or suggestions on which stocks I should analyze, please leave a comment below.

If you enjoyed this analysis, I would appreciate it if you smashed that LIKE or BOOST button and maybe consider following my channel.

thank you!

Netflix Analysis 11.02.2022Hello Traders,

welcome to this free and educational analysis.

I am going to explain where I think this asset is going to go over the next few days and weeks and where I would look for trading opportunities.

If you have any questions or suggestions which asset I should analyse tomorrow, please leave a comment below.

I will personally reply to every single comment!

If you enjoyed this analysis, I would definitely appreciate it, if you smash that like button and maybe consider following my channel.

Thank you for watching and I will see you tomorrow!

NETFLIX(NFLX) FUTURE PREDICTIONTechnical Analysis Summary (POLKADOT)

NTFX/USDT

TREND ANALYSIS

We have 3 upwardtrend which is currently active in green.

The wider the trend the longer it is respected.

FUTURE PREDICTIONS

We have to keep respecting and holding new weekly levels and maintaning the trend to keep moving upward.

ALL THE GREEN SUPPORT LEVELS SHOW HOW NETFLEX KEPT LADDERING AND RESPECTING NEW AND HIGHER WEEKLY LEVELS AND CREATING TIGHTER TRENDS.

Good luck everyone, stay safe!

If you need help don't hesitate to send me a message or comment

Trading Involves High Risk

Not Financial Advice

Exercise Proper Risk Management

$NFLXShares of Netflix (NASDAQ:NFLX) were up 4.8% as of 1:14 p.m EDT on Tuesday. The streaming media veteran saw a bullish earnings preview from analyst firm Cowen & Co., which included rosy results from Cowen's proprietary media viewership survey

In a third-quarter survey of 2,500 U.S. consumers, Cowen asked which media platform has the best video content right now.

Netflix led the pack with 28% of the vote, far ahead of YouTube's second-place tally of 15% and basic cable's third-place showing at 10%.

The "other" category, which includes social networks and various smaller video publishing platforms, added up to 13% of the vote.

Netflix was also found to be the leading service that consumers use most often for viewing videos, ahead of "other" platforms and basic cable.

This figure rose to 33% when zooming in on the important age group of 18- to 34-year-olds.

The stock reached another all-time high today, having posted a market-beating gain of 11% in the last three months.

Whether Netflix meets or misses Wall Street's expectations on Oct. 19, the stock is primed to make a big move on the news. Either way, Netflix remains one of my favorite stocks in the digital media space.

On the technical side of things Netflix is looking extremely bullish on the higher frames.

Breaking above previous resistance with a continuation up, I can’t see why this wouldn’t stop here.

It’s a little on the overbought side of things on the daily chart so could see slight pullbacks but overall should continue it’s way up.

MACD bullish.

RSI overbought.

Next point. $700

Watchlist this.

NFLX Long/Short?NFLX been having the same pattern for a long while now. But let the market pick the direction before entering a trade.

Bullish over 509, PT 520-525

Bearish under 491, PT 478.43-470

Still stuck in that channel wait for a break of the purple trendline for long, grey trendline for short. Also its tricky with vaccine and stim news. Who cares about NFLX now?!

NFLX AnalysisBeautiful setup on NFLX!

Ideal entry: 477.50 OR purple trendline

1st PT (safe exit): 505

2nd PT: 520

Final PT: 560 OR blue trendline OR ATH

I expect NFLX to reach ATHs by the end of Nov.

The best part about nflx is that it's lockdown proof. Meaning with a bullish market nflx goes up, even with bad covid news nflx still goes up.

NFLX Long 4:1 R:RNFLX is at support, which has held a few times already.

Although the recent news about Pfizer's vaccine had a negative impact, the company did benefit from subscriber growth during the pandemic and is in overall a good spot.

I see this trade as worth taking, considering the R:R ratio but will nevertheless be cautious, as tech might continue to trend down heavily duo to the vaccine news.