Ng1!f

NATGAS Massive Long! BUY!

My dear friends,

My technical analysis for NATGAS is below:

The market is trading on 3.072 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 3.428

Recommended Stop Loss - 2.914

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

———————————

WISH YOU ALL LUCK

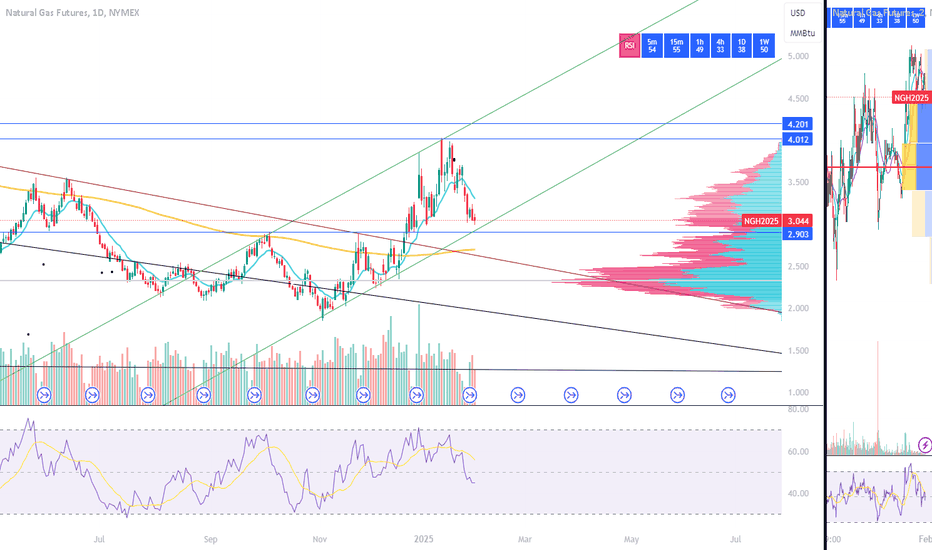

NATURAL GAS: Channel Down bottomed and is rebounding to 4.800Natural Gas is neutral on its 1D technical outlook (RSI = 47.119, MACD = -0.072, ADX = 39.523) as the bearish wave of the long term Channel Up found support on its bottom and the 1D MA100 and is rebounding. It hasn't yet crossed over the 1D MA50 but when it does the bullish signal will be validated. On any occassion, last time the 1D RSI rebounded near this level, it was on the October 18th and August 27th 2024 lows. Both later rebounded by at least +60.48%. We aim for a similar target (TP = 4.800).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

NATGAS: Trading Signal From Our Team

NATGAS

- Classic bullish setup

- Our team expects bullish continuation

SUGGESTED TRADE:

Swing Trade

Long NATGAS

Entry Point - 3.072

Stop Loss - 2.846

Take Profit - 3.554

Our Risk - 1%

Start protection of your profits from lower levels

❤️ Please, support our work with like & comment! ❤️

NATGAS Swing Long! Buy!

Hello,Traders!

NATGAS has lost almost

30% from the local highs

In no time so It is oversold

And as the Gas is about to

Retest the horizontal support

Of 2.948$ we will be expecting

A local bullish rebound

And a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

NATGAS Buyers In Panic! SELL!

My dear friends,

Please, find my technical outlook for NATGAS below:

The price is coiling around a solid key level - 4.010

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 3.872

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

———————————

WISH YOU ALL LUCK

NATGAS A Fall Expected! SELL!

My dear followers,

I analysed this chart on NATGAS and concluded the following:

The market is trading on 3.981 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 3.750

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

———————————

WISH YOU ALL LUCK

NATGAS Rising Support Ahead! Buy!

Hello,Traders!

NATGAS is trading in a

Rising opening wedge pattern

And the price will soon

Retest the rising support

Below so we are bullish

Biased and we will be

Expecting a move up

From the support line

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

NATGAS Technical Analysis! BUY!

My dear friends,

NATGAS looks like it will make a good move, and here are the details:

The market is trading on 3.916 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 4.025

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

———————————

WISH YOU ALL LUCK

NATURAL GAS Long-term buy on the next pull-back.Natural Gas (NG1!) broke this month above its 1W MA200 (orange trend-line) for the first time in two years (last January 2023). Naturally this is a very bullish signal for the long-term and it is more effectively put into context by using our infamous 'Multi-year Cycles', which we introduced on Natural Gas a few years back.

As you can see, every time NG broke above the 1W MA200 after a Support Zone rebound since 1990, it pulled back towards the 1W MA50 (blue trend-line) before resuming the uptrend for a new High.

As a result, we will wait for that right pull-back opportunity to buy and target at least 6.000, which should be achieved by December 2026, which is the Top of the Sine Waves Cycle.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

NG1! BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

We are going short on the NG1! with the target of 3.012 level, because the pair is overbought and will soon hit the resistance line above. We deduced the overbought condition from the price being near to the upper BB band. However, we should use low risk here because the 1W TF is green and gives us a counter-signal.

✅LIKE AND COMMENT MY IDEAS✅

NATGAS: Bearish Continuation & Short Signal

NATGAS

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short NATGAS

Entry Point - 3.981

Stop Loss - 4.130

Take Profit - 3.669

Our Risk - 1%

Start protection of your profits from lower levels

❤️ Please, support our work with like & comment! ❤️

Will Europe's Gas Gambit Reshape the Global Energy Landscape?In a bold move reverberating across global energy markets, Ukraine's decision to halt Russian gas transit on New Year's Day 2025 has ushered in a new era of energy geopolitics. This watershed moment not only challenges decades-old supply patterns but also tests Europe's resilience and strategic foresight in securing its energy future. The immediate market response, with gas prices surging to levels unseen since late 2023, underscores the significance of this pivotal shift.

Against this backdrop of uncertainty, Norway's Troll field has emerged as a beacon of hope, setting unprecedented production records and demonstrating Europe's capacity for strategic adaptation. With production reaching 42.5 billion standard cubic meters in 2024, this achievement showcases how technological innovation and operational excellence can help reshape traditional energy dependencies. Meanwhile, BMI's forecast of a 40% price increase for 2025 signals the complex interplay between supply disruptions, growing demand, and market expectations.

The transformation of Europe's energy landscape extends beyond mere supply chain reorganization. While countries like Slovakia, Austria, and Moldova face immediate challenges in securing alternative gas sources, the broader European response highlights a remarkable shift in energy security strategy. With storage facilities maintaining robust levels and infrastructure upgrades underway, Europe's energy transition demonstrates how geopolitical challenges can catalyze innovation and strategic resilience in the global energy sector.

NG1! SENDS CLEAR BULLISH SIGNALS|LONG

Hello, Friends!

NG1! pair is in the uptrend because previous week’s candle is green, while the price is obviously falling on the 9H timeframe. And after the retest of the support line below I believe we will see a move up towards the target above at 3.928 because the pair is oversold due to its proximity to the lower BB band and a bullish correction is likely.

✅LIKE AND COMMENT MY IDEAS✅

NatGAS is heating upA close above the white Center-Line projects higher prices to come.

There are 2 scenarios I see:

1. pull-back to the white CL, then up.

2. cross above the petrol CL, further and fast continuation to the north.

...oh, there's 3rd scenario:

3. price is getting punched back below the white Center-Line again. If that comes true, price has another chance to go south, with a target at the 1/4 line, or even way down to the L-MLH.