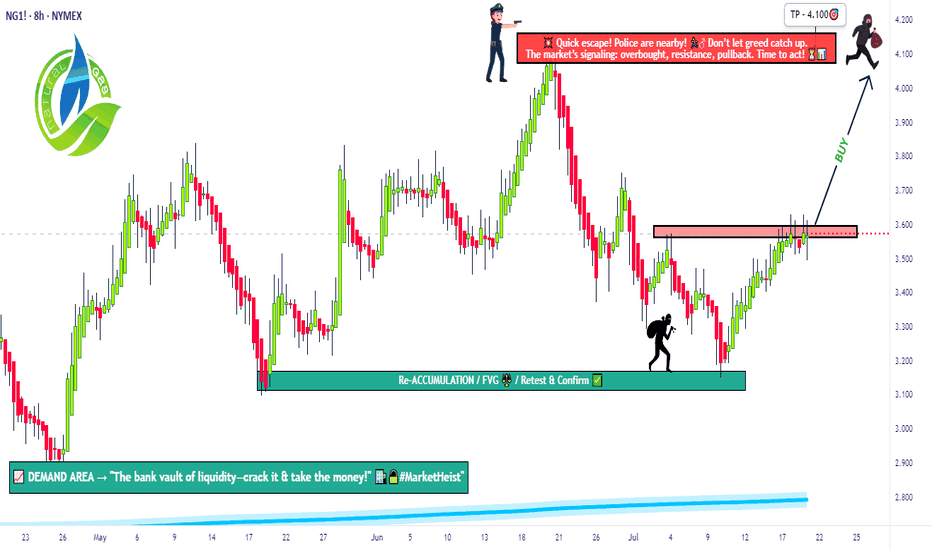

The Great Gas Heist: Load Your Longs Before It Blows💎🚨“Operation Gas Vault: NG1! Breakout Robbery Blueprint”🚨💎

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Welcome to all my Market Hustlers & Silent Robbers 🕵️♂️💼💰

Today’s target: NG1! Henry Hub Natural Gas Futures

📍Strategy: A bullish heist mission with a calculated escape plan.

🔥Thief Trading Blueprint: Gas Market Heist🔥

🎯 Entry Gameplan

“The vault cracks open at 3.630 – That’s your cue.”

Wait for resistance breakout 🧱 (around 3.630) – that’s the signal.

Set Buy Stop orders above the Moving Average.

Or, use a layered DCA entry via Limit Orders near swing highs/lows (15m or 30m timeframe).

Thief Tip: Set an alert/alarm so you don’t miss the breakout bang 🔔💥

🛡 Stop Loss Setup (Post-Breakout Only!)

“Don’t be reckless. No SL before breakout — wait for confirmation.”

SL Location: Swing low (4H) near 3.370.

Set SL after breakout happens, not before.

Adjust based on your risk tolerance, lot size & number of open entries.

⚠️ Placing early SL = triggering the trap before the door opens.

🏴☠️ Loot Target 🎯

Take Profit Zone: 4.100

Escape Tip: No need to be greedy. Take profit before the police arrive (resistance)!

🧲 Scalper’s Shortcut

Only go Long – avoid fighting the current.

If you’ve got cash flow, strike early. If not, ride with the swing crew.

Use trailing SL to protect your stack 💼📉

📊 Fundamental Clues Behind the Heist

The gas vault is heating up thanks to:

🔥COT Reports

🛢 Inventory & Storage data

📈 Seasonal trends

💹 Sentiment flows

⚖ Intermarket linkages

Checkk your own global indicators 🌍🔗 – don’t enter blindfolded.

🗞️ News Traps & Position Protection

Avoid new entries during major news releases 📰🚫

Trail stops to guard running positions

Markets react fast. Adapt even faster.

⚠️ Disclaimer: This is educational info, not personal investment advice. Your money, your risk, your decisions.

💥 Support the Robbery Squad 💥

If you vibe with the Thief Trading Style, smash that Boost Button 💖

Grow the gang, expand the vaults, and master this money maze together! 🤑🏆🚀

Stay tuned – another heist plan is on the way.

Until then, trade smart, trade sharp. 👊🕶💼

🔒#NaturalGas #ThiefTrading #BreakoutStrategy #SwingTrade #FuturesHeist #NG1Plan #RobTheMarket

Ngaslong

Natural Gas is in the Buying DirectionHello Traders

In This Chart NATGAS HOURLY Forex Forecast By FOREX PLANET

today NATGAS analysis 👆

🟢This Chart includes_ (NATGAS market update)

🟢What is The Next Opportunity on NATGAS Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

XNG/USD "Natural Gas" Energy Market Robbery (Bullish Plan)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XNG/USD "Natural Gas" Energy Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (3.700) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 4H timeframe (3.300) Day/Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 4.200 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💨⛽XNG/USD "Natural Gas" Energy Market Heist Plan (Swing / Day Trade) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Inventory and Storage Analysis, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Natural Gas ( XNGUSD ) Buy Opportunity Current Price: $3.267

Setup: Natural Gas is bouncing off a strong demand zone and respecting the ascending trendline support, indicating potential for a bullish move. The RSI is turning upwards, suggesting momentum in favor of buyers.

Entry: $3.267

Stop Loss: $3.15 (below demand zone and trendline support for safety)

Take Profits:

TP1: $3.36

TP2: $3.55

TP3: $3.98

Why Buy?

Price is rebounding from a solid demand zone.

Clear respect for the trendline, confirming bullish sentiment.

Rising RSI signals growing momentum for a move higher.

Up to 7,200 USD profit per lot!

$1,100 Risk per lot !

🎯 Plan your trade and manage your risk! Let’s make some great trades together! 💹

Natural Gas Bullish OpportunityWhy the Bullish Sentiment?

🌬 Cold Weather Incoming: Frigid forecasts are set to spike heating demand, boosting natural gas consumption.

🌍 Global LNG Demand: International markets, particularly Europe and Asia, are tightening the supply, fueling upward pressure.

📉 Lower Storage Levels: US inventories are running below the 5-year average, creating a potential supply crunch.

⚠️ Geopolitical Tensions: Supply concerns in Europe continue to drive bullish sentiment, making natural gas an attractive play.

With all these factors aligning, the stage is set for a potential rally! 📈

Entry: 3.40 USD.

Take Profit Levels:

🎯 Take Profit 1: 3.49 USD

🎯 Take Profit 2: 3.61 USD

🏆 Take Profit 3: 3.81 USD

Stop Loss: Set your safety net at 3.25 USD, just below the support level. 🛡

Where do you think Natural Gas will go?

Cold Weather Sparks Natural Gas Rally – $5+ in Sight!🔥 Natural Gas Breaks Out – Bulls Charge as Cold Weather Fuels Demand! 🔥

Natural Gas Futures are soaring, backed by January’s colder-than-expected weather forecasts driving heating demand. The breakout above the critical $3.614 level signals powerful bullish momentum, with prices now trading around $3.8610 .

🚀 Why This Rally is Just Getting Started:

$3.614: A Key Level Overcome

Previously a strong resistance, this level had historically acted as support. Its decisive break confirms a shift in market dynamics and solidifies the bullish trend.

Gap to Be Filled at $4.1681

A price gap at $4.1681 suggests a strong upward magnet, as markets often seek to close such gaps. This aligns perfectly with the next major resistance target.

🌟 Trade :

Current Price: $3.8610

Take Profit 1: $4.1681 – The gap-fill level and next major resistance zone.

Take Profit 2: $5.3064 – A long-term target if cold weather continues to drive demand.

Stop Loss: $3.4300 – Protect your capital below this level, as it marks the lower boundary of this bullish momentum.

Natural gas is heating up, and the market is poised for an extended rally. The breakout above a historically significant level, combined with the gap at $4.1681, underscores strong bullish potential. With January’s cold weather expected to persist, this rally could have plenty of room to run.

The bulls are in control – ride the wave to new highs! 🐂🔥

NGAS - UniverseMetta - Signal#NGAS - UniverseMetta - Signal

D1 - Potential rebound from the level, after the impulse correction.

H4 - Formation of the 3rd wave with an exit from the descending channel. You can try to consider an entry from the current levels or wait for the formation of the pattern

Stop for the 2nd wave on H4.

Entry: 2.3492 - *2.3683

TP: 2.3953 - 2.5080 - 2.6169 - 2.8299

Stop: 2.3064

NGAS (Henry Hub) - NO LOSS Trade OpportunityFrom the highest of 10 mark till the lowest of 1.5.. at the moment Natural Gas is giving the golden opportunity to buy and accumulate for apparently 1-2 months of holding with a good reward of 1:4+.

This is literally a NO LOSS Trade but for those who can wait patiently for a golden reward

Good Luck!

XNG/USD "NATURAL GAS" Robbery plan in Long SideHola ola My Dear,

Robbers / Money Makers & Losers,

This is our master plan to Heist XNG/USD "NATURAL GAS" Mines based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Note: If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money.

Entry : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low

Stop Loss : Recent Swing Low using 2h timeframe

Warning : Fundamental Analysis comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

NGAS - UniverseMetta - Analysis#NGAS - UniverseMetta - Analysis

Continuation of the trend - potential 5th wave, consolidation behind the trend line. The structure may continue and allow the price to continue its momentum towards the level of 4.16. In order not to increase risks, it is better to consider an exit when it consolidates or breaks through the support level of 1.98. Local goals 2.75. Next, a correction may form, since there were rebounds from these levels.

Target 2.75 - 4.16

NG is a buy with S/L 2.69Entry Price: Enter the trade at the current market price of 2.80.

Stop Loss: Place a stop-loss order at 2.69, which is slightly below the recent support level. This will limit your potential losses if the price of NG falls unexpectedly.

Target Prices: Take partial profits at the first target price of 3.00 and consider trailing the stop-loss to lock in profits. The second target price of 3.20 can be used as an exit point for the remaining position.

💡 Don't miss the great Buy opportunity in NG1!(Gas)Hi everyone

It seems that we have to wait for an increase in gas prices in the coming months. If there are no special problems, I think we can predict the price of 3.6 dollars for gas.

Do you agree with my opinion? Please support me with likes and comments.

NatGas: Take-off 🛫The price of NatGas has gained significantly again since Friday and could thereby move further away from the support at $2.48. Thus, we assume that it has already left the white wave (2) and is ready for high flights. For the white wave (3), it must rise significantly above the resistance at $2.75. After the completion of this wave, we expect a small correction and then another significant rise in the form of the white wave 5. Hence, we see a lot of movement on the upside at the moment. However, it should be noted that there is still an alternative scenario with a probability of 28%, which occurs if the price now falls contrary to our expectations. Then it would first have to fall below the support at $2.48.

Natural Gas Future Outlook Weekly /Daily S&R Technical Analysis - AMEX:NG Finally got a 4 hour uptrend need more follow through tomorrow to confirm

- likely heading to $2.5 if 4 hour uptrend confirm follow through tomorrow

- tradeable ticker AMEX:UNG and AMEX:BOIL still use the NG chart if you are trading natural gas.

second chart is a charm... NG bounce or another free fallSeems like Germany bought at whatever price the Gas was, hence the previous rally, and preparing soon to rebuy (it is still cold in here).

If the 786 fib is not the bottom, i will let this one go and possibly revisit it if my SL gets hit again 2635. ~ DYOR.

note... DXY might also have to wake the hell up (similar trend on both).

💡 (NGas) NG1! Will it be ready for upside ?Hello every one

If the triangle seems to be broken, maybe the gas will return from these price ranges, and I think there is a high probability that we are now at the bottom of the gas price. A triangle has been drawn that if the candles leave the upper part of the triangle, there is a possibility of an upward trend. Be sure to keep an eye on the chart and don't miss this wonderful opportunity.

What do you think? I'm happy to comment❤️🌹