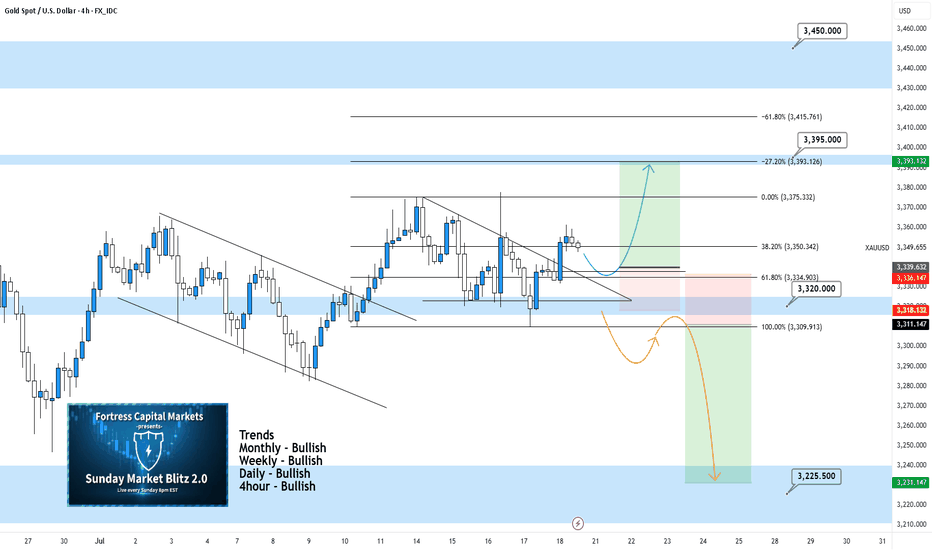

XAUUSD 4Hour TF - July 27th, 2025XAUUSD 7/27/2025

XAUUSD 4 hour Neutral Idea

Monthly - Bullish

Weekly - Bullish

Daily - Bullish

4hour - Bearish

Last week we saw a perfect setup playout and then it retraced 100% to close out the week. This is looking more bearish on the 4Hour timeframe now but we need to see how price action reacts at the 3,320 support zone first.

Here are two potential scenarios we want to see for the week ahead.

Bullish Reversal - If we are to see gold as bullish again we would ideally like to see some consolidation at the current level followed by strong bullish conviction.

We need to see convincing price action before we can begin targeting higher. Consolidation + Bullish conviction will be our best chance at a long position.

Bearish Continuation - The 4hour sure looks bearish but will it sustain? Looking ahead into the week we want to see price action push below 3,320 with bearish structure below.

I would also like to see a pattern or a few hours to a day of consolidation below 3,320. If this happens we can begin to target lower toward major support levels like 3,225.

Nickdarcfx

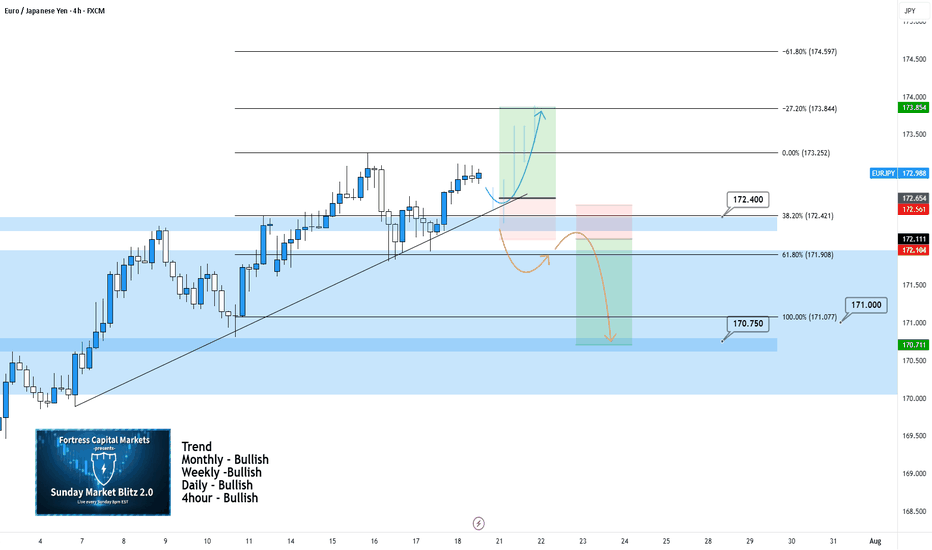

EURJPY 4Hour TF - July 27th, 2025EURJPY 7/27/2025

EURJPY 4hour Bullish Idea

Monthly - Bullish

Weekly - Bullish

Daily - Bullish

4hour - Bullish

All timeframes suggest we are bullish and after last week that is clear. We’re expecting a bit of a pullback but let’s get into two potential setups for the week ahead:

Bullish Continuation - If we are to continue with the bullish trend we would like to enter a trade at the next point of structure. In this scenario, the next point of structure would be a higher low as close to 172.250 support & our 61.8% fib level as possible.

Look to target higher toward our -27% fib level if this happens.

Bearish Reversal - For us to consider EJ bearish again we would need to see a strong break below our support at 172.250.

If we see bearish structure below this zone we can say price action will most likely fall lower, potentially down to 170.750.

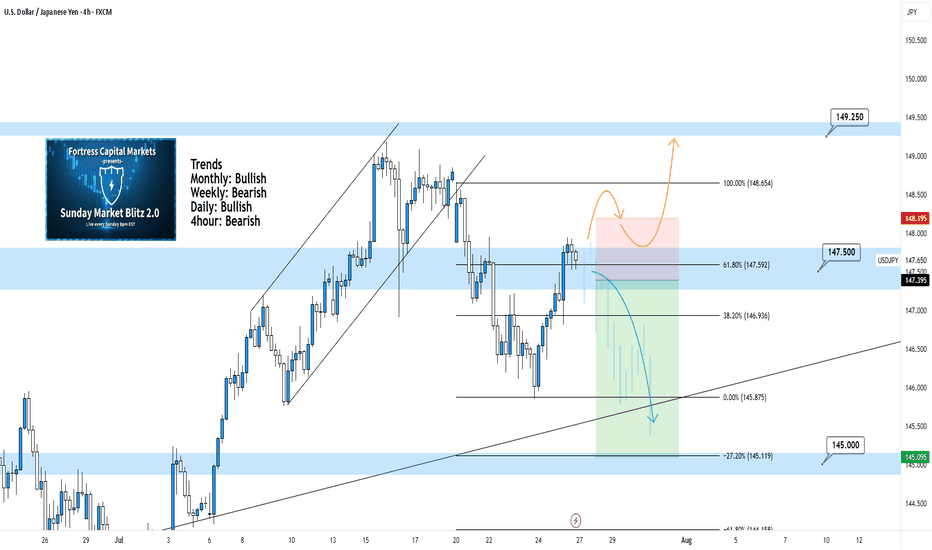

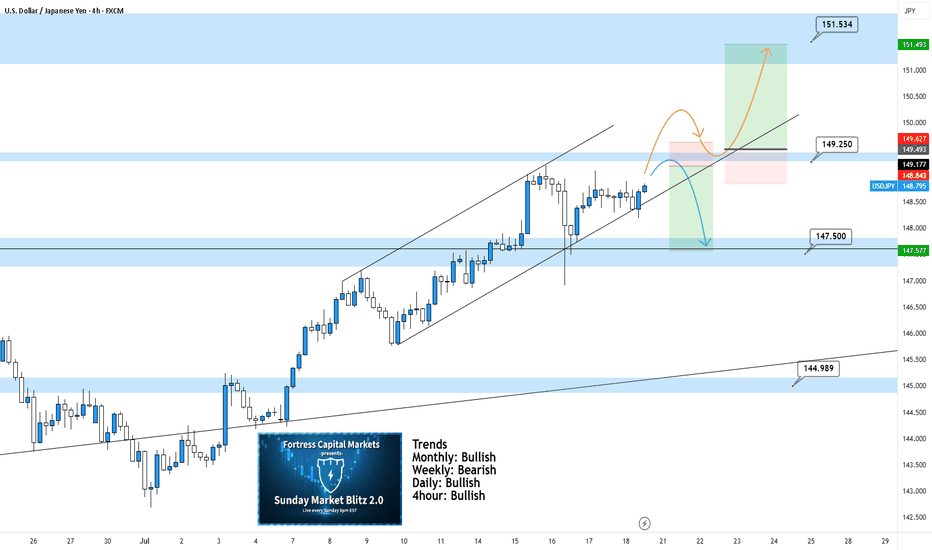

USDJPY 4Hour TF - July 27th, 2025USDJPY 7/27/2025

USDJPY 4Hour Neutral Idea

Monthly - Bullish

Weekly - Bearish

Daily - Bullish

4Hour - Bearish

We’re getting some mixed signals going into this week on UJ but it does look primarily bearish, especially after the move last week.

Currently price action is resting at 147.500 and we’re waiting to see if it will hold as resistance.

Here are two potential ways price action could play out for the week ahead:

Bearish Continuation - This is the most likely based on the context clues of last week. We’re clearly bearish and that lines up with the DXY bias at the moment.

For us to spot a confident short position on UJ we would need to see some bearish conviction coming off our 147.500 zone. We could see this happen after some consolidation or immediately so be cautious and be patient.

Bullish Reversal - This is the only bullish set up I'd be interested in if it plays out. We need to be convinced price action will move higher so I would need to see a significant push above 147.500 resistance with new structure in the form of higher low above. I’d look to target higher toward key levels of resistance if this happens.

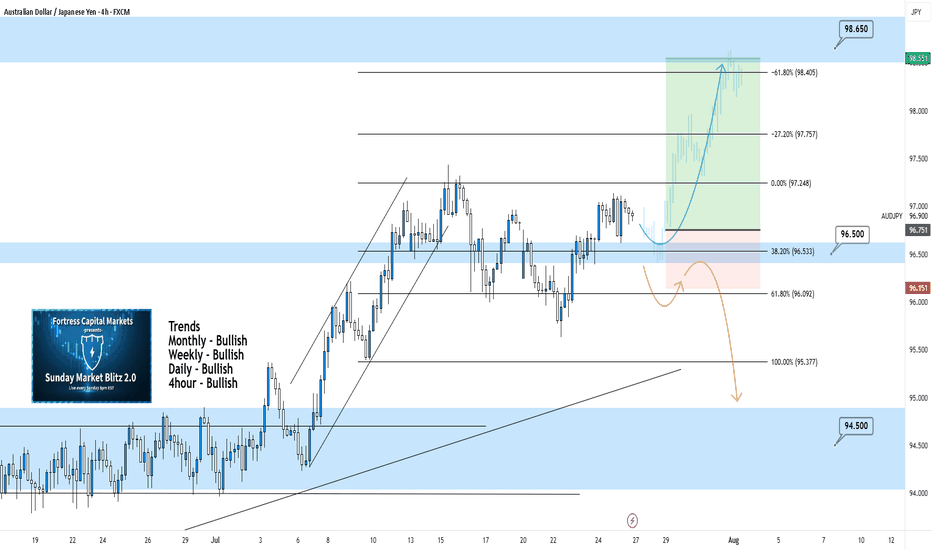

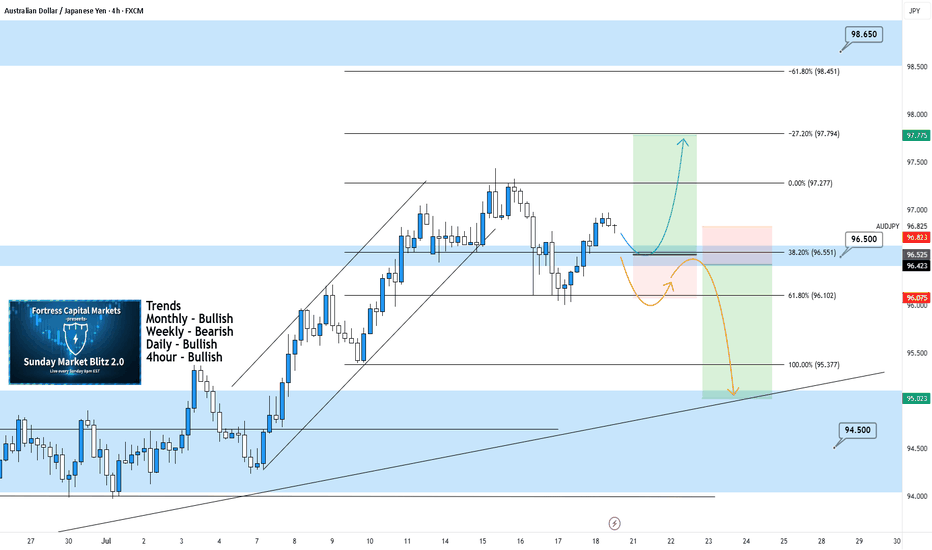

AUDJPY 4Hour TF - July 27th, 2025AUDJPY 7/27/2025

AUDJPY 4hour Bullish Idea

Monthly - Bullish

Weekly - Bullish

Dailly - Bullish

4hour - Bullish

We’re looking bullish again on AUDJPY for the week ahead, but will it stick? The overall higher timeframes suggest we are bullish as well but we will need to see key structure before entering any trades. Let’s take a look at two potential scenarios we would want to see happen this week.

Bullish Continuation - We ended last week in a perfect spot, right above our 96.500 zone. This leaves us in a position for a potential long opportunity where we only need to see 1 or two more forms of confirmation.

Look for our 96.500 zone to be tested and held as support. If this happens and we can confirm a higher low above 96.500 we’ll be looking to enter and target higher toward major levels of resistance like 98.650.

Bearish Reversal - For us to consider AJ bearish again we would need to see a strong break below the current zone at 96.500.

Look for signs of structure (LL, LH) to form below the current zone. If this happens we can consider targeting lower toward major levels of support like 94.500

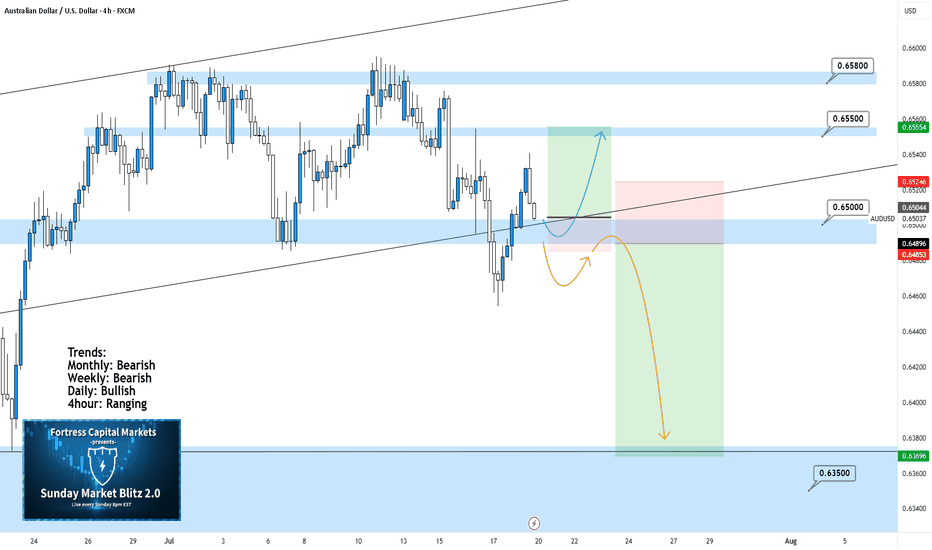

AUDUSD 4Hour TF - July 27th, 2025AUDUSD 7/27/2025

AUDUSD 4hour Bullish idea

Monthly - Bearish

Weekly - Bearish

Dailly - Bullish

4hour - Bullish

AUDUSD is holding steady in this weekly channel but has been showing signs of high volume ranging over the last month. Going into this week we’re looking mostly bullish but we have some minor zones that could slow price action down.

Here are two scenarios we are looking out for, for the week ahead:

Bullish Continuation - This is our ideal scenario as we want the trend to continue so we can have the best quality trade. For us to get comfortable going long AU we need to see structure above our 0.65800 zone. We want to see price action use this zone as support and establish structure (the next higher low).

If this happens we can look to target higher toward major resistance levels and key fib levels.

Bearish Reversal into range - If we fail to see bullish conviction at the current zone it’s possible price action will fall back into the range. This is a likely scenario as we have seen price action bounce between 0.65800 and 0.65000 multiple times over the last month.

I wouldn’t recommend trading this scenario as I don’t like trading ranges but we could see price action head lower to 0.65000.

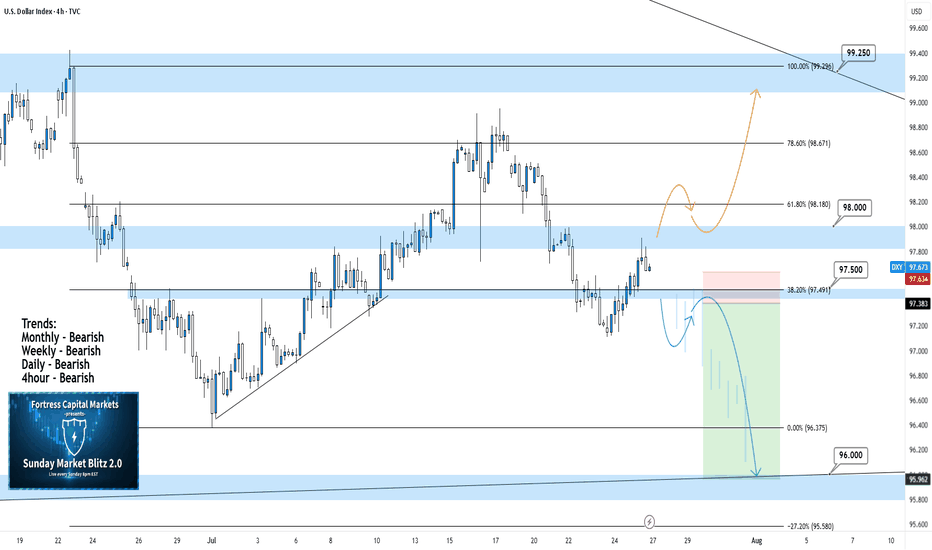

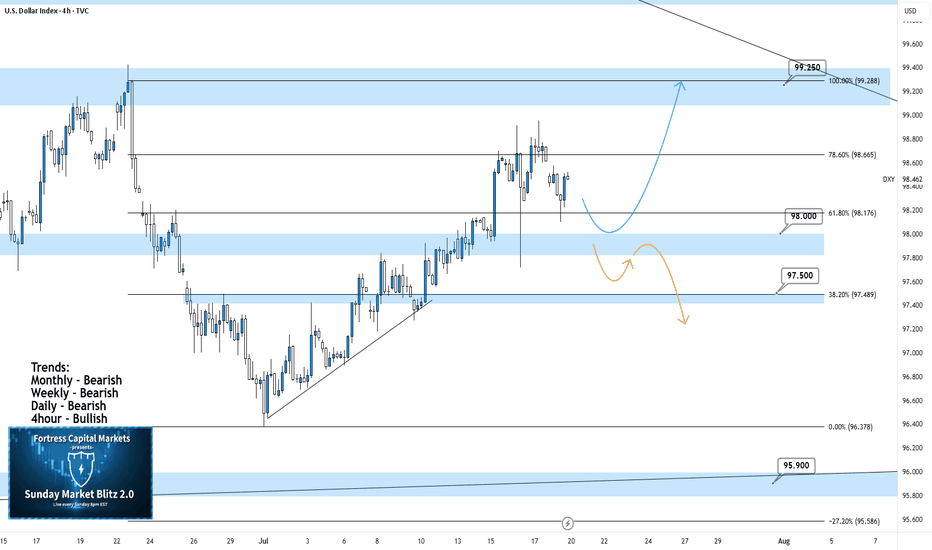

DXY 4Hour TF - July 27, 2025DXY 7/27/2025

DXY 4hour Bearish Idea

Monthly - Bearish

Weekly - Bearish

Dailly - Bearish

4hour - Bearish

**We analyze DXY as an indicator of USD strength on a week to week basis**

This week is looking like we can expect bearish momentum on USD but here are two scenarios breaking down the potential:

Bearish Continuation - USD pulled a strong bearish reversal all last week which pushed us below our major 98.000 support zone.

We are now testing that same 98.000 zone as resistance and are looking to see if it will hold. Ideally, we can confirm further bearish structure to gain confidence in a bearish USD for the week ahead.

Bullish Reversal- For us to consider DXY as bullish again we would need to see bullish structure above our 98.000 zone. This would include: A break back above 98.000 with an established HH and HL.

XAUUSD 4Hour TF - July 20th, 2025XAUUSD 7/20/2025

XAUUSD 4 hour Long Idea

Monthly - Bullish

Weekly - Bullish

Daily - Bullish

4hour - Bullish

GOLD,GOLD,GOLD. This thing has been bullish on all timeframes and doesn’t really show any signs of stopping just yet.

We can see two scenarios for the week ahead so let’s dive in:

Bullish continuation - Price action on gold is breaking out of a descending triangle pattern. This is a strong bullish move but for us to consider trades we want the confirmation.

Look for a retest of our 61.8% fib level and mostly recently broken structure. If we can spot bullish conviction coming off this level we can then consider targeting higher resistance levels like 3.395.000. Our -27% fib level lines up with this zone as well.

Bearish Reversal - For us to consider Gold bearish again we would need to see something very convincing. If we did see a break below 3,320.000 with a confirmed lower high I would then consider short scenarios.

Look to target toward major support levels on the way down to 3,225.000, our next monthly support zone.

EURJPY 4Hour TF - July 20th, 2025EURJPY 7/20/2025

EURJPY 4hour Bullish Idea

Monthly - Bullish

Weekly - Bullish

Daily - Bullish

4hour - Bullish

Bullish Continuation - This is the most likely scenario for EJ this week as nothing suggests anything other than Bullish activity.

EJ could take off right at market open and start pushing up without giving us a retest to enter on. If we do get some sort of retest or pullback, look for rejection as close to 172.400 as possible before looking long.

If this does execute it looks like it will be a very small window of opportunity to enter. Trade cautiously with EJ in this bullish scenario.

Bearish Reversal - This scenario is less likely but is much more favorable in my opinion.

For us to consider EJ bearish we would need to see a clear break below 172.400 with a lower high below. This would give us enough confidence to consider short scenarios and start looking lower toward major support levels like 170.750.

USDJPY 4Hour TF - July 20th,2025USDJPY 7/20/2025

USDJPY 4Hour Neutral Idea

Monthly - Bullish

Weekly - Bearish

Daily - Bullish

4Hour - Bullish

UJ is looking better than a couple weeks ago and at least we can spot some decent setups for the week ahead. These are NOT perfect setups but we have two scenarios that we are ready for if price action shows it is ready too. Here are the two scenarios we’re looking at for the week:

Bullish Continuation - We can see UJ in a nice 4hour channel but we are currently seeing a bit of flat price action. For us to consider UJ long setups again we would need to be convinced. Look for a break above our 149.250 zone with a confirmed higher low above. This would be enough to consider longs and target higher toward key levels of resistance.

Bearish Reversal - If price action continues to stall, this bearish setup will become more and more likely. Ideally, we want to see some strong rejection from our 149.250. If this happens look to target lower toward 147.500.

AUDJPY 4Hour TF - July 20th,2025AUDJPY 7/20/2025

AUDJPY 4hour Bullish Idea

Monthly - Bullish

Weekly - Bearish

Dailly - Bullish

4hour - Bullish

We’re looking mostly bullish on AJ going into this week but will this 96.500 hold as support? Let’s take a look at two potential scenarios for the week ahead:

Bullish Continuation - This is the most likely for AU this week according to the trends in play. For us to get confident in long scenarios, we would like to see strong bullish rejection from support around 96.500. If this happens look to target higher toward our negative fib levels and key resistance.

Bearish Reversal - For us to consider AJ bearish for the week, we would need to see some bearish pressure step in and push us below 96.500. If this happens we only need confirmation in the form of a lower high below 96.500.

Look to target lower toward major support levels like 94.500 area if this happens.

AUDUSD 4Hour TF - July 20th, 2025AUDUSD 7/20/2025

AUDUSD 4hour Neutral idea

Monthly - Bearish

Weekly - Bearish

Dailly - Bullish

4hour - Ranging

We’re looking at a fairly large range here on AU and although the higher timeframe suggests a potential bearish move, I am unsure until we have some clarity around 0.65000. Here are two scenarios that break down what could happen this week and how 0.65000 plays into it:

Range Continuation - Since late June we have seen price action establish this large range and stick to it (0.65800 Resistance & 0.65000 Support).

Currently, we can see price action attempting to break 0.65000 support but it has not done so yet. If we don’t break below 0.65000 early this week it is very likely we will see a rally into the top of the range.

Bearish Breakout - This is the setup we want to see play out this week as it presents a beauty of a trade.

For us to see AU as bearish on the 4hour we need to see a clear break below 0.65000 with a confirmed lower high below. If this happens look to target toward major support levels like 0.63500 area.

DXY 4Hour TF - July 20th, 2025DXY 7/20/2025

DXY 4hour Neutral Idea

Monthly - Bearish

Weekly - Bearish

Dailly - Bearish

4hour - Bullish

Higher timeframe trend analysis suggests that DXY is primarily bearish and is currently retracing to potential resistance.

Going into this week we are looking to see if our 98.000 zone will stay as support or transition into resistance. Here are two scenarios which highlight both a bullish and bearish outcome:

Bullish Continuation - Last week we saw a strong rally through our 98.000 zone which seems to still be holding. If this 4hour bullish trend is to continue we would like to see some sort of rejection off 98.000 support while also confirming a higher low. If this happens look to target higher toward major resistance levels like 99.250.

Bearish Reversal- If we are to consider DXY bearish again on the 4hour we would need to see a break below 98.000 support and confirm this level as new resistance.

There are a few major support levels to watch out for but DXY has the potential to fall dramatically if we see price get below 97.500.

XAUUSD 4Hour TF - July 13th, 2025XAUUSD 7/13/2025

XAUUSD 4 hour Long Idea

Monthly - Bullish

Weekly - Bullish

Daily - Bullish

4hour - Bullish

Gold is looking pretty bullish this week as we saw a significant push above our 3,320.000 resistance zone. Looking to ride that same trend through this next week.

Bullish continuation - After a nice rally last week gold looks primed for another long setup. Ideally, price action goes for the retest of 3,320.000 and forms a higher low. This would confirm bullish structure and we can begin targeting higher toward major levels of resistance.

Bearish Reversal - For us to consider bearish setups we would first need to see a break back below 3,320.000 followed by a confirmed lower high. If this happens we can consider short positions and look to target lower toward major levels of support.

EURJPY 4hour TF - July 13th, 2025EURJPY 7/13/2025

EURJPY 4hour Bullish Idea

Monthly - Bullish

Weekly - Bullish

Daily - Bullish

4hour - Bullish

EJ has been paying out for the last couple weeks and the analysis has been spot on for these setups. Going into this week though we’re starting to get a bit uncertain. The fact that we’ve been in a rally since late June leaves me wondering how much more EJ has in it before a correction. So I think this week warrants some caution on EJ especially as we remain around this monthly 171.000 zone.

Let’s keep a look out for two potential scenarios going into this week:

Bullish Continuation - This is the most likely scenario and this idea lines up with all the major trends as well. For us to comfortably consider long setups I’d like to see a clear break above 172.400 zone / our 0% fib level followed by a retest for confirmation. This is what we would like to see but keep in mind price action has been moving aggressively and may not provide a retest.

Bearish Reversal into Range - This is a possibility but could also be a sign of consolidation around 171.000. There may be a decent short opportunity if we see the right kind of rejection/reversal from 172.400. In this scenario, it looks like this would be a potential range trade and I wouldn’t try to repeat this setup more than once.

USDJPY 4Hour TF - July 13th, 2025USDJPY 7/13/2025

USDJPY 4Hour Neutral Idea

Monthly - Bullish

Weekly - Bearish

Daily - Bearish

4Hour - Bullish

Finally UJ is looking more clear. We’re now able to drop to the 4Hour instead of the Daily TF due to price action reaching a major zone of anticipated reactions.

As always we’re looking at two trade scenarios going into the week ahead:

Bullish Continuation - UJ is currently sitting at 147.500 resistance and closed there last week. Going into this week we could see the bullish trend continue but we would need to see a clear break of 147.500 resistance to gain confidence. Look for a higher low confirmed above 147.500 followed by strong bullish setups to enter long on. Look to target higher toward major resistance levels like 149.250 area.

Bearish Reversal: Despite the strong bullish momentum we saw from last week, a reversal is still possible as price action is near our 147.250 zone. In order to consider bearish setups we would need to see strong rejection from the current level of resistance. Look to target lower toward 145.000 support.

AUDJPY 4Hour TF - July 13th, 2025AUDJPY 7/13/2025

AUDJPY 4hour Bullish Idea

Monthly - Bullish

Weekly - Bearish

Dailly - Bearish

4hour - Bullish

Looking good on AJ! Last week’s analysis played out perfectly and we can see going into this week we have a similar scenario.

Here are the two potential trade paths for the week ahead:

Bullish Continuation - This is the most likely scenario going into this week as we just broke our 96.500 resistance and are now testing it as support. If we can confirm a higher low with strong bullish conviction we can look to enter long and target higher toward major resistance levels.

Bearish Reversal - For us to consider AJ bearish we would first need to see a break back below 96.500. If we can spot a clear trend change and some lower highs below 96.500 we can begin looking short. Target lower toward major support levels if this happens.

AUDUSD 4Hour TF - July 13th,2025AUDUSD 7/13/2025

AUDUSD 4hour Bullish idea

Monthly - Bearish

Weekly - Bearish

Dailly - Bullish

4hour - Bullish

We’re looking like we’re back to bullish after last week. The 4Hour timeframe has been moving up nicely and as of last week we’re sitting just below 0.65800. Going into this week we’re looking mainly bullish but we are still going to mark up two potential scenarios:

Bullish Continuation - This is looking like the most likely scenario. Ideally, price action pushes above 0.65800 then retests as support and confirms the next higher low. I’d be interested in positions as the higher low is forming and as I can spot bullish conviction to enter long on.

Bearish Reversal - Even though it’s likely we will continue bullish, a reversal is still possible as nothing is definite. For us to consider bearish setups we would need to see a break below 0.65500 with a retest of that zone as new resistance. Look for a lower high to short on below 0.65500.

DXY 4Hour TF - July 13th, 2025DXY 7/13/2025

DXY 4hour Neutral Idea

Monthly - Bearish

Weekly - Bearish

Dailly - Bearish

4hour - Ranging

Keep in mind, we analyze and follow DXY more so as an indicator. The USD makes up for a large portion of trade so it makes sense to analyze it.

Going into this week we can see DXY made an attempt to push higher. Where it closed on Friday is a major zone around 98.000. We’re still majorly bearish on higher time frames so we will keep that in mind throughout this week.

As always, we will mark up two potential paths for this week, they are as follows:

Bullish Breakout - The two main zones we want to bring out attention to are 98.000 resistance and 97.500 support. We will have to wait until price action leaves this area to spot a high quality setup. Look for a convincing push above 98.000 resistance followed by a retest of 98.000 but as support. Look for a higher low to form with bullish confirmation to long on.

Bearish Continuation- Going bearish is still very possible we just need to clear 97.500 support first. Look for a break below 97.500 with a confirmed lower high and convincing bearish setups to short on.

XAUUSD 4Hour TF - July 6th, 2025XAUUSD 7/6/2025

XAUUSD 4 hour Long Idea

Monthly - Bullish

Weekly - Bullish

Daily - Bullish

4hour - Bullish

Back to bullish here on Gold but that comes as no surprise when you look at the higher timeframe trends.

I’m mainly considering long scenarios for the week ahead but let's take a look at two for the week ahead:

4hour bearish continuation - Currently we can see price action broke above 3,320.00 resistance and is currently looking to find some footing. We’re keeping an eye out for higher lows at or near this level to then consider long scenarios. 3,395.000 seems like a good target but gold has potential to go higher.

4hour trend reversal - If we are to consider short positions on gold we would need to see a break back below our 3,320.000 zone. Look for confirmed lower highs below 3,320.000 and target lower key support levels if this happens.

EURJPY 4Hour TF - July 6th, 2025EURJPY 7/6/2025

EURJPY 4hour Bullish Idea

Monthly - Bullish

Weekly - Bullish

Daily - Bullish

4hour - Bullish

EJ is doing it’s thing and sticking with it’s bullish trend for now. The only conflicting signal is this major monthly zone around the 171.000 area so we will have to be careful.

Let’s keep a look out for two potential scenarios going into this week:

Bullish Continuation - We just saw a break above the 169.750 4hour zone which is fairly significant and it is signaling new support for this currently forming higher low, which is great. From here we’re looking for this bullish trend to continue, look for strong bullish conviction coming off this 169.750 zone and look to target higher.

Trend Reversal - This is a possibility with our 171.000 looming overhead. If we start to see bearish rejection look for a lower high below 169.750 and look to target lower toward key support levels.

USDJPY Daily TF - July 6th, 2025USDJPY 7/6/2025

USDJPY Daily Neutral Idea

Monthly - Bullish

Weekly - Bearish

Daily - Bearish

We’re still on the daily timeframe with UJ as there is nothing worthwhile. We are clearly in some daily consolidation phase and price action has no clear direction from a swing perspective.

Bearish Continuation - For us to consider a bearish continuation, which is the most likely, we would like to see a retest of our 147.500 zone followed by strong bearish rejection. If we can spot rejection around the 147.500 zone it could present some decent short positions. I’d be looking to target lower toward key support levels.

Aside from this potential setup i’m not looking at any other scenarios for UJ.

AUDJPY 4Hour TF - July 6th, 2025AUDJPY 7/6/2025

AUDJPY 4hour Neutral Idea

Monthly - Bullish

Weekly - Bearish

Dailly - Bearish

4hour - Ranging

We’re getting some mixed signals here on AJ so i’ll keep this as a neutral idea as we need more info from price action. Most of the major trends seem bearish but the 4hour trend seems to have some bullish pressure. Let’s see how this could play out this week:

Bullish Breakout - We already saw a pretty significant bullish attempt to break out of this range around 94.500. If we can spot some bullish conviction, now that we're retesting what seems to be a broken range, then we can confirm a bullish 4hour trend and prepare for potential long scenarios. I’ll be looking higher toward key resistance around 96.500 if this happens.

Bearish Breakout - For us to consider comfortable bearish scenarios, we would need to see price action fall back through our 94.500 zone and form a lower high. If we see structure formed below 94.500 we can begin targeting lower for potential short positions. Look toward key support levels as targets.

AUDUSD 4hour TF - July 6th, 2025AUDUSD 7/6/2025

AUDUSD 4hour Neutral idea

Monthly - Bearish

Weekly - Bearish

Dailly - Bullish

4hour - Ranging

We are still technically bullish overall but we can see here on the 4hour that AU is ranging between 0.65800 & 0.65500. This is a fairly small range so we’re not that interested in taking trades while price action is bouncing between these two zones.

We’re looking for conviction above 0.65800 or below 0.65500 before we can comfortably make a move. Let’s see what both of those situations would look like:

Bullish Continuation - Most of the trend data is suggesting AU is still bullish but we would need to see a strong push above resistance around 0.65800 with a confirmed higher low above before getting into any trades. If we do see this play out I'm looking toward 0.66750 resistance as a target.

Reversal back into channel - Price action seems to be poking out of the bottom of this range but we are still not convinced just yet. For us to strongly consider this a bearish move we would like to see a retest of 0.65500 as resistance followed by bearish conviction. Look for price action to move lower toward key support areas if this happens.