Nifty Analysis EOD – June 23, 2025 – Monday🟢 Nifty Analysis EOD – June 23, 2025 – Monday 🔴

👊 Tug of War Between Optimism and Pessimism

Nifty opened with a sharp 140-point gap-down, weighed by geopolitical tensions and negative news cues. The mood was clearly pessimistic — yet, from the deep low of 24,824.85, bulls made a bold comeback.

What followed was a classic textbook reversal:Price clawed back up, cutting through multiple key resistances — S1, VWAP, CDH, CPR BC, and Central CPR — before kissing the CPR TC, where it marked the day high at 25,057. This level acted as a supply zone and pushed Nifty back down toward the CPR BC, where it managed to close above the open — a quiet victory for the bulls, even in a red session overall.

The level 24,825 has now proven itself once again — the market’s respect for this support zone grows stronger with every bounce.

Today’s candle was a spinning top-style doji and also formed an inside bar, with all movement inside Friday’s wide-range candle (352 pts). Despite a smaller 232-point range today, this still requires caution — inside bars after large-range candles often result in false breakouts, especially amid macro noise.

📌 When the world looks bearish, and the chart looks bullish — trust your system.And that’s exactly what I did today — sticking to the Gladiator Strategy, a simple, disciplined intraday price action-based option buying framework.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 24,939.75

High: 25,057.00

Low: 24,824.85

Close: 24,971.90

Change: −140.50 (−0.56%)

📊 Candle Structure Breakdown

Real Body: 32.15 pts (small green body)

Upper Wick: 85.10 pts

Lower Wick: 114.90 pts

🔍 Interpretation

Despite a lower close than Friday, it was a green-bodied candle (close > open).

Long lower wick shows strong buying near 24,825.

Long upper wick signals resistance near 25,050–25,060.

🕯 Candle Type

📍 Spinning Top with Long Wicks — Sign of indecision, but slight bullish bias due to buying off the lows.

📌 Key Insight

Support at 24,825 holds strong.

Upper rejection near 25,050 indicates tight overhead pressure.

Watch closely:

Break above 25,060 → May trigger bullish continuation.

Break below 24,820 → Could open downside to 24,735–24,660 zone.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 254.95

IB Range: 163.25 → Medium IB

Market Structure: ⚖️ Balanced

Trades Triggered:

🟢 10:14 AM – Long Trade → ✅ Target Achieved (Trailing Exit, R:R 1:4.51)

🔴 2:16 PM – Short Signal → ❌ Discarded (RR not favorable)

📌 Support & Resistance Zones

Resistance Levels

24,980 ~ 25,000

25,060 ~ 25,080

25,125 ~ 25,150

25,180 ~ 25,212

25,285

Support Levels

24,965

24,894 ~ 24,882

24,825

24,800 ~ 24,768

24,735 ~ 24,725

💭 Final Thoughts

Markets are currently walking a tightrope — with bearish headlines on one side and bullish price action on the other.The Gladiator approach today helped sidestep the noise and focus on what matters: price structure and clean levels.

📌 Trade the chart, not the news. And when in doubt — zoom out.

🧠 “Uncertainty is the playground of the disciplined.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty50analysis

Nifty Analysis EOD – June 20, 2025 – Friday🟢 Nifty Analysis EOD – June 20, 2025 – Friday 🔴

🚀 Bull Run Out of the Blue 🚀 – A Masterclass in Price Action

Nifty kicked off the session with a +56-point gap-up — surprising many, especially since Gift Nifty hinted flat to negative and yesterday’s close was weak. The real jolt came when, in the very first minute, price broke above the Previous Day High (PDH) and opened directly above the CPR zone — a rare occurrence when geopolitical tensions are peaking.

As I often say:

📌 “Market rarely follows the obvious. It thrives in the unexpected.”

Today was a textbook example of that.

Luckily, we were prepped. In yesterday’s note, I mentioned the bullish trigger above 24,862 — and right from the open, Nifty respected every level, offering "hope-on" and "hope-off" trades. What seemed like a 25K test turned into a blast to 25,136, with 100 points added in the last 30 minutes, leaving even seasoned traders awestruck.

The intraday close at 25,079.75 and the adjusted close at 25,112.40 — both above the 15th May closing levels — give a bullish vibe heading into the weekend. 🤞

💬 Personal Note:

Today was special — I sat with my elder daughter, helping her understand real-time market behavior. And what a day it was! From trend reversals, cup & handle, head & shoulders, wedges, shallow pullbacks, to aggressive one-way rallies — everything aligned perfectly to make this a live-action lesson in intraday trading.

🕯 5 Min Time Frame Chart with Levels

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown

Open: 24,787.65

High: 25,136.20

Low: 24,783.65

Close: 25,112.40

Change: +319.15 (+1.29%)

📊 Candle Structure Breakdown

Real Body: 324.75 pts → ✅ Strong Green Candle

Upper Wick: 23.80 pts

Lower Wick: 4.00 pts

🔍 Interpretation

Opened flat and never looked back.

Minimal wicks = clear directional strength.

Buyers in full control from open to close.

🕯 Candle Type

📈 Bullish Marubozu-like — One of the strongest bullish signals. A powerful sign of trend continuation or breakout momentum.

📌 Key Insight

Today’s candle reinforces bullish strength.

Holding above 25,100 is key going forward.

A move above 25,136 could invite fresh upside targets — possibly 25,180+ and beyond.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 251.32

IB Range: 116.6 → Medium IB

Market Structure: 📈 ImBalanced

Trades Triggered:

🔹 9:41 AM – Long Trade → Target Achieved (Trailing Exit, R:R 1:4.79)

🔹 12:18 PM – Short Contra Trade → Target Achieved (R:R 1:2)

🔹 1:07 PM – Long Trade → Target Achieved (Trailing Exit, R:R 1:2.62)

📌 Support & Resistance Zones

Resistance Levels

25,125 ~ 25,150

25,180 ~ 25,212

25,285

Support Levels

25,080 ~ 25,060

25,000 ~ 24,980

24,965

24,894 ~ 24,882

💭 Final Thoughts

The market surprised today — not just in movement but in clarity.The clean break, follow-through strength, and intraday structure hint at momentum continuation — but weekends can bring surprise news.

📌 Watch 25,100 as line in the sand on Monday.

🧠 “Markets are teachers. Today’s lesson? Expect the unexpected, but prepare like it’s already here.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – June 18, 2025 – Wednesday🟢 Nifty Analysis EOD – June 18, 2025 – Wednesday 🔴

⚖️ Dhamakedar Start, But Indecisive Close – Weekly Expiry Caution Ahead

Nifty opened with a 65-point gap-down at 24,788.35, but what followed was a power-packed bullish start — within just 25 minutes, it surged over 150 points, hitting a day high of 24,947.55.

However, the euphoria didn’t last.

As the session progressed, the index gradually gave up all its gains, slipped below the previous day’s low, and finally found support at 24,750, a critical level. By the end of the day, Nifty settled around the opening zone at 24,812.05, just +23 points above open, while net change remained −41.35 points from the previous close.

The day showcased both strength and weakness — a typical "everyone-expected-fall-but-it-didn't-fall-enough" kind of day. The long upper wick reflects failed attempts by bulls, while the lack of breakdown keeps the bears in check.

Tomorrow is weekly expiry — caution is advised.

🕯 5 Min Time Frame Chart with Levels

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown

Open: 24,788.35

High: 24,947.55

Low: 24,750.45

Close: 24,812.05

Change: −41.35 (−0.17%)

📊 Candle Structure Breakdown

Real Body: 23.70 pts → ✅ Green Candle (tiny body)

Upper Wick: 135.50 pts

Lower Wick: 37.90 pts

🔍 Interpretation

Strong bullish momentum early on, but buyers failed to hold above 24,900.

Long upper wick signals supply or profit-booking at higher levels.

Price closed near open despite wide range → indecision between bulls and bears.

🕯 Candle Type

🟨 Spinning Top – A textbook indecisive candle, often seen at turning points or during pauses in trend.

📌 Key Insight

Buyers couldn’t reclaim or close above 24,950 — resistance strengthened.

Support held at 24,750 — but barely.

Watch 24,950 on upside and 24,750 on downside — a breakout from either may decide expiry-day trend.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 252.34

IB Range: 170.65 → Medium IB

Market Structure: ⚖️ Balanced

Trades:🚫 Short Trigger at 12:45 : Trapped - SL Hit

📌 Support & Resistance Zones

Resistance Levels

24,894 ~ 24,882

24,972 ~ 25,000

25,060 ~ 25,080

25,102 ~ 25,125

Support Levels

24,825 ~ 24,847

24,725 ~ 24,735

24,660

24,590

💭 Final Thoughts

When price travels 200 points but closes flat, it tells you something: Smart money is waiting.Weekly expiry ahead could bring unexpected moves.✅ Stay nimble. Stay alert.

🧠 “When in doubt, let the market shout — not whisper. Listen for the breakout.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – June 13, 2025 – Friday 🟢 Nifty Analysis EOD – June 13, 2025 – Friday 🔴

🕊️ Gap-Down on Geopolitical Tension – Buyers Step In at Crucial Support

Nifty opened with a massive gap-down of 415 points at 24,473 triggered by overnight geopolitical tensions — testing a crucial swing low from May 22. Interestingly, the market formed an OL (Open = Low) pattern and staged a powerful 281-point intraday recovery, closing near the day’s high at 24,718.60.

While the adjusted close still reflects a −0.68% drop, the price action was dominantly bullish. The strong bounce from the 24,460–24,520 demand zone — a region that had acted as a reversal zone multiple times earlier — reaffirms its significance.

🧭 If global cues stabilize or turn positive, this could pave the way for a bounce back toward 25,000. But if Friday’s low is breached, sentiment damage may deepen further. For now, intraday opportunities are preferable over positional plays, as uncertainty persists.

📝 A reminder from the May 22 note:

“Is the retracement run finished? Technically, YES. A bold call, but unless global headwinds reappear, today’s low must sustain.”

Nifty has once again honored this level — but the coming sessions will determine whether this bounce was genuine or temporary.

🛡 5 Min Chart with Levels

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown

Open: 24,473.00

High: 24,754.35

Low: 24,473.00

Close: 24,718.60

Net Change: −169.60 (−0.68%)

📊 Candle Structure Breakdown

Real Body: 245.60 pts → 🟢 Strong Green Candle

Upper Wick: 35.75 pts

Lower Wick: None (OL Formation)

🔍 Interpretation

Despite the gap-down, bulls took control right from the open.

The absence of a lower wick signals firm intraday confidence.

Closing near the high reinforces the buying strength, even on a net down day.

🔦 Candle Type

💚 Bullish Marubozu–like (OL) Candle– Represents a strong intra-session reversal, where buyers dominated from the very first tick.

📌 Key Insight

Price respected the 24,460–24,520 zone, once again validating it as key support.

If the next session crosses and sustains above 24,750–24,770, a short-term reversal confirmation could follow.

However, a breakdown below 24,473 may renew bearish pressure.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 269.05

IB Range: 145.05 → Medium IB

Market Structure: Balanced

Trades:✅ 10:20 AM – Long Triggered → Target Achieved, Trailing SL Hit (RR: 1:1.7)

📌 Support & Resistance Zones

Resistance Levels

24,725 ~ 24,735

24,825 ~ 24,847 (Fibonacci 0.5 retracement level)

24,882 ~ 24,894

24,972 ~ 25,000

25,060 ~ 25,080

Support Levels

24,660

24,640 ~ 24,625

24,420

24,365 ~ 24,330

24,245 ~ 24,220

💭 Final Thoughts

Friday’s session was a battle between fear and resilience — and bulls showed up just in time. The key test ahead: can the index reclaim 25K or will the bounce fade away?

🧠 “Great rebounds are born from great fear — but follow-through is what separates noise from reversal.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Market Recap & Outlook – Nifty and S&P 500, Bulls coming?The Indian stock market witnessed a volatile week, with the Nifty 50 closing at 24,718, down nearly 300 points from the previous week's close. The index hit a high of 25,222 and a low of 24,473, moving precisely within the range of 25,500–24,500 that I highlighted last week. I hope some of you took advantage of the cautionary signal!

Key Support Zone in Focus

The 24,400 level continues to act as a strong support—bulls have fiercely defended this zone for the past five weeks. However, if this level cracks, we could see Nifty test deeper supports at 23,900 and 23,700.

Geopolitical Overhang

The ongoing Iran-Israel tensions remain a wildcard. Unless the situation escalates significantly, I expect Nifty to trade in the 24,400–25,200 range this week.

Short-Term Strategy

I believe the current selling pressure might persist for 2–3 more sessions before the bulls regain control. Historically, Nifty tends to stay under pressure until mid-June, followed by a bullish phase leading into mid-July. If we get more dips, I’ll be looking to accumulate quality mid-cap and small-cap stocks for potential short-term gains.

S&P 500 Update

The S&P 500 closed at 5,976, down just 25 points from the previous week. The index made a high of 6,059 and a low of 5,963, forming a bearish candle on the weekly chart.

Watch These Levels

If 5,963 breaks, expect further downside towards 5,899 and 5,875. On the flip side, a sustained move above 6,030 could ignite bullish momentum, targeting resistance zones at 6,090 and 6,142.

Final Take – Bulls Gearing Up?

The broader trend still favors bulls, especially if key support levels hold. Watch for a turnaround by mid-week—"Bulls may soon reclaim the throne!"

Nifty50 Index MovementNSE:NIFTY Index is indicating an Upward Movement. The Rectangular Pattern needs to be broken and move upwards which is what is expected. We could soon expect 26k Range.

More over, if the RBI Moneytary policy today make any rate cut, this will accelerate the Movement.

This is truely for Educational Purpose and if the graph goes as expected we can expect good movement for Nifty 50 stocks Primarily.

"Nifty 50 Near Resistance: Wedge Signals Reversal or Breakout"1. Trend Channel: The index is moving within a well-defined **upward sloping channel**, marked by two parallel purple trendlines.

* Price is currently hovering near the **upper boundary** of the broader ascending channel — a potential area for either breakout or rejection.

2. Short-Term Rising Wedge: A narrow rising wedge is visible (formed with tighter converging trendlines in the last few candles).

* Rising wedges are generally considered bearish reversal patterns, especially near resistance zones, suggesting potential for a pullback.

3. Resistance Levels: 25,031.30 : Immediate resistance (recent high & wedge upper boundary). A breakout above this could lead to a strong bullish continuation.

Upper channel trendline: Around 25,050–25,100 zone — further confluence resistance.

4. Support Levels: 24,982.55 Near-term support (bottom of the wedge structure). A breakdown below this level confirms wedge breakdown.

24,767.50 : Strong horizontal support from prior consolidation zone.

24,561.90, 24,407.75, and 24,272.20 : Sequential key support levels for downside targets if a breakdown accelerates.

**Volume Analysis:**

1. Volume Spike seen during the recent bullish candles, indicating strong buying interest. However, during the formation of the wedge, volume has declined, signaling weakening momentum— a typical precursor to a breakout or breakdown.

Possible Scenarios:

Bullish Scenario:

Break above 25,031.30 with volume could initiate a **fresh leg of uptrend**, possibly targeting the upper end of the channel (\~25,100+).

Bearish Scenario:

Breakdown below 24,982.55 from the wedge pattern could trigger a **short-term correction**, with immediate targets at 24,767.50 and 24,561.90.

The bearish divergence between price action and declining volume further supports this view.

Weekly Market Wrap: Nifty Surges Past 25,000 – What's Next? The Nifty 50 index closed the week at 25,019, posting an impressive 1,000-point rally from the previous week’s close. The index made a high of 25,116 and a low of 24,378. The rally was driven by short covering and a surprise truce between India and Pakistan, which injected a wave of optimism into the market.

More importantly, Nifty broke out of the consolidation range of 23,200–24,600, closing strong above the psychologically significant 25,000 mark – a clear sign of bullish sentiment.

What to Expect Next Week (Outlook May 20–24)

Expected Range: 24,450 – 25,600

A breakout above 25,600 could open the doors for a retest of the all-time high (ATH) at 26,277.

As long as Nifty trades above 23,800, the broader trend remains intact.

Monthly Chart Patterns to Watch

A bullish "W" pattern could be forming, which ideally would require a pullback from current levels before resuming upward.

On the flip side, a bearish "M" pattern may emerge if the index tests ATH and faces rejection, which could trigger a sharp correction of 2,500–2,600 points.

For now, I remain cautious until the monthly time frame confirms a clear bullish breakout.

Global Markets Check: S&P 500 Eyes Key Resistance

The S&P 500 closed at 5,958, gaining 300 points week-on-week. As anticipated, a breakout above 5,770 propelled the index to meet all short-term targets of 5,821 / 5,850 / 5,900.

Key Level to Watch: 6,013

This is a major Fibonacci resistance — the same level where the market started correcting back on March 3, 2025.

A weekly close above 6,013 would be bullish, potentially triggering rallies toward 6,091 / 6,142 / 6,225.

However, a breakdown below this week’s low of 5,786 would confirm a failed breakout, with downside targets at 5,637 / 5,551 / 5,458.

Momentum traders, get ready – sharp moves are coming either way!

Weekly Market Wrap: Nifty Dips 340 Points Amid Global TensionsThis week, the Nifty 50 ended on a cautious note, closing at 24,008, down 340 points from the previous week's close. The index traded within a tight range, hitting a high of 24,526 and a low of 23,935—well within my anticipated levels of 24,900 to 23,800.

Silver Lining: Despite ongoing geopolitical tensions and negative news flow—including war-related developments—bulls managed to defend the critical psychological support of 24,000. That’s a sign of resilience in an otherwise shaky environment.

What’s Ahead?

For the upcoming week, expect high volatility. I see Nifty moving between 24,600 and 23,200. A weekly close below 23,800 could spell trouble for bulls, potentially opening the door for a drop toward major support zones at 23,200 and 23,000.

Technical Outlook:

Monthly & Daily Timeframes: Weak

Weekly Timeframe: Still bullish

So, while long-term charts show vulnerability, the weekly trend gives hope. I'm staying cautiously bullish—but will only turn aggressive once the monthly chart flips positive. Until then, it’s time to stay vigilant, not impulsive.

Global Cues: S&P 500 Holding Up Amid Uncertainty

The S&P 500 closed at 5,659, just 30 points down from the previous week, forming a doji candle—a clear sign of indecision. As long as the index holds above 5,532, there's no major cause for concern.

Bearish Trigger: Below 5,532, expect downside pressure toward 5,458 and 5,392, which could spill over into already fragile emerging markets like India.

Bullish Breakout: Above 5,770, bulls gain momentum, with potential upside targets of 5,821, 5,850, and 5,900. A rally here could bring relief to global equities, including Indian markets.

Weekly Market Wrap Nifty, Mid & Small Caps, and S&P 500 OutlookNifty ended the week on a strong bullish note, closing at 24,346, up by 307 points from the previous week. The index traded within a tight range, hitting a high of 24,589 and a low of 24,054, aligning perfectly with my projected range of 24,650–23,400.

📌 Key Technical Levels to Watch:

Nifty closed just below a crucial Fibonacci resistance at 24,414.

A daily close above 24,414 next week could open the door for a sharp move towards the next major resistance at 24,770.

While my system suggests a broader range of 24,900–23,800, I personally hope for a healthy consolidation to cool off some momentum—paving the way for a stronger, faster rally in the coming weeks.

Caution Zone:

A break below 23,800 might signal the return of bears, potentially dragging the index down to test critical support at 23,200/23,100.

Midcap & Smallcap Watch:

I’ve received a lot of queries about Midcap and Smallcap indices, and here’s the honest truth—they remain in a 'no-trade' zone. Despite Nifty's strength, the rally hasn’t lifted most Mid & Small Cap stocks.

👉 Investors holding quality, fundamentally strong stocks in these segments should stay calm, but avoid high PE or overvalued stocks until we get a clear monthly buy signal on the charts.

🌍 Global Markets – S&P 500 Analysis:

The S&P 500 closed the week at 5,686, just above the strong Fibonacci level of 5,637. Sustaining above this level could lead to a rally toward 5,770/5,821. However, a failure to hold this support might trigger a 2–3% pullback, which could ripple across global markets, including India.

📣 Bottom Line:

Nifty bulls need a close above 24,414 to push higher.

Mid & Small Cap space remains tricky—stay selective.

Watch global cues, especially from the US, for broader market direction.

Stay nimble, stay informed. ✅

Nifty Wkly Market Outlook: Bulls Regain Momentum Amid key brkoutThe Indian benchmark index Nifty 50 ended the week on a strong note, closing at 24,039, marking a robust gain of nearly 200 points from last week's close. During the week, Nifty made a high of 24,365 and a low of 23,847, trading perfectly within the anticipated range of 24,414 – 23,200, as projected in our previous analysis.

Importantly, the index managed to secure a weekly close above the psychological resistance level of 24,000, signaling a possible continuation of bullish momentum. As we head into the next trading week, the bulls are expected to have the upper hand, provided Nifty stays above 23,700. A daily close below 23,700, however, could shift sentiment in favor of the bears, exposing key support zones at 23,400 and 23,200.

Looking ahead, traders and investors should watch for price action within the broader range of 24,650 to 23,400. If the bulls manage to break and sustain above the critical Fibonacci resistance level of 24,414, we could see an upside move toward 24,650 and even 24,770.

On the global front, the S&P 500 index also delivered a strong performance, closing at 5,525, up a significant 250 points from the previous week. As highlighted earlier, the bullish W pattern on the charts has played out well, driving momentum higher.

If the S&P 500 sustains above the key breakout level of 5,551, it could potentially rally further to test resistance at 5,638, 5,670, and 5,715. However, a break below 5,391 may invite selling pressure, dragging the index down to test supports at 5,368, 5,327, or even 5,246, which could trigger a negative ripple effect across global markets.

Key Takeaways:

Nifty bullish above 24,000; watch 24,414 for breakout confirmation.

S&P 500 bullish continuation above 5,551; potential to test 5,715.

Bearish reversal levels to monitor: 23,700 for Nifty and 5,391 for S&P 500.

Nifty Closes 1000 Points Higher – Will It Catch Up with BNFIn a strong move, Nifty 50 surged by 1000 points to close at 23,851, compared to last week’s close. The index made a weekly high of 23,872 and a low of 23,207. As highlighted in last week's analysis, a breakout above 23,400 could push Nifty toward 23,900 — a target it missed by just 23 points.

However, an intriguing divergence has emerged between Nifty and Bank Nifty. While Bank Nifty has scaled a new all-time high, Nifty still trades significantly below its previous all-time high of 26,277. This sets the stage for an interesting dynamic: Will Nifty rally to close the gap, or will Bank Nifty face a correction?

What to Expect Next Week?

For the upcoming week, Nifty is expected to trade in a range between 23,200 and 24,414. Despite the bullish signals on the daily and weekly timeframes, the monthly chart remains weak, indicating that volatility is likely to persist until a broader trend confirmation.

S&P 500 Outlook: Bounce or Breakdown?

The S&P 500 index saw a mild pullback, closing around 80 points lower from the previous week’s close of 5,363. Our “sell on rise” strategy mentioned last week worked well, as the index dipped post-rally.

Now, things get technically interesting. On the weekly chart, the S&P 500 is forming a potential bullish W pattern and an inside bar. A breakout above the previous week's high of 5,481 could trigger upward targets of 5,551, 5,637, and 5,679.

However, on the downside, a break below 5,115 would reintroduce bearish pressure, which could have negative ripple effects across global markets.

Key Market Takeaways:

Nifty 50: Strong rally, but still below ATH. Watch 23,200–24,414 range next week.

Bank Nifty: At ATH, diverging from Nifty – crucial to monitor.

S&P 500: At a technical crossroads – potential for breakout or breakdown

Nifty50 Wkly Anlysis – Strong Reversal, But Volatility AheadThe Indian stock market closed the week on an interesting note. The Nifty 50 index ended at 22,828, just 70 points lower than last week's close, after forming a significant bullish reversal from a low of 21,743 to a high of 22,923.

As we mentioned in last week's market outlook, a base formation was underway—and this week's price action confirmed it. With the next week being truncated due to market holidays on Monday and Friday, traders should expect increased volatility and sideways movement.

Key Technical Levels:

Support: 22,200 – This is 50% of this week's candle; a break may bring bearish momentum.

Resistance: 23,400 – A close above this could ignite a rally toward 23,900, 24,100, and possibly 24,414.

On the global front, the S&P 500 respected the 4,800 support level, rebounding sharply to close at 5,363. However, underlying market weakness remains, so it's a sell-on-rise situation in U.S. equities.

Pro Tip:

Indian investors should keep an eye out for quality, fundamentally strong stocks. Any correction in the market may offer excellent long-term buying opportunities.

Nifty Wkly Outlook: Market Volatility, Supprt Lvls & Possible

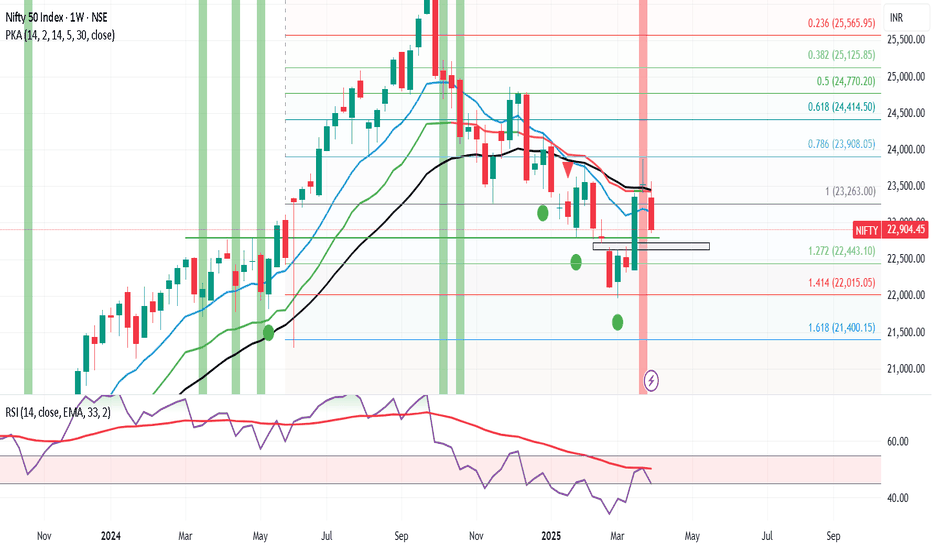

Nifty ended the week at 22,904, marking a significant decline of 600 points from the previous week’s close. The index reached a high of 23,565 and a low of 22,857. As anticipated, the dragonfly doji formation from last week, coupled with concerns over Trump’s new tariff measures taking effect from April 2nd, contributed to global market jitters. These factors spooked investors and led to heightened volatility across the board.

My initial forecast for Nifty's trading range this week was 24,000-23,000, but the lower end of that range was breached by 150 points, indicating increased downside pressure. Looking ahead, there is potential for Nifty to find support around the 22,600/22,400 zone, where it may consolidate and form a base to attempt a rebound towards the 24,000 level. However, if the index were to break below the critical support level of 21,964 (which, frankly, seems unlikely), a deeper correction towards 19,700 could unfold. * That said, I believe most of the negative news has already been priced in, and we could see a market recovery within the next 10-15days, depending on how the bulls respond to this pullback .*

In the global markets, the S&P 500 has closed below its 100-week exponential moving average (WEMA) at 5,074, and if it falls below this week’s low of 5,069, we could see a further slide towards 4,750/4,800, representing a 6% drop from current levels. Should Nifty also correct by 6% from its current position, this aligns with a potential support zone around 21,900/22,000, making it an interesting technical level to watch.

It will be crucial to monitor if the wounded bulls can stage a comeback or if the market will continue its downward trajectory. Stay tuned!

nifty50 directioncurrent scenario suggest price to follow the bearish trend as todays low was broken after a early morning pullback that infuse the liquidity more on the supply side than demand and we saw a big red bar it is likely to come back at the area around 23000 to 22950 with minor intraday pullbacks

#Nifty50 Market Update: A Week of Volatility and Uncertainty

The #Nifty50 closed at 23,519, marking a 170-point rise from last week's close, after hitting a high of 23,869 and a low of 23,412. As anticipated last week, once Nifty managed to sustain above the crucial 23,300 level, it surged to a high of 23,869, before retracing to close at 23,519. However, this week’s market candle formed a Dragonfly Doji, indicating that bears continue to hold control, as concerns over the financial year-end and the looming uncertainty of Trump's new tariff policy, set to take effect on April 2, dampened market sentiment.

With the market facing such pressure, it's crucial to consider the potential volatility for next week, as the market will be truncated due to the Eid holiday on Monday. As a result, Nifty could trade within a broad range of 24,000 to 23,000. For the next phase of an uptrend, Nifty must hold above 24,000, after which it could test higher levels of 24,200, 24,414 (a key Fibonacci level), and possibly 24,600.

Looking at the broader market trends, the monthly time frame remains bearish, while the weekly is slightly bullish and the daily trend is bullish. If favorable conditions align, we may begin to see upward movement in Nifty and other indices by mid-April, though in the interim, we’ll likely need to weather the storm and remain patient with the bearish sentiment.

S&P 500 Market Update: Testing Critical Support Levels

The S&P 500 closed at 5,580, down about 90 points from the previous week's close, hitting a low of 5,572. With the index closing near its weekly low, it suggests downward pressure may persist into the next week, with potential support levels at 5,550 and 5,458 (another key Fibonacci level). A test of these levels could put additional strain on Indian markets as well, amplifying volatility.

Overall, the market remains in a precarious position, and investors should brace for potential swings until more clarity emerges, especially with the geopolitical and policy risks at play.

Nifty's Strong Surge: What's Next for the Market?

This week, Nifty surged to 23,350, an impressive 950-point rally from last week’s close. The index hit a high of 23,402 and a low of 22,353. As I highlighted last week, I expected Nifty to trade within a narrow range of 22,850 – 21,950. However, Nifty broke out of this range, shattering the upper limit, and the resulting short covering led to a strong bullish close.

Next Week: A Critical Turning Point

Looking ahead, next week is going to be crucial. Despite the strong move, Nifty is still in a bearish phase on both the weekly and monthly time frames. However, if Nifty manages to retrace slightly to 23,000 and sustain above the 22,900 – 23,000 range, we could see the bulls taking control, pushing the market up toward 23,800/23,850.

On the other hand, if Nifty falls below 22,800, it would signal a breakout failure, which would be bad news for the bulls. In that case, Nifty could potentially drop to 22,000.

March-End Volatility: Be Ready for Both Sides

At the end of March, traders typically start booking their losses to offset gains for the financial year, creating increased volatility. This makes it an exciting time for directional traders, as we could see sharp movements in both directions.

For me, as long as the monthly and weekly charts remain bearish, I am cautious and not ready to turn bullish just yet. However, there are some sectors showing relative strength, and these could offer trading opportunities:

Nifty Energy

Nifty Financial Services

Nifty Metal

Nifty Public Sector Enterprises (PSE)

Keep an eye on stocks from these sectors, as they are currently outperforming others.

S&P 500: Mixed Signals

On the global front, the S&P 500 closed this week at 5,667, barely 30 points above last week’s close. The index has failed to sustain above the DEMA200 level at 5,705, signaling that the bulls are struggling to maintain momentum. A consecutive daily close above this level would help restore confidence among the bulls, potentially targeting 5,850.

However, if S&P 500 drops below 5,600, we could see a faster sell-off, with the recent low of 5,500 likely to come into play. It’s going to be a tense week as we await to see whether the bulls or the bears take control.

In Summary: Prepare for Volatility

Next week promises to be an exciting week for traders, as both domestic and global markets face critical levels. Directional traders should remain flexible, prepared for sharp moves in both directions. Focus on key sectors showing strength and stay vigilant for any breakout or breakdown in the Nifty and S&P 500.

Nifty Faces Range-Bound Phase,brace for volatility till Mid ApriNifty ended the week at 22,397, marking a decline of about 150 points from the previous week's close. The index reached a high of 22,676 and a low of 22,314, trading in a narrow range of just 360 points. This suggests that next week, Nifty could experience a wider range, with potential moves between 22,850 and 21,950 .

Despite the weakness seen on both the monthly and weekly charts, Nifty remains range-bound as long as the critical support level of 21,950 holds. However, with the end of March approaching, many investors will likely start booking losses to offset any gains they’ve made this year. This could trigger another round of selling pressure in the market. As a result, we may not see a meaningful recovery until mid-April, meaning we could face one more month of market volatility and pessimism.

It's crucial to keep cash ready to invest in fundamentally strong stocks during this period of market uncertainty. On the global front, the S&P 500 closed the week at 5,521, slipping below its 50-week exponential moving average (50WEMA). It seems likely that the index will test the 100-week exponential moving average (100WEMA) at around 5,240–5,250, which is about 4% below its current level. If this happens, we could see additional pressure across global markets, including India.

In summary, brace yourself for another month of market negativity before any potential relief arrives. Stay cautious and focus on high-quality stocks for the long term.

Nifty Market Update: Bears Are in Control – A Rough Ride Ahead?The Nifty closed at 22,795 this week, down by 134 points from the previous week’s close, with a high of 23,049 and a low of 22,720. The formation of a Gravestone Doji candle indicates that the market is firmly under the control of the bears, signaling potential weakness ahead. As forecasted last week, Nifty moved within the range of 23,450 to 22,400, aligning perfectly with my predictions.

Looking ahead to next week, I expect Nifty to trade between the 23,300 to 22,250 range. While 22,300-22,400 offers a strong support zone, if the index slips below 22,250, it could test the WEMA100 at 22,050, which could offer some relief.

Digging deeper, I analyzed the Nifty50 monthly chart from 2004 onwards and noticed a recurring pattern: whenever Nifty closes below the monthly EMA21, it tends to test the EMA50, which currently stands at 19,450. If this month’s close is below 22,400, we could be heading toward 19,450, so brace yourselves for what could be a bumpy ride ahead.

On the international front, the S&P 500 is showing signs of forming a bearish M-pattern, a negative signal for the broader market. This is troubling news for Indian markets, which are already under pressure. From the current level of 6,013, a 1.5% correction could see the index testing support levels around 5,900.

The battle between bears and bulls continues, but for now, I believe the bears still have the upper hand. Stay cautious and keep a close watch on market movements – volatility is here to stay!

Nifty Analysis: Potential Final Low and Key Reversal ZonesNifty Analysis: Potential Final Low and Key Reversal Zones

Pattern & Wave Structure

=====================

1. The market appears to be in the late stages of a higher-degree Wave (4) correction in a classical A‑B‑C formation.

2. Based on current wave counts, the 17th February low could mark the completion of Wave C (and thus Wave (4)).

3. If the price undercuts that low again, the 25th Feb–6th March window stands out as another high‑probability reversal zone.

Price & Time Analysis

================

1. Fibonacci Retracements near the 23,400–22,550 region align with typical corrective targets (0.382 and 0.5 retracements).

2. Several cycle durations (High‑High, Low‑Low, etc.) also converge in the late Feb to early March window, suggesting that if the 17th Feb low fails, price is likely to pivot within this narrow time band.

Momentum Across Multiple Time Frames

==============================

1. Daily (8‑ & 13‑period Stoch RSI): Just triggered a bullish reversal signal, indicating a near‑term upside bias.

2. Weekly Stoch RSI: Currently in a bearish phase but could shift higher if price stabilizes or rallies from current levels.

3. Monthly Momentum: Deep in oversold territory, suggesting the market is nearing a major inflection point (downside risk appears more limited).

Overall Outlook

===========

With three time frames hinting that bearish momentum is losing steam—and a clear confluence of Fibonacci targets and time cycles—downside appears limited if not already exhausted.

A decisive push above recent swing highs would strengthen the case that the 17th Feb low was a significant bottom.

Conversely, a brief extension lower into late Feb–early March could still offer a strong rebound if support is confirmed in that zone.

Conclusion

=========

The interplay of price levels, time cycles, and momentum indicators points to a potential final leg of the correction nearing completion. If 17th Feb was not the turning point, then the upcoming 25th Feb–6th March window may serve as an important inflection date for Nifty. Keep an eye on key Fibonacci support zones and the evolving Stoch RSI signals for confirmation of a sustained upside move.

Market Update: Nifty Faces Bearish Pressure, 17-21st feb

Nifty closed at 22,929 this week, marking a decline of 630 points from the previous week's close. The index reached a high of 23,568 and a low of 22,774. As highlighted in my previous post, the bearish sentiment in Nifty remains intact, as both the monthly and weekly timeframes show negative trends. Until there is a significant reversal on these timeframes, the bearish outlook is expected to continue.

Looking ahead to next week, I anticipate Nifty will move within a range of 23,450 to 22,400 . The 22,300/22,400 zone offers strong support, and if this level is breached, we could see Nifty heading towards the 21,800 levels. Given this volatility, Nifty might not be the ideal index for small investors, particularly those heavily invested in mid and small-cap stocks. Let’s now take a closer look at the mid-cap and small-cap indices.

The Mid-Cap Index is currently near its key support level of 48,700 on the monthly chart. If it manages to hold this support next week, a potential reversal could follow, offering some relief to investors. On the other hand, the Small-Cap Index is still far from its crucial support of 14,500, which suggests that we could witness further downside of 4-5% in this segment . This could add more pressure on small-cap stocks, which are already facing a tough environment.

On a global front, the S&P 500 has finally broken through the strong resistance at 6,100 and closed above this level. If it manages to sustain above 6,100, we could see it reach 6,225 or even 6,376. This could potentially provide some tailwinds for the Indian markets, but for now, it seems that the Indian market remains under the tight grip of bearish forces.

In conclusion, while there are some signs of potential recovery in specific indices, the overall sentiment remains cautious. Investors should stay vigilant, especially in mid and small-cap segments, as the road ahead could be bumpy.

Nifty's Battle Between Bears and Bulls & S&P 500 resistance test#Nifty50 wrapped up the week at 23,560, marking a 80-point increase from the previous week's close. It reached a high of 23,807 and a low of 23,222. As predicted last week, Nifty traded within the range of 24,000-22,950, and looking ahead, I anticipate the index will continue moving within the range of 24,000-23,050 next week.

Currently, the monthly and weekly timeframes are both bearish, while the daily timeframe shows a slight bullish bias. This indicates that the bears remain in control, and they will likely seize every bounce as an opportunity to initiate short positions. I still believe that the 22,400/22,500 level is critical, as it presents an opportunity for the bulls to establish a base and potentially push Nifty higher.

The BJP's victory in the Delhi assembly elections could have a positive impact on the market come Monday, offering a window to offload positions and create fresh shorts. My focus will remain on stocks that are either building a strong base or demonstrating resilience in this otherwise negative market environment. These hidden gems, or 'dark horses,' could emerge as the true winners in the near future.

On the global front, the S&P 500 closed at 6,025, a mere 14 points down from the previous week's close, with a high of 6,101 and a low of 5,923. Over the past three weeks, the S&P 500 bulls have repeatedly attempted to break the strong resistance level at 6,100, but they’ve failed to maintain momentum above it. A decisive close above 6,100 is now critical for the rally to gain steam and target levels at 6,142, 6,225, and 6,376. If this resistance holds, the bears are ready to pounce, and we could see a test of support levels around 5,850—about 3% lower than the current level.

It’s a crucial battle ahead, and while I’m rooting for the bulls, my focus is on the bears. Let’s see who comes out on top!

#nifty50 Week ahead, 3-7th Feb 2025The Nifty ended the week at 23,482, up nearly 400 points from last Friday’s close, with a high of 23,632 and a low of 22,786. With Saturday's budget announcement and tax break news, all eyes will be on Monday, which could be a game-changer. The new tax slabs will bring relief to many in the middle class, but institutional investors are carefully assessing its impact on the broader market. Monday’s closing could give us a clearer picture of how they’re positioning themselves, making it a critical day to watch.

Looking ahead, I anticipate Nifty may trade within the range of 24,000 to 22,950 next week. However, the weekly and monthly charts are still in a bearish phase, and until we see a shift toward a bullish trend on at least a weekly timeframe, the best approach remains to "sell on rallies."

Meanwhile, the S&P 500 closed at 6,040, about 60 points lower than last week. It tried to break through the strong resistance at 6,100 but couldn’t manage it. The weekly chart suggests a potential "W" pattern, but for that to play out, the index may need to drop and test support levels of 5,880-5,850. If that happens, it could trigger selling pressure on global markets, including India.

It’s going to be a crucial week ahead—prepare for a potentially volatile market environment!