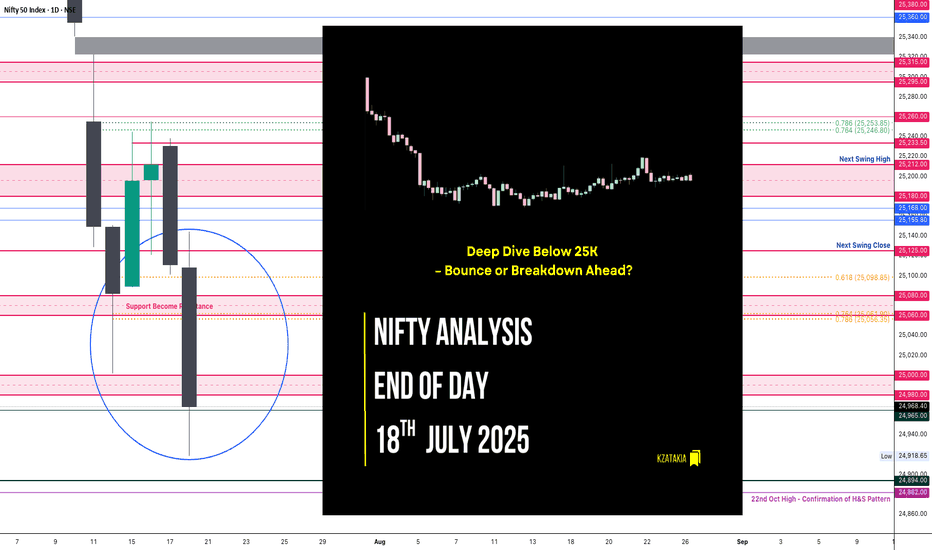

Nifty Analysis EOD – July 18, 2025 – Friday🟢 Nifty Analysis EOD – July 18, 2025 – Friday 🔴

“Deep Dive Below 25K – Bounce or Breakdown Ahead?”

As we discussed yesterday, a big move was on the cards — and Nifty delivered.

The index started flat to negative, and from the opening tick, sellers took firm control. It sharply broke through multiple key supports: PDC, PDL, S1, the important 25,080–25,060 support zone, swing low, 25,000–24,980, and even 24,965.

Buyers finally showed up near 24,920, a crucial level, and pulled off a modest 86-point recovery. The session ended at 24,968.40, still below the psychological 25,000 mark and the fractal swing low of July 14.

🕯 5 Min Time Frame Chart with Intraday Levels

🔍 Mixed Signals:

✅ Positive: Today’s low aligns with the 0.618 Fib retracement from the June 13 low to June 30 high — potential support zone.

✅ Positive: RSI(3 of 3) shows bullish divergence — early reversal sign?

❌ Negative: Closed below July 14 swing low — weak structural signal.

❌ Negative: Below 25,000 — psychological breakdown.

❓Now the big question: Will this bearish move continue, or is it a fakeout before reversal?

You're still bullish on the overall daily trend, but tactically bearish for intraday until a close above 25,125 confirms strength.

🕯 Daily Time Frame Chart For Additional View

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,108.55

High: 25,144.60

Low: 24,918.65

Close: 24,968.40

Change: −143.05 (−0.57%)

📊 Candle Structure Breakdown

Real Body: 140.15 pts → Large red bearish body

Upper Wick: 36.05 pts → rejection near early highs

Lower Wick: 49.75 pts → dip buying near 24,920

🔍 Interpretation

Mildly negative open with early strength attempt near 25,140

Sharp decline through major support zones

Buyers stepped in at 24,920, but recovery lacked follow-through

Close below 25K and key swing low confirms steady intraday selling pressure

🕯 Candle Type

Strong Bearish Candle with both wicks — sellers dominated, but not without some resistance from buyers at the lows.

📌 Key Insight

Short-term bearish momentum confirmed

24,920–24,890 is next critical support; breakdown may extend to 24,882–24,825

Bulls need to close above 25,125+ to reclaim control

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 181.56

IB Range: 126.45 → Medium IB

Market Structure: 🔴 Imbalanced

🟢 Trades Triggered:

09:42 AM – Short Trade → ✅ Trailed SL Hit Profit (R:R = 1 : 3.87)

📌 Support & Resistance Levels

Resistance Levels:

24,980 ~ 25,000

25,080 ~ 25,060

25,125

25,168

25,180 ~ 25,212

Support Levels:

24,965

24,894 ~ 24,882

24,825

24,800 ~ 24,768

💭 Final Thoughts

“Sometimes markets fall not to reverse, but to recharge.”

Today’s drop pierced major support zones, but the bounce from 0.618 Fib hints at possible resilience.

Structure needs clarity — Monday’s session will reveal whether this was a trap or fuel for bears.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty50levels

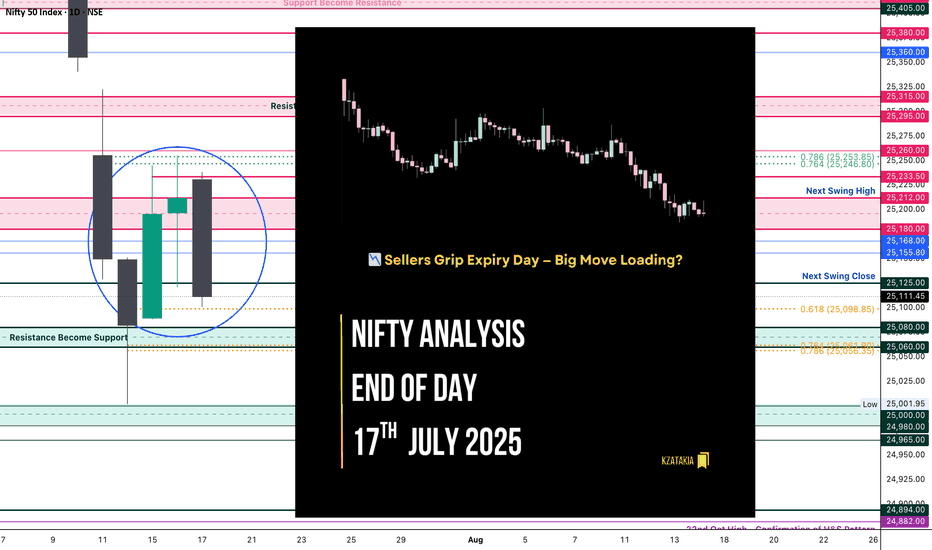

Nifty Analysis EOD – July 17, 2025 – Thursday🟢 Nifty Analysis EOD – July 17, 2025 – Thursday 🔴

📉 Sellers Grip Expiry Day — Big Move Loading?

Nifty started again with an OH (Open = High) formation and slipped down 94 points before 10:30 AM, marking the day’s low at 25,144. During this fall, it broke the support zone of 25,212 ~ 25,180. Although a retracement followed, it couldn’t sustain above the mean and eventually broke below the previous day’s low (PDL), closing at 25,111.45.

The weekly expiry was wild and volatile — especially from 12:30 to 2:30 PM. Interestingly, if we consider the total range of the last three sessions, it is just 166 points — well below average. This suggests a phase of consolidation. A significant move may emerge once Nifty decisively breaks the broader zone of 25,000 to 25,255.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

📊 Daily Candle Breakdown

Open: 25,230.75

High: 25,238.35

Low: 25,101.00

Close: 25,111.45

Change: −100.60 (−0.40%)

Candle structure breakdown:

Real body:

Red candle (Close < Open): 25,230.75 − 25,111.45 = 119.30 points → Decent-sized bearish body

Upper wick:

25,238.35 − 25,230.75 = 7.60 points → Very small

Lower wick:

25,111.45 − 25,101.00 = 10.45 points → Small

Interpretation:

Nifty opened slightly lower, made a weak attempt upward, then saw consistent selling throughout the day, closing near the session’s low. The negligible wicks indicate that sellers were in full control, and buyers had little room to fight back.

Candle Type:

A strong bearish candle (almost Marubozu) with very small wicks → Clear dominance by sellers.

Key Insight:

The test of the 25,100 zone again shows weakening bullish strength.

If the next session breaks below 25,100, the fall may extend toward 25,000–25,050.

For bulls to regain short-term momentum, a close above 25,200–25,220 is necessary.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 176.62

IB Range: 60.85 → Medium IB

Market Structure: Balanced

Trades Triggered:

🕒 10:53 AM – Long Trade → Trailed SL Hit Profit (R:R = 1:0.42)

🧭 What’s Next? / Bias Direction

The market is coiling within a narrow range across multiple sessions, hinting at a potential breakout move.

📌 Watch Zone: 25,000 to 25,255

🔻 A break below 25,000 may open 24,950–24,900

🔺 A close above 25,260 could drive price toward 25,350+

Bias remains neutral-to-bearish unless bulls reclaim 25,220 decisively.

🧱 Support & Resistance Levels

Resistance Levels

25,168

25,180 ~ 25,212

25,260

25,295 ~ 25,315

Support Levels

25,125

25,080 ~ 25,060

25,000 ~ 24,980

24,965

🧠 Final Thoughts

"Structure is key. When levels work, respect them. When they break, adapt."

Three sessions of compression hint at expansion soon — stay alert and trade level-to-level with discipline.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

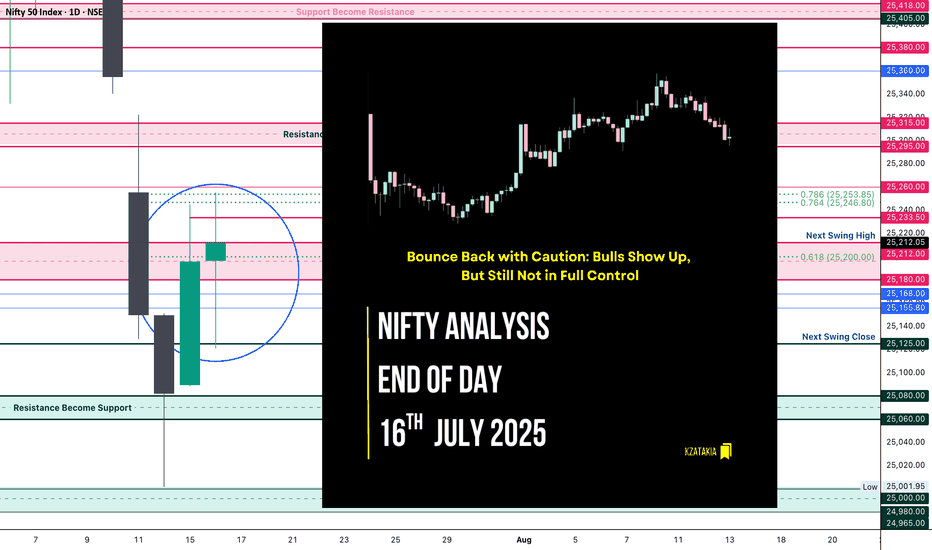

Nifty Analysis EOD – July 16, 2025 – Wednesday🟢 Nifty Analysis EOD – July 16, 2025 – Wednesday 🔴

"Bounce Back with Caution: Bulls Show Up, But Still Not in Full Control"

Nifty started the day on a flat note, but the opening candle turned out to be the day’s high, and from there, it quickly lost 91 points, marking the day’s low at 25,121 within the first hour. The early pressure gave a bearish opening tone, but bulls gradually stepped in.

Around 11:45 AM, Nifty broke above the VWAP–Day Low range, crossed the CPR zone, and then pushed toward PDH. It did make one attempt to break PDH, but failed, resulting in a slow drift downward toward VWAP and CPR into the close. The day ended at 25,212.05, nearly at CPR — a zone of indecision.

📉 The structure shows sharp reversal from the lows, but also clear hesitation near resistance zones. The session was volatile, forming a typical pre-expiry pattern with mixed sentiment. Bulls must take charge tomorrow by crossing the 25,250–25,260 zone to regain strength.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,196.60

High: 25,255.30

Low: 25,121.05

Close: 25,212.05

Change: +16.25 (+0.06%)

📊 Candle Structure Breakdown

Real Body: 15.45 points → small green body

Upper Wick: 43.25 points

Lower Wick: 75.55 points → significant downside recovery

🔍 Interpretation

Market opened flat, dropped quickly to test 25,120 zone

Strong buying emerged after initial fall

Buyers lifted the index above CPR, but failed to hold breakout above PDH

Candle closes with long lower wick → buyers defended dip, but lacked closing dominance

🕯 Candle TypeSpinning Top with Long Lower Wick — often a neutral to mildly bullish candle, suggesting buying interest at lower levels, but with uncertain momentum.

📌 Key Insight

Bulls clearly defended the 25,120–25,125 support zone

Momentum will only resume above 25,250–25,260, leading to targets around 25,300–25,315

Failure to hold 25,120 could reopen downside toward 25,000–25,050

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 180.99

IB Range: 91.20 → Medium IB

Market Structure: 🟡 Balanced

Trades Triggered

11:34 AM – Long Trade → ✅ Target Achieved, Trailed SL Hit (R:R 1:2.42)

📌 Support & Resistance Zones

Resistance Levels

25,168

25,180 ~ 25,212

25,260

25,295 ~ 25,315

Support Levels

25,125

25,080 ~ 25,060

25,000 ~ 24,980

24,965

💭 Final Thoughts

“Structure is forming — but conviction is lacking. Let expiry day bring clarity. Above 25,260 we fly, below 25,120 we fall.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

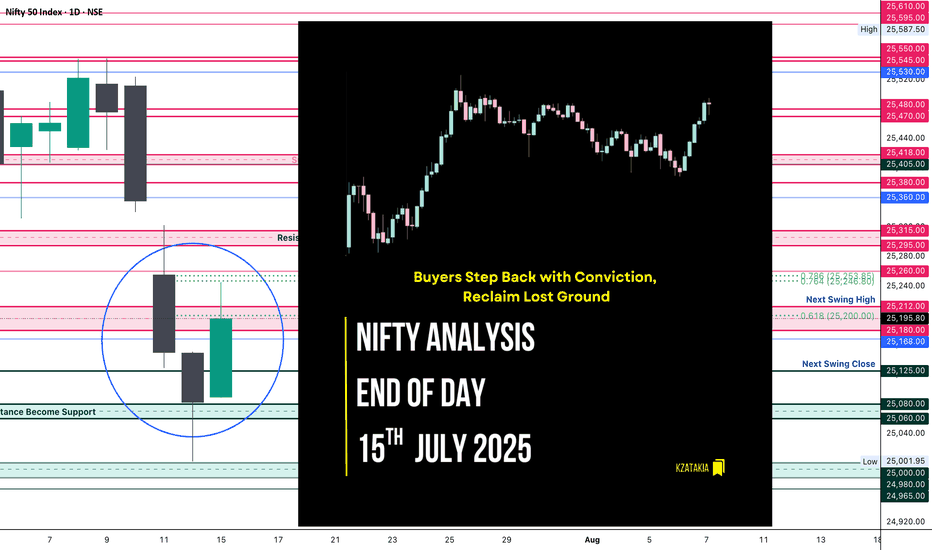

Nifty Analysis EOD – July 15, 2025 – Tuesday🟢 Nifty Analysis EOD – July 15, 2025 – Tuesday 🔴

"Buyers Step Back with Conviction, Reclaim Lost Ground"

Nifty began the session with a flat-to-positive tone, and the first 5-minute candle confidently added 60 points, pushing the index toward 25,150 – aligning with the Previous Day High (PDH). However, the level couldn't hold on the first attempt and Nifty slipped back to the day's open. After a brief consolidation, bulls made a strong comeback.

The second push broke through the PDH, Day High, and the resistance zone of 25,180–25,212, and extended the move up to mark the day’s high at 25,245.20. Post that, the index hovered above the breakout zone and closed solidly at 25,195.80, showing strength and follow-through.

📈 The day’s structure was clean and directional — a healthy bounce and hold above critical levels, reinforcing the idea that buyers are regaining control after last week’s consolidation and weakness.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,089.50

High: 25,245.20

Low: 25,088.45

Close: 25,195.80

Change: +113.50 (+0.45%)

📊 Candle Structure Breakdown

Real Body: 106.30 points – strong green bullish body

Upper Wick: 49.40 points – profit-taking or resistance at highs

Lower Wick: 1.05 points – negligible dip from open

🔍 Interpretation

Opened flat and quickly built momentum.

Temporary pullback in first 15 minutes was bought into strongly.

Closed with a clean green body, showing clear intraday bullish intent.

Holding above the 25,180–25,212 zone is a big win for bulls.

🕯 Candle Type

Bullish Marubozu-like (strong green body with minimal lower wick) — shows conviction and potential start of a new upswing post recent chop.

📌 Key Insight

25,080–25,100 is now a key base and must be protected.

If Nifty can break and hold above 25,240–25,250, a move toward 25,295–25,315 looks likely.

Failure to hold above 25,180 would be first sign of hesitation.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 186.18

IB Range: 67.35 → Medium IB

Market Structure: 🟢 Balanced

Trades Triggered

10:30 AM – Long Trade → ✅ Target Achieved, Trailed SL (R:R 1:2.48)

📌 Support & Resistance Zones

Resistance Levels

25,168

25,180 ~ 25,212

25,260

25,295 ~ 25,315

Support Levels

25,125

25,080 ~ 25,060

25,000 ~ 24,980

24,965

💭 Final Thoughts

"Trend is nothing without follow-through — today buyers showed up, but tomorrow they must push past 25,250 to prove it wasn't just a bounce."

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – July 14, 2025 – Monday🟢 Nifty Analysis EOD – July 14, 2025 – Monday 🔴

"Broken Support, Fought Resistance – Tug of War in Play"

Nifty began the day with a classic Open = High (OH) setup, instantly rejecting any bullish intent. The crucial support zone of 25,080–25,060 was taken out early, and the market went on to mark the day's low at 25,001.95, a level that quickly turned into a decisive battleground.

After a bounce from the low, 25,125 emerged as a stiff resistance that pushed the index back below the broken support zone. For most of the session, the same support zone turned into resistance — a textbook polarity flip. However, in the final hour, Nifty showed resilience and finally closed back above 25,080, ending the session at 25,082.30.

🔄 The structure was full of failed intraday breakouts, signaling confusion and conflict — likely fueled by a wider CPR, imbalanced market structure, and medium IB of 109 pts. It was a low-volatility session, but packed with psychological tests.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,149.50

High: 25,151.10

Low: 25,001.95

Close: 25,082.30

Change: −67.55 (−0.27%)

📊 Candle Structure Breakdown

Real Body: 67.20 points – small to moderate bearish body

Upper Wick: 1.60 points – negligible upside attempt

Lower Wick: 80.35 points – strong defense from day’s low

🔍 Interpretation

Opened higher but got instantly rejected (OH formation).

Sellers took charge early but failed to hold momentum all the way.

The long lower wick reflects buyer presence at key 25,000 zone.

The close below open but above reclaimed support suggests tug of war — with bulls slightly redeeming themselves by EOD.

🕯 Candle Type

Hammer-like red candle — while bearish on close, the long lower shadow indicates potential exhaustion of selling and hints at reversal if follow-through buying emerges next session.

📌 Key Insight

25,000–25,020 has emerged as crucial near-term support.

A strong open or close above 25,150–25,180 may confirm a bullish reversal setup.

Breakdown below 25,000 opens the door for a fall toward 24,950 or lower.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 188.77

IB Range: 109.20 → Medium IB

Market Structure: 🔴 Imbalanced

Trades Triggered

09:50 AM – Long Trade → ❌ SL Hit

01:05 PM – Short Trade → ❌ SL Hit

📉 Tough day for directional trades — false breakouts dominated.

📌 Support & Resistance Zones

Resistance Levels

25,125

25,168

25,180 ~ 25,212

25,260

25,295 ~ 25,315

Support Levels

25,080 ~ 25,060

25,000 ~ 24,980

24,965

💭 Final Thoughts

“Reclaimed ground doesn’t mean victory – yet. Watch the next move. Rejection below 25,000 ends the bulls' narrative; a strong move above 25,180 rewrites it.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – July 11, 2025 – Friday🟢 Nifty Analysis EOD – July 11, 2025 – Friday 🔴

"Smooth Slide, Silent Pressure – Bulls on the Edge"

Nifty opened with a 60-point gap-down, and despite an initial attempt to fill the gap with a 40-point bounce, the index couldn’t sustain. What followed was classic, smooth selling pressure — a slow bleed marked by 16 consecutive 5-minute candles that never broke the previous candle’s high.

There was no panic, just a persistent drift downward. The day’s structure was a silent yet firm rejection from higher levels, with 25,150 acting as an anchor for most of the session, eventually closing near 25,140.

📉 This session marks a revisit to the breakout zone of June 26–27.

Is this a false breakout or a healthy retest?

Only time — and a bounce or breakdown from 25,080–25,060 — will tell.

⚠️ If we close below 25,000, the entire bullish move from late June might be invalidated.

But a sharp bounce from the 25080–25060 zone could spark a hopeful reversal setup.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,255.50

High: 25,322.45

Low: 25,129.00

Close: 25,149.85

Change: −205.40 (−0.81%)

📊 Candle Structure Breakdown

Real Body: 105.65 points – clean bearish body

Upper Wick: 66.95 points – buyers rejected

Lower Wick: 20.85 points – weak defense at bottom

🔍 Interpretation

Price opened weak and stayed weak.

An intraday push to 25,320 was sharply sold into.

Closing near the day’s low shows full bear control.

Minimal bounce from day low indicates lack of bullish confidence.

🕯 Candle Type

A Bearish Rejection Candle – resembles an inverted hammer in a downtrend; suggests sellers still strong and bulls hesitant

📌 Key Insight

The zone of 25,320–25,350 has turned into firm intraday resistance.

25,100–25,130 is the immediate make-or-break support — below that lies 25,000–25,050.

For bulls to breathe again, we need a bounce and hold above 25,250–25,300.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 193.17

IB Range: 78.45 → Medium IB

Market Structure: 🔴 Imbalanced

Trades Triggered

10:21 AM – Short Trade → 🎯 Trailing SL Hit (R:R 1:2.41)

📌 Support & Resistance Zones

Resistance Levels

25,168

25,180 ~ 25,212

25,260

25,295 ~ 25,315

Support Levels

25,125

25,080 ~ 25,060

25,000 ~ 24,980

24,965

💭 Final Thoughts

"It wasn’t a crash, it was a quiet rejection — and that makes it more dangerous. If bulls don’t show up now, bears might get bolder from here."

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – July 10, 2025 – Thursday🟢 Nifty Analysis EOD – July 10, 2025 – Thursday 🔴

"False Hopes, True Drop – Bears Tighten Their Grip"

Nifty opened with a mild 50-point gap-up, but within the very first minute, that optimism was crushed. It dropped nearly 100 points, breaching the previous day’s low, and entered the key support zone of 25405–25418, which held briefly for about half an hour.

But this wasn’t a day for bulls.

After a weak attempt to recover from the 25360 support (which held twice intraday), sellers regained momentum, dragged the index further down, and finally closed at the lowest point of the day – 25348.

🔸 Expiry volatility played its part — trapping option buyers and luring them into false reversals.

🔸 However, quick scalpers and intraday short-sellers likely capitalized well.

🔸 The structure was decisively bearish, with no meaningful intraday bounce.

Tomorrow becomes crucial.

Bulls have one last stronghold at the 25300 level.

Bears, already in charge, may extend the damage further if this breaks.

⚠️ Bias Levels:

🟢 Bullish above: 25420

🔴 Bearish below: 25290

⚪ Between = Neutral / Watch Mode

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,511.65

High: 25,524.05

Low: 25,340.45

Close: 25,355.25

Change: −120.85 (−0.47%)

📊 Candle Structure Breakdown

Real Body: 156.40 points – large red candle

Upper Wick: 12.40 points – minimal bullish push

Lower Wick: 14.80 points – bears kept pressure till close

🔍 Interpretation

Bears took over early and never let go

The close at day low shows strong conviction from sellers

Lack of significant wicks → no real fight from bulls

🕯 Candle Type

Bearish Marubozu-style candle – clear sign of dominance by sellers, and potential for continuation if no quick reversal

📌 Key Insight

Market is in a critical zone — hovering above the edge of deeper correction

25300–25290 is the line in the sand

A breakdown below can target 25,200–25,250

Bulls can only regain momentum above 25,420

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 189.49

IB Range: 113.75 → Medium IB

Market Structure: 🟡 Balanced

Trades Triggered

10:52 AM – Short Trade → 🎯 Trail SL Hit (R:R 1:0.38)

📌 Support & Resistance Zones

Resistance Levels

25,380

25,405 ~ 25,418

25,470 ~ 25,480

25,530

25,545 ~ 25,550

Support Levels

25,315 ~ 25,295

25,260

25,212 ~ 25,180

25,125

💭 Final Thoughts

"Expiry days often blur the picture, but today’s price action was sharp. Unless bulls step up quickly, the breakdown may just be getting started."

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – June 20, 2025 – Friday🟢 Nifty Analysis EOD – June 20, 2025 – Friday 🔴

🚀 Bull Run Out of the Blue 🚀 – A Masterclass in Price Action

Nifty kicked off the session with a +56-point gap-up — surprising many, especially since Gift Nifty hinted flat to negative and yesterday’s close was weak. The real jolt came when, in the very first minute, price broke above the Previous Day High (PDH) and opened directly above the CPR zone — a rare occurrence when geopolitical tensions are peaking.

As I often say:

📌 “Market rarely follows the obvious. It thrives in the unexpected.”

Today was a textbook example of that.

Luckily, we were prepped. In yesterday’s note, I mentioned the bullish trigger above 24,862 — and right from the open, Nifty respected every level, offering "hope-on" and "hope-off" trades. What seemed like a 25K test turned into a blast to 25,136, with 100 points added in the last 30 minutes, leaving even seasoned traders awestruck.

The intraday close at 25,079.75 and the adjusted close at 25,112.40 — both above the 15th May closing levels — give a bullish vibe heading into the weekend. 🤞

💬 Personal Note:

Today was special — I sat with my elder daughter, helping her understand real-time market behavior. And what a day it was! From trend reversals, cup & handle, head & shoulders, wedges, shallow pullbacks, to aggressive one-way rallies — everything aligned perfectly to make this a live-action lesson in intraday trading.

🕯 5 Min Time Frame Chart with Levels

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown

Open: 24,787.65

High: 25,136.20

Low: 24,783.65

Close: 25,112.40

Change: +319.15 (+1.29%)

📊 Candle Structure Breakdown

Real Body: 324.75 pts → ✅ Strong Green Candle

Upper Wick: 23.80 pts

Lower Wick: 4.00 pts

🔍 Interpretation

Opened flat and never looked back.

Minimal wicks = clear directional strength.

Buyers in full control from open to close.

🕯 Candle Type

📈 Bullish Marubozu-like — One of the strongest bullish signals. A powerful sign of trend continuation or breakout momentum.

📌 Key Insight

Today’s candle reinforces bullish strength.

Holding above 25,100 is key going forward.

A move above 25,136 could invite fresh upside targets — possibly 25,180+ and beyond.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 251.32

IB Range: 116.6 → Medium IB

Market Structure: 📈 ImBalanced

Trades Triggered:

🔹 9:41 AM – Long Trade → Target Achieved (Trailing Exit, R:R 1:4.79)

🔹 12:18 PM – Short Contra Trade → Target Achieved (R:R 1:2)

🔹 1:07 PM – Long Trade → Target Achieved (Trailing Exit, R:R 1:2.62)

📌 Support & Resistance Zones

Resistance Levels

25,125 ~ 25,150

25,180 ~ 25,212

25,285

Support Levels

25,080 ~ 25,060

25,000 ~ 24,980

24,965

24,894 ~ 24,882

💭 Final Thoughts

The market surprised today — not just in movement but in clarity.The clean break, follow-through strength, and intraday structure hint at momentum continuation — but weekends can bring surprise news.

📌 Watch 25,100 as line in the sand on Monday.

🧠 “Markets are teachers. Today’s lesson? Expect the unexpected, but prepare like it’s already here.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – June 19, 2025 – Thursday🟢 Nifty Analysis EOD – June 19, 2025 – Thursday 🔴

📉 Bookish Spinning Top Doji – Another Day of Indecision on Expiry

Nifty opened with a mild +16-point gap-up and immediately dipped to test the Previous Day Low (PDL), marking the day low at 24,738.10. A quick reversal took the index 125 points higher, reaching a high of 24,863, only to settle back into theta-eating mode around VWAP.

Just as things looked ready to turn, a 13:50 breakout attempt fizzled as the price faced rejection above the CPR zone, leading to a final dip below the previous low, touching a new intraday low at 24,733.

Though the intraday close was at 24,744.70, the settlement close was 24,793.25 — a 47.65-point difference that’s not trivial, especially on expiry day.

The entire day remained a narrow-range, rollercoaster ride — clearly showing neither bulls nor bears could take charge. The total range was just 130 points, forming a textbook Spinning Top, which reflects market contraction.

📌 Now what?

Keep a close eye on the range:

🟢Bullish Breakout ➤ above 24,862 (CDH)

🔴Bearish Breakdown ➤ below 24,733 (CDL)

The squeeze is on. Expansion is near.

🕯 5 Min Time Frame Chart with Levels

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown

Open: 24,803.25

High: 24,863.10

Low: 24,733.40

Close: 24,793.25

Change: −18.80 (−0.08%)

📊 Candle Structure Breakdown

Real Body: 10.00 pts → 🔻 Small Red Candle

Upper Wick: 59.85 pts

Lower Wick: 59.85 pts

🔍 Interpretation

Equal wicks show balanced buying and selling.

Small real body signals strong indecision.

Intraday volatility was neutral despite expiry impact.

🕯 Candle Type

⚖️ Perfect Spinning Top / Doji-like Candle – Indicates market contraction, waiting for directional resolution.

📌 Key Insight

The market continues its tight range-bound structure.

Any breakout beyond 24,865 or breakdown below 24,730 could trigger directional moves.

Till then: “Wait and watch mode.”

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 240.08

IB Range: 125.00 → Medium IB

Market Structure: ⚖️ Balanced

Trades:🚫 No Trade Triggered by System

📌 Support & Resistance Zones

Resistance Levels

24,894 ~ 24,882

24,972 ~ 25,000

25,060 ~ 25,080

25,102 ~ 25,125

Support Levels

24,825 ~ 24,847

24,725 ~ 24,735

24,660

24,590

💭 Final Thoughts

The market is compressing like a coiled spring.Spinning tops near resistance often signal upcoming volatility.Let the breakout come to you — don’t pre-empt, participate.

🧠 “When the market sleeps in narrow ranges, it dreams of big moves.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – June 13, 2025 – Friday 🟢 Nifty Analysis EOD – June 13, 2025 – Friday 🔴

🕊️ Gap-Down on Geopolitical Tension – Buyers Step In at Crucial Support

Nifty opened with a massive gap-down of 415 points at 24,473 triggered by overnight geopolitical tensions — testing a crucial swing low from May 22. Interestingly, the market formed an OL (Open = Low) pattern and staged a powerful 281-point intraday recovery, closing near the day’s high at 24,718.60.

While the adjusted close still reflects a −0.68% drop, the price action was dominantly bullish. The strong bounce from the 24,460–24,520 demand zone — a region that had acted as a reversal zone multiple times earlier — reaffirms its significance.

🧭 If global cues stabilize or turn positive, this could pave the way for a bounce back toward 25,000. But if Friday’s low is breached, sentiment damage may deepen further. For now, intraday opportunities are preferable over positional plays, as uncertainty persists.

📝 A reminder from the May 22 note:

“Is the retracement run finished? Technically, YES. A bold call, but unless global headwinds reappear, today’s low must sustain.”

Nifty has once again honored this level — but the coming sessions will determine whether this bounce was genuine or temporary.

🛡 5 Min Chart with Levels

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown

Open: 24,473.00

High: 24,754.35

Low: 24,473.00

Close: 24,718.60

Net Change: −169.60 (−0.68%)

📊 Candle Structure Breakdown

Real Body: 245.60 pts → 🟢 Strong Green Candle

Upper Wick: 35.75 pts

Lower Wick: None (OL Formation)

🔍 Interpretation

Despite the gap-down, bulls took control right from the open.

The absence of a lower wick signals firm intraday confidence.

Closing near the high reinforces the buying strength, even on a net down day.

🔦 Candle Type

💚 Bullish Marubozu–like (OL) Candle– Represents a strong intra-session reversal, where buyers dominated from the very first tick.

📌 Key Insight

Price respected the 24,460–24,520 zone, once again validating it as key support.

If the next session crosses and sustains above 24,750–24,770, a short-term reversal confirmation could follow.

However, a breakdown below 24,473 may renew bearish pressure.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 269.05

IB Range: 145.05 → Medium IB

Market Structure: Balanced

Trades:✅ 10:20 AM – Long Triggered → Target Achieved, Trailing SL Hit (RR: 1:1.7)

📌 Support & Resistance Zones

Resistance Levels

24,725 ~ 24,735

24,825 ~ 24,847 (Fibonacci 0.5 retracement level)

24,882 ~ 24,894

24,972 ~ 25,000

25,060 ~ 25,080

Support Levels

24,660

24,640 ~ 24,625

24,420

24,365 ~ 24,330

24,245 ~ 24,220

💭 Final Thoughts

Friday’s session was a battle between fear and resilience — and bulls showed up just in time. The key test ahead: can the index reclaim 25K or will the bounce fade away?

🧠 “Great rebounds are born from great fear — but follow-through is what separates noise from reversal.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Wkly Outlook: Market Volatility, Supprt Lvls & Possible

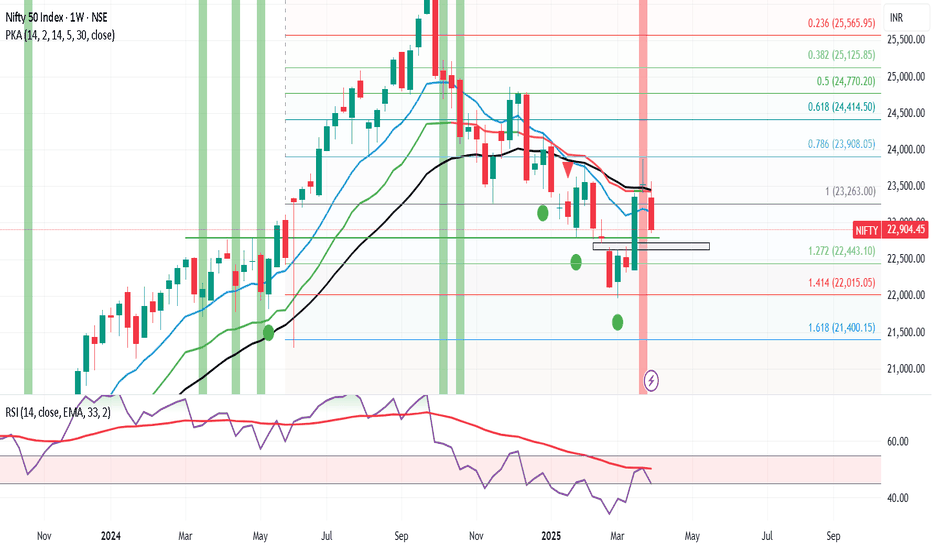

Nifty ended the week at 22,904, marking a significant decline of 600 points from the previous week’s close. The index reached a high of 23,565 and a low of 22,857. As anticipated, the dragonfly doji formation from last week, coupled with concerns over Trump’s new tariff measures taking effect from April 2nd, contributed to global market jitters. These factors spooked investors and led to heightened volatility across the board.

My initial forecast for Nifty's trading range this week was 24,000-23,000, but the lower end of that range was breached by 150 points, indicating increased downside pressure. Looking ahead, there is potential for Nifty to find support around the 22,600/22,400 zone, where it may consolidate and form a base to attempt a rebound towards the 24,000 level. However, if the index were to break below the critical support level of 21,964 (which, frankly, seems unlikely), a deeper correction towards 19,700 could unfold. * That said, I believe most of the negative news has already been priced in, and we could see a market recovery within the next 10-15days, depending on how the bulls respond to this pullback .*

In the global markets, the S&P 500 has closed below its 100-week exponential moving average (WEMA) at 5,074, and if it falls below this week’s low of 5,069, we could see a further slide towards 4,750/4,800, representing a 6% drop from current levels. Should Nifty also correct by 6% from its current position, this aligns with a potential support zone around 21,900/22,000, making it an interesting technical level to watch.

It will be crucial to monitor if the wounded bulls can stage a comeback or if the market will continue its downward trajectory. Stay tuned!

Nifty Faces Range-Bound Phase,brace for volatility till Mid ApriNifty ended the week at 22,397, marking a decline of about 150 points from the previous week's close. The index reached a high of 22,676 and a low of 22,314, trading in a narrow range of just 360 points. This suggests that next week, Nifty could experience a wider range, with potential moves between 22,850 and 21,950 .

Despite the weakness seen on both the monthly and weekly charts, Nifty remains range-bound as long as the critical support level of 21,950 holds. However, with the end of March approaching, many investors will likely start booking losses to offset any gains they’ve made this year. This could trigger another round of selling pressure in the market. As a result, we may not see a meaningful recovery until mid-April, meaning we could face one more month of market volatility and pessimism.

It's crucial to keep cash ready to invest in fundamentally strong stocks during this period of market uncertainty. On the global front, the S&P 500 closed the week at 5,521, slipping below its 50-week exponential moving average (50WEMA). It seems likely that the index will test the 100-week exponential moving average (100WEMA) at around 5,240–5,250, which is about 4% below its current level. If this happens, we could see additional pressure across global markets, including India.

In summary, brace yourself for another month of market negativity before any potential relief arrives. Stay cautious and focus on high-quality stocks for the long term.

#Nifty50 Outlook for upcoming week 30-3rd Jan 2025The Nifty roared this week, gaining a solid 226 points, closing at a strong 23813! It reached a peak of 23938 before dipping to 23647. As predicted, the Nifty stayed within the 24100-23000 range, forming an interesting inside candle pattern. Excitingly, a bullish "W" pattern has emerged on the weekly chart!

If the Nifty can hold above the crucial 23900 level next week, we could see it trading between 24300 and 23400 . However, while a bounce is expected, the bearish Monthly chart might tempt big players to unload their positions. Stay alert!

Across the pond, the S&P500 took a 2.5% hit, closing at 5970 after reaching a high of 6049. The 5870-5850 support zone is critical. A breach could trigger a faster selloff, potentially testing the 5637/5551 support levels. For an upward move, the S&P500 needs to conquer 6050, paving the way for resistance levels at 6094/6142/6225.

Bottom line: Use any bounce next week as an opportunity to lock in profits. Stay informed and trade wisely!"

Wishing everyone a very happy & prosperous New Year.

#nifty50 analysis for upcoming week 23-27th Sept 2024The #Nifty50 soared to a new all-time weekly high of 25,791, gaining a remarkable 430 points from the previous week's close. It reached a peak of 25,849 and a low of 25,285. As predicted, the Nifty has been trading within the 25,810-24,750 range. For the upcoming week, I anticipate a trading range of 26,400-25,200 . A breach of these levels could ignite significant market volatility.

As highlighted last week, the strong Fibonacci level of 25,810 is crucial. If the Nifty closes above this level next week, be prepared for a potential rally towards the next magical level of 26,990 or 27,000. Although reaching these levels may take some time, it's essential to be positioned for such a move.

Meanwhile, the S&P 500 finally broke through the strong resistance of 5,637, thanks to the Federal Reserve's rate cut. If it can maintain above this week's high of 5,733, we could see further gains towards resistance levels of 5,800, 6,000, or even 6,140. Since the S&P 500 has surpassed a significant Fibonacci level, it's poised to potentially reach another strong Fibonacci level of 6,959, which is 20% higher than current levels. Such a move would likely propel the Nifty towards 27,000.

A breakdown below this week's low of 5,604 would indicate a failed breakout and could lead to a test of support levels at 5,445 or 5,432. Exciting times are ahead!"

#nifty50 analysis for upcoming week 12-16th Aug 2024The Nifty index concluded the week at 24,367, shedding 350 points from the previous close. The index touched a high of 24,419 and a low of 23,893. A global market downturn, ignited by the unwinding of yen-funded positions, sent shockwaves through financial markets worldwide.

Looking ahead, the Nifty is projected to oscillate between 25,150-23,800. A breach below the crucial 23,800 support could trigger a deeper correction towards 23,500. On the upside, 24,700 is a key resistance level to watch, representing a potential gap fill. Short-term chart patterns hint at a bullish reversal, supported by the positive outlook on weekly and monthly timeframes. Also remember next week is truncated due to 15th Aug holiday so it will be a 4 day week for Indian markets.

The S&P 500 found support near the DEMA 200. To sustain its upward momentum, the index must hold above 5,400, opening the door to potential targets at 5,433, 5,500, and 5,566. Conversely, a dip below 5,233 could reignite the downtrend, with support levels at 5,180, 5,088 (DEMA 200), and 5,016 exerting downward pressure on global markets.

Prepare for continued market volatility.

NIFTY 50 Analysis For Feb 22nd!Hello Traders,

Here is a Brief Overview About The Analysis of NIFTY 50 For Feb 22nd,

There Are Total of 3 Support Zones Which You Need To Look For And Same 2 Resistance Zones And To Be Mentioned One Grey Area And We Have 5 Imbalance Zones!

The Horizontal Lines From Volume To Volume And OI To OI Indicates The Market Range in Between For That Particular Day!

The Blue And Red Arrow Path Showing The Direction of The NIFTY 50 For That Day.

Note : Those Levels Are For That Particular Day Only.

Please Note That The Only Purpose of The Information On This Page is Purely Educational.

We Are Not Registered with SEBI; Therefore, Before Making Any Financial Decisions OR Investing, Please Consult with A SEBI-Qualified Financial Advisor. We Don't Have Any Responsibility For Your Profits OR Losses.

I Would Welcome Your Participation And Support in the Form of Likes, Comments, And Follow us to Offer Some Encouragement.

Thank You.

NIFTY 50 - Trend Lines (8th Dec Exp)NIFTY 50

- If Candle Breaks & sustains Green line (above / Below) then the target is next green line

- If Candle Breaks & sustains Blue line (above / Below) then the target is next Blue line

Market Range

High Range: 18780 - 18920

Mid Range: 18640 - 18780

Low Range: 18500 - 18640

caution:

cannot guarantee the accuracy of the data & it's presentation

stock market investments are risky by nature so we are not responsible for

your losses or profits, and your returns will depend on

your own personal trading methods only.