#NIFTY Intraday Support and Resistance Levels - 23/04/2025Gap up opening expected in nifty. After opening if nifty sustain above 24250 level then upside rally upto 24500+ level expected in index. Upside 24500 level will act as a strong resistance for today's session. Any further strong rally only expected after breakout of this level. Any downside movement only expected if nifty starts trading below 24200 level.

Niftyprediction

Nifty Futures Intraday Trend Analysis for April 22, 2025The primary trend remains bullish as Nifty Futures continues to trade above the Sine Wave. However, Market Timing is indicating a bearish signal, which is further confirmed by the MastersCycleSignal indicator. If the price moves lower, the first support level is at 23,875, followed by a stronger support at 23,628 (Sine Wave level).

This is my personal view. Traders are advised to rely on their technical analysis and always trade with a Stop-Loss.

#NIFTY Intraday Support and Resistance Levels - 22/04/2025Today slightly gap up opening expected in nifty. After opening if nifty starts trading above 24250 level then expected further bullish rally upto 24500+ level in today's session. 24000-24200 level will act as a consolidation zone for today's session. Any major downside only expected below 24000 level.

22 April important level trading zone #Nifty50 #option trading

99% working trading plan

👉Gap up open 24238 above & 15m hold after positive trade target 24508,

👉Gap up open 24008 below 15 m not break upside after nigetive trade target 24008, 23853

👉Gap down open 24008 above 15m hold after positive trade target 24238 , 24508

👉Gap down open 24008 below 15 m not break upside after nigetive trade target 23853, 23653

💫big gapdown open 23853 above hold 1st positive trade view

💫big Gapup opening 24508 below nigetive trade view

📌 Trade plan for education purpose I'm not responsible your trade

More education follow & support me

#NIFTY Intraday Support and Resistance Levels - 21/04/2025Today will be flat opening expected in nifty. After opening 23850 will act as a resistance for today's session. If nifty starts trading below this resistance level then expected downside upto 23600 support level. Strong bullish rally expected in nifty if it's started trading above 23900 level. This upside bullish rally can goes upto 24200+ level in today's session.

Decoding NIFTYDear Traders,

I hope this message finds you well in your trading endeavours and personal pursuits. I am excited to share a compelling opportunity with you through a new NIFTY analysis that sheds light on the continuation of the market shift.

Preliminary Analysis Overview:

The downtrend from all-time highs has reached approximately 65% of its progression.

The recent upward surge is somewhat concerning due to concerns about a new trend or a correction within a correction in a larger degree (downtrend).

Let us discuss the key points to distinguish between these two scenarios:

The second leg of the downtrend is experiencing a correction, having completed approximately 89/90 days (which reinforces the interim trend’s completion).

The current correction is progressing rapidly, exhibiting limited sub-waves, which is typically not a characteristic of a motive wave (especially at the beginning of a trend).

The accompanying chart illustrates this point.

Let us elucidate the reasons behind this assertion:

Reason I:

As a staunch believer and ardent follower of Master WDG , the significance of time cannot be disregarded.

The primary downtrend commenced on September 27, 2024, and is poised to encounter a pivotal juncture, namely 180 days from its commencement on March 25, 2025 (Tuesday). This date also coincides with a cross-over with the Fibonacci value of 21 from March 4, 2025, where the interim correction commenced (21,964.60).

The 180D is a component of both the tetragram and the hexagram, and it also represents the midway point of a complete circle (360).

There is also another weird correlation, 4th MAR’25 & 25th MAR’25 both falls on Tuesday marking initiation & termination, the same day.

Reason II:

The geometric patterns of preceding and ongoing movements further support this analysis.

Analyzed both on a daily and weekly basis. The correction responded favorably to both Fibonacci retracements and trendlines. Upcoming resistance levels include:

RI: 23,590~23,600

RII:23,653 (23.6% of the downtrend)

RIII: 23,807

The previous support level is acting as a crucial resistance.

I also observe that there will not be a positive close in 3M charts.

Reference:

Important Dates to Remember:

As suggested, March 25, 2025, marks a significant juncture in the overall trend.

This is pure technical based analysis & does not involve any economic data releases other factors.

** Final Verdict: **

The market is anticipated to conclude its final leg of the downtrend, commencing from this Tuesday. However, the duration of this leg can range from 1 to 2 months.

I have identified several crucial dates for monitoring the upcoming trend. Stay informed!

**Strategy:**

Given the prevailing market conditions, adopting a bearish stance appears prudent.

Any sell positions executed after 23,550 will yield positive returns.

While it may seem counterintuitive to deviate from the prevailing trend, I am merely adhering to the established rules (without expressing any personal sentiment). However, it is inherently risky. Therefore, it is imperative to implement robust risk management strategies during such high-risk trades that are significantly influencing the market.

Additionally, please exercise caution regarding option buying. The low volatility environment is concerning, but it is anticipated to normalize as the downtrend progresses.

Fellow Traders,

The creation of this valuable analytical resource has required countless hours of dedication and effort. If you find it useful, I humbly request your support by boosting the idea and following me (updates will be provided via this post, new posts, and through minds). Your comments and thoughts on this idea are highly valued, and I am committed to engaging with each one personally.

Thank you for investing your time in reading this article.

Wishing you profitable and fulfilling trading endeavors!

Disclaimer:

Before concluding, I must emphasize that the insights shared are based on my analysis. It is crucial for you to conduct your own research and, if necessary, consult with a financial advisor before making any trading decisions. The dynamic nature of financial markets necessitates that your strategies align with your financial objectives and risk tolerance.

21 April Nifty50 trading zone

#Nifty50 #option trading

99% working trading plan

👉Gap up open 23918 above & 15m hold after positive trade target 24032, 24212

👉Gap up open 23918 below 15 m not break upside after nigetive trade target 23760, 23680

👉Gap down open 23760 above 15m hold after positive trade target 23912, 24032

👉Gap down open 23760 below 15 m not break upside after nigetive trade target 23684, 23460

💫big gapdown open 23680 above hold 1st positive trade view

💫big Gapup opening 24032 below nigetive trade view

📌 Trade plan for education purpose I'm not responsible your trade

More education follow & support me

$NIFTY in bullish momentum. More upside-expectedDuring the last few days, we have been discussing the weakness in the US Dollar and the TVC:DXY index and what it means for the commodities like Gold ( AMEX:GLD ) and Oil ( TVC:USOIL ). But we never discussed the positive effect it has on the emerging markets like $NIFTY. The index NSE:NIFTY which consists of top 50 stocks based on market cap in India is having a positive momentum divergence after touching the lower bound of the upward sloping Fib retracement levels. Here in this blog space on 17th March we posted that NSE:NIFTY looks oversold and we might be ready for a bounce. We favored going long NSE:NIFTY at 22000. Since then, the RSI bottomed and we up 8% form the lows of 22032.

If we still follow the Fib levels from the last blog, the charts are telling us that we might be headed to 25000 before having any meaning full pullback. The index internals look healthy with RSI hovering around 50 and not in overbought territory. And the tailwind to all this is still the US Dollar story. Here we are targeting 95 in the TVC:DXY on a short-term basis. This might push NSE:NIFTY to 25000 and beyond.

Verdict : NSE:NIFTY rally continues to 25000; TVC:DXY to 95.

$NIFTY in bullish momentum. More upside-expectedDuring the last few days, we have been discussing the weakness in the US Dollar and the TVC:DXY index and what it means for the commodities like Gold ( AMEX:GLD ) and Oil ( TVC:USOIL ). But we never discussed the positive effect it has on the emerging markets like $NIFTY. The index NSE:NIFTY which consists of top 50 stocks based on market cap in India is having a positive momentum divergence after touching the lower bound of the upward sloping Fib retracement levels. Here in this blog space on 17th March we posted that NSE:NIFTY looks oversold and we might be ready for a bounce. We favored going long NSE:NIFTY at 22000. Since then, the RSI bottomed and we up 8% form the lows of 22032.

If we still follow the Fib levels from the last blog, the charts are telling us that we might be headed to 25000 before having any meaning full pullback. The index internals look healthy with RSI hovering around 50 and not in overbought territory. And the tailwind to all this is still the US Dollar story. Here we are targeting 95 in the TVC:DXY on a short-term basis. This might push NSE:NIFTY to 25000 and beyond.

Verdict : NSE:NIFTY rally continues to 25000; TVC:DXY to 95.

Nifty Futures intraday analysis for April 17, 2025As explained yesterday, I foresee a bearish trend and the support1 zone at 23358 and Support 2 is at 23313. A breakout below 23313 will bring the Nifty Futures down to 23237. Our Market Timing indicator is in line to our analysis.

This is just my view for the day. Traders must use their own technical study before entering into trades. Stop-Loss is a must for every trade.

#NIFTY Intraday Support and Resistance Levels - 17/04/2025Slightly gap down expected in nifty. After opening if nifty sustain above 23300 level then expected nifty will consolidated between 23300 to 23500 level in today's session. Any strong rally in index only expected breakout of this level. Strong upside rally expected if nifty starts trading above 23500 level in today's session.

Nifty Futures Daily Trend analysis for April 17, 2025As mentioned in my post yesterday (April 15, 2025), we have been eyeing the Nifty Futures resistance level at 23,460. Today, the price is approaching this level. Our Masters Cycle has confirmed a buy signal today, with a stop-loss set at 21,859.

Now, how should we approach intraday trading for tomorrow (April 17, 2025)?

As highlighted in yesterday’s update, our Future Candle Reversal Projection indicator has signaled a reversal day for April 17. Additionally, the Dynamic Candle Reversal indicator (note the small blue line plotted today) has confirmed an intraday bearish setup for tomorrow.

Considering these signals, we will focus on intraday shorting opportunities for April 17. However, for positional trades, we continue to maintain a bullish bias.

Disclaimer:

The views shared here reflect my personal analysis and are intended for educational purposes only. Market conditions may differ in real-time. If you are a trader, please conduct your own research and analysis before making any trading decisions. Always ensure that you trade with a proper Stop-Loss in place.

#NIFTY Intraday Support and Resistance Levels - 16/04/2025Today will be slightly gap up opening expected in nifty. After opening if nifty sustain above 23300 level then possible upside rally upto 23500 in opening session. This rally can be expected for further 200+ points in case nifty gives breakout and starts trading above 23550 level. Any major downside only expected below 23250 level.

#16 April Nifty50 trade zone

#Nifty50

99% working trading plan

👉Gap up open 23418 above & 15m hold after positive trade target 23482, 23640

👉Gap up open 23418 below 15 m not break upside after nigetive trade target 23262, 23188

👉Gap down open 23262 above 15m hold after positive trade target 23418 , 23482

👉Gap down open 23262 below 15 m not break upside after nigetive trade target 23188, 23084

💫big gapdown open 23188 above hold 1st positive trade view

💫big Gapup opening 23482 below nigetive trade view

📌 Trade plan for education purpose I'm not responsible your trade

More education following me

Nifty Futures Daily Trend AnalysisNifty Futures has been in an uptrend since closing above the SSL level at 23,018. The MastersCycleSignal indicator is currently acting as resistance at 23,460. A breakout above this level could open the path toward the next resistance at 23,801.

The Future Candle Reversal Projection indicator highlights potential upcoming intraday opportunities that contrast with the intraday trend of the day prior to the reversal. This is my personal view and shared for educational purposes only. Please conduct your own technical analysis and always trade with a stop-loss.

#NIFTY Intraday Support and Resistance Levels - 15/04/2025Nifty will open gap up in today's session. Expected opening above 23050 level. After opening if it's sustain above this level then possible short upside rally upto 23300+ level in opening session. 23300 level will act as an immediate resistance. Expected reversal from this level. Any further upside rally only possible above this level. Major downside expected if nifty starts trading below 23000 level in today's session.

Nifty 50 @ 22800 Crucial Support / Resistance LevelThere was a Head & Shoulder Pattern in Making and 22800 was a Support for NIFTY 50 but Due to TTT Trump Terrif Threats there was a Gap down and it Kissed 22000 Again.

A Massive Support and Power is Generated from 22000 and now Nifty is @ 22800 which was Support and now acting as Resistance.

It is again at the point where it left the continuation of Head & Shoulder Pattern which is 22800

if Nifty gets a good support @ 22800 now it can first phase Rally till 23800 and then continue for its journey towards 25800. should be there by 2-3 more months.

I see a support @ 22800 coz

1. Continuation of H&S Pattern

2. RSI Daily is near 50 and could get a bullish crossover with RSI MOVING AVERAGE

3. MACD is also showing signs for turning Green and crossover with its MA

Lets See!

15 April Nifty50 trading zone #15 April Nifty50 trading zone

#Nifty50 #Toady #TCS #NIFTYBANK #options

99% working trading plan

👉Gap up open 22910 above & 15m hold after positive trade target 23020, 23180

👉Gap up open 22910 below 15 m not break upside after nigetive trade target 22690 ,22492

👉Gap down open 22690 above 15m hold after positive trade target 22910, 23020

👉Gap down open 22690 below 15 m not break upside after nigetive trade target 22492, 22330

💫big gapdown open 22492 above hold 1st positive trade view

💫big Gapup opening 22022 below nigetive trade view

📌 Trade plan for education purpose I'm not responsible your trade

More education following me

NIFTY Futures | Liquidity Sweep + Bullish Structure Shift NIFTY Futures (15min) – Technical Analysis using SMC | ICT | Price Action

1. Price took liquidity below 22,405, sweeping sell-side stops — a common smart money move

before reversing.

2. A clear market structure shift occurred as price broke previous swing highs after the liquidity

grab.

3. Price is currently reacting from a bullish order block between 22,440 – 22,480, showing signs

of accumulation.

4. The entry aligns with ICT’s Optimal Trade Entry (OTE) zone near the 61.8% Fibonacci

retracement level.

5. Price was consolidating in a tight range (5min) and has now started breaking out to the

upside.

6. There is a visible imbalance / fair value gaps between 22,760 – 22,920 that price may look to

fill.

7. Immediate targets are:

- 22,760 (start of imbalance)

- 22,920 (buy-side liquidity above recent highs)

- 23,250 (clean inefficiency zone)

- 23,310 (major resistance / previous high)

8. The setup becomes invalid if price breaks and closes below 22,405 — that’s the stop-loss level.

Thanks for your time..

#NIFTY Intraday Support and Resistance Levels - 11/04/2025Gap up opening near 23000 level expected in nifty. After opening if nifty starts trading above 23050 level then expected further upside rally upto 23250+ level in opening session. Downside 22800 level will act as a strong support for today's session. Any major downside rally only expected if nifty not sustain above level and starts trading below 22750 level.

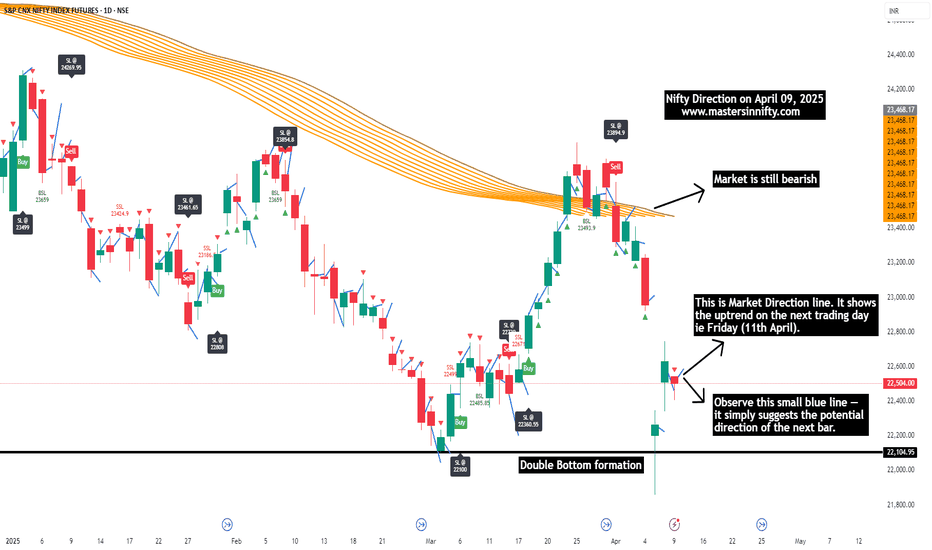

Nifty Daily view on Friday (April 11, 2025)According to my analysis, the Nifty is still bearish on a daily basis. However, I foresee an opportunity in the bullish signals on April 11, 2025. Since I am considering the gaps on the either direction, traders should follow technical analysis before entering into trades.