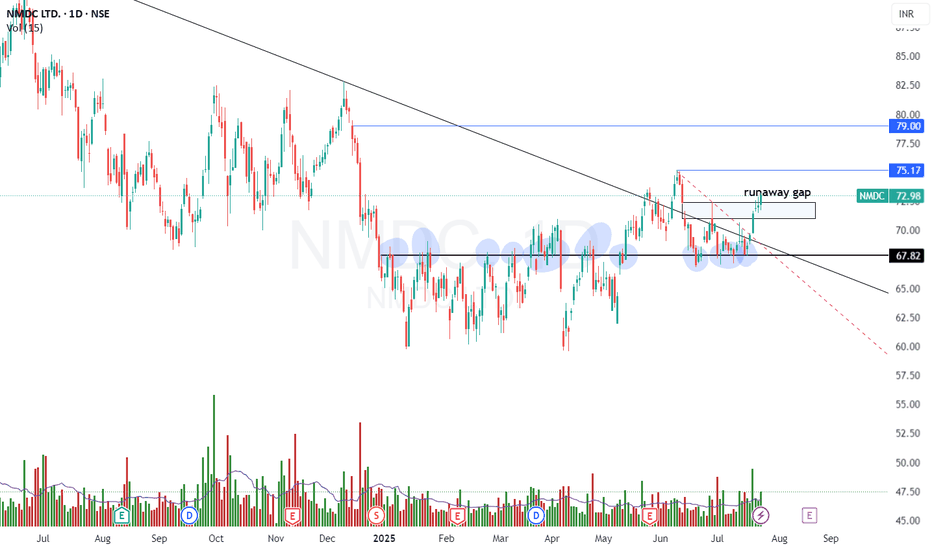

NMDC – Bullish Trend Reversal with Breakout Setup📈 NMDC – Bullish Trend Reversal with Breakout Setup (For Study Purpose Only)

NMDC has displayed a bullish trend reversal following a prolonged 6-month consolidation between ₹60–68. The stock broke out decisively above this range and has since retested the breakout zone successfully, confirming it as a strong support.

Subsequently, the stock entered a 1-month sideways consolidation between ₹67–73, forming a tight base—typically a sign of strength and potential continuation.

🔍 Technical Highlights:

✅ Breakout Zone: ₹68 (now acting as strong support)

🔁 Retest Completed: Post-breakout pullback respected support

🧱 Current Range: ₹70–73 (tight consolidation near highs)

📊 Volume: Gradual increase near resistance, indicating accumulation

📈 RSI & MACD: RSI climbing steadily; MACD shows bullish crossover

🎯 Trade Setup (for study purpose only):

Watch for strength above: ₹73

Stop-Loss (SL): ₹69

Targets: ₹75 (initial), ₹80–82 (extended)

📌 Note:

This analysis is intended for educational and study purposes only. Always conduct your own due diligence or consult a certified financial advisor before making any investment decisions.

Nmdcltd

NMDC SHORT Trade Setup and levelsNMDC SHORT Trade Setup and levels

Got a clear short entry on 28 August

Entry: 226

Stoploss: 230

Target 1: 222 (DONE)

Target 2: 215 (DONE)

Target 3: 208

Target 4: 204

Current Trailing Stop loss: 224

Hope this helps.

Support my work by following my profile for more such actionable charts.

NMDC Low Risk High Reward IdeaAs per my analysis, best level to take buy entry on NSE:NMDC is 107 with stop loss of 103 (-04 Points Risk). We can get upside target of 109.60 & 118 (+11 Points). This could be low risk and high reward idea.

Note: This is my personal analysis, only to learn stock market behavior. Thanks.

NMDC Harmonic & downtrend Potential BreakoutThe idea here is about NMDC:

NMDC Limited (NMDC) is an India-based iron ore producer and exporter. The Company operates in two business segments: iron ore and other minerals and services. The Company is engaged in the exploration of a range of minerals including iron ore, copper, rock phosphate, lime stone, dolomite, gypsum, bentonite, magnesite, diamond, tin, tungsten, graphite, and beach sands.

My view is very bullish for the below observed technical factors & News.

NEWS: MCA (Ministry Of Corporate Affairs) has approved the demerger of NMDC steel from NMDC with ratio of 1:1. Do your own research for more information.

Points as per TA on a Weekly & daily Chart:

1. Currently under downtrend & support has been re established @ 129.00 on a weekly chart as per below:

2. Gartley Harmonic Pattern completed with confirmed entry & target 1 completed at the time of publishing on a weekly chart as per below:

3. Bearish Nen Star Harmonic CD leg under progress on a weekly chart as per below:

4. Trading way above 20 & 200 EMA on a weekly chart & 20 EMA cross over expected soon.

5. Trading above 20 & below 200 EMA on daily chart.

6. Bullish flag pattern on weekly chart observed as per below:

7. Multiple divergence confirmed in the same direction on weekly chart as per below:

8. Ichimoku Cloud analysis: Kumo Breakout & Kumo Twist on a daily is neutral, weekly is strong downtrend & monthly chart is consolidating at the time of publishing.

9. RSI is at 51.46 on a weekly Chart and 53.56 on daily chart at the time of publishing.

10. MACD above signal line on weekly & below signal line on daily chart.

11. Hull Moving average on daily & weekly is a sell and other moving averages on a daily,weekly & monthly chart is a buy.

12. ADX (Average directional index ) trend strength is at 20.53 on a weekly, which indicates a absent or weak trend (ADX between 0-25 is a Absent or weak trend) and 25.32 on a daily chart.

Projected Target with %: Provided in the chart as per Gartley & Bearish Nen Star harmonic pattern.

Stop Loss: Provided in the chart as per Gartley.

Note : Any further dip can be considered to accumulate & Average it down.

Disclaimer: “The above is an Educational idea only and not any kind of financial or investment advice. So please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas!!

Want to keep yourself updated with current market action? Then don’t forget boost & to subscribe for more analysis.

Do leave your valuable feedback & comments for any improvisations.

Cheers.

NMDC Trend AnalysisCan this public sector company beat its private sector rivals in ROI?

Technically price has just bounced off from support and closed as bullish pin bar on weekly TF at the top 25% level which is considered highly bullish.

Broader pattern shows Cup with Handle formation as highlighted.

Good to buy at CMP or accumulate around 95-110 levels for the following targets:

Medium term swing target @ 188 (82.5% ROI with 4.72 R:R)

Medium term positional target @ 240 (133% ROI with 7.6 R:R)

Long term positional target @ 330 (220% ROI with 12.6 R:R)

Stop loss @ 85

Strong fundamentals with highest ever net profit YOY.

High capex because of commissioning of new steel plant (will be operational soon), for slurry pipeline and for third screening plant.

Demerger with Nagarnar Steel Plant which will take about 3 months.

NMDC is not in export market, hence there is no ‘direct impact’ as such on Imposition of 50% export duty on iron ore and 45% on pellets.

Demand is not an issue for NMDC as its top three customers account for 70% of the produced ore, with the balance taken up by Chhattisgarh DRI plants who are dependent on NMDC ore.

Do your own due diligence before taking any action.

Peace!!