NOK

Target hit. Now Rising towards a Lower High/ Resistance.TP = 13.4897 hit as NOKJPY hit the former Rectangle's 13.3513 support and even broke it to test the 1W support = 13.000. A strong rebound has followed that will either peak at 13.700 (if 1W is a Channel Down, MACD = -0.114, B/BP = -0.1600) or at the 13.8900 Resistance (if 1W honors the previous Rectangle sideways, RSI = 49.542, Highs/Lows = 0). After either of those scenarios, another test of 13.3500 is expected.

Previous target hit. Approaching a 1W Higher Low. Long on supporThe last TP = 6.0866 hit and CADNOK has since rose within the long term 1W Channel Up (MACD = 0.038, Highs/Lows = 0.0111, B/BP = 0.0930) which is now pulling back towards its potential Higher Low (RSI = 53.641) near 6.27730. That is carried out within a 1D Channel Down (green channel, Highs/Lows = -0.0262). Once the low is made, we will be going long, TP = 6.500.

NOK/JPY - Short 200 PipsAs long as the 50 EMA on the 8 hour chart continues to act as resistence, we can expect NOK/JPY to fall.

It was not able to find support on top of it and thus, it may reverse back down after these few days of consolidation.

A pending order could be placed right underneaght the lows, that is at 13.2, so that you may enter right when the break down happens.

Previous target hit. 1D Channel Up emerged. Long.TP = 8.12285 hit as the previous Head and Shoulders pattern on 1D evolved into a Channel Up (RSI = 62.333, Highs/Lows = 0.0042, B/BP = 0.0108). The Higher Low appears to have been priced on USDNOK so we are going long with TP = 8.55 but may close at 8.50 if we see enough Resistance by the previous Higher High.

USD/NOK 1H Chart: Pressured by 55– and 100-hour SMAsAfter scoring 2018 high at the 8.50 mark, the USD/NOK exchange rate has been declining since the middle August.

The pair has been following a short-term bearish channel. This lack of direction is caused by the 55– and 100-hour SMAs which are pressuring the rate from north. At the time of this analysis, both moving averages were located at 8.3588 and 8.3809, accordingly.

It is expected that a breakout of these lines would be met with a surge in the respective scenario. Technical indicators on longer time-framers are in favour of the bullish scenario. In this case, a few-day target is the weekly PP at 8.3768. On the other hand, bears are likely to push the rate down to the weekly S2 at 8.2154.

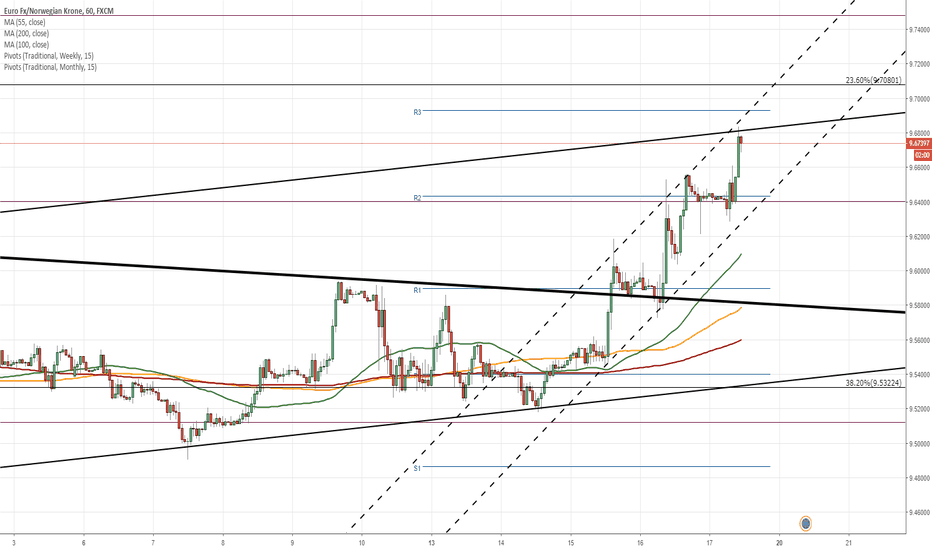

EUR/NOK 1H Chart: Pair shows signs of reversalThe most recent development of the EUR/NOK exchange rate is a breakout from the senior channel which occurred near 9.59 on August 16. This move has extended the pair’s three-day gain to 1.65%.

As a result, the Euro reached the upper boundary of a ten-week ascending channel at 9.68. Even though the price still continues to edge higher today, technical indicators are starting to point to a possible change in sentiment.

It is likely that a reversal south occurs soon, as the current three-day surge cannot be sustainable for long. It is likely that the pair makes a U-turn near the channel line and the 23.60% Fibonacci retracement somewhere in the 9.70 area. A possible downside target for the following sessions is the 55– and 100-period (4H) SMAs and the monthly PP at 9.50.

Rectangle Pattern on 1W. Scalp.NOKSEK is trading within a long term Rectangle on 1W (Williams = -53.421, CCI = 12.5397, Highs/Lows = 0.0000) with 1D indicating that at the moment the price is on the pivot (RSI = 51.985, ADX = 17.916) with both directions equally probable. We will be scalping within the Resistance (1.09456) and Support (1.07445) lines indicated in blue.

Target hit. Lower High made. Short continuation.TP = 10.5800 as the 1D Channel Down on GBPNOK marginally crossed the previous Lower Low. As you see it is now limited to the resisting line, making repetitive Lower Highs under this mark, hence the neutral RSI = 52.471, Highs/Lows = 0.0000. We have place a new short now with TP again = 10.5800 and if crossed extension to 10.5000.

1W Channel Down. Long-term short.EURNOK has just posted a Lower High on the long term 1W Channel Down (RSI = 48.488, MACD = -0.015, ROC = -1.366). 9.500 is an important 1D support level and will be tested shortly to confirm the new bearish leg on 1D (now on neutral RSI, Highs/Lows). We are taking this opportunity to open a medium term short with TP = 9.38806.

Target hit. Channel Down continuation. Short.The previous TP = 10.68907 was hit and as expected the 1D Channel Down on GBPNOK (RSI = 41.174, ADX = 24.685) has continued lower on a more steady pace and controlled bands (MACD = -0.023, Highs/Lows = 0, B/BP = -0.0513). We continue to short, TP = 10.5800.

Resistance rejection on long term Rectangle. Short.NOKJPY is trading within a monthly Rectangle (RSI = 51.832, ADX = 21.125, CCI = 20.9692, Highs/Lows = 0) since early February (13.3500 - 13.900). Since July 10th it has been rejected 3 times on the Resistance so a short has been added, TP = 13.4897.

meanwhile in the forgotten land of scandinavian forex ....while people are stuck and excited on the big pairs .... and losing a lot of money, the best pairs are the forgotten ones. noksek is closely monitored by the swedish and norwegian central banks, so that there is no big deviation so no big losses on your account, and the moves are repetitive like a parrot. we have reached again a situation with a parallel UBB, MM and LBB, nothing more perfect than that for a calm and without risk move on noksek. it will decrease steadily with a first corrective bounce at 1.04 (because of the first geometric blockade on a weekly zoom). just short noksek, and wait .... if the monthly candle creates an opening upward of the slope of the UBB, it will completely invalidate the move, noksek will be able to drift upward again, but you will see it coming as noksek evolves smoothly and slowly, so you will have the time to see and react before accumulating big latent losses.

USD/NOK 1H Chart: Bearish in medium termUSD/NOK is trading in a long-term ascending channel. The rate bounced off its upper boundary at 8.33—its highest position in 2018 - late in May.

Subsequently, the US Dollar initiated a new wave down towards the other senior channel line located circa 7.90. This bearish movement was stopped by the monthly S1, the 50.00% Fibonacci retracement and the 55– and 200-day SMAs at the 8.00 mark. This resulted in a reversal back to the upside.

It seems that the pair might be ready to breach the short-term ascending channel to the downside, thus resuming its decline until the bottom channel line in the 8.00/05 range is reached somewhere in July. A possible confirmation of this bearish scenario should be provided by the US Dollar breaching the combined support of the 55-, 100– and 200-period (4H) SMAs at 8.10.

4H Channel Down. Short.CADNOK is on a common Channel Down on 4H (RSI = 37.434, Highs/Lows = -0.0223, B/BP = -0.0495). It is now looking for the next Lower Low but is near two important 1D support levels (6.12584 and 6.0866). If they break then 6.04 will be the Lower Low. Our TP is the 2nd support = 6.0866 and we will pursuit 6.0400 with SL brought down on profit zone.

USD/NOK 1H Chart: Pair returns to senior channelStrong upside momentum has driven the USD/NOK exchange rate since late March. The pair had appreciated 8.60% until it peaked near the 8.32 mark on Tuesday. It likewise breached the prevailing one-year channel on the same day. As a result, the US Dollar shot up to the 8.32 level and subsequently fell back to the breached senior channel.

During the past few weeks, the pair has been trading in a rising wedge pattern. It is expected that the pair remains trading in this pattern and thus edges lower within the following sessions. The pair is likely to find strong support at its bottom boundary which is reinforced by the weekly PP, the 200-hour SMA and the monthly R1 at 8.10.

Meanwhile, the pair’s overall direction within the following two weeks should be towards its ten-month high near 8.45.

EURNOK 4HR SHORT OPPORTUNITYTrade what we see:

Price is following a bearish channel with lower highs forming.

We have two support lines to work off, one formed on the 4hr chart and the second formed on the daily time frame.

A pin bar is forming now and I am waiting to setup this short position which has a great risk / reward ratio.

If this pair breaks out and we see a successful retest, then there will be a good long bias.

EUR/NOK 1H Chart: Long-term triangle dominatesThe EUR/NOK exchange rate has been constrained by a descending triangle which was formed in November, 2017. After testing the upper boundary of this long-term pattern early in May, the common European currency began depreciating against its Norwegian counterpart, thus reaching its bottom boundary at 9.47, likewise reinforced by the monthly S2, mid-yesterday.

It is likely that some downward pressure still prevails during the remaining part of this week, given that the pair might be pressured lower by the combined resistance of the 55-, 100– and 200-day SMAs near 9.60. However, the general price direction should nevertheless remain upwards in line with the prevailing triangle pattern, with its upper boundary being located at 9.65.