Novo

NVO Soaring Towards TargetsOur NVO call debit spreads and LEAPS options soaring towards targets at the 233 EMA here.

Beautiful thing when fundamentals, valuations and technicals align.

Impulse move from the bottom gave us a hat trick - triple green tags (white circles) for bullish A+ momentum signals into a consolidation period in which we built our position and added on the consolidation breakout

Novo Nordisk | NVO | Long at $86.74The Good:

NYSE:NVO expects its GLP-1 drugs Wegovy and Ozempic to soon come off the Food and Drug Administration's official shortage list.

Just reported better-than-expected net profit in Q4 2024, amid soaring demand for its obesity drugs.

Revenues for the Q4 2024 came in at $11.6 billion, up 30% compared to the same quarter in 2023.

From a technical analysis perspective, hovering near my historical simple moving average which may lead to a near-term price increase due to positive earnings

The Bad:

Slower growth in 2025 (16%-24% for 2025 vs 18%-26% in 2024).

Chart has been on a major run since 2020 and may be due for further correction.

Personally, the positives outweigh the negatives given the obesity drug demand. Thus, at $86.74, NYSE:NVO is in a personal buy zone.

Targets:

$96.00

$105.00

Novo Nordisk hit my target this week and I have started to buy The head and shoulders pattern successfully played out, with OMXCOP:NOVO_B reaching my full target at 670.

Check out my original post:

The stock experienced a significant drop, falling as much as 27% on the Friday before Christmas. This was triggered by test results for their obesity drug, CagriSema, which showed patient weight loss of 22.7% - below the anticipated 25%.

I believe this reaction is an overcorrection and have taken advantage of this rare opportunity to purchase OMXCOP:NOVO_B , first at 680 and again at 600. I now plan to hold patiently, expecting Novo Nordisk to reach new all-time highs in the coming years.

Novo Nordisk (NVO): Beautiful Reversal Pattern is emerging Novo Nordisk price has charted a famous and beautiful reversal pattern - Head & Shoulders.

We have 3 peaks with the middle one the tallest also called Head.

The Right Shoulder inclines down so the magnitude of the bearish move is strong.

The dotted line between valleys of the Head is called a Neckline.

The bearish target for this reversal is located at the distance of Head's height subtracted from the breakdown point on the Neckline.

So, the target is at $89.

This area aligns very well with the bottom of last October and the peak of last May.

Novo Nordisk Surges to Record HighsNovo Nordisk ( NYSE:NVO ) made waves in the pharmaceutical industry as its stock skyrocketed to unprecedented heights following the announcement of groundbreaking results from its experimental oral weight-loss drug, amycretin. The drugmaker's innovative approach, which combines GLP-1 and amylin hormones, surpassed expectations by demonstrating remarkable efficacy in comparison to established market competitors like Wegovy.

Key Highlights of Novo Nordisk's Breakthrough:

- Performance Comparison: Amycretin achieved exceptional results, with patients experiencing over 13% weight loss within 12 weeks, overshadowing the 6% weight loss recorded by Wegovy, Novo's existing weekly shot.

- Analyst Reactions: Industry experts hailed amycretin's performance as "solid," emphasizing its potential to revolutionize weight-loss treatments.

- Future Prospects: Novo plans to initiate Phase 2 studies for amycretin in late 2024, aiming to further validate its efficacy and pave the way for regulatory approval.

Market Impact:

Novo Nordisk's stellar performance sent its stock soaring by over 9.39%, reaching an all-time high. Meanwhile, competitors such as Eli Lilly ( NYSE:LLY ) and Viking Therapeutics ( NASDAQ:VKTX ) experienced fluctuations in response to Novo's breakthrough.

Competitive Landscape:

Novo Nordisk's ( NYSE:NVO ) success has intensified competition within the weight-loss drug market, with companies like Eli Lilly and Viking Therapeutics racing to develop similar treatments targeting multiple hormones for enhanced efficacy.

Manufacturing Challenges and Future Outlook:

Despite the excitement surrounding amycretin, Novo ( NYSE:NVO ) faces manufacturing hurdles due to the substantial demand for its existing products like semaglutide injections. However, the company is exploring innovative packaging solutions to address these challenges and capitalize on amycretin's commercial potential.

Conclusion:

Novo Nordisk's ( NYSE:NVO ) groundbreaking achievement underscores its commitment to innovation and addressing unmet medical needs in the weight-loss sector. As the company continues to advance amycretin through clinical trials and navigate manufacturing constraints, investor confidence remains high, propelling its stock to record levels and solidifying its position as a frontrunner in the pharmaceutical industry.

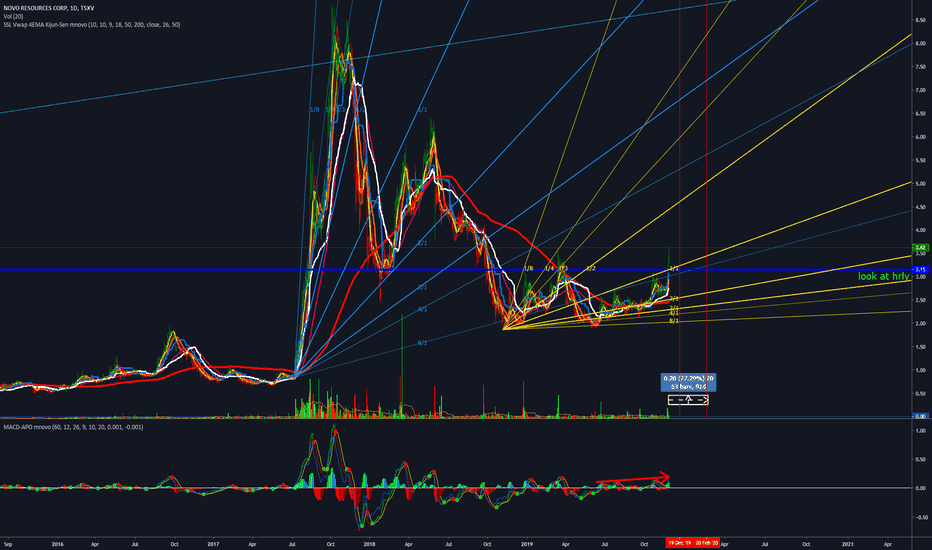

Novo Resources will choose direction before end of August '19Novo Resources ( TSXV:NVO ) is about to end a massive triangle, completion to be expected before the end of August 2019. My bet, with gold back in bullmarket, is that Novo will move strongly upward.

Background: this junior is active in the Western Australian Pilbara region and has found massive gold resources, being researched now for inclusion in the M&I resources. This could be one of the largest gold discoveries ever. Do your own Due Dilligence please.

Novo resources in wave (3) of wave 3, could see new highs soonTSX:NVO seems to have completed it's wave (2) of 3 correction, has started its wave (3) of 3, the most impulsive and powerful wave.

The break above the $6.4o area would invalidate the most basic bearish count and a break above $6.80 would give credit to the bullish scenario.

This idea is valid as long as the key support of $3.80/$4.00 area holds.