NVDA

Nvidia Partners With General Motors to Build Self-driving CarsNVIDIA Corporation, a computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally Partners With General Motors to Build Self-driving Cars.

Also in another news, IBM Taps NVIDIA AI Data Platform Technologies to Accelerate AI at Scale.

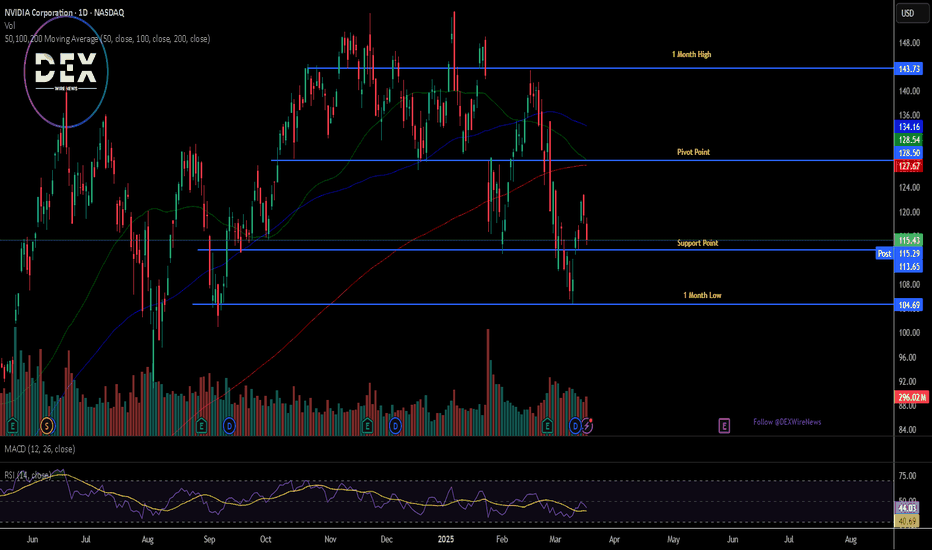

Apparently, shares of Nvidia (NASDAQ: NASDAQ:NVDA ) is undeterred by all this news presently down 3.43% trading with a weak RSI of 44.

The 78.6% Fibonacci retracement point is acting as support point for shares of NVidia a break below that pivot could lead to a dip to the 1-month axis. Similarly, a breakout above the 38.2% Fibonacci retracement point could catalyse a bullish renaissance for $NVDA.

Nvidia - That's Officially The Brutal End!Nvidia ( NASDAQ:NVDA ) is breaking all structure:

Click chart above to see the detailed analysis👆🏻

Following previous cycles, Nvidia has been rallying for more than 2 years, creating an overall pump of approximately +1.000%. But now, everything is literally pointing to a significant towards the downside and with a potential drop of -30%, bears are totally taking over Nvidia now.

Levels to watch: $70

Keep your long term vision,

Philip (BasicTrading)

$QQQ WARNING! April Fool's Market a Joke this year at SUB $400Is this happening? I'm going to have to bet my money on yes. I have been doing this for a long time. Pattern Chart Trading . This has a high probability of happening imo. Is it absolute? Of course not. Is it better to be prepared? Absolutely. Now for the technicals of it.. I'm trying to do better with this...

If we take a bearish perspective on the fib from the previous high in December , and the most previous lower low mid January , we have ourselves at the 1.61 Golden Pocket below. I have a Bullish perspective if we hold here and move above the 1.00 Fib Level, mid January Lows at $499.70 . Last defense would be a 50% retracement to the .786 FIB at the $508 area. Currently, I expect a rally to the 50 day SMA for a retest, then a SLAM to $380s in April . This is the possibility. Take it with a Grain of Salt. The possibility is there. I have one Bullish outlook.. I will post after this...

Nvidia (NVDA) Bullish Opportunity – GTC 2025 & AI GrowthCurrent Price: $121.67

✅ TP1: $130 – (short-term resistance, +7%)

✅ TP2: $145 – (medium-term breakout target, +19%)

✅ TP3: $175 – (analyst target, +43%)

🔥 Why Bullish?

1️⃣ GTC 2025 Conference (March 17-21)

CEO Jensen Huang’s Keynote (March 18) is expected to unveil:

Blackwell Ultra (B300 series): Next-gen AI GPU with 288GB memory.

Rubin GPU Preview: NVIDIA’s roadmap beyond 2026.

Quantum Day (March 20): NVIDIA’s first quantum event, showcasing its role in quantum simulation despite earlier skepticism—potentially broadening its tech leadership.

Market Sentiment: High anticipation for AI & chip updates, with some seeing 30%-50% upside if AI demand is reaffirmed (e.g., new contracts, backlog growth).

2️⃣ Analyst Ratings & Price Targets

Strong Buy Consensus from analysts.

Average 12-Month Price Target: $174.79 → +43.59% upside.

Price Target Range: $120 (low) to $220 (high).

3️⃣ Technical Setup – Breakout Potential

Falling Channel Formation – Price is bouncing from strong support (~$115).

MACD Bullish Crossover – Momentum is shifting in favor of buyers.

Breakout Level: Above $130 would trigger stronger upside.

$140 - $150 are imminent for NVDANVIDIA Stock Analysis & Forecast

Price Outlook: $140 - $150 in Sight

NVIDIA (NVDA) has consistently been one of the most rewarding stocks for investors, delivering substantial returns over the past few years. However, following its all-time high (ATH) of approximately $153 on January 7, 2025, the stock experienced a notable pullback, declining to around $105.

Since that dip, NVDA has shown signs of recovery, with the current price stabilizing at $121.67. This upward momentum suggests a potential rally toward the $140 - $150 range in the near term.

Investment Strategy

Long-Term Perspective: Given NVIDIA’s strong fundamentals and market dominance, accumulating shares for long-term investment remains a solid strategy.

Short-Term Trading: For traders, technical indicators suggest potential entry and exit points. Refer to my chart for the accompanying chart for detailed technical analysis (TA) insights.

While the stock has shown resilience, monitoring key support and resistance levels will be crucial in determining the next phase of its movement.

Nvidia Rises Over 4.5% and Reclaims $120 ZoneBy the end of the week, Nvidia's stock has surged to $120 , with the strong bullish movement likely driven by positive results from its largest supplier. Taiwanese company Hon Hai Precision Industry (Foxconn) reported revenues exceeding $30 billion and announced plans to establish the world's largest chip manufacturing plant in Mexico, aimed at improving supply efficiency for its main client, Nvidia. This news has restored investor confidence in the short term, and if this positive momentum persists, the bullish pressure surrounding the stock could intensify further.

Large Bearish Channel:

Despite the recent confidence in Nvidia, it is important to note that since early January, the stock has been forming a large bearish channel, and its current price remains midway within that channel. This suggests that the short-term buying momentum still has room to grow, but it has not yet been strong enough to break the dominant bearish formation.

RSI Indicator:

The RSI indicator has started showing an upward slope, and the RSI line is preparing to cross the neutral 50 level. This could indicate that buying momentum may begin to take control, especially if the RSI line continues to move consistently above this neutral level in the upcoming sessions.

MACD Indicator:

The MACD histogram is showing a similar pattern, as it is currently testing the neutral 0 line. If a crossover occurs, it would suggest that the moving average trends are turning bullish, potentially reinforcing buying confidence in the following sessions.

Key Levels:

$130 – Significant Resistance: This level coincides with the bearish trendline and the 38.2% Fibonacci retracement level. A breakout above this level could challenge the current bearish channel and pave the way for stronger buying momentum.

$115 – Near-term Support: This level aligns with the 61.8% Fibonacci retracement barrier. If bearish oscillations push the price below this level, it could completely negate the current buying sentiment and extend the long-term bearish trend that has persisted for weeks.

By Julian Pineda, CFA – Market Analyst

$4 to $16 with power hour making +60% run $10 to $16It was consolidating for 4 hours after morning news that investor or group purchased at least 5% stake in the company and filled with SEC. This made the stock pop to +150% on the day as traders speculated it could be a big reputable firm or individual so they want to be in as well. After strong support it moved further to +300% area total on the day and I warned everyone on time to get ready for $10 and $11 buys for the vertical new highs.

Last hour brought easy money NASDAQ:RGC

NVDA Short Term BuyPrice is currently consolidating within a tight range, and a breakout appears imminent. I am looking for a clean break above resistance, followed by a retest of the breakout level, which could provide a strong buy opportunity. If this setup plays out, the next key target would be the $135 level.

However, this move is likely to be a short-term retracement within a larger downtrend. If price struggles to sustain momentum above $135 and shows signs of weakness, it could indicate a continuation of the broader bearish trend. Confirmation will come from price action signals and volume dynamics on the retest.

Nvidia Just Under Major SupportNvidia seems to have been pulled down by the Dow just like Apple as both are just under major support. I'm sorry for my previous Nvidia chart that drew support near 140, I recognize where I screwed up, but this chart should be good. Fortunately actual 117 support wasn't that far below and my NVDA isn't too in the red.

NVDA has the lowest revenue multiple in years right now. I know it's well off it's long term trend line, but it's growth rate is unlike anything it's ever been so expecting a steeper trend line to appear makes a lot of sense. Eventually I would imagine we'll get back to that trend line, but not anytime soon.

The Dow hitting major support should finally lift NVDA and the others that have been dragged down like AAPL and AMZN.

Good luck!

Nvidia (NVDA) Share Price Rises Over 6%Nvidia (NVDA) Share Price Rises Over 6%

The NVDA stock chart shows that following yesterday’s trading session, the share price climbed over 6%, outperforming the Nasdaq 100 index (US Tech 100 mini on FXOpen), which gained just over 1%.

Despite this recovery from a six-month low, NVDA shares remain down 15% year-to-date.

Why Did Nvidia (NVDA) Shares Rise Yesterday?

Positive sentiment swept through the stock market after U.S. inflation data came in lower than expected. The Consumer Price Index (CPI) for the month stood at 0.2%, below analyst forecasts of 0.3% and the previous reading of 0.4%.

Investors may now be looking for opportunities following the March sell-off, triggered by Trump’s tariff policies and recession fears—and NVDA shares appear attractive in this context.

Barron’s suggests that NVDA stock may currently be undervalued, while MarketWatch cites BofA analyst Vivek Arya, who advises investors to focus on Nvidia’s gross profit margins as a key driver of significant share price growth.

Technical Analysis of NVDA Stock

Earlier this month, we identified a descending channel (marked in red) and suggested that its lower boundary could act as support—which was confirmed (highlighted by the circle).

Bullish perspective:

- The stock opened with a bullish gap and gained throughout the session, failing to hold below the psychological $110 level.

Bearish perspective:

- The price remains within the descending channel, with the median line potentially acting as resistance.

- The $117.50 level, previously a support, has turned into resistance (as indicated by the arrows) and may pose a challenge to further recovery.

NVDA Share Price Forecast

According to TipRanks:

- 39 out of 42 analysts recommend buying NVDA stock.

- The average 12-month price target for NVDA shares is $177.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

NVDA - Bearish IdeaA Three downward move situation with the last dip being the largest pushing price down to a lower trend line in red (dotted line)

Bars pattern tool in red shows my thoughts of the bearish movement

I think price will continue down below the green line that has previously been seen as support

Daily chart

$2.36 to $6.54 Strong vertical move $CRVO$2.36 to $6.54 🚀 Strong vertical move on 4 Buy Alerts 🎯 NASDAQ:CRVO

By far beats trading NASDAQ:NVDA NASDAQ:TSLA even on their strongest day

it's trading at 137 million shares so far, at $6 per share that's $1 Billion USD exchaning hands and we still have power hour left.

NVDA Lost it's key support level. Are we headed to 50$ ?The critical support level has been breached, and the price action suggests we could be headed toward the $50 zone 📉. Adding fuel to the bearish case, we see a major bearish divergence on the MFI indicator, signaling weakening momentum.

Is this the beginning of a deeper correction? Stay sharp! ⚠️

New day, new DOUBLED stock $RAY $0.87 to $2.14Doesn't matter what the market is doing!

Our stocks still double! 💯

It's time to adjust your trading strategy to get ahead

Trading NASDAQ:NVDA NASDAQ:TSLA competing with wall street sharks for 10% 20% over weeks or months is not it!

It's much easier taking money from retail shortsellers as they get squeezed into vertical +100% +200% moves

NVIDIA 9-month Channel Up bottomed! Is it a buy??NVIDIA Corporation (NVDA) has been trading within a Channel Up pattern for almost 9 months (since the June 20 2024 High). The correction since the start of January is technically the pattern's Bearish Leg and yesterday it hit the bottom (Higher Low trend-line).

Last time it did so was on August 05 2024 and an instant rebound followed. That was also the time the 1D RSI was on the 34.00 Support, just like today. In fact every time in the past 11 months that this RSI Support was tested, the price rebounded aggressively by at least +26.85%.

Since the previous Higher High rebound peaked on the 1.236 Fibonacci extension, our Target on the medium-term will be $164.00.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

$SPY Short Term Bullish atm.. idea for BullsWell... seeing is we hit my target, I thought I might bless the Bulls with a little bit of Eye Candy.... This is what you want...

The Fib breakdown of the Golden Pocket above at the 1.61... we hit the retracement... and now back to the .78

We hold here and it can get bullish quick.

Bearish Path in Next post... otherwise we make a lower high and fall to $525 and fast.

$1.51 to $3.25 casually DOUBLED while rest of the market crashes$1.51 to $3.25 casually DOUBLED today after being mentioned in chat many times

Sweet catch on NASDAQ:HMR 👏🤑

All while the rest of the market continues to hits new lows on a big red day NASDAQ:TSLA NASDAQ:NVDA AMEX:SPY NASDAQ:QQQ AMEX:DIA NASDAQ:META NASDAQ:AMZN NASDAQ:GOOG

Got to love these type of stocks

AEON 1.26 - 1.33 (+5.5%)

HMR 3.02 - 3.16 (+4.6%)

Total profit today: +10.1%

Nice profit today again while the rest of the market goes into deeper red.

Bulletproof strategy delivers again, no matter the overall market conditions.

Congrats!

See you in the morning!

NVIDIA: Megaphone bottomed. Rally to $195 starting.NVIDIA is almost oversold on its 1D technical outlook (RSI = 34.183, MACD = -6.220, ADX = 39.717) as it reach the bottom (LL) trendline of the Megaphone pattern that it has been trading in since November 21st 2024. This is not the first time we see NVDA inside such Megaphone pattern. As a matter of fact, it was during July-October 2023 when it last did so. The 3rd LL was the buy signal and it coincided with a Triple Bottom on the 1D RSI. This is the exact position we are at right now. The stock has completed three lows below the 1D MA50 and looks ready to rebound with force. The smallest recent rally has been +86.41%. The trade is long, TP = 195.00.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##