June 27th, 2025 - Morning BriefFriday, June 27, 2025. Markets are on the edge, and if you thought summer would bring calm, think again. Today’s script is pure adrenaline.

Overnight, the U.S. and China finally inked a trade deal that actually matters: tariffs are coming down, and rare earths are flowing again. Tech and manufacturing stocks are already celebrating, with SP:SPX and CME_MINI:NQ1! futures inching toward fresh record highs. NASDAQ:NVDA is still the market’s favorite lottery ticket, hitting another all-time high. Meanwhile, NYSE:NKE just spiked 10% premarket after beating earnings. Never mind the $1 billion tariff punch, they’ll “manage it.” Sure.

But the real show is the May PCE inflation data dropping this morning. The Fed’s favorite gauge is expected to tick up to 2.3% year-over-year, with core PCE at 2.6%. If the numbers surprise, brace for whiplash in rates and risk assets. GDP’s third estimate confirmed a -0.5% contraction in Q1, so the “soft landing” crowd is sweating. Jobless claims and new home sales hit at 10:00 AM ET. Expect every algo on the Street to be watching.

Trump is making noise about firing Powell before 2026, which has traders betting on earlier rate cuts. If you’re looking for stability, you’re in the wrong casino.

Here’s where things stand:

- OANDA:XAUUSD : $3,280–$3,334/oz (slipping as risk appetite returns)

- BLACKBULL:WTI : $65.64–$65.82/barrel (steady, but one headline away from chaos)

- BINANCE:BTCUSDT : $107,215–$107,477 (down, but still a six-figure fever dream)

- CME_MINI:ES1! : Hovering just below the 6,144 record

Today’s takeaway: The market’s running on hope, caffeine, and denial. Stay sharp, one bad print and the rally could turn into a stampede for the exits. Welcome to the volatility vortex.

Been building something for US swing traders — if you’re one, I’d really appreciate your feedback. Free to test, link in Bio

NVDA

06/26/25 Trade Journal, and ES_F Stock Market analysis 06/26/25 Trade Journal, and ES_F Stock Market analysis

EOD accountability report: +731.25

Sleep: 5 hours

Overall health: meh

** VX Algo System Signals from (9:30am to 2pm) 3/3 success**

— 9:38 AM Market Structure flipped bullish on VX Algo X3

— 10:30 AM Market Structure flipped bullish on VX Algo X3!

— 11:27 AM VXAlgo ES X1 Sell Signal

What’s are some news or takeaway from today?

and What major news or event impacted the market today?

today was another interesting day, i am noticing that when market structure changes 2x in the same direction, it is usally pretty effective and scammy at the same time

News

*NVIDIA NASDAQ:NVDA SHARES HIT A NEW HIGH TO RECLAIM WORLD'S LARGEST STOCK TITLE - market is being carried by the momentum of mag 7

What are the critical support levels to watch?

--> Above 6175 = Bullish, Under 6155= Bearish

Video Recaps -->https://www.tradingview.com/u/WallSt007/#published-charts

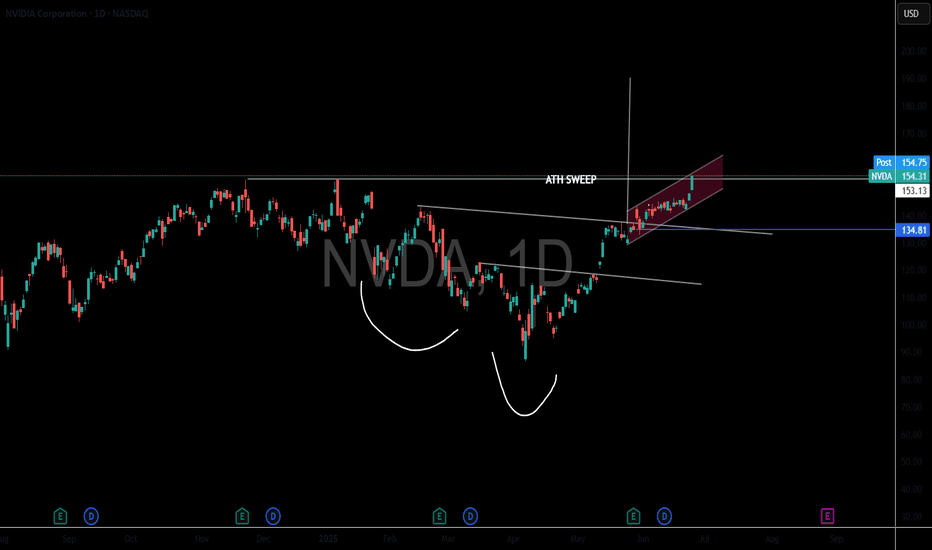

My buy view for NVDAMy buy view for NVDA.

Nvidia has made a significant push up after the meltdown following the new US tariff news.

The push-up is likely cooling off for this baby.

If the current consolidation continues to be sustained by the support zone (TL) in this zone, we are likely to see NVDA rally to $149 and $152 as TP1 and TP2, respectively.

My SL will be around $128.9 zone for both.

RR of 1:4 and 1:4.8

Trade with care

Nvidia (NVDA) Share Price Soars to Record HighNvidia (NVDA) Share Price Soars to Record High

Yesterday, Nvidia’s (NVDA) share price surged by over 4%, with the following key developments:

→ It broke through the psychological $150 per share level;

→ It reached a new all-time high;

→ It also contributed to the Nasdaq 100 index hitting a record peak, as we reported earlier this morning.

As a result, Nvidia has reclaimed its status as the world’s most valuable company. Demand for its shares is being fuelled by the CEO’s optimism.

“We have many growth opportunities across our company, with AI and robotics the two largest, representing a multitrillion-dollar growth opportunity,” said Jensen Huang at Nvidia’s annual investor conference.

Technical Analysis of the NVDA Chart

The last three candlesticks reflect strong demand, as:

→ There are bullish gaps between the candles;

→ Lower wicks are either absent or minimal;

→ Candles are closing near their highs with progressively widening spreads.

This suggests strong momentum as the price confidently breaks through the key $150 resistance level. It is reasonable to assume that the current imbalance in favour of buyers around the $146–150 area (highlighted in purple) may form a support zone in the event of a pullback — for instance, within the existing upward channel (shown in blue).

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

AMD - Inverted Head & Shoulders (Bullish Reversal)Let´s see if we can break the neckline (White trendline) and stay above with a close and possibly a retest on the neckline to confirm this pattern. If so, Im looking for the previous top on daily which is the all time high (So far).

This is not a financial advise. Always do your own research and decision before investing.

Nvidia & Nasdaq History - What you need to know!Record-high share price: NVDA hit a new all-time high as U.S. stock markets rallied and Wall Street analysts forecast continued upside

Nvidia is pushing towards the first ever $4 Trillion market cap.

Today it surpassed MSFT as the largest company in the world closing up over 4% on the session.

Micron earnings are adding extra fuel to the fire for semi conductors.

Short term picture for semis - they're very extended and need some consolidation.

Micron earnings: Revenue: $8.05 billion, up ~38% YoY, beating the ~$7.89 billion consensus

Data‑center revenue: Tripled YoY, powered by surging demand for high‑bandwidth memory (HBM)

HBM sales: Exceeded $1 billion, growing over 50% sequentially

Strong margin and revenue beat; robust cash flow (~$857 million free cash flow) with a solid balance sheet ($9.6 billion in liquidity)

Nvidia - 100% new all time highs!Nvidia - NASDAQ:NVDA - is just too bullish now:

(click chart above to see the in depth analysis👆🏻)

Honestly it was not unexpected that Nvidia is now the most valuable company in the world. The chart is just so strong and perfectly following structure; it seems to be just a matter of days until Nvidia will create a new all time high. If this happens, a breakout rally will follow.

Levels to watch: $150

Keep your long term vision!

Philip (BasicTrading)

NVIDIA Corporation More Bullish Than BearishIt has been a while since we looked at Nvidia and here we have a mixed and tricky chart. I will try to make an accurate prediction nonetheless, watch!

It is tricky because the bullish move stalled and found resistance. The candles started to curve and there is little growth. Nothing to worry though. There is no retrace and the action is happening above 0.786 Fib. extension. This means that the action around resistance is likely to result in additional growth. Resistance is being weakened the more it is challenged.

If the bears were going to push prices lower they had their chance but nothing. If they tried, they failed and this is all bullish.

I predict NVDA will continue growing long-term. This goes in accordance with the analyzes I made back in early April of this year. We can expect a new all-time high in the latter part of 2025.

Summary

To me, the bullish bias is now confirmed. A continuation should happen in the coming days or weeks. Growth is expected long long-term.

Namaste.

$NVDA 6/27 exp week; $150 calls. Quick ChartHello. Market is moving up off the “news” of “ceasefire” from Trump. Take what is given I suppose. NASDAQ:NVDA could see a beautiful upside towards the psych level of $150 in just one session (Tuesday, 6/24) which is just a “small” move of 3%. Could break out of its rising wedge. This name has been lackluster as of late (kinda sorta). $150 calls will be entered at open (6/24) and my first target will be $148.98. There are multiple rejections at these levels. Good luck!

WSL

$NVDA has topped, new lows incomingNVDA has now topped, you can see that we've just formed another high time frame lower high and the rejection up here has the potential to create a strong bearish move.

I think it's very likely that the bearish move will take us all the way down to the bottom support before it's completed.

The bounce from the bottom went higher than I initially thought it would (which is why I'm creating a new chart), but price can't escape gravity and the same outcome is inevitable.

Let's see how it plays out over the coming weeks.

$AVGO above its previous ATH and holding on. 400 $ reachable. The poster child of the AI rally has been NASDAQ:NVDA and $AVGO. Here we have analysed both the stocks multiple times fundamentally and technically. But the lesser known NASDAQ:AVGO has performed better than the NASDAQ:NVDA since the April lows. NASDAQ:AVGO is still above its previous ATH and closed above yesterday which was 242 $ in Jan 2025. NASDAQ:NVDA is still below its Jan 2025 highs of 152 $.

The Semis index NASDAQ:SMH is also 6.3% below its ATH of 262 $. So not many stocks in this index have a more bullish chart than $AVGO. My assessment is that NASDAQ:AVGO will continue its dominant outperformance in the NASDAQ:SMH sector in comparison to others like $NVDA.

Going back to technical and plotting the Fib Extension levels form the last bull run before Aug 2024 we can see that the next possible near-term target is 275 $, a 10% upside form here and in the medium term the target is 400 $.

Verdict : Long NASDAQ:AVGO over NASDAQ:SMH and $NVDA. First Target 275 $ then we go to 400 $.

NVIDIA – Best Buy of the Decade (2 Years from now) 🚀💻 NVIDIA – Best Buy of the Decade (2 Years from now) 🔥🧠

Hey everyone! Back in 2021, I called NVIDIA the best buy of the decade, and in 2023, we followed up as NVDA rocketed to my target of $143. Now in 2025, it’s time for Part 3 — and the case for NVDA being a generational play just got even stronger. 💪

✅ On April 4th, I re-entered around $96.85, right at my alert level. The setup? A rounded bottom reversal pattern forming with 4 strong bullish divergences on key indicators (Stoch, CCI, MOM, MFI). Target levels ahead:

📍 $143

📍 $182

📍 $227

📉 Yes, Nvidia took a 6% hit after announcing a $5.5B impact from U.S. export restrictions on its H20 chip to China — a reminder that macro & geopolitical factors still matter. But…

💡 The company just launched DGX Spark and DGX Station, bringing AI supercomputing to the desktop — powered by Grace Blackwell architecture. That’s next-level innovation, not just for enterprises, but for developers, students, and researchers alike. A true desktop AI revolution.

🇺🇸 And most importantly: NVIDIA will now manufacture AI supercomputers on U.S. soil — in Arizona and Texas — aiming to produce $500 billion worth over the next four years. This initiative is a bold move toward supply chain resilience, economic growth, and cementing NVIDIA’s leadership in the AI arms race.

⚠️ If we lose the $96 level, I’ll re-evaluate. But for now? The technical and fundamentals still say: Best Buy of the Decade (2 Years from now we will revisit this chart).

💬 What’s your outlook? Are you buying the dip or waiting on clarity?

One Love,

The FXPROFESSOR 💙

NVIDIA (NVDA) – Ending Diagonal at the Top? 126 Next?NVDA is currently trading inside a potential ending diagonal, often signaling a reversal or strong correction. With multiple Breaks of Structure (BoS) and a visible Fair Value Gap (FVG) left behind, this setup is aligning with Smart Money Concepts.

📉 Bearish Rejection Expected?

Price might sweep liquidity and revisit the 126–129 demand zone, where strong unmitigated orders sit. If this zone holds, a bullish continuation toward 152+ is likely.

🔍 Key Highlights:

⚠️ Ending Diagonal pattern near local top

📊 Multiple BoS confirming internal structure shifts

📉 Unfilled Fair Value Gap (FVG) near 129

🟩 Strong demand zones at 129–126 and 108

🔄 Potential liquidity sweep before reversal

🧠 Smart money footprint visible

📅 Watch for price reaction around 129.8–126.1.

📈 Breakout above 145 with strength may invalidate the drop.

SPY & MegaCap strengthSPY saw a very strong gap up, negating most of the selling from last week.

despite rising tensions in the middle east - investors have shrugged off volatility and bought the initial dip.

This may be proving that "war" is good for stocks.

we observed a very close correlation between the indices and oil today.

As oil reversed higher - markets saw a bit of weakness. As oil fell markets rallied.

TSLA trying to break a 4 hour bullish pattern

META new Smart Glasses release causing a surge.

MSFT new all time high tap

NVDA firm with ripping semiconductors

GOOGL looking strong for continuation

AMZN moving nicely off support

AAPL lagging the mega's but positive

NVDA Swing Trade – Overbought Reversal Setup (June 12, 2025)📉 NVDA Swing Trade – Overbought Reversal Setup (June 12, 2025)

Ticker: NASDAQ:NVDA | Bias: 🔻 Moderately Bearish

Strategy: Short-Term Swing | Timeframe: ~2 weeks

Confidence: 75% | Entry Timing: Market Open

Expiry: June 27, 2025

🔍 Market & Technical Snapshot

• Price: ~$144.67

• Trend: Weekly and M15 uptrend still intact

• RSI (Daily): ~70.63 → Overbought

• MACD: Bearish crossover on Daily

• Options Data:

– Heavy put OI at $140 (14,803 contracts)

– Max pain at $135 → potential pull lower

– High call OI at $145–$150 caps upside

🧠 AI Model Breakdown

🔼 Grok/xAI (Bullish Swing):

• Calls out strong technicals, 5-min momentum

• Suggests $155C for upside play

🔽 DeepSeek (Bearish Swing – Preferred):

• Overbought daily RSI + bearish MACD

• Strong put volume + options market pressure

• Targets pullback to $138–$140 → PUT @ $140

✅ Recommended Trade Setup

🎯 Direction: PUT

📍 Strike: $140

📅 Expiry: 2025-06-27

💵 Entry Price: $2.09

🎯 Profit Target: $3.10 (+48%)

🛑 Stop Loss: $1.25 (–40%)

📈 Confidence: 75%

📏 Size: 1 contract

⏰ Entry Timing: Market Open

⚠️ Risk Considerations

• Weekly chart still bullish → risk of trend continuation

• Low VIX (17.26) = slower option premium movement

• Positive news surprise could cause upside gap

• Use tight risk controls and monitor intraday structure

💭 NASDAQ:NVDA : Extended or just gearing up for another breakout?

📉 Drop your play below — Put buyers vs. breakout chasers 👇

$SMCI "Buy The Dip" Value AreaSMCI (Super Micro Computer) has weathered the storm from all the negative press and I believe it is poised to go on a big run. This $26-$47 area is the BEST value you are going to get on it. This is probably the last discount before takeoff. We may not see this level again. As NVDA continues to fly, so will SMCI. Always do your own DD.

Nvidia - The breakout will eventually follow!Nvidia - NASDAQ:NVDA - will break out soon:

(click chart above to see the in depth analysis👆🏻)

Over the course of the past couple of days, we saw a quite strong rally of +50% on Nvidia. Considering the market cap of this company, such a move is quite impressive. Following this overall very strong bullish momentum, an all time high breakout is quite likely to happen soon.

Levels to watch: $150

Keep your long term vision!

Philip (BasicTrading)

AI Chip Stocks NVDA and AMD Showing 5 Wave RiseNASDAQ:NVDA and NASDAQ:AMD are both showing 5 wave rise in weekly chart after a correction in WXY. I haven't checked but other AI related stocks also might be doing something similar.

Once the 5 waves are over, we can expect some correction but the 5-wave rise post a correction typically signals fresh uptrend so it might be worth keeping an eye on these stocks. Waiting till retracement/correction of this rise is complete.

Is NVDA Building Strength Before a Breakout?After cooling off from its $150 highs, NVIDIA (NVDA) is consolidating in the $140–$145 zone. While some traders fear the AI hype has peaked, others see this as the calm before another rally. With solid fundamentals, continued leadership in AI, and strong institutional backing, NVDA remains a name to watch closely.

🎯 Trade Setup:

Entry Points

✅ $142 – Current price zone (speculative buy)

✅ $135–$130 – Strong support (ideal swing entry)

✅ $125 (only if market-wide pullback occurs)

Profit Targets

📈 TP1: $149 – All-time high retest

🚀 TP2: $160 – Extension target

💰 TP3: $175+ – Long-term bullish scenario if momentum returns

💡 Strategy: This is a “buy-the-dip, trade-the-breakout” setup. Wait for confirmation above $146 if you're conservative, or accumulate gradually into weakness with a clear risk plan.

📌 Disclaimer: This is not financial advice. Always do your own research and use proper risk management. I'm sharing my personal view for educational purposes.

OKTA - DAY TRADE IDEAOKTA is setting up for a day trade scalp long...perhaps an aggressive swing trade as well. The day trade is a much higher probability of success around the $98.50-$99.30

Okta's stock has seen some volatility recently. After a strong rally earlier this year, it pulled back following cautious guidance from the company. Despite beating expectations on sales and earnings for Q1 fiscal 2026, investors were concerned about slowing growth, leading to a 14.6% drop in its stock price.

Okta reported $688 million in revenue, a 12% year-over-year increase, and positive free cash flow of $238 million, but its GAAP earnings were significantly lower than its adjusted earnings. The company maintained its full-year revenue forecast of $2.85 billion to $2.86 billion, reflecting 9% to 10% growth, but analysts tempered their optimism due to macroeconomic uncertainties.

Technicals

- Multiyear Support

- 50 % Fib Retrace

- Upsloping Trendline

- Positive Divergence building on 1/ 4 hour chart.