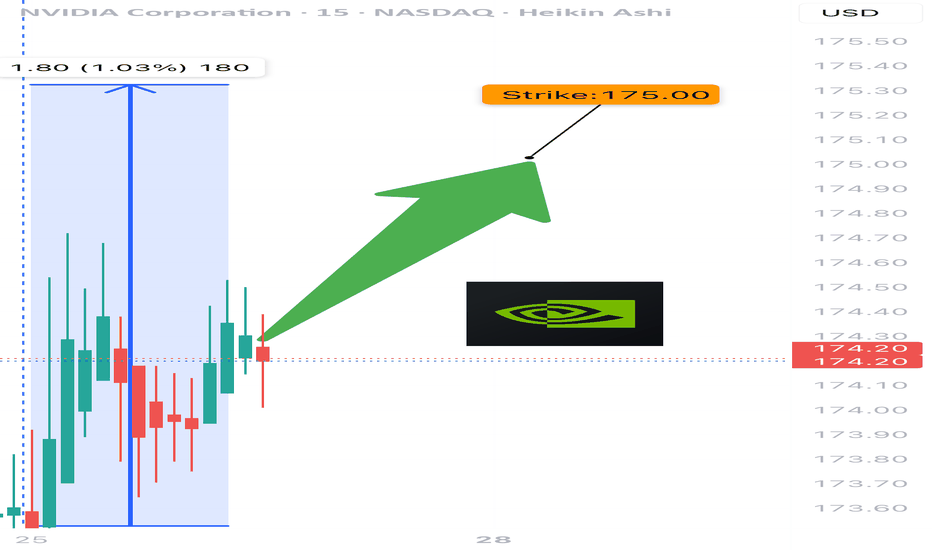

NVDA 0DTE TRADE SIGNAL – JULY 25, 2025

⚡ NVDA 0DTE TRADE SIGNAL – JULY 25, 2025 ⚡

🚀 Strong Bullish Momentum – But Friday Expiration = Gamma Trap?

⸻

📊 Market Stats:

• 💰 Call Volume: Strong

• 🔻 Weak Volume Overall

• ⚖️ Call/Put Ratio: Bullish

• 📈 RSI: Overbought but still pushing

• ⏳ Time Decay: Accelerating

• ☠️ Gamma Risk: 🔥 MAX today (0DTE)

⸻

🧠 Model Summary:

• Grok/xAI: 🔒 NO TRADE today – wait for Monday

• Claude: 🛑 Caution – avoid entries today

• DeepSeek: ⏸️ 4/5 Bullish, wait for cleaner setup

• Gemini: 💡 Suggests $180C next week

• Llama: ✅ Bullish bias, but gamma risk = no go for Friday

⸻

📌 TRADE IDEA: Wait for Monday

📍 Strike: $175 Call

📆 Expiry: Today (0DTE)

💵 Entry Price: $0.56

🎯 Target: $0.95

🛑 Stop: $0.30

📈 Confidence: 65%

🕒 Entry Timing: Monday open IF support holds

⸻

⚠️ Key Warning:

Don’t get trapped by 0DTE gamma swings. Momentum says yes, time decay says no…

✅ Best move? Watch NVDA closely, then strike on Monday if volume confirms.

⸻

👍 Like & save if you’re tracking NVDA.

🔁 Repost if you’re waiting for the perfect Monday setup!

#NVDA #OptionsTrading #0DTE #GammaRisk #BullishSetup #TradingView #TechStocks #WeeklyOptions

Nvdacall

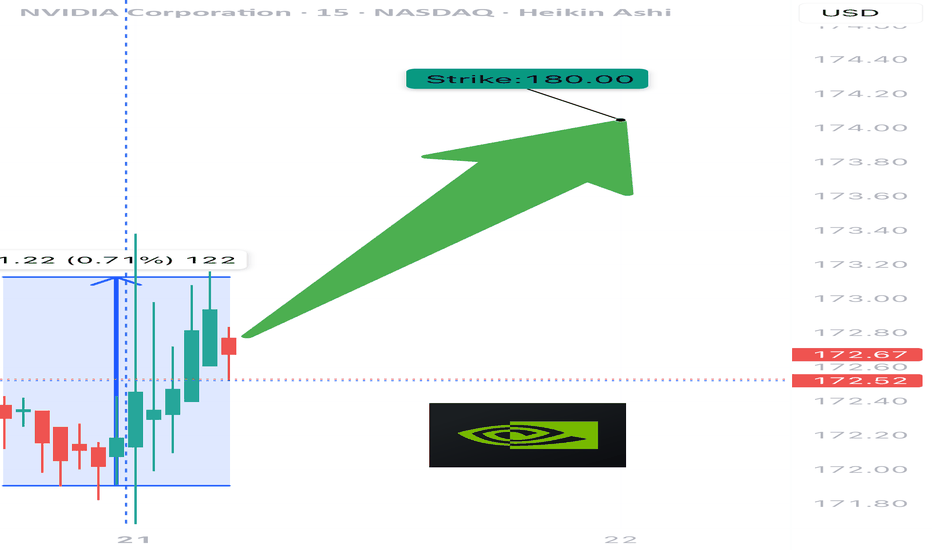

$NVDA WEEKLY TRADE IDEA – JULY 21, 2025

💥 NASDAQ:NVDA WEEKLY TRADE IDEA – JULY 21, 2025 💥

🔥 Bullish Options Flow + Weekly RSI Strength = Controlled Momentum Play

⸻

📊 Trade Details

🔹 Type: Long Call

🎯 Strike: $180.00

📆 Expiry: July 25, 2025 (4DTE)

💰 Entry: $0.51

🎯 Target: $1.02 (💯% Gain)

🛑 Stop: $0.20 (~40% Risk)

📈 Confidence: 65%

🕰️ Timing: Monday Open

📦 Size: 1 Contract (Adjust based on risk tolerance)

⸻

📈 Why This Trade?

✅ Call/Put Ratio = 1.48 → Bullish bias confirmed

📈 Weekly RSI = 77.0 → Strong momentum

🔻 Daily RSI = 80.8 (falling) → Short-term pullback risk

📉 Volume = flat (1.0x) → Weak confirmation = tighter risk mgmt

🧠 Strike Clustering: $177.50 & $180 = strong OI zones

🌬️ VIX = 16.7 → Favorable for long premium plays

⸻

⚠️ Risks & Strategy Notes

❗ Daily RSI = caution: short-term exhaustion possible

📉 Weak volume = lack of institutional chase

⏳ Exit before Friday – avoid IV crush and gamma slam

🔐 Set alerts at $178.75 and $179.80 – pre-breakout signals

⸻

🎯 Plan:

• Enter Monday open

• Scale partials if price hits +30–50%

• Full exit by Thursday unless price is breaking through $180 early with strong volume

⸻

🏁 Quick Verdict:

This is a momentum continuation setup, not a fresh breakout.

Play the trend, respect RSI signals, and cut fast if flow dries up.

NASDAQ:NVDA 180C — Risk $0.20 to Target $1.02

Let the call ride… just don’t overstay.

⸻

#NVDA #OptionsTrading #CallOption #WeeklyPlay #MomentumTrade #FlowBasedSetup #TradingViewIdeas #GammaPlay #BullishBias #NVIDIA

NVDA’s Wild Crash Alert: I’m Braced for a Heart-Stopping Drop!NVDA’s like a rocket losing altitude, and I’m on edge! It’s at $95.99, but I’m seeing it tumble to $90, maybe $88.95, then $83.59 if the bears go wild. If that breaks, whoa—$77.48 could hit hard! I’m glued to $90 for the first clue—big selling there, and it’s game on for a slide.

Kris/Mindbloome Exchange

Trade Smarter Live Better

Bullish NVDA 30m EMA Crossover - 2/21 $127cNice "Buy" signal EMA crossing on the 30m chart there at the end of the day along with a breakthrough of the downward trend line - may see a pump before the open tomorrow and, if she holds, could see an inverse of what I predicted a little while ago where we actually have MM's catch bears in a trap with their puts and sky this thing. Would make sense since a lot of people are saying NVDA will go down further.

Current play is the 2/21 $127c @ $6/contract. Targeting a 100% return to $12. If we get momentum, could see this go to $18 or even back to the high before Monday's gap down to $22. Could put a SL in around $5.

$NVDA - Resilience in ActionNASDAQ:NVDA

In my previous post (linked above) I noted the amount of macro upwards pressure NASDAQ:NVDA

Even with the market becoming leary of (or noticing other A.I. developer options), NASDAQ:NVDA still just makes the HARDWARE that these A.I. models are able to use and abuse in order to perform better. NASDAQ:NVDA will continue to create great hardware, and continually iterate on the items that will continue to make A.I. great.

My recommendation? Continue to hold, and buy at these lower levels. NASDAQ:NVDA will continue to rise.

Is NVIDIA Ready to Break Out or Break Down?Good morning, trading family!

How’s everyone feeling today? Got your coffee? Charts ready? It’s time to dive in and see what the market has in store for us.

Here’s the vibe: NVIDIA’s setting up for something big—are we aiming for $142 or sliding to $119? It’s like a game of tug-of-war, and the market’s holding the rope.

Quick Tip: Remember, trading is about patience and discipline. If you’re feeling stuck, step away, take a breath, and come back with a clear head. The market’s not going anywhere.

If you want a closer look at these setups or other ideas I’m watching, feel free to check out my profile or send me a DM—I’m always happy to share insights or answer questions. Let’s make it a great day!

Kris /Mindbloome Exchange

Trade What You See

NVIDIA Update: Big Levels to WatchHere’s the deal with NVDA right now:

1)If it keeps dropping, we’re looking at a move down to $130–$127.

2)But if it can break above $139, we could see it climb to $145 or higher.

It all comes down to whether $139 holds strong or if the price slips lower. Just keep an eye on those levels and let the market do its thing!

Kris/Mindbloome Exchange

Trade What You See

NVIDIA’s Next Move: Ready to Rally or Slip Lower?Good morning, trading family!

Let’s take a simple look at NVIDIA (NVDA) and where it might be headed from here. We’re at an important crossroads, so here’s what we’re watching:

If NVDA Moves Higher:

If NVDA can hold its current position, it has room to drive up into the $150 range. This could signal that buyers are stepping in and momentum is building for a rally.

If NVDA Moves Lower:

A drop could take us to the following key levels:

$144: First potential stop for support.

$138–$137: A zone where buyers might try to step in.

$132: A deeper pullback that could see some consolidation.

$129 and $120: These are lower support areas to watch if selling pressure continues.

How to Approach This:

Mark These Levels: Add them to your chart for reference.

Wait for Confirmation: Don’t rush in—see how NVDA reacts at each level.

Trade What You See: Let the price action guide you, not your emotions.

We’re at a moment where NVDA could make a strong move in either direction. Keep it simple, stay patient, and watch the levels.

Let’s make it a great trading day!

Mindbloome Trading // Kris

NVDA Set to Make Waves: Big Levels Ahead!Update:

Good morning, trading family. Here to break this down nice and easy for you. Let’s ride the NVDA waves together:

1️⃣ First scenario: NVDA climbs to $154–$156. From there, it could either break higher or pull back to $150, maybe lower. Watch for a bounce if it dips.

2️⃣ Second scenario: A move to $168 is on the table, but expect a pullback to $164 before the next push higher. If the pullback goes deeper, it’s just a chance to reset.

3️⃣ Third scenario: If NVDA powers through all those levels, $179 is next, with a potential correction back to $168 along the way.

Mindbloome Trading/ Kris

Trade What You See

NVDA Great ROI Trade To 150 Good morning Trading Family

The market corrected a bit deeper than expected however we got a correction lol

We have a great bullish opportunity from the 139.80 level to enter in so we go to the levels of 150 possibly beyond

I give you my reasoning on what I see and why

Mindbloome Trading

Trade What You See

NVIDIA 4 Hour -30 Minute Wave Counting Where are We Going ? Morning Traders

We are looking at if this market has finished making a wave 4 correction or are we in for a treat with either a small correction down before we punch up to the 137-138 target we have in our wave counting and projections.

The question is always be aware of the worst case scenario here and the best case scenario, take caution

Happy Trading

MB Trader

NIVIDIA 4 HR: Correcting back to 130.70 or We Pushing Higher UP Morning Traders

Quick update here, currently if we make a break above the 132.70 range the 137.30 is our goal and target however their are a couple hurdles along the way.

We can possibly still correct down to the 130.70 level

I go over the market from 4 hour to 30 minute giving you some levels to look for in today's trading day

Happy Trading

MB Trader

NIVIDIA BULLISH 137 Here IS WHY ? MUST WATCH Morning Traders

I throw the whole kitchen sink at this market from forks to fibs to projections and what we have is the following. We are either breaking up to the 137 range then we will see a nice deep 8-12 dollar retracement. Or we go to 137 and consolidate a touch then keep pushing up to th3 150's. Or we break 131.80 in our correction and then looking at levels of 130.64 as a point of entry for our long position up.

Enjoy the video : like, comment, boost if you found this video helpful or give me your thoughts on where you see the market going

MB trader

Happy Trading

NVIDIA"S Four-Hour Target 137's Good morning traders

The market planned out into what our thesis originally was from ages ago ie we are hitting 137 range -138 max then seeing a correction of some sort or we blow through this level up and keep going to 150's

In this video I am most certainly long and feel lets look for a correction at the 137's between 8-12 dollars.

If this doesn't happen dont fret then we will be reanalyzing the market to 150's and possibly beyond....

Thanks for watching, if you like the video, hate it or have another thesis share away in the comments section below

Happy trading and lets keep riding those waves

MB Trader

30 Min- 5 Min NVDA We are Going Up But to Where ???? Good morning Traders

Everyone has a coffee in hand lets get into it

So in the video I break down a bit more wave counting, a few projections on where we are going up and where we might encounter some resistance plus our thesis is still in check on hitting 128-129 zone like we discussed before.

Enjoy

MB trader

NVDA: 4 hour-30 Min HOW Deep Will We Correct ? Happy Weekend Traders

I made a quick video for you in the relation NVDA

I can see the following scenarios playing out so keep your eyes peeled on these levels:

1) From 120.56 we hold and go up

2) We go down to the 61.8 percent retracement @ 118.45 hold here and go up

3) We go down to 112.88 where we can sky rocket back up from here or start breaking further South

If you have any questions, comments let me know. I will be doing a few training videos on the different tools I use to see the market with if your interested let me know

MB Trader

Happy Hunting

NVIDIA's Four-Hour Dip: A Macro Correction or Bigger Shift UPGood afternoon or evening, traders!

What a rollercoaster of a day! The market followed our expectations—correcting, then taking a dive. But wow, did anyone expect that explosive breakout at 9:30 am? That’s the thrill of the open!

In this video, I'm staying neutral, but here’s what we need to watch: a breakout above 119-120 opens the door to 140 and beyond—a very real possibility. On the flip side, a dip below current levels could see us exploring the 90 range. Something to keep in mind!

Thanks for watching, and apologies if I sound a bit tired—it’s been an intense day.

Happy trading, and let’s keep riding those waves!

MB Trader

NVDA MICRO ANALYSIS TO LOOK FOR ON WHERE WE ARE GOING Good evening traders,

It's super late here; however, I wanted to inform you of some levels with this video to give you the information needed to make a better trade.

Based on what I see, we can do the following:

-Correct up to the middle pitchfork area and head back down.

-Correct up to the 50%, 61.8%, or 78.2% fib line and back down.

-Break all those levels up and keep going to 145.

Let me know what you think of the video: questions, comments, what you liked, didn't like—let me know in the comments below.

Happy hunting,

MB Trader

NVDA 4 hour : How High Are We Going????Good morning Traders

Today's quick video I look at the four hour approach on the different things this market can do:

1) We go the top then retrace down

2) We break the Top and then retrace then back up to 122 range

3) We hold on the top and then we make a tight triangle holding this market in then we see a break up or down

Enjoy the video

Any comments or questions let me know

Happy Hunting

MB Trader

For #Nvidia, $154 is not a dream#Nvda 1D chart;

Continues its 8-month steady rise from the beginning of the year to today

It had given the first bearish signal with its divergence in the $140 zone, which is the Ath level.

As of the $90 level, the bullish pattern started and the target points are as in the chart.

NVDA Possible Option Play - $126 Call expiring June 28, 2024Data Summary:

Open: 123.24

High: 126.50

Low: 118.04

Close: 125.76

Change: -0.81 (-0.64%)

Volume: 820.663M

Last Day Change: +7.65 (+6.48%)

SMA 50: 67.66

EMA 20: 98.03

Pivot Points:

Pivot R2: 131.91

Pivot R1: 128.85

Pivot S1: 120.39

Pivot S2: 114.99

Breakout SMA 21: 65.44

Technical Analysis:

Current Price Movement:

The stock is trading at 125.76, which is above the EMA 20 (98.03) and the SMA 50 (67.66), indicating a strong bullish trend.

The significant increase in the last day (+6.48%) shows strong buying momentum.

Pivot Points:

The stock is trading just below Pivot R1 (128.85), suggesting a key resistance level.

Support levels are at Pivot S1 (120.39) and Pivot S2 (114.99).

Volume:

The volume of 820.663M is significantly high, indicating strong trading activity and interest in the stock.

Preferred Option Play:

Call Option Play:

Buy NVDA $126 Call expiring June 28, 2024

Last Price: $4.10

Rationale:

The stock is showing strong bullish momentum, trading above key moving averages and near the resistance level.

A Call option leverages the potential upward movement towards the resistance levels.

Summary:

Based on the technical indicators and the current price being near resistance levels, a Call option is preferred to capture potential upward movement.

This strategy is speculative and should be considered with caution. Always consider your risk tolerance and consult with a financial advisor before making any trades.

$NVDA ride the wave after earnings. $NVDA could make a possible bullish reversal here after a good earning results. although NVDA made a record breaking profits it doesn't mean it would be bullish tomorrow.

overall market still looking very choppy and bearish. wait about an hour to find your entry if you want to get in cheaper prices for options.

Day trade or scalp target play: 02/17/22

Buy call above 268.00 sell at 272.00

Buy puts below 255.00 sell at 249.00

Hello everyone,

welcome to this free technical analysis . ( mostly momentum play )

I am going to explain where I think this stock is going to go over the next day or week play and where I would look for trading opportunities

for day trades or scalp play.

If you have any questions or suggestions which stock I should analyze, please leave a comment below.

If you enjoyed this analysis, I would definitely appreciate it, if you smash that LIKE button and maybe consider following my channel.

Thank you for stopping by and stay tune for more.

My technical analysis is not to be regarded as investment advice. but for general informational proposes only.