Bad News from NVDA and ASML Put Pressure on AI StocksTwo pieces of bad news hit the chip sector in a single day.

First, the U.S. announced new restrictions on Nvidia, blocking the sale of its H20 chip to China. H20 was the only AI chip Nvidia could legally sell to China under existing regulations. The company stated the new restrictions could cost up to $5.5 billion.

The second blow came from ASML’s earnings report. ASML is the sole producer of EUV machines, which are critical for manufacturing advanced chips, including those used in AI. ASML's revenue miss, combined with the Nvidia news, weighed heavily on technology stocks. However, there is a silver lining: the revenue miss was due to weaker DUV machine sales, which are used for more basic chips. EUV sales actually beat market expectations by 33.54%, indicating that investment in AI infrastructure remains strong.

Nvidia shares are down more than 6% in premarket trading. This downward pressure may continue after the market opens. If the price drops below 100, it could present a buying opportunity for medium- to long-term investors. AI investment continues globally, and countries outside the U.S. are likely to accelerate their efforts to catch up. Despite the recent negative sentiment, there is no major change in the long-term outlook for the sector.

Nvidia

$NVDA one more leg lower $58-76 targetNASDAQ:NVDA bounced off the lows at $86 but is now finding resistance, I think it's likely that we turn lower next week and start falling towards the targets below.

I think it's very likely that we make it down to the lower supports at $63-58 before we see a sustainable bounce form.

Let's see how it plays out over the coming weeks.

Nvidia Prepares For New All-Time High, Last Chance To Buy Low!The market always gives as second chance. This is a phrase that I love to share and it is true, it is confirmed here on this very chart.

The action for NVDA moved back down to produce a higher low —your second and last chance. This higher low is happening within a very strong buy-zone and this can mean the difference between massive profits or an opportunity that is lost. From here on, Nvidia will grow long-term set to produce a new All-Time High in the coming months.

The minimum target and price level for this rise stands around ~150 within 1-3 months. Then a correction and then higher, much higher... Up, up and up go we.

I can entertain you with tons of details I have the ability but I will not do so. I will go straight to the point.

» The next All-Time High and main target for this wave is 194, this can take a little more, or less, than 6 months.

What will happen next, we will have to wait to ask the chart.

It is my pleasure to write for you again.

Make sure to boost if you would like more updates.

If you boost and comment, we can move to daily updates as the market grow.

Go in, go now, buy-in and go LONG!

Nvidia is going up! Together with Bitcoin and the Altcoins.

Thanks a lot for your continued support.

Namaste.

Nvidia - The Chart Just Told Us So!Nvidia ( NASDAQ:NVDA ) might just still head a little lower:

Click chart above to see the detailed analysis👆🏻

After Nvidia perfectly retested the previous rising channel resistance just a couple of months ago, it was quite expected that we'll see a retracement. The overall trend however still remains bullish and if Nvidia drops a little more, the overall bullrun continuation rally might just follow.

Levels to watch: $80

Keep your long term vision,

Philip (BasicTrading)

IM BEARISH ON NVIDIA WITH A TARGET OF $55.00. HERE IS WHY:NVIDIA (NVDA) Known for their GPUs, recently has experienced a decline in asset price. Trump tariff's may have been a bearish news catalyst, but do the technicals show a bigger bearish picture?

1 Day chart: While the RSI recently signaled oversold conditions, the RSI line looks to be crossing down the RSI based moving average. Furthermore the 200 Day EMA and 65 Day EMAs appear to be forming a death cross. DMI is still indicating bearish, and the ADX is still above 20.

With recent political news, the tech company has been working on bolstering their U.S based production. But with inflation cooling (6 month low) , I believe many high performing blue chip stocks may see a dip as traders and institutions price in deflation, new news and political events.

My opinion on a target is $55.00 , and there is significant open interest on long puts for this price that are expiring in the coming months.

Will NVIDIA pull out of this downtrend? Or will it become a great value buy for investors?

Disclaimer: Not financial advice.

Nvidia: Bullish Monday?A new week is about to get started and we would like to know if the NVIDIA Corporation (NVDA) chart supports a bullish Monday.

What is the chart saying on the daily timeframe?

The chart has many positive signals and support a strong week but...

Good Sunday my fellow Cryptocurrency trader, how are you feeling in this wonderful day?

I hope you are doing great.

Let's read the chart; together, let's trade!

The chart looks really good and the short-term can always surprise, anything goes.

The chart is saying, "up, straight up," and even though the markets are unpredictable, I can easily tell you what the market is doing and is most likely to happen after the weekly close.

NVDA is super bullish and likely to continue growing based on multiple signals:

1) The falling wedge pattern is already confirmed. The action broke above it.

2) The trading volume supports a continuation of the pattern breakout.

3) The correction was really strong but the reaction to support was even stronger. Such a strong reaction indicates that traders were anxious and ready to buy. The only reason to sell was based on political bad news. With the bad news removed, up we go. NVDA is solid and with Bitcoin and mining growing, the market expanding, AI, NVDA is set to follow and also grow.

4) Both the 0.786 and 0.618 Fib. retracement levels are major support and gauge the strength of a stock. If the action is happening below, bearish; when the action happens above bullish. The fact that the action moved below just to recover makes this a strong bullish signal. A failed signal for the bears because they failed to move prices lower. A strong bullish signals for the bulls because the action is back above long-term critical support.

5) The session 10-April closed as a hammer and this also points up.

6) Finally, NVDA managed to close daily above EMA8, EMA13 and EMA21. Short-term bullish bias is now valid, active and confirmed.

All these are bullish signals saying that the market will move higher next.

What needs to happen for all this to become invalid?

NVDA would need to close daily below the last low.

No need to worry about short-term moves and noise. We are going up long-term.

The correction here reached more than 43%. Believe it or not, a 43% drop is a very strong drop. For the market to go lower, it would need to be the end of the company or worse. What need is there for a stock like this one, with a great product in huge demand, to drop by 80%, for what reason?

We are going up.

Namaste.

Chipmaker Stocks DeclinesChipmaker Stocks Declines

According to the charts, semiconductor stocks underperformed the broader equity market yesterday. While the S&P 500 index (US SPX 500 mini on FXOpen) fell by around 2.2%, the drop was far steeper across the chip sector:

→ The bullish semiconductor ETF (SOXL) declined by 15%;

→ Nvidia (NVDA) shares fell by 6.9%;

→ Advanced Micro Devices (AMD) dropped by 7.3%.

In other words, chipmaker stocks dragged down the broader market, raising concerns ahead of the upcoming earnings season.

Why Are Chip Stocks Falling?

The decline stems from corporate assessments of how the escalating global trade war and new tariffs could impact future performance.

According to media reports:

→ AMD expects to face tariffs of up to $800 million on exports to China;

→ For Nvidia, similar levies could exceed $5 billion.

Technical Analysis – Nvidia (NVDA)

The price continues to fluctuate within a downward channel, previously identified in our analysis:

The lower boundary of the channel is acting as support, helping the price close near its opening level yesterday (forming a Doji candle on the daily chart).

Technical Analysis – AMD

A similar picture is emerging on the AMD chart:

The $96 level now appears to be a key resistance zone.

In Summary

All eyes are on today’s earnings report from chipmaker TSMC (TSM), which could significantly influence the currently bearish sentiment in the sector.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Nvidia Drops 9%+ Amid Export Curbs and Fed WarningNvidia Corporation (NVDA) saw its stock fall by 9.18%, trading at $101.68 as renewed fears over U.S.-China trade tensions and monetary policy signals shook investor confidence. The decline came after the company confirmed costly new restrictions on chip exports to China, intensifying market concerns about long-term demand and global supply chain disruptions.

The broader market reacted sharply to these developments. The Nasdaq Composite dropped nearly 4.3%, while the S&P 500 shed around 3.1%. The Dow Jones Industrial Average also lost more than 900 points, a drop of about 2.2%. Contributing further to the sell-off, Federal Reserve Chair Jerome Powell delivered remarks in Chicago, stating that the central bank would “wait for greater clarity” before making interest rate changes.

Powell highlighted the conflicting effects of tariffs, warning that they could bring “higher inflation and slower growth,” placing the Fed’s dual mandate of stable prices and full employment under pressure. These comments, coupled with geopolitical uncertainty, pushed stocks to session lows.

Technical Analysis

Nvidia's price action shows a notable rebound from a major support zone near $92, which has historically attracted strong buying interest. Despite Wednesday’s sharp drop, the price trades above this level, suggesting traders are still defending it.

The next key resistance lies at $153.13, a level that capped previous rallies. If Nvidia breaks above this zone, it could signal a bullish continuation, potentially leading to a move toward new all-time highs. However, rejection at this point could trigger a pullback, with a possible retest of the $92 support.

The Relative Strength Index stands at 41, indicating a close to average momentum. This positions Nvidia at a crossroads, where upcoming price action around the resistance will determine the near-term trend.

NVDA Weekly Options Trade Plan 2025-04-16NASDAQ:NVDA NVDA Weekly Analysis Summary (2025-04-16)

Below is our integrated analysis based on all available model reports.

──────────────────────────────

SUMMARY OF KEY POINTS FROM EACH MODEL

• Grok/xAI Report

– Technical indicators on lower timeframes (5‐minute) have shown short‑term weakness (price below the 10‑period EMA and bearish MACD) while the daily chart remains more neutral to slightly bullish.

– The max pain level ($110.00) lies below the current price ($112.20), suggesting there could be some pull‐back pressure.

– With mixed signals and elevated volatility, the analysis does not provide a strong directional conviction – hence no trade was recommended.

• Llama/Meta Report

– The shorter‑term (5‑minute) technicals indicate a bearish setup (MACD below signal, RSI near 45) despite the daily chart’s support from above‑average prices, supporting a slight downside bias.

– The report favors a put option (near ATM), suggesting that an option between the current price and the max pain level may capture a potential move downwards.

– Their setup initially mentioned the possibility of a trade “if premium is acceptable.”

• Gemini/Google Report

– Detailed multi‑timeframe analysis points to:

○ Immediate (M5) weakness (price trading below very short‑term EMAs and with bearish MACD signal),

○ Negative catalyst from export restrictions and the high–yet falling–VIX, and

○ A gravitational pull toward $110 (the max pain).

– This model’s analysis is moderately bearish and recommends buying a weekly naked put.

– Their trade plan suggests buying a put with a strike near $111 (which sits between the current price and max pain) with an entry at market open, a target premium gain of roughly 80–100% and a stop loss at about 50% of the premium.

• DeepSeek Report

– Also reviews technicals and sentiment inputs but concludes that conflicting signals and incomplete options data render a clear trade decision uncertain f

or today.

• The report leans toward “no trade” until further clarity is available.

──────────────────────────────

AREAS OF AGREEMENT AND DISAGREEMENT

• Agreement points:

– Most analyses agree that NVDA is trading a strong 5‑day rally and that, with the max pain level set at $110.00, there’s potential for a pullback.

– All reports also note the mixed technical picture when viewing short‑term versus daily charts.

– The immediate (intraday) indicators (M5 MACD, EMAs) lean toward weakness, even if the longer‑term trend remains less clear.

• Disagreements:

– Grok/xAI and DeepSeek lean toward “no trade” given the ambiguity and risk, whereas Llama/Meta and Gemini/Google see a moderate bearish opportunity.

– The recommended strike levels differ slightly: one report referenced the ATM region near $112 while the more detailed Gemini/Google plan suggests a slightly lower strike ($111) to better capture a potential move toward max pain.

──────────────────────────────

CONCLUSION & RECOMMENDED TRADE

Overall Market Direction Consensus:

• Although there is no unanimity, the preponderance of evidence—especially the short‑term technical weakness, the negative export restrictions news, elevated (but falling) volatility, and the max pain setup—leans toward a moderately bearish bias for today’s session.

Recommended Trade:

• We recommend a weekly naked put option trade (using only weekly options) if NVDA trades within or near our expected range at the open.

• Best execution is near market open provided the premium falls into or near our target range ($0.30–$0.60, allowing for slight flexibility).

• Specifically, purchase a $111 put expiring on April 17, 2025, which places you between the current trading level and the $110 max pain level.

• Entry Timing: At market open.

• Confidence Level: Approximately 65%

• Key risk factors include:

– The inherent conflict between short‐term and longer‐term signals,

– Possibility of the stock continuing its r

ecent rally (or failing to reach down near $110), and

– Extreme theta decay and premium volatility with only one day to expiration.

• Trade Parameters (example):

– Entry premium target about $0.50 per contract (if within acceptable range),

– Profit target set around $0.90 (roughly an 80% gain on premium), and

– Stop loss around $0.25 (50% of entry premium).

──────────────────────────────

TRADE_DETAILS (JSON Format)

{

"instrument": "NVDA",

"direction": "put",

"strike": 111.0,

"expiry": "2025-04-17",

"confidence": 0.65,

"profit_target": 0.90,

"stop_loss": 0.25,

"size": 1,

"entry_price": 0.50,

"entry_timing": "open"

}

Chips Down: What Shadows Loom Over Nvidia's Path?While Nvidia remains a dominant force in the AI revolution, its stellar trajectory faces mounting geopolitical and supply chain pressures. Recent US export restrictions targeting its advanced H20 AI chip sales to China have resulted in a significant $5.5 billion charge and curtailed access to a crucial market. This action, stemming from national security concerns within the escalating US-China tech rivalry, highlights the direct financial and strategic risks confronting the semiconductor giant.

In response to this volatile environment, Nvidia is initiating a strategic diversification of its manufacturing footprint. The company is spearheading a massive investment initiative, potentially reaching $500 billion, to build AI infrastructure and chip production capabilities within the United States. This involves critical collaborations with partners like TSMC in Arizona, Foxconn in Texas, and other key players, aiming to enhance supply chain resilience and navigate the complexities of trade tensions and potential tariffs.

Despite these proactive steps, Nvidia's core operations remain heavily dependent on Taiwan Semiconductor Manufacturing Co. (TSMC) for producing its most advanced chips, primarily in Taiwan. This concentration exposes Nvidia to significant risk, particularly given the island's geopolitical sensitivity. A potential conflict disrupting TSMC's Taiwanese fabs could trigger a catastrophic global semiconductor shortage, halting Nvidia's production and causing severe economic repercussions worldwide, estimated in the trillions of dollars. Successfully navigating these intertwined market, supply chain, and geopolitical risks is the critical challenge defining Nvidia's path forward.

US President Says All Necessary Permits Will Be Given to NVDAIn shocking turn of events today, US President Donald Trump said "All necessary permits will be expedited delivered to Nvidia."

The asset however, fail to play according to the rhythm of the fundamental, up by 1.51% as of the time of writing with the RSI at 56.27. Nvidia has also been plaque by Trump's tariff rate increment that saw the shares lose about 29% in market value for the past 3 weeks.

For Nvidia Shares ( NASDAQ:NVDA ), a break above the $150 resistant could pave way for a bullish course. Similarly, failure to break pass the resistant point could resort to a bearish reversal bringing it back to the support point.

Analyst Forecast

According to 43 analysts, the average rating for NVDA stock is "Strong Buy." The 12-month stock price forecast is $172.76, which is an increase of 53.68% from the latest price.

NVIDIA ---> The jorney TO ---> 90s and 80s (UPDATED) PART 2Okay guys. Here is my UPDATED idea (just dont know how to insert an updated chart in the previous exsiting idea).

I think it could be usful, CAUSE many guys burning for bullish.

I was straight bearish in the first part of idea, but here is some corrections cause of Trump canceled the additonal tarrifs for import from China, for critical technologies such as semiconductors, chips, smartphones and laptops.

So I assume the price can go first up to 113 and go down or even touch 117 and then the "Journey" at least to 90s and even 80s. As we see the lines of resistance in that areas on the chart.

The dead line for the price reversal is Tuesday, April 15

(in my opinion).

My technical analysis telling me this.

Let's watch what will happen.

NVIDIA ---> The jorney TO ---> 90s and 80s According to my technical analysis + Political causes of US trade policies and tarrifs uncertanties, which brought to losing in trust of partners and invesors to the current US administration, due to Trump's market manipulations.

My thoughts: it is should happen within next 1-3 days.

Buckle up! :)

Nvidia (NASDAQ: $NVDA) Advances AI Strategy Amid Tariff PauseNvidia (NASDAQ: NASDAQ:NVDA ) is quickly strengthening its positions in artificial intelligence and data center technologies. This comes as the U.S. government temporarily halts new export restrictions, offering relief to the semiconductor sector.

Nvidia will continue selling its H20 AI chips to China following a decision not to enforce new trade limits. This followed a key meeting between CEO Jensen Huang and former President Donald Trump. The announcement eased concerns over losing access to a major international market. Nvidia recently introduced its latest innovation, the Blackwell Ultra AI chips, at the GPU Technology Conference. These chips target the rising demand for high-performance computing used in AI systems. The move could boost Nvidia’s market lead as competition grows.

Market volatility followed the government’s tariff update. Nvidia stock surged nearly 19% after the 90-day tariff pause announcement, excluding China-specific measures. The next day, the stock dropped 5.8% to close at $107.74.

Technical Analysis

Nvidia's price bounced sharply from the $92 support zone. This area has attracted strong buying activity. The RSI is currently at 44, showing neutral market momentum. The key resistance level to watch is $153.13. If the price breaks this level, it could rise toward a new all-time high. Failure to do so may lead to a pullback toward $92.

Watch the $153 level closely for confirmation of trend direction. Nvidia's recent price movement leaves room for both uptrend continuation and short-term correction depending on upcoming market signals.

Support Zone: 106.19

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(NVDA Chart)

The HA-Low indicator on the 1D chart was formed at 106.19.

Therefore, the key is whether it can receive support and rise near 106.19.

-

(30m chart)

If it falls below 106.19,

1st: M-Signal indicator on 1M chart

2nd: HA-Low indicator on 30m chart

You need to check if it is supported near the 1st and 2nd above.

In order to continue the uptrend, the price must be maintained above the M-Signal indicator on the 1M chart.

-

(1D chart)

Since the HA-Low indicator on the 1D chart has been newly created, the key is whether it can be supported near this area and rise above the M-Signal indicator on the 1D chart.

If so, it is expected to turn into a short-term uptrend.

If not, there is a possibility of a stepwise downtrend, so the current position is an important section.

-

Thank you for reading to the end.

I hope your transaction will be successful.

--------------------------------------------------

PEG @ 0.22 DEBT/ASSET @ 0.09 NVIDIA LOOKS CHEAP WITH SELL-OFFFundamental metrics favour NVIDIA and with the company's return on equity (ROE) stands above 119%, NVDA stock price looks irresistible below 105.

N.B!

- NVDA price might not follow the drawn lines . Actual price movements may likely differ from the forecast.

- Let emotions and sentiments work for you

- ALWAYS Use Proper Risk Management In Your Trades

#nvda

#nasdaq

#nyse

NVIDIA Update 3 Rangebound with new Low for longsIn this video I bring to your attention what we could possibly expect if we lose the current level and if we do then where is the next crucial zone to look for Longs.

If you have read this then pls do Boost my work and any questions then leave them below

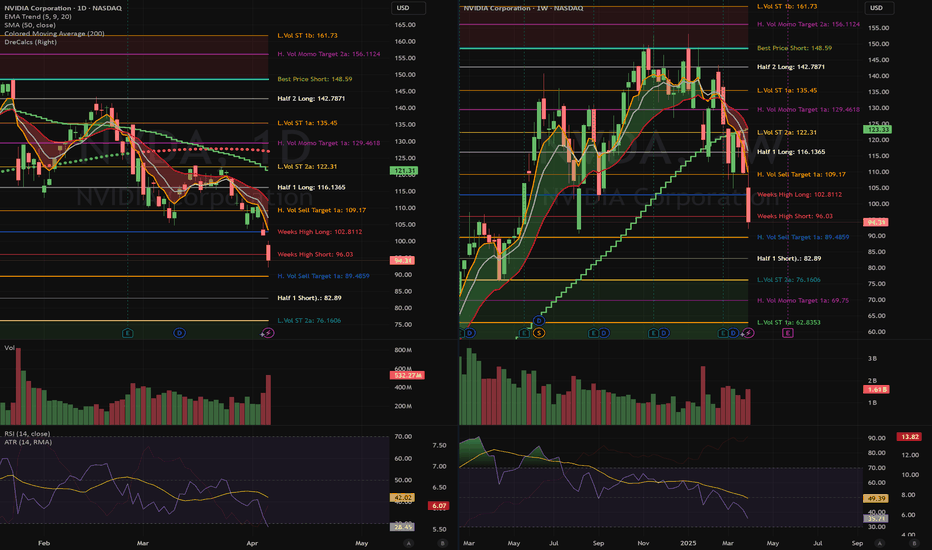

NVIDIA (NVDA): Oversold or Start of a Larger Correction?Overview & Market Context

NVIDIA just saw a major sell-off, dropping around 7% in a single session and slicing below key support levels. This abrupt move has raised questions: Is NVDA oversold enough for a bounce, or are we at the onset of a broader bearish trend? High trading volume suggests significant institutional distribution, so caution is warranted for both bulls and bears.

1. Price Action & Volume

* NVDA closed near the $94.31 mark after the sharp decline.

* Volume spiked (~532M), confirming that large players have been active—often a sign of heightened volatility and potential trend changes.

2. Moving Averages

* The 200-day SMA sits near $127.07, which NVDA fell below decisively. Historically, losing the 200-day often signals a medium-term bearish bias, making it a key level to watch on any rebound attempts.

3. RSI & Momentum

* The RSI on the daily timeframe is hovering around the high-20s, indicating oversold conditions. While this can lead to a short-term bounce, oversold can remain oversold if negative momentum persists.

Key Levels to Watch

Immediate Resistance:

* $96–$100 Range: Minor overhead supply; if price rallies here, watch to see if it rolls over again.

* $105–$110: This region aligns with prior support-turned-resistance. A strong push above $110 would challenge the bearish thesis.

Primary Support Targets

* $90 (Psychological Marker): Could be the first zone for a pause or bounce.

* $82.89 (“Half 1 Short” from algorithmic levels): A logical next stop if the sell-off continues.

* $76 Area: Deep support from earlier consolidation zones; if selling intensifies, the stock may reach these levels.

Potential Trade Setups

1. Bearish Continuation (Short)

Entry:

* On a weak bounce into the $96–$100 zone, or

* A breakdown below $94 on strong volume.

Stop Loss:

* Conservative approach: Above $105–$110, where a bullish reversal could invalidate the short setup.

Profit Targets:

* $90 (near-term psychological level),

* $82.89 (algorithmic short target),

* $76 (longer-term support).

2. Contrarian Bounce (Long)

* Entry: Around $90 or upon a clear intraday reversal signal (e.g., a bullish engulfing candle on strong volume).

* Stop Loss: Below $88 to reduce risk of a deeper flush.

* Profit Targets:

* $96–$100 (short-term push),

* Extended target near $105–$110 if momentum sharply reverses.

Thought Process & Strategy

* The extreme volume and steep decline reflect a high-conviction move. Usually, when you see volume spikes on a breakdown, it suggests institutional selling, meaning rallies may be met with further supply.

* However, the oversold reading (RSI in the high-20s) hints that a bounce might come soon—though it could be short-lived unless macro or fundamental conditions shift.

* Clearly defining both bullish and bearish scenarios—along with exact stop-loss levels—removes emotion and helps avoid “decision paralysis.” Trading is about probabilities, not certainties.

Final Notes

* Risk Management: Always size positions so that a single trade does not jeopardize your account.

* Emotional Control: These levels are algorithmically defined, aiming to reduce subjective bias. Watch how price reacts at each support/resistance zone.

* Stay Vigilant: With elevated volatility, rapid intraday swings are possible. Monitor real-time price action for confirmation.

Disclaimer: This is not financial advice. Perform your own due diligence, and trade responsibly.

Microsoft Regains Top Spot as Most Valuable Company Microsoft Corp. (NASDAQ: NASDAQ:MSFT ) has reclaimed its place as the world’s most valuable public company. The tech giant now holds a market capitalization of $2.64 trillion, surpassing Apple Inc. (NASDAQ: NASDAQ:AAPL ), which fell to $2.59 trillion.

Apple’s sharp decline followed a major 23% sell-off over four days. This came after President Trump announced sweeping new tariffs. These tariffs hit countries like China, India, Vietnam, and Brazil. Apple’s heavy reliance on these regions for manufacturing intensified investor concerns.

Meanwhile, Microsoft appears less exposed to tariff risks. Analysts say the company remains a stable large-cap stock during ongoing market volatility. Microsoft previously held the top spot briefly last year but was overtaken by Apple and Nvidia (NASDAQ: NASDAQ:NVDA ), now ranked third at $2.35 trillion.

Technical Analysis

Microsoft’s stock is trading at $383.15, up 8.06%, with a high of $387.07 so far today. The price rebounded sharply from the support level near $345. This zone had previously acted as resistance in late 2021 and early 2022. It now serves as strong support. The volume spike confirms buyer interest at this level.

The projected path shows a potential bounce toward $468, the recent high. If the trend holds, Microsoft may attempt a new all-time high.

NVIDIA: Still has a long way to go.NVIDIA turned from oversold to neutral on its 1D technical outlook (RSI = 48.969, MACD = 44.021, ADX = 44.021) and is about to do the same on 1W too, as today's 90-day tariff pause announcement is giving the market an aggressive comeback. Technically though that doesn't seem enough to restore the tremendous bullish sentiment of 2023 and 1st half of 2024 as the trend is currently restricted by not only the 1D MA50 and MA200 but a LH trendline also coming straight from the ATH.

The same kind of LH kept NVDA at bay on its last main correction to the August 5th 2024 bottom. This started a +44.46% rally that got rejected on the LH trendline. If we apply that today we get a projected 1D MA200 test just under the LH trendline. A TP = 125.00 fits perfectly on the short term, but long term we still have a long way to go.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

NVIDIA on Bear Market territory. Will the 1W MA100 save the day?NVIDIA Corporation (NVDA) has officially entered Bear Market territory as it has declined by almost -45% from the January 2025 All Time High (ATH) and just hit its 1W MA100 (green trend-line) for the first time since the week of January 30 2023.

This is the strongest correction the stock has seen since the 2022 Inflation Crisis and based on the Time Cycle Indicator of the last two Cycle Tops, the week of Jan 06 2025 falls indeed on the third count. This high degree of symmetry isn't only present on the price action but on the 1W RSI sequence itself as the current time range from the RSI High (March 18 2024) to today's Low is fairly consistent (54 weeks, 378 days) with the top-to-bottom range of the previous two Bear Markets, 2022 and 2018 (red Channel Down patterns).

So far the current correction looks similar to the September - December 2018 as not only their RSI counts are similar but both are more aggressive and fast than the 2022 Inflation Crisis. The 2018 correction though didn't top on the 1W MA100 but almost reached the 1W MA200 (orange trend-line) before making a bottom, but it did so in less than 2 months and declined by -57.40%. The current correction is already running for 3 months.

So what remains to be seen is if the 1W MA100 will manage to hold and kick-start a bullish reversal on its own, despite this correction being 'only' -43.39%. The 1W RSI dropped close enough to 30.00 (the oversold limit) though, which has historically been a very reliable indicator for a long-term buy on NVDA.

If those work in favor of the 1W MA100 holding, expect to see a strong rebound, that will confirm the new Bull Cycle with a break above the 1W MA50 (blue trend-line) and can technically aim for at least a +1000% rise from the bottom, as both previous Bull Cycles did.

If the 1W MA100 fails, we expect a bottom by the end of June 2025 around the 1W MA200 between $65-60. Again a +1000% rise from that level is technically plausible, potentially giving a Target estimate of at least $660.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Cryptocurrency and Stocks will DecoupleI still remember the AI saying that NVDA was going to 320 "in the near future." This was back in June 2024. No matter when you asked the AI, its only prediction would be up, it couldn't make an analysis based on the data coming from the chart. The program wasn't very intelligent, that's what I concluded.

I disagreed. NVDA is going down and this is now fully confirmed.

We are seeing a very long distribution phase and the crash is now taking place.

Ok, but what about Bitcoin?

Bitcoin will decouple from traditional markets, just look at the news.

While Cryptocurrency is due a generational bullish wave, the stock market is due a generational retrace.

I honestly don't know how the stock market will perform but I can look at individual charts. NVDA is bearish and going down strong.

NVDA, TSLA, the SPX, the NDX and Crypto are not the same. These are two completely different monsters.

The SPX and NDX is landline.

Crypto is free wireless internet for all.

The SPX and the NDX is centralization and control.

Bitcoin is decentralization, innovation, technology and freedom.

Times change.

The stock market will recover and it is sure to continue growing long-term.

Will the establishment let it crash or will they jump in and pump it up?

I don't know. But NVDA is bearish and going down. What one does, the rest follows.

But, what about Bitcoin? Bitcoin is going up.

It is very simple. They will decouple, they will not move together anymore. Many, many Altcoins are trading at bottom prices, many stocks are trading high up.

The giant stocks will crash, while the Cryptocurrency market goes up. This is one more of the reasons why we are about to experience the biggest bull-market in the history of Crypto.

People are evolving, the world is changing. We are changing from centralized monopoly money, to a free decentralized technology that is available for all.

Money is not the paper, the shiny stone or the codes; money is what we decide to use for the purpose of exchanging value.

At one time, salt used to be money as well as cows. Sea shells, glass and cacao are also on the list. People used to use these things as money.

The argument that Bitcoin has no value is obviously flawed. If you want to buy a Bitcoin you have to pay a price, that's value, nothing more.

If we decide to use something as money, it becomes money.

Bitcoin is money for the new generation.

The old generation dies out and a new one takes its place.

Life will continue to evolve and money will do the same.

Now it is Bitcoin, later down the road it will be something else. But Bitcoin has value, it is really expensive and it will continue to grow.

After the crash, NVDA will recover for sure.

Namaste.