NVDA’s Final Act: A Breakout Waiting to HappenNVDA appears to be nearing the completion of its corrective phase, setting the stage for a potential move to new highs. The current pattern resembles a falling wedge, indicative of an ending diagonal formation, which often signals a reversal and the start of an upward trend.

The structure of the corrective channel, along with the termination of the diagonal pattern, suggests a high likelihood of a running flat formation. Buyers are likely to intensify demand pressure as the price approaches the lower boundary of the trendline. A trend reversal may occur if there is a decisive breakout above the Wave 4 level of the ending diagonal.

Buying opportunity with minimal stop is possible after the reversal from lower side of the channel. Targets can be 112 - 120 - 132 - 140.

I'll be sharing more details shortly.

Nvidia

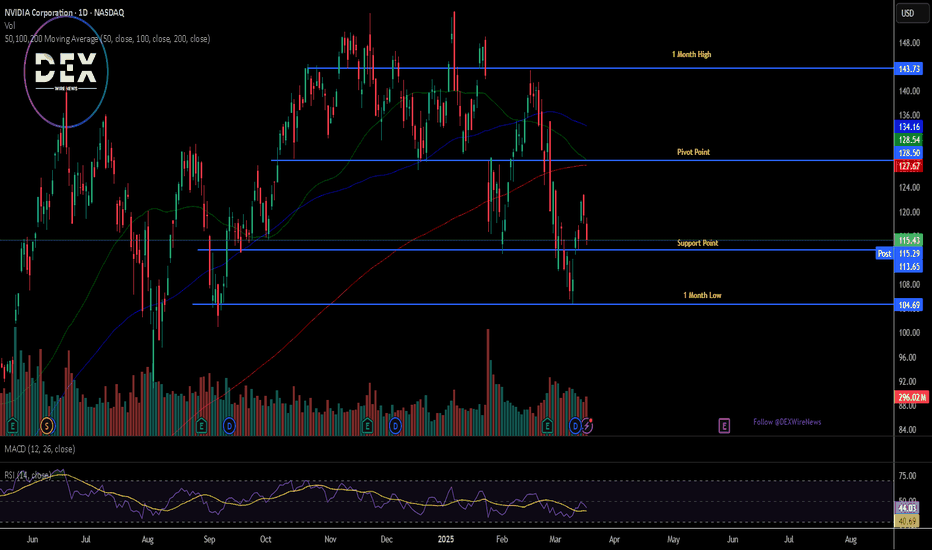

$NVDA | A Double Bottom in the Making? We’re spotting the early structure of a double bottom pattern forming on NASDAQ:NVDA — a classic bullish reversal signal. After a steep decline, price action is showing signs of stabilization, testing support twice, and trying to recover from the lows.

But there’s a catch...

📌 No confirmation yet.

The neckline still needs to be broken with strong momentum to validate this formation and trigger potential upside.

⚠️ Today’s tariff-related news could be the catalyst. A strong reaction may either confirm the breakout or invalidate the pattern entirely.

What to watch:

Break above the neckline with volume = potential entry ✅

Failure + breakdown = more pain to come ❌

This is a key technical level. Stay sharp and let price action lead the way.

NVIDIA The chance to buy for $230 is NOWNVIDIA is forming a Double Bottom on a 1day RSI bullish divergence, same kind it did on the October 31st 2023 low.

The prevailing pattern is a Channel Up and the double bottom could technically kick start the new bullish wave.

The last one almost reached the 5.0 Fibonacci extension before pulling back under the 1day MA50.

Best opportunity to buy in 2025. Target just under the 5.0 Fib at $230.

Follow us, like the idea and leave a comment below!!

FX Market Preview: NFP week - EUR/USD in focusIn this FX market preview I go into recapping the EUR/USD, GBP/USD and USD/JPY price action last week and what I'm looking at for this week.

I also take a look at ETF's QQQE and Nvidia opportunities.

I continue to hold my EUR/USD short positions while keeping a strong eye on 1.0860 and then 1.0900. I feel these areas are important for the bears to hold the line if we're going to continue the slide down.

NFP in focus this week as well as Trump Tariffs.

As always, Good Luck & Trade Safe.

NVDA Silicon Slippage: The Bearish Case for NVDA in 5 ContractsNVDA Bearish Options Thesis — “AI’s Reality Check”

A $500 Bet Against Hype, Headwinds, and a Tired Rally

Underlying: NVIDIA (NVDA)

Current Price: $109.67

Strategy: Buy 5x $90 PUTs expiring May 2, 2025 @ $1.00

Total Cost (Risk): $500

Breakeven: $89.00

Max Value at Expiry: $45,000 (if NVDA → $0)

Target Zone: $85–$95

Risk/Reward Profile: Asymmetric 1:9+

🧠 Thesis Summary: Why NVDA Could Drop

NVIDIA, the undisputed champion of the AI GPU race, now finds itself under increasing pressure from macro forces, competition, and sentiment. This trade capitalizes on a short-term reversal thesis into earnings season and macro repricing.

🚨 Key Catalysts for Downside:

🧬 1. AI Hype Fatigue

The market is cooling on generative AI names after 12+ months of hype.

Investor sentiment is shifting toward monetization over narrative — which hits NVDA’s high-multiple story.

💥 2. DeepSeek & Chinese Competition

The emergence of DeepSeek (a competitive LLM) raises the risk of a hardware shift in the East.

China accelerating self-sufficiency in chips = reduced NVDA demand.

📉 3. Macro Headwinds & Tariffs

Renewed trade war tensions threaten advanced chip exports.

Tariffs and tighter regulations = real demand compression for NVDA’s top-line growth.

📊 4. Technical Breakdown Confirmed

Weekly close below Fib 0.382 ($109.44) — now resistance.

RSI at 41.44 — weak and trending down.

Below VWAP ($113.65), signaling momentum shift.

"NVIDIA isn't breaking down because it's bad — it's breaking down because the market is waking up."

💰 Trade Breakdown: 5x $90 PUTs @ $1.00 (May 2, 2025)

Metric Value

Contracts 5

Cost per Contract $100

Total Premium $500

Breakeven $89.00

Max Gain $45,000

Max Loss $500 (premium only)

📊 P&L Scenarios (5 Contracts)

NVDA Price Drop % Intrinsic Value Total Payout Net Profit ROI (%)

$100 -8.8% $0.00 $0 -$500 -100%

$95 -13.4% $0.00 $0 -$500 -100%

$90 -17.9% $0.00 $0 -$500 -100%

$85 -22.5% $5.00 $2,500 $2,000 400%

$82.70 -24.6% $7.30 $3,650 $3,150 630%

$80 -27.1% $10.00 $5,000 $4,500 900%

🧮 Technical Levels to Watch

Level Price Notes

VWAP $113.65 Rejected

0.382 Fib $109.44 Just breached

0.5 Fib $96.07 Strong support

0.618 Fib $82.70 Bearish target

RSI 41.44 Weak momentum

✅ Summary

Factor Insight

Total Spent $500 (5x $90 PUTs @ $1.00)

Breakeven $89.00

Risk Fully capped at $500

Potential Return Up to $4,500 (900%) if NVDA → $80

Catalyst Market re-rating AI, earnings unknowns, regulatory clouds

Trade Horizon 33 days — high velocity post-breakdown possible

NVDA NVIDIA Price Target by Year-EndNVIDIA Corporation (NVDA) remains a dominant force in the AI and semiconductor markets, with its forward price-to-earnings (P/E) ratio currently at 19.37—a reasonable valuation considering its growth trajectory and market position.

NVIDIA’s leadership in the AI sector, particularly through its cutting-edge GPUs, has driven strong demand from data centers, cloud providers, and AI developers. The company’s recent product launches, including the Hopper and Blackwell architectures, have further solidified its competitive edge.

Despite recent market volatility, NVIDIA's consistent revenue growth and expanding profit margins support the bullish case. The current P/E of 19.37 reflects a balanced risk-reward profile, suggesting that the stock is not overvalued despite its impressive performance.

A price target of $145 by year-end reflects approximately 15% upside from current levels, driven by sustained AI demand and growing market penetration. Investors should watch for quarterly earnings reports and updates on AI chip demand, as these will likely act as key catalysts for upward momentum.

Nvidia Update New levels to the downside Longs and shortsIn this video I discuss the market structure shift in Nvidia and highlight new levels to be aware of to the downside . Potential here for longs and shorts .

Tools used Fibs, Gann Square , Speed Fan , Order blocks .

Please Like and comment if you have any questions . Have a great Day and thanks for your support

Nvidia (NVDA) Share Price Continues Bearish TrendNvidia (NVDA) Share Price Continues Bearish Trend

Earlier this month, our analysis of NVDA's share price led us to:

→ Establish a downward channel (marked in red).

→ Suggest that the lower boundary could act as support, which was confirmed (circled).

On 13 March, we anticipated the median line of this channel might serve as resistance, and yesterday’s ~5% drop in NVDA’s share price (marked by a red arrow) aligns with this scenario.

As a result, NVDA’s price has declined by approximately 17% since the start of 2025, despite being a market leader in 2024.

Why Did Nvidia (NVDA) Shares Drop Yesterday?

Market sentiment turned negative amid concerns that the Trump administration may soon impose previously delayed international trade tariffs.

Additionally, the Financial Times reported that Chinese regulators are encouraging firms to adopt data centre chips that meet stringent environmental standards. This raises concerns that Nvidia’s H20 chip, despite complying with U.S. export controls, may not meet China’s environmental regulations. Investors seemingly viewed this as a bearish signal for Nvidia’s future sales in China.

Technical Analysis of Nvidia’s Share Price

Currently, NVDA’s price is encountering resistance at the bullish gap formed on 12 March, around $112.50.

Given the broader market context, this setup could indicate an attempt by bears to resume the downtrend after a temporary rebound from oversold conditions. A consolidation pattern in the form of a narrowing triangle (marked in red) has also emerged.

If market conditions remain challenging, bears may push NVDA’s price towards the psychologically significant $100 level.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

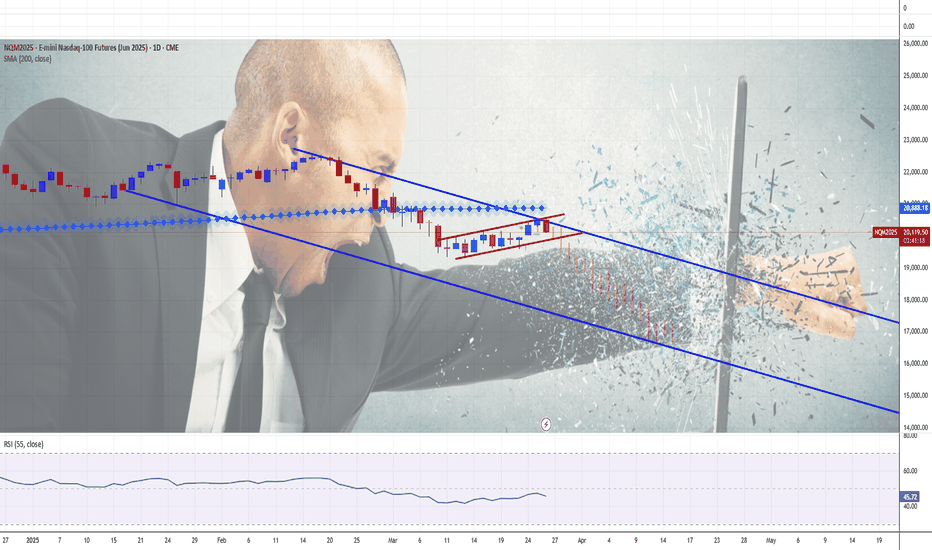

US Cash Market Goes 'Flippant'. Understanding Revenge in TradingFirst of all, revenge trading is a destructive pattern of behavior in trading where individuals make impulsive and emotionally-driven decisions in an attempt to recoup previous losses. This practice is not limited to novice traders; even experienced traders can fall prey to it. The primary emotions driving revenge trading include anger, frustration, greed, fear, and shame, which cloud judgment and lead to irrational decision-making.

Causes of Revenge Trading

Emotional Response: Traders often react emotionally to significant losses, feeling compelled to immediately recover their losses without adequate analysis or strategy.

Lack of Discipline: Deviating from established trading plans and risk management principles is common in revenge trading.

Psychological Triggers: Feelings of injustice, anger, or a desire for vengeance against the market can trigger revenge trading.

Consequences of Revenge Trading

Financial Losses: Revenge trading often results in larger losses due to riskier trades and poor timing.

Emotional Burnout: The stress and frustration from repeated losses can lead to emotional exhaustion and decreased trading performance.

Career Impact: Persistent revenge trading can erode confidence and lead to a trader questioning their abilities.

Real-Life Examples of Revenge Trading

Increasing Position Size: A trader experiences a significant loss and decides to double or triple their position size in the next trade, hoping to quickly recover their losses. This action disregards risk management principles and often leads to even greater losses.

Ignoring Stop-Loss Orders: After a loss, a trader might hold onto a losing position longer than planned, hoping it will turn around. This behavior ignores established stop-loss orders and can result in further financial damage.

Chasing Trades: A trader feels compelled to enter trades without proper analysis, driven by the urge to recoup losses quickly. This impulsive behavior can lead to a series of poor trading decisions.

Market Reversal Scenario: A trader suffers a loss due to a sudden market reversal. In an attempt to recover, they enter a trade in the opposite direction without thorough analysis, which can exacerbate their losses.

Wish more examples? Watch recent one below 👇👇

How to Avoid Revenge Trading

To avoid revenge trading, traders should focus on maintaining discipline and adhering to their trading strategies. This includes:

Taking Breaks: After a loss, taking time to reassess the market and calm emotions can help prevent impulsive decisions.

Sticking to Plans: Adhering to established trading plans and risk management principles is crucial.

Emotional Awareness: Recognizing emotional triggers and taking steps to manage them can help prevent revenge trading.

In conclusion, revenge trading is a HARMFUL AND DANGEROUS practice that can lead to significant financial and emotional consequences. Understanding its causes and recognizing its signs are essential steps in avoiding this behavior and maintaining a successful trading career.

--

Best wishes,

@PandorraResearch Team 😎

U.S. Big Tech 10 (NYSE FANG+) Index. Another Day. Another DollarThe remarkable performance of U.S. large cap equities in the past two years was closely tied to the dominance of tech-related sectors, exemplified by companies akin to those in the high-performing NYSE FANG+ Index ICEUS:NYFANG .

The NYSE FANG+ Index (“Index”), also known as the NYSE U.S. Big Tech 10 Index, is a rules-based, equal-weighted equity benchmark designed to track the performance of 10 highly-traded growth stocks of technology and tech-enabled companies in the technology, media & communications and consumer discretionary sectors.

The Index undergoes a reconstitution quarterly after the close of the third Friday in March, June, September and December (the “Effective Date”).

The NYSE FANG+ Index provides exposure to 10 of today’s highly-traded tech giants

Access the index through a futures and options contract designed to help you increase or reduce exposure to this key group of growth stocks in a capital-efficient manner.

Ten constituents of The U.S. Big Tech 10 (NYSE FANG+) Index as of Friday, December 9,

2022 (10% equal weighting):

Meta NASDAQ:META

Apple NASDAQ:AAPL

Amazon NASDAQ:AMZN

Netflix NASDAQ:NFLX

Microsoft NASDAQ:MSFT

Google NASDAQ:GOOGL

Tesla NASDAQ:TSLA

NVIDIA NASDAQ:NVDA

Snowflake NYSE:SNOW

Advanced Micro Devices NASDAQ:AMD

The main technical weekly graph indicates The U.S. Big Tech 10 (NYSE FANG+) Index remains aboму 200-day SMA (so far), following the upside path that has been taken in early 2023 after 50 percent decline in 2022.

--

Best wishes,

@PandorraResearch Team

AMD stock up over 20% off the lows- outperform NVidia?AMD is still cheap relative to its growth and still way down from all time highs.

Seeking alpha analysts expect 25-30% annual growth in earnings yearly. The stock is still in the low 20s PE. Stock can double and still be a good business worth owning for the long term and let compounding earnings work.

Low rsi and bollinger bands gave us the signal to buy, we bought with leverage, now we are in the shares unlevered.

Target would be all time highs over the next 2-3 years.

Nvdia has a new Aggressor.The boxes you are observing are the Larger scale supply and demand zones. These areas map out the current large liquidity. This includes the newest Player (collective players). This new player has been aggressively on the 17th and 18th.

Why does identifying a new aggressor matter?

New aggressors shape the way we view previous areas of supply and demand. Some look at the price getting to their target, without giving any thought to HOW it gets there.

In this instance:

Previous supply and demand have been established (we do not know how big they are or who is stronger). Some clues we do have is how it approaches these areas, and new aggressors can give us the clues we need... Will it bounce off demand? or fulfill it and continue lower?

New aggressors can put more pressure on these Demand or supply zones simply because they are becoming more aggressive closer to these areas.

Prediction

Scenario 1

Rolling over, and touching the 106 demand zone. Get's bought up, and new aggressors presents themself (bringing more demand). Price Target = 123.

If there is continued demand through this area, a case can be made for a 138 target before a correction/ reversal.

Scenario 2

New demand chews up this new aggressor. We should then have a bullish run to 131. 131 would present itself as a great short-term options (short).

Scenario 3

Rolling over with NEW (short) aggressors. This will put tons of pressure on the 106 players, and hopefully the 96's hang on (not charted).

Please feel free to share you input, thank you for taking the time.

Happy Trading!

Microsoft (MSFT): The "Can’t Go Wrong" Stock... Until It DoesAh, Microsoft—the tech titan that could probably survive a meteor impact. 🌍☄️ With a market cap so large it could buy entire countries and still have spare change for a few yachts, MSFT is the stock that everyone loves... even when it’s overvalued. But hey, let’s take a look at the "genius" behind the current price action. 🔍💰

📊 The Almighty Stock Performance (Because Fundamentals Don’t Matter Anymore?)

📉 Price: $385.76 (up a whole 0.00584%! Call the champagne guy! 🍾)

📊 Intraday High: $387.88

📉 Intraday Low: $383.27 (because even Microsoft has bad days, right? 😅)

🔮 200-day moving average: $423.98 (oh look, it's trading below that... bearish much? 🐻)

So, let me get this straight. MSFT is 7.80% down year-to-date, but analysts are still screaming “BUY! 🚀.” Sure, because blindly trusting price targets has always worked out well for retail investors. 🤑

💰 Valuation: Overpriced? Who Cares, It’s Microsoft!

📢 Intrinsic Value Estimate: $316.34

😬 Current Price: $385.76

💰 Overvaluation? About 18%

But let’s be honest—does valuation even matter anymore? If people are throwing money at meme coins, why not pay a premium for MSFT? 🤷♂️ It’s basically a subscription service at this point—you pay every month, and the stock just keeps draining your wallet. 💸

🤖 AI Goldmine or Just Another Buzzword?

Microsoft has been riding the AI hype train harder than a teenager with ChatGPT. 🚂💨 Their enterprise AI growth is over 100%, and they’re pulling in a $13 billion annual run rate from AI services. But sure, let’s pretend that no one remembers the last time “the next big thing” crashed and burned. (cough dot-com bubble cough). 💀💾

Evercore analysts claim MSFT will dominate AI for enterprises. Well, duh. If you’re an enterprise and don’t buy Microsoft AI services, Satya Nadella himself might show up at your office and force you to install Windows 11. 🏢💻

📉 Risk Factors? No Way! MSFT is Invincible... Right?

🦅 Hawkish Fed = Potential Market Sell-Off (But don’t worry, just HODL, right? 🤡)

🚀 Tech Bubble Concerns (Microsoft will totally be the exception… like every overhyped stock before it. 😬)

🧐 Overvaluation? Pfft, who cares? (People said the same about Tesla at $400. Look how that turned out. 🪦)

📢 Analyst Hot Takes (Because They’re Always Right 😂)

📊 D.A. Davidson: Upgraded to Buy with a price target of $450. (Ah yes, let’s just throw numbers out there. Why not $500? $600? 🚀)

🔮 UBS: Predicts $3,200 for gold, but Microsoft will somehow go even higher. (Probably. Because… reasons. 🤷♂️)

🎭 Final Thoughts: Buy? Sell? Just Panic?

Microsoft is basically the “safe” tech stock everyone clings to while pretending that the market isn’t built on dreams and overleveraged hedge funds. 🏦💰 If you believe in the power of monopolies, overpriced AI services, and analysts pulling price targets out of thin air, then MSFT is your golden ticket. 🎟️💎

Otherwise, maybe—just maybe—waiting for a dip below fair value isn’t the worst idea in the world. But what do I know? I’m just some guy on the internet. 🤷♂️

🚀💸 Good luck, traders. You’ll need it. 😈📉

💬 What do you think? Drop your thoughts below! 👇🔥

I HAVE A NEW STRATEGY! Watch it work for me. SAYS SELL🚨 Exclusive Trading Opportunity – Limited Time Only! 🚨

I've developed an amazing new trading strategy that’s completely unique and never seen before! It’s called the Skyline Scalping Strategy, and it’s designed to pinpoint market direction with extreme accuracy—something that can easily be back-tested by reviewing my previous predictions.

For a limited time, I’ll be posting daily trade signals based on this strategy, allowing you to see exactly where I anticipate the market will move next. Whether you're an amateur trader or a seasoned professional, this is your chance to witness something game-changing in action.

⚠️ Disclaimer: I’m not providing financial advice—just sharing the direction I am planning to make money. The Skyline Scalping Strategy works exclusively on the daily chart, so stay tuned and watch as the predictions unfold!

FOLLOW NOW and don’t miss out on these powerful insights! 📊🔥

Vertical lines are colored and placed to indicate the expected direction of the price. Just my thoughts.

Nvidia Partners With General Motors to Build Self-driving CarsNVIDIA Corporation, a computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally Partners With General Motors to Build Self-driving Cars.

Also in another news, IBM Taps NVIDIA AI Data Platform Technologies to Accelerate AI at Scale.

Apparently, shares of Nvidia (NASDAQ: NASDAQ:NVDA ) is undeterred by all this news presently down 3.43% trading with a weak RSI of 44.

The 78.6% Fibonacci retracement point is acting as support point for shares of NVidia a break below that pivot could lead to a dip to the 1-month axis. Similarly, a breakout above the 38.2% Fibonacci retracement point could catalyse a bullish renaissance for $NVDA.

US Technology Sector Futures. The Heartbreak HotelPresident Donald Trump's tariffs on imported tech goods, targeting China, the EU, Canada, and Mexico, are reshaping the U.S. technology sector through higher costs, supply chain disruptions, and retaliatory trade risks. While intended to boost domestic manufacturing and reduce trade deficits, these measures are creating immediate economic strain across critical industries. Below is an analysis of their key negative impacts:

Rising Consumer Prices and Hardware Costs

The 25% tariff on EU semiconductors, 10% levy on Chinese goods, and 25% duties on Canadian/Mexican imports are projected to add $50 billion in new costs to North American tech supply chains. This directly affects consumer electronics:

Smartphones and laptops. Apple’s iPhone production in China exposes it to 10% tariffs, likely forcing U.S. price hikes.

Semiconductors. The U.S. relies on China and Taiwan for 80% of 20-45nm chips and 70% of 50-180nm chips, with tariffs disrupting access to essential components.

Cloud/AI infrastructure. Steel and aluminum tariffs (25%) increase data center construction costs, potentially raising prices for AWS, Google Cloud, and Microsoft Azure services.

Experts warn companies may pass 60-100% of tariff costs to consumers rather than absorb profit losses.

Supply Chain Disruptions and North American Integration

The tariffs jeopardize tightly integrated North American production networks:

Cross-border dependencies. Components often cross U.S.-Mexico or U.S.-Canada borders multiple times during manufacturing. Christine McDaniel of the Mercatus Center notes this integration means tariffs “hurt the pricing power of the U.S.” by inflating domestic costs.

Critical material shortages. Canada supplies nickel and cobalt for batteries, while Mexico handles assembly for firms like Foxconn. Tariffs risk delays and renegotiations with suppliers.

Retaliatory measures. The EU may respond with fines or trade barriers against U.S. tech giants like Apple and Google, escalating tensions.

Sector-Specific Challenges

Semiconductors and Hardware

Chip shortages. With limited domestic foundry capacity, tariffs on EU semiconductors threaten AI development and device manufacturing.

Networking equipment. Proposed 10% tariffs on Chinese-made routers and modems could disrupt cloud providers reliant on these components.

Data Centers and AI

Construction delays. Steel/aluminum tariffs increase costs for server racks and cooling systems, potentially delaying $80 billion in planned U.S. data center investments.

AI infrastructure. Projects like the $500 billion Stargate initiative face higher expenses for imported components, slowing AI adoption.

Macroeconomic Risks

Trade deficit growth. Despite tariffs aiming to reduce the $1 trillion U.S. goods trade deficit, S&P Global warns retaliatory Chinese tariffs could worsen imbalances.

Job losses. Economic modeling suggests tariffs may cost 125,000+ U.S. tech jobs through reduced consumer spending and IT budget cuts.

Innovation slowdown. While firms like TSMC and Intel accelerate U.S. fab construction, short-term supply chain reallocations divert R&D funding.

Corporate Responses and Limitations

Some companies are attempting mitigation strategies:

Stockpiling. NVIDIA and AMD are urging partners to increase pre-tariff production.

Domestic shifts. Apple plans $500 billion in U.S. manufacturing, while TSMC pledged $160 billion for stateside fabs.

However, these efforts face scalability issues. Building advanced chip foundries takes 3-5 years, leaving gaps in critical components. Meanwhile, 65% of IT firms report difficulty finding tariff-free alternatives for Chinese inputs.

Technical challenge

The main technical graph for US Technology Select Sector Futures CME_MINI:XAK1! (CME Group mode of AMEX:XLK - SPDR Select Sector Fund - S&P500 Technology ETF) indicates on further Bearish market in development since major support of 52-week SMA has been broken already, with possible upcoming Bearish cascade effects in the future.

It is also important to note the almost complete absence of a Trump-a-rally in the 2024 holiday quarter, which contributed to the formation of a multi-resistance top.

Conclusion

While the tariffs aim to strengthen U.S. tech autonomy, their immediate effects—higher prices, supply instability, and strained international relations—outweigh potential long-term benefits. With global IT spending still projected to grow 9% in 2025, the sector’s resilience is being tested by policy-driven headwinds that threaten America’s competitive edge in semiconductors, AI, and consumer electronics.

Investing in S&P500 Technology Sector Futures / ETFs seeks to provide precise exposure to companies from technology hardware, storage and peripherals; software; communications equipment; semiconductors and semiconductor equipment; IT services; and electronic equipment, instruments and components industries; allows investors to take strategic or tactical positions at a more targeted level than traditional wide style based investing.

S&P500 Technology Sector Futures / ETFs are designed for investing at a more targeted Technology level, since nearly 50 percent of holdings weight just a five well-known names:

Name Weight

APPLE INC NASDAQ:AAPL 15.61%

MICROSOFT CORP 12.83%

NVIDIA CORP NASDAQ:NVDA 11.91%

BROADCOM INC NASDAQ:AVGO 5.18%

SALESFORCE INC NYSE:CRM 3.11%

--

Best 'Heartbreaking' wishes,

@PandorraResearch Team 😎

Nvidia - That's Officially The Brutal End!Nvidia ( NASDAQ:NVDA ) is breaking all structure:

Click chart above to see the detailed analysis👆🏻

Following previous cycles, Nvidia has been rallying for more than 2 years, creating an overall pump of approximately +1.000%. But now, everything is literally pointing to a significant towards the downside and with a potential drop of -30%, bears are totally taking over Nvidia now.

Levels to watch: $70

Keep your long term vision,

Philip (BasicTrading)

Nvidia (NVDA) Bullish Opportunity – GTC 2025 & AI GrowthCurrent Price: $121.67

✅ TP1: $130 – (short-term resistance, +7%)

✅ TP2: $145 – (medium-term breakout target, +19%)

✅ TP3: $175 – (analyst target, +43%)

🔥 Why Bullish?

1️⃣ GTC 2025 Conference (March 17-21)

CEO Jensen Huang’s Keynote (March 18) is expected to unveil:

Blackwell Ultra (B300 series): Next-gen AI GPU with 288GB memory.

Rubin GPU Preview: NVIDIA’s roadmap beyond 2026.

Quantum Day (March 20): NVIDIA’s first quantum event, showcasing its role in quantum simulation despite earlier skepticism—potentially broadening its tech leadership.

Market Sentiment: High anticipation for AI & chip updates, with some seeing 30%-50% upside if AI demand is reaffirmed (e.g., new contracts, backlog growth).

2️⃣ Analyst Ratings & Price Targets

Strong Buy Consensus from analysts.

Average 12-Month Price Target: $174.79 → +43.59% upside.

Price Target Range: $120 (low) to $220 (high).

3️⃣ Technical Setup – Breakout Potential

Falling Channel Formation – Price is bouncing from strong support (~$115).

MACD Bullish Crossover – Momentum is shifting in favor of buyers.

Breakout Level: Above $130 would trigger stronger upside.

Nvidia Rises Over 4.5% and Reclaims $120 ZoneBy the end of the week, Nvidia's stock has surged to $120 , with the strong bullish movement likely driven by positive results from its largest supplier. Taiwanese company Hon Hai Precision Industry (Foxconn) reported revenues exceeding $30 billion and announced plans to establish the world's largest chip manufacturing plant in Mexico, aimed at improving supply efficiency for its main client, Nvidia. This news has restored investor confidence in the short term, and if this positive momentum persists, the bullish pressure surrounding the stock could intensify further.

Large Bearish Channel:

Despite the recent confidence in Nvidia, it is important to note that since early January, the stock has been forming a large bearish channel, and its current price remains midway within that channel. This suggests that the short-term buying momentum still has room to grow, but it has not yet been strong enough to break the dominant bearish formation.

RSI Indicator:

The RSI indicator has started showing an upward slope, and the RSI line is preparing to cross the neutral 50 level. This could indicate that buying momentum may begin to take control, especially if the RSI line continues to move consistently above this neutral level in the upcoming sessions.

MACD Indicator:

The MACD histogram is showing a similar pattern, as it is currently testing the neutral 0 line. If a crossover occurs, it would suggest that the moving average trends are turning bullish, potentially reinforcing buying confidence in the following sessions.

Key Levels:

$130 – Significant Resistance: This level coincides with the bearish trendline and the 38.2% Fibonacci retracement level. A breakout above this level could challenge the current bearish channel and pave the way for stronger buying momentum.

$115 – Near-term Support: This level aligns with the 61.8% Fibonacci retracement barrier. If bearish oscillations push the price below this level, it could completely negate the current buying sentiment and extend the long-term bearish trend that has persisted for weeks.

By Julian Pineda, CFA – Market Analyst

NVDA Short Term BuyPrice is currently consolidating within a tight range, and a breakout appears imminent. I am looking for a clean break above resistance, followed by a retest of the breakout level, which could provide a strong buy opportunity. If this setup plays out, the next key target would be the $135 level.

However, this move is likely to be a short-term retracement within a larger downtrend. If price struggles to sustain momentum above $135 and shows signs of weakness, it could indicate a continuation of the broader bearish trend. Confirmation will come from price action signals and volume dynamics on the retest.