Bearish Gameplan Activated – NZD/CAD Heist Operation💣 NZD/CAD “Kiwi vs Loonie” Forex Vault Robbery Heist Plan 🔫💰

Bearish Plan | Multiple Limit Orders | Scalping/Swing Style

🧠💼 Welcome to another high-stakes Thief Trader Heist – this time we're targeting the NZD/CAD vault. The Loonie's got weakness in its wings, and the Kiwi’s already flapping into the trap zone. Let's rob this pair clean!

📉 ENTRY – THE BREAK-IN

💼 "We ain't knocking... we entering ANY PRICE LEVEL!"

Layer your sell limit orders like traps in a museum – closest to recent highs on the 15m/30m/1H zones. Precision is profit. 🧨

🛑 STOP LOSS – EXIT ROUTE IF CAUGHT

🔐 0.81800 — placed at the swing high (4H chart level) for clean cutouts. Adjust based on your lot size & how many bags you carry 🧳📊

🎯 TARGET – VAULT LOCATION

🏁 0.80400 — that’s where we grab the loot and disappear like ghosts!

🎯 Day traders aim here.

🎯 Scalpers escape quicker with trailing SLs – grab and vanish!

⚙️ STRATEGY – THE THIEF’S TOOLKIT

🔹 Scalping? Only short!

🔹 Swinging? Ride the bearish tide 🌊

🔹 Use price traps, liquidity zones, fake breakouts – we exploit retail psychology 😈

🔹 Heist based on momentum, reversal patterns, exhaustion candles 🕵️♂️

📉 Sentiment shows retail stuck long 🪤

📈 Institutions flipping short 👀

📉 Trend = weak Kiwi, stronger Loonie boost from commodities

🚨 NEWS ALERT – STAY IN SHADOWS

Avoid high-impact news like CPI, BoC or RBNZ shocks. Thieves don’t rob during spotlight hours 🔦📉

🔥 Hit BOOST 💥 if you’re riding with the THIEF GANG 🔥

👑 Let’s make this plan viral, hit likes, share it, and rob the market clean 💰💸

Stay stealthy. Stay rich. Stay Thief. 🐱👤🕵️♂️💼

Nzdcadforecast

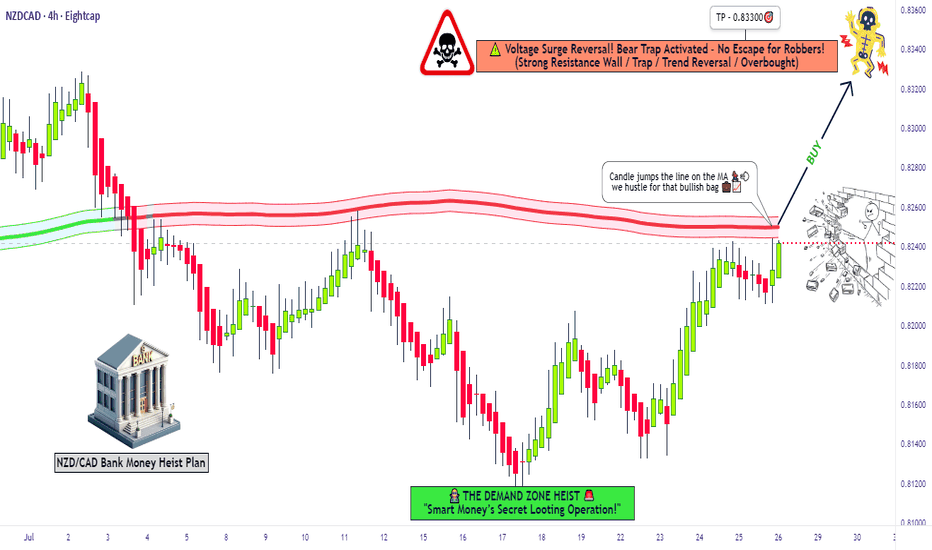

"NZD/CAD Reversal Play – Ride the Bullish Wave!🦹♂️💰 "THE KIWI-LOONIE HEIST: High-Voltage Forex Robbery Plan (NZD/CAD)" 💰🦹♂️

🌍 Attention all Market Pirates, Thieves & Profit Bandits! 🌍

🔥 Thief Trading Alert – NZD/CAD Bullish Heist Setup! 🔥

The "Kiwi vs Loonie" is setting up for a high-risk, high-reward robbery—and we’re locking in the master plan. Long entry is the play, but this ain’t for the weak hands. Overbought? Consolidation? Reversal trap? Perfect. That’s where we strike.

🎯 THE HEIST BLUEPRINT

🔑 ENTRY ZONE (Breakout & Retest Strategy)

"Wait for the 4H candle to CLOSE ABOVE 0.82600 (MA Breakout + Retest)."

Option 1: Place a BUY STOP above the MA (momentum confirmation).

Option 2: BUY LIMIT near recent swing lows (15M/30M precision).

🚨 Set an ALERT! Don’t miss the breakout—timing is everything.

🛑 STOP LOSS (Escape Route)

SL at 0.82000 (near swing low wick on 4H).

⚠️ Golden Rule: NO ORDERS BEFORE BREAKOUT! Wait for confirmation.

Adjust SL based on your risk, lot size, and multi-order strategy.

🎯 TARGETS (Profit Escape Plan)

Take Profit 1: 0.83300 (First resistance).

Or… Exit Early if the market turns shaky.

Scalpers: Long-only scalp plays! Use trailing SL to lock in gains.

⚡ THIEF TRADER PRO TIPS

✅ Fundamental Backing: Check COT reports, macro trends, intermarket signals.

✅ News Alert: Avoid new trades during high-impact news—protect open positions with trailing stops.

✅ Risk Management: Small lots, multiple entries = smarter heist.

💥 BOOST THE HEIST! (Let’s Get Rich Together) 💥

👉 Smash that 👍 LIKE button to fuel our next robbery plan!

👉 Follow for daily high-voltage setups.

👉 Comment "🚀" if you’re joining the heist!

🤑 NEXT HEIST COMING SOON… STAY TUNED, BANDITS! 🤑

🔥 WHY THIS TRADE? (Thief’s Edge)

Bullish momentum but trapped bears = perfect robbery setup.

Institutional levels + retail traps = our opportunity.

Not financial advice—just a well-planned theft. 😉

⚠️ Warning: Trading = Risk. Only play with funds you can afford to lose.

NZD/CAD THIEF TRADING ALERT: Bullish Loot Ahead – Are You In?🔥 NZD/CAD Heist: Bullish Loot Ahead! 🏴☠️💰

🌟 Greetings, Market Pirates! 🌟

Hola! Oi! Bonjour! Hallo! Marhaba! 🚀

💸 The Master Plan:

Based on Thief Trading tactics (technical + fundamental analysis), we’re plotting a bullish heist on NZD/CAD ("Kiwi vs Loonie"). The vault is open—time to swipe the loot!

📈 Entry (Long Only):

Buy Limit Orders preferred (15-30min TF for pullbacks).

Aggressive? Enter anytime—just stick to the strategy!

🛑 Stop Loss (Protect Your Loot!):

Nearest swing low (4H TF) → 0.81500 (adjust based on risk & lot size).

Scalpers? Use trailing SL to lock profits!

🎯 Take Profit (Escape Before Cops Arrive!):

Primary Target: 0.83800 (or exit earlier if momentum fades).

⚠️ Warning (High Risk!):

Overbought? Yes. Bear traps? Likely.

Consolidation zone → trend reversal risk!

News releases? Avoid new trades—hedge or trail stops!

📊 Market Context:

Neutral trend (bullish bias forming 🐂).

Check: COT reports, macro trends, sentiment & intermarket signals BEFORE executing! 🔍 (go ahead to read 🔗🌏).

💥 Boost This Idea!

Hit 👍 LIKE & 🔔 FOLLOW to support the Thief Trading crew! More heists coming soon—stay tuned! 🚀

🚨 Reminder: Trade responsibly. This is NOT financial advice—just a risky, high-reward play. Manage your risk or get rekt!

NZDCAD - Looking To Sell Pullbacks In The Short TermM15 - Bearish divergence followed by the most recent uptrend line breakout.

No opposite signs.

Expecting pullbacks and bearish continuation until the strong resistance zone holds.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

BANK JOB: NZD/CAD LOOT GRAB (Swing Heist Plan) 🏦 "Market Heist: NZD/CAD Long Before Trap Closes! 💰

🦹♂️ Attention All Market Thieves!

(Hola! Oi! Salut! Hallo! Ahlan!) 🎭💸

🔥 Thief Trading Intel Confirmed!

The NZD/CAD "Kiwi vs Loonie" vault is primed for cracking! Our bullish heist blueprint targets the red zone - but we escape before the bears set their trap!

🔓 ENTRY: CRACKING THE SAFE

"Resistance wall at 0.83150 is the vault door!"

✔ Option 1: Buy Stop above resistance (breakout play)

✔ Option 2: Buy Limit at swing low (15m/30m pullback)

🔔 Pro Tip: Set breakout alerts - don't miss the heist!

🚨 STOP LOSS: POLICE EVASION PLAN

📍 Thief SL: 0.82200 (below 4H swing low & MA)

⚠️ Warning: No SL before breakout! You'll trigger the alarms!

💎 TARGET: ESCAPE WITH THE LOOT

🎯 Primary Take: 0.84400

💰 Scalpers: Long-only! Trail your SL like a getaway car!

📊 MARKET CONDITIONS

🐂 Bullish Trend (but overbought - time it right!)

🔍 Key Intel Needed: COT reports, macro data, sentiment

🌐 Full Briefing: Check bi0 linkss 👉🔗

🚦 RISK MANAGEMENT PROTOCOLS

• ❌ Avoid news event heists

• 🔒 Always use trailing stops

• 💣 Position size = explosive potential

🦾 SUPPORT THE SYNDICATE

💥 SMASH THAT BOOST BUTTON!

💬 Comment your heist results below!

🔔 Next job coming soon - stay tuned!

🤑 Remember thieves: Book profits before the cops arrive!

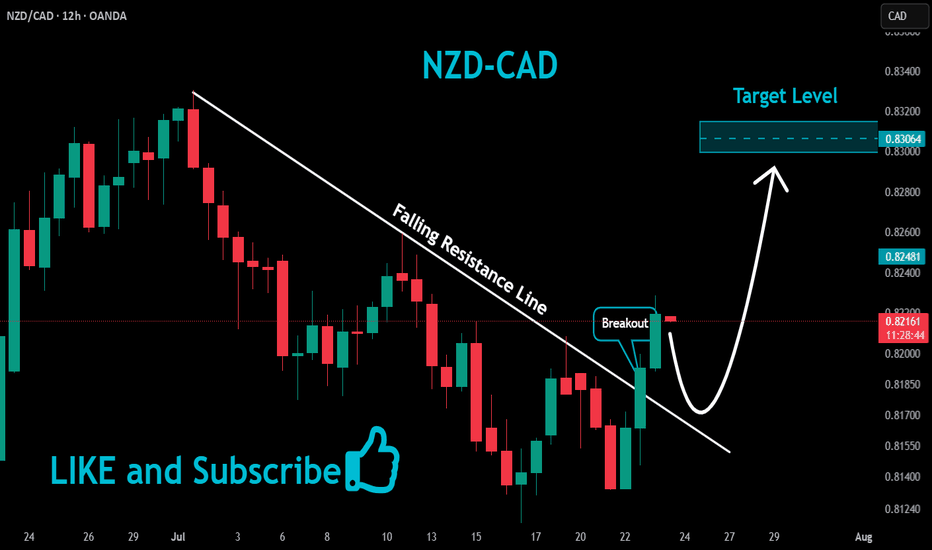

Is the NZDCAD uptrend still strong?NZDCAD has broken the trendline structure and is heading towards the resistance at 0.83500

0.827 has become a confluence of support and trendline. The pair is looking for more buying momentum at the support zone.

2 zones to watch are 0.827 and 0.823

If the 0.823 zone is broken, the uptrend is broken and the market turns to a downtrend. The target of the downtrend and the market finds the bottom of last month around 0.812.

Confirm SELL signal when breaking 0.823

NZDCAD Selling Trading IdeaHello Traders

In This Chart nzdcad HOURLY Forex Forecast By FOREX PLANET

today NZDCAD analysis 👆

🟢This Chart includes_ (NZDCAD market update)

🟢What is The Next Opportunity on NZDCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

NZDCAD - Short Term Sell Trade Update!!!Hi Traders, on May 7th I shared this idea "NZDCAD - Looking To Sell Pullbacks In The Short Term"

I expected to see retraces and further continuation lower. You can read the full post using the link above.

Retrace and push lower happened as per the plan!!!

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDCAD: Last Idea Running 300+ Pips, Next Big Opportunity OTW! Dear Traders,

Our last idea hit 340+ pips successfully, and we expect price to continue rising up, after touching our imbalance zone. That area remain a strong possible buying area for buyers. Once rejected at the area we can see strong rebound from our buying zone. 400-500 pips move is expected.

Good Luck and Trade Safe

**If you like our idea then please do like, comment and follow for more**

NZDCAD - Looking To Sell Pullbacks In The Short TermM15 - Bearish divergence followed by the most recent uptrend line breakout.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the strong resistance zone holds.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDCAD at Key Resistance Level: Will it Drop To 0.81608?OANDA:NZDCAD is approaching a key resistance level that has previously acted as a strong barrier, triggering bearish momentum in the past. This zone also aligns with prior supply areas where sellers have stepped in, making it a potential point of interest for those looking for short opportunities. Given its historical significance, how price reacts here could set the tone for the next move.

If bearish signals emerge, such as rejection wicks, bearish candlestick patterns, or signs of weakening bullish pressure, I anticipate a move toward the 0.81608 level. However, a clear breakout above this resistance could challenge the bearish outlook and open the door for further upside. It's a pivotal area where price action will likely provide clearer clues on the next direction.

Just my take on support and resistance zones, not financial advice. Always confirm your setups and trade with a proper risk management.

Best of luck!

#NZDCAD: Two Areas To Sell From! Swing SellThe NZDCAD has hit a critical level, and it might start going down from where we set our selling points. We also have two targets for when we should enter the market.

Good luck and trade safely!

Thanks for your support! 😊

If you want to help us out, here are a few things you can do:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️

#NZDCAD: Great Time To Swing Sell! Comment Your View! NZDCAD is at a critical selling level, and we expect a significant drop. The chart shows potential price reversals, either continuing in our direction or rising to the red circle before reversing. A risk-managed trade could benefit from this.

Good luck and trade safely!

Much Love ❤️

Team Setupsfx_

NZD/CAD "Kiwi vs Loonie" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/CAD "Kiwi vs Loonie" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (0.82800) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low or high level Using the 4H timeframe (0.81800) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.83700 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

NZD/CAD "Kiwi vs Loonie" Forex Market is currently experiencing a Bullish trend., driven by several key factors. 📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook, Future Trend Move:

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Bearish momentum gaining tractionMarket Analysis:

The current market structure is unfolding with clarity, exhibiting a familiar technical pattern. The price action initiated with a consolidation phase, characteristic of accumulation, followed by a bearish rally to the order block at 0.81400. This rally successfully broke the previous higher high, transitioning into a manipulation phase.

Subsequently, bearish momentum gained traction, reaching the swing low and executing a slight liquidity sweep. The price then marginally rebounded to respect the immediate internal supply zone at 0.81600. A significant rejection occurred at this supply zone, culminating in the clearance of the swing low and resulting in displacement.

Given this shift, the market is anticipated to reverse to the upside, facilitating a liquidity sweep and mitigation of the fair value gap. This final lag of the technique is expected to provide a bearish entry for the distribution phase, targeting the rejection block.

Trade Setup:

- Entry: 0.81700

- Stop Loss: 20 pips at 0.81900

- Target: 100 pips at 0.80700

NZDCAD AnalysisNZD/CAD Technical Perspective:

The NZD/CAD pair is currently positioned at a key support zone, where price action has historically reversed direction. Following a recent rebound from this level, the pair is now retesting the support area. Given the broader uptrend structure (characterized by higher highs and higher lows), this retest presents a potential opportunity to enter long positions, contingent on bullish confirmation at this critical juncture.

Key Observations:

Established Uptrend: The pair’s consistent upward trajectory on higher time frames supports a bullish bias.

Support Retest: The current pullback to the support zone aligns with typical price behavior in trending markets, where retests of prior levels often precede trend resumptions, but a decisive close below the support would invalidate the bullish setup, potentially signaling a trend reversal or deeper correction.

Risk Management Strategy: A prudent approach would involve placing a stop-loss below the support zone to protect against a breakdown, while targeting the next resistance level for profit-taking.

Final Assessment:

The setup aligns with bullish momentum, provided the support holds. Traders should await confirmation (e.g., bullish candlestick patterns, rising momentum indicators) before committing to long positions.

NZDCAD - D, H4, H1 forecast, Technical Analysis & Trading IdeasMidterm forecast:

While the price is above the support 0.79427, beginning of uptrend is expected.

We make sure when the resistance at 0.82009 breaks.

If the support at 0.79427 is broken, the short-term forecast -beginning of uptrend- will be invalid.

Technical analysis:

A trough is formed in daily chart at 0.80285 on 02/12/2025, so more gains to resistance(s) 0.81380 and maximum to Major Resistance (0.82009) is expected.

__________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 BOOST button,

. . . . . . . . . . . Drop some feedback below in the comment!

🙏 Your Support is appreciated!

Let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

NZD/CAD "Kiwi vs Canadian" Forex Market Heist Plan on Bullish🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/CAD "Kiwi vs Canadian Dollar" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 👀 Be wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a Bull trade after the MA Breakout,

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 2h period, the recent / nearest low or high level.

Goal 🎯: 0.82000 (or) Escape before the target

Scalpers, take note : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Fundamental Outlook 📰🗞️

The NZD/CAD pair is expected to move in a bullish trend, driven by several fundamental factors:

New Zealand Economy:

Increase in dairy prices

Surge in tourism

Improvement in business confidence

Increase in consumer spending

Canadian Economy:

Decline in crude oil prices

Slowdown in the labor market

Decrease in housing market activity

Increase in trade deficits

Interest Rate Divergence:

Reserve Bank of New Zealand (RBNZ) keeps interest rates steady

Bank of Canada (BOC) cuts interest rates

Narrowing of the interest rate differential between the two currencies

Commodity Prices:

Increase in dairy prices

Increase in meat prices

Increase in other commodity prices that are important to New Zealand's economy

Currency Flows:

Increase in demand for the NZD

Decrease in demand for the CAD

Flows of capital into New Zealand's economy

Technical Analysis:

Breakout above the 0.80872 resistance level

Bullish chart patterns, such as a head and shoulders or a inverse head and shoulders

Bullish indicators, such as a moving average crossover or a relative strength index (RSI) MACD breakout

Sentiment Analysis:

Bullish sentiment among traders and investors

Increase in long positions in the NZD/CAD pair

Decrease in short positions in the NZD/CAD pair

Event-Driven Factors:

Positive news about New Zealand's economy, such as a new trade agreement

Negative news about Canada's economy, such as a natural disaster

Changes in government policies or regulations that affect the economies of New Zealand or Canada

These are just a few examples of the types of factors that could lead to a bullish trend for the NZD/CAD pair. As always, it's essential to monitor the market and adjust your trading strategy accordingly.

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂