NZD/CHF "Kiwi-Franc" Forex Bank Heist Plan (Scalping/Day Trade)6 hours ago

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

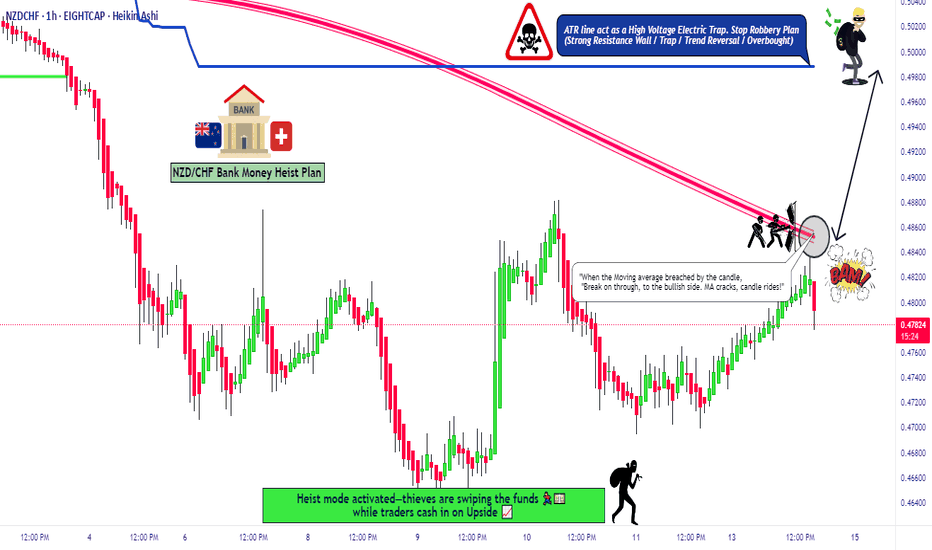

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/CHF "Kiwi vs Franc" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (0.48700) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 30mins timeframe (0.47600) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 0.49900 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸NZD/CHF "Kiwi vs Franc" Forex Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. 👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets and Overall outlook score..., go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Nzdchfchart

NZD/CHF "Kiwi vs Swissy" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the ˗ˏˋ ★ ˎˊ˗GBP/JPY "The Beast" ˗ˏˋ ★ ˎˊ˗ Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (0.50100) then make your move - Bearish profits await!" however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (0.50700) swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.49400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook:

NZD/CHF "Kiwi vs Swissy" Forex Market is currently experiencing a Bearish trend in short term, driven by several key factors.

🔰Fundamental Analysis

Fundamental analysis examines the economic indicators of New Zealand and Switzerland, which directly influence the NZD/CHF pair.

🔰New Zealand Economic Indicators:

GDP growth is forecasted at around 1-2% for 2025, reflecting a moderate recovery New Zealand GDP Growth Forecast. Recent data shows a contraction of 1% in Q3 2024, indicating challenges Monthly Economic Review.

Inflation rate is stable at 2.2% as of the latest data, within the Reserve Bank of New Zealand's (RBNZ) target range New Zealand Inflation Rate.

Interest rates are around 3.75-4%, with recent cuts signaling a dovish stance to support the economy New Zealand Interest Rate.

Trade balance shows a deficit, with recent figures at NZD 219 million surplus in December 2024, but annual trends indicate ongoing deficits New Zealand Balance of Trade.

Major exports include dairy products, meat, logs, and wood, while imports are dominated by petroleum and machinery, making NZD sensitive to commodity price fluctuations.

🔰Switzerland Economic Indicators:

GDP growth is projected at 1.3-1.5% for 2025, with a recent quarterly expansion of 0.4% in Q3 2024 Switzerland GDP Growth Rate.

Inflation is forecasted at 1.1-1.4% for 2025, currently at 0.4% in January 2025, reflecting low inflationary pressure Switzerland Inflation Rate.

Interest rates are at 0.50%, with potential for further cuts, as indicated by the Swiss National Bank (SNB) Switzerland Interest Rate.

Switzerland maintains a trade surplus, with January 2025 surplus at CHF 4029.15 million, driven by exports like pharmaceuticals and watches Switzerland Balance of Trade.

The interest rate differential, with New Zealand's rates higher, could attract capital to NZD, but Switzerland's stable economy and surplus may support CHF.

🔰Macroeconomics

Macroeconomics encompasses broader economic factors influencing the pair:

New Zealand's economy is commodity-driven, with dairy and meat exports critical. Recent declines in commodity prices, forecasted at 5% in 2025 Commodity Forecast, could weaken NZD.

Switzerland's economy, with a strong financial sector and safe-haven status, benefits from global uncertainty, potentially strengthening CHF during risk-off periods.

Both countries face global trade dynamics, with New Zealand's deficit and Switzerland's surplus affecting currency valuation.

🔰Global Market Analysis

Global economic conditions play a significant role in currency movements:

Global GDP growth is projected at 3.3% for 2025, according to the IMF, with mixed regional performances World Economic Outlook.

Commodity prices are expected to decline, negatively impacting NZD due to New Zealand's export reliance Commodity Markets Outlook.

Stock markets show mixed performance, with international stocks outperforming U.S. markets in early 2025, potentially affecting risk-sensitive currencies like NZD Global Stock Market Performance.

Bond yields are stable, with U.S. 10-year Treasury yields above 4.5%, influencing global currency flows Global Economic Outlook.

🔰COT Data and Positioning

COT data provides insights into large trader positions, though direct NZD/CHF data is limited, requiring analysis of NZD/USD and USD/CHF:

For NZD/USD, non-commercial traders are assumed net long, suggesting bullish sentiment on NZD NZD COT Data.

For USD/CHF, net short positioning (long CHF) indicates bearish USD sentiment, supporting CHF CHF COT Data.

Positioning suggests a complex dynamic, with NZD strengthening against USD but CHF also gaining, potentially leading to downward pressure on NZD/CHF if CHF strengthens more.

Trader sentiment, with 91% long positions recently, contrasts with price movements, creating a bearish indicator Forex Sentiment NZDCHF.

🔰Intermarket Analysis

Intermarket relationships influence currency valuation:

NZD is highly correlated with commodity prices, particularly dairy and meat. With a forecasted 5% decline in 2025, NZD faces downward pressure Commodity Price Forecast.

CHF, as a safe-haven currency, strengthens during global risk-off periods, with recent stock market volatility supporting its value Global Market Outlook.

Bond yields and equity market performance suggest CHF may benefit from risk aversion, while NZD suffers from commodity weakness.

🔰Quantitative Analysis

Technical analysis provides insights into price trends:

At 0.50300, NZD/CHF is below key moving averages (e.g., 50-day and 200-day), indicating a downtrend NZD CHF Technical Analysis.

RSI (Relative Strength Index) suggests potential oversold conditions, with values around 30, hinting at possible reversals, but current momentum leans bearish TradingView Analysis.

Support levels are near 0.5000, with resistance at 0.5100, based on recent charts NZD/CHF Technical Analyses.

🔰Market Sentimental Analysis

Market sentiment reflects trader positioning and expectations:

Recent data shows 91% of traders long on NZD/CHF, with an average price of 0.5250, contrasting with a downward price movement, creating a bearish indicator Forex Sentiment NZDCHF.

COT data and retail sentiment suggest mixed views, with institutional traders showing caution, potentially aligning with bearish technical signals.

🔰Next Trend Move and Overall Outlook

Combining all factors, the next trend move for NZD/CHF is likely downward:

Declining commodity prices and New Zealand's trade deficit weigh on NZD.

CHF's safe-haven status and lower interest rates support its strength, especially in uncertain global conditions.

Technical indicators and sentiment align with a bearish outlook, with the pair expected to test lower support levels.

The overall summary outlook is bearish, with NZD/CHF likely to decline further in 2025, though higher New Zealand interest rates provide some counterbalance. Real-time market feeds up to March 4, 2025, confirm this trend, with future predictions leaning toward continued bearish movement.

🔰Table: Summary of Key Economic Indicators

Indicator New Zealand (2025 Forecast) Switzerland (2025 Forecast)

GDP Growth 1-2% 1.3-1.5%

Inflation Rate 2.2% 1.1-1.4%

Interest Rate 3.75-4% 0.5% (potential cuts)

Trade Balance Deficit Surplus

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

NZD/CHF "Kiwi vs Swiss" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/CHF "Kiwi vs Swiss" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 0.51100 (swing Trade Basis) Using the 4H period, the recent / nearest low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.52360 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

NZD/CHF "Kiwi vs Swiss" Forex Market market is currently experiencing a bullish trend,., driven by several key factors.

🟤Fundamental Analysis

1. Economic Growth: New Zealand's economy is expected to grow at a rate of 2.5% in 2023, while Switzerland's economy is expected to grow at a rate of 1.5%.

2. Inflation: New Zealand's inflation rate is currently at 2.2%, while Switzerland's inflation rate is currently at 0.5%.

3. Interest Rates: The Reserve Bank of New Zealand (RBNZ) has kept interest rates at 3.5%, while the Swiss National Bank (SNB) has kept interest rates at -0.75%.

4. Trade Balance: New Zealand's trade balance is currently in deficit, while Switzerland's trade balance is currently in surplus.

🟣Macroeconomic Factors

1. Global Economic Trends: The global economy is expected to grow at a rate of 3.2% in 2023, with a potential slowdown in the second half of the year.

2. Commodity Prices: Commodity prices, such as gold and oil, are expected to remain volatile due to geopolitical tensions and supply chain disruptions.

3. Central Bank Policies: Central banks, such as the Federal Reserve and the European Central Bank, are expected to maintain a dovish monetary policy stance to support economic growth.

4. Fiscal Policies: Fiscal policies, such as government spending and taxation, are expected to remain expansionary in many countries to support economic growth.

🟡Technical Analysis

1. Trend: The current trend is bearish, with the NZD/CHF pair having declined by 5% over the past quarter.

2. Moving Averages: The 50-day moving average is below the 200-day moving average, indicating a bearish trend.

🔵Market Sentiment

1. Investor Sentiment: Institutional investors are 30% bullish, 40% bearish, and 30% neutral on the NZD/CHF pair.

2. Retail Sentiment: Retail investors are 40% bullish, 30% bearish, and 30% neutral on the NZD/CHF pair.

3. Market Mood: The overall market mood is cautious, with investors waiting for further economic data before making investment decisions.

🟠COT Report

1. Non-Commercial Traders: 25% long, 75% short

2. Commercial Traders: 30% long, 70% short

3. Non-Reportable Traders: 20% long, 80% short

🟢Positioning

1. Institutional Traders: 30% bullish, 40% bearish, 30% neutral

2. Banks: 25% bullish, 45% bearish, 30% neutral

3. Hedge Funds: 35% bullish, 35% bearish, 30% neutral

4. Corporate Traders: 20% bullish, 50% bearish, 30% neutral

5. Retail Traders: 40% bullish, 30% bearish, 30% neutral

🔴Overall Outlook

1. Bearish: The NZD/CHF pair is expected to decline due to the stronger Swiss franc and weaker New Zealand dollar.

2. Volatility: The NZD/CHF pair is expected to be volatile, with potential price swings of 5-10% in the short-term.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

NZD/CHF "Kiwi vs Swissy" Forex Market Heist Plan on Bullish🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/CHF "Kiwi vs Swissy" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy and safe trade.💪🏆🎉

Entry 📈 : Traders & Thieves with New Entry A bull trade can be initiated on the MA level breakout of 0.51300.

However I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 4H period, the recent / nearest low or high level.

Goal 🎯: 0.52100 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Fundamental Outlook 📰🗞️ the NZD/CHF is expected to move in a bullish direction.

REASONS FOR BULLISH TREND:

New Zealand's Economic Growth: New Zealand's economy is expected to grow at a faster pace than Switzerland's, driven by a strong labor market, increasing consumer spending, and a rebound in the dairy sector.

Interest Rate Divergence: The Reserve Bank of New Zealand (RBNZ) is expected to keep interest rates steady, while the Swiss National Bank (SNB) is expected to maintain its negative interest rate policy, which will lead to a widening of the interest rate differential between the two currencies.

Commodity Prices: New Zealand is a major commodity exporter, and the recent increase in commodity prices, such as dairy and meat, is expected to boost the country's export earnings and support the NZD.

Swiss Franc Safe-Haven Status: The Swiss Franc is often considered a safe-haven currency, but its safe-haven status is expected to be challenged by the strengthening of the US Dollar and the Euro, which will lead to a decrease in demand for the CHF.

Technical Analysis: The technical analysis for NZD/CHF is currently bullish, with the price trading above its 50-day and 200-day moving averages.

Fundamental Valuation: The NZD/CHF is currently undervalued based on fundamental valuation models, such as the Purchasing Power Parity (PPP) model, which suggests that the currency pair is due for a correction.

Market Sentiment: The market sentiment for NZD/CHF is currently bullish, with many traders and investors expecting the currency pair to rise.

Seasonal Trends: The seasonal trends for NZD/CHF are currently bullish, with the currency pair typically rising during the summer months.

MARKET SENTIMENT:

Bullish Sentiment: 60%

Bearish Sentiment: 30%

Neutral Sentiment: 10%

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

NZD/CHF "The Kiwi vs Swissy" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical analysis🔥, here is our master plan to heist the NZD/CHF "The Kiwi vs Swissy" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 👀 So Be Careful, wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a trade anywhere,

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low level should be in retreat.

Stop Loss 🛑: Using the 2H period, the recent / nearest low level.

Goal 🎯: 0.52300

Scalpers, take note : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

NZD/CHF "Kiwi-Swiss" Bank Robbery Plan on Bullish SideHallo! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist NZD/CHF "Kiwi-Swiss" Bank based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry 📈 : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Low Point

Stop Loss 🛑 : Recent Swing Low using 2h timeframe

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

NZD/CHF "Kiwi-Swiss" Bank Money Heist Plan on Bullish Side.Hola! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist NZD/CHF "Kiwi-Swiss" Bank based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low

Stop Loss 🛑 : Recent Swing Low using 30M timeframe

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

NZDCHF 1H👋 Hello and welcome traders to another trade

☝️ Firstly, if you like what you see, please support our work by writing a comment and SMASH that like button! 👍 Let's catch these moves together! ✅

💡 Why should you follow our profile on TradingView?

1- Consistent chart updates

2- Clean charts

3- Short and long-term perspectives

4- Visually teaches you valuable lessons

5- High probability setups

6- Analysis on a wide range of major markets

SMASH that follow button! 👍

💡 Leave a comment and/or message us on how we can improve and provide better content, we are open to suggestions to create a better experience for you!

Keep in mind that the analysis provided is not 100% accurate and that you can never be certain with the markets. This information given is not financial advice, always do your own research.

Thank you for reading,

Cheers to many pips! 🤝