NZD/CHF "Kiwi-Franc" Forex Bank Heist Plan (Scalping/Day Trade)6 hours ago

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

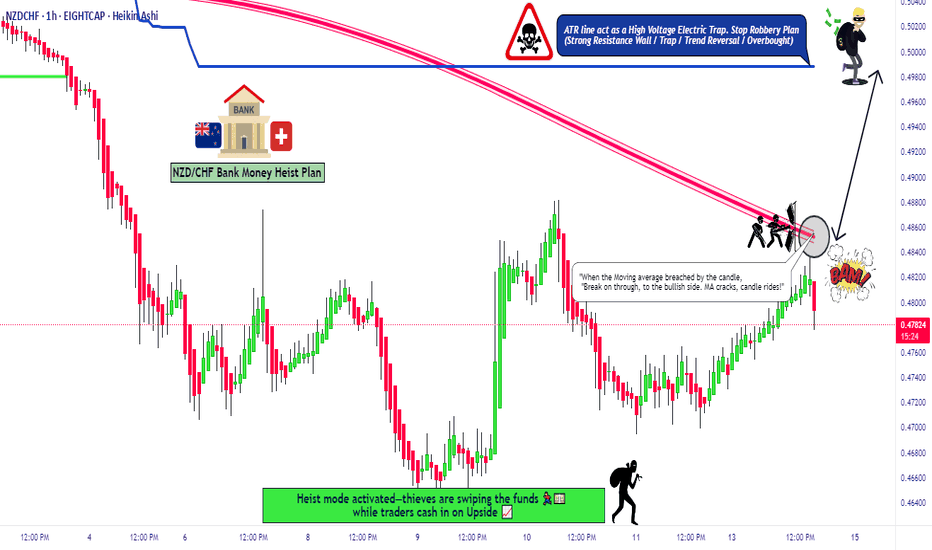

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/CHF "Kiwi vs Franc" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (0.48700) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 30mins timeframe (0.47600) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 0.49900 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸NZD/CHF "Kiwi vs Franc" Forex Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. 👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets and Overall outlook score..., go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Nzdchfsignals

NZD/CHF "Kiwi-Swiss" Bank Robbery Plan on Bullish SideHallo! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist NZD/CHF "Kiwi-Swiss" Bank based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry 📈 : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Low Point

Stop Loss 🛑 : Recent Swing Low using 2h timeframe

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

NZDCHF Channel Down and Head and Shoulders driving it much lowerThe NZDCHF pair gave us a spot on buy signal last time we looked into it (August 23, see chart below) that easily hit the target and immediately after started a correction that broke the Channel Up to the downside:

What has emerged from that top is a Channel Down pattern, which made yesterday a new Lower High on the 1D MA50 (blue trend-line). That's not all however. As you can see, this Lower High can technically be the Right Shoulder of a Head and Shoulders (H&S) pattern, which makes the trend even more bearish.

The 1st Bearish Leg of the Channel Down reached a -4.55% decline, so another such Leg would price a Lower Low at 0.50255. This happens to be just above the 2.0 Fibonacci extension, which is a standard target for H&S patterns. Our Target is marginally above both at 0.50500.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

NZD/CHF "Kiwi-Swiss" Bank Money Heist Plan on Bearish Side.Ola! Ola! My Dear Robbers / Money Makers & Losers, 🤑💰

This is our master plan to Heist NZD/CHF "Kiwi-Swiss" Bank based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Short entry. Our target is Green Zone that is High risk Dangerous level, market is oversold / Consolidation / Trend Reversal / Trap at the level Bullish Robbers / Traders gain the strength. Be safe and be careful and Be rich 💰.

Entry : Can be taken Anywhere, What I suggest you to Place Sell Limit Orders in 15mins Timeframe Recent / Nearest Swing High

Stop Loss 🛑: Recent Swing High using 30m timeframe

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

#NZDCHF 1DAYNZD/CHF (1D) Buy Opportunity:

The NZD/CHF pair is showing bullish potential on the daily chart. The price has bounced off a key support level and is forming higher lows, signaling upward momentum. A bullish crossover in the moving averages and a strong RSI above 50 add further confirmation. Fundamental factors, including New Zealand's economic strength and weakening Swiss Franc due to global risk sentiment, support this view.

Trade Idea: Consider buying near the support level with a stop loss below it. Target recent resistance levels for take-profit.

NZDCHF Short-term buy on this Channel Up.The NZDCHF pair has been trading within a short-term Channel Up and yesterday hit its bottom, technically pricing the new Higher Low. Being around the 4H MA50 (blue trend-line) currently, we expect this to be the start of the new Bullish Leg.

The previous two rose by +2.63% and +2.19% respectively so we expect the current one to be at least another +2.19% from the Higher Low. As a result our short-term Target is 0.53100.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

NZDCHF Strong buy opportunity within the Channel Up.The NZDCHF pair delivered a fast-profit buy signal last time (May 09, see chart below), with the price even breaking above the established Channel Up:

A new Channel Up prevailed as seen on the current chart and since it held the Support of the 1D MA200 (orange trend-line), it broke again above the 1D MA50 (blue trend-line) and gave a bullish confirmation.

We expect the extension of the uptrend in the form of the new Bullish Leg of the Channel Up (1D RSI also rebounded on a bottom formation similar to all previous buy opportunities). Our Target is 0.56750 (Resistance 2).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

NZDCHF Short-term buy opportunity.The NZDCHF pair delivered a strong buy signal following our last bullish call (February 29, see chart below) and after hitting the top of the Channel Up, it immediately pulled back to its bottom (Higher Lows trend-line):

The price is already on former Resistance 1 but has some more room left to expand to upwards before pulling back again, as the minimum Bullish Leg within the Channel Up has been +4.05%. As a result we are bullish short-term with a 0.54950 Target (+4.05%).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

NZDCHF Strong buy opportunity on the 1D MA50.The NZDCHF pair has been trading within a Channel Up pattern since the October 23 2023 Low. After breaking above the 1D MA200 (orange trend-line) for the first time in more than 1 year (since January 31 2023), the pair confirmed the trend shift from long-term bearish to long-term bullish. The recent 3-day pull-back to the 1D MA200 is a technical buy opportunity.

As long as we close 1D candles above the 1D MA50 (blue trend-line), this is a buy opportunity, targeting the top of the Channel Up and Resistance 2 at 0.55140. Notice how this is exactly on the -0.236 Fibonacci extension, which is the level that the November 29 2023 Higher High was priced at. Also the 0.5 Fibonacci retracement is the level where it double bottomed (November 17 2023) and started the rebound to the Higher High. We are at the 0.5 currently, which indicates a strong Support case.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

NZDCHF Sell near the 1D MA200The NZDCHF pair has been trading within a Falling Wedge pattern since the March 28 2022 High. As you can see the two so far corrective waves have followed a similar Lower Lows structure.

The price is currently on the bullish leg to the Lower Highs trend-line, supported by both the 1D MA100 (green trend-line) and the 1D MA50 (blue trend-line). The 1D MACD Bearish Cross that is about to be completed calls for a sell preparation, as every Bearish Cross above the 0.0 level since March 2022 has been a sell signal. The closer the price gets to the 1D MA200 (orange trend-line), the more efficient the sell entry will be. We will target a projected 1D MA50 contact at 0.53500.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

NZDCHF top-down analysisHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

NZDCHF top-down analysisHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

NZDCHF Strongest possible long-term buy signal.The NZDCHF pair is on a brutal 4 week sell-off having lost almost -8%. This is of course an extension of the longer term bearish trend since the March 2022 High. As you see that High was made at the bottom of the Lower Highs trend-line that started back on the April 2013 Top.

The 1W RSI however is flashing the strongest buy signal possible on the long-term as it breached the 25.000 level. There have been another 4 similar occurrences since January 2015, all of which formed bottoms and pushed the pair to at lest a 1W MA50 (blue trend-line) test, even the 1W MA200 (orange trend-line) on a longer-term time-frame. Apply the proper risk management and pursue those targets.

-------------------------------------------------------------------------------

** Please LIKE 👍, SUBSCRIBE ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support me, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

You may also TELL ME 🙋♀️🙋♂️ in the comments section which symbol you want me to analyze next and on which time-frame. The one with the most posts will be published tomorrow! 👏🎁

-------------------------------------------------------------------------------

👇 👇 👇 👇 👇 👇

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

NZDCHF About to break the 1D MA50 towards a new High.The NZDCHF pair has been trading within a long-term Channel Down pattern since the February 25 2021 High. The last Lower Low on the Channel took place on July 01 2022 and that Low was re-tested on August 29, which held, making the Support so far a Double Bottom.

The 3 day rebound is now testing again the 1D MA50 (blue trend-line) for the 4th time in the past 2 weeks with strong probabilities of breaking out not just due to the Double Bottom but also due to the 1D RSI and MACD indicators. Those show that the current rebound is similar to the one that started on February. A break above the 1D MA50 can kick start the new bullish leg to the Lower Highs (top) trend-line of the Channel Down. Moderate target would be the 1D MA200 (orange trend-line).

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

NZDCHF Wait for one last pull-back or buy the 1D MA50 breakThe NZDCHF pair has been trading within a Channel Down pattern since March 2021. It made its most recent Lower Low on July 01 2022 but since July 08 it has been consolidating sideways. This has caused the 1D MA50 (blue trend-line) to get very close. If it breaks, that would be a technical break-out buy signal.

However as long as it fails to break, there are higher probabilities to buy lower. At least this is what took place on January 13 where after a near rejection, the price made one last pull-back to the Lower Lows (bottom) trend-line of the Channel and then emphatically rebounded for two months. The 1D RSI sequence tends to agree that we are replicating a similar price action. In both cases the target would be the red trend-line just below the Lower Highs (top) of the Channel.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

NZDCHF Bullish above 0.6400 but act quickly if Support breaksThe NZDCHF pair has hit our first macro target as illustrated on the long-term (1W time-frame) analysis posted in May:

Now that the Support has been tested, we see (current chart on the 1D time-frame) a bullish reaction as the price is rebounding today. As long as the correlation with the 2017 fractal continue to hold, we should see a prolonged rebound towards at least the 0.618 Fibonacci retracement level (which is now a little over 0.64000). The 1D RSI is approaching the 30.00 oversold barrier, further enhancing that perspective.

On the other hand, be quick to cut losses and open a counter sell if a candle closes below the 0.60700 Support, as that would most likely be the start of a long-term selling sequence towards the -0.618 Fibonacci extension (a little over 0.57000).

--------------------------------------------------------------------------------------------------------

Please like, subscribe and share your ideas and charts with the community!

--------------------------------------------------------------------------------------------------------

NZDCHF A safe long-term sell optionThe NZDCHF pair has been under the selling pressure of a Lower Highs zone for more than 5 years (since December 2016), forming a long-term bearish Channel that is more accurately illustrated by the Fibonacci Channel extensions and retracements. This zone has rejected the price 7 times with the most recent being on the March 28 2022 1W (weekly) candle. This chart is on the 1W time-frame.

What makes NZDCHF an even stronger long-term sell opportunity, is that the price action from December 2020 until today, resembles the sequence from May 2016 to August 2017. Common characteristics besides the price action and the three Lower Highs zone rejections, include the 1W RSI sequences and the 1W MA50 (blue trend-line)/ 1W MA200 (orange trend-line) convergence.

After the 3rd rejection, the price dropped to the Support of the last Lower Low of the Channel. Right now this Support is at 0.60800 and this is our target within Q3 of this year.

--------------------------------------------------------------------------------------------------------

Please like, subscribe and share your ideas and charts with the community!

--------------------------------------------------------------------------------------------------------

NZDCHF top-down analysisHello traders, this is the full breakdown of this pair. We will take this trade if all the conditions are satisfied as discussed in the analysis. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.