NZD/USD Broke The Res , Good Chance To Buy To Get 200 Pips !Here is my NZD/USD Long Setup , we have a daily closure above the res and also it`s a very good support and we can trust it , we can enter a buy trade if the price go back to retest the broken res , and if we have a good bullish price action then we can enter a buy trade and targeting 200 pips .

This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

Nzdusdanalysis

Market Analysis: NZD/USD Gains Pace, Bulls Are Back?Market Analysis: NZD/USD Gains Pace, Bulls Are Back?

NZD/USD is also rising and might aim for more gains above 0.5850.

Important Takeaways for NZD USD Analysis Today

- NZD/USD is consolidating gains above the 0.5765 zone.

- There is a key bullish trend line forming with support at 0.5825 on the hourly chart of NZD/USD at FXOpen.

NZD/USD Technical Analysis

On the hourly chart of NZD/USD on FXOpen, the pair started a steady increase from the 0.5515 zone. The New Zealand Dollar broke the 0.5670 resistance to start the recent increase against the US Dollar.

The pair settled above 0.5765 and the 50-hour simple moving average. It tested the 0.5850 zone and is currently consolidating gains. The pair corrected lower below the 0.5840 level. However, the bulls are active above the 0.5825 level.

The NZD/USD chart suggests that the RSI is stable above 50. On the upside, the pair might struggle near 0.5850. The next major resistance is near the 0.5880 level.

A clear move above the 0.5880 level might even push the pair toward the 0.5920 level. Any more gains might clear the path for a move toward the 0.6000 resistance zone in the coming days.

On the downside, immediate support is near the 0.5825 level. There is also a key bullish trend line forming with support at 0.5825. The first key support is near the 0.5765 level. The next major support is near the 0.5670 level and the 50% Fib retracement level of the upward move from the 0.5485 swing low to the 0.5853 high.

If there is a downside break below the 0.5670 support, the pair might slide toward the 0.5570 support. Any more losses could lead NZD/USD in a bearish zone to 0.5515.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

NZD/USD 1H Chart Setup – Demand Zone Bounce & Bullish Target1. Chart Overview

Pair: NZD/USD

Timeframe: 1H

Current Price: 0.56961

Indicator Used: 9 EMA (📈)

2. Key Zones & Levels

🔵 Demand Zone

Area: Approx. 0.55933 – 0.56600

Role: Strong support area where buyers have shown interest

Bounce already observed from this zone

🟥 Re-Entry Zone

Slight pullback expected into this minor resistance-turned-support

Potential entry for bulls (🐂)

🎯 Target Point

Price: 0.58434

Gain: +3.59%

Strong resistance above

🛑 Stop Loss

Price: 0.55933

Just below the demand zone for protection

Keeps risk tight (🔒)

3. Trade Idea (Buy Setup)

📍 Entry Plan:

Wait for a pullback into the red zone

Confirm support holds

Look for long position setup

📈 Target:

Aim for 0.58434

High reward potential

📉 Stop Loss:

Below 0.55933 to minimize loss if setup fails

✅ Risk-Reward Ratio:

Attractive (approx. 2:1 or better)

Summary

Demand zone is strong (🛡️)

Market structure supports bullish move (🚀)

Setup favors a pullback buy strategy

NZD/USD Analysis: Exchange Rate Nears 2025 LowNZD/USD Analysis: Exchange Rate Nears 2025 Low

Less than a month ago, we analysed the NZD/USD chart and:

→ highlighted the key resistance level at 0.5800;

→ outlined a potential scenario involving a decline from that zone.

Now, the NZD/USD pair is trading close to its lowest level of 2025, recorded on 3 February near 0.5525. The latest surge in volatility appears to be driven by President Trump’s widely discussed decision to impose substantial tariffs on trade with multiple countries.

For context, the Australian dollar has fallen to a five-year low amid concerns that retaliatory trade measures could trigger a global recession. The New Zealand dollar, however, has remained somewhat more stable — possibly because traders are anticipating Wednesday’s Reserve Bank of New Zealand (RBNZ) meeting, where the central bank may signal efforts to stabilise the currency. According to Forex Factory, a rate cut from 3.75% to 3.50% is expected.

Technical analysis of NZD/USD chart

Price movements in 2025 have formed an ascending channel (marked in blue), but bears broke through the lower boundary late last week near the 0.5666 level.

This suggests that even if NZD/USD sees a short-term rebound, it may face resistance around that same level — a classic “break-and-retest” pattern often watched by traders.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

NZD/USD 4H Chart Breakdown – Trendline Breach & Bearish Setup📉 NZD/USD 4H Chart Analysis

1. Trendline Break 🚨

* Price was following a strong uptrend line (↗️)

* Broke below it sharply ➡️ Bearish sign

* Momentum shifted from bullish to bearish

2. Retest Resistance Zone 🔄

* After the drop, price bounced back into a blue resistance box (🧱)

* This was previous support → now resistance

* Classic "break → retest → drop?" setup forming

* Expecting a possible rejection here (✋)

3. Target Point 🎯

* Bearish continuation may push price to 0.55166 zone

* This is your target point (📍)

* Previous key support — might attract buyers again

4. Scenarios to Watch:

✅ Bearish Confirmation:

Price gets rejected at resistance (🧱)

Forms bearish candle (📉)

Continues down to target (🔽🎯)

❌ Bullish Invalidator:

Price closes above resistance zone (🔼)

Breaks back inside trend = Bullish comeback (🟢)

Current Bias:

🔴 Bearish unless price reclaims resistance above 0.5700

👀 Watch that zone closely for a potential entry signal

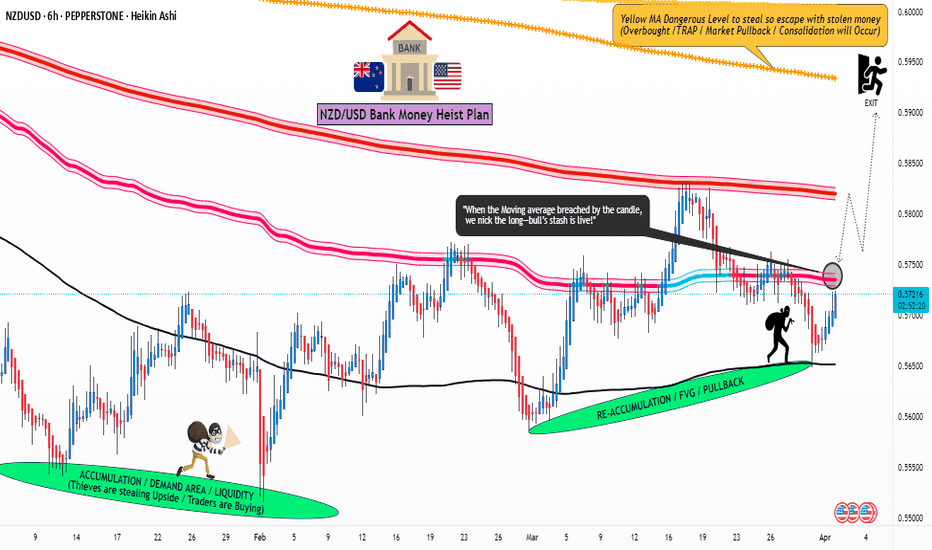

NZD/USD "The Kiwi" Forex Bank Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/USD "The Kiwi" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Yellow MA Zone. It's Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move at (0.57500) - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) after the MA breakout Place buy limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing low or high level Using the 6H timeframe (0.56500) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 0.59400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💵💰NZD/USD "The Kiwi" Forex Bank Heist Plan (Swing / Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Market Analysis: NZD/USD Struggles to Sustain Gains—What’s Next?Market Analysis: NZD/USD Struggles to Sustain Gains—What’s Next?

NZD/USD is also moving lower and might extend losses below 0.5700.

Important Takeaways for NZD/USD Analysis Today

- NZD/USD declined steadily from the 0.5760 resistance zone.

- There is a major bearish trend line forming with resistance at 0.5715 on the hourly chart of NZD/USD at FXOpen.

NZD/USD Technical Analysis

On the hourly chart of NZD/USD on FXOpen, the pair also followed a similar pattern and declined from the 0.5760 zone. The New Zealand Dollar gained bearish momentum and traded below 0.5725 against the US Dollar.

The pair settled below the 0.5720 level and the 50-hour simple moving average. Finally, it tested the 0.5695 zone and is currently consolidating losses.

Immediate resistance on the upside is near the 50% Fib retracement level of the downward move from the 0.5736 swing high to the 0.5693 low at 0.5715. There is also a major bearish trend line forming with resistance at 0.5715.

The next resistance is the 0.5725 level or the 76.4% Fib retracement level of the downward move from the 0.5736 swing high to the 0.5693 low. If there is a move above 0.5725, the pair could rise toward 0.5750.

Any more gains might open the doors for a move toward the 0.5800 resistance zone in the coming days. On the downside, immediate support on the NZD/USD chart is near the 0.5705 level.

The next major support is near the 0.5695 zone. If there is a downside break below 0.5695, the pair could extend its decline toward the 0.5665 level. The next key support is near 0.5640.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

DeGRAM | NZDUSD pullbackNZDUSD is in an ascending channel between trend lines.

The price is moving from the upper boundary of the channel, the upper trend line, which has already acted as a pullback point, as well as from the important psychological resistance level of $0.583.

Indicators point to the bearish divergence being worked out on the 1H Timeframe.

The chart has formed a pattern AB=CD.

We expect a continuation of the pullback in the channel after consolidation under the 38.2% retracement level.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

NZD/USD "The Kiwi" Forex Market Money Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/USD "The Kiwi" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (0.57500) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low or high level Using the 4H timeframe (0.56800) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

✂Primary Target - 0.58350 (or) Escape Before the Target

✂Secondary Target - 0.59600 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Read the Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook before start the plan.

NZD/USD "The Kiwi" Forex market is currently experiencing a Bullish 🐃 trend,., driven by several key factors.

🟡Fundamental Analysis

- Economic Indicators: New Zealand's GDP growth rate is 2.5%, inflation rate is 2.3%, and unemployment rate is 3.7%.

- Monetary Policy: The Reserve Bank of New Zealand's official cash rate is 3.25%.

- Fiscal Policy: The New Zealand government's budget deficit is 1.2% of GDP.

⚫Macroeconomic Factors

- Inflation Rate: The inflation rate in New Zealand is 2.3%, which is within the Reserve Bank's target range of 1-3%.

- Interest Rates: The Reserve Bank of New Zealand's official cash rate is 3.25%, which is relatively high compared to other developed economies.

- GDP Growth Rate: New Zealand's GDP growth rate is 2.5%, which is moderate compared to other developed economies.

- Trade Balance: New Zealand's trade balance is improving, with exports increasing.

🟠Global Market Analysis

- US Economic Indicators: The US GDP growth rate is 2.2%, inflation rate is 2.2%, and unemployment rate is 3.5%.

- Commodity Prices: The price of gold is $1,700 per ounce, and the price of oil is $65 per barrel.

- Global Economic Growth: The global economic growth rate is 3.5%, which is moderate.

🔴COT Data

- Non-Commercial Traders: Non-commercial traders, such as hedge funds and speculators, have been net long on the NZD, with 30,000 contracts.

- Commercial Traders: Commercial traders, such as banks and institutions, have been net short on the NZD, with 20,000 contracts.

- Open Interest: The total number of outstanding contracts in the futures market is 120,000.

🟣Intermarket Analysis

- Correlation with AUD/USD: The NZD/USD exchange rate has a strong positive correlation with the AUD/USD exchange rate, with a correlation coefficient of 0.8.

- Correlation with Gold: The NZD/USD exchange rate has a moderate positive correlation with gold prices, with a correlation coefficient of 0.5.

🟤Quantitative Analysis

- Moving Averages: The 50-day moving average is 0.5820, and the 200-day moving average is 0.5750.

- Relative Strength Index (RSI): The RSI is currently at 60, indicating bullish conditions.

- Bollinger Bands: The NZD/USD exchange rate is currently trading above its Bollinger Bands, indicating a strong uptrend.

🔵Market Sentimental Analysis

- Bullish Sentiment: 60% of market participants are bullish on the NZD/USD exchange rate.

- Bearish Sentiment: 40% of market participants are bearish on the NZD/USD exchange rate.

- Fear and Greed Index: The fear and greed index is currently at 70, indicating greed.

🟢Positioning

- Short-Term: Long NZD/USD, targeting 0.59000.

- Long-Term: Long NZD/USD, targeting 0.62000.

⚪Next Trend Move

- Upward: The NZD/USD exchange rate is expected to move upward in the short term.

🟡Overall Summary Outlook

- Bullish: The NZD/USD exchange rate is expected to move upward in the short term, driven by macroeconomic factors, global market analysis, and quantitative analysis.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

NZD/USD 4H Analysis – Smart Money Perspective🔍 NZD/USD – 4H Smart Money Concept Analysis by "Asif Brain Wave"

Key Zones Marked:

🔴 Weekly Fair Value Gap (FVG) and Order Block (OB) marked as strong resistance zones.

🟢 Two Bullish Order Blocks (+OB) highlighted below – potential areas for retracement or reaction.

🔵 +FVG (H4) near the Monthly Target, indicating a possible price magnet.

Market Structure & Expectation:

A clear CISD (Change in Structure Direction) indicates bearish market behavior.

The red path projection shows:

A potential short-term retracement into the upper OB area.

Followed by a sharp bearish drop toward the monthly target.

💘 Final target near 0.55154, marked with a heart symbol as a visual touch – representing your target zone with a personal flair.

Highlighted Price Levels:

High: 0.58305

Current Price: 0.57272

Projected Target (Low): 0.55154

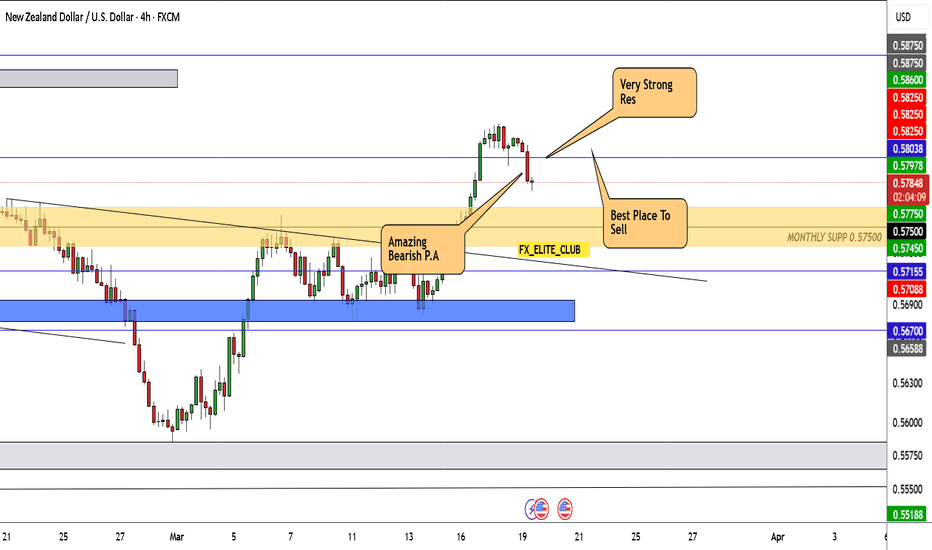

NZD/USD Giving Amazing Bearish P.A , Is It A Good Area To Sell ?Here is my opinion on NZD/USD , If you check the chart you will see that the price moved to upside without any correction and the price didn`t respect this old res yesterday but today the price back again below the res and respect it 100% and now the price closed below it with amazing bearish candle so i will sell this pair and targeting at least 100 pips.

This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

NZD/USD Analysis: Exchange Rate at 2025 HighNZD/USD Analysis: Exchange Rate at 2025 High

As shown on the NZD/USD chart today, the exchange rate is around 0.58250—the highest level for the Kiwi against the US dollar since December 2024.

NZD strength is supported by optimism about China's economy, a key trading partner for New Zealand. The Hang Seng Index (Hong Kong 50 on FXOpen) is near three-year highs, driven by:

→ Optimism surrounding AI development in China, including models from DeepSeek and Alibaba.

→ Government stimulus measures boosting the Chinese economy.

Meanwhile, traders are assessing the USD's outlook in light of the Trump administration's trade tariff policies.

Technical Analysis of NZD/USD

The recent rally accelerated after bulls broke through the downward trendline (shown in orange). However, bears may expect a correction due to three key factors:

→ The price is near the 0.58000 level, which previously acted as support (as indicated by arrows). It may now serve as resistance, limiting further gains.

→ The RSI indicator is in overbought territory, unsurprising given the rally's pace over the past week.

→ The price is near the upper boundary of the ascending channel (in place since early 2025), which could also act as resistance to further upside.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

NZDUSD is in the Selling DirectionHello Traders

In This Chart NZDUSD HOURLY Forex Forecast By FOREX PLANET

today GBPUSD analysis 👆

🟢This Chart includes_ (NZDUSD market update)

🟢What is The Next Opportunity on NZDUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

#NZDUSD 1DAYNZDUSD (1D Timeframe) Analysis

Market Structure:

The price is approaching a significant support level, which has previously acted as a key area for price reversals. This level is important for identifying potential buying opportunities.

Forecast:

It is recommended to wait for the price to reach the support level. If bullish confirmation is observed, such as bullish candlestick patterns or increased buying momentum, a buy position can be considered.

Key Levels to Watch:

- Entry Zone: Monitor the price behavior near the support level and consider buying if a clear bounce or bullish signal is confirmed.

- Risk Management:

- Stop Loss: Placed below the support zone to protect against a potential breakdown.

- Take Profit: Target the next resistance levels for potential gains.

Market Sentiment:

Confirmation of bullish sentiment will depend on how the price reacts at the support level. A strong bounce would indicate potential for upward movement, while a breakdown may signal further downside. Waiting for confirmation will provide better trade accuracy.

Market Analysis: NZD/USD Could Continue HigherMarket Analysis: NZD/USD Could Continue Higher

NZD/USD is showing positive signs and might attempt a fresh increase above 0.5720.

Important Takeaways for NZD USD Analysis Today

- NZD/USD is holding gains above the 0.5695 support zone.

- There was a break below a major bullish trend line with support at 0.5720 on the hourly chart of NZD/USD at FXOpen.

NZD/USD Technical Analysis

On the hourly chart of NZD/USD on FXOpen, the pair started a steady increase from the 0.5585 zone. The New Zealand Dollar broke the 0.5635 resistance to start the recent increase against the US Dollar.

The pair settled above 0.5695 and the 50-hour simple moving average. It tested the 0.5760 zone and is currently correcting gains. The pair corrected lower below the 0.5720 level. The pair also traded below the 23.6% Fib retracement level of the upward wave from the 0.5595 swing low to the 0.5759 high.

Besides, there was a break below a major bullish trend line with support at 0.5720. The NZD/USD chart suggests that the RSI is now below 50. On the downside, there is major support forming near 0.5695.

The next major support is near the 61.8% Fib retracement level of the upward wave from the 0.5595 swing low to the 0.5759 high at 0.5660.

If there is a downside break below the 0.5660 support, the pair might slide toward the 0.5635 support. Any more losses could lead NZD/USD in a bearish zone to 05585.

On the upside, the pair might struggle near 0.5720. The next major resistance is near the 0.5760 level. A clear move above the 0.5760 level might even push the pair toward the 0.5800 level. Any more gains might clear the path for a move toward the 0.5840 resistance zone in the coming days.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

NZDUSD Ready for a Bullish MoveHello Traders

In This Chart NZDUSD HOURLY Forex Forecast By FOREX PLANET

today NZDUSD analysis 👆

🟢This Chart includes_ (NZDUSD market update)

🟢What is The Next Opportunity on NZDUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts