NZD/USD H&S Reversal Pattern Clear,Short Setup To Get 150 Pips !Here is my opinion On NZD/USD On 4H T.F , If we checked the chart we will see that we have a very strong Historical res that forced the price many times to respect it and stay below it and now we have another good confirmation , we have a perfect reversal pattern and we have a clear closure below our neckline so the pattern already confirmed , i`m waiting the price to go up a little to retest my broken neckline and then we can enter a sell trade . only 1 case i will avoid this idea , if we have a daily closure agin above my res with clear closure .

Nzdusdsell

NZDUSD Trade Idea. Key Levels for a Potential NZD/USD Short📉 NZD/USD is trending strongly bearish, and I’ve just posted a new breakdown on TradingView 🎥. The current price action looks overextended, and the pair remains under heavy selling pressure 🔻.

I’m watching for a potential retracement into the Fibonacci 50%–61.8% zone 🔄 — the equilibrium area where I’ll be eyeing a possible short entry 🎯.

The video covers entry ideas, stop-loss placement, and target levels 🎯📍.

⚠️ This is not financial advice — for educational purposes only.

NZDUSD - Expecting Bearish Continuation In The Short TermH1 - Clean bearish trend with the price creating series of lower highs, lower lows.

No opposite signs.

Expecting further continuation lower until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

nzdusd sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

NZDUSD Range Tightens – Breakout Setup BuildingNZDUSD continues to coil within a contracting triangle, forming a symmetrical wedge bounded by lower highs and higher lows. Price is approaching the resistance zone near 0.6028, with visible indecision and rejection wicks, signaling potential for either breakout or rejection.

Key Levels:

Resistance: 0.6028 (structural ceiling, key pivot)

Support: ~0.5800 (ascending support line of wedge)

Breakout Target (Bullish): 0.6150–0.6200

Breakdown Target (Bearish): 0.5650–0.5550

Scenarios to Watch:

🔹 Bearish Rejection

Price rejects off 0.6028 and returns inside range

Watch for momentum drop and move toward wedge base (0.5800)

Clean breakdown opens path toward April lows (~0.5509)

🔹 Bullish Breakout

Break and hold above 0.6028

Confirmation on 4H close + retest

Opens room for bullish extension toward 0.6150+

Outlook:

Price is nearing apex compression, suggesting breakout is imminent.

Bias is neutral until price breaks out of the current wedge structure.

Expect volatility spike around the 0.6028 test.

NZDUSD potential 50 pip drop? NZDUSD 4h crossed the previous liquidity zone with strong false breakout giving a high probability for the price to form a potential inverted head & shoulder and may continue to drop to 0.5308 which may lead a 50 pip drop with market open as the market is in strong down trend.

A possible sell trade setup with market open is highly probable!

NZDUSD..SHORTPrice is nearing a critical level around .

** No setup, no trade. **

For me, a solid plan always comes before any prediction.

*****If the zone is broken and confirmed with a retest, I’ll adjust my plan accordingly for a possible reverse trade.

For detailed entry points, trade management, and high-probability setups, follow the channel:

ForexCSP

nzdusd sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

NZDUSD LONG SIGNAL IDEAUnder current market conditions, the area near 0.5928 has been identified as a critical support zone, where the AI model detects a high-probability trade setup.

From a technical perspective, a clear directional bias based on recent price action patterns. If the market demonstrates increased volume and price stability above key moving averages in the 0.5928 area, traders are advised to monitor for trend-continuation entry opportunities in alignment with the prevailing momentum.

Profit targets are defined at 0.5971 and 0.6013, corresponding to logical technical resistance zones. These levels are designed for staged profit-taking across different trade management styles. Stop-loss should be strictly enforced at the designated level; once breached, the strategy is considered invalidated in order to limit potential downside.

#NZDUSD:DXY Gaining Its Strength Back, Is it end for the Bulls? The OANDA:NZDUSD DXY index shows a change in price character and momentum, indicating a possible price reversal for the shorter term. This aligns with our fundamental analysis, as there’s a likelihood of a China-US trade deal that could significantly influence the demand for the DXY.

There are two possible selling entries, allowing you to choose between a riskier or safer approach. Alongside these entries, we’ve set targets accordingly to your chosen entry.

Good luck and trade safely!

Thank you for your unwavering support! 😊

If you’d like to contribute, here are a few ways you can help us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

nzdusd sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

SHORT ON NZD/USDNZD/USD Is currently at a major resistance level/zone and has created a double top or equal highs.

Price has started to fall a bit, but I do believe price will rise to take out the equal highs in a "Liquidity hunt"

Overall I am taking a market execution sell on NZD/USD to the next demand level looking to catch over 300+ pips.

SHORT ON NZD/USDPrice is in a overall uptrend but has started its pullback phase from the high.

Got a choc (change of character) to the downside as well as equal highs/ double top forming.

Dollar news just came out positive and there is a good chance this pair could fall 200-300 pips by the end of the week.

NZDUSD Discretionary Analysis: Bounce at 0.59Hello traders.

NZDUSD has potential for me. I'm expecting the momentum to continue, and I've got my eye on that 0.59 level to get involved. That's where I'll be looking for a setup.

Discretionary Trading: Where Experience Becomes the Edge

Discretionary trading is all about making decisions based on what you see, what you feel, and what you've learned through experience. Unlike systematic strategies that rely on fixed rules or algorithms, discretionary traders use their judgment to read the market in real time. It's a skill that can't be rushed, because it's built on screen time, pattern recognition, and the ability to stay calm under pressure.

There's no shortcut here. You need to see enough market conditions, wins, and losses to build that intuition—the kind that tells you when to pull the trigger or sit on your hands. Charts might look the same, but context changes everything, and that's something only experience can teach you.

At the end of the day, discretionary trading is an art, refined over time, sharpened through mistakes, and driven by instinct. It's not for everyone, but for those who've put in the work, it can be a powerful way to trade.

NZD/USD 4H Chart Breakdown – Trendline Breach & Bearish Setup📉 NZD/USD 4H Chart Analysis

1. Trendline Break 🚨

* Price was following a strong uptrend line (↗️)

* Broke below it sharply ➡️ Bearish sign

* Momentum shifted from bullish to bearish

2. Retest Resistance Zone 🔄

* After the drop, price bounced back into a blue resistance box (🧱)

* This was previous support → now resistance

* Classic "break → retest → drop?" setup forming

* Expecting a possible rejection here (✋)

3. Target Point 🎯

* Bearish continuation may push price to 0.55166 zone

* This is your target point (📍)

* Previous key support — might attract buyers again

4. Scenarios to Watch:

✅ Bearish Confirmation:

Price gets rejected at resistance (🧱)

Forms bearish candle (📉)

Continues down to target (🔽🎯)

❌ Bullish Invalidator:

Price closes above resistance zone (🔼)

Breaks back inside trend = Bullish comeback (🟢)

Current Bias:

🔴 Bearish unless price reclaims resistance above 0.5700

👀 Watch that zone closely for a potential entry signal

SELL Signal – NZD/USD - Targeting 226 PipsEntry: 0.5764

TP: 0.5538

SL: 0.5889

Risk/Reward: 2.32

Reasoning:

Monetary Divergence: The RBNZ has paused rate hikes, weakening NZD appeal, while USD strength is supported by higher U.S. Treasury yields and reduced Fed rate-cut expectations.

Economic Weakness: New Zealand faces slowing growth, a weak housing market, and reduced demand from China.

Bearish Momentum: NZD/USD recently broke two long-term support levels, suggesting further downside toward the 0.5538 demand zone.

Strong USD: Global monetary easing (e.g., Switzerland, Canada, ECB) and policy concerns are bolstering the USD, further pressuring NZD.

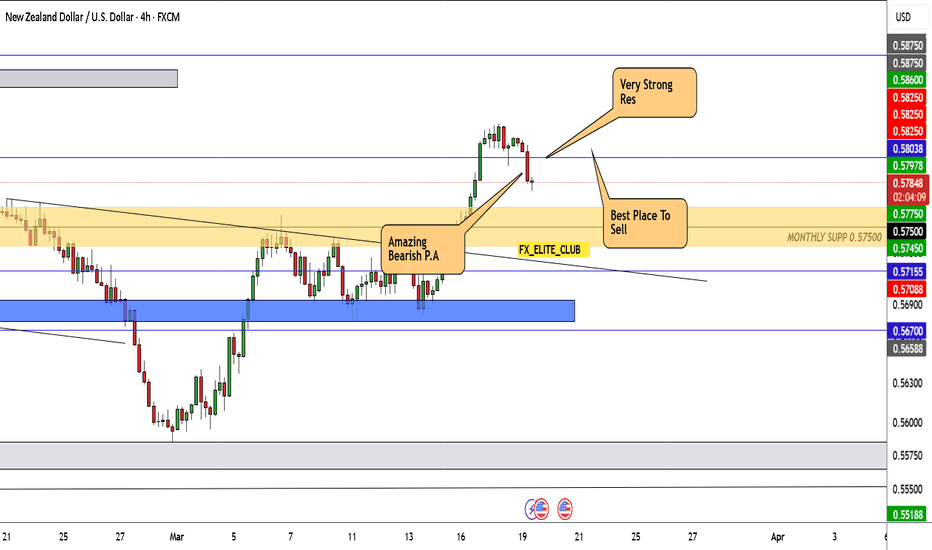

NZD/USD Giving Amazing Bearish P.A , Is It A Good Area To Sell ?Here is my opinion on NZD/USD , If you check the chart you will see that the price moved to upside without any correction and the price didn`t respect this old res yesterday but today the price back again below the res and respect it 100% and now the price closed below it with amazing bearish candle so i will sell this pair and targeting at least 100 pips.

This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

NZDUSD is in the Selling DirectionHello Traders

In This Chart NZDUSD HOURLY Forex Forecast By FOREX PLANET

today GBPUSD analysis 👆

🟢This Chart includes_ (NZDUSD market update)

🟢What is The Next Opportunity on NZDUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

NZDUSD - Long from bullish OB !!Hello traders!

‼️ This is my perspective on NZDUSD.

Technical analysis: Here we are in a bullish market structure from 4H timeframe perspective, so I look for a long. I expect price to continue the retracement to fill that small imbalance lower and then to reject from bullish OB.

Like, comment and subscribe to be in touch with my content!

NZD/USD Made H&S Pattern , Is It The Time To Change Direction ?The price made head and shoulders pattern which is will change the direction , also we have a very good confirmation and closure below neckline , so i think the price will go down next days , let`s see what will happen .

This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.