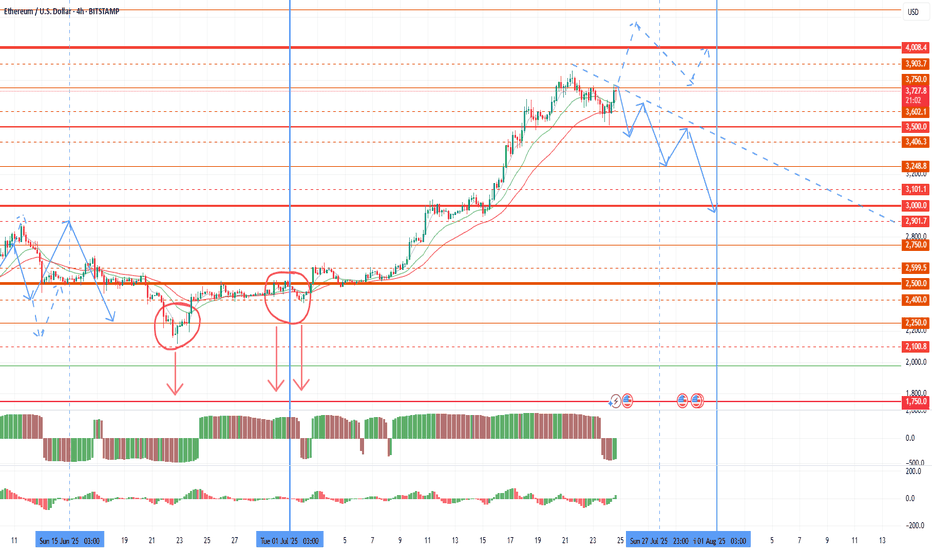

Possible market drawdown before the end of the monthToday I want to review the market and give a warning on further purchases. Since the last review, as expected, volatility in the market began to grow with a flat of about 2500 on ether until the half-year change. The growth of the euro and oil gave rise to a 4k retest in the new half of the year. However, the half-year has opened below 2,500, which is a technical selling signal that bears will use at the end of each major period. A large volume of sales was also left before the half-year change, which can be retested up to 2100-2250. The first pullback is already possible for the current monthly candle, with its pinbar reversal up to 2750-2900 on ether. This pullback started yesterday and is likely to accelerate in the last weekly candle of the month. Further sales are highly likely to continue in the first half of the new month as part of the shadow drawing for the new monthly candle. In an optimistic scenario, the bulls will be able to take 4,000 by the end of the week, in which case the pullback on the current monthly candle will be compensated.

Given the increased likelihood of sales in the market, I recommend fixing profits by the end of the week and reducing the number of coins in operation. The current rollback for some coins will also end with the assignment of the monitoring tag at the beginning of the month and a further collapse, which puts pressure on the coins.

Most of the coins that I considered for work provided good opportunities for making money, especially the growth impulses of pivx and data with sharp breakouts stood out. Adx fio chess cos token also showed growth, but at a smoother pace. The most negative dynamics was given by slf, which eventually received the monitoring tag, and I will not consider it in the future.

Despite the pleasant impulses of 50%+ for individual fantokens, this group as a whole shows extremely negative dynamics relative to the market, and remains in the most oversold position, even relative to coins with the monitoring tag. In an optimistic scenario, fantokens will become interesting to speculators against the background of the general decline of altcoins that has begun, and we can expect a good bull run on them before the end of the month. In a negative scenario, binance may be preparing to assign the monitoring tag to some tokens of this group or chz. In this regard, I leave such tokens as atm acm city porto Lazio as the most undervalued in a small lot. But at the beginning of the month, I also recommend keeping short stops on them in the first half of the day of the first week of the new month to insure against assigning the monitoring tag. Or temporarily sell them for a given period.

In addition to fan tokens, I will choose new coins for operation after assigning the monitoring tag in the new month.

OG

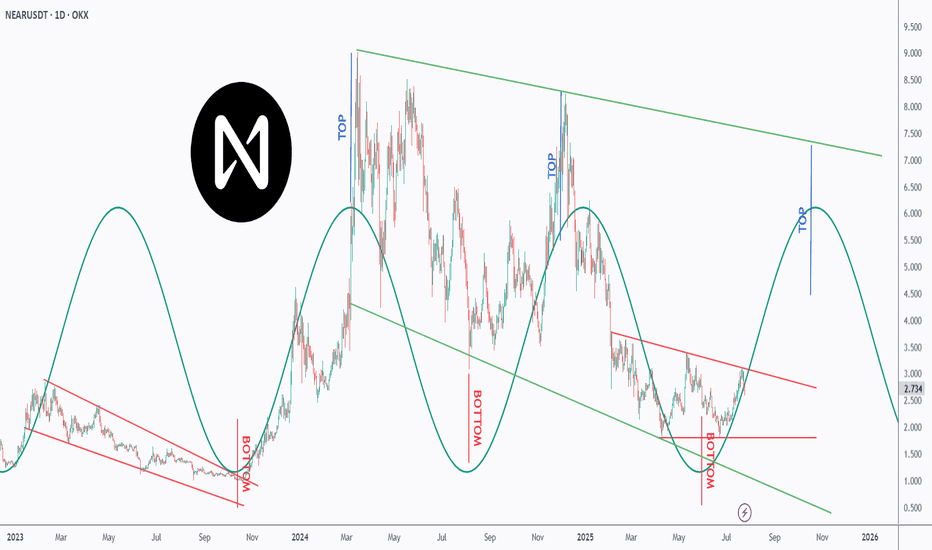

Is NEAR NEARing Its Next Explosion? Watch This Perfect Pattern!NEAR is dancing to a powerful rhythm — and it’s all in the cycles 🔁

This chart uncovers a repeating top-bottom cycle that has held since early 2023, with precise peaks and valleys emerging every few months 📉📈.

After bouncing off a major bottom at ~$2, NEAR is now approaching the mid-line of the descending red channel, suggesting a potential trend reversal is underway 🔄.

Each previous “BOTTOM” aligned with strong recovery waves 🚀, while the projected “TOP” now points toward the $6–7 zone — aligning perfectly with the upper green trendline resistance 🎯.

If the pattern continues, we could be looking at another macro push before year-end 2025 📆.

📊 Will NEAR ride this wave to new local highs — or is it just another lower high in the making? Either way, the rhythm of this chart is too clean to ignore.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

ETH Hits $3K — Next Stop: Moon or Pause?ETH just tagged the psychological $3 000 barrier after a sharp impulse, printing a fresh higher high inside its rising channel.

🧠 Game plan:

1️⃣Pullback zone: The orange structure area at $2 550 – $2 700 aligns with the channel’s lower trend-line — a prime spot for bulls to reload.

2️⃣Continuation trigger: A clean 4H close back above $3 000 turns the level into support, unlocking the path toward $3 100 (first target) and potentially higher into the summer.

3️⃣Invalidation: A decisive break below the channel would neutralise the setup and shift focus back to the macro support near $2 400.

Until then, every dip toward the orange demand is a gift in this bullish structure. Trade the plan, not the noise.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

XRP - Trade The Range!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈XRP has been trading within a range between $2 and $2.35 in the shape of a flat rising broadening wedge pattern in red.

🏹 The highlighted blue circle is a strong area to look for buy setups as it is the intersection of the green support and lower red trendline acting as a non-horizontal support.

📚 As per my trading style:

As #XRP approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

LDO - Next Impulse Starting Soon!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

After breaking above the $0.8 major high, LDO has shifted from bearish to bullish from a long-term perspective. 📈

This week, it has been undergoing a correction phase within a falling channel marked in red. 🔻

For the bulls to take over and kick off the next impulsive wave toward the $1.5 mark, a breakout above the upper red trendline is needed. 🚀

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

XRP is so BACK!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

As per our last XRP idea, attached on the chart, it rejected the lower green structure and surged by over 25%.

📈XRP is now bullish long-term trading within the rising channel marked in blue.

Moreover, the upper green zone is a strong structure!

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of structure and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #XRP retests the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Continuation of the PORTO trendAccording to porto, the picture resembles alpine, the goal is also to try to take the level of 1.5 with the opening of the second half of the quarter higher, which will create the ground for a stable trend immediately to 2.5. The main medium-term goal is the range of 2.5-3.5, where large volumes of purchases were previously left. I would like to note that the level of 2.5 is the threshold for the growth of volatility, and in case of its breakdown, any growth wave can give an impulse up to 5 and 7.5. If there is insufficient volatility, there is a possibility of a rollback to a 0.9-1.0 retest and a second attempt to take 1.5 by the beginning of the new month.

Porto Lazio adm city acm does not have futures on finance yet and may be added in the near future, which will cause a wave of growth up to 100%+ for these tokens. Together with this group, I am considering alpine for work, while the rest of the fan tokens are still in a more overbought zone.

Bull run over the weekend amid strong signals for market growthTo date, the crypt has been given a number of positive factors and the basis for a very stormy weekend.

Binance monitoring did not give a new assignment of the tag, which was immediately responded to by pivx, which I recommended for work. I think the holidays in China had an impact. In the new rules for assigning the binance tag, it obviously means the first working week of the month. Apparently, the assignment of the tag can be expected from Tuesday with the start of the working week in China.

This week, almost all important statistics on the United States came out negative, in addition to last week. For oil, the same picture is for purchases.

The combination of these factors sets the stage for an attempt at an annual turnaround of the crypt with disruptions to the tops. It's too early to talk about the consolidation of such a scenario before the second half of the month, but the signal itself for a possible trend for bitcoin at 210k and ether at 5000k+ sets the stage for a bull run on altcoins.

Due to this picture, a very stormy weekend is likely ahead, followed by a correction in tag assignment and a new wave of growth in the second half of the coming week.

This weekend, first of all, we can expect bull runs on fantokens, which remained the most oversold instruments after another delisting, which makes them extremely attractive to speculators. First of all, I am considering atm city acm asr. Their breakout potential is up to 3-5X, depending on volatility.

Among altcoins, bifi fio chess retains a good potential for breakouts of similar pivx. A repeated pulse on pivx can be considered already in the case of the start of a bull run. According to these coins, growth impulses of up to 50-70% are likely. Koma is also in an interesting position on binance alpha, which can show growth up to 0.050-75.

OG Strong Chart Will Yield 888% Profits Within 6 MonthsI had to choose between this one and Milan's fan token. I went with this one because the chart is different. Milan (ACMUSDT) has the same chart as Atlético de Madrid (ATMUSDT). So you know what to look for there and you can also know now that ACMUSDT too is also bullish and coming out of major market bottom and low.

OG's chart is much more different though, the bottom was hit in May 2022 with a long-term higher low in August 2024 and another higher low on the 3rd of February 2025. This is a strong pair based on TA and guess what? It is ready now for a new wave of growth.

"Higher lows lead to higher highs," is a saying that I like to repeat over and over because it sounds nice. It doesn't necessarily have to be true but it will be true this time.

Most of the Altcoins produced a lower low in April compared to February or March, the fact that OGUSDT produced a higher low in April is a signal strength. This is enough to support a bullish wave.

The four weeks of bullish consolidation (prices moving slowly higher and the sessions closing green) supports the higher low signal.

Low volume in this instance —context is always needed for a signal to be interpreted correctly—means that the real action is yet to start. Not that the "growth is weak" but rather that there is no growth yet. So this is a positive signal. The fact that the market isn't dropping and is slowly growing and consolidating will lead to a strong bullish jump.

Ok. The technical analysis and signals are in place.

Now that we are done with the technological jargon we can move to the part we like most, take profits targets (TP for short).

Spoiler alert! I use the fibonacci tool to extract my targets against all other methods because this has been proven the most accurate over the years. Period.

» The purple target at ~$43 can yield 888% profits.

» The red target at $32 can yield 634% profits.

» The blue target at $21 can give an easy 380% profits if you were to buy at the current price and sell when this target hits.

Will these target hit or will they miss?

Just wait and see.

I can assure you that the market will turn green. That's all that matters to me.

It matters to me to give you a great entry price and great timing.

You are the one that should focus on securing your profits, it is a win-win-win.

Abundance, love, wealth, health and peace.

Thanks for being with me.

When I am gone, you will miss me.

Namaste.

Growth to 150-250% by pda in the coming week.As I wrote earlier, April is the most powerful seasonal growth period in the first half of the year. The first half of the month was under selling pressure against the background of the continuation of the trend of the previous month and quarter, but as we approach the middle of the month, the activity of buyers is likely to begin to increase and from the second half of this week we can expect breakouts in coins with a subsequent trend. To date, coins with the monitoring tag that are not included in the delisting announcement have a high probability of growth, because They are the most oversold due to concerns related to the announcement, but now they have time to wait for the next announcement. Wing was the first to react, and it retains the probability of a new wave of up to 50%+ this month. But today I want to focus on the pda, where the main goal is to retest the range of 0.021-25 at least and attempt a test of 0.035-50 with sufficient volatility. Even with growth towards the immediate goal, the profit will be up to 150%+. VIB and alpaca have similar potential.

More interesting assets for speculators are only the coins from the delisting announcement, because due to the minimal capitalization, even a small influx of buyers gives a large percentage of growth. In this regard, before the actual delisting, there is a possibility of powerful exit pumps this week, as it already was on vidt. In particular, according to uft, the momentum may reach several x's by the end of the week. Cream and troy have less potential, but they can also show profitable growth impulses in the event of increased customer activity in the market. I would like to note that uft and troy have very high non-closed targets on the retest of 0.21-25 and 0.0031-35, which may lead to growth after delisting from binance at the expense of other exchanges.

(XLM) STELLARBefore large businesses finally consume the market of defi to become well established payment systems, small businesses can do so sooner than later. Even if large businesses are not using cryptocurrency to receive and transaction payments, there is no reason small businesses and freelancers cannot offer a way to receive and send payments through decentralized means. If most people used defi payment systems of some type (Preferred by the user) the need to care about whether the largest banks connected the two points as a bridge would not be necessary or important. In a way, it is as if society expects the banks, instead of the businesses (large, med, small) to make it possible to connect with payment crypto systems. If the business uses or even requires crypto payment transactions the bank is the one that will need to keep up and not the other way around. Why are we living in a world where we let the people that do the least amount of future thinking decisions control the way the future will be shaped. Banks have power through the people. Power to the people, not the banks. Banks collect all the money and use the collective bargaining chip to control people. From an individual standpoint people are more important than banks and as a network of individuals the movement of money is free flowing only if people choose to control their future and money. It is the end of the world, we're all going to die, this is the end, oh no. Investing in risky assets was never a safe bet as much as a risk worth taking. Keep that in mind. Using a feeless service like XLM for transactions that happen instantaneously would not be subject to issues of volatility in price. If there was a way to buy a crypto at the same time as transacting the cryptocurrency for the purpose of a transaction, now that would be revolutionary; so as to avoid the idea of holding the cryptocurrency to make the transaction.

Quarter reversal from the weekendTo date, we are clearly moving along the scenario outlined in the last review and are approaching an important bifurcation point and the possibility of purchases or toppings by position. The market remains under the influence of multidirectional signals. On the one hand, the positive opening of the quarter gives rise to a powerful market buy-off for the reversal of the quarterly candle for coins. On the other hand, the negative opening of the second half of the quarter delays this wave of purchases. As a result, the growth wave in the middle of the quarter was rather weak, although it was comforted by good growth waves for individual coins. As a result, the main purchases, as mentioned in previous reviews, are expected in the last monthly candle of the quarter.

Against the background of the end of the sales period, the bears have the last opportunity to test 2600 on the air today and tomorrow. Sales attempts will be made against the background of the planned powerful statistics for the United States. Judging by the technical picture, the levels of 2500 and 2600 for ether will not be broken, and as we approach the end of the month, we will see an increase in purchases of altcoins from the weekend, with major breakouts in the new month.

In the most optimistic scenario, the statistics will be negative and will give an opportunity to hike above 2750 this month.

Among the coins to work with, I mainly consider vib og alpaca uft pda vidt in the medium term with likely growth waves up to 70-100%, according to which I will consider increasing the position by the weekend. Ast burger pivx wing quick looks just as good for scalping, with likely growth waves of up to 30%+ at least.

Among the coins with the monitoring tag, troy still looks the most interesting, with open targets in the range of 0.0032-35 and a possible breakout at a retest of 0.0050-75 with a positive market. I am also considering hard and cream for scalping.

According to vite, which unfortunately did not fulfill the technical goals left, there is a fairly high probability of an exit pump over the weekend with an attempt to reverse the weekly candle against the background of its opening above 0.0075 and the bullish last candle. In an optimistic scenario, especially in the case of negative statistics on the United States, there is a possibility of growth up to 0.0125-150-210 , similar to the exit pump of gft, which closed its intended targets before delisting. In a more negative scenario and low volatility, a pullback from the 0.0075-60 levels is likely over the weekend, which can already bring up to 150% profit. I recommend investing in this scenario after the statistics are released and the risk of additional drawdown is reduced. Today and tomorrow, the potential of the 0.0020-25 test remains before the pump. It is also worth weighing the extremely high risk of such an investment. Powerful technical signals remained for this token, up to a retest of 0.021-25, and therefore, after delisting from binance, there is a possibility that these goals will be fulfilled. If the coins remain in stock after delisting, it makes sense to hold them until the end of the attempt to reverse the quarter on the market until the end of April.

A new wave of VIB growthToday, another opportunity has formed for vib, which once again showed the best dynamics in January with a breakdown of 90%+. The year for the token opened quite positively above 0.0975, which gives a signal to consolidate above 0.01 in the future. The last impulse was given by the collapse of the last peaks, which gives a signal for at least a retest of strong resistance at 0.105, consolidation above which ensures an increase in volatility up to 0.15-25, especially considering the strong signal for a collapse left before the new year. At the moment, the price has traded near the long-term support of 0.055-625, a hike below which is likely only in the case of serious force majeure with a drop in ether by 1500-1750, bitcoin by 75k, or the assignment of the monitoring tag to the token (I expect the next tag changes in early April).

Given the successful opening of the second half of the quarter above the interim support at 0.06 and the time reserve before the possible assignment of the tag, there is a high probability of a repeat attempt to reverse the quarter. It is highly likely that we will see a strong resistance test at 0.075 by the end of the week with a likely breakdown, given the significantly higher final targets. If a new week opens above 0.075, there is a chance of stable support for purchases with breakouts at 0.0925, 0.105 and higher. To date, the token is the most oversold on binance and has the greatest growth potential of up to 100%+ among coins without the monitoring tag. There is also a possibility of adding futures, in which case growth up to 0.25 will not take long. In case of a fall below the 0.0550-625 support, a return to the retest of this resistance up to 0.075 is almost guaranteed, given the current oversold conditions, which makes investments quite reliable.

At the moment, the token is well suited for storing funds in an average amount along with og uft pda vidt.

Resumption of sales on the market before the end of the monthTo date, the market has passed an important boundary in the middle of the quarter, and therefore it is time to make another review of the prospects. Unfortunately, with a good opening of the year, there continues to be a deterrence of purchases in the market and the maintenance of the medium-term correction that has begun. The previous plan worked out according to the least volatile scenario with an increase in purchases only by the middle of the quarter. However, the activity of buyers was not enough even to open the second half of the quarter above 2750. Large investors are selective with investments and are in no hurry. With this picture, the probability of holding sales until the end of this month prevails, but the opening level of the quarter will play a role in the new monthly candle, on the basis of which I expect a good bull run on altcoins for the retest of the opening of the year along with ether aimed at 3250+.

There is no obvious sales signal, so I think the flat will remain quite technical. This week, I expect purchases to remain until the weekly candle closes. In the first days of the new week, it is also likely that purchases will continue based on the inertia of the current week, but from Tuesday to Wednesday, the probability of resuming sales to draw the second bottom on the daily chart around 2600 AETHER and resuming purchases as we approach the new month prevails. The main task of the bulls will be to keep the price above 2500 until the end of the month, which will be enough to turn the quarter around. There is still a possibility of a smooth release of ether above 3000 this month, however, the probability of this at the current opening of the second half of the month is rather weak in my opinion. Significant factors with a sharp drop in the dollar should contribute to this.

With the current picture of coins showing good growth, the probability of a pullback to the second bottom from the nearest resistances prevails. In particular, for alpaca from 0.175-190 or for OG from 4.75-90. Also, the probability of a pullback prevails for combo and slf, which is likely to make it possible to re-borrow more profitably with further higher levels in the medium term.

First of all, in the remaining time until the middle of the new week, I am considering coins that have not yet shown good growth, such as vib uft pda vidt ast with possible breakouts of up to 50%+ in the coming days. I can also show growth impulses for coins with the monitoring tag, which often give growth last on weekends. The most oversold among them are vite troy amb cream.

Stable purchases on OGFollowing the alpaca testing, OG is ready to give a similar picture with an attempt to overtake the previous impulse. The previous impulse has already rechecked the opening level of the year with a local overlap, which opens the way for a test of levels 6 and 7.5. With the current market and the continuing likelihood of a new general drawdown, we are unlikely to see a hike above 6 on the first attempt. On the eve of passing through the middle of the quarter in the next two or three days, there is a high probability of a breakdown attempt of 5 with a stable continuation of the trend until the end of the month. With a more negative market, the volatility of the token may not be sufficient for a breakdown, in which case the probability of smooth growth prevails until the end of the month with a chance to open a new monthly candle above 5.

In the medium term, the token remains a reliable tool for storing funds, as the year opened above the 4.75 support near the key level for volatility growth of 5. Such an opening gives a flat signal for a retest of loyals due to an opening below 5, but also an exit to the 5-7.5 range in the medium term due to an opening above 4.75. Full-time support for a reversal With the current market, it is 3.5, from which there is a probability of a trend up to 7.5+ before the summer. There is a possibility of a test of a lower level of 2.5, but this will happen only in an extremely negative market with a drawdown of bitcoin by 75k or ether by 1500-1750. In this scenario, the token is likely to remain fairly stable and will give a smaller drawdown relative to the rest of the altcoin market, providing an excellent opportunity for topping up.

Along with og, vidt vib PDAs occupy an interesting position, which I primarily consider for storing funds in the mid-range due to the opening of the annual candle above key levels, which gives a signal for its bullish reversal in the future. The main goal for them, similar to alpaca and og, is so far a retest of the opening of the year followed by a rollback.

I am also considering uft wing slf burger ast quick pivx for scalping with a continuing growth potential of up to 30-50%.

Coins with the tag monitoring vite hard cream amb troy with a growth potential of up to 100%+ also retain a high potential for breakouts. Let me remind you that when working with these assets, I recommend keeping a short stop under the price in the first half of the week until noon to insure against delisting, or to hire them from the middle of the week.

UFT are preparing for a trend reversalFollowing the alpaca testing, OG is ready to give a similar picture with an attempt to overtake the previous impulse. The previous impulse has already rechecked the opening level of the year with a local overlap, which opens the way for a test of levels 6 and 7.5. With the current market and the continuing likelihood of a new general drawdown, we are unlikely to see a hike above 6 on the first attempt. On the eve of passing through the middle of the quarter in the next two or three days, there is a high probability of a breakdown attempt of 5 with a stable continuation of the trend until the end of the month. With a more negative market, the volatility of the token may not be sufficient for a breakdown, in which case the probability of smooth growth prevails until the end of the month with a chance to open a new monthly candle above 5.

In the medium term, the token remains a reliable tool for storing funds, as the year opened above the 4.75 support near the key level for volatility growth of 5. Such an opening gives a flat signal for a retest of loyals due to an opening below 5, but also an exit to the 5-7.5 range in the medium term due to an opening above 4.75. Full-time support for a reversal With the current market, it is 3.5, from which there is a probability of a trend up to 7.5+ before the summer. There is a possibility of a test of a lower level of 2.5, but this will happen only in an extremely negative market with a drawdown of bitcoin by 75k or ether by 1500-1750. In this scenario, the token is likely to remain fairly stable and will give a smaller drawdown relative to the rest of the altcoin market, providing an excellent opportunity for topping up.

Along with og, vidt vib PDAs occupy an interesting position, which I primarily consider for storing funds in the mid-range due to the opening of the annual candle above key levels, which gives a signal for its bullish reversal in the future. The main goal for them, similar to alpaca and og, is so far a retest of the opening of the year followed by a rollback.

I am also considering uft wing slf burger ast quick pivx for scalping with a continuing growth potential of up to 30-50%.

Coins with the tag monitoring vite hard cream amb troy with a growth potential of up to 100%+ also retain a high potential for breakouts. Let me remind you that when working with these assets, I recommend keeping a short stop under the price in the first half of the week until noon to insure against delisting, or to hire them from the middle of the week.

Pullback to the second bottom on ALPACAAs we approach the middle of the quarter, there is an increase in purchases of altcoins, in preparation for which I recommended purchases in the second half of last week. To date, I have pleasantly shown the alpaca token, on the example of which I want to consider further scenarios for the development of events.

The token has opened an annual candle above the key level of 0.15, which gives a signal for a hike to the levels 0.25-35-50 . However, the market has been overbought since last year and there is still a possibility of further drawdown of the tops up to 75k and below for bitcoin. In this regard, a reliable scenario for altcoins is so far only a retest of the opening of the year with a further pullback to draw the second bottom, from where we can expect a more confident trend towards a reversal of the annual candle. In particular, for alpaca, the probability of a rollback prevails with an attempt to reverse the month again before closing the monthly candle. If a new monthly candle opens below 0.15 and, moreover, 0.14, growth may linger until the second half of March.

Today, a more interesting position is occupied by og vidt vib PDAs, which I primarily consider for storing funds in the mid-range due to the opening of the annual candle above key levels, which gives a signal for its bullish reversal in the future. The main goal for them, similar to alpaca, so far is a retest of the opening of the year followed by a rollback.

I am also considering uft wing slf burger ast quick pivx for scalping with a continuing growth potential of up to 30-50%.

Coins with the tag monitoring vite hard cream amb troy with a growth potential of up to 100%+ also retain a high potential for breakouts. Let me remind you that when working with these assets, I recommend keeping a short stop under the price in the first half of the week until noon to insure against delisting, or to hire them from the middle of the week.

SOL - Two Massive Longs Ahead!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 SOL is currently approaching an interesting zone as it nears the upper bound of the channel and its previous all-time high.

🏹For SOL to enter the price discovery phase and reach new ATHs, a daily candle close above $260 is required.

On the other hand, if it retests the green structure and the lower trendline, it would present a massive opportunity to accumulate at a discounted rate.

For now, we wait! ⏱️

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

A new signal to maintain purchasesTo date, we have passed the middle of the month, I want to consider the prospects for the end of the year. The second half of the month opened positively on the air above 3750 and 3850, which gives signals to exit above 4000 in order to test the 4250-4500 range. This is a positive signal for altcoins, and therefore we have seen new growth impulses for coins for the upcoming continuation of the trend. Bitcoin opened the second half of the month above 100k, which reduces the probability of a retest of 75-85k in the near future. However, an opening below 102.5 gives a signal for a flat of about 100k with attempts to go lower. With this picture, it is likely to go to the 110-115k test with a further return to 100k by the end of the year, which will lead to a rollback on the air, even taking into account positive signals.

According to the overall picture, the probability of growth this week prevails as part of the continuation of the trend of the current month and quarter. But from next week until the end of the year, it is worth keeping in mind the likelihood of a new wave of pullback in the market according to the annual schedule, which may continue in January. With such a picture, it is worth being careful about overbought coins with large capitalization. As I wrote earlier, the rollback on such coins, which began at the first market disruption at the beginning of the month, may continue until the end of the year with the transition to active sales in the new year. More interesting are the oversold coins, which continue to turn the annual candle into a bullish one.

New waves of growth on the local market, in particular, can be expected for VIB. Signals have been left for further overshooting and in the event of a breakdown from the third wave of 0.125, the road to the range of 0.15-25 will open. Growth is still going against the entrenched bearish trend on the monthly chart, giving rebounds from key levels and new opportunities for safe earnings without excessive overbought.

A local replay can also show OG TROY AST. According to OG, there are clear signals for a retest of 7.5-9$ at least. The token has quite a lot of liquidity, which provides sharp breakouts.

TROY, along with OG, has signals for further overshooting. In the case of a 0.0075 breakdown, there is a probability of a powerful growth wave for the 0.0125-150 test. At the moment, we are working out the sales momentum of 0.0035, which occurred before the last wave of growth. From 0.035-40 from the third wave, there is already a chance to break above 0.0075. However, with a negative market, there is a probability of a breakdown to 0.0250-275 before the start of growth on the move.

AST has targets at 0.21-25, where it can break through in case of consolidation above 0.15. However, incomplete emission exerts additional pressure, which leads to trend disruptions and increases the likelihood of a breakdown as we approach the end of the year.

This month, there has not yet been a new delisting announcement, which threatens the dynamics of coins with the monitoring tag. If there is no announcement in the next couple of days, I will be looking at new AKRO and VITE purchases in the second half of the week. Also, with them, HARD can give a new impetus. However, the threat of delisting next week is likely to make the growth waves quite short-term.

New wave up to 80%+ on VITEToday, another delisting announcement was released, in connection with which I warned against working with coins of the monitoring tag in the first half of the week. Now the coins that were not included in the announcement are becoming interesting. First of all, this is VITE, which is the most oversold at the moment. Last week, a signal was left for further overshooting and a likely test of the key level of 0.025, opening the way to 0.035-50. Given the assignment of the monitoring tag, I do not think that the price will easily gain a foothold above this level, despite the strong signal for a retest of about 0.035.

So far, the most likely scenario is a test of the 0.0225-75 flat range with a further rebound and determination of the closing level of the year, depending on the overall market dynamics. The month opened above 0.014, the second half of the month above 0.015, which is also a signal for growth to 0.02+. The zone of the set of positions is the flat range of 0.014-16 near the key level of 0.015. In the absence of a deeper drawdown on the tops today, the weekly candle will begin to turn bullish today and we will not see prices below the current VITE. In the event of an additional market drawdown after the decision on the US interest rate, VITE will probably be quite effective in compensating for the market drawdown, due to the high growth potential and after the flat it will give a breakdown on Thursday-Friday against the background of the general market growth in the second half of the week.

On the 0.025 test, it is worth carefully monitoring the dynamics, since there is a probability of a breakdown immediately by 0.035 within the framework of the reversal of the annual candle. But even if there is no consolidation above the level, the current wave of growth can bring up to 75% profit.

Also, from coins with the monitoring tag, HARD and FIRO can show pleasant growth waves, although they currently have lower goals of up to 30-50%.

VITE with a target of growth to 0.025 and VIB with a target of 0.15 are the most oversold coins on the binance, which have not yet shown a reversal of the annual candle, which may return them to the top of growth in the coming days similar to last week. As I have repeatedly written, for most overbought coins that have been on the radar for the last two months and have shown significant growth, the probability of continued sales prevails until the beginning of the new year.

Probable move over VIBAgainst the background of maintaining purchases this week, there is a fairly high probability of moving over VIB, which has already given 6 waves of 25-70% over the past two months. Trying to grow against the established bearish trend on the monthly chart, technical rollbacks occur from most levels to the base of the previous figure, which gives new and new opportunities for scalping, despite the fact that the token remains in a rather oversold position with a small risk of drawdown. So far, the goal in the case of a calm market is to continue the reversal of the annual candle with an attempt to test the range of 0.15-25.

To date, we are drawing a shadow on a new weekly candle. The main reversal zone is the flat range of 0.0875-950 near the strong formed support level of 0.09. The opening of the month above 0.075 gives a signal for an attempt to consolidate above 0.1. The opening of the second half of the month above 0.09 supports this dynamic.

In an optimistic scenario and in the absence of a deeper pullback on the tops, a reversal and return to the bullish VIB trend is possible today with a reversal of the current daily candle into a bullish one. With less volatility and the closing of a new daily candle above 0.09, a return to the hay is likely within a couple of days. With a reversal today and tomorrow, there is a possibility of returning to the top of growth in the binance, even with a small percentage of price increase, given the low–volatility market. This could lead to a sharp influx of liquidity and a new breakdown, which we observed over the weekend. The new wave can give up to 50-70% growth at least.

With an extremely negative market and disruption of the tops, there is a probability of a deeper retest of 0.075-80. To date, a retest of this range is more likely at the end of the month after the breakout and in the absence of price consolidation above 0.125 or with a rebound from this level from the third wave.

Besides OG and TROY, VIB has the highest goals among coins without a monitoring tag.

OG is trying to return to the trendTo date, the market has consolidated in anticipation of passing the middle of the month and determining the direction for the end of the year. The decision on the US interest rate may have a big impact. But for now, there is still an opportunity for the growth of individual coins with technical signals. TROY is showing itself well, aiming for a breakout of 0.0075. But in this article I want to consider OG, which from the second bottom at the key support of $ 5 can give a trend and catch up with TROY in dynamics. With a successful exit above the previously formed trend line, the nearest target will be a test of the 7.5-9 range. With a successful opening of the second half of the month above 7.5, you can expect the trend to consolidate and further overshoot. For now, the pressure of the unprocessed targets of the bears at 3000-3100 on the ether and 75-85k on the cue ball remains, in connection with which a new wave of sales at the change of the week may be deeper, with a payback after the decision on the US interest rate, in case the dollar weakens. In this negative scenario, OG can test $3.5-$4 where it will be possible to make a top-up, as it was possible to do with TROY. In the medium term, both TROY and OG are good tools with probable.

VIB also gave a new opportunity to re-buy profitably, which, in an optimistic scenario, can turn a weekly candle into a bullish one in order to continue the trend by 0.15 due to the opening of the week above 0.1.