CRUDE OIL Local Long! Buy!

Hello,Traders!

USOIL has retested a

Nice round horizontal

Support level of 60$

And we are predictably

Seeing a bullish reaction

From the level which we

Believe will take the price

A bit higher still

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Oil(wti)

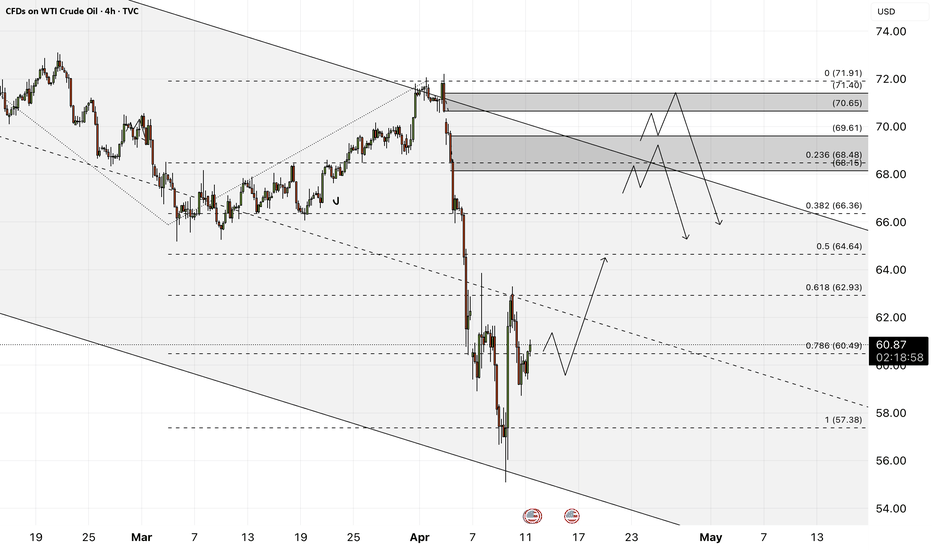

WTI OIL Buy and sell levels within its Channel Down.WTI Oil (USOIL) has been trading within a Channel Down pattern on the 1D time-frame. The price is now rising having priced its most recent technical Lower Low. Every Lower High rejection happened either on or above the 1D MA200 (orange trend-line).

With the current rebound looking similar to September - October 2024, we expect a 0.786 Fib and 1D MA200 test at $68.50 (buy) and then reversal to a minimum -17.30% decline to $57.00 (sell).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Crude oil gains could be limited. Here's whyAlong with other risk assets, crude oil has had a positive day, albeit a much quieter one compared to the major indices. It has been held back in part by the dollar also finding good support. So, I think a large part of the rally today in WTI is just a function of the market pricing in higher demand because of lower tariffs. Thus, it is the removal of a bearish factor driving prices higher, which could be factor for a while yet as market finds a new equilibrium. The underlying issue of an oversupplied market is what will ultimately determine oil prices. On that front, you have the OPEC ready to release more withheld supplies as it doesn’t want to lose more market share to non-OPEC producers. Thus, the upside linked to a brighter demand outlook should be capped. So, while I do think prices may rise a little further, I don’t think that we will see significantly higher prices with the current state of supply picture. I wouldn’t be surprised if $70 turns into resistance now on Brent, or if WTI holds this shaded yellow resistance range you can see on this chart around $65 area.

By Fawad Razaqzada, market analyst with FOREX.com

WTI on high time frame

"Hello traders, focusing on WTI, the price is currently at a critical level of $62.

Candle formations on high time frames indicate a higher probability of the price declining to $53.

Given the influence of political and geopolitical news, there may be increased volatility in the price. This analysis will be updated accordingly."

If you have any more details to add or need further assistance, please feel free to let me know!

CRUDE OIL Bullish Breakout! Buy!

Hello,Traders!

CRUDE OIL is making a bullish

Correction from the lows and

The price made a bullish

Breakout of the key horizontal

Level of 60.10$ then made a

Retest and a rebound so we

Are bullish biased and we will

Be expecting a further bullish

Continuation on Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Oil Analysis: WTI Approaches the $60 Level AgainOver the past two trading sessions, oil has gained more than 4.5%, and is once again approaching the psychological barrier of $60 per barrel. This recent bullish movement persists despite OPEC+’s clear stance on increasing supply in June and the International Energy Agency’s (IEA) cautious outlook on global oil demand for the remainder of the year. As such, it appears that oil prices are currently benefiting from improving market sentiment, particularly as investors await the outcome of the upcoming U.S.–China trade negotiations.

Persistent Bearish Trend

Since mid-January, oil has maintained a steady downtrend, and so far, minor bullish retracements have not been strong enough to signal a meaningful reversal. Therefore, this downward technical formation remains the dominant structure to monitor in upcoming trading sessions.

RSI

The Relative Strength Index (RSI) continues to hover around the 50 level, indicating a sustained balance between bullish and bearish momentum. As long as this equilibrium remains, a neutral bias could dominate short-term price movements.

ADX

The Average Directional Index (ADX) remains close to the 40 mark, though the line has recently begun to flatten. This could be interpreted as a sign of weakening trend strength in the short term, likely due to the price currently testing a significant resistance zone.

Key Levels to Watch:

$60 – Nearby resistance: A short-term psychological level. A break above this zone could reactivate a bullish bias and potentially lead to the formation of a new short-term uptrend.

$63 – Main resistance: Aligned with the 50-period moving average. Sustained price action above this level could challenge the prevailing long-term bearish structure.

$57 – Nearby support: A zone that matches recent multi-week lows. A drop below this level could reinforce bearish momentum and provide more room for the current downtrend to extend.

Written by Julian Pineda, CFA – Market Analyst

USOIL SHORT SIGNAL|

✅CRUDE OIL made a retest

Of the horizontal resistance level

Of 59.80$ and we are already seeing

A bearish reaction so we are bearish

Biased and we can enter a short trade

With the TP of 58.10$ and the

SL of 59.93$

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

WTI OIL Bearish Cross confirming more selling ahead.WTI Oil (USOIL) has been trading within a Channel Down pattern since the December 06 2024 Low. The last Bearish Leg started on a 1D MA200 (orange trend-line) rejection and was confirmed with a 1D MACD Bearish Cross 3 days after.

At the moment we have had a 1D MA50 (blue trend-line) rejection and today we will complete a new 1D MACD Bearish Cross. As a result, we almost have a new sell confirmation. Once completed, sell and target $53.50 (-19% from the point of the rejection).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Habibi, the Price is Right at 70-79$Habibi, the Price is Right

Post Content (with emojis version of title at the top):

🤝🛢️ Habibi, the Price is Right at 70–79$ 💸🎯

The Call That Never Happened (But Might Have)

📞 I was just updating my crude oil chart when suddenly… my phone rang.

No caller ID. I answered. And somehow— I was patched into a live call between:

🍊🦅 Trump and 🌴👑 the King of Saudi Arabia.

They mistook me for a translator.

So naturally, I stayed on the line.

Here’s how the oil market actually got settled...

🍊🦅 Trump: “Hello? Who is this? I have the best phone security. The Chinese can’t hack it. Nobody can.”

🌴👑 King: “Donald, ya’ani... it’s me!”

🍊🦅 Trump: “Me who? I know the most people, you sound like an immigrant, do you have a visa?”

🌴👑 King: “Your King of Saudi Arabia, habibi! Your favorite oil guy! I can afford all the Visas and Mastercards!”

🍊🦅 Trump: “My King! My favorite King, my guy, what a Tremendous timing. Oil prices are way too high. I need cheap oil to start my tariff wars again! ”

🌴👑 King: “Habibi, we said $88! We need to fund flying taxis and desert ski slopes. The Line isn’t building itself, ya’ani.”

🍊🦅 Trump: “But I gave you the PGA Tour! LIV Golf is huge ! You’re welcome.”

🌴👑 King: “ Mashallah , yes... but we paid this Tiger Woods $800 million just to say no. Wallah , that’s expensive rejection, Donald.”

🍊🦅 Trump: “That’s nothing my King. Peanuts. Melania’s token did better than that. Peanuts my King, peanuts for the camels. What about $76?”

🌴👑 King: “Cristiano Ronaldo costs $200M a year! And he wants an oasis with seven pools! And now we want Messi from Miami and Ronaldinho. Mashallah! ”

🍊🦅 Trump: “I need lower gas prices my King or I can’t revive the economy!

And you made Messi cry in the World Cup, my King — not my fault. You kicked his ass, not my fault..I need to check on his visa if he is legally in my great country (again) or i will send him to El Salvador and you can get him cheap from there”

🌴👑 King: “Inshallah. But we’re also building a ski slope in the desert. With real snow.

We need $88.88 oil Donald! 88$ minimum”

💙🧠 FXPROFESSOR: “Uh... sorry to interrupt... I don’t know how I got on this call... but I think I can help.

I understand charts.”

🍊🦅 Trump: “Who is that?!I know the voice, who is that?”

💙🧠 FXPROFESSOR: “I’m the FXPROFESSOR. And I might have a solution for you.

It’s called… The Compromise Zone. ”

🌴👑 King: “Ya’ani… go on.”

💙🧠 FXPROFESSOR: “$70–79. That’s where the technicals align.

Trump gets a few more months below that, help him with low oil for inflation until he can deal with Powell, then you two take it sideways in that range 70-79$ and you get stability for The Line, the AI and all the great things the Kingdom is working on.”

🍊🦅 Trump: “I know the Professor! I follow him on TradingView. Genius. Huge brain. One of the best brains. I bought Ethereum at 4400$ because of him and I'm down 60% but it's ok..peanuts, great guy the Professor, great guy”

🌴👑 King: “Inshallah. But we still have losses. Ya’ani... Donald, how do we cover them? And how did this guy get on our call habibi”

🍊🦅 Trump: “Easy King, it's easy! We launch a Great meme coin together, me and you, the greatest token in the world. We call it — $KINGOFARABIA —meme token, we Pump it on Solana. We'll pump it like you pump Oil. Gonna be Great, we will Cover the gap my King.”

🌴👑 King: “We tried blockchain before. Royal IT guy lost the wallet. Had to… correct the situation. Plus i also invested on Ethereum Donald, Solana is for the kids and the stuff”

🍊🦅 Trump: “Let's find a solution my King and i will do this for you: I’ll send Jerome Powell. A gift. Let him run your rates. Take him for free (please take him)”

🌴👑 King: “Jerome is good for my country, he is so cold he will make the temeratures drop 2 degrees, ok we take him but One more thing Donald… I want Taylor Swift at my nephew’s wedding? And please she comes dressed properly and act respectfully”

🍊🦅 Trump: “Done. Nobody says no to me. Except from the Feds, the Europeans, the Japanese, Canada and the penguins i taxed by accident. But that's ok, we make America Great again. I will send you the new Trump memorabilia collection, the best MAGA t-shirt for you my King. It's still made in China but it's soon to be made here at home, soon. ”

🌴👑 King: “Wait Donald! I just remembered.. Also... we want UFC in Riyadh, for ever! Big events. I want Dana White to agree and i want a podcast with Josh Rogans.”

🍊🦅 Trump: “I’ll talk to Joe Rogan, great guy Joe. I’ll call Dana. Maybe Khabib makes a comeback. I know fighters. Strong fighters. Big ratings. They love me. They love you too my King”

📉 And that’s how oil found balance between memes, monarchs, and macro.

📊 Chart Insights – USOIL 12h

❌ $93 = clear rejection

🟦 Compromise Zone: $70–79

🟢 $88 = Saudi’s macro target

🔻 $70 = Trump’s inflation floor

🔄 Consolidation expected unless OPEC or Powell shift the game

💬 What do you think? Are we just memeing the macro?

Or is this really how the oil market works in 2025?

One Love,

The FXPROFESSOR 💙🧠

Disclaimer: This is a fictional satire written for entertainment and educational purposes.

Any resemblance to real negotiations is purely… coincidental.

The chart is real, though — and so is the technical compromise.

Special Salam and much love to my friends in Saudi Arabia 🇸🇦 — the most wonderful people I’ve met in the world.The image is not of the new King but that's ok, great image.It's great! ❤️

Analysis of the BRENT chart with expectations for 2025-2026◽️Technically, all conditions for the completion of the second wave correction have been met, and now quotes can be safely reversed up. However, current events in the global economy do not yet provide grounds for confidently asserting this. Locally, the price may still be driven down to $50 per barrel and even slightly lower. One way or another, it is important to understand a simple thing: everything below $70 per barrel should be seen as an opportunity to buy oil and everything related to it cheaply.

◽️According to my estimates, there is probably still time for deliberation on purchases until the end of spring. But further, from the beginning of summer, I expect a sharp rise in prices amid the escalation in the Middle East. From above, in the $100-150 range, growth will likely be contained for some time, which will be interpreted as the formation of sub-waves (i)-(ii), where after sharp rise in the first sub-wave from approximately $50-60 to $120-130, a local correction will follow within the second sub-wave.

◽️The growth period may take 3-6 months, and the correction to it another 2-4 quarters, and then a breakout of the $120-150 resistance zone and further "to the moon" in the third waves is expected.

🙏 Thank you for your attention and 🚀 for the idea.

☘️ Good luck, take care!

📟 See you later.

WTI - Will Iran return to the group of oil producers?!WTI oil is below the EMA200 and EMA50 on the 4-hour timeframe and is moving in its medium-term descending channel. If the correction towards the supply zone continues, the next oil selling opportunity with a suitable reward for risk will be provided for us. In this direction, with confirmation, we can look for oil buying transactions.

The U.S. Energy Information Administration (EIA), in its latest report, has downgraded its forecasts for oil and natural gas production, consumption, and prices for 2025 and 2026, while warning about the uncertain outlook of the energy market amidst economic volatility and escalating trade tensions.

According to the updated estimates, U.S. crude oil production in 2025 is expected to reach 13.51 million barrels per day, down from the previous forecast of 13.61 million barrels. For 2026, the figure has been revised to 13.56 million barrels per day, a reduction from the earlier 13.76 million forecast. Monthly data shows average U.S. oil output stood at 13.44 million barrels per day in April and 13.55 million in March, with similar levels expected in May.

Globally, EIA projects oil production in 2025 to be around 104.1 million barrels per day, slightly down from the earlier estimate of 104.2 million. For 2026, the revised figure stands at 105.3 million barrels per day compared to the previous 105.8 million.

On the demand side, global oil consumption forecasts have also been reduced. In 2025, demand is now estimated at 103.6 million barrels per day instead of 104.1 million, and for 2026 it is projected at 104.7 million barrels per day, down from the prior estimate of 105.3 million.

Regarding natural gas, the EIA reports that average U.S. gas production in April will be around 115 billion cubic feet per day, slightly lower than the 115.3 billion cubic feet reported in March. May’s forecast stands at 115.4 billion cubic feet. Demand has also dipped, with estimates for 2025 now at 91.2 billion cubic feet per day (down from 92), and for 2026 at 90.5 billion (previously 91.1).

In terms of pricing, EIA has made significant downward revisions. The average price of West Texas Intermediate (WTI) crude oil is now forecast to be $63.88 per barrel in 2025, compared to the earlier $70.68. For 2026, this drops further to $57.48. Brent crude is now estimated at $67.87 for 2025 and $61.48 for 2026, both notably lower than prior projections.

One key highlight from the report is EIA’s warning about high volatility in major commodity prices, especially crude oil. The agency underlined that reciprocal tariffs between China and the U.S. could heavily impact markets, particularly the propane sector.

EIA noted that U.S. liquefied natural gas (LNG) exports are likely to remain resilient despite trade disputes. This is attributed to strong global demand and the flexible nature of U.S. export contracts, which allow unrestricted shipments to multiple destinations.

However, when it comes to oil and petroleum products, the agency maintained a more cautious tone, emphasizing that recent shifts in global trade policies and oil production patterns may slow the growth of demand for petroleum-based products through 2026.

Altogether, the downward revisions by the EIA carry a clear message: the energy market outlook over the coming years is fraught with uncertainty. From supply and demand to pricing, political and economic forces such as trade wars and potential global recessions are expected to play decisive roles.

Meanwhile, according to Reuters, after U.S. President Donald Trump once again threatened military action if Tehran refuses to agree to a nuclear deal, a senior Iranian official responded by warning that Iran may halt its cooperation with the U.N.’s nuclear watchdog.

Reports indicate that American and Iranian diplomats will meet in Oman on Saturday to begin talks on Tehran’s nuclear program. Trump stated that he would have the final say on whether the negotiations are failing, which could place Iran in a highly dangerous position.

Ali Shamkhani, a senior adviser to Iran’s Supreme Leader, posted on X (formerly Twitter) that ongoing foreign threats and the looming threat of military confrontation could lead to deterrent actions such as expelling International Atomic Energy Agency (IAEA) inspectors and cutting ties with the agency.He also mentioned that relocating enriched uranium to secure, undisclosed locations within Iran may be under consideration

WTI Continues Sharp Decline and Enters Oversold TerritoryOver the past five trading sessions, oil prices have dropped more than 17% , with WTI crude falling below the $60 per barrel mark. This move reflects ongoing market uncertainty, as investors expect the new trade war to significantly weaken oil demand in the coming months. As long as confidence remains in a fragile zone, downward pressure on oil prices is likely to persist.

Break of the Sideways Channel

In recent weeks, a key sideways channel that had held since November 2023 has been broken. This shift could alter the neutral outlook that has dominated the oil market in the long term and now points toward seller dominance. As price movements stabilize, a stronger bearish trend may begin to develop in the short term.

Oversold Conditions Appear

RSI: The RSI line is currently holding below the 30 level, which signals oversold conditions on the indicator. This suggests that while bearish pressure has been dominant, the market may be entering an early stage of exhaustion, potentially opening the door for short-term bullish corrections.

Bollinger Bands: The price has completely broken through the lower Bollinger Band, indicating that it has moved beyond two standard deviations from the mean. This reflects high volatility and could signal a pause in selling momentum. In turn, it may lead to potential rebound zones forming soon.

Key Levels:

$58 – Near Support: This is the most important short-term barrier, aligning with multi-year lows not seen since 2021. Continued selling below this level could reinforce the current bearish bias.

$66 – Near Resistance: This level marks the lower boundary of the former sideways channel. It may act as a potential zone for bullish corrections in the short term.

$73 – Distant Resistance: This level aligns with the 200-period moving average. Price action approaching this area could reactivate the previously abandoned uptrend.

By Julian Pineda, CFA – Market Analyst

Oil in a multi-week declining triangle patternPYTH:USOILSPOT

Oil has been in a multi-week declining triangle pattern, lasting over 2 years so far, which will eventually break to the downside. When it does, the price target should be around $35 USD. Which is calculated subtracting the width of the triangle from the base of the triangle.

When? Probably when we have a stock market crash, which could be soon. Fundamentally speaking, a global recession should reduce global demand for crude oil. Also, a resolution of the Ukraine-Rusia conflict should increase global supply of crude oil.

Good luck to you

Hellena | Oil (4H): SHORT to support area 65.268.We need to talk about one important nuance. Many people ask “Hellena, you say you can't buy oil, but it's going up. Well, it is, yes. But all my data and wave markings suggest that the price will soon start a downward movement. There are major changes in geopolitics and I am not in a position to stop them. I just set a stoploss and wait for the trade that will bring me profit.

Now coming to the forecast, I think that the downward movement will start soon, but before it, the price may rise quite high, maybe even to the area of 74.000.

But the main direction is the support area of 65.268.

There are 2 possible ways to enter the trade:

1) Entry at market price.

2) Limit pending sell orders if the price starts an upward movement to the area of 74.484.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Oil - Short Term Buy Idea Update!!!Hi Traders, on March 25th I shared this "Oil - Expecting Retraces and Further Continuation Higher"

I expected to see retraces and further continuation higher. You can read the full post using the link above.

The bullish move delivered as expected!!!

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CRUDE OIL LONG SIGNAL|

✅CRUDE OIL is trading in a

Strong uptrend and was making

A local bearish correction but

A horizontal support level was

Hit at 71.00$ so we can go

Long on with the TP of 71.72$

And the SL of 70.59$

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

WTI OIL Approaching a potential rejection level.Our last short-term analysis (March 18, see chart below) on WTI Oil (USOIL) hit the $70.00 Target and is currently extending the uptrend:

We believe however that this uptrend may be coming to a temporary end as not only does it approach the 1D MA200 (orange trend-line) that has been intact since February 03, but also the 73.40 Symmetrical Resistance that kick started the -7.70% September 24 2024 rejection.

As you can this this is also where the 1D RSI 67.00 Resistance is, which has also caused 2 rejections.

Based on that, we will wait for a short on the 1D MA200 to target $68.00.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Oil - Expecting The Price To Bounce Higher FurtherH1 - Price has created series of higher highs, higher lows structure

Strong bullish momentum

Higher highs based on the moving averages of the MACD indicator

Expecting retraces and further continuation higher until the two strong support zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

WTI CRUDE OIL: 1M MA100 providing huge buying pressure to $77.50WTI Crude Oil has reclaimed its bullish technical outlook on 1D (RSI = 62.688, MACD = -0.001, ADX = 49.608) as is about to end the month on a strong green 1M candle and a huge 1M RSI bullish divergence. The most important development here is that the current 1M candle (March) marginally hit the 1M MA100 and immediately rebounded. This trendline has been the market's major long term support since April 2021, so essentially for the last 4 years. We believe that this is enough to cause a medium term rebound to the LH Zone and possibly even just outside of it to test the 1M MA50. For now however, our target is contained inside this zone (TP = 77.50).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

WTI CRUDE OIL: Last pull to 4H MA50 possible, $72 target remainsWTI Crude Oil just turned bullish on its 1D technical outlook (RSI = 55.181, MACD = -0.570, ADX = 39.438) as it crossed above the 4H MA200. It is still under the 1D MA50, so the newly emerged Channel Up may pull the price back under the 4H MA50 one last time before the next, even stronger bullish wave. Overall, we remain long (TP = 72.00), even more so on the long term.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##