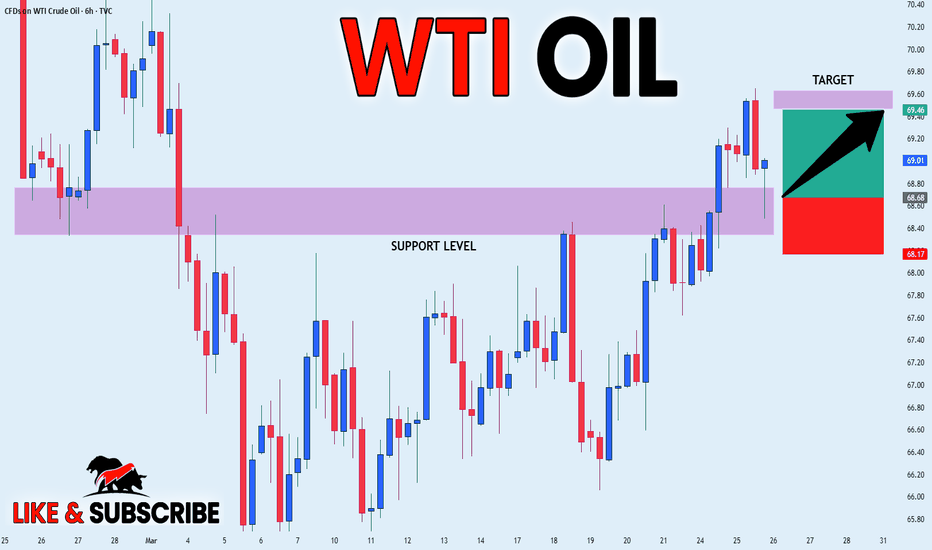

CRUDE OIL LONG SIGNAL|

✅USOIL made a retest

Of the horizontal support

Of 68.60$ so we are bullish

Biased so we can enter a

Long trade with the TP of 69.46$

And the SL of 68.17$

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Oil(wti)

Oil - Expecting Retraces and Further Continuation HigherH1 - Bullish trend pattern in the form of higher highs, higher lows structure

Strong bullish momentum

Bearish divergence on the moving averages of the MACD indicator.

Expecting retraces and further continuation higher until the two strong support zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CRUDE OIL Will Go Up After Pullback! Buy!

Hello,Traders!

CRUDE OIL is trading in a

Local uptrend and the price

Made a strong bullish breakout

Of the key horizontal level

Of 68.40$ so after a pullback

And a retest of the new support

We will be expecting a further

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

WTI CRUDE OIL: Hard rebound on 1.5 year support targeting $72.WTI Crude Oil is neutral on its 1D technical outlook (RSI = 48.748, MACD = -1.080, ADX = 23.603), which indicates the slow transition from a bearish trend to bullish. This started when the price hit the S1 level, a 1.5 year Support, and bottomed. The slow rebound that we're having since formed a Channel Up on a bullish 1D RSI, much like the one in September 2024, which eventually peaked after a +10.70% price increase. A similar rebound is expected to test the 1D MA200. The trade is long, TP = 72.00.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

CRUDE OIL Free Signal! Sell!

Hello,Traders!

CRUDE OIL made a sharp

And sudden move up

And it seems that it will

Soon hit a horizontal

Resistance level of 68.80$

From where we can go short

On Oil with the TP of 67.67$

And the SL of 68.87$

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

WTI Possible Scenarios:

1- Bullish Scenario:

If the price holds above 66.160, it could push towards 67.900, filling the Fair Value Gap.

A break above 67.900 could confirm further upside potential.

2-Bearish Scenario:

If price breaks below 65.800, it could signal further downside towards 65.500 or lower.

The trendline resistance could push price lower if rejection occurs.

Entry Zone: Around 66.160.

Stop Loss: Around 65.800.

Target Price: Around 67.895.

OIL / WTI PoV - LONGThe analysis of the current oil price highlights the $65/66 range as a critical level for a potential rally. After a period of consolidation and corrections in recent weeks, oil seems to have found strong support around these levels, with prices oscillating between $65 and $66 per barrel. These levels represent an important liquidity zone, as in the past, the price has found support here, suggesting that there could be an opportunity for a bullish rebound if the price manages to remain stable above this threshold.

A rally above the $65/66 level could be supported by several fundamental factors, including improved demand prospects, a reduction in global inventories, and potential policies from OPEC. If demand for oil increases, especially with economic recoveries in certain regions or a rise in industrial production globally, there could be further support for prices. Additionally, OPEC+'s stance in the production-limiting agreement and potential supply cuts could keep the market tight, pushing prices higher.

Geopolitical dynamics also play a significant role in determining the direction of oil. Any tensions or disruptions in supply from key producing countries, such as those in the Middle East, could serve as catalysts for further price increases. Another factor that could support prices is the depreciation of the dollar, which typically benefits oil, as the commodity is priced in dollars.

However, if the price fails to maintain stability above the $65/66 level, we might see a new correction phase, with prices possibly retreating to lower levels. A move away from these levels could mark the beginning of a new bearish phase, with the risk of prices sliding back towards $60 per barrel or even lower if demand weakens or if there are supply excesses in the market.

In summary, the $65/66 level is crucial for the price of oil. Maintaining or closing above these levels could pave the way for a rally, while failure to do so could lead to further price weakening. With OPEC+ policies playing a key role in balancing the market, the next few months will be critical in determining the future direction of oil prices.

WTIThis chart is focused on short-term ICT analysis, showing liquidity zones, displacement, and market structure shifts.

1. Smart Money Liquidity Grab at 63.59-64.61

This is an Expected Liquidity Pool.

ICT concepts suggest that institutions often engineer liquidity grabs at key support levels before reversing.

The area around 64.61 is a sell-side liquidity sweep, designed to trap retail shorts before Smart Money initiates a bullish move.

2. Market Structure Shift (MSS) at 68.53

A break above 68.53 is a bullish shift, signaling a change in trend.

Displacement with a fair value gap (FVG) around 68.53 confirms momentum.

If price reclaims 68.53, expect Smart Money to target buy-side liquidity at 79.32 and later 91.21.

3. Buying Zone & Smart Money Accumulation (75-77 Range)

Once price reaches 79.32, expect a retracement into the 75-77 range, allowing Smart Money to re-accumulate.

A break above 91.21 unlocks the potential for higher moves, aligning with the higher time frame Elliott Wave 5 targets.

Treasury Secretary Bessent: Make Iran broke again Treasury Secretary Scott Bessent, speaking at the Economic Club of New York, said the U.S. is enforcing sanctions on Iran for “immediate maximum impact,” warning that Iranians should move their money out of the rial.

The goal is to cut Iran’s oil exports from 1.5 million barrels per day to near zero.

His comments came as oil prices fell to multiyear lows on Wednesday, driven by concerns that tariffs on Canada, Mexico, and China could slow economic growth and weaken crude demand.

Following Bessent’s remarks, both U.S. crude and Brent prices turned positive, with JP Morgan analysts noting that a decline in Iranian supply is currently the only bullish factor for oil prices.

Bessent also signaled that the administration is prepared to impose full-scale sanctions on Russian energy if it helps lead to a ceasefire in Ukraine. This is a welcome shift from the Trump administration, who so far has only been pressuring the victim of the war rather than the perpetrator.

USOIL WTI The price was in a downward trend, moving within a descending channel. A breakout from this channel indicates potential trend reversal or correction.

Consolidation Zone Identified:

The price is currently in a consolidation phase (marked in orange).

A breakout above this zone could confirm bullish momentum, while rejection could push it lower.

Key Resistance Levels for Upside Targets:

If the price breaks above the consolidation zone, it could rally toward 71.246 and 72.103 as potential resistance levels.

Green arrows indicate bullish breakout targets.

Key Support Levels for Bearish Move:

If the price fails to break above the consolidation zone, A further breakdown below this support level could push the price toward 68.400 and 66.888, the next major support.

Conclusion:

The next major move will depend on how price reacts to the consolidation zone. A breakout above could lead to bullish targets, while failure could send prices lower toward the next major support. Traders should watch for confirmation before entering trades. 🚀📉

Hellena | Oil (4H): SHORT to the area of 67,037 (Wave C).The price is still in a downtrend and I believe that before the price starts an upward movement it needs to complete a big “ABC” correction and a small five-wave formation.

I think the price will reach the level of 67,037. This level is quite important, because in its area we need to look carefully for reversal patterns.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

WTI CRUDE OIL: Approaching the 2year Buy Zone.WTI Crude Oil turned bearish on its 1D technical outlook (RSI = 35.899, MACD = -0.720, ADX = 32.215) failing to cross above the 1D MA50 last Thursday and eventually getting rejected to today's low. This low just hit the HL trendline of September and is about to enter the S1 Zone that has been holding since March 2023. Every breach inside this Zone has been the best long term buy opportunity on WTI. Until the Zone breaks, we will treat it as the best buy entry, aiming at the LH Zone (TP = 77.00).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Hellena | Oil (4H): SHORT to the area of 68.926 (Wave C).Colleagues, price has worked the downward movement perfectly, but I believe the downward movement is not over yet.

Wave “C” is a five-wave wave and now the price is in the correction of wave “4”.

I expect the price to reach the downtrend line in the area of 72.00 level, then I expect the price to decline to the area of 68.926.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

WTI OIL Weak price action on the medium-term.WTI Oil (USOIL) is extending the Bearish Leg of the Triangle pattern after the recent January 13 rejection on the 1W MA200 (orange trend-line). Until the 1W RSI turns bearish again, and more importantly the Support Zone gets hit, we expect this bearish trend to be extended.

The strongest Demand Level for the past 2 years has been this Support Zone, so our medium-term Target is on its top at $68.00.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

WTI CRUDE OIL: Aiming at 82.00 long term.WTI Crude Oil is neutral on its 1D technical outlook (RSI = 48.507, MACD = -0.150, ADX = 34.872) as only today it crossed above the 1D MA50, following a correction since Jan 15th. The prevailing pattern is a Channel Up and we are very close to its bottom. The two bullish waves it had already, peaked after at least a +20% rise. As the 1D RSI is already on the S1 Zone, we anticipate a new bullish wave to start gradually and aim at the top of the Channel Up (TP = 82.00).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##