Oilforecast

OIL | XTIUSD | USOIL |USO |DECRYPTERSHI PEOPLE WELCOME TO DECRYPTERS

We may see 4H to Play first and NEXT WEEK Possible REVERSAL in oil, AS Reversal pattern is on Daily Timeframe it will take 7-13 candles At least to reach Targets 0f 86$ - 88$ , The Demand for oil will increase once china is Fully open

Smart money bought really cheap Hey everyone,

it looks like smart money bought really cheap in Covid crysis turn and now the prices are really high

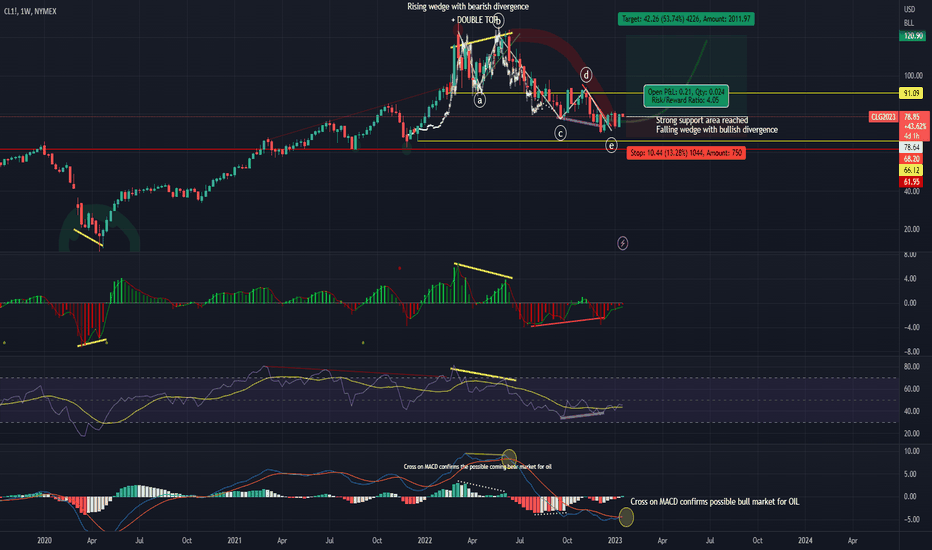

Fundamentals are all bad sh1* all here and there now but the chart and TA indicators speaks for itself on this Weekly chart for me.

What I see is rising wedge formation with bearish divergence all over major indicators with very likely double top formation.

I would wait a little bit more for that bear diverged MACD to cross out to enter levearaged short on this oil setup.

This Oil & BTC bubble is so much fun to ride

Money about to moove and sentiment clima about to change very soon very likely

Chachain

KEYWORDS

Oil, CL1!, R:R, money management, risk, reward, technique, style, trading, bitcoin , bitcointrading, profitable trading, profittrading, profit trading, secret, divergence, bull divergence, bear divergence, divergencetrading, divergence trading, trading strategy, how to trade bitcoin , bitcoin trades, bitcoin trading, make profit, take profit, trading strategy, trading technique, successful, successful trader, successful technique, successful strategy, successful secret, how to trade, trend analysis, technical analysis , indicators, rsi , relative strenght index, let it rain, successful life, easy strategy, easy trading, easy technique, make money, crypto investing, investing, crypto, cryptocurrency, cryptocurrencies, mentoring, money, chartart, beyond

Nice R:R4 50% long setup for oilHey everyone,

after a patient play out of short seen below, finally a long setup popped up on me.

I see a finished EW correction topped out by falling wedge formation with bullish divergence on indicators.

Markets turning bullish and with Bitcoin and cryptocurrencies , I´m adding in bag some oil longs.

This is very nice and conservative Risk:Reward 4 ratio setup

Entry: 78-80 USD

SL: 68 USD

TP1: 100 USD

TP2: 120 UD

Chachain

KEYWORDS

Oil , CL1! , R:R, money management, risk, reward, technique, style, trading, bitcoin , bitcointrading, profitable trading, profittrading, profit trading, secret, divergence, bull divergence, bear divergence, divergencetrading, divergence trading, trading strategy, how to trade bitcoin , bitcoin trades, bitcoin trading, make profit, take profit, trading strategy, trading technique, successful, successful trader, successful technique, successful strategy, successful secret, how to trade, trend analysis, technical analysis , indicators, rsi , relative strenght index, let it rain, successful life, easy strategy, easy trading, easy technique, make money, crypto investing, investing, crypto, cryptocurrency, cryptocurrencies, mentoring, money, chartart, beyond

Potential SHORT/LONG on OIL IF...Like my previous analysis, i am looking to see if OIL rejects or breaks the trend-line which is at the $80 level. Coincidentally, this is also where the 50EMA is at. I would want to see what it does at he 80-81.4 price. 80 price is at the trend-line and 81.4 is the previous resistance. If it breaks that level, we can see a nice push to $90s. If we see rejections, we can see retest support at he $70 level

Crude oil💥1D -TIMEFRAME ANALYSISCrude oil💥1D -TIMEFRAME ANALYSIS

💗Hello ladies and gentlemen

This is my new idea for 💥Oil

I hope my idea is clear

Support me by like and share thank you

Stay Safe💯💲💲💲

Good luck💰😍

Volatile start to year for gold and oil In December, the price of gold moved through a volatile uptrend but did seemingly reject at $1,819. However, a daily candle managed to close above this resistance zone on the last day of 2022, which has been followed by a continuation to the upside at the start of the new year. Although the volatile uptrend pattern appears to remain intact.

Currently, XAU/USD is sitting in the green “buy zone” of the Investing Zone Indicator. The Alma Trend Ribbon included in this indicator is presently blue, further suggesting that gold is bullish at this point. If gold manages to sustain this bullish outlook, $1,900 might be an appropriate pivot point, with $1,940 perhaps as far as a price traders might like to target.

Meanwhile, Crude Oil appears to be in a downward trend, with the price below the pink (bearish) Alma Trend Ribbon. In 2023, the price cratered from ~$80.00 a barrel to as low as ~$73.00, in the first 4 days before consolidating near this low, but not without printing some impressive wicks. This week, crude oil has experienced a small rally to avoid moving deeper into the yellow sell-zone of the Investing Zone Indicator. $76.50 now appears to be a resistance level for oil, so traders might like to watch for further rejections, particularly at $74-$75, before looking for price targets below $73.00 in the days ahead.

Crude Oil Weekly Volatility Analysis 9-13 Jan 2023 Crude Oil Weekly Volatility Analysis 9-13 Jan 2023

We can see that currently the implied volatility for this week is 5.72%

With this in mind, currently from ATR point of view we are located in the 74th percentile.

Based on this, we can expect that the current weekly candles ( from open to close ) are going to between:

*For calculations, I am using the data since 2022*

Bullish: 4.6% movement

Bearish: 5.7% movement

At the same time, with this data, we can make a top/bot channel which is going to contain inside the movement of this asset,

meaning that there is a 29% that our close of the weekly candle of this asset is going to be either above/below the next channel:

TOP: 77.9

BOT: 69.22

Taking into consideration the previous weekly high/low, currently for this candle there is :

31.5% probability we are going to touch previous weekly high

66.8% probability we are going to touch previous weekly low

Lastly, from the technical analysis point of view, currently from

Daily timeframe indicates -53.33% BEARISH trend from the moving averages index

Weekly timeframe indicates -66.67 BEARISH trend from the moving averages index

Monthly timeframe indicates 13.33% BULLISH trend from the moving averages index

Financial Wave. CLWe have adjusted our priority scenario in CL. Downward acceleration in wave 3 looks most likely and could bring oil prices to $62.92. If the price of oil rises to $81.72 we’ll change our view. In support of our opinion, we also want to note:

1. Strong winds and mild temperatures will certainly reduce energy demand.

2. Bubbles burst in the financial markets. One of them, the real estate market in Canada, UK, Sweden and Australia. This is another sign that social sentiment is turning negative.

BCO Technical Analysis On a we weekly we have gotten close to our resistance level

we can get the following two plays: price going up and closing above 86.149 on a weekly chart or we may get pullback where then we will have to evaluate longs

for now i am bullish since levels held perfectly

my entries are pullback after retest (roughly as demonstrated on the chart)

Let me know your ideas on oil!

Would like to see some consolidation....Crude has been honoring this trendline since tagging my supply zone a couple of weeks ago. I think we have a good chance of tagging the 200 ema at around 88 but would like to see some consolidation for a few days, similar to the consolidation that occurred on Dec 19-22. Nice inverted H&S pattern forming plus all of the bullish factors I mentioned in my last post makes this a high probability trade imo. China opening up should provide some tailwinds as well. Thanks for reading and let me know what you think. Cheers.

USOIl Crude Oil important Support LevelWTI Crude Oil is at a key support level now and i don`t think we have seen the last of it.

OPEC+ unexpectedly decided to cut output in October by 100,000 barrels a day.

It`s not much for now, but they will continue cutting the supply until they will get the oil to $90.

I`m looking for a bounce to the $85 - $92 area before heading to $62 by the end of next year, when i expect the beginning of an electric revolution worldwide.

Looking forward to read your opinion about it.

west oil updatewe are in a big extended triangle , after making wave d of this triangle , now it’s want to ready for making wave E , targets are at least $140 and above $200 for all 2023