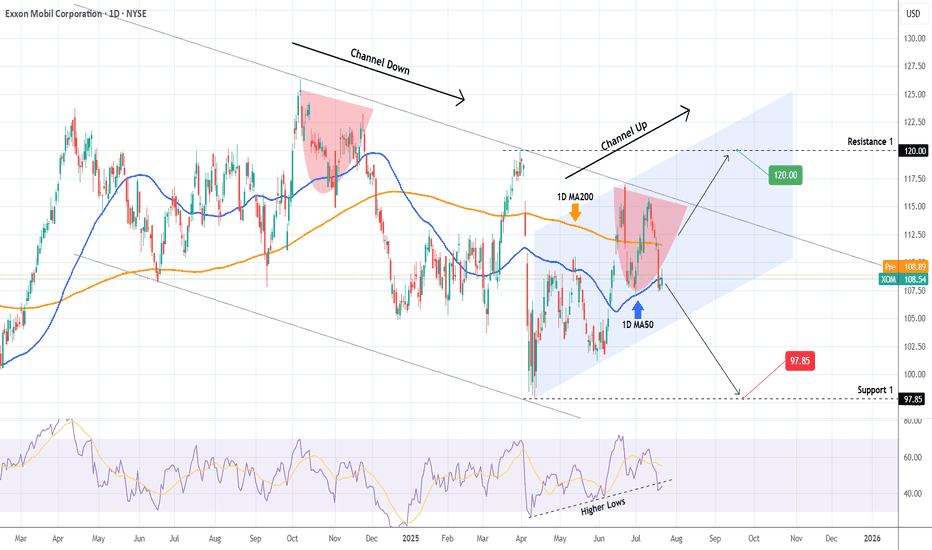

EXXON MOBIL Critical crossroads.Exxon Mobil (XOM) has been trading within a Channel Down since the June 17 2024 Low and just recently on the July 11 2025 High, it made a Lower High pattern similar to November 22 2024.

As long as the price trades below the 1D MA200 (orange trend-line), we expect to start the new Bearish Leg and test at least Support 1 (97.85).

If however it breaks above the 1D MA200 it will invalidate all prior Lower High patterns, and will most likely follow the (blue) Channel Up to break above the Channel Down. In that case, we will be targeting Resistance 1 (120.00).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Oilstocks

CRUDE set to fire 82 $ 90 $ 104 $ ????Crude Daily Elliot waves count suggest big UP setup in progress right now

55 $ key level to watch for buyer Extension point

Due to amid middle-east war situation may trigger Up move impulse wave towards 82 $ to 104 $ range

EW count are keeping changing during different price action in different time frame & multiple forecast .

this educational based chart as per EW theory method

Oil Prices Up as Trump Delays EU Tariffs (Temporary Relief?) The global oil market, a sensitive barometer of economic health and geopolitical stability, registered a slight uptick in prices following the news that the Trump administration would extend the deadline for imposing new tariffs on a range of European Union goods. This minor rally, however, comes against a backdrop of a broader downtrend that has characterized the oil markets since mid-January. The persistent downward pressure has been largely attributed to the chilling effect of existing and threatened tariffs, not just between the US and the EU, but on a global scale, which have cast a long shadow over the outlook for global energy demand.

To understand the significance of this deadline extension and its nuanced impact on oil prices, it's crucial to first appreciate the environment in which it occurred. For several months, the dominant narrative surrounding oil has been one of demand-side anxiety. President Trump's "America First" trade policy, which has seen the imposition of sweeping tariffs on goods from various countries, most notably China, and the persistent threat of more to come against allies like the European Union, has injected a significant dose of uncertainty into the global economic system.

Tariffs, at their core, are taxes on imported goods. Their imposition typically leads to a cascade of negative economic consequences. Businesses that rely on imported components face higher input costs, which can either be absorbed, thereby reducing profit margins, or passed on to consumers in the form of higher prices. Higher consumer prices can dampen spending, a key driver of economic growth. Furthermore, the uncertainty created by an unpredictable trade policy environment often leads businesses to postpone investment decisions and hiring, further stagnating economic activity.

This economic slowdown, or even the fear of it, directly translates into weaker demand for oil. Manufacturing activity, a significant consumer of energy, tends to decline. Global shipping and freight, which rely heavily on bunker fuel and diesel, slow down as trade volumes shrink. Consumer demand for gasoline and jet fuel can also wane if economic hardship leads to reduced travel and leisure activities. The retaliatory measures often taken by targeted nations – imposing their own tariffs on US goods – only serve to exacerbate this negative feedback loop, creating a tit-for-tat escalation that further erodes business confidence and global trade flows.

It is this overarching concern about a tariff-induced global economic slowdown that has been weighing heavily on oil prices since the middle of January. Market participants, from large institutional investors to commodity traders, have been pricing in the potential for significantly reduced oil consumption in the months and years ahead if these trade disputes were to escalate or become entrenched. Every new tariff announcement or threat has typically sent ripples of concern through the market, often pushing oil prices lower.

Against this gloomy backdrop, the news of an extension to the tariff deadline on EU goods, while not a resolution, acts as a momentary pause button on further immediate escalation. It offers a temporary reprieve, a brief window where the worst-case scenario of new, damaging tariffs being instantly applied is averted. This is likely why oil prices "edged higher."

The market's reaction can be interpreted in several ways. Firstly, it reflects a slight easing of immediate downside risk to the European economy. The EU is a massive economic bloc and a significant consumer of oil. The imposition of new US tariffs on key European goods, such as automobiles or luxury products, would undoubtedly have a detrimental impact on European industries, potentially tipping already fragile economies closer to recession. An extension of the deadline pushes this immediate threat further down the road, offering a sliver of hope that a negotiated solution might yet be found, or at least that the economic pain is deferred. This deferral, however slight, can lead to a marginal upward revision of short-term oil demand expectations from the region.

Secondly, the extension can be seen as a signal, however faint, that dialogue and negotiation are still possible. In the fraught world of international trade diplomacy, any indication that parties are willing to continue talking rather than immediately resorting to punitive measures can be interpreted positively by markets. It reduces, fractionally, the "uncertainty premium" that has been built into asset prices, including oil.

However, it is crucial to temper any optimism. The fact that oil only "edged higher" rather than surged indicates the market's deep-seated caution. An extension is not a cancellation. The underlying threat of tariffs remains very much on the table. The fundamental disagreements that led to the tariff threats in the first place have not been resolved. Therefore, while the immediate pressure point has been alleviated, the chronic condition of trade uncertainty persists.

The oil market is acutely aware that this extension could simply be a tactical move, buying time for political reasons without altering the fundamental trajectory of trade policy. If, at the end of the extended period, no agreement is reached and tariffs are indeed imposed, the negative impact on oil demand expectations would likely resurface with renewed force. The market is therefore likely to adopt a "wait and see" approach, with traders hesitant to make significant bullish bets based solely on a deadline postponement.

Furthermore, the US-EU trade dynamic is just one piece of a larger global puzzle. The ongoing trade tensions with China, for instance, continue to be a major drag on global growth projections and, by extension, oil demand. Progress, or lack thereof, on that front often has a more substantial impact on oil prices than developments in the US-EU relationship, given the sheer scale of US-China trade and China's role as the world's largest oil importer.

The slight rise in oil prices also needs to be seen in the context of other market-moving factors. Supply-side dynamics, such as OPEC+ production decisions, geopolitical events in major oil-producing regions like the Middle East, and fluctuations in US shale output, constantly interact with demand-side sentiment. A deadline extension on EU tariffs might provide a small boost, but it can be easily overshadowed by a surprise inventory build, an unexpected increase in OPEC production, or signs of weakening economic data from other major economies.

In conclusion, the decision by the Trump administration to extend the tariff deadline on EU goods offered a moment of temporary relief to an oil market that has been under duress from trade war anxieties. This relief manifested as a marginal increase in oil prices, reflecting a slight reduction in immediate perceived risk to global economic activity and oil demand, particularly from Europe. However, this should not be mistaken for a fundamental shift in market sentiment or a resolution to the underlying trade disputes. The threat of tariffs remains, and the broader concerns about a global economic slowdown fueled by protectionist policies continue to loom large. The oil market's cautious reaction underscores the prevailing uncertainty, suggesting that while this extension provides a brief breathing space, the path ahead for oil prices will continue to be heavily influenced by the unpredictable currents of international trade policy.

Crude oil---Buy near 70.60, target 71.90-76.00Crude oil market analysis:

Today's crude oil is still bought at a low price, and short-term bulls have started. Yesterday, gold fell in the US market, but did not fall in the Asian market, but repaired at a high level. The strong support of the daily line has reached 70.00, and the small support is 70.50. Today's idea is to find buying opportunities above 71.50. The daily moving average of crude oil is lined up, and there is still a lot of room for growth.

Fundamental analysis:

This week is a data week. Today, pay attention to the ADP employment data, which is the pre-agricultural data.

Operation suggestions:

Crude oil---Buy near 70.60, target 71.90-76.00

USOil Sell 70.000Crude oil has been fluctuating and rising recently, reaching a three-week high. From a fundamental perspective:

Supply: The United States has intensified its energy sanctions against Iran. Attacks on Saudi facilities have affected their performance. The OPEC+ will gradually lift the voluntary production cuts starting from April and may increase production for the second time in May. The 30-day ceasefire agreement between Russia and Ukraine has not been effectively implemented in substance. However, recently, the United States, Russia, and Ukraine have reached some consensus on Black Sea navigation and the protection of energy facilities.

Inventory: According to API data, for the week ending March 25, U.S. crude oil inventories dropped significantly by nearly 9 million barrels. However, commercial crude oil inventories have been increasing continuously for several weeks, and the overall inventory remains at a high level.

Geopolitics: The U.S. airstrikes against the Houthi armed group in Yemen and Israel's military operations in the Gaza Strip have heightened concerns about the disruption of crude oil supplies in the Middle East. The United States' continuous strengthening of sanctions against Iran and Venezuela also includes a plan to impose a 25% tariff on countries importing Venezuelan crude oil.

Production Increase Pressure: The daily supply increments of non-OPEC countries (such as the United States and Brazil) far exceed the global demand growth rate, which has long-term downward pressure on the oil price center.

💎💎💎 USOIL 💎💎💎

🎁 Sell@70.000 - 70.200

🎁 TP 68.5 68.0 67.5

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

OIL Today's strategyIn the short term, there is a simultaneous advance of the long positions in crude oil. The price has tested the vicinity of $68.5 several times but encountered resistance. Moreover, after reaching around $65.2 at the lower level, it rebounded rapidly. The market still needs further testing. In the short term, it is advisable to sell high and buy low within the range of $68.5 to $65.2.

OIL Today's strategy

sell@67.5-67.9

buy:65.7-66.2

If you don't know how to do it, you can refer to my transaction.

EXXON MOBIL Will it recover the devastating December?Exxon Mobil (XOM) gave us an excellent buy signal on our last idea (September 27 2024, see chart below) as it quickly hit our $120 Target:

Since the November 22 2024 (Lower) High though, it had an aggressive sell-of that stopped on the December 20 2024 Low. The price has stabilized for now but hasn't yet gained the necessary momentum to stage a rebound.

On the other hand, there are some very encouraging signals that justify going long as the Risk/ Reward Ratio has turned very favorable for buying. The price might not be exactly at the bottom (Higher Lows trend-line) of the Channel Up but the 1W RSI is on the 38.35 Support, which is the exact level where the it bottomed on January 19 2024, on the previous Higher Low.

At the same time, the 1D MACD has completed a Bullish Cross, which has always been a solid buy entry below the 0.0 level. As a result, even though the stock may deliver one last pull-back to test the bottom of the 14-month Channel Up, it is worth buying now as the upside is significantly higher. Our Target is the Resistance 2 level at $126.40.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

CHEVRON Ideal sell at the top of the 2-year Channel Down.Chevron (CVX) has been trading within a long-term Channel Down since the November 14 2022 High (almost 2 years). The price is currently on a 4 week rejection streak on the 1W MA50 (blue trend-line) but despite the selling pressure, it closes every 1W candle flat, refusing to decline.

This is most likely the same accumulation/ pull-back phase that the previous two Bullish Legs went through upon testing the 1W MA50. They both eventually broke it and peaked at the top of the Channel Down.

We expect a similar peak within the 1W MA100 (green trend-line) and the 1W MA50. Once the 1W RSI also peaks and starts reversing (red arc), we will sell and target 132.00 (just above the 1.236 Fibonacci extension).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

EXXON MOBIL Buy signal on the 1D MA200.Exxon Mobil (XOM) has turned sideways since the June 17 Low and yesterday hit and held and 1D MA200 (orange trend-line). Technically this calls for at least a Resistance 1 test on the short-term so we turn bullish, targeting 120.00 (marginally below that level).

If however it turns out that the dominant pattern is indeed now a Channel Up, on the long-term we can see prices as high as the 1.5 Fibonacci extension (131.50), which is where the previous Higher High was priced on April 12 2014.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Oil Traders Navigate Geopolitical Risk in Already Tight MarketThe recent escalation in the Iran-Israel conflict has cast a long shadow over the global oil market. Already grappling with tight supply and high prices, oil traders are now forced to factor in the potential for disruptions caused by the ongoing hostilities. This idea explores the current situation, potential outcomes, and analyst perspectives on the future of oil prices.

A Market on Edge: Tight Supply and Geopolitical Risk

The oil market entered 2024 facing a confluence of factors pushing prices upwards. Limited production increases from OPEC+, ongoing geopolitical tensions surrounding the Russia-Ukraine war, and a rebounding global economy demanding more energy all contributed to a tight supply situation. This dynamic sent oil prices surging above $90 a barrel earlier this year.

The escalation in tensions between Iran and Israel adds a new layer of uncertainty to this already volatile market. Iran's direct attack on Israel marks a significant shift, raising concerns about potential disruptions to oil supplies from the Middle East, a region that accounts for roughly a fifth of global oil production.

Focus on the Strait of Hormuz

A key concern for oil traders is the potential for disruptions in the Strait of Hormuz, a critical chokepoint through which a significant portion of the world's oil transits. Any actions that threaten the free flow of oil through this strategic waterway could send prices skyrocketing. Iran has previously threatened to close the Strait in response to heightened tensions, and recent events have heightened focus on this possibility.

Futures Market Reacts, But Risks Remain

Following the initial attack by Iran, oil futures prices did experience a spike as traders factored in the increased risk premium. However, prices have since eased somewhat, indicating a degree of cautious optimism that the situation might not escalate further. Despite this, analysts warn that the underlying risks remain.

Analysts Weigh In: Possible Outcomes and Price Predictions

Several potential scenarios could emerge from the current situation, each with its own impact on oil prices.

• Tighter Sanctions: Banks like Goldman Sachs highlight the possibility of stricter sanctions being imposed on Iran, potentially leading to a loss of 500,000 to 1 million barrels of oil per day from the global market.

• Israeli Military Response: Analysts at RBC Capital Markets warn that a significant Israeli retaliation could trigger a destabilizing cycle, further disrupting oil supplies and pushing prices even higher.

• Limited Conflict: Other analysts, like ING, suggest that the market had already priced in the possibility of a limited attack, and the potential for a measured Israeli response could see prices stabilize or even decline slightly.

•

Citigroup, however, takes a more cautious approach, raising its short-term price forecasts due to the "extremely high" tensions. They estimate that a full-blown conflict between Iran and Israel could see oil prices surge as high as $100 per barrel.

Looking Ahead: A Market in Flux

The future trajectory of oil prices hinges largely on how the situation between Iran and Israel unfolds. While the easing of futures prices offers a glimmer of hope, the underlying risks remain. Oil traders must closely monitor developments in the region and adjust their strategies accordingly. Analysts remain divided, with some predicting further escalation and others hoping for a de-escalation. One thing is certain: the coming weeks will be crucial in determining the fate of oil prices in the near future.

Hedge Funds Go Long Oil as Middle East Tensions SimmerBuckle Up for Black Gold: Hedge Funds Go Long Oil as Middle East Tensions Simmer

Oil Bulls Charge as Geopolitical Heat Rises

The rumble of tanks in the Middle East is echoing through financial markets, with hedge funds piling into long positions on oil futures at a record pace. This aggressive bullish stance is a direct response to intensifying conflict in the region, a major source of the world's crude.

The So Long, So Short of It

The logic is simple: supply disruptions = higher prices. When tensions flare and the threat of production or export interruptions looms large, the perception of scarcity sends chills down the spines of oil-dependent economies. This fear translates into action, with buyers willing to pay a premium to secure reliable supplies, pushing prices upwards.

Hedge Funds See Green in the Black

Hedge funds, notorious for their high-risk, high-reward strategies, see this geopolitical instability as a golden opportunity. By taking long positions in oil futures contracts, they're essentially placing a hefty bet that oil prices will continue their upward trajectory. If their predictions hold true, they stand to reap significant profits.

Hold Onto Your Stetsons: Prices Could Go Wild

Should the situation in the Middle East escalate further, potentially leading to a disruption in oil production or exports, brace yourselves for a price surge. This scenario would be a boon for the long-oil hedge funds, but a major headache for consumers and businesses worldwide, as energy costs would skyrocket.

A Word to the Wise: Don't Get Bucked Off

The oil market is a complex beast, influenced by a multitude of factors beyond geopolitical tensions. A diplomatic breakthrough or the emergence of alternative sources of supply could cause prices to plummet. Before jumping on the long-oil bandwagon, investors should carefully consider their risk tolerance and conduct thorough research.

TradingView: Your Oil Market Oasis

Navigate the volatile currents of the oil market with confidence using TradingView's robust charting tools and in-depth market analysis. Track oil price movements, stay updated on geopolitical developments, and leverage expert insights to make informed trading decisions.

Disclaimer

This article is for informational purposes only and should not be considered financial advice. Consult with a qualified financial professional before making any investment decisions.

Exxon Mobil Signals Profit Dip Amidst Weak Oil and Gas PricesExxon Mobil ( NYSE:XOM ) faces turbulent seas ahead as it braces for a dip in first-quarter operating results, signaling a departure from the record-breaking profits of yesteryears. With weaker oil and gas prices, coupled with significant losses in fuel derivatives, Exxon ( NYSE:XOM ) finds itself navigating through challenging terrain after two years of unprecedented prosperity.

Navigating Market Volatility:

The once-profitable energy giant now grapples with the impact of fluctuating natural gas prices and fuel derivatives, marking a stark reversal from the buoyant market conditions of previous quarters. Despite its efforts to weather the storm, Exxon's operating profit for the quarter is projected to plummet, underscoring the harsh realities of a volatile market environment.

Profit Projections and Investor Sentiment:

Investors brace for a downturn in Exxon's fortunes, with adjusted per-share profit expected to fall short of previous benchmarks. Financial firm LSEG's consensus estimate paints a sobering picture, reflecting a decline in profitability compared to the company's robust performance in the year-ago period. As Exxon's profitability wanes, investor confidence faces a stern test amidst mounting uncertainties.

Factors Contributing to Profit Erosion:

The erosion of Exxon's profits can be attributed to a confluence of factors, including plummeting natural gas prices and adverse movements in fuel derivatives. The company's bottom line takes a hit as refining maintenance costs surge, exacerbating the financial strain caused by weakened market conditions. Against this backdrop, Exxon grapples with the formidable task of mitigating losses and safeguarding shareholder value.

Strategic Moves Amidst Adversity:

In the face of adversity, Exxon ( NYSE:XOM ) remains proactive in its pursuit of strategic opportunities to bolster its position in the market. From all-stock deals with U.S. shale oil producers to assertive claims over prized assets, Exxon ( NYSE:XOM ) demonstrates resilience in the face of market headwinds. However, the path forward remains fraught with challenges as the company navigates a rapidly evolving energy landscape.

Technical Outlook

Exxon Mobil ( NYSE:XOM ) stock is trading above the 200, 100, and 50-day Moving Averages respectively with a Relative Strength Index (RSI) of 85.21 indicating an overbought position for the stock. NYSE:XOM 's 1-day chart shows a cup and handle pattern indicting the potential for a downturn at any moment.

Will U.S. oil rebound and repair next week?Crude oil is currently going through a wave of surges and falls on the weekly trend, but it still maintains its operation on the short-term moving average. Pay attention to whether there will be continued adjustment on the line next week. On the daily trend, the current price has begun to touch near the previous support band, and the downward trend has begun to slow down. After the continuous low fluctuations in the intraday 4-hour trend, the technical form showed signs of gradual recovery. The K-line began to slowly stand on the short-term moving average. It is believed that crude oil will rebound to a certain extent in the short-term trend.

If you are not confident in your trading, you can follow me and I will share trading ideas every day

Jump on the Oil Trend as Russia Refineries Attacks Drive Prices I wanted to bring to your attention the latest trend in the oil market - prices are on the rise due to recent attacks on refineries in Russia.

These attacks have caused disruptions in the supply chain, leading to an increase in oil prices. This presents a great opportunity for you to capitalize on this trend and make some significant profits by going long on oil.

Don't miss out on this golden opportunity to make some quick gains in the market. Take advantage of the current situation and place your bets on oil to see your investments grow.

So, what are you waiting for? Get in on the action and go long on oil today

MEDC: Repeating Bullish Pattern, Upside Potential +16%?Hi Realistic Traders, let's delve into the technical analysis of IDX:MEDC !

The current market trend for the stock unmistakably showcases a bullish continuation pattern, marked by consistent upward movement above the EMA200 Line, signaling enduring momentum. At the same time, MEDC has formed a descending broadening wedge pattern twice. In December 2023, this pattern served as a catalyst, igniting a bullish reversal or heralding the start of a bullish trend. Yet, the subsequent formation of the descending broadening wedge pattern took on a new significance, becoming a widely recognized indication of ongoing bullish sentiment.

What's particularly notable is the recent breakout from the DBW pattern, accompanied by a significant surge in trading volume. This reinforces our confidence in a sustained upward trajectory. Given these compelling indicators, we anticipate an exciting potential upward movement in price. Our analysis points to a designated target ripe for potential gains, making this an enticing opportunity for traders looking to capitalize on market trends.

It is essential to note that the analysis will no longer hold validity once the target/support area is reached.

Disclaimer:

"Please note that this analysis is solely for educational purposes and should not be considered a recommendation to take a long or short position on Medco Energi International."

Please support the channel by engaging with the content, using the rocket button, and sharing your opinions in the comments below!

Diamondback and Endeavor Forge $50 Billion Powerhouse

In a seismic shift within the energy sector, two major players in the U.S. shale oil industry, Diamondback Energy ( NASDAQ:FANG ) and Endeavor Energy Resources, are on the brink of sealing a historic deal worth a staggering $25 billion in cash and stock. Sources close to the negotiations reveal that this landmark agreement is poised to create a behemoth valued at over $50 billion, positioning it as the largest, pure-play oil producer in the prolific Permian shale field.

The proposed merger, which could be announced as early as Monday, underscores a strategic move by Diamondback ( NASDAQ:FANG ) and Endeavor to consolidate their strengths and capitalize on synergies in a fiercely competitive market. With Diamondback's shareholders expected to hold the majority stake in the combined entity, the newly formed company is set to dominate the Permian landscape, surpassing even industry giants like Exxon Mobil and Chevron.

Dan Pickering, Chief Investment Officer of Pickering Energy Partners, describes the impending merger as a "layup" due to the natural fit and acreage overlap between the two entities. This sentiment is echoed by industry analysts who anticipate that the deal will not only enhance operational efficiencies but also exert pressure on remaining players in the Permian basin to explore similar consolidation strategies.

The consolidation trend within the Permian basin reflects a broader push among oil producers to secure future drilling inventory and optimize output amidst evolving market dynamics. Andrew Dittmar, Senior Vice President at data analytics firm Enverus, observes that while future deals may not match the magnitude of recent transactions, the Diamondback-Endeavor merger is poised to set a new benchmark for industry consolidation.

Autry Stephens, founder of Endeavor Energy Resources, is expected to retain a significant role in the merged entity, underscoring the deep-rooted legacy of the company he built over four decades. Endeavor's formidable operations spanning 350,000 acres in the Midland portion of the Permian Basin reflect Stephens' astute strategy of acquiring undervalued assets and leveraging innovative technologies to drive profitability.

The impending merger between Diamondback ( NASDAQ:FANG ) and Endeavor represents a pivotal moment in the oil industry, signaling a paradigm shift towards consolidation and collaboration in the pursuit of sustainable growth and operational excellence. As investors eagerly await the market's response to this transformative deal, all eyes are on Wall Street to gauge the resonance of this monumental merger within the energy sector and beyond.

Oil Market Volatility due to Shipping Disruptions in the Red SeaIt has come to our attention that several shipping companies have temporarily halted their operations in the Red Sea, leading to a slight disruption in the transportation of oil.

As you are aware, the Red Sea is a crucial shipping route for oil tankers, connecting major oil-producing regions to global markets. Any disruption in this route can have far-reaching implications, causing ripple effects throughout the oil market. The current situation demands cautious consideration of our trading strategies, particularly regarding long oil positions.

While the exact reasons behind the shipping companies' decision to temporarily halt their operations in the Red Sea remain undisclosed, it is imperative that we closely monitor the situation and assess its potential impact on oil prices. The reduced availability of shipping routes may result in increased transportation costs, delays in deliveries, and potential supply constraints. These factors can contribute to short-term volatility and uncertainty in the oil market.

In light of this development, I encourage you to exercise caution when considering long oil positions. It is crucial to stay informed about the latest updates regarding the shipping disruptions in the Red Sea and their potential implications on oil supply and demand dynamics. We can better navigate the market and make informed trading decisions by remaining vigilant and responsive to these changes.

To stay updated, I recommend closely monitoring reputable news sources, industry reports, and official statements from shipping companies and relevant authorities. Additionally, engaging in discussions with fellow traders and industry experts can provide valuable insights and perspectives.

As always, I would like to emphasize the importance of conducting thorough research and analysis before making any trading decisions. While volatility can present opportunities, it also carries risks that need to be carefully evaluated. By maintaining a cautious approach and considering the potential consequences of the shipping disruptions in the Red Sea, we can mitigate potential losses and capitalize on favorable market conditions.

Should you have any questions or require further information, please do not hesitate to reach out to me via comment.

EXXON MOBIL: Strong buy at the bottom of a 1 year Rectangle.XOM has been trading inside a Rectangle pattern since the October 11th 2022 low and just last week the 1D RSI got oversold below 30.000. Now the 1D technical outlook is neutral (RSI = 46.595, MACD = -1.790, ADX = 43.208) but that oversold level was the first buy signal as it took place very close to the Rectangle's bottom.

The second and final validation buy signal will be when the stock closes a 1D candle over the LH trendline. Yesterday it crossed over it but closed on it. We will take this opportunity to target the 0.786 Fibonacci level (TP = 115.00) as this was the minimum target that the previous three rallies hit.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##