OILU LONG SET UP OILU ULTRAPRO 3X CRUDE OIL ETF

ENTRY 1 1.20

ENTRY 2 1.00

SL 0.13

TP.1 $8.00

TP.2 18.20

TP.3 28.20

TP.4 36.00

TP.5 48.00

act.webull.com

Your free stock is waiting for you! Join Robinhood and we'll both get a stock like Apple, Ford, or Facebook for free. Sign up with my link. join.robinhood.com

Oilstocks

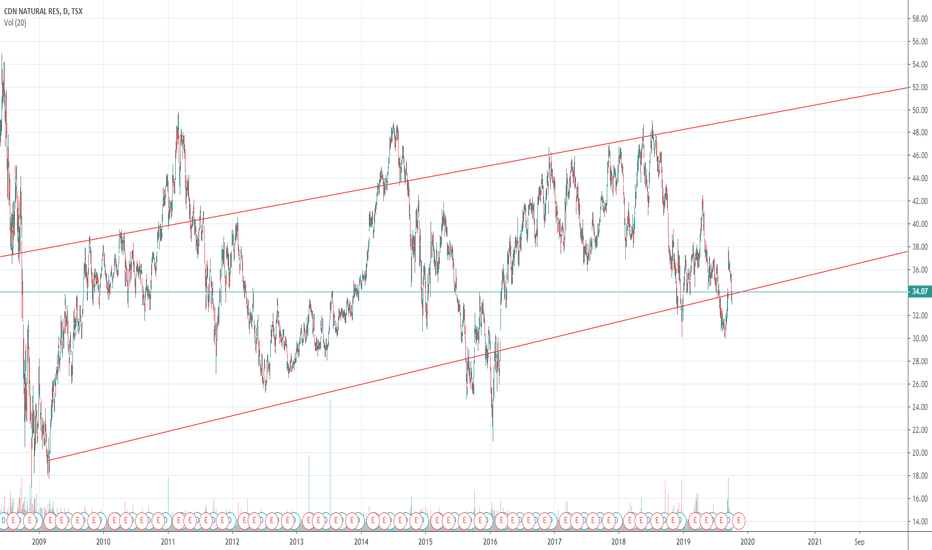

$3.57 bottom for HuskyHusky Energy is on the final wave 5 of it's greater wave C correction which may see a potential bottom of $3.57 in the coming months.

CRUDE OIL Price Will Drop To $20 or Worst $18.15| 3rd March 2020Price oil not only has been a target to a massive selling from investor but the oversupply from the country exporters while China that has to be no.1 oil purchaser has not buying oil price as per regular basis. As per chat on monthly timeframe, there was a significant supply has been going on in the market recently. The chart clearly shown that the supply of oil still continue to supply even the crisis of pandemic has gotten worst.

To prevent this to be oversupply, the oil producer has being in the decision to cut the oil supply so that to maintain the fair price of oil around $50 per barrel.

While this cut is implementing, it will takes time to be control. The price right now closed around $45 as 1st March 2020.

The price has done the correction pattern which is why it tends to slope against the prior uptrend. It is a short term pattern and this will tally to the cutting implementation from the oil producers countries.

I am predicting the price of oil will bearish hitting around $20.00 or worst $18.15 per barrel before it will continue bullish to meet the fair price.

Please like, subscribe and share this post. Dont forget to thumbs up if you like.

Please follow me to get the latest news regarding the trending topic of prophecy.

Regards,

Zezu Zaza

Oil Prices, Triangle Continuation or Break Below?Oil prices has stalled temporarily as price has bumped into a powerful daily triangle formation. Due to the strength of this triangle in the past, I'm leaning to the short side here for a rebound after a strong bounce. We're currently watching a few levels here

As always, even though we may lean one side or another on a trade(Long/Short), its important to come to the charts with a zero bias mindset. This is why I love the concept of trading with market structure. If you're wrong, you can know you're wrong in a very short amount of time and close the trade for a small loss. The structure gives you a higher percentage of success by only taking entries using key turning points in the market from the past. For the time being, market structure is giving a signal that price wants to go down. However, if price were to come back above 60.19, I'd change my bias and say Oil wants to continue moving up.

USOIL (Gravy Train)Rough sketch but you get the picture. I'm fairly new to trading so I'm not sure of all the fancy wave names and the technical nomenclature but this is what the chart is saying to me. I'm just listening to what its saying (or moreso what I see). It's damn a near flip flop of how the directional trend got started.

Lets eat. Amen.

Hurricane Enery - Buying the bottom of the rangeBuy Hurricane Energy (HUR.L)

Hurricane Energy plc is engaged in the exploration of oil and gas reserves principally on the United Kingdom Continental Shelf. The Company's acreage is on the United Kingdom Continental Shelf, West of Shetland, on which the Company has approximately two basement reservoir discoveries, each containing approximately 200 million barrels of oil equivalent (MMboe).

Market Cap: £827.54Million

Hurricane Energy is trading in a neat range on the daily chart. The support at 38p has held successfully and the shares look set to close above the 10EMA. This could be a sign that bullish momentum is about to return. The upper end of the range comes in at 60.70p which is our short to medium term target.

Stop: 36.4p

Target 1: 60.70p

Interested in UK Small Caps?

Join our free Telegram channel for up to date analysis on the best small-cap opportunities in the UK right now.

t.me

Elliott Wave View: Oil Resumes Lower ImpulsivelyShort term Elliott Wave view on Oil suggests wave (B) rally ended at 63.38 on September 17, 2019 high. The commodity has since turned lower within wave (C) which is unfolding as 5 waves impulse Elliott Wave structure. This view will get validation when it breaks below the previous low on August 7, 2019 low (50.52). Down from 63.38, wave 1 ended at 57.67 and the bounce to 59.54 ended wave 2. Oil then resumes lower in wave 3 which is extended and subdivides as an impulse in lesser degree.

Wave ((i)) of 3 ended at 58.01 and wave ((ii)) of 3 ended at 59.39. Wave ((iii)) of 3 ended at 53.05 and wave ((iv)) of 3 ended at 54.42. Near term, while bounce stays below 59.54, expect Oil to extend lower to continue the 5 waves move from September 17, 2019 high (63.38). We don’t like buying Oil and as far as pivot at 59.54 stays intact, expect any bounce to fail in 3, 7, or 11 swing.

MCF Still Chugging But Can The Volume Continue?Another penny stock that has been on a tearing run over the course of the past three weeks is Contango Oil & Gas Company ( MCF ). We originally reported on the company in September, “5 Top Penny Stocks To Watch Before October 1.”

" During the course of the three weeks, the stock has gained in excess of 455%. This came after two key developments. Towards the end of September, the company announced that it had reached an agreement to buy the assets of White Star Petroleum. White Star had filed for bankruptcy and Contango decided to pounce. "

Source: 3 Penny Stocks To Buy or Sell In October?

RoyalDutchShell (RDS.A) upcoming attractive oil stock dividend"The Company consists of the upstream businesses of Exploration & Production and Gas & Power and the downstream businesses of Oil Products and Chemicals. It also has interests in other industry segments such as Renewables and Hydrogen." right now Shell currently offers the highest dividend yield among the oil majors, at 6.5%. Moreover, that dividend is comparatively safe: Even during the oil price downturn of 2014 to 2017, Shell didn't cut its dividend like many independent oil producers. It is also trading at an attractive valuation right now,, a consistent payout.. its a gasoline play thats not about the gas,, this is to become an attractive dividend stock by far.

HollyFrontier Corporation: Buy Opportunity on multiple signals.HFC is currently testing the August 01 High (53.90) and 1D Resistance after a non-stop 15 day bullish sequence that nearly made 1D overbought (RSI = 72.486, STOCH = 79.880, MACD = 1.560, ADX = 60.274). If we convincingly break above that level then 1D will print the Golden Cross formation (MA50 over MA200).

The same pattern was last seen in 2017 and resulted in a +70% rise on a January 2018 Top. The RSI is also replicating a similar pattern. Based on that we are bullish on this stock aiming on the medium term at 65.00.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.